Beruflich Dokumente

Kultur Dokumente

Selling Climx

Hochgeladen von

Rahul ChaturvediCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Selling Climx

Hochgeladen von

Rahul ChaturvediCopyright:

Verfügbare Formate

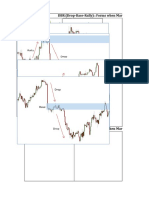

The phenomenon of the Selling Climax is caused by the panicky unloading of stocks

(supply) by the public and other weak holders which is matched against buying

(demand) of (l) experienced operators; (2) the large interests and sponsors of

various stocks who now either see an excellent opportunity to replace at low prices

the stocks they sold higher up, or wish to prevent further demoralization by giving

the market support temporarily; and (3) short covering by the bears who sense a

turn.

Stocks thus become either temporarily or more lastingly lodged in strong hands. An

abnormal increase in volume is one of the characteristic symptoms of a selling

climax, since supply and demand must both expand sharply under these conditions.

But the supply is now of poor, and the demand of good quality; and since the force

of supply now will have been exhausted, a technical rally ensues.

If buying on the break (i.e., during the Selling Climax) was principally for the

purpose of supporting prices temporarily and checking a panic, or relieving a

panicky situation, this support stock will be thrown back on the market at the

first favorable opportunity, usually on the technical rebound which customarily

follows a selling climax. This, and other selling on the rebound, may increase

supply sufficiently to drive prices through the lows of the climax day and bring

about a new decline, that is, a resumption of liquidation.

On the other hand, should a secondary reaction occur after the technical rally

above referred to, and prices hold around or above the climax lows while volume at

the same time shrinks appreciably, we have an indication that liquida- tion was

completed and, support is again coming into the market. Therefore, the market's

behavior on these secondary reactions is usually indicative of the next important

move.

In this connection, it should be noted that the same principles which apply to the

large swings also apply to the smaller moves and to the day-to-day buying and

selling waves. Thus, a careful examination of your Trend Charts, Group Charts and

charts of individual stocks over a period of time, will reveal numerous examples of

the above phenomena. These will appear on a small as well as a large scale.

However, you must allow for variations. That is, do not expect one selling climax

to look exactly like another. The same basic characteristics may be observed; but

the time and magnitude of price movement and volume, and the extent and sequence of

price movements almost invariably will differ.

For example, the abnormal volume may last either one or several days; or the

abnormal volume may precede the recording of the extreme low point one or more

days. In other words, a selling climax may be completed in one day or be spread

over a few days, and volume may reach unusual proportions on the day the low point

is made or some days ahead of the final low.

evidence that liquidation was not completed and that support which turned the

market upward on the 17th has been withdrawn. (See Footnote, Pg. 3, Par. 3.) On the

other hand, if, as happened to be the case, the buying support comes in around or

at a higher level than 135 1/2, we may conclude that demand is beginning to

overcome supply, (Footnote, Pg. 3, Par. 4) and that the next logical development

for final confirmation of an important reversal will be the market's ability to

rise above the top of the last rally, which was around 150, Dec. 18th.

On January 3rd these averages rise above 152, which gives final confirma- tion of

an upward swing which might develop into a rise of substantial proportions.

In taking a position in the market, which, of course, would be a long position, we

have had, up to now, three opportunities:

(1) when the market gave indications of having completed a selling climax, and

at the same time, as shown by the entry on our vertical chart for that day, was

able to rally vigorously on increasing volume. This was the first time it had

shown ability to rally aggressively and the first time increasing volume had been

shown on an advance for sometime past. On the basis of these tentatively bullish

indications we are justified in establishing long positions if we can get in near

enough to the lows so that, when we place stop orders (Sect. 23M, Pg. 3, Par. 1) on

our commitments two or three points under our

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 84 Yoga Asanas All in OneDokument6 Seiten84 Yoga Asanas All in OneRahul Chaturvedi80% (10)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Akshara Mala Sri Vidya MeditationDokument7 SeitenAkshara Mala Sri Vidya MeditationRahul Chaturvedi89% (28)

