Beruflich Dokumente

Kultur Dokumente

Tax Cards

Hochgeladen von

Zeeshan JaveedCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Cards

Hochgeladen von

Zeeshan JaveedCopyright:

Verfügbare Formate

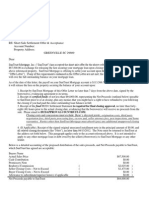

RATES FOR WITHHOLDING (INCOME) TAX | TAX YEAR 2020 Tariq Abdul Ghani Maqbool & Co.

Applicable July 01, 2019 to June 30, 2020 as updated vide the Finance Act, 2019 Chartered Accountants Member TAG Group

WHAT THIS DOCUMENT AIMS AT? Tax Rate Nature of Tax Rate Nature of

Activity/ Nature of Payment Activity/ Nature of Payment

Filer Non-Filer Tax Filer Non-Filer Tax

The purpose of this document is to summarize activity-wise rates

and treatment of withholding income tax, taking into account the PAYMENTS FOR SERVICES | S 153(1)(b), 153(2), Div. III & Div IV P III 1st Sch. DOMESTIC AIR TICKETS | Sec 236B, Div IX Part IV 1st Sch

amendments vide the Finance Act, 2019 (the Act). The information Advertising services (elec. & print media) 1.5% 3% On routes for Baluchistan coastal belt,

summarized herein is general and based on our interpretation of the Not Applicable

Transport, Freight forwarding, Air AJ&K, FATA, Gilgit-Baltistan & Chitral

Income Tax Ordinance, 2001 and significant amendments thereto

cargo services, Courier, Manpower Other routes 5% Adv. Tax

vide the Act becoming effective from July 01, 2019 – i.e. for the Tax

outsourcing, Hotel, Security guard,

Year 2020. This information does not constitute any opinion or

Software development, IT and IT SALE/ TRANSFER OF IMMOVABLE PROPERTY | S236C, DvX PIV 1st Sch

advice and may also not be acceptable to taxation authorities in any

enabled services [as defined u/c (133) of To be collected from

particular case. Tax laws are subject to change from time to time Up to 5 Years 1% Advance

Pt I of 2nd Sch.], Tracking services, Seller/ Transferor,

and we do neither warrant at any time the currency of the above 3% 6% Tax

Advertising (other than by print or electronic where Holding Period is: Above 5 Years Not Applicable

details nor accept any responsibility to update the same. Minimum

media), Share registrar services,

Engineering services, Car rental, Tax

FUNCTIONS AND GATHERINGS | Sec 236D, Div XI Pt IV 1st Sch

SALARY | Sec 149, Div I Part I 1st Schedule Building maintenance, Services of

PSX & PMEL, Inspection, Certification, Functions of marriage (in Islamabad,

Taxable Income Lahore, Multan, Faisalabad, Rawalpindi,

Rate of Tax Testing & Training services

From To Gujranwala, Bahawalpur, Sargodha, Sahiwal,

Companies providing other services 8% 16% Sheikhupura, Dera Ghazi Khan, Karachi, Higher of 5% of

Up to 600,000 0%

AOPs & Ind. providing other services 10% 20% Hyderabad, Sukkur, Thatta, Larkana, Mirpur bill ad-valorem

600,000 1,200,000 5% on amount exceeding Rs. 600,000 Khas, Nawabshah, Peshawar, Mardan, or Rs.20,000

Stitching, dying, printing, embroidery, Advance

1% 2% Abbottabad, Kohat, Dera Ismail Khan, Quetta,

1,200,001 1,800,000 30,000 10% on amount > Rs.1.2M washing, sizing & weaving for Exporters Tax

Sibi, Loralai, Khuzdar, Dera Murad Jamali and

1,800,001 2,500,000 90,000 15% on amount > Rs.1.8M Note: No tax to be withheld for payments in case where payments made against services Turbat)

rendered is less than Rs. 30,000/- in aggregate, during a financial year.

