Beruflich Dokumente

Kultur Dokumente

Boice Mellon Beach House Transfer

Hochgeladen von

Glen HellmanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Boice Mellon Beach House Transfer

Hochgeladen von

Glen HellmanCopyright:

Verfügbare Formate

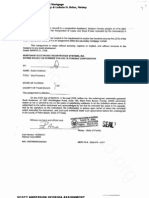

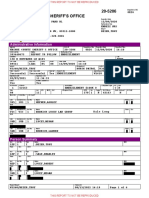

1111111Hiil11111 lllll llHI 1111111111111

-

0 ?019089414 Bk 03847 Pss 94S-949

Recorded Count~ of Cape Ma~, HJ

~

Consideration S1.00

•

Cape May County

Reult~ Transfer Fee $0.00

Document Summary Sheet Date 04/09/2019 14:13:29 B~ JK

Rita Marie Fulsiniti, Count~ Clerk

Return Name and Address Recording Fees $83.00

CAPE MAY COUNTY CLERK Raymond L. Poling, P .C.

PO BOX 5000 4210 Landis Ave

7 NORTII MAIN STREET Sea Isle City NJ 08243

CAPE MAY COURT HOUSE

NJ 08210-5000

Official Use Only

Submitting Company Raymond L. Poling, P.C.

Document Date (mmldd!WW) 03/18/2019

Document Type DEED

No, of Pages of the Original Signed Document

(Including the cover sheet) 5

Cqnsideration Amount (ff applfcable) $1.00

Name(s)

I (Last Name First Name Middle Initial Suffix) Address (Optlonol)

(or Company Name as written)

First Party Boice, Daniel K 8805 Wlnthrop Drive Alexandria VA 22308

(Gron tor or Mortgagor or

Assignor)

(Enter up to five names)

Name(s)

I (Last Name First Name Middle Initial Suffix) Address (Optional)

£ Second Party

·{or Company Name as written)

Mellon, Jennifer L 625 S Saint Asaph Street Alexandrla VA 22314

~ ) (Grantee or Mortgagee or

Assignee)

(Enter up to five names)

Munfcfpalfty Block Lot Qualffler Property Address

Parcel Information Sea Isle City 73.02 757 C-W 14 73rd Street, West Unit

(Enter up to three entries)

Book Type Book Begf nnfns Page Instrument No. Recorded/Ffle Date

Reference Information

(Enter up ta three entries)

*DO HOT REMOVE THIS PAGE.

COVER SHEET [DOCUMENT SUMMARY FORM] IS PART OF CAPE MAY COUNTY F1UNG RECORD.

RETAIN THIS PAGE FOR FUTURE REFERENCE.

Book384 7/Page945 CFN#2019089414 Page 1 of 5

POOlS-19/mmJ

BARGAIN AND SALE DEED

Prepared by:

DEED

~ ~,I }, = \y;' ,2019

Raymond L. Poling, Esq.

This Deed is made on

BETWEEN DANIEL K. BOICE, whose address is 8805 Winthrop Drive, Alexandria, VA 22308,

·referred to as the Grantor,

AND JENNIFER L. MELLON, whose address is 625 S. Saint Asaph Street, Alexandria, VA

22314, referred to as the Grantee.

The words "Grantor" and "Grantee" shall mean all Grantors and all Grantees listed above.

Transfer of Ownership. The Grantor grants and conveys (transfers ownership ·of) the property

described below to Grantee. This transfer is made for $1.00. The Grantor acknowledges receipt of said

consideration.

Tax Map Reference. [N.J.S;A. 46:26A-3(a)(5)(b)] City of Sea Isle City, County of Cape May,

Block No. 73.02 Lot No. 757 Qualifier No. (C-W) Account No.

Property. The property consists of the land and all the buildings and structures on the land in the

City of Sea Isle City, County of Cape May and State of New Jersey. The legal description is:

ALL the following described parcel lying and being in the City of Sea Isle City, County of Cape May, State

of New Jersey, including the appurtenances thereto in fee simple, subject to the provisions of the New Jersey

Condominium Act (RS. 46:8B-1 et seq.), its amendments and supplements, and to the provisions of that

Master Deed of "14 73n1 STREET CONDOMINIUM", a_ ~~dominium date4 Augµst 10, 2017 apd

- - - recorded August 23, 2017-in the- tape May-Counfy Clerk's office in Deed Book 3747, page 616; more

particularly described as Unit West in said condominium, and an undivided 50% interest in the common

elements of said condominium, which unit and common elements have been more specifically defined in the

Master Deed aforesaid, as same may be lawfully amended from time to time in conformity with RS. 46:8B-

10.

