Beruflich Dokumente

Kultur Dokumente

Income Tax Law 1

Hochgeladen von

Sumit SharmaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Income Tax Law 1

Hochgeladen von

Sumit SharmaCopyright:

Verfügbare Formate

Paper 4A Income-tax Law (New Course)

1. Which of the following benefits are not allowable to Ms. Sakshi, a non-resident, while computing her total

income and tax liability for A.Y. 2019-20 under the Income-tax Act, 1961?

(a) Deduction of 30% of gross annual value while computing her income from house property in Bangalore

(b) Tax rebate of Rs.2,500 from tax payable on her total income of Rs.3,40,000

(c) Deduction for donation made by her to Prime Minister’s National Relief Fund

(d) Deduction for interest earned by her on NRO savings account.

2. Unexhausted basic exemption limit, if any, of a non-resident for A.Y. 2019-20 can be adjusted against –

(a) Only LTCG taxable @20%

(b) Only STCG taxable @15%

(c) Both (a) and (b)

(d) Neither (a) nor (b)

3. Under the provisions of the Income-tax Act, 1961, the term “Person” would not include:

(a) A body corporate incorporated in a country outside India

(b) A Limited Liability Partnership (LLP)

(c) Indian branch of a foreign company

(d) A co-operative society

4. Which of the following incomes is not deemed to accrue or arise in India under section 9(1)(i) of the

Income-tax Act, 1961?

(a) Income from any business connection in India

(b) Income through or from any property in India

(c) Income arising from transfer of a capital asset situate in India

(d) Income relating to operations which are confined to purchase of goods in India for the purpose of

export

5. During the P.Y. 2018-19, Mr. Samar, a non-resident, received Rs.75,00,000 on account of sale of

agricultural land in Mauritius. The money was first received in Mauritius and then remitted to his Indian

bank account. Is the sum taxable in India?

(a) No, as agricultural income is exempt u/s 10(1).

(b) No, as the income has accrued and arisen outside India and is also received outside India.

(c) Yes, since it is remitted to India in the same year.

(d) Yes, as agricultural income earned outside India is not exempted in India in the hands of a non-

resident.

6. Gross total income of Arpita for P.Y. 2018-19 is Rs.6,00,000. She had taken a loan of Rs.7,20,000 in the

financial year 2015-16 from a bank for her husband who is pursuing MBA course from IIM, Kolkata. On

02.04.2018, she paid the first installment of loan of Rs.45,000 and interest of Rs.65,000. Compute her total

income for A.Y. 2019-20.

(a) Rs.6,00,000

(b) Rs.5,35,000

(c) Rs.4,90,000

(d) Rs.5,55,000

7. Soumil, aged 47 years, paid medical insurance premium of Rs.15,000 and Rs.20,000 to insure health of

himself and his spouse, respectively. He also paid medical insurance premium of Rs.43,000 to insure health

© The Institute of Chartered Accountants of India

of his father, aged 69 years, not dependant on him. He had also incurred Rs.4,000 in cash on preventive

health check up of his father. Total deduction admissible under section 80D to Mr. Soumil is:

(a) Rs.55,000

(b) Rs.29,000

(c) Rs.68,000

(d) Rs.72,000

8. Mr. X, a resident employee of Hindustan Company established in India, received a scholarship of

Rs.5,00,000 from his employer to meet the cost of education of his children. X actually spent an amount of

Rs.4,50,000 on education of his children. What will be the amount of income exempt in the hands of X?

(a) Nil

(b) Rs.4,50,000

(c) Rs.50,000

(d) Rs.5,00,000

9. Mr. Pulkit, aged 45 years, paid health insurance premium in lump sum of Rs.90,000 for three years on 01-

05-2018. Compute the amount of deduction allowable to him for A.Y. 2019-20.

(a) Rs.90,000

(b) Rs.30,000

(c) Rs.25,000

(d) Nil

10. Mr. Agarwal moved to Mumbai. He took a property on rent for his residential purpose. However, the property

was not fully occupied by him. He let out the property to his friend at Rs.15,000 p.m. from 01.04.2018 to

31.03.2019. Mr. Agarwal is of the view that income from subletting of property is taxable as Income from

House Property. As tax advisor of Mr. Agarwal, find out whether his view is correct?