2,500,001 3,500,000 195,000 17.5% on amount > Rs.2.5M Higher of 5% of

Functions of marriage in other cities bill ad-valorem

3,500,001 5,000,000 370,000 20% on amount > Rs.3.5M EXECUTION OF CONTRACTS | Sec 153(1)(c), Div III Pt III 1st Sch or Rs.10,000

Received by Listed Companies Adv. Tax

PLUS

5,000,001 8,000,000 670,000 22.5% on amount > Rs.5M 7% 14% Other functions 5% of Bill

8,000,001 12,000,000 1,345,000 25% on amount > Rs.8M

Received by Other Companies

Minimum

Received by sportspersons 10% 20% CABLE OPERATORS & OTHERS | S236F & DivXIII PIV 1st Sch

12,000,001 30,000,000 2,345,000 27.5% on amount > Rs.12M Tax

Received by others 7.5% 15% From IPTV, FM Radio, MMDS, Mobile 20% of the

30,000,001 50,000,000 7,295,000 30% on amount > Rs.30M

TV, Mobile Audio, Satellite TV Channel permission fee

50,000,001 75,000,000 13,295,000 32.5% on amount > Rs.50M ROYALTY TO RESIDENT PERSONS | Sec 153B, Div, IIIB Pt III 1st Sch and Landing Rights or renewal fee

Gross amount of royalty 15% 30% Adv. Tax Advance

Above 75,000,000 21,420,000 35% on amount > Rs.75M From cable operators Various Rates

Tax

From TV channels for screening/ 50% of the

Detailed Handout on TAXATION OF SALARY is available for EXPORTS | Sec 154, Div IV Pt III 1st Sch, Cl 47C Pt IV 2nd Sch viewing Foreign TV Drama serial/ plays permission fee

download at https://tagm.co/pdf/Update-Salary(TY-2020).pdf Realization of export proceeds in any non-English language or renewal fee

[Exemption to cooking oil or vegetable ghee

exported to Afghanistan if tax u/s 148 is paid]

Final Tax

Tax Rate Nature of Inland back-to-back LC by exporter on TAX ON SALES TO DISTRIBUTORS, DEALERS & WHOLESALERS

Activity/ Nature of Payment Exporters

Filer Non-Filer Tax sale of goods under an arrangement BY MANUFACTURERS & COMMERCIAL IMPORTERS | Sec 236G,

may opt for

1% Div XIV Pt IV 1st Sch

prescribed by FBR Minimum

IMPORTS | Section 148 & Part II First Schedule On sale of fertilizers 0.7% 1.4%

Export of goods by EPZ units Tax

Industrial undertakings importing Advance Tax: Regime at On sale of electronics, sugar, cement,

Payment for a firm contract by direct Advance

remeltable steel & directly reduced - raw material

the time of iron & steel products, motorcycles,

or plant & exporters reg. under DTRE Rules, 0.1% 0.2% Tax

iron for own use machinery filing of pesticides, cigarettes, glass, textile,

2001, to indirect exporters

Persons importing potassic fertilizers imported by return beverages, paint, batteries or foam

Realization of proceeds on account of

under ECC‘s decision ECC- industrial 5%

undertakings commission to indenting agent

155/12/2004 dt. 9 Dec 2004 for own use; TAX ON SALES TO RETAILERS & WHOLESALERS BY

Persons importing urea 1% 2% - imports by MANUFACTURERS, DISTRIBUTORS, DEALERS, WHOLESALERS

PROPERTY INCOME/ RENTALS | Sec 155, Div V Pt III 1st Sch

Manufacturers (importing items covered

large Import & COMMERCIAL IMPORTERS | Sec 236H, Div XV Pt IV 1st Sch

houses; Where recipient is a company 15% Adv. Tax

under SRO 1125(I)/2011 dt. 31 Dec’ 2011) - motor vehicles On sale of electronics 1% 2%

Persons importing gold in CBU Other recipients Advance Tax On sale of sugar, cement, iron & steel

condition Annual Rent (Rs.) Advance

Persons importing cotton Tax products, motorcycles, pesticides,

imported by

From To 0.5% 1% Tax

Persons importing LNG on behalf of manufacturers cigarettes, glass, textile, beverages,

of motor Up to 200,000 NIL paint, batteries or foam

Govt. of Pakistan vehicles 200,001 600,000 5% of the amount exceeding 200,000

Persons importing Pulses 2% 4% - Foreign

600,001 1,000,000 20,000 + 10% of the amount above 0.6M

Industrial undertakings importing produced film TAX ON SALES OF PETROLEUM PRODUCTS | S 236HA, DivXVA

