Beruflich Dokumente

Kultur Dokumente

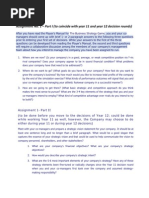

Capstone Round 3 Courier

Hochgeladen von

KitarpCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capstone Round 3 Courier

Hochgeladen von

KitarpCopyright:

Verfügbare Formate

Round: 3

Dec. 31, C109133

2022

Andrews Baldwin Chester

Sagar Bhawnani Srimanti Basak

zignesh biswal Ridhima Dutta

Anshu Jain Karthika Jayprakash

Sahil Jain Darshil Mehta

Maitri Joshi Saurabh Periwal

Ria Narayan Mrudul Sharma

Digby Erie Ferris

Rajarshi Chatterjee Chitij Asthana Tanmay Bajpai

Pratyusha Peesapati Avisekh Bharati Abhishek Bajpai

Vihang Sampat RIDHIMA GROVER Ankit Bansal

Divya Shah Rushil Gupta RAJESH PATIL

SHOBHIT SHARMA Divyanshu Malhan Apurva Sehgal

Manan Thacker Rajsantosi Mohapatr Prachi Toshniwal

Selected Financial Statistics

Andrews Baldwin Chester Digby Erie Ferris

ROS -1.3% 3.9% 5.4% -15.6% 8.7% -9.6%

Asset Turnover 0.84 1.33 1.17 0.55 1.06 0.78

ROA -1.1% 5.2% 6.3% -8.5% 9.2% -7.4%

Leverage 2.2 2.3 1.7 3.5 1.8 2.2

ROE -2.4% 11.9% 10.6% -30.3% 16.7% -16.6%

Emergency Loan $0 $0 $6,631,296 $31,562,208 $0 $23,261,092

Sales $124,187,478 $171,175,319 $159,362,318 $71,984,071 $252,101,218 $107,958,487

EBIT $6,473,672 $18,456,923 $19,663,223 ($4,190,677) $46,306,661 ($6,131,981)

Profits ($1,561,513) $6,723,097 $8,548,945 ($11,209,113) $21,905,712 ($10,346,801)

Cumulative Profit ($378,059) $24,949,605 $32,595,628 ($10,254,346) $35,666,800 $3,127,481

SG&A / Sales 16.1% 10.3% 11.7% 17.7% 10.9% 18.6%

Contrib. Margin % 34.0% 28.7% 34.2% 26.6% 42.9% 27.0%

CAPSTONE ® COURIER Page 1

Round: 3

Stock & Bonds C109133 Dec. 31, 2022

Stock Market Summary

MarketCap

Company Close Change Shares Book Value EPS Dividend Yield P/E

($M)

Andrews $16.95 $5.54 3,010,138 $51 $21.88 ($0.52) $0.00 0.0% -32.7

Baldwin $49.80 $1.27 2,000,000 $100 $28.14 $3.36 $1.89 3.8% 14.8

Chester $56.66 ($3.06) 2,117,216 $120 $37.92 $4.04 $0.50 0.9% 14.0

Digby $1.00 ($15.96) 2,399,812 $2 $15.42 ($4.67) $0.00 0.0% -0.2

Erie $63.65 $23.63 3,455,253 $220 $38.07 $6.34 $0.00 0.0% 10.0

Ferris $7.77 ($28.04) 2,456,999 $19 $25.34 ($4.21) $0.25 3.2% -1.8

Bond Market Summary

Company Series# Face Yield Close$ S&P Company Series# Face Yield Close$ S&P

Andrews Digby

14.0S2025 $13,060,717 13.8% 101.64 CCC 12.5S2023 $13,775,522 12.7% 98.25 DDD

10.1S2031 $10,000,000 12.1% 83.76 CCC 14.0S2025 $20,850,000 14.2% 98.85 DDD

11.9S2032 $37,500,000 12.9% 92.49 CCC 13.0S2031 $22,508,000 14.0% 92.71 DDD

Baldwin Erie

12.5S2023 $13,900,000 12.6% 99.21 CC 12.5S2023 $13,801,008 12.5% 100.27 BB

14.0S2025 $20,850,000 13.8% 101.41 CC 14.0S2025 $20,850,000 13.4% 104.31 BB

12.5S2031 $32,379 13.1% 95.45 CC 11.3S2030 $18,994,000 11.8% 95.56 BB

13.0S2032 $2,783,174 13.3% 97.86 CC 12.2S2032 $15,470,000 12.2% 100.00 BB

Chester Ferris

12.5S2023 $13,900,000 12.4% 100.63 BBB 12.5S2023 $13,900,000 12.6% 99.29 CCC

14.0S2025 $20,850,000 13.3% 105.30 BBB 14.0S2025 $20,850,000 13.8% 101.64 CCC

11.4S2032 $3,000,000 11.7% 97.72 BBB 11.3S2030 $10,000,000 12.5% 90.50 CCC

Next Year's Prime Rate8.50%

CAPSTONE ® COURIER Page 2

Round: 3

Financial Summary C109133 Dec. 31, 2022

Cash Flow Statement Survey Andrews Baldwin Chester Digby Erie Ferris

CashFlows from operating activities

Net Income(Loss) ($1,562) $6,723 $8,549 ($11,209) $21,906 ($10,347)

Adjustment for non-cash items:

Depreciation $11,127 $8,373 $10,687 $9,570 $16,427 $10,120

Extraordinary gains/losses/writeoffs $0 ($340) $0 $0 $0 $0

Changes in current assets and liablilities

Accounts payable ($2,952) $2,737 $2,565 ($314) ($479) ($1,993)

Inventory $7,114 ($2,122) ($17,352) ($20,021) ($17,985) ($8,150)

Accounts Receivable ($6,406) ($3,382) ($1,127) $4,573 ($18,005) $1,658

Net cash from operations $7,321 $11,990 $3,321 ($17,401) $1,862 ($8,711)

Cash flows from investing activities

Plant improvements(net) ($24,800) ($13,620) ($36,000) $0 ($67,400) ($14,880)

Cash flows from financing activities

Dividends paid $0 ($3,779) ($1,059) $0 $0 ($614)

Sales of common stock $5,500 $0 $7,000 $0 $23,044 $8,000

Purchase of common stock $0 $0 $0 $0 $0 $0

Cash from long term debt issued $37,500 $2,783 $3,000 $0 $15,470 $0

Early retirement of long term debt $0 $0 $0 $0 $0 $0

Retirement of current debt ($23,088) ($29,805) ($6,950) ($20,000) ($23,000) ($9,056)

Cash from current debt borrowing $15,000 $24,830 $2,000 $0 $30,000 $2,000

Cash from emergency loan $0 $0 $6,631 $31,562 $0 $23,261

Net cash from financing activities $34,912 ($5,972) $10,623 $11,562 $45,514 $23,591