BEING KNOWN AS Unit West, Lot 757 (C-W), Block 73.02 on the current Official Tax Map of the City

of Sea Isle City, New Jersey.

UNDER AND SUBJECT to any and all covenants, conditions, encumbrances, rights, reservations,

restrictions and easements of record, if any.

BEING THE SAME PREMISES which Dustin Laricks, LLC by a Deed dated August 15, 2017 and

recorded August 23, 2017 in the Cape May County Clerk's Office in Deed Book 3747, page 637, granted

and conveyed unto Daniel K. Boice and Jennifer L. Mellon, husband and wife.

THIS DEED is made in accordance with the terms and conditions of the Property Settlement Agreement

executed by and between Daniel K. Boice .and Jennifer L. Mellon.

Book384 7/Page946 CFN#2019089414 Page 2 of 5

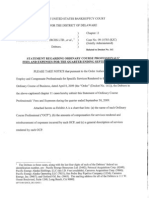

RTF-1 (Rev. 7114110)

MUST SUBMIT IN DUPLICATE STATE OF NEW JERSEY

AFFIDAVIT OF CONSIDERATION FOR USE BY SELLER

{Chapter 49, P.L 1968, as amended through Chapter 33, P.L. 2006) (N.J.S.A. 46: 15-5 et seq.)

BEFORE COMPLETING THIS AFFIDAVIT, PLEASE READ THE INSTRUCTIONS ON THE REVERSE SIDE OF THIS FORM.

STATE OF NEW JERSEY

}ss. County Munlcfpal Code

COUNTY 0509

MUNICIPALITY OF PROPERTY LOCATION Sea Isle City *Use symbol "C" to Indicate that fee Is excluslvely for county use.

---------

(1) PARTY OR LEGAL REPRESENTATIVE (See lnstructlons #3 and#4 on reverse side)

Deponent, Daniel K. Boice being duly sworn according to law upon his/her oath,

(Name) \ \

deposes and says that he/she is the Grantor In a deed dated --~--'-+-•\_:0'~1::-','d-CJ~-\~°'~- transferring

(Granter, Legal Rep1'911entatlw, Corporate Offtcer, Officer of ntle Company, Lending Institution, etc.)

real property identified as Block number _7_3_.0_2_ _ _ _ _ _ _ _ _ Lot number _7_57~(C-_W)~_ _ _ _ _ _ _ located at

14 73rd Street, West Unit, Sea Isle City and annexed thereto.

(Street Address, Town)

(2) CONSIDERATION $~_ _ _ _ _1_._oo_(lnstructlons #1 and #5 on reverse side) [}io prior mortgage to which property is subject.

(3) Property transferred is Class 4A 4B 4C (circle one). If property transferred is Class 4A, calculation in Section 3A below Is required.

(3A)REQUIRED CALCULATION OF EQUALIZED VALUATION FOR ALL CLASS 4A (COMMERCiAl) PROPERTY TRANSACTIONS:

(se·e Instructions #SA and #7 on reverse side)

Total Assessed Valuation + Director's Ratio =Equalized Assessed Valuation

$ + % = $_ _ _ _ _ _ _ _ __

If Director's Ratio Is less than 100%, the equalized valuattor:i will be an arnount greater than the assessed value. tf Director's Ratio Is equal to or In excess of

100%, the assessed value wlll be equal to the equallZed valuation.

(4) FULL EXEMPTION FROM FEE (See Instruction #8 on reverse side)

Deponent states that this deed transaction Is fully exempt from the Realty Transfer Fee Imposed by C. 49, P.L 1968, as amended through

C. 66, P.L. 2004, for the followlng reason(s). Mere reference to exemption symbol ls Insufficient. Explain in detail.

lnl Between husband and wife

(5) PARTIAL EXEMPTION FROM FEE (Instruction #9 on reverse side)

NOTE: All boxes below apply to--grantor(s) only. ALLBOXESJN_APP-ROP-RIATE.CATEGORY MUST BE CHECKED. Failure to do so wlil

void claim for partial exemption. Deponent claims that this deed transaction Is exempt from State portions of the Basic, Supplemental, and

General Purpose Fees, as applicable, imposed by C. 176, P.L. 1975, C. 113, P.L 2004, and C. 66, P.L 2004 for the following reason(s):

A. SENIOR CITIZE~ Grantor(s) 62 years of age or over. * (Instruction #9 on reverse side for A or B)

B. BLIND PERSON Grantor(s) legally blind or, *

{ DISABLED PERSON Grantor(s) permanently and totally disabled OreceMng disability payments Dnot gainfully employed*

citizens, blind persons, or disabled persons must ~meet all of the following criteria:

ed and occupied by grantor(s) at time of sale. esldent of State of New Jersey.

or two-family residential premises. wners as joint tenants must all quallfy.

