Beruflich Dokumente

Kultur Dokumente

Accounting 2nd Year (R & T) FLp-2

Hochgeladen von

imtiaz ahmedOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting 2nd Year (R & T) FLp-2

Hochgeladen von

imtiaz ahmedCopyright:

Verfügbare Formate

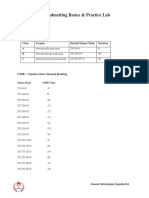

KIPS COLLEGE

ISB-RWP-GRW-FSD-LHR-KSR-MTN

CLASS: SY SUBJECT: Accounting FLP-2

Time: 03:00 Hours Marks: 100 DATE: 07–04–2018

Name: ____________________________Class: ________________ Roll No. ________________

Qno.1 Choose the correct statement: - (10)

1- At the time of admission of a new partner in partnership, goodwill raised should be written off in:

(a) Gaining ratio (b) New profit sharing ratio (c)Old profit sharing ratio (d) Sacrifice ratio

2- It is prepared to calculate the profit or loss of old partners on the admission of a new partner:

(a) Revaluation account (b)Realization account (c) Profit & loss account (d) All of these

3- Revaluation account is also known as:

(a) Revaluation account (b) Profit & loss adjustment account (c)Profit & loss account (d) Capital

account

4- Revaluation profit or loss is credited or debited to old partner’s capital accounts in:

(a) Gaining ratio (b) New profit sharing ratio (c) Old profit sharing ratio (d) Sacrifice

ratio

5-On admission of a partner, the decrease in the value of assets should be debited to:

(a) Revaluation account (b) Realization account (c) Assets account (d) New partner’s capital account

6- On admission of a partner, the decrease in the value of assets should be debited to:

(a) Revaluation account (b) Realization account (c) Assets account (d) Partners capital account

7-The increase in the value of liabilities on the admission of a new partner should be credited to:

(a) Revaluation account (b) Liabilities account (c)Profit and loss account(d) Partners capital account

8- The decrease in the value of liabilities on the admission of a new partner should be credited to:

(a) Profit and loss adjustment account (b) Liabilities account (c) Profit and loss account

(d) Partners capital account

9- Profit on revaluation should be credited to:

(a) Revaluation account (b) Liabilities account (c) Assets account (d) Old partners capital

account

10- The decrease in the value of building, stock on the admission of a partner should be debited to:

Building account (b) Stock account (c) ‘a’ & ‘b’ (d) Revaluation account

11- It sets out the terms on which partners agreed to form a partnership:

(a) Partnership agreement (b) Partnership deed (c) “a” & “b” (d) None

12- In the absence of an agreement, profit and loss are divided by partners in the ratio of:

(a) Capital (b)Time devoted by each partner (c) Equally (d) Interest on capital

13- In the absence of an agreement, interest on drawings is to be charged by the firm at the rate

of:

(a) 5% p.a. (b) 6% p.a. (c) 10% p.a. (d) None of these

14- In the absence of an agreement, interest on loan advanced by a partner to the firm is allowed

at the rate of:

(a) Six per cent (b) Five per cent (c) Twelve per cent (d) Seven per cent

15- The partnership act is:

(a) 1932 (b) 1912 (c) 1962 (d) 1984

16- When capital is introduced by a partner, we should be debited to:

(a) Cash account (b) Capital account (c)Current account (d) Loan account

17- Partner’s current accounts should be opened when capital accounts are:

(a) Fixed (b) Fluctuating (c) Current (d) Nominal

18- The maximum amount which each partner will draw from the business in anticipation of the

share of profit is his:

(a) Drawings (b) Profit (c) Loss (d) Capital

19- The current account of a partner:

(a) Will always have a credit balance (b) Will always have a debit balance

(c) May have a debit balance or a credit balance (d) none of these

20- The relation between person who have agreed to share the profits of a business carried on by

all or any one of them acting for all is called:

(a) Sole proprietorship (b) Partnership (c) Joint stock company (d) Individual

KIPS COLLEGE

ISB-RWP-GRW-FSD-LHR-KSR-MTN

CLASS: SY SUBJECT: Accounting FLP-2

Time: 03:00 Hours Marks: 100 DATE: 07–04–2018

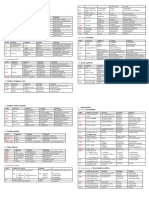

Short Questions: (10X2 = 20)

(1) Realization Account (2) Dissolution of firm

(3) Dissolution by court (4) Growing ratio and sacrifice ratio

(5)Revaluation Method (6) Memorandum Revaluation Account

(7) Profit and loss appropriation account (8) Dissolution on happening of certain contingencies

(9) Dissolution by Agreement (10) Define firm

(11) Active Partner (12) Sleeping partner (13) Junior Partner

Section II

Long Questions: (20 X 3 = 60)

Q1: A company issued 20,000 shares of Rs.10 each to general public at 10% premium. Applications

were received for 35000 shares. Shares were allotted and money was refunded to the applicants of

15000 shares.

Record the above transactions in the books of the company and draft the Balance Sheet.

Q2: Imran textiles Ltd. acquired the business of M/s Noor and Sons. The assets and liabilities of

M/s Noor & Sons at book value are given below:

Land & Building 50, 000 Sundry Creditors 10, 000

Machinery 40, 000

Furniture 14, 000

Debtors 5000

The purchase consideration is to be paid by the company in fully paid up shares of Rs. 10 each. Pass

the journal entries if the shares are issued:

(a) At par (b) At 10% Discount (c) At 10% Premium

Q3: Pass the following entries of debentures in each case:

(i) Debentures issued at Rs. 90 and redeemable at Rs. 100

(ii) Debentures issued at Rs. 100 and redeemable at Rs. 110.

(iii) Debentures issued at Rs. 110 and redeemable at Rs. 100.

(iv) Debentures issued at Rs. 90 and redeemable at Rs. 110.

(v) Debentures issued at Rs. 100 and redeemable at Rs. 100.

Q4: On 1st July 2001, a firm purchased machinery worth rupees 50, 000 and spend 5000 on its

installation. On July, 2003, a firm purchased another machine worth Rs. 30, 000 on April 2004 first

machine was sold at Rs. 40000.

Depreciation rate is 10% on original cost method.

Prepare machinery account for 5 years.

A company purchased a truck for rupees 400000

Residual value is 20000.

Life of truck is 10 years.

Rate of depreciation is 15%. Prepare truck account for 5 years.

Das könnte Ihnen auch gefallen

- Jaiib NewDokument18 SeitenJaiib NewShreyas NatialaNoch keine Bewertungen

- Sem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease AccountingDokument11 SeitenSem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease Accountinglol0% (1)

- Accountancy XIIDokument6 SeitenAccountancy XIIGurmehar KaurNoch keine Bewertungen

- JAIIB Question Papers On Accounting and Finance Previous Year QuestionDokument18 SeitenJAIIB Question Papers On Accounting and Finance Previous Year Questionanon_980188189Noch keine Bewertungen

- JAIIB Model Paper (Accouting & Finance)Dokument25 SeitenJAIIB Model Paper (Accouting & Finance)praveenaero3Noch keine Bewertungen

- Reg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksDokument12 SeitenReg. No 20UCO3CC5 Jamal Mohamed College (Autonomous) Tiruchirappalli - 620 020 Commerce Third Semester Core: Time: Three Hours Maximum: 75 MarksMuhammad ThanveerNoch keine Bewertungen

- CPT Model Test PaperDokument41 SeitenCPT Model Test PaperAshraf ValappilNoch keine Bewertungen

- 12 Accc 23Dokument8 Seiten12 Accc 23Shail CareerNoch keine Bewertungen

- Jaiib Af Mcqs Mod DDokument19 SeitenJaiib Af Mcqs Mod DPooja GarodharaNoch keine Bewertungen