Net change in cash position $17,434 ($7,601) ($22,056) ($5,838) ($20,024) $0

Balance Sheet Survey Andrews Baldwin Chester Digby Erie Ferris

Cash $17,434 $27,032 $0 $0 $13,300 $0

Accounts Receivable $10,207 $14,069 $13,098 $5,916 $31,081 $8,873

Inventory $18,619 $14,443 $21,800 $46,681 $17,985 $44,287

Total Current Assets $46,259 $55,545 $34,898 $52,598 $62,367 $53,160

Plant and equipment $166,900 $125,600 $160,300 $143,548 $246,400 $151,800

Accumulated Depreciation ($65,760) ($52,400) ($58,693) ($64,908) ($71,533) ($65,976)

Total Fixed Assets $101,140 $73,200 $101,607 $78,640 $174,867 $85,824

Total Assets $147,399 $128,745 $136,505 $131,238 $237,233 $138,984

Accounts Payable $5,963 $10,069 $9,833 $5,527 $6,570 $6,706

Current Debt $15,000 $24,830 $8,631 $31,562 $30,000 $25,261

Long Term Debt $60,561 $37,566 $37,750 $57,134 $69,115 $44,750

Total Liabilities $81,524 $72,464 $56,215 $94,223 $105,685 $76,717

Common Stock $40,860 $18,360 $25,360 $21,876 $70,488 $34,360

Retained Earnings $25,016 $37,921 $54,931 $15,139 $61,060 $27,907

Total Equity $65,875 $56,281 $80,290 $37,015 $131,548 $62,267

Total Liabilities & Owners Equity $147,399 $128,745 $136,505 $131,238 $237,233 $138,984

Income Statement Survey Andrews Baldwin Chester Digby Erie Ferris

Sales $124,187 $171,175 $159,362 $71,984 $252,101 $107,958

Variable Costs(Labor,Material,Carry) $81,904 $122,112 $104,903 $52,829 $144,043 $78,759

Depreciation $11,127 $8,373 $10,687 $9,570 $16,427 $10,120

SGA(R&D,Promo,Sales,Admin) $20,034 $17,684 $18,609 $12,776 $27,399 $20,111

Other(Fees,Writeoffs,TQM,Bonuses) $4,650 $4,549 $5,500 $1,000 $17,926 $5,100

EBIT $6,474 $18,457 $19,663 ($4,191) $46,307 ($6,132)

Interest(Short term,Long term) $8,876 $7,903 $6,243 $13,054 $11,918 $9,786

Taxes ($841) $3,694 $4,697 ($6,036) $12,036 ($5,571)

Profit Sharing $0 $137 $174 $0 $447 $0

Net Profit ($1,562) $6,723 $8,549 ($11,209) $21,906 ($10,347)

CAPSTONE ® COURIER Page 3

Round: 3

Production Analysis C109133 Dec. 31, 2022

2nd

Shift Auto

Unit & mation Capacity

Primary Units Inven Revision Age Pfmn Size Material Labor Contr. Over- Next Next Plant

Name Segment Sold tory Date Dec.31 MTBF Coord Coord Price

Cost

Cost Marg. time Round Round Utiliz.

Able Trad 1,268 545 6/8/2022 1.7 15000 6.6 13.3 $26.70 $9.32 $7.39 31% 0% 7.0 1,800 76%

Acre Low 2,236 180 1/19/2022 7.6 12000 3.0 17.0 $19.80 $5.19 $7.22 34% 57% 7.0 1,400 156%

Adam High 335 250 6/7/2022 1.5 21000 10.1 10.0 $38.50 $14.13 $7.39 37% 0% 5.0 850 42%

Aft Pfmn 563 0 7/17/2022 1.5 27000 11.2 14.6 $33.50 $14.89 $7.39 32% 0% 6.0 600 66%

Agape Size 437 62 9/20/2022 1.4 16000 5.5 9.2 $32.75 $11.38 $7.39 39% 0% 6.0 600 47%

Baker Trad 1,137 227 4/4/2022 1.7 16000 6.5 13.6 $28.50 $9.44 $7.53 38% 5% 5.0 1,100 104%

Bead Low 2,129 251 5/25/2015 7.6 14000 3.0 17.0 $20.50 $5.79 $5.74 41% 54% 7.5 1,500 152%

Bid High 734 125 12/4/2022 1.1 23500 11.6 8.4 $38.50 $16.25 $11.01 29% 33% 3.0 1,000 132%

Bold Trad 1,146 110 7/27/2022 1.5 19000 8.6 12.6 $28.50 $11.74 $12.18 13% 100% 3.5 600 198%

Buddy Trad 1,201 64 9/2/2022 1.5 17000 7.4 11.6 $28.50 $11.04 $12.18 19% 100% 3.5 650 198%

Cake Trad 1,018 799 5/21/2022 1.8 14000 6.5 13.5 $26.80 $8.85 $8.36 29% 24% 5.5 1,450 123%

Cedar Low 2,395 308 1/15/2020 7.6 13000 3.0 17.0 $19.80 $5.47 $5.08 45% 95% 8.5 1,450 193%

Cid High 145 65 3/21/2023 2.7 23000 9.1 11.6 $34.00 $13.52 $9.42 26% 0% 5.0 850 22%

Coat Pfmn 911 0 6/10/2022 1.7 27000 11.4 14.9 $34.00 $14.86 $9.82 27% 67% 5.0 550 166%

Cure Size 657 0 7/9/2022 1.6 17000 5.1 8.5 $33.75 $11.93 $9.73 36% 7% 5.0 550 106%

Cute High 681 111 4/18/2022 1.0 23000 10.6 9.4 $39.00 $15.14 $11.66 29% 100% 4.0 500 198%

Daze Trad 858 1,722 4/15/2021 3.1 17500 6.1 14.0 $25.99 $9.54 $7.38 15% 0% 5.0 1,804 99%

Dell Low 1,189 306 8/12/2021 3.2 14000 2.9 17.1 $20.50 $5.70 $7.38 33% 0% 5.0 1,400 99%

Dixie High 258 381 7/1/2021 3.1 23000 9.8 10.4 $38.75 $14.42 $7.38 31% 0% 5.0 900 44%

Dot Pfmn 202 0 7/26/2020 4.0 25000 10.4 15.3 $33.99 $13.66 $8.61 27% 0% 4.0 602 8%

Dune Size 257 164 12/9/2020 3.8 19000 4.7 9.6 $33.00 $11.86 $8.61 32% 0% 4.0 600 66%

Dove 0 0 5/17/2021 1.6 24000 10.9 14.6 $33.50 $0.00 $0.00 0% 0% 5.0 400 0%

Eat Trad 1,308 490 9/29/2022 1.6 15000 6.9 13.1 $27.00 $9.06 $6.27 42% 29% 8.0 1,400 128%

Ebb Low 2,750 46 1/29/2020 7.6 12000 3.0 17.0 $20.50 $4.93 $4.21 54% 100% 10.0 1,800 200%