*IN CASE OF HUSBAND AND VVIFE, PARTNERS IN A CML UNION COUPLE, ONLY ONE GRANTOR NEED QUALIFY IF TENANTS BY THE ENTIRETY.

C.

(6) N CO S Tl N (Instructions #2, #10 and #12 Efrreverse side) ·

Entirely new improvement. ot previously occupied.

Not previously used for any purpose. NEW CONSTRUCTION" printed clearly at top of first page of the deed.

(7) RELATED LEGAL ENTITIES TO LEGAL ENTITIES (Instructions #5, #12, #14 on reverse side)

DNo prior mortgage assumed or to which property Is subject at time of sale.

t:]No contributions to capital by either granter or grantee legal entity.

CJN.o stock or money exchanged by or between granter or. ra e legal entities.

(8) Deponent makes this Affidavit to lnduee county clerk or regi ter of d eel and accept the fee submitted herewith in

accordance with the provisions of Chapter 49, P.L. 1968, as am ed th u 006.

Subscribed and sworn to before me anlel K. Boice

this 1'{!1# day of March , 20 19 Granter Name

\AJ \y'\-t~ \\0\? \) Q' ~'"6D5 Wl\'\..\\\r()\) UR....

~L1f!~ '{A\Q>icCLY)(\f ~ ~ ~~ dJ(M

Deponent Ad ress

(A\~V\cln'C\_ VA~

Granter Address at llme of Sale

NOTARY PUBLIC OF NEW JERSEY

MY COMMISSION EXPIRES JAN. 2~~ree digits In ecurity Number Name/Company of Settlement Officer

FOR OFFICIAL USE ONLY

lrnitrument Number County_ _ _ _ __

Deed Number Book Page_ __

Deed Dated Date Recorded _ _ _ __

County recording officers shall forward one copy of each RTF-1 form when Section 3A is completed to: STATE OF NEW JERSEY

POBOX2Sl

TRENTON, NJ 08695-0251

ATIENTION: REALTY TRANSFER FEE UNIT

The Director of the Division of Taxation In the Department of the Treasury has prescribed this form as required by law, and may not be altered or amended

without prior approval of the Director. For Information on the Realty Transfer Fee or to print a copy of this Affidavit, visit the DMslon of Taxation website at

www.state.nJ.us/treasury/taxatlon/lpt/locattax. htm

Book384 7/Page94 7 CFN#2019089414 Page 3 of 5

'/ .

I •

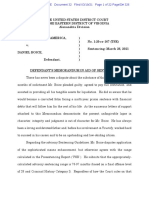

GIT/REP-3

State of New Jersey (9-2010)

SELLER'S RESIDENCY CERTIFICATION/EXEMPTION

(Please Print or Type)

SELLER'S INFORMATION

Name(s)

DANIEL K. BOICE

Block(s) Lot(s) Qualifier

73.02 757 C-W

Street Addr.ess

14 73RD STREET WEST UNIT

City, Town, Post Office Box State Zip Code.

SEA IS.LE CllY NJ 08243

Seller's Percentage of Ownership Total Consideration Owner's Share of Consideration

50% 50%

1. D Seller Is a resident taxpayer (lndivldual, estate, or trust) of the ~te of New Jersey pursuant to the New Jersey Gross Income Tax Act.,

wlll file a resident gross Income tax return, and will pay any applicable tax&a on any gain or Income from the disposition of this

2.

3.

8 property.

The real property sold.or transferred Is used exclusively as a principal residence a8 defined in 26 U.S. Code section 121.

seller Is a mortgagor conveying the mortgaged property to a mortgagee in foreclosure or in a transfer In lieu of foreclosure with no

additional consideration.

4. CJ Seller, transferor, or transferee is an agency or authority of the United States of America, an agency or authority of the State of New

Jersey, the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, the Government National Mortgage

Association, or a private mortgage insurance company.