1.75% 3.5% for screening 1,000,001 2,000,000 60,000 + 15% of the amount above 1M PIV 1st Sch

plastic raw material (PCT 39.01 to 39.12) & viewing 2,000,001 4,000,000 210,000 + 20% of the amount above 2M

purposes On supply of petroleum products to a Advance

Commercial importers importing 4,000,001 6,000,000 610,000 + 25% of the amount above 4M 0.5% 1%

4.5% 9% petrol pump operator or distributer Tax

plastic raw material (PCT 39.01 to 39.12) Minimum Tax: 6,000,001 8,000,000 1,110,000 + 30% of the amount above 6M

Commercial imports covered under - Goods sold

3% 6% same

Above 8,000,000 1,710,000 + 35% of the amount above 8M COLLECTION OF TAX BY EDUCATIONAL INSTITUTIONS WHERE

S.R.O. 1125(I)/2011 dt. 31 Dec 2011 condition they FEE EXCEEDS RS. 200,000/- | Sec 236I, Div XVI Pt IV 1st Sch

Persons importing coal were imported PRIZES AND WINNINGS | Sec 156, Div VI Pt III 1st Sch

- Edible Oil From residents 5% of Fee Advance

Persons importing finished pharma - Packing On prize bonds & crossword puzzle 15% 30%

4% 8% From non-residents Not Applicable Tax

products, not manufactured locally as Material Raffle, lottery, winning quiz & prizes on Final Tax

- plastic raw 20% 40%

certified by the DRAP sales promotion schemes

material (PCT TAX ON DEALERS, COMMISSION AGENTS & ARHATIS ON

Ship breakers on import of ships 4.5% 9% heading 39.01 ISSUANCE/ RENEWAL OF LICENSE | Sec 236J, Div XVII Pt IV 1st Sch

Companies & industrial undertakings to 39.12), PETROLEUM PRODUCTS | Sec 156A, Div VIA Pt III 1st Sch

5.5% 11% packing Group/ Class A Rs. 100,000 p.a.

not covered above Commission/ discount to petrol pump

material & 12% 24% Final Tax Group/ Class B Rs. 75,000 p.a. Advance

edible oil operators on petroleum products

Others 6% 12% Group/ Class C Tax

Rs. 50,000 p.a.

WITHDRAWAL OF BALANCE UNDER PENSION FUND | Sec 156B Any other category

DIVIDEND | S 150, 236S, Div. I Pt III 1 Sch. & Cl. 11B Part IV 2nd Sch.

st

Dividend from Independent Power Withdrawal before retirement age Lower of 3 past

Withdrawal in excess of 50% balance years’ ART or Final Tax PURCHASE OF IMMOVABLE PROPERTY | S236K, DivXVIII Pt IV 1st Sch

Purchasers, being a pass-through item

at or after retirement age current ART On fair market value 1% 2% Adv. Tax

under Implementation/ Power/ Energy 7.5% 15%

Purch. Agreement, required to be

reimbursed by CPPA-G CASH WITHDRAWALS FROM BANKS | S 231A, Div VI P IV 1st Sch, Cl 28B P II 2nd Sch INTERNATIONAL AIR TICKETS | Sec 236L, Div XX Pt IV 1st Sch

Final Tax By licensed Exchange companies 0.15% Adv. Tax First/ executive class Rs.16,000

Dividend if no tax is payable by the Co. Adv. Tax

25% 50% From PKR accounts against foreign Others, excluding economy Rs.12,000

due to exemption, c/f loss, tax credits Not Applicable (N/A)

remittances credited in such accounts Economy NIL

Other cases, including mutual funds &

repatriation of after-tax profits by 15% 30% Other cases, if total withdrawal from all Advance

N/A 0.6%

branches of foreign companies accounts is Rs.50K+ in a day Tax NON-CASH BANKING TRANSACTIONS | Sec 236P, Div XXI Pt IV

Inter-corp. divid. under group taxation Not Applicable 1ST Sch

TRANSACTIONS IN BANK | Sec 231AA, Div VIA Pt IV 1st Sch Non-cash payment transactions (all types) N/A 0.6% Adv. Tax

All payment transactions N/A 0.6% Adv. Tax

INVESTMENT IN SUKUKS | Sec. 150A, Div. IB Pt III 1 st Sch.