Echo Trad 1,166 632 4/6/2022 1.8 15000 6.6 13.4 $27.00 $8.81 $7.02 37% 100% 8.0 900 200%

Edge Pfmn 899 0 8/25/2022 1.5 27000 11.9 14.3 $33.50 $14.59 $6.57 37% 50% 6.0 700 150%

Egg Size 1,199 0 7/31/2022 1.5 19000 5.7 8.1 $33.50 $12.31 $7.02 43% 100% 6.0 800 200%

Eee High 796 3 4/14/2022 1.0 22500 11.0 9.0 $38.50 $14.65 $8.42 39% 100% 5.0 600 200%

Eee2 High 728 0 2/2/2022 0.9 22500 11.4 8.6 $38.50 $14.98 $8.42 38% 100% 5.0 600 182%

Fast Trad 1,163 1,005 8/11/2022 1.7 17000 6.4 13.6 $26.25 $9.69 $8.62 22% 0% 4.5 2,000 50%

Feat Low 1,608 736 4/27/2022 2.9 14000 3.0 17.0 $19.75 $5.79 $7.02 30% 0% 6.0 2,000 99%

Fist High 203 468 12/11/2022 1.3 23500 10.5 10.0 $39.00 $15.05 $9.60 21% 0% 4.0 900 55%

Foam Pfmn 624 0 7/18/2022 1.7 27000 11.0 14.9 $34.00 $14.69 $9.85 28% 0% 3.5 600 99%

Fume Size 490 219 9/29/2022 1.5 19000 5.2 8.8 $33.75 $12.43 $9.85 32% 0% 3.5 600 87%

CAPSTONE ® COURIER Page 4

Traditional Segment Analysis C109133 Round: 3

Dec. 31, 2022

Traditional Statistics

Total Industry Unit Demand 9,619

Actual Industry Unit Sales |9,619

Segment % of Total Industry |29.4%

Next Year's Segment Growth Rate |9.2%

Traditional Customer Buying Criteria

Expectations Importance

1. Age Ideal Age = 2.0 47%

2. Price $18.50 - 28.50 23%

3. Ideal Position Pfmn 7.1 Size 12.9 21%

4. Reliability MTBF 14000-19000 9%

Top Products in Traditional Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Eat 13% 1,277 9/29/2022 6.9 13.1 $27.00 15000 1.61 $1,500 93% $1,000 63% 43

Able 13% 1,258 6/8/2022 6.6 13.3 $26.70 15000 1.74 $1,500 85% $1,800 53% 37

Echo 12% 1,163 4/6/2022 6.6 13.4 $27.00 15000 1.85 $1,500 58% $1,000 63% 36

Baker 12% 1,137 4/4/2022 6.5 13.6 $28.50 16000 1.75 $1,300 82% $1,200 69% 35

Fast 11% 1,096 8/11/2022 6.4 13.6 $26.25 17000 1.75 $1,500 82% $1,700 46% 36

Cake 10% 1,008 5/21/2022 6.5 13.5 $26.80 14000 1.81 $1,300 79% $1,300 45% 31

Bold 10% 946 7/27/2022 8.6 12.6 $28.50 19000 1.55 $1,300 79% $1,200 69% 31

Buddy 9% 895 9/2/2022 7.4 11.6 $28.50 17000 1.48 $1,300 79% $1,200 69% 28

Daze 8% 800 4/15/2021 6.1 14.0 $25.99 17500 3.08 $1,000 59% $1,000 35% 13

Agape 0% 40 9/20/2022 5.5 9.2 $32.75 16000 1.45 $1,500 68% $1,500 53% 0

CAPSTONE ® COURIER Page 5

Low End Segment Analysis C109133 Round: 3

Dec. 31, 2022

Low End Statistics

Total Industry Unit Demand 12,487

Actual Industry Unit Sales |12,487

Segment % of Total Industry |38.2%

Next Year's Segment Growth Rate |11.7%

Low End Customer Buying Criteria

Expectations Importance

1. Price $13.50 - 23.50 53%

2. Age Ideal Age = 7.0 24%

3. Ideal Position Pfmn 3.2 Size 16.8 16%

4. Reliability MTBF 12000-17000 7%

Top Products in Low End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Ebb 22% 2,750 1/29/2020 3.0 17.0 $20.50 12000 7.60 $1,500 92% $2,000 58% 29

Cedar 19% 2,395 1/15/2020 3.0 17.0 $19.80 13000 7.60 $1,300 79% $1,400 45% 26

Acre 18% 2,236 1/19/2022 3.0 17.0 $19.80 12000 7.60 $1,500 73% $1,800 44% 24

Bead 17% 2,129 5/25/2015 3.0 17.0 $20.50 14000 7.60 $1,300 81% $1,200 38% 23

Feat 13% 1,608 4/27/2022 3.0 17.0 $19.75 14000 2.91 $1,500 80% $1,700 51% 17

Dell 10% 1,189 8/12/2021 2.9 17.1 $20.50 14000 3.15 $1,400 80% $1,350 42% 13

Fast 1% 67 8/11/2022 6.4 13.6 $26.25 17000 1.75 $1,500 82% $1,700 51% 0

Daze 0% 58 4/15/2021 6.1 14.0 $25.99 17500 3.08 $1,000 59% $1,000 42% 1

Eat 0% 32 9/29/2022 6.9 13.1 $27.00 15000 1.61 $1,500 93% $1,000 58% 0

Cake 0% 10 5/21/2022 6.5 13.5 $26.80 14000 1.81 $1,300 79% $1,300 45% 0

Able 0% 10 6/8/2022 6.6 13.3 $26.70 15000 1.74 $1,500 85% $1,800 44% 0

Echo 0% 3 4/6/2022 6.6 13.4 $27.00 15000 1.85 $1,500 58% $1,000 58% 0

CAPSTONE ® COURIER Page 6

High End Segment Analysis C109133 Round: 3

Dec. 31, 2022

High End Statistics

Total Industry Unit Demand 4,006

Actual Industry Unit Sales |4,006

Segment % of Total Industry |12.3%

Next Year's Segment Growth Rate |16.2%

High End Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 11.6 Size 8.4 43%

2. Age Ideal Age = 0.0 29%

3. Reliability MTBF 20000-25000 19%

4. Price $28.50 - 38.50 9%

Top Products in High End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Eee 20% 796 4/14/2022 11.0 9.0 $38.50 22500 0.96 $1,500 57% $1,000 44% 32

