Beruflich Dokumente

Kultur Dokumente

Bank Syst

Hochgeladen von

Mujtaba AzizOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank Syst

Hochgeladen von

Mujtaba AzizCopyright:

Verfügbare Formate

Mobile Banking

Submitted By: Shahid Nadeem R-MBA-FALL-11-025

Bilal Asad R-MBA-FALL-12-036

Muhammad Basir R-MBA-FALL-12-061

Submitted To: Sir Hammad Nasir

Project Constraint

IB&M, UET Lahore 5/15/15 Management

Acknowledgement

First and foremost we would like to express our thanks to Allah because of His

blessings and strength that He has given to us to finish this report as our final project

report. We have put the best of our efforts in this project.

However, it would not have been possible without the kind support and help of Sofia

Faruq Senior Software Engineer and Project Manager at Inov8. We would like to

extend our sincere thanks to all of them.

We are highly indebted to Inov8 managers for their guidance and supervision as well

as for providing necessary information regarding the project & also for their support

in answering the questions.

We would like to express our gratitude towards our parents & member of our group

for their kind co-operation and encouragement which helped us in completion of this

project.

MOBILE BANKING - MAY 2015 1

Table of Contents

Executive Summary ........................................................................................................................ 5

Inov8 Limited.................................................................................................................................. 6

Vision and Mission ......................................................................................................................... 6

Success at a Glance ......................................................................................................................... 7

Background of Project .................................................................................................................... 7

Mobile Banking Product – The Falcon Platform ............................................................................ 7

Role of the Project Manager ........................................................................................................... 9

Project Management in Falcon ..................................................................................................... 10

Initiating Process Group ............................................................................................................... 11

1. Brief Intro to Customer .......................................................................................................... 11

2. Backend or Complete Detail of Product ................................................................................ 12

3. Development of Project Charter ............................................................................................ 12

1) Transactions Details ........................................................................................................... 13

Funds Transfer................................................................................................................ 13

Bill Payments ................................................................................................................. 13

Top Up............................................................................................................................ 13

Retail Payment ............................................................................................................... 13

Mini Statement ............................................................................................................... 13

Balance Check ................................................................................................................ 14

Other Services ................................................................................................................ 14

2) Business Case..................................................................................................................... 14

3) Technical Information........................................................................................................ 15

Superior Technology ...................................................................................................... 15

MOBILE BANKING - MAY 2015 2

Fast Integration time ...................................................................................................... 15

Middleware Strengths .................................................................................................... 15

4) System Component ............................................................................................................ 15

4. Technical and Pricing ............................................................................................................ 16

1. Hardware Recommended ................................................................................................... 16

2. Software Requirement ....................................................................................................... 17

3. Pricing ................................................................................................................................ 17

Planning Process Group ................................................................................................................ 18

1. Requirement Gathering .......................................................................................................... 19

2. Project Scope ......................................................................................................................... 19

3. Work Breakdown Structure ................................................................................................... 20

4. Time Management ................................................................................................................. 21

5. Cost Management .................................................................................................................. 21

6. Contract Type......................................................................................................................... 22

7. Project Plan ............................................................................................................................ 22

8. Test Plan................................................................................................................................. 23

9. Risk Register .......................................................................................................................... 23

Executing Process Group .............................................................................................................. 24

1. Development .......................................................................................................................... 24

2. Testing and Quality Assurance .............................................................................................. 24

3. Risk Response ........................................................................................................................ 26

Monitoring Control Process Group ............................................................................................... 26

1. Project Report ........................................................................................................................ 26

2. Change Requests .................................................................................................................... 26

3. Maintenance ........................................................................................................................... 27

Closing Process Group .................................................................................................................. 27

MOBILE BANKING - MAY 2015 3

1. Phase Closure ......................................................................................................................... 27

1. Release Acceptance Form .................................................................................................. 27

2. UAT Sign Off .................................................................................................................... 27

2. Soft Launch and Live Launch ................................................................................................ 27

Recommendation .......................................................................................................................... 28

MOBILE BANKING - MAY 2015 4

Executive Summary

This document will serve as the report for a project that is used is Mobile Banking

Application for Meezan Bank powered by Inov8 Limited. According to recent

research people are spending more time on mobile instead of internet and this is

a big opportunity for the banks to jump into the mobile banking solutions. The

purpose of this project is to provide a Bank with the Mobile Banking platform.

The Meezan bank wants to have Mobile Banking system for their current

customer base who are already registered for the Internet Banking.

This report gives the detail information of the project carrying out by the

Inov8 Ltd. a banking platform development and consulting company. This

project report gives you the detail information about the platform of Inov8

branchless banking named as Falcon Platform for the customer Meezan

bank.