(a) Correct, as any income from a house property is taxable under the head Income from House Property.

(b) Incorrect, as Mr. Agarwal is not the owner of the property let out by him. The income from subletting

shall be taxable under the head Profits and Gains of Business or Profession.

(c) Incorrect, as Mr. Agarwal is not the owner of the property let out by him. The income from subletting

shall be taxable under the head Income from other sources.

(d) Correct, as income from subletting of a property is directly attributable to the property itself and hence,

chargeable to tax as income from house property.

11. Mr. Happy, a US citizen, came to India for an assignment from 11.01.2015 to 09.10.2015 and went back to

his home country on completion of the same. He thereafter, visited India on 05.07.2017 again for an

assignment, which ended on 26.05.2018. What is the latest date by which Mr. Happy should depart from

India after completing the assignment so as to qualify as non-resident for P.Y. 2018-19? (Assume that he

shall not be visiting India again during the year)

(a) 29-05-2018

(b) 30-05-2018

(c) 31-05-2018

(d) 28-09-2018

12. M/s PQR & Co., a firm carrying on business, furnishes the following particulars for the P.Y. 2018-19.

Particulars Rs.

Book profits (before setting of unabsorbed depreciation and 2,70,000

brought forward business loss)

Unabsorbed depreciation of P.Y.2012-13 1,20,000

© The Institute of Chartered Accountants of India

Brought forward business loss of P.Y.2017-18 2,00,000

Compute the amount of remuneration allowable under section 40(b) from the book profit.

(a) Rs. 2,43,000

(b) Rs.1,80,000

(c) Rs.1,50,000

(d) Nil

13. Mr. B acquires 1000 equity shares on 01.01.2016 at Rs.200. The Fair Market Value of the said shares on

31.01.2018 is Rs.500. Mr. B sells the said shares on 30.04.2018 at Rs.400. Calculate the amount of capital

gain in the hands of Mr. B, assuming that securities transaction tax has been paid by Mr. B on acquisition

and transfer of the said equity shares.

(a) Nil

(b) (-) Rs. 1,00,000

(c) Rs. 2,00,000

(d) Rs. 3,00,000

14. Mr. Dinesh owns 7 goods vehicle and declares profit on presumptive basis under section 44AE for

A.Y.2019-20. He is –

(a) liable to pay advance tax in four instalments in June, September, December and March

(b) liable to pay advance tax in three instalments in September, December and March

(c) liable to pay advance tax in one instalment in March

(d) not liable to pay advance tax since he is declaring profit on presumptive basis.

15. Mr. Ravi incurred loss of Rs.4 lakh in the P.Y.2018-19 in leather business. Against which of the

following incomes earned during the same year, can he set-off such loss?

(i) Profit of Rs.1 lakh from apparel business

(ii) Long-term capital gains of Rs.2 lakhs on sale of jewellery

(iii) Salary income of Rs.1 lakh

Choose the correct answer.

(a) Only (i)

(b) Only (ii)

(c) Only (iii)

(d) Both (i) and (ii)

Solution

1 (b) 6 (b) 11 (a)

2 (d) 7 (d) 12 (b)

3 (c) 8 (d) 13 (a)

4 (d) 9 (c) 14 (a)

5 (b) 10 (c) 15 (d)

© The Institute of Chartered Accountants of India

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Germination DiscussionDokument3 SeitenGermination DiscussionMay Lacdao100% (1)

- Week 33 17Dokument56 SeitenWeek 33 17Adam RudnickNoch keine Bewertungen

- Unit I Fundamentals of Computer GraphicsDokument25 SeitenUnit I Fundamentals of Computer GraphicsChockalingamNoch keine Bewertungen

- Benefits of Group Discussion as a Teaching MethodDokument40 SeitenBenefits of Group Discussion as a Teaching MethodSweety YadavNoch keine Bewertungen