Bid 18% 734 12/4/2022 11.6 8.4 $38.50 23500 1.13 $1,250 77% $1,200 54% 40

Eee2 18% 728 2/2/2022 YES 11.4 8.6 $38.50 22500 0.91 $1,500 61% $1,000 44% 37

Cute 17% 681 4/18/2022 10.6 9.4 $39.00 23000 1.03 $1,500 53% $1,500 38% 20

Adam 8% 335 6/7/2022 10.1 10.0 $38.50 21000 1.45 $1,500 64% $1,500 34% 11

Dixie 6% 258 7/1/2021 9.8 10.4 $38.75 23000 3.10 $1,300 78% $1,300 38% 6

Fist 5% 203 12/11/2022 10.5 10.0 $39.00 23500 1.31 $1,200 59% $1,600 35% 16

Cid 3% 139 3/21/2023 9.1 11.6 $34.00 23000 2.69 $200 37% $200 38% 4

Bold 3% 112 7/27/2022 8.6 12.6 $28.50 19000 1.55 $1,300 79% $1,200 54% 3

Buddy 1% 21 9/2/2022 7.4 11.6 $28.50 17000 1.48 $1,300 79% $1,200 54% 1

CAPSTONE ® COURIER Page 7

Performance Segment Analysis C109133 Round: 3

Dec. 31, 2022

Performance Statistics

Total Industry Unit Demand 3,293

Actual Industry Unit Sales |3,293

Segment % of Total Industry |10.1%

Next Year's Segment Growth Rate |19.8%

Performance Customer Buying Criteria

Expectations Importance

1. Reliability MTBF 22000-27000 43%

2. Ideal Position Pfmn 12.4 Size 13.9 29%

3. Price $23.50 - 33.50 19%

4. Age Ideal Age = 1.0 9%

Top Products in Performance Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Coat 28% 911 6/10/2022 YES 11.4 14.9 $34.00 27000 1.68 $1,250 71% $1,250 31% 27

Edge 27% 899 8/25/2022 YES 11.9 14.3 $33.50 27000 1.51 $1,500 74% $1,500 35% 41

Foam 19% 624 7/18/2022 YES 11.0 14.9 $34.00 27000 1.69 $1,000 60% $1,300 29% 23

Aft 17% 563 7/17/2022 YES 11.2 14.6 $33.50 27000 1.55 $1,500 66% $1,500 31% 29

Dot 6% 202 7/26/2020 YES 10.4 15.3 $33.99 25000 3.96 $1,000 59% $1,200 31% 8

Bold 3% 88 7/27/2022 8.6 12.6 $28.50 19000 1.55 $1,300 79% $1,200 26% 1

Cid 0% 6 3/21/2023 9.1 11.6 $34.00 23000 2.69 $200 37% $200 31% 0

CAPSTONE ® COURIER Page 8

Size Segment Analysis C109133 Round: 3

Dec. 31, 2022

Size Statistics

Total Industry Unit Demand 3,284

Actual Industry Unit Sales |3,284

Segment % of Total Industry |10.1%

Next Year's Segment Growth Rate |18.3%

Size Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 6.1 Size 7.6 43%

2. Age Ideal Age = 1.5 29%

3. Reliability MTBF 16000-21000 19%

4. Price $23.50 - 33.50 9%

Top Products in Size Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Egg 37% 1,199 7/31/2022 YES 5.7 8.1 $33.50 19000 1.52 $1,500 74% $1,500 38% 39

Cure 20% 657 7/9/2022 YES 5.1 8.5 $33.75 17000 1.60 $1,100 62% $1,100 31% 15

Fume 15% 490 9/29/2022 5.2 8.8 $33.75 19000 1.55 $1,000 55% $1,200 30% 16

Agape 12% 396 9/20/2022 5.5 9.2 $32.75 16000 1.45 $1,500 68% $1,500 34% 11

Buddy 9% 285 9/2/2022 7.4 11.6 $28.50 17000 1.48 $1,300 79% $1,200 29% 4

Dune 8% 257 12/9/2020 4.7 9.6 $33.00 19000 3.82 $1,000 55% $1,000 28% 3

CAPSTONE ® COURIER Page 9

Round: 3

Market Share C109133 Dec. 31, 2022

Actual Market Share in Units Potential Market Share in Units

Trad Low High Pfmn Size Total Trad Low High Pfmn Size Total

Industry Unit Sales 9,619 12,487 4,006 3,293 3,284 32,689 Units Demanded 9,619 12,487 4,006 3,293 3,284 32,689

% of Market 29.4% 38.2% 12.3% 10.1% 10.1% 100.0% % of Market 29.4% 38.2% 12.3% 10.1% 10.1% 100.0%

Able 13.1% 3.9% Able 13.1% 3.9%

Acre 17.9% 6.8% Acre 17.9% 6.8%

Adam 8.4% 1.0% Adam 7.6% 0.9%

Aft 17.1% 1.7% Aft 19.3% 1.9%

Agape 0.4% 12.1% 1.3% Agape 0.4% 10.8% 1.2%

Total 13.5% 18.0% 8.4% 17.1% 12.1% 14.8% Total 13.5% 18.0% 7.6% 19.3% 10.8% 14.8%

Baker 11.8% 3.5% Baker 11.8% 3.5%

Bead 17.1% 6.5% Bead 17.0% 6.5%

Bid 18.3% 2.3% Bid 16.9% 2.1%

Bold 9.8% 2.8% 2.7% 3.5% Bold 9.8% 2.6% 2.0% 3.4%

Buddy 9.3% 0.5% 8.7% 3.7% Buddy 9.3% 0.5% 7.9% 3.6%

Total 31.0% 17.1% 21.6% 2.7% 8.7% 19.4% Total 31.0% 17.1% 20.0% 2.1% 7.9% 19.1%

Cake 10.5% 3.1% Cake 10.5% 3.1%

Cedar 19.2% 7.3% Cedar 19.2% 7.3%

Cid 3.5% 0.2% 0.4% Cid 3.2% 0.4%

Coat 27.7% 2.8% Coat 20.2% 2.0%

Cure 20.0% 2.0% Cure 18.3% 1.8%

Cute 17.0% 2.1% Cute 15.6% 1.9%

Total 10.5% 19.3% 20.5% 27.9% 20.0% 17.8% Total 10.5% 19.3% 18.8% 20.3% 18.3% 16.6%

Daze 8.3% 0.5% 2.6% Daze 8.3% 0.5% 2.6%

Dell 9.5% 3.6% Dell 9.5% 3.6%

Dixie 6.4% 0.8% Dixie 5.9% 0.7%

Dot 6.1% 0.6% Dot 7.6% 0.8%

Dune 7.8% 0.8% Dune 7.1% 0.7%

Total 8.3% 10.0% 6.4% 6.1% 7.8% 8.5% Total 8.3% 10.0% 5.9% 15.0% 7.1% 9.2%

Eat 13.3% 0.3% 4.0% Eat 13.3% 0.3% 4.0%

Ebb 22.0% 8.4% Ebb 22.0% 8.4%

Echo 12.1% 3.6% Echo 12.1% 3.6%

Edge 27.3% 2.8% Edge 27.9% 2.8%

Egg 36.5% 3.7% Egg 42.5% 4.3%

Eee 19.9% 2.4% Eee 22.3% 2.7%

Eee2 18.2% 2.2% Eee2 20.7% 2.5%

Total 25.4% 22.3% 38.0% 27.3% 36.5% 27.1% Total 25.4% 22.3% 43.0% 28.0% 42.5% 28.3%