This project is of 110 days, this paper provides you the thorough

information of the how the project management is being done in this project

and how they are carrying out this project

MOBILE BANKING - MAY 2015 5

Banking App

The Falcon Platform

Inov8 Limited

Incorporated in 2004, Inov8 has grown to become the leading provider for technology and

consulting solutions for all players in the mobile and branchless banking ecosystem including

financial institutions, mobile operators, agent networks, merchants, money transfer organizations,

regulators and governments. Our experience comes from working with some of the best

organizations in the world, including Fortune 100, and Fortune 500 companies.

Inov8’s team comprises individuals with an in depth understanding of mobile commerce and

payments along with their individual areas of expertise ranging from business and covering all

technology required for designing, deploying, integrating and supporting products and solutions.

The underlying strengths of Inov8 are its people and technology. We promise and deliver

innovative strategies and technology in an age where competition does not allow for learning

curves.

Vision and Mission

Inov8’s vision is to use technology and innovation for enabling access to mobile financial services

for the unbanked and to make mobile payments more convenient for the banked.

Inov8’s mission is to provide technology and consulting solutions for all players in the mobile and

branchless banking ecosystem including financial institutions, mobile operators, agent networks,

merchants, money transfer organizations, regulators and governments, representing a

fundamentally transformational opportunity to connect millions of people to the digital economy.

MOBILE BANKING - MAY 2015 6

Success at a Glance

Inov8’s history of successes include setting up and deploying one of the world’s first interoperable

shared mobile payments and settlement platforms in 2007. In 2008, Inov8 launched Pakistan’s first

mobile banking service with a shared, interoperable platform through the largest Mobile Network

Operator (MNO), multiple banks, utility companies, insurance, fast food and retail.

Working in collaboration with Askari Bank and Zong, Inov8 has successfully implemented and

launched, TimePey, Pakistan’s largest branchless banking deployment with a G2P focus. This

project entails salary transfers and pensions for servicemen, branchless banking for the unbanked,

mobile banking, next generation mobile commerce and remittances.

Inov8 has grown to become one of the region’s leading technology and mobile commerce

companies over the last decade. We have become experts in designing, implementing, rolling out

and optimizing large and complex m-commerce projects.

Background of Project

This document will serve as the report for a project that is used is Mobile Banking Application for

Meezan Bank powered by Inov8 Limited. According to recent research people are spending more

time on mobile instead of internet and this is a big opportunity for the banks to jump into the

mobile banking solutions. The purpose of this project is to provide a Bank with the Mobile Banking

platform. The Meezan bank wants to have Mobile Banking system for their current customer base

who are already registered for the Internet Banking.

Mobile Banking Product – The Falcon Platform

The Falcon Platform is the module of the Inov8 Ltd. i8Microbank Platform, it allows Banks to

further penetrate the mobile financial services industry and provide an alternate channel for

payments. At present, the banked customers are a major market to target for mobile financial

services, as they just need access from the mobile phone in a secure manner. Customers will be

MOBILE BANKING - MAY 2015 7

able to access their accounts (Credit, Debit, and Account) of the particular bank and can use them

on the go using the mobile app, anytime and anywhere.

INOV8’s Flacon Platform provides integrations with third party financial systems, and offer direct

integrations to banks where all processing, routing, and switching is done by I8Microbank System

thus reducing turnaround times, eliminating reconciliation issues - all as a cost effective solution,

with low total cost of ownership.

As the branchless banking industry currently stands, more than 95% of transactions which are

carried out through agents, whereas transactions initiated from customers via smartphones are still

limited, with conversion relatively low. There is market data which suggests that a service for the

banked segment presents an excellent opportunity for growing P2P revenues.

It allows a customer to conduct a variety of mobile financial transactions in real time – all while

choosing from any of their linked financial accounts from multiple financial entities. This can be

configured either before, or during a transaction. This allows them to truly digitize their accounts.

Customers will need to activate their accounts at their respective financial institutions for use, as

per SBP guidelines.

I8Microbank is designed and implemented to meet all bank and carrier grade requirements.

The features of the platform are as follows:

Real time processing and settlement

Security

Scalability

Reliability

Advanced customer relationship management (CRM) service portals for banks

MOBILE BANKING - MAY 2015 8

Advanced User and role management definition portals

Complaint management systems, with escalation, and definable TAT’s

Dispute resolution systems

Advanced Reconciliation and reporting

Integration with Branchless systems

Session based charging for Mobile App Channel

A full proposal with broken out functionality will be available upon request.

Role of the Project Manager

All the pre execution process were performed by the PCC/PMO without participation of the project

manager. It is worth mentioning that all the resources such as supply of materials, equipments,

contractors, project team etc. were provided by the PCC / PMO office.

Project manager’s core responsibilities were to direct and manage project work, prepare

WBS,QA/QC , direct project team, supervised the development works in execution, conduct daily

progress review meeting at site, weekly progress appraisal meeting at PMO office, prepare

schedule for resources demand, to ensure progress of work as per schedule and specifications.