- Industrial Coatings: Recommended ProductsDokument2 SeitenIndustrial Coatings: Recommended ProductsAPEX SONNoch keine Bewertungen

- LSP1 circuit board component layout and schematicDokument1 SeiteLSP1 circuit board component layout and schematicEvely BlenggoNoch keine Bewertungen

- Financial Ratio AnalysisDokument8 SeitenFinancial Ratio AnalysisrapsisonNoch keine Bewertungen

- Sator N Pavloff N Couedel L Statistical PhysicsDokument451 SeitenSator N Pavloff N Couedel L Statistical PhysicsStrahinja Donic100% (1)

- Results and Discussion of Lipid Solubility, Identification, and AnalysisDokument5 SeitenResults and Discussion of Lipid Solubility, Identification, and AnalysisStarrrNoch keine Bewertungen

- Glenn GreenbergDokument3 SeitenGlenn Greenbergannsusan21Noch keine Bewertungen

- Advance Accountancy Inter PaperDokument14 SeitenAdvance Accountancy Inter PaperAbhishek goyalNoch keine Bewertungen

- PGP-AIML Curriculum - Great LakesDokument43 SeitenPGP-AIML Curriculum - Great LakesArnabNoch keine Bewertungen

- NUS Physics PaperDokument6 SeitenNUS Physics PaperBilin ZhuangNoch keine Bewertungen

- Chicken Run: Activity Overview Suggested Teaching and Learning SequenceDokument1 SeiteChicken Run: Activity Overview Suggested Teaching and Learning SequencePaulieNoch keine Bewertungen

- CCE Student Wise SA1 Marks Report for Class 3 Section ADokument1 SeiteCCE Student Wise SA1 Marks Report for Class 3 Section AKalpana AttadaNoch keine Bewertungen

- Wells Fargo Preferred CheckingDokument4 SeitenWells Fargo Preferred Checkingjames50% (2)

- Data Analytics, Data Visualization and Big DataDokument25 SeitenData Analytics, Data Visualization and Big DataRajiv RanjanNoch keine Bewertungen

- Graphical RepresentationDokument8 SeitenGraphical RepresentationMD. JOBAYEDNoch keine Bewertungen

- DevOps Overview PDFDokument50 SeitenDevOps Overview PDFSubba Rao KedarisettyNoch keine Bewertungen

- CopdDokument74 SeitenCopdSardor AnorboevNoch keine Bewertungen

- Semi-Log Analysis: Well Test Interpretation MethodologyDokument31 SeitenSemi-Log Analysis: Well Test Interpretation MethodologyAshraf SeragNoch keine Bewertungen

- Opa An AssDokument8 SeitenOpa An Assgvkreddyg100% (1)

- Articol Indicatori de PerformantaDokument12 SeitenArticol Indicatori de PerformantaAdrianaMihaiNoch keine Bewertungen

- Strategic Supply Chain Management (Om367, 04835) : Meeting Time & LocationDokument9 SeitenStrategic Supply Chain Management (Om367, 04835) : Meeting Time & Locationw;pjo2hNoch keine Bewertungen

- Sorted CatalogueDokument14 SeitenSorted CatalogueHipocrates FCNoch keine Bewertungen

- A Sample Demonstration Lesson PlanDokument9 SeitenA Sample Demonstration Lesson PlanMarie Patrize Punzalan100% (1)

- Section 9 - ProppantsDokument18 SeitenSection 9 - ProppantsIllimination Illuminated MinisatanNoch keine Bewertungen

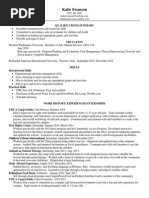

- Katie SwansonDokument1 SeiteKatie Swansonapi-254829665Noch keine Bewertungen

- Hospitality Enterprise 2 RajendraDokument31 SeitenHospitality Enterprise 2 RajendraChristian AgultoNoch keine Bewertungen

- One Bread One Body ChordsDokument2 SeitenOne Bread One Body ChordspiedadmarkNoch keine Bewertungen