- NAVODAYA VIDYALAYA SAMITI MID TERM EXAMINATIONDokument7 SeitenNAVODAYA VIDYALAYA SAMITI MID TERM EXAMINATIONGaurang AgarwalNoch keine Bewertungen

- R.E.D. Group Midterm Accountancy ExamDokument6 SeitenR.E.D. Group Midterm Accountancy ExamGaurang AgarwalNoch keine Bewertungen

- Sem1 MCQ FinancialaccountDokument14 SeitenSem1 MCQ FinancialaccountHema LathaNoch keine Bewertungen

- 12 Accountancy QP Prep T1 21Dokument9 Seiten12 Accountancy QP Prep T1 21mitaliNoch keine Bewertungen

- Jaiib Questions Accounting & Finance Module D Part 1: Current InvestmentsDokument120 SeitenJaiib Questions Accounting & Finance Module D Part 1: Current InvestmentsBiswajit DasNoch keine Bewertungen

- Sem1 MCQ FinancialaccountDokument14 SeitenSem1 MCQ FinancialaccountVemu SaiNoch keine Bewertungen

- Accountancy Class XII Practice PaperDokument7 SeitenAccountancy Class XII Practice PaperмŕίȡùĻ νέŕмάNoch keine Bewertungen

- Class 12 Term 1 AccountancyDokument7 SeitenClass 12 Term 1 AccountancyTûshar ThakúrNoch keine Bewertungen

- Mcqs Bba 3rdDokument4 SeitenMcqs Bba 3rdmuqaddus zulfiqarNoch keine Bewertungen

- CPT Model Papers 1Dokument418 SeitenCPT Model Papers 1Kalyan SagarNoch keine Bewertungen

- Xii Mcqs CH 1 Accounting For Not For Profit Organisations 13 Files MergedDokument43 SeitenXii Mcqs CH 1 Accounting For Not For Profit Organisations 13 Files MergedTanu Tarar100% (1)

- P5 PDFDokument20 SeitenP5 PDFTeddy BearNoch keine Bewertungen

- Question Bank - XII Accounts MCQDokument192 SeitenQuestion Bank - XII Accounts MCQHarshal KaramchandaniNoch keine Bewertungen

- First Formal Weekly Test For Coaching ClassesDokument3 SeitenFirst Formal Weekly Test For Coaching ClassesFarhan Ali ShahNoch keine Bewertungen

- MMCAC31Dokument7 SeitenMMCAC31imphoenix008Noch keine Bewertungen

- STO Model Question PaperDokument26 SeitenSTO Model Question PaperMumthaz MohammedNoch keine Bewertungen

- SF Financial-Accounting-18UCO101Dokument27 SeitenSF Financial-Accounting-18UCO101MugeshNoch keine Bewertungen

- STD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsDokument4 SeitenSTD: 12 First Term MARKS:100 Subject: Accounts Duration:3 HrsAayush PatelNoch keine Bewertungen

- Mock Full Book 02 BookDokument3 SeitenMock Full Book 02 Bookgoharmahmood203Noch keine Bewertungen

- ULTIMATE BOOK OF ACCOUNTANCY CLASS 12Dokument14 SeitenULTIMATE BOOK OF ACCOUNTANCY CLASS 12TrostingNoch keine Bewertungen

- Accounts: Common Proficiency Test - CPT Innova Sample PaperDokument19 SeitenAccounts: Common Proficiency Test - CPT Innova Sample PapercptinnovaNoch keine Bewertungen

- Paper II ITO Advancedaccountancy - 13072009Dokument15 SeitenPaper II ITO Advancedaccountancy - 13072009mukeshNoch keine Bewertungen

- Corporate Accounting MCQDokument10 SeitenCorporate Accounting MCQKumareshg GctkumareshNoch keine Bewertungen