Received by Company 15% 30% Adv. Tax RENT OR PAYMENT FOR RIGHT TO USE MACHINERY &

TAX ON MOTOR VEHICLES | S 231B&234, Div VII, Div III Pt IV 1st Sch EQUIPMENT | S 236Q, Div XXIII Pt IV 1ST Sch

Received by individuals or AOPs and

12.5% 25% Purchase/ transfer of motor vehicles Based on Eng. Cap. Advance To be collected for industrial,

the profit is above Rs. 1M

Final Tax Leasing on Vehicle (based on value) N/A 4% Tax commercial and scientific equipment & 10% Final Tax

Received by individuals or AOPs and machinery

10% 20%

the profit is up to Rs. 1M

BROKERAGE & COMMISSION | Sec 233, Div II Pt IV 1st Sch Note: WHT deduction shall not be applicable in the following cases:

Advertising commission 10% 20% a. Agricultural machinery; and

PROFIT ON DEBT | Section 151, Div. IA Part III 1st Sch. Minimum b. Machinery owned and leased by leasing companies, investment banks,

Where yield is up to Rs. 500,000 10% Life Insur. Comm. up to Rs. 0.5M p.a. 8% 16% modarabas, scheduled banks or DFIs

Tax

Final Tax Others 12% 24%

Where yield is above Rs. 500,000 15% 30%

EDUCATION RELATED EXPENSES REMITTED ABROAD |

TAX COLLECTION BY NCCPL FROM STOCK EXCHANGE MEMBERS Sec 236R, Div XXIV Pt IV 1st Sch

PAYMENTS TO NON-RESIDENTS | S152, Div. IV Pt. I, Div. II Pt. III 1st Sch.

On financing of COT, margin U/s Remittance of tuition fee, boarding &

Royalty or fee for technical services 15% 15% 233AA, Advance

Fee for offshore digital services 5% 10% financing, margin trading or Div IIB Pt 10% lodging expenses, payments for distant Advance

Tax 5%

securities lending IV 1st Sch learning programs and any other Tax

Contracts or related services 7% 14%

Minimum expense related to foreign education

Insurance or re-insurance premium 5% 5%

Tax CNG STATIONS | Sec 234A, Div VIB Pt III 1st Sch

Advertisement services 10% 20% INSURANCE PREMIUM | Sec 236U, DivXXV Pt IV 1st Sch

On the amount of gas bill 4% Min. Tax

Execution of contract by sportspersons 10% 20% General insurance premium N/A 4%

Other payments 20% 20% Advance

ELECTRICITY CONSUMPTION | S235, DivIV P IV 1st Sch, Cl 66 P IV 2nd Sch Life insurance premium above Rs. 0.3M

Tax

N/A 1%

Min. Tax for per annum

PAYMENTS TO PE OF NON-RESIDENTS | S 152, Div. II Pt III 1st Sch. Electricity bill of commercial or AOPs & Ind.

For supplies by PE of N/R Companies 4% 8% industrial consumers | Exporters-cum- for Bill Amt. up

EXTRACTION OF MINERALS | Sec 236V, Div XXVI Pt IV 1st Sch

Various rates to Rs. 360K

For supplies by PE of other N/Resid. 4.5% 9% manufacturers are exempt from this

Adv. Tax for To be collected by provincial revenue

For services by PE of N/R Companies 8% 16% collection

Minimum other cases authority/ board on value of minerals

Advance

For services by PE of other N/Resid. 10% 20% Tax extracted, produced, dispatched & N/A 5%

Tax

For transport services 2% 4% DOMESTIC ELECTRICITY CONSUMP. | S 235A, DivXIX PIV 1st Sch carried away from licensed or leased

For other contracts 7% 14% Monthly bill is below Rs. 75,000 0% Advance areas of mines

Monthly bill is Rs. 75,000 and above 7.5% Tax

PAYMENT FOR FOREIGN PRODUCED COMMERCIALS | Section 152A PURCHASE OF TOBACCO | Section 236X

Foreign produced commercials 20% Final Tax TAX ON STEEL MELTERS, ETC. | Sec 235B, Sec 153(1) To be collected by Pakistan Tobacco

Electricity consumed for producing Board or its contractor on value of Advance

5%

SUPPLY OF GOODS| S153(1)(a), Div. III P III 1st Sch, Cl 24A, 24C P II 2nd Sch steel billets, ingots & MS products, Rs. 1 per unit Non tobacco purchased by a person, Tax