5. D Seller Is not an Individual, estate, or trust and is not required to make an estimated gross income tax _payment.

6. raJ The total consideration for the property is $1,000 or less so the seller Is not required to make an estimated income tax paymenl

7. O The gain from the sale is not recognized for federal income tax purposes under 26 U.S. Co.de section 721, 1031, or 1033 (CIRCLE

THE APPLICABLE SECTION). If the Indicated section doe& not ultimately apply to this transaction, the seller acknowledges the

obligation to file a New Jersey Income tax return-for the year-of th9 ilale-and reporMhe recognized-gain.

D Seller did not receive non-like kind property. · · · ·

8. D The real property Is being transferred by an executor or administrator of a decedent to a devises or heir to effect distribution of the

decedent's estate in accordance with the provisions of the decedent's will or the Int.estate laws of this State.

9. D The real property being sold is subject to a short sale instituted by the mortgagee, whereby the seller agreed not to receive any

proceeds from the sale and the mortgagee wlll receive all proceeds paying off an agreed amount of the mortgage.

10. D The deed Is dated prior to August 1, 2004, and was not previously recorded.

11. D the re81 property 1s being transferred under a re1ocat1on company transaction where a trustee ot the re1ocat1on company buys the

property from the seller and then sells the house to a third party buyer for the sam~ price.

12. [El The real property Is being transferred between spouses or incident to a divorce decree or property settlement agreement under 26

U.S. Code section 1041.

13. D The property transferred Is a cemetery plol

14. 0 The seller Is not receiving net proceeds from the sale. Net proceeds from the sale means the net amount due to the seller on the

settlement sheet

atlon and that any false

laration and, to the best of

the seller(s) has been

Date Signature

(SeUer) Please Indicate If Power of Attorney or Attorney In Fact

Book384 7/Page948 CFN#2019089414 Page 4 of 5

Promises by Grantor. The Gran.tor promises that the Gran.tor has done no act to encumber the

property. This promise is called a "covenant as to grantor's acts" (N.J.S.A.46:4--0). This promise means that

the Gran.tor has not allowed anyone else to obtain any legal rights which affect the property (such as by

making a mortgage or allowing a judgment to be entered against the Gran.tor). -

Signatures. The Grantor signs this Deed as of the date at the of the first page.

Witnessed by:

~

STATEOF !l.JttJ :J~-/ , COUNTY OF C!tMJ'/? &) } S.S.

I CERTIFY that on 4JJ.Rc/I l <jj , 2019, DANIEL K. BOICE, personally came

before me and acknowledged under oath, to my satisfaction, that this person (or if more than one, each

person):

(a) is named in and personally signed this Deed;

(b) signed, sealed and delivered this Deed as his or her act and deed; and

(c) made this Deed for $1.00 as the full and actual consideration paid or to be paid for the transfer

of title. (Such consideration is defined in N.J.S.A. 45:15-5)

(/ .

. JOSEPH P. MCMICHAEL

NOTARY PUBLIC OF NEW JERSEY

MY COMMISSION EXPIRES JAN. 24, 2021

Record and Return to:

Raymond L. Poling, P.C.

4210 Landis Avenue

Sea Isle City, New Jersey 08243

Book384 7/Page949 CFN#2019089414 Page 5 of 5

Das könnte Ihnen auch gefallen

- Trump Bankruptcy Creditors (9/9/2014)Dokument170 SeitenTrump Bankruptcy Creditors (9/9/2014)Anonymous Cmc545ujNoch keine Bewertungen

- Load #Oc Oak r110324 - InvoiceDokument3 SeitenLoad #Oc Oak r110324 - InvoiceDenzel WillingtonNoch keine Bewertungen

- Men. WEIGH: Notice of Real Estate Settlement (For Use by An Attorney at Law of New Jersey) Chapter 406 Laws of 1979Dokument55 SeitenMen. WEIGH: Notice of Real Estate Settlement (For Use by An Attorney at Law of New Jersey) Chapter 406 Laws of 1979Deborah Joyce DoweNoch keine Bewertungen

- New CXDokument1 SeiteNew CXAlexandra CortacNoch keine Bewertungen

- How To Caveat Title SearchDokument14 SeitenHow To Caveat Title SearchShuvodip DasNoch keine Bewertungen

