Beruflich Dokumente

Kultur Dokumente

57 PDF

Hochgeladen von

CHANDAN KUMAR SahaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

57 PDF

Hochgeladen von

CHANDAN KUMAR SahaCopyright:

Verfügbare Formate

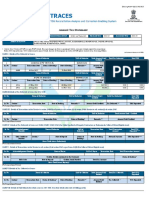

FORM NO.

57

[See rule 117B]

Certificate under section 222 or 223 of the Income -tax Act, 1961

Notice of demand under rule 2 of the Second Schedule to the Income -Tax Act, 1961

Office of the TRO

Dated the

To

(GIR/PAN)

1. * This is to certify that a sum of Rs. has become due from you on in

the status of details of which are given on the reverse. Whereas a certificate

bearing Serial Number dated had been forwarded by the Tax

Recovery Officer, [name of the place], for the

recovery of the sum of Rs. details of which are given on the reverse [and the said Tax

Recovery Officer has sent a certified copy of the said certificate to the undersigned under section 223(2) of

the Income-tax Act, 1961], specifying a sum of Rs. which is to be recovered from you.

2. You are hereby directed to pay the above sum within 15 days of the receipt of this notice failing which the

recovery shall be made in accordance with the provisions of section 222 to section 232 of the Income-tax

Act, 1961, and the Second Schedule to the said Act and the rules made thereunder.

3. In addition to the sums aforesaid, you will also be liable for,-

(a) such interest as is payable in accordance with section 220(2) of the said Act for the period commencing

immediately after the issue of this notice;

(b) all costs, charges and expenses incurred in respect of the services of this notice and of warrants and

other processes and all other proceedings taken for realising the arrears.

SEAL .

Tax Recovery Officer

*Score out whichever paragraph is not applicable.

DETAILS OF AMOUNT IN ARREARS

Rupees

Regular Advance Provisional Asst. year

1. Income-tax

2. Surcharge

3. Additional tax u/s 143

4. Penalty u/s .

5. Interest u/s .

6. Fine u/s 131

7. Any other sum (give details)

8. Interest u/s 220(2) from the day

when amount became due

9. Total

Printed from www.incometaxindia.gov.in Page 1 of 1

Das könnte Ihnen auch gefallen

- 2023721217646921CircularNo 1of2023-2024Dokument4 Seiten2023721217646921CircularNo 1of2023-2024krebs38Noch keine Bewertungen

- Form No. 16-ADokument1 SeiteForm No. 16-AJay100% (6)

- Sri Shabari Lubricants - 26asDokument6 SeitenSri Shabari Lubricants - 26asKATTA VENKATA KRISHNAIAHNoch keine Bewertungen

- TDS Form 16 & 16ADokument14 SeitenTDS Form 16 & 16AVaibhav NagoriNoch keine Bewertungen

- Withholding On Other TaxesDokument22 SeitenWithholding On Other Taxesdea34.drNoch keine Bewertungen

- FORM No. 26ADokument3 SeitenFORM No. 26AKumar KumarNoch keine Bewertungen

- CA Final DT Amendments For May 2022 Exam - Part 2Dokument23 SeitenCA Final DT Amendments For May 2022 Exam - Part 2Bhuvanesh RavichandranNoch keine Bewertungen

- Refund Forms For Centre and StateDokument20 SeitenRefund Forms For Centre and StateShail MehtaNoch keine Bewertungen

- Applicable For Casual or Non-Resident Taxable Person, Tax Deductor, Tax Collector, Un-Registered Person and Other Registered Taxable PersonDokument8 SeitenApplicable For Casual or Non-Resident Taxable Person, Tax Deductor, Tax Collector, Un-Registered Person and Other Registered Taxable PersonVAIBHAV ARORANoch keine Bewertungen

- Form No 16Dokument2 SeitenForm No 16scorpio.vinodNoch keine Bewertungen

- HBGPK3760R 2023Dokument4 SeitenHBGPK3760R 2023cadarshanshirodaNoch keine Bewertungen

- Circularno 24 CGSTDokument4 SeitenCircularno 24 CGSTHr legaladviserNoch keine Bewertungen

- Aaqha9773c 2023Dokument4 SeitenAaqha9773c 2023Bhavesh JainNoch keine Bewertungen

- Cfopb3507c 2023Dokument4 SeitenCfopb3507c 2023Mohan KumarNoch keine Bewertungen

- Form No. 7: Notice of Demand Under Section 156 of The Income-Tax Act, 1961Dokument1 SeiteForm No. 7: Notice of Demand Under Section 156 of The Income-Tax Act, 1961Yashwant SahaNoch keine Bewertungen

- Voluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityDokument29 SeitenVoluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityEdward GanNoch keine Bewertungen

- All The Due Dates and Time Limits in GSTDokument10 SeitenAll The Due Dates and Time Limits in GST2d77gp69kzNoch keine Bewertungen

- CGPPV3292L 2021Dokument4 SeitenCGPPV3292L 2021SANJAY KUMARNoch keine Bewertungen

- 1a. Refund Formats17052017 Revised3 28Dokument28 Seiten1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNoch keine Bewertungen

- Unit 5 GSTDokument3 SeitenUnit 5 GSTNishu KatiyarNoch keine Bewertungen

- Asypj1551d 2023Dokument4 SeitenAsypj1551d 2023BIKRAM KUMAR BEHERANoch keine Bewertungen

- GST Amdts Part 2Dokument5 SeitenGST Amdts Part 2amankhurana0910Noch keine Bewertungen

- BCLPD4484R 2023Dokument4 SeitenBCLPD4484R 2023imt caNoch keine Bewertungen

- 26 AsDokument4 Seiten26 AsAnkrut VaghasiyaNoch keine Bewertungen

- PenaltiesDokument44 SeitenPenaltiesabcNoch keine Bewertungen

- Form GST RFD 01aDokument8 SeitenForm GST RFD 01adizzi dagerNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: Cauayan Petron Service Center / Ferdinand GalopeDokument3 SeitenCertificate of Creditable Tax Withheld at Source: Cauayan Petron Service Center / Ferdinand GalopeAnnalyn Gonzales ModeloNoch keine Bewertungen

- Aactt0535b 2023Dokument4 SeitenAactt0535b 2023LaxusNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Subhransu SarangiNoch keine Bewertungen

- Akrpb2039b 2010Dokument4 SeitenAkrpb2039b 2010soujanya rajeshNoch keine Bewertungen

- The Mumbai Bazaar 22 26ASDokument4 SeitenThe Mumbai Bazaar 22 26ASSanjeev RanjanNoch keine Bewertungen

- Crzpb6128e 2021Dokument4 SeitenCrzpb6128e 2021PAMELANoch keine Bewertungen

- Apzpr3785d 2024Dokument4 SeitenApzpr3785d 2024laskarmohinNoch keine Bewertungen

- Circular CGST 131 NewDokument5 SeitenCircular CGST 131 NewSanjeev BorgohainNoch keine Bewertungen

- 26AS of BJZPK9513P-2023Dokument4 Seiten26AS of BJZPK9513P-2023Satheesh CharyNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961forty oneNoch keine Bewertungen

- Bjzpd9636e 2024Dokument4 SeitenBjzpd9636e 2024mechedaadityaNoch keine Bewertungen

- General Provisions and Tax Procedures: Arie Pratama, Se, Cpsak, Cpma, CertifrDokument64 SeitenGeneral Provisions and Tax Procedures: Arie Pratama, Se, Cpsak, Cpma, CertifrKucing HitamNoch keine Bewertungen

- Form No. 16A (See Rule31 (L) (B) )Dokument4 SeitenForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNoch keine Bewertungen

- 'RFD 06Dokument3 Seiten'RFD 06ahmgstserviceNoch keine Bewertungen

- ShowfileDokument4 SeitenShowfileMkNoch keine Bewertungen

- Aecpv2564e 2019Dokument4 SeitenAecpv2564e 2019Quality CapitalNoch keine Bewertungen

- Cfa AccountsDokument4 SeitenCfa AccountsBhavesh SharmaNoch keine Bewertungen

- Presentation ON Penal Provision in Income Tax: Submitted To: Head of Department Dr. Meenu ChopraDokument24 SeitenPresentation ON Penal Provision in Income Tax: Submitted To: Head of Department Dr. Meenu Chopradiksha singhNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NN Sarfaesi Solutions AgencyNoch keine Bewertungen

- Form GST Rfd11Dokument63 SeitenForm GST Rfd11forbooksNoch keine Bewertungen

- Rdao 05-01Dokument3 SeitenRdao 05-01cmv mendoza100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961vignesh vickyNoch keine Bewertungen

- Assignment CTP Tecnia Institute of Advanced Studies Penalties and ProsecutionsDokument7 SeitenAssignment CTP Tecnia Institute of Advanced Studies Penalties and ProsecutionssyedarsalNoch keine Bewertungen

- Tax LawDokument32 SeitenTax Lawgilbert213Noch keine Bewertungen

- FSDK Comparison of Documentary Requirements FT 16Dokument52 SeitenFSDK Comparison of Documentary Requirements FT 16nieves.averheaNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rayon fashionNoch keine Bewertungen

