Beruflich Dokumente

Kultur Dokumente

Receivables Are Financial Assets That Represent A Contractual Right To Receive Cash or Another Financial Asset From

Hochgeladen von

MjhayeOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Receivables Are Financial Assets That Represent A Contractual Right To Receive Cash or Another Financial Asset From

Hochgeladen von

MjhayeCopyright:

Verfügbare Formate

CHAPTER

BLUE NOTES

3 S

L

Receivables are financial assets that represent a contractual right to receive cash or another financial asset from

another entity.

Trade Receivables – these are claims arising from the sale Nontrade Receivables – represent claims arising from

of merchandise or services in the ordinary course of sources other than the sale of merchandise or services in

business. These claims are classified as current assets the ordinary course of business. These claims are

because they are expected to be realized in cash within classified as current assets when they are expected to be

the normal operating cycle or one year, whichever is realized in cash within one year notwithstanding the

longer. It includes: length of the operating cycle. Otherwise, they are

1. Account receivables – are open accounts or those classified as noncurrent assets.

not supported by promissory notes. Examples:

2. Notes receivables – those supported by formal 1. Receivables from shareholders, directors, officers

promises to pay in the form of notes. or employees – classified as either current or

noncurrent assets depending on the period of its

collectability.

2. Advances to affiliates – usually treated as

noncurrent assets.

3. Advances to supplier for acquisition of

merchandise – current asset

4. Subscriptions receivable – current assets if

collectible within one year. Otherwise, they are

shown as a deduction from subscribed share

capital.

5. Creditors’ accounts with debit balances – results

from overpayment or returns and allowances.

Classified as current assets. If the debit balances

are not material, an offset against the creditors’

accounts with credit balances may be made and

only the net accounts payable may be presented.

6. Special deposits on contract bids – classified as

either current or noncurrent assets depending on

the period of its collectability.

7. Accrued income (dividends receivable, accrued

rent income, accrued royalties income and

accrued interest on bond investment) – current

assets.

8. Claims receivable (claims against common carriers

for losses or damages, claim for rebates and tax

refunds, claims from insurance companies) –

current assets

Theory of Accounts Practical Accounting 1

12 USL Blue Notes Chapter 3 – Accounts Receivable

Initial Measurement of Receivables

PFRS 9, paragraph 5.1.1, states that a financial asset shall be recognized initially at fair value plus transaction cost

that are directly attributable to the acquisition.

Long-term Receivables

Short-term Receivables

Interest-bearing Noninterest-bearing

Fair value Face value or original Face value Present value of all future

equivalent invoice amount cash flows discounted

using the prevailing

market rate of interest for

similar receivables.

Presentation of Receivables

Trade and nontrade receivables that are currently collectible shall be presented on the face of the statement of

financial position as one line item called trade and other receivables. However, the details of the total trade and

other receivables shall be disclosed in the notes to financial statements.

Note: Customers’ credit balances are classified as current liabilities. If the debit balances are not material, an offset against the

customers’ accounts with credit balances may be made and only the net accounts receivable may be presented.

Accounts receivable are open accounts or those not supported by promissory notes arising from sale of merchandise or

services in the ordinary course of business.

Initial Measurement

at face value or original invoice amount

Subsequent Measurement

at net realizable value (NRV) which means the amount of cash expected to be collected or the estimated

recoverable amount

In estimating the NRV of trade accounts receivable, deductions for the following are made:

1. Allowance for freight charge – occurs when the goods are sold FOB destination but shipped freight

collect with the understanding that the freight will be paid by the buyer and will be deducted from

the receivable of the seller. The seller records this by debiting freight out and crediting allowance

for freight charge.

FOB destination – ownership of the goods sold is vested in the seller until it reaches the buyer.

Thus, the seller shall be responsible for freight charge.

FOB shipping point – ownership of the goods sold is vested in the buyer upon shipment. Thus, the

buyer shall be responsible for freight charge.