- 2819 SteeplechaseDokument1 Seite2819 SteeplechaseafahomeNoch keine Bewertungen

- Invoice # OC - OAK - M112007Dokument4 SeitenInvoice # OC - OAK - M112007Denzel WillingtonNoch keine Bewertungen

- Aguiar 32-Day Pre-General Disclosure ReportDokument14 SeitenAguiar 32-Day Pre-General Disclosure ReportRiverheadLOCALNoch keine Bewertungen

- No. 05-3-02756-0 Amana I.K.M. Fisher & Stephanie J. SeymourDokument417 SeitenNo. 05-3-02756-0 Amana I.K.M. Fisher & Stephanie J. SeymourV Freitas LegalNoch keine Bewertungen

- Caswell County - Carolina Sunrock Invoice Through 8-31-20-C1 PDFDokument3 SeitenCaswell County - Carolina Sunrock Invoice Through 8-31-20-C1 PDFLisa SorgNoch keine Bewertungen

- Sen Robert Duncan Flight Records Oct ADokument3 SeitenSen Robert Duncan Flight Records Oct ALee Ann O'NealNoch keine Bewertungen

- Invoice # OC - OAK - M112008Dokument4 SeitenInvoice # OC - OAK - M112008Denzel WillingtonNoch keine Bewertungen

- PLA Intiff'S Exhibit 73Dokument13 SeitenPLA Intiff'S Exhibit 73Jessie SmithNoch keine Bewertungen

- Rep 3110072849Dokument2.537 SeitenRep 3110072849graceenggint8799Noch keine Bewertungen

- Invoice # OC - OAK - M112009Dokument5 SeitenInvoice # OC - OAK - M112009Denzel WillingtonNoch keine Bewertungen

- BuildingreportmountolympusnurseryDokument15 SeitenBuildingreportmountolympusnurseryapi-385626757Noch keine Bewertungen

- Invoice # Oc - Oak - m112004Dokument4 SeitenInvoice # Oc - Oak - m112004Denzel WillingtonNoch keine Bewertungen

- Wa0005.Dokument2 SeitenWa0005.Dember DemberNoch keine Bewertungen

- Po 57Dokument1 SeitePo 57tom6375Noch keine Bewertungen

- Watkins ComplaintDokument81 SeitenWatkins ComplaintloomcNoch keine Bewertungen

- Invoice # OC - OAK - M112006Dokument4 SeitenInvoice # OC - OAK - M112006Denzel WillingtonNoch keine Bewertungen

- 55 CV 19 6491Dokument2 Seiten55 CV 19 6491voltprinterNoch keine Bewertungen

- Nims MRAP 16L Resp 12 04 2019 OcrDokument7 SeitenNims MRAP 16L Resp 12 04 2019 OcrRussinatorNoch keine Bewertungen

- Application For Approval of Cbre As Real Estate Broker For The Estates of Atled, Ltd. and Staci Properties, LTDDokument10 SeitenApplication For Approval of Cbre As Real Estate Broker For The Estates of Atled, Ltd. and Staci Properties, LTDChapter 11 DocketsNoch keine Bewertungen

- Voluntary Petition - Case Number - 05 16979 1 RelDokument35 SeitenVoluntary Petition - Case Number - 05 16979 1 RelAlec VenturaNoch keine Bewertungen

- Foreclosure Mill Albertelli LawDokument12 SeitenForeclosure Mill Albertelli LawAlbertelli_Law100% (3)

- Rep 3001114106Dokument761 SeitenRep 3001114106maegan criswellNoch keine Bewertungen

- Invoice # OC - OAK - M112001Dokument4 SeitenInvoice # OC - OAK - M112001Denzel WillingtonNoch keine Bewertungen

- 408 Pla Ex. 6, 3.27.19, May 26, 2020Dokument27 Seiten408 Pla Ex. 6, 3.27.19, May 26, 2020larry-612445Noch keine Bewertungen

- Yvette AguiarDokument10 SeitenYvette AguiarRiverheadLOCALNoch keine Bewertungen

- Geogia Filing Scott AndersonDokument2 SeitenGeogia Filing Scott AndersonForeclosure FraudNoch keine Bewertungen

- Aguiar 11 Day Pre GeneralDokument7 SeitenAguiar 11 Day Pre GeneralRiverheadLOCALNoch keine Bewertungen

- Hoger Dizayee-Ervil, LLC ComplaintDokument8 SeitenHoger Dizayee-Ervil, LLC ComplaintJaram JohnsonNoch keine Bewertungen