- CGPPV3292L 2022Dokument4 SeitenCGPPV3292L 2022SANJAY KUMARNoch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rahul kumarNoch keine Bewertungen

- GST RFD 01Dokument15 SeitenGST RFD 01Rajdev AssociatesNoch keine Bewertungen

- Ay 2021-22Dokument4 SeitenAy 2021-22Aman JaiswalNoch keine Bewertungen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDokument8 SeitenCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNoch keine Bewertungen

- Tan VS CirDokument3 SeitenTan VS CirJani MisterioNoch keine Bewertungen

- Tax2 Midterm Exam-SentDokument12 SeitenTax2 Midterm Exam-SentRen A EleponioNoch keine Bewertungen

- Brgy FDP FormDokument1 SeiteBrgy FDP FormJerelle Margallo100% (5)

- HDFC Health Insurance 80DDokument1 SeiteHDFC Health Insurance 80DjasjeetsNoch keine Bewertungen

- GST Calu-Aug-19 PDFDokument1 SeiteGST Calu-Aug-19 PDFLokambal RNoch keine Bewertungen

- ACT Yearly BillDokument2 SeitenACT Yearly BillNarenNoch keine Bewertungen

- TTD Accommodation ReceiptDokument1 SeiteTTD Accommodation ReceiptDeepak RaguNoch keine Bewertungen

- 2012 Ateneo LawTaxation Law Summer ReviewerDokument165 Seiten2012 Ateneo LawTaxation Law Summer ReviewerAllan Ydia89% (9)

- New VinothDokument3 SeitenNew VinothRenga NathanNoch keine Bewertungen

- Advanced Accounting Solutions Chapter 7 ProblemsDokument2 SeitenAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNoch keine Bewertungen

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDokument2 SeitenStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Sapthagiri - Inv-131Dokument3 SeitenSapthagiri - Inv-131KK SinghNoch keine Bewertungen

- Transfer Tax (Tax 1)Dokument5 SeitenTransfer Tax (Tax 1)Irdo Kwan100% (1)

- Government Budget and Its ComponentsDokument38 SeitenGovernment Budget and Its ComponentsAditi Mahale50% (4)

- FBO InvoiceDokument2 SeitenFBO InvoiceMohammad IrfanNoch keine Bewertungen

- Payroll Statement InsentifDokument3 SeitenPayroll Statement Insentifdhika agustyaNoch keine Bewertungen

- Set Off and Carry Forward of LossesDokument23 SeitenSet Off and Carry Forward of Lossessankymahadik1120Noch keine Bewertungen

- Awareness and Perception of Taxpayers Towards Goods and Services Tax (GST) Implementation1Dokument19 SeitenAwareness and Perception of Taxpayers Towards Goods and Services Tax (GST) Implementation1Bhagaban DasNoch keine Bewertungen

- Employer Employee Not Later Than 1 MonthDokument1 SeiteEmployer Employee Not Later Than 1 MonthNazreen MohammedNoch keine Bewertungen

- SMP 15 Year 1 LAKHDokument3 SeitenSMP 15 Year 1 LAKHTamil Vanan NNoch keine Bewertungen

- Invoice 2260, 2261, 2262Dokument4 SeitenInvoice 2260, 2261, 2262miroljubNoch keine Bewertungen

- Excel Budget ProjectDokument6 SeitenExcel Budget Projectapi-314303195Noch keine Bewertungen

- Payroll 2023 1Dokument19 SeitenPayroll 2023 1Carl Dela CruzNoch keine Bewertungen

- (D) The Provisions of Taxation in The Philippine Constitution Are Grants of Power and Not Limitations On Taxing PowersDokument44 Seiten(D) The Provisions of Taxation in The Philippine Constitution Are Grants of Power and Not Limitations On Taxing PowersCyril John RamosNoch keine Bewertungen

- Flipkart BillDokument1 SeiteFlipkart BillAnsh RajanNoch keine Bewertungen

- KD Chem Pharma - Proforma InvoiceDokument1 SeiteKD Chem Pharma - Proforma InvoiceJOYSON NOEL DSOUZANoch keine Bewertungen

- G.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.Dokument2 SeitenG.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.thelionleo1Noch keine Bewertungen

- Income Tax Department: Computerized Payment Receipt (CPR - It)Dokument2 SeitenIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNoch keine Bewertungen

- Sundar Shetty: Eligibility Comes From Efforts, Luck Comes From Opportunities L - 1Dokument36 SeitenSundar Shetty: Eligibility Comes From Efforts, Luck Comes From Opportunities L - 1Abhay GroverNoch keine Bewertungen