Freight collect – freight charge is not yet paid and will be collected from the buyer.

Freight prepaid – freight charge is already paid by the seller.

2. Allowance for sales returns – recognizes the probability that some customers will return goods that

are unsatisfactory or will claim a reduction of the amount due in case of shipment shortages and

defects.

3. Allowance for sales discount – these are estimates of cash discounts granted to customers for their

prompt payment at the end of the period based on past experience.

4. Allowance for doubtful accounts – estimates of uncollectible accounts. It recognizes the risk that

some customers will not pay their accounts.

Practical Accounting 1 Theory of Accounts

Chapter 3 – Accounts Receivable USL Blue Notes 13

Accounts Receivable

Less:

Allowance for Doubtful Accounts

Allowance for Sales Discounts

Allowance for Sales Returns

Allowance for Freight Charge

Net Realizable Value

Accounting for Sales Discount

1. Gross method - the accounts receivable and sales are recorded at gross amount of the invoice.

2. Net method - the accounts receivable and sales are recorded at net amount of the invoice (invoice price

minus the cash discount)

Note: Under the Net Method, Sales Discount Forfeited is classified as other income.

Accounting for Bad Debts/ Doubtful Accounts

Generally accepted accounting principles require the use of the allowance method because it conforms to

the matching principle.

Doubtful accounts expense is recognized if the account is doubtful of collection, as contrast to the direct

write-off method that recognizes bad debt expense if the account is worthless or uncollectible.

Methods of Estimating Doubtful Accounts

1. Aging of accounts receivable (“Statement of financial position approach”)

2. Percent of accounts receivable (“Statement of financial position approach”)

3. Percent of sales (“Income statement approach”)

Note: Aging of Accounts Receiveble and Percent of Accounts Receivable presents the accounts receivable at net realizable value. Under

these two methods, the computed amount is already the ending balance of allowance for doubtful accounts. Under the Percent

of Sales Method, the computed amount is the bad debt expense for the period.

Theory of Accounts Practical Accounting 1

Das könnte Ihnen auch gefallen

- FAR - Accounts Receivable DigestDokument3 SeitenFAR - Accounts Receivable DigestBernard FernandezNoch keine Bewertungen

- Handouts 51Dokument20 SeitenHandouts 51Ziyeon SongNoch keine Bewertungen

- FAR Self-Made ReviewerDokument2 SeitenFAR Self-Made ReviewerAngelica SumatraNoch keine Bewertungen

- NU - Audit of Cash and Cash EquivalentsDokument14 SeitenNU - Audit of Cash and Cash EquivalentsDawn QuimatNoch keine Bewertungen

- Handout - Intro To Financial StatementsDokument2 SeitenHandout - Intro To Financial StatementsApril SasamNoch keine Bewertungen

- Accounts ReceivablesDokument37 SeitenAccounts ReceivablesYassi CurtisNoch keine Bewertungen

- Cash & Cash Equivalents, Lecture &exercisesDokument16 SeitenCash & Cash Equivalents, Lecture &exercisesDessa GarongNoch keine Bewertungen

- Audit - Cash and Cash Equivalents PDFDokument15 SeitenAudit - Cash and Cash Equivalents PDFSiena Farne100% (1)

- Cash & Cash Equivalents, Lecture &exercisesDokument16 SeitenCash & Cash Equivalents, Lecture &exercisesNMCartNoch keine Bewertungen

- Cash & Cash Equivalents, LECTURE &EXERCISESDokument16 SeitenCash & Cash Equivalents, LECTURE &EXERCISESNMCartNoch keine Bewertungen

- Statement of Financial PositionDokument2 SeitenStatement of Financial PositionRhianne AndradaNoch keine Bewertungen

- CFAS Chapter 5 - Accounts ReceivableDokument6 SeitenCFAS Chapter 5 - Accounts ReceivableAngelaMariePeñarandaNoch keine Bewertungen