- United States Bankruptcy Court District of Nevada Southern DivisionDokument4 SeitenUnited States Bankruptcy Court District of Nevada Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- 20-5206 RedactedDokument6 Seiten20-5206 RedactedPicon Press Media LLCNoch keine Bewertungen

- 7133 - White Oak DR: (Click Here For Additional Photos.)Dokument2 Seiten7133 - White Oak DR: (Click Here For Additional Photos.)Laura Sampson100% (1)

- Jones Foster 6.18.19, May 6, 2020 D.E. 420 Pla. Ex. 19Dokument11 SeitenJones Foster 6.18.19, May 6, 2020 D.E. 420 Pla. Ex. 19larry-612445Noch keine Bewertungen

- United States Bankruptcy Court District of NevadaDokument3 SeitenUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNoch keine Bewertungen

- Broward Homes For Sale in Oakland Park FloridaDokument98 SeitenBroward Homes For Sale in Oakland Park FloridaThomas Martin 954-667-9110Noch keine Bewertungen

- In Re:) : Debtors.)Dokument7 SeitenIn Re:) : Debtors.)Chapter 11 DocketsNoch keine Bewertungen

- Dakota Well - Bit Spec PDFDokument42 SeitenDakota Well - Bit Spec PDFMygroup 5544Noch keine Bewertungen

- Aequitas Management Receiver's ReportDokument174 SeitenAequitas Management Receiver's ReportMatthew Kish100% (1)

- All IL Corporate Filings by The Save-A-Life Foundation (SALF) Including 9/17/09 Dissolution (1993-2009)Dokument48 SeitenAll IL Corporate Filings by The Save-A-Life Foundation (SALF) Including 9/17/09 Dissolution (1993-2009)Peter M. HeimlichNoch keine Bewertungen

- 4114 Greenvale DriveDokument14 Seiten4114 Greenvale DriveseoversightNoch keine Bewertungen

- Etal.,: Commission# 1980246 Notary Public - California Los Angeles County .. M Comm. Expires Jun 26. 2016 inDokument11 SeitenEtal.,: Commission# 1980246 Notary Public - California Los Angeles County .. M Comm. Expires Jun 26. 2016 inChapter 11 DocketsNoch keine Bewertungen

- Full Deposition of Beth Cottrell Part 1Dokument120 SeitenFull Deposition of Beth Cottrell Part 1Foreclosure Fraud100% (1)

- 2017 223 Release PDFDokument102 Seiten2017 223 Release PDFTayyab KhanNoch keine Bewertungen

- Broward Homes For Sale 10-7-10Dokument128 SeitenBroward Homes For Sale 10-7-10Thomas Martin 954-667-9110Noch keine Bewertungen

- Exhibit 76-JG and TG Edits To or Letter To LeFleur Asking For Communications With Various Parties About NPLDokument81 SeitenExhibit 76-JG and TG Edits To or Letter To LeFleur Asking For Communications With Various Parties About NPLGASPgroupNoch keine Bewertungen

- Election 20030501 SkormanDokument9 SeitenElection 20030501 SkormanspydraNoch keine Bewertungen

- Notice of Bankruptcy Filed For TakataDokument29 SeitenNotice of Bankruptcy Filed For Takata10News WTSPNoch keine Bewertungen

- Not A Certified Copy: Notice of Filing Excerpt of TH A.Prlb - 7. 2017 Hearing TranscriptDokument9 SeitenNot A Certified Copy: Notice of Filing Excerpt of TH A.Prlb - 7. 2017 Hearing Transcriptlarry-612445Noch keine Bewertungen

- United States Bankruptcy Court District of NevadaDokument114 SeitenUnited States Bankruptcy Court District of NevadaChapter 11 DocketsNoch keine Bewertungen

- 17 Gillard Client Package Jan 2024Dokument3 Seiten17 Gillard Client Package Jan 2024Jujhar GillNoch keine Bewertungen

- Maverick Real Estate Investing: The Art of Buying and Selling Properties Like Trump, Zell, Simon, and the World's Greatest Land OwnersVon EverandMaverick Real Estate Investing: The Art of Buying and Selling Properties Like Trump, Zell, Simon, and the World's Greatest Land OwnersBewertung: 5 von 5 Sternen5/5 (1)

- All in the Record: One Couple’s Fight to Expose Deceit in Lancaster County, VirginiaVon EverandAll in the Record: One Couple’s Fight to Expose Deceit in Lancaster County, VirginiaNoch keine Bewertungen