Fast 11.4% 0.5% 3.6% Fast 11.4% 0.5% 3.6%

Feat 12.9% 4.9% Feat 12.9% 4.9%

Fist 5.1% 0.6% Fist 4.7% 0.6%

Foam 18.9% 1.9% Foam 15.4% 1.6%

Fume 14.9% 1.5% Fume 13.4% 1.3%

Total 11.4% 13.4% 5.1% 18.9% 14.9% 12.5% Total 11.4% 13.4% 4.7% 15.4% 13.4% 11.9%

CAPSTONE ® COURIER Page 10

Round: 3

Perceptual Map C109133 Dec. 31, 2022

Andrews Baldwin Chester

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Able 6.6 13.3 6/8/2022 Baker 6.5 13.6 4/4/2022 Cake 6.5 13.5 5/21/2022

Acre 3.0 17.0 1/19/2022 Bead 3.0 17.0 5/25/2015 Cedar 3.0 17.0 1/15/2020

Adam 10.1 10.0 6/7/2022 Bid 11.6 8.4 12/4/2022 Cid 9.1 11.6 3/21/2023

Aft 11.2 14.6 7/17/2022 Bold 8.6 12.6 7/27/2022 Coat 11.4 14.9 6/10/2022

Agape 5.5 9.2 9/20/2022 Buddy 7.4 11.6 9/2/2022 Cure 5.1 8.5 7/9/2022

Cute 10.6 9.4 4/18/2022

Digby Erie Ferris

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Daze 6.1 14.0 4/15/2021 Eat 6.9 13.1 9/29/2022 Fast 6.4 13.6 8/11/2022

Dell 2.9 17.1 8/12/2021 Ebb 3.0 17.0 1/29/2020 Feat 3.0 17.0 4/27/2022

Dixie 9.8 10.4 7/1/2021 Echo 6.6 13.4 4/6/2022 Fist 10.5 10.0 12/11/2022

Dot 10.4 15.3 7/26/2020 Edge 11.9 14.3 8/25/2022 Foam 11.0 14.9 7/18/2022

Dune 4.7 9.6 12/9/2020 Egg 5.7 8.1 7/31/2022 Fume 5.2 8.8 9/29/2022

Dove 10.9 14.6 5/17/2021 Eee 11.0 9.0 4/14/2022

Eee2 11.4 8.6 2/2/2022

CAPSTONE ® COURIER Page 11

Round: 3

HR/TQM Report C109133 Dec. 31, 2022

HUMAN RESOURCES SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Needed Complement 638 1,002 920 602 1,070 760

Complement 638 1,002 920 602 1,070 760

1st Shift Complement 538 649 618 602 611 760

2nd Shift Complement 100 354 302 0 459 0

Overtime Percent 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Turnover Rate 7.0% 8.8% 9.6% 9.1% 7.0% 9.2%

New Employees 45 337 249 55 424 70

Separated Employees 45 0 0 57 0 215

Recruiting Spend $1,500 $2,000 $0 $1,500 $5,000 $10

Training Hours 80 30 10 25 80 20

Productivity Index 101.3% 101.1% 100.0% 100.0% 108.2% 100.0%

Recruiting Cost $112 $1,010 $249 $136 $2,543 $71

Separation Cost $225 $0 $0 $285 $0 $1,075

Training Cost $1,021 $601 $184 $301 $1,712 $304

Total HR Admin Cost $1,357 $1,611 $433 $722 $4,255 $1,450

Labor Contract Next Year

Wages $24.31 $24.31 $24.31 $24.31 $24.31 $24.31

Benefits 2,500 2,500 2,500 2,500 2,500 2,500

Profit Sharing 2.0% 2.0% 2.0% 2.0% 2.0% 2.0%

Annual Raise 5.0% 5.0% 5.0% 5.0% 5.0% 5.0%

Starting Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Ceiling Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Adjusted Labor Demands

Wages

Benefits

Profit Sharing

Annual Raise

Strike Days

TQM SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Process Mgt Budgets Last Year

CPI Systems $0 $0 $1,000 $0 $1,500 $1,000

VendorJIT $0 $0 $0 $0 $1,500 $0

Quality Initiative Training $0 $0 $1,500 $0 $1,500 $0

Channel Support Systems $0 $750 $0 $0 $1,500 $1,000

Concurrent Engineering $1,500 $750 $0 $0 $1,500 $700

UNEP Green Programs $0 $0 $0 $0 $1,500 $0

TQM Budgets Last Year

Benchmarking $0 $750 $0 $0 $1,500 $0

Quality Function Deployment Effort $0 $750 $0 $0 $1,500 $1,000

CCE/6 Sigma Training $0 $750 $1,500 $0 $1,500 $0

GEMI TQEM Sustainability Initiatives $0 $0 $0 $0 $1,500 $0

Total Expenditures $1,500 $3,750 $4,000 $0 $15,000 $3,700

Cumulative Impacts

Material Cost Reduction 0.00% 0.01% 0.47% 0.00% 5.03% 0.07%

Labor Cost Reduction 0.00% 0.04% 4.23% 0.00% 6.21% 0.02%

Reduction R&D Cycle Time 13.54% 3.93% 0.00% 0.00% 27.25% 5.33%

Reduction Admin Costs 0.00% 2.44% 0.00% 0.00% 43.11% 0.00%

Demand Increase 0.00% 0.32% 0.00% 0.00% 6.63% 0.97%

CAPSTONE ® COURIER Page 12

Round: 3

Ethics Report C109133 Dec. 31, 2022

ETHICS SUMMARY

Other (Fees, Writeoffs, etc.) The actual dollar impact. Example, $120 means Other increased by $120.

Demand Factor The % of normal. 98% means demand fell 2%.

Material Cost Impact The % of normal. 104% means matieral costs rose 4%.

Admin Cost Impact The % of normal. 103% means admin costs rose 3%.

Productivity Impact The % of normal. 104% means productivity increased by 4%.

Awareness Impact The % of normal. 105% means normal awareness was multiplied by 1.05.

Accessibility Impact The % of normal. 98% means normal accessiblity was multiplied by 0.98.

Normal means the value that would have been produced if the problem had not been presented.