CEO

Change

Control Board

Project

Manager

Senior

Senior Soft. Quality Manger

Engineer Admin

Engineer

Soft. Engineer Soft. Engineer Soft. Engineer Soft. Engineer Quality Quality Quality

Surveyor

1 2 3 4 Engineer 1 Engineer 2 Engineer 3

MOBILE BANKING - MAY 2015 9

Project Management in Falcon

Inov8 uses the concept of PMBOK recommended by Project Management Institute (PMI) in the

development of every project. This project also includes all five process groups of project

management, but some knowledge areas completely and some are partially skipped. The table

below gives the detail information of the knowledge areas used

Project Management Process Group and Knowledge Area Mapping

Knowledge Project Management Process Groups

Area

Initiating Planning Executing Monitoring Closing

Controlling

P. 4.1 Develop 4.2 Develop 4.3 Direct and 4.4 4.6 Close

Integration Project Project Manage Project MonitorControl Project

Management Charter Management Plan Work Project Work or Phase

P. Scope 5.2 Collect 5.5 Validate Scope

Management Requirements 5.6 Control Scope

5.3 Define Scope

5.4 Create WBS

P. Time 6.1Plan Schedule

Management Management

P. Cost 7.1 Plan Cost

Management Management

P. Quality 8.1 Plan Quality 8.3 Control

Management Management Quality

P. Risk 11.2 Identify Risks

Management

MOBILE BANKING - MAY 2015 10

Initiating Process Group

In initiating process group of this project covers following points

1. Brief intro to Customer

2. Backend or Complete detail of product

3. Development of Project Charter

4. Technicality and Pricing

5. Agreements

1. Brief Intro to Customer

Initially customers are presented with the product briefs and brochures. Demonstrations are

conducted with the Client. All the features of the product are displayed to the client of the current

system. After the complete walk through of the product, the client can request the product as it is

or can propose some new features or updates.

MOBILE BANKING - MAY 2015 11

2. Backend or Complete Detail of Product

After viewing the front, mostly the Client are more interested in knowing more about the backend

system with integrations. Backend is composed of multiple layers. The two most important layers

are i8Microbank layer and Integration Layer. I8Microbank is the heart of the system and it has

different variants or versions to support multiple product line.

After demonstration a Client can request a Project Charter with a Business Case in order to evaluate

the numbers or stats.

3. Development of Project Charter

Project charter includes introduction about the product which has already discussed above and the

detail information about project. i8Microbank project charter includes following;

1. Transactions Details

2. Business Case

3. Technical Information

MOBILE BANKING - MAY 2015 12

1) Transactions Details

Funds Transfer

I8Microbank System facilitates Intra-Bank and Inter-Bank funds transfer (IBFT) using its

integration with banking middleware. Onward transactions for interbank funds transfer can

be routed via 1Link, or other remittance options (i.e. Visa Personal Payments). The funds

transfer process is very simple and largely similar to the one already in place on ATMs that

offer IBFT. This lays the groundwork for processing both domestic and incoming

international mobile remittance services

Bill Payments

I8Microbank facilitates a multitude of public and private sector bill payments. These

payments can be made via 1-Link, Phoenix, Rendezvous or 3rd party billing systems.

Generally banks use their own bill payment processing relationships for the same.

Top Up

The top up functionality allows the user to purchase mobile airtime. Mobile top up is

provisioned in real time and the payment is deducted from the user’s linked account

instantaneously. The user has the option to top up his own mobile or he can send mobile

credit to other users.

Retail Payment

Mobile Banking customers can easily pay for their retail purchases directly from their

mobile banking service at participating retailers. Customers can be charged a convenience

fee if required, where a merchant does not fulfill qualification for a merchant fee. It is likely

that all Telco top-up retailers can be converted to receive mobile banking payments. High

end merchants can be catered for via web or mobile apps.

Mini Statement

Mobile Banking customers can view their mini statements from any of their accounts.

Customers will be able to view his/her last 5 transactions pertaining to their accounts within

respective banks.

MOBILE BANKING - MAY 2015 13

Balance Check

The balance check functionality will allow the users to check their balance of their accounts

in real time.

Other Services

The I8Microbank platform provides the following services in addition to the above:

Salary payments and bulk disbursements

Supply chain payments and automation

Online Payments (Like PayPal for local settlement)

Closed user group payments for corporate

Customer segmentation capabilities with IN functionality (pricing products and

services different for groups)

2) Business Case

Assumption 1

Total number of current mobile subscribers 134,907,976

Banked Population (11 %) 20,000,000

Monthly throughput from Mobile Apps 2 Billion

Assumption 2

The model assumes that will gain customers in 8 quarters meaning 500,000

2.1% of its total subscribers 23,345,258

12.9% of its subscribers who have a bank account

Per Transaction on Bill Payment + Transfer (900+220) 1120

Total Expected Revenue in 8th Quarter 540000000

MOBILE BANKING - MAY 2015 14

3) Technical Information

I8Microbank System is a proprietary mobile financial services middleware platform, which can

connect to multiple hosts and various systems. It facilitates, manages, routers, switches, and

processes transactions between different entities. With an additional module, it manages the latest

smartphone based mobile commerce applications as well.