- Commodity Investing: Maximizing Returns Through Fundamental AnalysisVon EverandCommodity Investing: Maximizing Returns Through Fundamental AnalysisNoch keine Bewertungen

- A History of Mount Airy, N.C. Commisioners' Meetings 1903 to 1907Von EverandA History of Mount Airy, N.C. Commisioners' Meetings 1903 to 1907Noch keine Bewertungen

- Danny Boice Defense LettersDokument7 SeitenDanny Boice Defense LettersGlen HellmanNoch keine Bewertungen

- Powers FBI Interview TranscriptDokument55 SeitenPowers FBI Interview TranscriptGlen HellmanNoch keine Bewertungen

- Danny Boice Court Filing SentencingDokument22 SeitenDanny Boice Court Filing SentencingGlen HellmanNoch keine Bewertungen

- Ram Reddy Demand LetterDokument1 SeiteRam Reddy Demand LetterGlen HellmanNoch keine Bewertungen

- Communiclique (AKA Clique API) Response by Creditors To Bankruptcy CourtDokument14 SeitenCommuniclique (AKA Clique API) Response by Creditors To Bankruptcy CourtGlen HellmanNoch keine Bewertungen

- Jive Vs Communiclique Re SpeekDokument22 SeitenJive Vs Communiclique Re SpeekGlen HellmanNoch keine Bewertungen

- Trump LetterDokument1 SeiteTrump LetterGlen HellmanNoch keine Bewertungen

- Trustify Buckley LLP Law Firm JudgementDokument4 SeitenTrustify Buckley LLP Law Firm JudgementGlen HellmanNoch keine Bewertungen

- CB EthicsNewsLetterDokument26 SeitenCB EthicsNewsLetterGlen HellmanNoch keine Bewertungen

- Andy Powers Communiclique Chapter 7 Riling ExtensionDokument6 SeitenAndy Powers Communiclique Chapter 7 Riling ExtensionGlen HellmanNoch keine Bewertungen

- Stanton ComplaintDokument2 SeitenStanton ComplaintGlen HellmanNoch keine Bewertungen

- Baordsi Corporate Filing Martin RowinskiDokument2 SeitenBaordsi Corporate Filing Martin RowinskiGlen HellmanNoch keine Bewertungen

- Communiclique Fraud AllegationDokument11 SeitenCommuniclique Fraud AllegationGlen HellmanNoch keine Bewertungen

- Trustify Demand LetterDokument5 SeitenTrustify Demand LetterGlen HellmanNoch keine Bewertungen

- Communiclique Las Angeles Landlord Sues For $374,000Dokument137 SeitenCommuniclique Las Angeles Landlord Sues For $374,000Glen HellmanNoch keine Bewertungen

- Powers Criminal ComplaintDokument20 SeitenPowers Criminal ComplaintDrew HansenNoch keine Bewertungen

- Powers Home EvictionDokument12 SeitenPowers Home EvictionGlen HellmanNoch keine Bewertungen

- Dini Von Mueffling Lawsuit Versus TrustifyDokument5 SeitenDini Von Mueffling Lawsuit Versus TrustifyGlen HellmanNoch keine Bewertungen

- Kristan Hopkins Vs Andy PowersDokument10 SeitenKristan Hopkins Vs Andy PowersGlen HellmanNoch keine Bewertungen

- Clique Donahue v. Communiclique Complaint 1Dokument12 SeitenClique Donahue v. Communiclique Complaint 1Glen Hellman0% (1)

- Donahue-Judgement Against CommunicliqueDokument3 SeitenDonahue-Judgement Against CommunicliqueGlen HellmanNoch keine Bewertungen

- Virginia Communiclique JudgementDokument7 SeitenVirginia Communiclique JudgementGlen HellmanNoch keine Bewertungen

- Andy Powers IndictmentDokument10 SeitenAndy Powers IndictmentGlen Hellman100% (1)

- FinalsDokument124 SeitenFinalsmuton20Noch keine Bewertungen

- Trust Deed Indian Family TrustDokument15 SeitenTrust Deed Indian Family TrustAbhishek Verma100% (1)

- Drafting May Be Defined As The Synthesis of Law and Fact in A Language Form. Perfection CannotDokument12 SeitenDrafting May Be Defined As The Synthesis of Law and Fact in A Language Form. Perfection Cannotmonali raiNoch keine Bewertungen