No Impact Andrews Baldwin Chester Digby Erie Ferris

Linked Out

Other (Fees, Writeoffs, etc.) $0 $-1000 $-1000 $-1000 $-1000 $-1000 $-1000

Demand Factor 100% 97% 97% 97% 97% 97% 97%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 100%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

Total

Other (Fees, Writeoffs, etc.) $0 $-1000 $-1000 $-1000 $-1000 $-1000 $-1000

Demand Factor 100% 97% 97% 97% 97% 97% 97%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 100%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

CAPSTONE ® COURIER Page 13

Annual Report

Round: 3

Annual Report Erie C109133

Dec. 31, 2022

Balance Sheet

DEFINITIONS: Common Size: The common size column

simply represents each item as a percentage of total ASSETS 2022 2021

assets for that year. Cash: Your end-of-year cash Common

position. Accounts Receivable: Reflects the lag between

Size

delivery and payment of your products. Inventories: The Cash $13,300 5.6% $33,324

current value of your inventory across all products. A zero

Account Receivable $31,081 13.1% $13,076

indicates your company stocked out. Unmet demand

would, of course, fall to your competitors. Plant & Inventory $17,985 7.6% $0

Equipment: The current value of your plant. Accum Total Current Assets $62,366 26.3% $46,400

Deprec: The total accumulated depreciation from your

plant. Accts Payable: What the company currently owes

Plant & Equipment $246,400 104.0% $179,000

suppliers for materials and services. Current Debt: The

debt the company is obligated to pay during the next year Accumulated Depreciation ($71,533) -30.2% ($55,107)

of operations. It includes emergency loans used to keep Total Fixed Assets $174,867 73.7% $123,893

your company solvent should you run out of cash during Total Assets $237,233 100.0% $170,293

the year. Long Term Debt: The companys long term debt

is in the form of bonds, and this represents the total value LIABILITIES & OWNERS

of your bonds. Common Stock: The amount of capital

EQUITY

invested by shareholders in the company. Retained

Earnings: The profits that the company chose to keep Accounts Payable $6,570 2.8% $7,049

instead of paying to shareholders as dividends.

Current Debt $30,000 12.6% $23,000

Long Term Debt $69,115 29.1% $53,645

Total Liabilities $105,685 44.5% $83,694

Common Stock $70,488 29.7% $47,444

Retained Earnings $61,060 25.7% $39,155

Total Equity $131,548 55.5% $86,599

Total Liab. & O. Equity $237,233 100.0% $170,293

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account Cash Flows from Operating Activities 2022 2021

during the year. Cash injections appear as positive numbers and cash Net Income(Loss) $21,906 $9,444

withdrawals as negative numbers. The Cash Flow Statement is an excellent Depreciation $16,427 $11,240

tool for diagnosing emergency loans. When negative cash flows exceed Extraordinary gains/losses/writeoffs $0 ($99)

positives, you are forced to seek emergency funding. For example, if sales Accounts Payable ($479) ($359)

are bad and you find yourself carrying an abundance of excess inventory,

Inventory ($17,985) $17,388

the report would show the increase in inventory as a huge negative cash

Accounts Receivable ($18,005) ($3,180)

flow. Too much unexpected inventory could outstrip your inflows, exhaust

your starting cash and force you to beg for money to keep your company Net cash from operation $1,862 $34,436

afloat. Cash Flows from Investing Activities

Plant Improvements ($67,400) ($35,600)

Cash Flows from Financing Activities

Dividends paid $0 $0

Sales of common stock $23,044 $15,398

Purchase of common stock $0 $0

Cash from long term debt $15,470 $0

Retirement of long term debt $0 ($6,950)

Change in current debt(net) $7,000 $3,000

Net cash from financing activities $45,514 $11,448

Net change in cash position ($20,024) $10,284

Closing cash position $13,300 $33,324

Annual Report Page 14

Round: 3

Annual Report Erie C109133

Dec. 31, 2022

2022 Income Statement

2022 Common

(Product Name) Eat Ebb Echo Edge Egg Eee Eee2

Total

Size

Sales $35,322 $56,381 $31,471 $30,113 $40,151 $30,651 $28,013 $0 $252,101 100.0%

Variable Costs:

Direct Labor $8,206 $11,583 $8,181 $5,907 $8,413 $6,706 $6,128 $0 $55,123 21.9%

Direct Material $11,381 $14,178 $10,542 $13,006 $14,665 $11,861 $11,129 $0 $86,762 34.4%

Inventory Carry $880 $52 $1,219 $0 $0 $8 $0 $0 $2,158 0.9%

Total Variable $20,467 $25,813 $19,942 $18,912 $23,077 $18,575 $17,258 $0 $144,043 57.1%

Contribution Margin $14,856 $30,568 $11,529 $11,201 $17,074 $12,075 $10,755 $0 $108,058 42.9%

Period Costs:

Depreciation $3,547 $5,520 $2,280 $1,400 $1,600 $1,040 $1,040 $0 $16,427 6.5%

SG&A: R&D $755 $0 $265 $656 $586 $288 $89 $0 $2,640 1.0%

Promotions $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $0 $10,500 4.2%

Sales $1,000 $2,000 $1,000 $1,500 $1,500 $1,000 $1,000 $0 $9,000 3.6%

Admin $737 $1,176 $657 $628 $838 $639 $584 $0 $5,259 2.1%

Total Period $7,538 $10,196 $5,702 $5,684 $6,024 $4,467 $4,214 $0 $43,826 17.4%

Net Margin $7,317 $20,372 $5,827 $5,516 $11,050 $7,608 $6,541 $0 $64,232 25.5%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce the product Other $17,926 7.1%

that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation: Calculated on EBIT $46,307 18.4%

straight-line. 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each Short Term Interest $3,240 1.3%

product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget Long Term Interest $8,678 3.4%

for each product. Sales: The sales force budget for each product. Other: Chargs not included in other Taxes $12,036 4.8%

categories such as Fees, Write offs, and TQM. The fees include money paid to investment bankers and Profit Sharing $447 0.2%

brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs Net Profit $21,906 8.7%

include the loss you might experience when you sell capacity or liquidate inventory as the result of

eliminating a production line. If the amount appears as a negative amount, then you actually made money

on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest:

Interest expense based on last years current debt, including short term debt, long term notes that have

become due, and emergency loans, Long Term Interest: Interest paid on outstanding bonds. Taxes:

Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor

contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Annual Report Page 15

Das könnte Ihnen auch gefallen

- Courier 4Dokument14 SeitenCourier 4vivek singhNoch keine Bewertungen

- Courier C102348 R6 TDK0 CADokument15 SeitenCourier C102348 R6 TDK0 CAOscar Gabriel FernándezNoch keine Bewertungen

- Capst Courier 7 RoundDokument15 SeitenCapst Courier 7 Roundkuala singhNoch keine Bewertungen

- Round: 2 Dec. 31, 2022: Selected Financial StatisticsDokument15 SeitenRound: 2 Dec. 31, 2022: Selected Financial StatisticsAshesh DasNoch keine Bewertungen

- Courier Round 7 (2028)Dokument15 SeitenCourier Round 7 (2028)G H O S TNoch keine Bewertungen