- Chakras For AllDokument9 SeitenChakras For AllRahul Chaturvedi92% (13)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Dasa Mahavidyas Sri VidyaDokument23 SeitenDasa Mahavidyas Sri VidyaRahul Chaturvedi100% (27)

- Czech Republic GAAPDokument25 SeitenCzech Republic GAAPFin Cassie Lazy100% (1)

- Crawler Base DX500/DX600/DX680/ DX700/DX780/DX800: Original InstructionsDokument46 SeitenCrawler Base DX500/DX600/DX680/ DX700/DX780/DX800: Original InstructionsdefiunikasungtiNoch keine Bewertungen

- Book 1Dokument27 SeitenBook 1Rahul Chaturvedi100% (1)

- What Is VolumeDokument9 SeitenWhat Is VolumeRahul Chaturvedi100% (1)

- Nyaya Sutras From Akshapada GoutamaDokument2 SeitenNyaya Sutras From Akshapada GoutamaRahul ChaturvediNoch keine Bewertungen

- Study of Open InterestDokument10 SeitenStudy of Open InterestRahul ChaturvediNoch keine Bewertungen

- Price Action Is The Study of PRICE of An Asset Changing With Respect To TIME and QUANTITY of That Asset Being TradedDokument3 SeitenPrice Action Is The Study of PRICE of An Asset Changing With Respect To TIME and QUANTITY of That Asset Being TradedRahul ChaturvediNoch keine Bewertungen

- Hydroponic Nutrients & Fertilizers: Nutrient QualityDokument11 SeitenHydroponic Nutrients & Fertilizers: Nutrient QualityRahul ChaturvediNoch keine Bewertungen

- Programming Iterative Loops: - For - WhileDokument21 SeitenProgramming Iterative Loops: - For - WhileRahul ChaturvediNoch keine Bewertungen

- Mahamrityunjya StrotamDokument3 SeitenMahamrityunjya StrotamRahul Chaturvedi100% (3)

- Nakshatra MantrasDokument2 SeitenNakshatra MantrasRahul Chaturvedi100% (1)

- Cosmos Chakras TattvasDokument16 SeitenCosmos Chakras TattvasRahul Chaturvedi100% (1)

- Shri Vidya Nava Avarana Puja VidhiDokument31 SeitenShri Vidya Nava Avarana Puja VidhiRahul Chaturvedi80% (5)

- Sri Sukta, Durga Sukta, Purusha Sukta, Narayana Sukta, Rudra SuktaDokument29 SeitenSri Sukta, Durga Sukta, Purusha Sukta, Narayana Sukta, Rudra SuktaRahul ChaturvediNoch keine Bewertungen

- Concentration Meditation and SadhanaDokument9 SeitenConcentration Meditation and SadhanaRahul Chaturvedi100% (5)

- Shiv Tandava Strotam Ravana KritDokument5 SeitenShiv Tandava Strotam Ravana KritRahul Chaturvedi100% (1)

- Shanti MantrasDokument1 SeiteShanti MantrasRahul ChaturvediNoch keine Bewertungen

- Photo (1) Photo (2)Dokument9 SeitenPhoto (1) Photo (2)Rahul Chaturvedi95% (19)

- Gayatri Mantra and Shaap VimochanaDokument4 SeitenGayatri Mantra and Shaap VimochanaRahul Chaturvedi88% (8)

- Portfolio Report Zarin Tasnim Tazin 1920143 8Dokument6 SeitenPortfolio Report Zarin Tasnim Tazin 1920143 8Fahad AlfiNoch keine Bewertungen

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDokument1 SeiteItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNoch keine Bewertungen

- Jetweigh BrochureDokument7 SeitenJetweigh BrochureYudi ErwantaNoch keine Bewertungen