Superior Technology

Technical highlights of I8Microbank System:

i8Microbank System is made using the latest state of the art tools and is n-tier

o The technology stack comprises a highly available, J2EE carrier and bank grade

application, using ideally Oracle Database technology backed by different components.

The solution is carrier class and is high availability configured

o There are no single redundant software / hardware nodes

o Software and Hardware based load balancing

o Clustering across all nodes

Please see section on infrastructure requirements to assess technology stack

Fast Integration time

Integration time between I8Microbank System and Telco and financial institutions will

have a quick turnaround time. This leads to shorter timelines for UAT, quick commercial

releases, and gives an edge over competitors. Furthermore, with standard interfaces and

with the experience of the integration team at INOV8 Ltd, these will be industry leading

times.

Middleware Strengths

The I8Microbank server also has middleware capabilities via its routing component. It can

acquire transactions from any network, do the routing, switching and get them processed

by a range of different systems including core banking systems, banking middleware such

as Phoenix, Rendezvous and IRIS, and remittance systems.

4) System Component

Webserver/Software load Balancer

DB Servers

SAN Storage

MOBILE BANKING - MAY 2015 15

SMS Gateway

IR - Intelligent Router

Over-all network design

4. Technical and Pricing

This is the fourth part of the initiating phase of this project it includes the hardware required for

the platform and pricing.

1. Hardware Recommended

i. The DB framework is based on an active - passive replication process using Oracle Real

Application Cluster (RAC) and core licensing.

ii. This configuration uses Oracle licensing at the CPU level.

iii. The entire system is plug and play for scalability, one of the strengths of our solution. Adding

a server to the application and DB cluster will require virtually no downtime.

iv. Prices and models may vary based upon availability.

v. Performance will not be affected because you have the application servers load balanced from

the Web Server using Apache MOD/JK.

vi. Recommended hardware may change upon bank’s actual business requirements and load

assessment.

Servers Specifications OS System Qty

(Virtualized) Behavior

WEB Layer Intel E5-4620 Xeon 2.2 GHz, 2 CentOS-6.5- Active/Passive 2

Core, 8 GB RAM, HD 75 GB x86_64

I8IR Layer Intel E5-4620 Xeon 2.2 GHz, 4 CentOS-6.5- Active/Passive 2

Core, 12 GB RAM, HD 150 GB x86_64

Application Intel E5-4620 Xeon 2.2 GHz, 4 CentOS-6.5- Active/Active 2

Layer Core, 12 GB RAM, HD 150 GB x86_64

SAN Storage 2 Terabytes of 1TB + 1TB N/A

data in your

existing SANS

MOBILE BANKING - MAY 2015 16

2. Software Requirement

Item Category Component Description Unit of Qty Note

No. Measure

1 Infrastructure CentOS & Operating System Per 12 8 servers at

Software Oracle Linux Server primary site and

4 server at DR

2 Software Apache Webserver Per 3 2 servers at

Server primary site and

1 server at DR

3 Infrastructure jboss-7.1.1.GA Application Per 6 Open Source

Software Platform Server

4 Infrastructure jdk (v 1.7) Java Environment Per 6 Open Source

Software Server

5 Infrastructure SSL Certificate Secure session Per 1

Software Domain

6 Infrastructure Oracle Database RDMS Database Per Core 6 4 at Primary and

Software 11g R2 Engine 2 at DR site

[11.2.0.4]

Enterprise

Edition

8 Infrastructure Oracle 11g R2 DB Clustering and Per Core 4 At Primary Site

Software [11.2.0.4] Grid Automatic Storage

Infrastructure Management(ASM)

7 Infrastructure Oracle Oracle Database Per Core 6 7

Software diagnostic Pack Options

Oracle tuning

pack

3. Pricing

Any other optional work will be billed at mutually agreed upon customization rates per

man day or per feature.

Meezan Bank will be responsible for providing all testing handsets.

All travel and board for personnel at all stages of the project will be Meezan Bank’s

responsibility.

Implementation and Licensing

60% at Master License Agreement sign-off

MOBILE BANKING - MAY 2015 17

20% upon signing off project plan / scope of work document

15% upon issuance of UAT sign-off Certificate by Licensee

5% upon expiry of 6 months after issuance of UAT Sign-off Certificate

Components Listed Price (USD)

MicroBank and Falcon Implementation and Customization $16,000

I8IR Integrations $ 60,000

SMSC/Aggregator

Monetique

Core Banking @ $ 20,000 per integration

Total (Project Cost) $ 76,000

Customization Listed Price (USD)

Per Man Day $250

Agreements

Agreements include software license agreements and service level agreements. For Meezan mobile

banking system only software license agreement was used.