- Capxm Final RoundDokument21 SeitenCapxm Final RoundManoj KuchipudiNoch keine Bewertungen

- Capstone Courier Round 5 ResultsDokument15 SeitenCapstone Courier Round 5 ResultsSanyam GulatiNoch keine Bewertungen

- Round: 7 Dec. 31, 2019: Selected Financial StatisticsDokument15 SeitenRound: 7 Dec. 31, 2019: Selected Financial StatisticsShubham UpadhyayNoch keine Bewertungen

- Courier C58866 Rounds 1-6 (With Scores)Dokument78 SeitenCourier C58866 Rounds 1-6 (With Scores)jackmooreausNoch keine Bewertungen

- CAPSIM Course Assignment 1Dokument1 SeiteCAPSIM Course Assignment 1Anup DhanukaNoch keine Bewertungen

- CapstoneDokument3.306 SeitenCapstoneVan Sj TYnNoch keine Bewertungen

- The CRM PhenomenonDokument16 SeitenThe CRM PhenomenonElena MateiNoch keine Bewertungen

- Capstone Courier Round 5Dokument13 SeitenCapstone Courier Round 5AkashNoch keine Bewertungen

- 256 Inquirer1Dokument41 Seiten256 Inquirer1sgoyal89Noch keine Bewertungen

- Route Mobile Limited: Axis CapitalDokument13 SeitenRoute Mobile Limited: Axis CapitalwhitenagarNoch keine Bewertungen

- CapstoneDokument772 SeitenCapstonePradeep KavangalNoch keine Bewertungen

- Super Project AnalysisDokument6 SeitenSuper Project AnalysisDHRUV SONAGARANoch keine Bewertungen

- POV - Balance in Balanced Scorecard - Service DeskDokument11 SeitenPOV - Balance in Balanced Scorecard - Service DeskAnsuman PradhanNoch keine Bewertungen

- B2 - Turn Around at YahooDokument7 SeitenB2 - Turn Around at YahooBarsha SinghNoch keine Bewertungen

- Maximize Your Investment: 10 Key Strategies for Effective Packaged Software ImplementationsVon EverandMaximize Your Investment: 10 Key Strategies for Effective Packaged Software ImplementationsNoch keine Bewertungen

- BAV Assignment-1 Group8Dokument18 SeitenBAV Assignment-1 Group8Aakash SinghalNoch keine Bewertungen

- Godrej AgrovetDokument37 SeitenGodrej AgrovetBandaru NarendrababuNoch keine Bewertungen

- MDCM Deliverable 1Dokument3 SeitenMDCM Deliverable 1api-314801558Noch keine Bewertungen

- Group 5 - Sec G - KEY Case SubmissionDokument41 SeitenGroup 5 - Sec G - KEY Case SubmissionPRIKSHIT SAINI IPM 2019-24 BatchNoch keine Bewertungen

- Vantage 2020: Famous Petha Yummy Vada PavDokument7 SeitenVantage 2020: Famous Petha Yummy Vada PavParth Hemant PurandareNoch keine Bewertungen

- Tata CustomersDokument140 SeitenTata Customersjai4747Noch keine Bewertungen

- Capsim Simulation: Team Eerie (Group 5)Dokument4 SeitenCapsim Simulation: Team Eerie (Group 5)Dhruv KumbhareNoch keine Bewertungen

- YUM! Brands DCF Financial ModelDokument54 SeitenYUM! Brands DCF Financial ModelLeo LuNoch keine Bewertungen

- Forbes Investor Jan2014 Master Buy List PDFDokument1 SeiteForbes Investor Jan2014 Master Buy List PDFForbesNoch keine Bewertungen

- DCF Application - Asian PaintsDokument6 SeitenDCF Application - Asian PaintsKashish PopliNoch keine Bewertungen

- Zipcar FishboneDokument24 SeitenZipcar FishboneKrishna Srikumar0% (3)

- Apo - 1 Aishwarya Mundada 210101139 Vamika Shah 210101121 Somnath Banerjee 210101109 Siddhant Goyal 210101166 Navneet Fatehpuria 210101182 Vissapragada Ananth 210101151 Victor D 21FRN-612Dokument3 SeitenApo - 1 Aishwarya Mundada 210101139 Vamika Shah 210101121 Somnath Banerjee 210101109 Siddhant Goyal 210101166 Navneet Fatehpuria 210101182 Vissapragada Ananth 210101151 Victor D 21FRN-612Siddhant Goyal100% (1)

- Mindtree Model ReferenceDokument66 SeitenMindtree Model Referencesaidutt sharma100% (1)

- Gap Analysis For ICICIDokument3 SeitenGap Analysis For ICICISandeep JannuNoch keine Bewertungen

- Gemini Electronics Template and Raw DataDokument9 SeitenGemini Electronics Template and Raw Datapierre balentineNoch keine Bewertungen

- CapstoneDokument3.303 SeitenCapstoneUTNoch keine Bewertungen

- Keywords Analysis - Top 20 Best-Sellers Based On SALES: Data Captured DateDokument3 SeitenKeywords Analysis - Top 20 Best-Sellers Based On SALES: Data Captured DateLi_Chen_LondonNoch keine Bewertungen

- Tire RatiosDokument7 SeitenTire Ratiospp pp100% (1)

- Capsimstrategy Blogspot Com AuDokument5 SeitenCapsimstrategy Blogspot Com AuCahyo EdiNoch keine Bewertungen

- Assignment - 2 AIT580: Shravan Chintha G01064991 Big DataDokument5 SeitenAssignment - 2 AIT580: Shravan Chintha G01064991 Big DataMulya ShreeNoch keine Bewertungen

- Problems-Finance Fall, 2014Dokument22 SeitenProblems-Finance Fall, 2014jyoon2140% (1)

- Assessment 1aDokument11 SeitenAssessment 1aMairaj WorkNoch keine Bewertungen

- COVID-19 Scenarios Financial Model Excel Template v1.0Dokument37 SeitenCOVID-19 Scenarios Financial Model Excel Template v1.0Setyo Tyas JarwantoNoch keine Bewertungen

- Capstone Round 0 ReportDokument16 SeitenCapstone Round 0 Reportcricket1223100% (1)

- CapsimDokument15 SeitenCapsimDamanpreet Singh100% (1)

- Gujarat, SMEDokument20 SeitenGujarat, SMEDeepak Pareek100% (1)

- Financial Modelling Cement CompanyDokument17 SeitenFinancial Modelling Cement CompanyAdarsh KumarNoch keine Bewertungen

- Mphasis: Performance HighlightsDokument13 SeitenMphasis: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Northwestern Mutual v2Dokument9 SeitenNorthwestern Mutual v2Shekhar PawarNoch keine Bewertungen

- S A M P L E: A Proposal Pack ForDokument11 SeitenS A M P L E: A Proposal Pack ForChee Eng HangNoch keine Bewertungen