Sale of rice, cottonseed oil & edible oil 1.5% 3% Advance excluding stainless steel, by steel of electricity Adjust- including manufacturers of cigarettes

Sale of cigarettes & pharma products Tax for melters & Composite Steel Units consumed able Tax

1% 2% Listed (Registered for Ch XI of Sales Tax Special REMITTANCE ABROAD THROUGH CREDIT, DEBIT OR PREPAID

by distributors & Large Import Houses Procedure Rules, 2007)

Sale of sugar, cement & edible oil by

companies CARDS | Sec 236Y, Division XVXVII Pt IV 1st Sch

0.25% 0.5% and

dealers & sub-dealers Companies TELEPHONE USERS | Sec 236, Div V Pt IV 1st Sch Gross amount remitted to abroad 1% 2% Adv. Tax

Sale by Corporate FMCG distributors 2% 4% Engaged in Mobile phone bills & prepaid cards 12.5%

Sale of goods by other (non-corporate)

Manu-

Landline bills exceeding Rs. 1,000 10%

Advance REACH US AT…

2.5% 5% facturing. Tax

FMCG distributors Postpaid internet & prepaid net cards 12.5%

Minimum Head Office: 173-W, Block 2, P.E.C.H.S., Karachi

Sale of other goods by companies 4% 8% Tax for other Tel: +92 (021) 34322 582 & 583, 34322 606 & 607

Sale of other goods by AOPs & Ind. 4.5% 9% cases. SALE BY AUCTION | Sec 236A, Div VIII Pt IV 1st Sch Email: info@tagm.co | Web: www.tagm.co

Note: No tax to be withheld in case of (a) where aggregate annual payment is below Rs Sale of property, goods or lease of right Advance LinkedIn: LinkedIn/TAGM | Facebook: FB/TAGM

75,000/- (b) yarn sold by traders to taxpayers specified in the sales tax zero-rated regime as

per Clause (45A) of Pt IV of 2nd Sched. AND (c) purchase of asset under lease & buy back

by public auction or tender 10% 20% Tax

agreement by modarabas, leasing/ banking companies or financial institutions. Sale of lease of the right to collect tolls Final Tax July 6, 2019 | Karachi

Das könnte Ihnen auch gefallen

- Creating a Real Estate Website with Joomla! 3 and Intellectual Property: Open Source Real Estate Websites Made EasyVon EverandCreating a Real Estate Website with Joomla! 3 and Intellectual Property: Open Source Real Estate Websites Made EasyBewertung: 5 von 5 Sternen5/5 (1)

- Nueces County Game Room RegulationsDokument24 SeitenNueces County Game Room RegulationscallertimesNoch keine Bewertungen

- 2018 05 18 Realtor University Speaker Series The B Word Can We Spot The Next Housing Bubble Len Kiefer Presentation SlidesDokument22 Seiten2018 05 18 Realtor University Speaker Series The B Word Can We Spot The Next Housing Bubble Len Kiefer Presentation SlidesNational Association of REALTORS®Noch keine Bewertungen

- A. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductionDokument67 SeitenA. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductioncjleopNoch keine Bewertungen

- Info LogsDokument130 SeitenInfo LogsDaniel Moreno GaleanoNoch keine Bewertungen

- 2016 Individual (Brading, Anthony H. & Amy N.) GovernmentDokument49 Seiten2016 Individual (Brading, Anthony H. & Amy N.) GovernmentAnonymous 9coWUONoch keine Bewertungen

- Palace Entertainment EE Handbook - 2011Dokument54 SeitenPalace Entertainment EE Handbook - 2011Jake C. SchneiderNoch keine Bewertungen

- RewardsCardBooklet Feb2019Dokument18 SeitenRewardsCardBooklet Feb2019Debbie Jamielyn Ong0% (1)

- INTERNATIONAL BUSINESS MACHINES CORP 10-K (Annual Reports) 2009-02-24Dokument289 SeitenINTERNATIONAL BUSINESS MACHINES CORP 10-K (Annual Reports) 2009-02-24http://secwatch.com100% (6)

- Income Tax AustraliaDokument9 SeitenIncome Tax AustraliaAbdul HadiNoch keine Bewertungen