Planning Process Group

Planning of this project includes the following areas;

1. Requirement Gathering

2. Project Scope

3. Work Breakdown Structure

4. Project Plan

5. Test Plan

6. Risk Register

MOBILE BANKING - MAY 2015 18

1. Requirement Gathering

This part is used to list the details of system features, to facilitate requirement gathering phase for

Meezan Mobile Banking Implementation. It was used to visualize the on demand work as per the

requirements and the product specifications document presented to Meezan Bank.

The queries mentioned herein will be responded to by Meezan Bank’s resources. Meezan Bank

given option to specify any customizations required in a flow/transaction. Requirement were

gather through following ways;

1. Questionnaires

2. Meetings

3. Conference Calls

4. Handbook Updates

a. Meezan Mobile App – Requirements Specification

b. Meezan Portal – Requirements Specification

2. Project Scope

Project Scope document defines the phase the project is currently in and identifies and lists the

features and functionalities that are in scope and also that are out of scope. There were 2 basic

scope of this project first is Mobile app which is at the user end and second is the portal which is

at the banks end.

Mobile App

Login via Falcon Mobile App

Ensuring that the Customer changes the Login PIN on first time Login

Establish a policy for implementing new, blacklist and obsolete versions of the Mobile app

Ability to perform Balance Inquiry

Ability to perform the Funds Transfer transaction

Ability to perform the IBFT transaction

Ability to view Mini Statement

Ability to change Login PIN

Ability to change Bank PIN (MPIN)

Ability to provide Branch Locator

Ability to integrate with Facebook

MOBILE BANKING - MAY 2015 19

Portal

Ability to cater following three users:

Super User (for operational activities)

Administrator (for configurations)

CSR

Ability to register /create customers (Account opening via Bank User)

Self-Activation/Registration for Mobile Banking Channel (?)

Link Payment Mode (Relink/Delink)

User Group Management

App & Bank PIN regeneration

Complaints Management

Application Version Management

3. Work Breakdown Structure

There are two kind of WBS for this project to completely understand the project deliverables. First

is front end which is used by the customer and second is backend or integration which is used by

the bank itself.

i. Front End WBS

1- Mobile

Application

1.1- Frontend 1.2- Integration

1.1.1- Login 1.1.2- Home

1.1.2.1- Fund 1.1.2.2- Bill 1.1.2.3- My 1.1.2.6- Block/

1.1.2.4- FAQs 1.1.2.5- Feedback

Transfer Payments Accounts Unblock Cards

1.1.2.1.1- Own

1.1.2.1.2- Third 1.1.2.2.2- Postpaid 1.1.2.2.3- Prepaid 1.1.2.2.5-

Account Fund 1.1.2.1.3- IBFT 1.1.2.2.1- Utility Bills 1.1.2.2.4- ISPs

Party Fund Transfer Bills Bills Registered

Transfer

Bills

MOBILE BANKING - MAY 2015 20

ii. Backend/integration WBS

1.2.4.3- Full

1.2- Integration

Statement

1.2.5- Card Block/ 1.2.4.2- Balance

1.2.1- Login 1.2.2- Fund Transfer 1.2.3- Bill Payments 1.2.4- My Accounts

Unblock Inquiry

1.2.1.1- User

1.2.4.1- Fetch

Authentication 1.2.2.1- Own Accounts

Account

1.2.2.2- Third Party 1.2.2.3- IBFT

1.2.1.2- Customer

Information 1.2.2.1.1- Fund

Transfer

1.2.2.3.2- 1.2.3.1- Bill Inquiry

1.2.2.3.1- Fetch 1.2.2.3.3- Fund

BeneficiaryTitle

Beneficiaries Transfer

Fetch

1.2.1.3- Card List

1.2.3.2- Bill

1.2.2.2.2- Payment

1.2.2.2.1- Fetch 1.2.2.2.3- Fund

Beneficiary Title

Beneficiaries Transfer

Fetch

4. Time Management

The time management for this project is done through the past experience basis. In our point of

view it shall be carried out properly through planning and estimation, this is discussed in detail in

recommendation section. This time allocated for this project is assigned to the overall project as

not for the each activity this project was meant to complete in 110 days of working time. As this

project is currently in the phase of execution. There was no definition of activities and allocation

of the resources.

5. Cost Management

The cost management in the project is been carried out the way time management was done, Inov8

give budget of the project on the two basis first is of the license cost and second is the hardware

cost. It includes all the cost of the man, material and overhead, which in our thinking is not an

effective way.

MOBILE BANKING - MAY 2015 21

Components Listed Price (USD)

MicroBank and Falcon Implementation and Customization $16,000

I8IR Integrations $ 60,000

SMSC/Aggregator

Monetique

Core Banking @ $ 20,000 per integration

Total (Project Cost) $ 76,000

Customization Listed Price (USD)

Per Man Day $250

6. Contract Type

The contract which was used to carry out this project is the Fixed-Price Contract. The most

commonly used contract type is the projects. It is favored by organizations because the price for

goods is set at the outset and not subject to change unless the scope of work changes. Any cost

increase due to adverse performance is the responsibility of Inov8 Ltd., who is obligated to

complete the effort. Under contract, Meezan Bank should precisely specify the product or services

to be procured, and any changes to the procurement specification can increase the costs to the

Inov8.