- KrauseDokument3 SeitenKrauseVasile CuprianNoch keine Bewertungen

- Entrep Q4 - Module 7Dokument5 SeitenEntrep Q4 - Module 7Paula DT PelitoNoch keine Bewertungen

- Gmo EssayDokument4 SeitenGmo Essayapi-270707439Noch keine Bewertungen

- The Finley ReportDokument46 SeitenThe Finley ReportToronto StarNoch keine Bewertungen

- Te 1569 Web PDFDokument272 SeitenTe 1569 Web PDFdavid19890109Noch keine Bewertungen

- GATE General Aptitude GA Syllabus Common To AllDokument2 SeitenGATE General Aptitude GA Syllabus Common To AllAbiramiAbiNoch keine Bewertungen

- CSA Report Fahim Final-1Dokument10 SeitenCSA Report Fahim Final-1Engr Fahimuddin QureshiNoch keine Bewertungen

- Guidelines Use of The Word AnzacDokument28 SeitenGuidelines Use of The Word AnzacMichael SmithNoch keine Bewertungen

- Assessment 21GES1475Dokument4 SeitenAssessment 21GES1475kavindupunsara02Noch keine Bewertungen

- Relevant Cost For Decision: Kelompok 2Dokument78 SeitenRelevant Cost For Decision: Kelompok 2prames tiNoch keine Bewertungen

- Accounting II SyllabusDokument4 SeitenAccounting II SyllabusRyan Busch100% (2)

- IP Based Fingerprint Access Control & Time Attendance: FeatureDokument2 SeitenIP Based Fingerprint Access Control & Time Attendance: FeaturenammarisNoch keine Bewertungen

- Matrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedDokument4 SeitenMatrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedAJ SantosNoch keine Bewertungen

- A CMOS Current-Mode Operational Amplifier: Thomas KaulbergDokument4 SeitenA CMOS Current-Mode Operational Amplifier: Thomas KaulbergAbesamis RanmaNoch keine Bewertungen

- Design & Construction of New River Bridge On Mula RiverDokument133 SeitenDesign & Construction of New River Bridge On Mula RiverJalal TamboliNoch keine Bewertungen

- DT2 (80 82)Dokument18 SeitenDT2 (80 82)Anonymous jbeHFUNoch keine Bewertungen

- Safety Data Sheet: Fumaric AcidDokument9 SeitenSafety Data Sheet: Fumaric AcidStephen StantonNoch keine Bewertungen

- 1.mukherjee - 2019 - SMM - Customers Passion For BrandsDokument14 Seiten1.mukherjee - 2019 - SMM - Customers Passion For BrandsnadimNoch keine Bewertungen

- The Concept of ElasticityDokument19 SeitenThe Concept of ElasticityVienRiveraNoch keine Bewertungen

- Dreamweaver Lure v. Heyne - ComplaintDokument27 SeitenDreamweaver Lure v. Heyne - ComplaintSarah BursteinNoch keine Bewertungen

- TP1743 - Kertas 1 Dan 2 Peperiksaan Percubaan SPM Sains 2023-20243Dokument12 SeitenTP1743 - Kertas 1 Dan 2 Peperiksaan Percubaan SPM Sains 2023-20243Felix ChewNoch keine Bewertungen

- Concrete For Water StructureDokument22 SeitenConcrete For Water StructureIntan MadiaaNoch keine Bewertungen

- ML7999A Universal Parallel-Positioning Actuator: FeaturesDokument8 SeitenML7999A Universal Parallel-Positioning Actuator: Featuresfrank torresNoch keine Bewertungen

- Data Mining - Exercise 2Dokument30 SeitenData Mining - Exercise 2Kiều Trần Nguyễn DiễmNoch keine Bewertungen

- MOFPED STRATEGIC PLAN 2016 - 2021 PrintedDokument102 SeitenMOFPED STRATEGIC PLAN 2016 - 2021 PrintedRujumba DukeNoch keine Bewertungen