- Guide Configure LCE Opsec Server Checkpoint FirewallDokument8 SeitenGuide Configure LCE Opsec Server Checkpoint FirewallAsado Aang NweightsNoch keine Bewertungen

- Ilovepdf MergedDokument21 SeitenIlovepdf MergedDILEEP COMPUTERS0% (1)

- Dgme Login: Access Employee Account atDokument6 SeitenDgme Login: Access Employee Account atStacey L. TravisNoch keine Bewertungen

- Caleb Discharge OrdersDokument1 SeiteCaleb Discharge OrdersDanyelle ChurchwellNoch keine Bewertungen

- COMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24Dokument350 SeitenCOMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24http://secwatch.comNoch keine Bewertungen

- AsgDokument307 SeitenAsgAlexandr TrotskyNoch keine Bewertungen

- Address: Scott Anthony Hughes 113 Methuen Road New Windsor Auckland 0600Dokument4 SeitenAddress: Scott Anthony Hughes 113 Methuen Road New Windsor Auckland 0600Scott HughesNoch keine Bewertungen

- ABKC Single Dog Registration Form International 17Dokument1 SeiteABKC Single Dog Registration Form International 17Iván ArciaNoch keine Bewertungen

- 2023 NAIDC FINAL HotelsDokument6 Seiten2023 NAIDC FINAL HotelsJennifer KoenemundNoch keine Bewertungen

- AMATIC Online GamingDokument4 SeitenAMATIC Online GamingPablo GonzalezNoch keine Bewertungen

- DCCC login credentials documentDokument11 SeitenDCCC login credentials documentFatima SaquilayanNoch keine Bewertungen

- Inititech Financial Case StudyDokument17 SeitenInititech Financial Case Studyapi-312352400Noch keine Bewertungen

- Reset Office Email Password in 3 Easy StepsDokument4 SeitenReset Office Email Password in 3 Easy StepsJojoNoch keine Bewertungen

- ACCOUNTSDokument1 SeiteACCOUNTSiskiNoch keine Bewertungen

- Jessica LaplaceDokument2 SeitenJessica Laplacejtm3323Noch keine Bewertungen

- Virginia DMVDokument2 SeitenVirginia DMVMissy FrederickNoch keine Bewertungen

- GoogleplaystoreDokument99 SeitenGoogleplaystoreCésar ParionaNoch keine Bewertungen

- Anexa 5 Amex CenturionDokument1 SeiteAnexa 5 Amex CenturionRaluca AndreeaNoch keine Bewertungen

- Direct Bill Authorization FormDokument8 SeitenDirect Bill Authorization Formzodaq50% (2)

- Chrome Operating SystemDokument29 SeitenChrome Operating SystemSai SruthiNoch keine Bewertungen

- Tenant ApplicationDokument32 SeitenTenant ApplicationDBHAAdminNoch keine Bewertungen

- Fundbox Blog-WPS OfficeDokument7 SeitenFundbox Blog-WPS OfficeChe DivineNoch keine Bewertungen

- What Causes Unemployment & How Is It MeasuredDokument8 SeitenWhat Causes Unemployment & How Is It MeasuredArsema ShimekitNoch keine Bewertungen

- 3D Secure Brochure Download VersionDokument4 Seiten3D Secure Brochure Download VersionofferNoch keine Bewertungen

- 2011 W-2 EarningsDokument144 Seiten2011 W-2 EarningsaroenNoch keine Bewertungen

- Mobile Cash WithdrawalDokument2 SeitenMobile Cash WithdrawalChan LeNoch keine Bewertungen

- Ultrafast Data VipDokument58 SeitenUltrafast Data VipFernando LoraNoch keine Bewertungen

- CSF Fy12 990Dokument100 SeitenCSF Fy12 990the wilsonsNoch keine Bewertungen

- FBF - ApplicationDokument1 SeiteFBF - ApplicationAnonymous WLOBYKE8NTNoch keine Bewertungen

- Carded RewriteDokument8 SeitenCarded RewriteRyan Teichmann50% (2)

- Allcoins - PW - Command Crypto Miner PDFDokument1 SeiteAllcoins - PW - Command Crypto Miner PDFjony rabuansyahNoch keine Bewertungen