7. Project Plan

Project management plan of this project includes the;

1. Detail Scope of the project

2. Project WBS

3. Costing

4. Time of the project to complete

5. Quality test plan

6. Change request

7. Risk Identification

MOBILE BANKING - MAY 2015 22

8. Test Plan

Sr. No. Task Start Date

1 Bill Payment(Backend)

2 Fund Transfer(Backend)

3 Feedback, Mini statement, Sign-out , My account, Title Fetch, Fetch

registered consumers, Fetch beneficiaries(Backend)

4 System Integration Testing

5 Testing on Android(Front End)

6 Testing on IOS(Front End)

7 UAT(Blank DB)

8 Performance testing

9. Risk Register

Risk Risk Description Action Risk

ID Status

1 Ability of the system to work under the load Load Testing was performed

of users for 500 virtual users at a time

2 Issue with the number of database Maximum database

connections while performing transactions connections were allocated

MOBILE BANKING - MAY 2015 23

3 Issue with the RAM of Application and Appropriate RAM was

database servers on production in case of assigned to both the servers

bulk of users

Executing Process Group

Following elements are used in this process

1. Development

This activity includes development of the project. It includes implementation of the features within

the scope on both Mobile Apps, Backend Servers and Integration.

Development also includes unit testing performed by developers of both Front End and Back End

Systems.

2. Testing and Quality Assurance

According the plan, builds of the Mobile Apps and patches of the server are sent to QA for testing

and quality check. Testing includes testing of the features and functionality, performance and load

testing. Defects are logged using a tool called Bugzilla or can be listed down or shared in an Excel

sheet.

Defects Sheet

Sr. Description Status

No

1 From account and To account are not shown on the report in case of IBFT Resolved

transaction

2 Bill Company Column should be renamed to Product column on the grid and Resolved

it should show the products. Transaction type column should show only two

transaction types i.e. Fund Transfer and Bill Payment. IBFT should be shown

MOBILE BANKING - MAY 2015 24

as the product of fund transfer. It should be included in product drop down

and nit in transaction type drop down in search criteria

3 Values in Product drop down should be populated on selecting the transaction Resolved

type.

4 Name of customer payment services transaction should be changed to bill Resolved

payment.

5 Detail link is missing from transaction details report Open

6 User is unable to type into transaction code field in search criteria Resolved

7 In case of own account fund transfer branch code is not shown with from and Resolved

to account fields

8 On the transaction detail report, there should be option to extract the report Resolved

in xslx format as well.

Load Testing Results

Login 100 11127 14446 16873 2452 17867 0 5.405113 29.74881

Fund Transfer third 100 4696 4638 5898 2582 7666 0 12.88328 4.202163

party

TOTAL 200 7912 5596 15235 2452 17867 0 6.516993 18.99703

MOBILE BANKING - MAY 2015 25

3. Risk Response

Risk Risk Description Action Risk

ID Status

1 Ability of the system to work under the load Load Testing was performed Closed

of users for 500 virtual users at a time

2 Issue with the number of database Maximum database Closed

connections while performing transactions connections were allocated

3 Issue with the RAM of Application and Appropriate RAM was Closed

database servers on production in case of assigned to both the servers

bulk of users

Monitoring Control Process Group

1. Project Report

In that project report is developed through the Test Plan which is developed in the planning stage.

It also includes different sheets and responses which are as follows:

1- Activity tracking sheet

2- Risk Tracking Log Sheet

3- Issues Reported

4- Change Request

2. Change Requests

Change request are handled through Change Request Form. A CR can be either billable or non-

billable depending on the functionality. A change request form is given to the customer if there is

a change required in the project, it can be submitted through that form. The change request then

first process by the Manger change at site if it required additional approval it will be send to PMO.

MOBILE BANKING - MAY 2015 26

3. Maintenance

During maintenance, Bug Fix Request, Change Requests from Client are received. The Change

Requests can be billable or non-billable.

Closing Process Group

It includes the following elements;

1. Phase Closure

As Meezan’s Mobile Banking Project comprised of Phases. Therefore, at the end of every Phase

following two documents are prepared.

1. Release Acceptance Form

2. UAT Sign Off

1. Release Acceptance Form

Release Acceptance Form consists of the complete identification and definition of the release that

Inov8 is delivering. Scope of the Phase is defined to let the Client know that Inov8 is delivering

according to the scope and requirements. Also Software Package Details are enclosed in the form.

Moreover, User Acceptance Test Cases for the system are also listed which needs to be filled by

the Client insuring that the Client himself has tested the whole system.

2. UAT Sign Off

Once Release Acceptance is completed, both the parties that are Technology Partner i.e. Inov8

Limited and Client i.e. Meezan Bank Limited sign Off the User Acceptance Testing.