- B.law ProjectDokument3 SeitenB.law ProjectAmna30jNoch keine Bewertungen

- Deed of Gift of Immovable Property: NOW THIS INDENTURE WITNESSETH That For Effectuating His Said DesireDokument3 SeitenDeed of Gift of Immovable Property: NOW THIS INDENTURE WITNESSETH That For Effectuating His Said DesireJugnu Chandra0% (1)

- Mortgage DeedDokument4 SeitenMortgage DeedShweta JoshiNoch keine Bewertungen

- 2 - Danguilan vs. IacDokument9 Seiten2 - Danguilan vs. IacKatNoch keine Bewertungen

- Ulysses Rudi VDokument13 SeitenUlysses Rudi VJevi RuiizNoch keine Bewertungen

- Spec ProDokument46 SeitenSpec Prom_ramas2001Noch keine Bewertungen

- Contract To Sell - GONZALESDokument3 SeitenContract To Sell - GONZALESAljunBaetiongDiazNoch keine Bewertungen

- Armando Sim. NG Corp Bay RealtyDokument13 SeitenArmando Sim. NG Corp Bay RealtyWendell MaunahanNoch keine Bewertungen

- Digest By: Miguel Alleandro AlagDokument3 SeitenDigest By: Miguel Alleandro AlagMiguel Alleandro AlagNoch keine Bewertungen

- Petition For Cancellation of Legal EncumbranceDokument3 SeitenPetition For Cancellation of Legal EncumbranceJon BandomaNoch keine Bewertungen

- 1) Spouses Dignos vs. Court of Appeals G.R. No. L-59266 February 29, 1988Dokument18 Seiten1) Spouses Dignos vs. Court of Appeals G.R. No. L-59266 February 29, 1988Edmart VicedoNoch keine Bewertungen

- Deed of Sale NHADokument1 SeiteDeed of Sale NHAIvy Veronica Torayno Negro-Tablando100% (2)

- Registration of Partnerships and CorporationsDokument6 SeitenRegistration of Partnerships and CorporationsPaolo LimNoch keine Bewertungen

- Almendra vs. Intermediate Appellate Court 204 SCRA 142, November 21, 1991 FactsDokument2 SeitenAlmendra vs. Intermediate Appellate Court 204 SCRA 142, November 21, 1991 FactsHazel LomonsodNoch keine Bewertungen

- The Punjab Pre-Emption Act, 1991Dokument3 SeitenThe Punjab Pre-Emption Act, 1991Atif RehmanNoch keine Bewertungen

- Credit Digest 5Dokument7 SeitenCredit Digest 5Ren ConchaNoch keine Bewertungen

- DECS Service ManualDokument3 SeitenDECS Service ManualDela Pena AmashaNoch keine Bewertungen

- PD 1529 - PertinentDokument3 SeitenPD 1529 - PertinentMaria Reylan GarciaNoch keine Bewertungen

- Sale Exam QuestionsDokument21 SeitenSale Exam QuestionsMary Neil Galviso75% (4)

- Additional Legal Opinion of Nafeesa PDFDokument6 SeitenAdditional Legal Opinion of Nafeesa PDFRaghavendra Prabhu100% (1)

- S A. F P: Ienna Lores RopertyDokument7 SeitenS A. F P: Ienna Lores RopertyMedj Broke Law StudentNoch keine Bewertungen

- Siguan V Lim Case DigestDokument2 SeitenSiguan V Lim Case DigestTivorshio Macabodbod100% (1)

- Specimen General Power of AttorneyDokument4 SeitenSpecimen General Power of AttorneyAbhishek Yadav100% (1)

- Government vs. Aballe, Et Al, G.R. No. 147212, 24 March 2006Dokument13 SeitenGovernment vs. Aballe, Et Al, G.R. No. 147212, 24 March 2006Mayjolica AgunodNoch keine Bewertungen

- In The Court of District Magistrate (Kapashera) Old Terminal Tax Building, Kapashera, New Delhi-110037Dokument7 SeitenIn The Court of District Magistrate (Kapashera) Old Terminal Tax Building, Kapashera, New Delhi-110037Mitul BarmanNoch keine Bewertungen

- Course Syllabus I. Course DescriptionDokument10 SeitenCourse Syllabus I. Course Descriptionxeileen08Noch keine Bewertungen

- Duenas vs. MBTCDokument10 SeitenDuenas vs. MBTCEyah LoberianoNoch keine Bewertungen