- Casino CoinDokument8 SeitenCasino Cointore giudiceNoch keine Bewertungen

- Jose JR Minoza Bernarte: Statement of AccountDokument4 SeitenJose JR Minoza Bernarte: Statement of AccountjunbernartNoch keine Bewertungen

- Evolis Primacy UserDokument65 SeitenEvolis Primacy UserDavid RossNoch keine Bewertungen

- IBAN Payment InformationDokument2 SeitenIBAN Payment InformationJillyin James100% (1)

- Application Form: (Please Print Clearly)Dokument1 SeiteApplication Form: (Please Print Clearly)Ic Frigillana HiadanNoch keine Bewertungen

- Envato Elements1Dokument20 SeitenEnvato Elements1Miantsa RajonahNoch keine Bewertungen

- RFID0950 Elevator ID Card Manual: Core Lift Accessories Co.,LtdDokument8 SeitenRFID0950 Elevator ID Card Manual: Core Lift Accessories Co.,LtdmohammedalathwaryNoch keine Bewertungen

- Hard Equity Financing: Welcome To Our Business Network!Dokument4 SeitenHard Equity Financing: Welcome To Our Business Network!CRYSR98100% (1)

- Font Awesome 4 7 0 Icons CheatsheetDokument7 SeitenFont Awesome 4 7 0 Icons CheatsheetSafe LogisticsNoch keine Bewertungen

- CBA Full-Year ResultsDokument156 SeitenCBA Full-Year ResultsTim MooreNoch keine Bewertungen

- Account OpeningDokument31 SeitenAccount OpeningUmair Hussain HashmiNoch keine Bewertungen

- SunTrust Short Sale Approval (Fannie Mae)Dokument3 SeitenSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- BTC Mining. Best Hack ScriptDokument4 SeitenBTC Mining. Best Hack ScriptJuan Marco BesoniaNoch keine Bewertungen

- Thailand Property Funds With DividendsDokument81 SeitenThailand Property Funds With DividendsMartinNoch keine Bewertungen

- Earnings Statement: Non NegotiableDokument1 SeiteEarnings Statement: Non NegotiableKang KimNoch keine Bewertungen

- Jim's LawncareDokument18 SeitenJim's LawncareJakeDickersonNoch keine Bewertungen

- US Internal Revenue Service: F1040a - 1991Dokument2 SeitenUS Internal Revenue Service: F1040a - 1991IRSNoch keine Bewertungen

- Customer purchase data analysisDokument3 SeitenCustomer purchase data analysisPeuli Das100% (1)

- Lesson 1 Process DefinitionDokument23 SeitenLesson 1 Process DefinitionZeeshan JaveedNoch keine Bewertungen

- Lesson 1 Process DefinitionDokument23 SeitenLesson 1 Process DefinitionZeeshan JaveedNoch keine Bewertungen

- A Manual On Pension Procedures (NEW)Dokument197 SeitenA Manual On Pension Procedures (NEW)Saaim Khan100% (1)

- Tax Rates and Rules for Individuals, AOPs, Companies in PakistanDokument3 SeitenTax Rates and Rules for Individuals, AOPs, Companies in PakistanThe MaximusNoch keine Bewertungen

- Amended PPR Rules 2009 - 31.12.2013 - PDFDokument23 SeitenAmended PPR Rules 2009 - 31.12.2013 - PDFZeeshan JaveedNoch keine Bewertungen

- PPRA Rules 2014 (Ammended Upto 06.01.2016)Dokument43 SeitenPPRA Rules 2014 (Ammended Upto 06.01.2016)Aamir Ghazi90% (10)

- Ppra Rules For Bidding For ContractorsDokument4 SeitenPpra Rules For Bidding For ContractorssaifullahbhuttaNoch keine Bewertungen

- Muhammad Kashif CVDokument1 SeiteMuhammad Kashif CVZeeshan JaveedNoch keine Bewertungen

- Capital Budgeting Techniques and Discounted Cash Flow AnalysisDokument30 SeitenCapital Budgeting Techniques and Discounted Cash Flow AnalysisErica Mae Vista100% (1)

- FM12 CH 05 Tool KitDokument31 SeitenFM12 CH 05 Tool KitJamie RossNoch keine Bewertungen

- Rick Koerber IndictmentDokument11 SeitenRick Koerber IndictmentLarryDCurtisNoch keine Bewertungen