- TERM-1 ACCOUNTANCY MCQ QUESTION BANKDokument12 SeitenTERM-1 ACCOUNTANCY MCQ QUESTION BANKaes event100% (1)

- CA CPT Accountancy Sample QuestionsDokument11 SeitenCA CPT Accountancy Sample QuestionsyuthikasNoch keine Bewertungen

- II Puc Accountancy MCQ Dec 2022Dokument15 SeitenII Puc Accountancy MCQ Dec 2022m2699291Noch keine Bewertungen

- Model Test Paper-2Dokument22 SeitenModel Test Paper-2none10069Noch keine Bewertungen

- Last Assignment of PRC-04 August 2022Dokument63 SeitenLast Assignment of PRC-04 August 2022ali khanNoch keine Bewertungen

- 1 ACF-Web Test 1 FinalDokument4 Seiten1 ACF-Web Test 1 FinalSathishkumar NatarajanNoch keine Bewertungen

- Partnership FundamentalsDokument5 SeitenPartnership Fundamentalsdiyadhannawat06Noch keine Bewertungen

- Xii Mcqs CH - 8 Dissolution of Partnership FirmDokument4 SeitenXii Mcqs CH - 8 Dissolution of Partnership FirmJoanna GarciaNoch keine Bewertungen

- +2-ACCOUNTANCY-1-2-3-5-MARK THEORY MATERIAL-EM-2023 (1)Dokument34 Seiten+2-ACCOUNTANCY-1-2-3-5-MARK THEORY MATERIAL-EM-2023 (1)saravanan.ma0611Noch keine Bewertungen

- Model Test Paper-1Dokument24 SeitenModel Test Paper-1dawraparul27Noch keine Bewertungen

- Advanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoiceDokument15 SeitenAdvanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoicepallaviNoch keine Bewertungen

- CBSE Class 12 Accountancy Retirement and Death of Partner Worksheet Set ADokument4 SeitenCBSE Class 12 Accountancy Retirement and Death of Partner Worksheet Set AMeena DhimanNoch keine Bewertungen

- Indicate The Correct Answer: 1.: Ans: (A) ShareholdersDokument39 SeitenIndicate The Correct Answer: 1.: Ans: (A) Shareholdersritika agrawalNoch keine Bewertungen

- Basic AccountingDokument35 SeitenBasic AccountingKaraCassandra LayuganNoch keine Bewertungen

- Corporate Accounting Exam QuestionsDokument6 SeitenCorporate Accounting Exam QuestionsUtkalika R SahooNoch keine Bewertungen

- AccountsDokument100 SeitenAccountskaran kNoch keine Bewertungen

- Wa0003.Dokument173 SeitenWa0003.labiot324Noch keine Bewertungen

- 12 Acc. PB 1Dokument7 Seiten12 Acc. PB 1Chirag KapoorNoch keine Bewertungen

- Model Test Paper-1Dokument24 SeitenModel Test Paper-1Rupali RoyNoch keine Bewertungen

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Dokument7 Seiten588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431Noch keine Bewertungen

- 12th Accountancy - Public Exam Model Question Paper - English Medium PDF DownloadDokument6 Seiten12th Accountancy - Public Exam Model Question Paper - English Medium PDF DownloadMohamed Jamil IrfanNoch keine Bewertungen

- Accountancy Final (R) XIIDokument55 SeitenAccountancy Final (R) XIIKavin .DNoch keine Bewertungen

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Von EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- CPA Financial Accounting and Reporting: Second EditionVon EverandCPA Financial Accounting and Reporting: Second EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- Electrocraft EAD BLDC CatalogDokument16 SeitenElectrocraft EAD BLDC CatalogElectromateNoch keine Bewertungen

- Curtis CatalogDokument9 SeitenCurtis CatalogtharngalNoch keine Bewertungen

- BetaDokument16 SeitenBetaAkshita Saxena100% (2)

- e-GP System User Manual - Tender Evaluation Committee UserDokument82 Seitene-GP System User Manual - Tender Evaluation Committee UserMd. Jakaria ApuNoch keine Bewertungen