- S6 E Working FinalDokument9 SeitenS6 E Working FinalROHIT PANDEYNoch keine Bewertungen

- Business Strategy SimulationDokument16 SeitenBusiness Strategy Simulationram sharmaNoch keine Bewertungen

- Comp-XM Basix Guide PDFDokument6 SeitenComp-XM Basix Guide PDFJai PhookanNoch keine Bewertungen

- Software Asssociates11Dokument13 SeitenSoftware Asssociates11Arslan ShaikhNoch keine Bewertungen

- Oshi Roosita Metabical 4183 (Version 1)Dokument6 SeitenOshi Roosita Metabical 4183 (Version 1)Patya NandaNoch keine Bewertungen

- Tata Pravesh Consumer Brochure DigitalDokument46 SeitenTata Pravesh Consumer Brochure Digitalnitin anandNoch keine Bewertungen

- M2018HRM053 Shyamkrishnan Jio MWallet Case PDFDokument4 SeitenM2018HRM053 Shyamkrishnan Jio MWallet Case PDFsaurabhNoch keine Bewertungen

- Sneaker Excel Sheet For Risk AnalysisDokument11 SeitenSneaker Excel Sheet For Risk AnalysisSuperGuyNoch keine Bewertungen

- Apple Quantitative AnalysisDokument6 SeitenApple Quantitative Analysisapi-356475460Noch keine Bewertungen

- Corporate Valuation Yeats and Tse CostingDokument27 SeitenCorporate Valuation Yeats and Tse CostingSagar IndranNoch keine Bewertungen

- Highlights of Health Centres in IndiaDokument4 SeitenHighlights of Health Centres in IndiaKitarpNoch keine Bewertungen

- ConditionsReport C71644 PDFDokument8 SeitenConditionsReport C71644 PDFRachel YoungNoch keine Bewertungen

- Capstone Round 3 CourierDokument15 SeitenCapstone Round 3 CourierKitarpNoch keine Bewertungen

- Sustainability and Corporate Social Responsibility at Hero Motocorp LTD."Dokument18 SeitenSustainability and Corporate Social Responsibility at Hero Motocorp LTD."KitarpNoch keine Bewertungen

- Sustainability and Corporate Social Responsibility at Hero Motocorp LTD."Dokument18 SeitenSustainability and Corporate Social Responsibility at Hero Motocorp LTD."KitarpNoch keine Bewertungen

- Acctg Lab 7Dokument8 SeitenAcctg Lab 7AngieNoch keine Bewertungen

- SAP Fi QuestionnaireDokument18 SeitenSAP Fi Questionnairejitinmangla970Noch keine Bewertungen

- Fixed Capital Working CapitalDokument26 SeitenFixed Capital Working CapitalShweta TrivediNoch keine Bewertungen

- Accountancy Model Paper-2-1Dokument9 SeitenAccountancy Model Paper-2-1Hashim SethNoch keine Bewertungen

- Depreciation, ProvisionDokument37 SeitenDepreciation, ProvisionSandhyaSharma100% (1)

- Chapter 17 ACCOUNTING FOR NOT FOR PROFIT ORGANIZATIONSDokument22 SeitenChapter 17 ACCOUNTING FOR NOT FOR PROFIT ORGANIZATIONSJammu JammuNoch keine Bewertungen

- 3RD Activity - ComprehensiveDokument19 Seiten3RD Activity - ComprehensiveJJ Longno100% (2)

- 1 1 4-Partnership-LiquidationDokument7 Seiten1 1 4-Partnership-LiquidationCundangan, Denzel Erick S.100% (2)

- Aditya: ForgeDokument17 SeitenAditya: ForgeanupNoch keine Bewertungen

- PPE Lecture With Assignments COMPLETEDokument4 SeitenPPE Lecture With Assignments COMPLETEsabina del monteNoch keine Bewertungen

- Cash Management Techniques of Selected ADokument50 SeitenCash Management Techniques of Selected AivyNoch keine Bewertungen

- Answer Q5Dokument2 SeitenAnswer Q5calebNoch keine Bewertungen

- Account ClassificationDokument3 SeitenAccount ClassificationUsama MukhtarNoch keine Bewertungen

- Partnership-FormationDokument47 SeitenPartnership-FormationStudent 101Noch keine Bewertungen

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDokument6 SeitenComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNoch keine Bewertungen

- Final Accounts of Sole ProprietorDokument33 SeitenFinal Accounts of Sole Proprietorrasmi78009Noch keine Bewertungen

- Net Worth Tracking SheetDokument1 SeiteNet Worth Tracking SheetNestor GonzalezNoch keine Bewertungen

- Chapter 2 - Understanding The Balance SheetDokument54 SeitenChapter 2 - Understanding The Balance SheetNguyễn Yến NhiNoch keine Bewertungen

- DATAMETICA - SOLUTIONS - PRIVATE - LIMITED - 2021-22 - Consolidated Financial Statement - XMLDokument58 SeitenDATAMETICA - SOLUTIONS - PRIVATE - LIMITED - 2021-22 - Consolidated Financial Statement - XMLSarah AliceNoch keine Bewertungen

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDokument60 SeitenIntermediate Accounting: Prepared by University of California, Santa BarbaraJamesNoch keine Bewertungen

- GTU MBA 2018 3rd Semester Winter 2830201 Strategic Financial ManagementDokument4 SeitenGTU MBA 2018 3rd Semester Winter 2830201 Strategic Financial ManagementAbhishek ChaturvediNoch keine Bewertungen

- Reviewer 1ST PPT (Fabm)Dokument15 SeitenReviewer 1ST PPT (Fabm)Jihane TanogNoch keine Bewertungen

- Modul AKLII-2 - Investor Acc MethodDokument31 SeitenModul AKLII-2 - Investor Acc MethodLisa SilviNoch keine Bewertungen

- CW 3 SolutionDokument2 SeitenCW 3 SolutionMtl AndyNoch keine Bewertungen

- Trout Inc. Prepared The Following Production Report-Weighted AverageDokument4 SeitenTrout Inc. Prepared The Following Production Report-Weighted AverageJalaj GuptaNoch keine Bewertungen

- Net Phone ProjectDokument4 SeitenNet Phone ProjectUyên TrầnNoch keine Bewertungen

- BUY BUY BUY BUY: Apollo Hospitals Enterprise LTDDokument14 SeitenBUY BUY BUY BUY: Apollo Hospitals Enterprise LTDnit111Noch keine Bewertungen

- Paradocs Bis S.A.R.LDokument0 SeitenParadocs Bis S.A.R.LAnti-corruption Action CentreNoch keine Bewertungen

- Akl Bab 9Dokument23 SeitenAkl Bab 9nisaa12Noch keine Bewertungen

- Entrepreneurship Business Plan Group 1Dokument44 SeitenEntrepreneurship Business Plan Group 1Martha NaldaNoch keine Bewertungen