2. Soft Launch and Live Launch

Soft Lunch was conducted for one month duration with 100 Bank Customers. During the soft

launch Bug Fix Requests, Change Requests or New Requirements are received on basis of

Customers feedback.

After the success of Soft Launch the system moves to the Project Launch. Project Launch includes

providing the Mobile Apps on the Android and iOS Markets form where anyone can download

and use the applications. The backend system is moved to the high end Production Servers and

Databases.

MOBILE BANKING - MAY 2015 27

Recommendation

There are some project management areas which are being missed throughout this project, if these

are followed this project can be completed in more effective way.

We shall discuss the missing areas one by one;

Time management

There was roughly time estimated for this project on the basis of previous experience of the project

team.

Project team should have defined the activities first of the basis of the WBS

There should proper allocation of the resources required for the each activity

After that time estimation for each activity to complete should be calculated

o Project team can use the Three Point Technique for the time estimation of each

activity

tO+4tM+tP

tE=

6

Then there should be the Sequencing the activates with the help of PDM or CPM

Project team could use the MS Project for sequencing activities above is the example of the some

activates which was carried out to during project, it clearly shows if activities were properly

sequenced then a project team could save 2 days to perform these activities. Following is the detail

of MS Project Interface of the activities.

MOBILE BANKING - MAY 2015 28

MOBILE BANKING - MAY 2015 29

Cost Management

Cost management and budget estimation is also done for this project is on Top down estimate. For

better cost management following thing could be done by the team

As explained earlier that there was not proper breakdown of WBS into activities, by doing

so project team could have made better estimate of the each activity or work package

Through allocating cost to each activity will help in the determine budget more accurately

Control cost is completely missed in this project and using EVM is not this company

practice

There should be proper cost controlling through EVM and TCPI

By following the above points company could save money and resources. It will also help company

to measure the performance of the project and to make changes.

Quality Management

Most of the quality management procedures were followed in this project and the requirement for

this nature can be met without the traditional standards of the project management.

Risk Management

The risk management for this project is done only at the planning phase, till the identification of

the risk. There was not proper quantification and response planning for the risk.

Following techniques can be used for the risk assessment and planning a response

Probability and impact matrix is one way to quantify risk it further used for the purpose of

developing Probability distribution for further clarification about the risk and planning

accordingly.

MOBILE BANKING - MAY 2015 30

Probability and Impact Matrix

Probability Threat Opportunity

0.90 0.05 0.09 0.18 0.36 0.72 0.72 0.36 0.18 0.09 0.05

0.70 0.04 0.07 0.14 0.28 0.56 0.56 0.28 0.14 0.07 0.04

0.50 0.03 0.05 0.10 0.20 0.40 0.40 0.20 0.10 0.05 0.03

0.30 0.02 0.03 0.06 0.12 0.24 0.24 0.12 0.06 0.03 0.02

0.10 0.01 0.01 0.02 0.04 0.08 0.08 0.04 0.02 0.01 0.01

0.05/ 0.10/ 0.20/ 0.40/ 0.80/ 0.80/ 0.40/ 0.20/ 0.10/ 0.05/

Low Moderate High Very Very High Moderate Low

Very low High High Very low

MOBILE BANKING - MAY 2015 31

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Name: Mujtaba Aziz Roll No: MITM-F18-063 Class: MIT (2A) Assignment: DbmsDokument5 SeitenName: Mujtaba Aziz Roll No: MITM-F18-063 Class: MIT (2A) Assignment: DbmsMujtaba AzizNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Assignment Ooad PracticeDokument23 SeitenAssignment Ooad PracticeAsad ButtNoch keine Bewertungen

- Ahsan Tariq Sana Aslam Gulam Mustafa Mujtaba AzizDokument2 SeitenAhsan Tariq Sana Aslam Gulam Mustafa Mujtaba AzizMujtaba AzizNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- DfadsdsdsDokument3 SeitenDfadsdsdsMujtaba AzizNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- DfadsdsdsDokument3 SeitenDfadsdsdsMujtaba AzizNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- WBS Easy SlidesDokument26 SeitenWBS Easy SlidesMujtaba AzizNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- 247 1901 PDFDokument3 Seiten247 1901 PDFRõçkēy HãñdsômëNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Users of Database System: Faiqa MaqsoodDokument13 SeitenUsers of Database System: Faiqa MaqsoodMujtaba AzizNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Banking System A Database Project ReportDokument31 SeitenBanking System A Database Project Reportstrmohan85% (34)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Netsol Achieves Cmmi Level 5 RecertificationDokument2 SeitenNetsol Achieves Cmmi Level 5 RecertificationMujtaba AzizNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- CMMi PDFDokument12 SeitenCMMi PDFMujtaba AzizNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Irjet V5i3139 PDFDokument3 SeitenIrjet V5i3139 PDFRupadevi BNoch keine Bewertungen