- SubNetting Practice LabDokument3 SeitenSubNetting Practice LabOdoch HerbertNoch keine Bewertungen

- Syllabi M.Tech. WRDMDokument114 SeitenSyllabi M.Tech. WRDMMadhab KoiralaNoch keine Bewertungen

- Rso PDFDokument120 SeitenRso PDFjohn shepardNoch keine Bewertungen

- Superalloy Brochure PDFDokument16 SeitenSuperalloy Brochure PDFDaren NeradNoch keine Bewertungen

- UG WeibullDokument776 SeitenUG WeibullCharles GuzmanNoch keine Bewertungen

- Max Born, Albert Einstein-The Born-Einstein Letters-Macmillan (1971)Dokument132 SeitenMax Born, Albert Einstein-The Born-Einstein Letters-Macmillan (1971)Brian O'SullivanNoch keine Bewertungen

- Enzyme Inhibition and ToxicityDokument12 SeitenEnzyme Inhibition and ToxicityDaniel OmolewaNoch keine Bewertungen

- Hydrocarbons NotesDokument15 SeitenHydrocarbons Notesarjunrkumar2024Noch keine Bewertungen

- Capsule Proposal TemplateDokument5 SeitenCapsule Proposal Templatematain elementary SchoolNoch keine Bewertungen

- ASP Flashcards - QuizletDokument36 SeitenASP Flashcards - QuizletRehman MuzaffarNoch keine Bewertungen

- Affixation (Landscape)Dokument4 SeitenAffixation (Landscape)difafalahudinNoch keine Bewertungen

- ANSYS ACT Developers GuideDokument506 SeitenANSYS ACT Developers GuideEDIZONNoch keine Bewertungen

- GL Setup ListDokument88 SeitenGL Setup ListSundaroraclefinNoch keine Bewertungen

- Inferential Statistics: Estimation and Confidence IntervalsDokument19 SeitenInferential Statistics: Estimation and Confidence IntervalsHasan HubailNoch keine Bewertungen

- Astm A6 A6m-08Dokument62 SeitenAstm A6 A6m-08Vũ Nhân HòaNoch keine Bewertungen

- VCTDS 00543 enDokument62 SeitenVCTDS 00543 enguido algaranazNoch keine Bewertungen

- Centrifugal Compressor Operation and MaintenanceDokument16 SeitenCentrifugal Compressor Operation and MaintenanceNEMSNoch keine Bewertungen

- Mitsubishi diesel forklifts 1.5-3.5 tonnesDokument2 SeitenMitsubishi diesel forklifts 1.5-3.5 tonnesJoniNoch keine Bewertungen

- Geophysical Report Megnatic SurveyDokument29 SeitenGeophysical Report Megnatic SurveyShahzad KhanNoch keine Bewertungen

- Excel Dynamic Arrays: Department Item Quantity Price Total $Dokument5 SeitenExcel Dynamic Arrays: Department Item Quantity Price Total $Bilal Hussein SousNoch keine Bewertungen

- Unit-3 BioinformaticsDokument15 SeitenUnit-3 Bioinformaticsp vmuraliNoch keine Bewertungen

- PM Master Data Template v1Dokument72 SeitenPM Master Data Template v1Naseer SultanNoch keine Bewertungen

- Toyo ML210 thread cutting gear assembly drawingsDokument12 SeitenToyo ML210 thread cutting gear assembly drawingsiril anwarNoch keine Bewertungen

- Bill of Material: The Hanover CompanyDokument17 SeitenBill of Material: The Hanover CompanyLIVIANoch keine Bewertungen

- Gabion Retaining Wall Design GuideDokument30 SeitenGabion Retaining Wall Design GuideThomas Hill80% (5)

- Spesifikasi Produk SL-500Dokument2 SeitenSpesifikasi Produk SL-500tekmed koesnadiNoch keine Bewertungen