- Dhirubhai Ambani BiographyDokument25 SeitenDhirubhai Ambani BiographyKarim MerchantNoch keine Bewertungen

- Octroi RulesDokument150 SeitenOctroi Rulesbharadvaj_jsplNoch keine Bewertungen

- Bank's Branch Head, 5 Others Get Life For Faking Documents To Avail Rs 1.5 Crore LoanDokument3 SeitenBank's Branch Head, 5 Others Get Life For Faking Documents To Avail Rs 1.5 Crore LoanJAGDISH GIANCHANDANINoch keine Bewertungen

- Landbank vs Cacayuran Rulings on Locus Standi, Loan Validity and Ultra Vires ActsDokument14 SeitenLandbank vs Cacayuran Rulings on Locus Standi, Loan Validity and Ultra Vires ActsPatatas SayoteNoch keine Bewertungen

- Functions of A Credit Rating AgencyDokument22 SeitenFunctions of A Credit Rating Agencyharshubhoskar3500Noch keine Bewertungen

- Reimbursement Rate Update MemoDokument2 SeitenReimbursement Rate Update MemoBrad AndersonNoch keine Bewertungen

- NIB Bank Internship ReportDokument41 SeitenNIB Bank Internship ReportAdnan Khan Alizai86% (7)

- Great Pacific Life vs. CA Scire LicetDokument2 SeitenGreat Pacific Life vs. CA Scire LicetJetJuárezNoch keine Bewertungen

- People Vs GasacaoDokument1 SeitePeople Vs GasacaoKling King0% (1)

- SME'sDokument7 SeitenSME'sJiezelEstebeNoch keine Bewertungen

- SAP in House CashDokument3 SeitenSAP in House Cashpaiashok0% (1)

- Meter or That The Subject Properties Be Sold To A Third Party, VOLCANO LAKEVIEW RESORTS, INC. (Claimed ToDokument3 SeitenMeter or That The Subject Properties Be Sold To A Third Party, VOLCANO LAKEVIEW RESORTS, INC. (Claimed ToDiane ヂエンNoch keine Bewertungen

- Analysis of 3 Indian Banks' Financial StatementsDokument24 SeitenAnalysis of 3 Indian Banks' Financial StatementsAnika VarkeyNoch keine Bewertungen

- Financial Derivatives: An International PerspectiveDokument131 SeitenFinancial Derivatives: An International Perspectiveअंजनी श्रीवास्तव0% (1)

- Whistleblower Report On Bank of America Foreclosure Reviews Ebook 4 13Dokument72 SeitenWhistleblower Report On Bank of America Foreclosure Reviews Ebook 4 13Allen Kaul100% (3)

- Workbook 3Dokument69 SeitenWorkbook 3Dody SuhermantoNoch keine Bewertungen

- Capsim ReportDokument23 SeitenCapsim Reportamanmessi50% (2)

- Ohada Accounting Plan PDFDokument72 SeitenOhada Accounting Plan PDFNchendeh Christian50% (2)

- Honorable A. Bruce CampbellDokument2 SeitenHonorable A. Bruce CampbellChapter 11 DocketsNoch keine Bewertungen

- Form 1023.non ProfitDokument28 SeitenForm 1023.non ProfitLawrence BolindNoch keine Bewertungen

- Bankruptcy Book PDFDokument166 SeitenBankruptcy Book PDFioanchiNoch keine Bewertungen

- Rajesh Sample White PaperDokument7 SeitenRajesh Sample White PaperRajesh RamadossNoch keine Bewertungen

- Oracle R12 Account PayablesDokument39 SeitenOracle R12 Account PayablesCA Vara Reddy100% (1)

- Islamic ReitsDokument8 SeitenIslamic ReitsYuuki KazamaNoch keine Bewertungen

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Dokument3 SeitenNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7Noch keine Bewertungen

- Ahmed Thesis: LOAN ADVANCING PROCEDURE AND PRACTICEDokument41 SeitenAhmed Thesis: LOAN ADVANCING PROCEDURE AND PRACTICETilahun Mikias67% (3)

- Reassessing The Facts About Inequality, Poverty, and RedistributionDokument24 SeitenReassessing The Facts About Inequality, Poverty, and RedistributionCato InstituteNoch keine Bewertungen