- WBS Easy SlidesDokument26 SeitenWBS Easy SlidesMujtaba AzizNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Irjet V5i3139 PDFDokument3 SeitenIrjet V5i3139 PDFRupadevi BNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- T1 ET Application For Endorsement 6-4-2016 2Dokument22 SeitenT1 ET Application For Endorsement 6-4-2016 2Kriti Chhabra100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Digital PaymentDokument26 SeitenDigital PaymentMotivation GirlNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Sap FSCMDokument2 SeitenSap FSCMLiss RgNoch keine Bewertungen

- Rules of Preparing Bank Reconciliation StatementDokument1 SeiteRules of Preparing Bank Reconciliation StatementMohammadSufyanNoch keine Bewertungen

- Ibo-01 AssignmentDokument16 SeitenIbo-01 AssignmentArunNoch keine Bewertungen

- VAT Amount: DateDokument29 SeitenVAT Amount: DateChinoArcillasNoch keine Bewertungen

- Print Reciept RequestDokument1 SeitePrint Reciept RequestMuhd AbdullahiNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- B B D4 PDFDokument100 SeitenB B D4 PDFcristea george86% (14)

- Concept of E-Money PDFDokument14 SeitenConcept of E-Money PDFLakshay KocherNoch keine Bewertungen

- Government of Tamilnadu Contract PaymentDokument3 SeitenGovernment of Tamilnadu Contract PaymentprastacharNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Savara PDFDokument1 SeiteSavara PDFANISUR RAHMANNoch keine Bewertungen

- P2P Interview Preparation - by Dinesh Kumar S PDFDokument94 SeitenP2P Interview Preparation - by Dinesh Kumar S PDFAmitPradhanNoch keine Bewertungen

- Problem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer ADokument37 SeitenProblem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer AAldrin Lozano87% (15)

- Events Management Portfolio SampleDokument69 SeitenEvents Management Portfolio SampleKrizel Marie AquinoNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Lo vs. KJS Eco-Formwork System Phil., Inc (2003)Dokument1 SeiteLo vs. KJS Eco-Formwork System Phil., Inc (2003)Maya Julieta Catacutan-EstabilloNoch keine Bewertungen

- Credit AgreementDokument8 SeitenCredit AgreementchaniaNoch keine Bewertungen

- SAP Accounts Receivable and Accounts Payable ConfigurationDokument120 SeitenSAP Accounts Receivable and Accounts Payable ConfigurationSanjeev100% (12)

- Dr. Filemon C. Aguilar Memorial College of Las Pinas: Golden Gate Subdivision, Talon III, Las Pinas, 1747 Metro ManilaDokument18 SeitenDr. Filemon C. Aguilar Memorial College of Las Pinas: Golden Gate Subdivision, Talon III, Las Pinas, 1747 Metro ManilaOliver AbordoNoch keine Bewertungen

- Consolidated County Governments - Financial Statements Template FY 2017-18 Amended May 2018Dokument49 SeitenConsolidated County Governments - Financial Statements Template FY 2017-18 Amended May 2018Calvin kamothoNoch keine Bewertungen

- Electronic Payment System: Amit Kumar Nayak Roll No:29401 Regd No:1005105001Dokument17 SeitenElectronic Payment System: Amit Kumar Nayak Roll No:29401 Regd No:1005105001Amit Kumar NayakNoch keine Bewertungen

- Cancelling Bill of Exchange Error If There Is A Partial PaymentDokument2 SeitenCancelling Bill of Exchange Error If There Is A Partial PaymentDj Esel OfficialNoch keine Bewertungen

- Secupay API Flexv2 en 2Dokument37 SeitenSecupay API Flexv2 en 2P3RuZzINoch keine Bewertungen

- Recuerdo Vs PeopleDokument9 SeitenRecuerdo Vs PeopleGlorious El DomineNoch keine Bewertungen

- Article 1233Dokument5 SeitenArticle 1233mEOW SNoch keine Bewertungen

- Private Joint-Venture Investment Agreement: Remittance of Cash For The Joint Venture InvestmentsDokument9 SeitenPrivate Joint-Venture Investment Agreement: Remittance of Cash For The Joint Venture InvestmentsJosé FerreiraNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Takeda Global Sap FSCM SolutionDokument49 SeitenTakeda Global Sap FSCM SolutionMohamed Saidq Ali AliNoch keine Bewertungen

- 73003Dokument2 Seiten73003Izo SeremNoch keine Bewertungen

- Savings Account Statement: Capitec B AnkDokument1 SeiteSavings Account Statement: Capitec B AnkforshNoch keine Bewertungen

- European Dividend Swap Master Confirmation AgreementDokument12 SeitenEuropean Dividend Swap Master Confirmation AgreementmartinkemberNoch keine Bewertungen

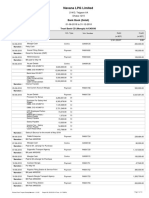

- Navana LPG Limited: Bank Book (Detail)Dokument13 SeitenNavana LPG Limited: Bank Book (Detail)M. A. Alim SohelNoch keine Bewertungen