- Module 1.2Dokument19 SeitenModule 1.2Althea mary kate MorenoNoch keine Bewertungen

- Intermediate Accounting Stice 18th Edition Solutions ManualDokument24 SeitenIntermediate Accounting Stice 18th Edition Solutions ManualCynthiaWalkerfeqb100% (36)

- NOTESmidtermDokument6 SeitenNOTESmidtermAlexis Jhan MagoNoch keine Bewertungen

- Cash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheDokument4 SeitenCash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheannyeongNoch keine Bewertungen

- Lecture Notes: Afar - Not For Profit OrganizationsDokument5 SeitenLecture Notes: Afar - Not For Profit OrganizationsJem Valmonte100% (1)

- Accounts ReceivableDokument34 SeitenAccounts ReceivableRose Aubrey A Cordova100% (1)

- Cash & Cash EquivalentsDokument20 SeitenCash & Cash Equivalentsalexis prada100% (2)

- Theories in Ia Midterms ExamDokument12 SeitenTheories in Ia Midterms ExamLOMA, ABIGAIL JOY C.Noch keine Bewertungen

- Cash Part1Dokument7 SeitenCash Part1cuaresmamonicaNoch keine Bewertungen

- Cash and Cash EquivalentsDokument5 SeitenCash and Cash EquivalentsCamille Joyce Corpuz Dela CruzNoch keine Bewertungen

- Inter. Accountting 1 Chapter 5Dokument5 SeitenInter. Accountting 1 Chapter 5kennedy othoroNoch keine Bewertungen

- 02 - Cash & Cash EquivalentDokument5 Seiten02 - Cash & Cash EquivalentEmmanuelNoch keine Bewertungen

- Module 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Dokument6 SeitenModule 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Cale Robert RascoNoch keine Bewertungen

- Chapter 3 - Sources of CapitalDokument7 SeitenChapter 3 - Sources of CapitalAnthony BalandoNoch keine Bewertungen

- Las 3Dokument8 SeitenLas 3Venus Abarico Banque-AbenionNoch keine Bewertungen

- Module 4 Loans and ReceivablesDokument55 SeitenModule 4 Loans and Receivableschuchu tvNoch keine Bewertungen

- Topic 1: Statement of Financial PositionDokument10 SeitenTopic 1: Statement of Financial Positionemman neri100% (1)

- FABM2 ReviewerDokument7 SeitenFABM2 ReviewerMakmak NoblezaNoch keine Bewertungen

- Current Assets:: What Is The Statement of Financial PositionDokument4 SeitenCurrent Assets:: What Is The Statement of Financial PositionEmar KimNoch keine Bewertungen

- Accounting For Cash and Cash Equivalents - PDF Filename UTF-8''AccountingDokument2 SeitenAccounting For Cash and Cash Equivalents - PDF Filename UTF-8''AccountingFrancis RaagasNoch keine Bewertungen

- KC FAR Notes-ADokument10 SeitenKC FAR Notes-Abryan lluismaNoch keine Bewertungen

- Module 2Dokument29 SeitenModule 2Althea mary kate MorenoNoch keine Bewertungen

- Module 3 Cash and Cash EquivalentsDokument32 SeitenModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- RECEIVABLESDokument12 SeitenRECEIVABLESNath BongalonNoch keine Bewertungen

- Accounting NotesDokument6 SeitenAccounting NotesD AngelaNoch keine Bewertungen

- Accounting Reviewer 2nd Long TestDokument45 SeitenAccounting Reviewer 2nd Long TestZachary Job YuipcoNoch keine Bewertungen

- Module 2 - Slides - Introducing Financial StatementsDokument12 SeitenModule 2 - Slides - Introducing Financial StatementsElizabethNoch keine Bewertungen

- Notes - FAR - Cash and Cash EquivalentsDokument9 SeitenNotes - FAR - Cash and Cash EquivalentsElaineJrV-IgotNoch keine Bewertungen

- Acccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Dokument7 SeitenAcccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Rey HandumonNoch keine Bewertungen

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Dokument10 SeitenNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNoch keine Bewertungen

- FINC6021 - Financial StatementsDokument126 SeitenFINC6021 - Financial Statements尹米勒Noch keine Bewertungen

- Cfas - ReceivablesDokument9 SeitenCfas - ReceivablesYna SarrondoNoch keine Bewertungen

- Declares A Share Dividend. Share Dividend Payable Is Part of EquityDokument2 SeitenDeclares A Share Dividend. Share Dividend Payable Is Part of EquityAsh imoNoch keine Bewertungen

- Assets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial StatementsDokument13 SeitenAssets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial Statementskessa thea salvatoreNoch keine Bewertungen

- CHAPTER 22 Theory Financial Assets at Fair ValueDokument3 SeitenCHAPTER 22 Theory Financial Assets at Fair ValueRomel BucaloyNoch keine Bewertungen

- Fabm 1 - Week 4Dokument3 SeitenFabm 1 - Week 4FERNANDO TAMZ2003Noch keine Bewertungen

- Current Vs Non-Current AssetsDokument3 SeitenCurrent Vs Non-Current AssetsTrisha GarciaNoch keine Bewertungen

- Business Finance Module 4Dokument9 SeitenBusiness Finance Module 4Lester MojadoNoch keine Bewertungen

- Ia ReviewerDokument11 SeitenIa Reviewermichelle donaireNoch keine Bewertungen

- Assets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial StatementsDokument6 SeitenAssets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial Statementskessa thea salvatoreNoch keine Bewertungen

- FABM 1 Lesson 8 Types of Major AccountsDokument7 SeitenFABM 1 Lesson 8 Types of Major AccountsTiffany CenizaNoch keine Bewertungen

- Chapter 6 Financial Statement Analysis Balance SheetDokument30 SeitenChapter 6 Financial Statement Analysis Balance SheetKhadija YaqoobNoch keine Bewertungen

- 05 Fa-I Chapter 5Dokument8 Seiten05 Fa-I Chapter 5History and EventNoch keine Bewertungen

- Chapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewDokument20 SeitenChapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewAngel RosalesNoch keine Bewertungen

- Intermediate Accounting Stice 18th Edition Solutions ManualDokument45 SeitenIntermediate Accounting Stice 18th Edition Solutions ManualJames CarsonNoch keine Bewertungen

- Fundamentals of Accountancy and Business Management: Trade and Other ReceivablesDokument7 SeitenFundamentals of Accountancy and Business Management: Trade and Other ReceivablesLey PagaduanNoch keine Bewertungen

- Chapter 7 Cash & Cash Equivalents: PayableDokument2 SeitenChapter 7 Cash & Cash Equivalents: PayableRey Joyce AbuelNoch keine Bewertungen

- Tax 13BDokument11 SeitenTax 13BMjhayeNoch keine Bewertungen

- Acctg 106 Practice DrillDokument2 SeitenAcctg 106 Practice DrillMjhayeNoch keine Bewertungen

- Tax EstateDokument9 SeitenTax EstateMjhayeNoch keine Bewertungen

- The Political Sources of Solidarity in Diverse SocietiesDokument42 SeitenThe Political Sources of Solidarity in Diverse SocietiesMjhayeNoch keine Bewertungen

- Measures of Central Tendency and Dispersion: ExamplesDokument8 SeitenMeasures of Central Tendency and Dispersion: ExamplesMjhayeNoch keine Bewertungen

- Finals Quiz 1 Dealings in Properties Answer KeyDokument6 SeitenFinals Quiz 1 Dealings in Properties Answer KeyMjhaye100% (1)

- Sustainable Development Strategy - Borough ofDokument60 SeitenSustainable Development Strategy - Borough ofMjhayeNoch keine Bewertungen

- Fringe Benefit TaxDokument5 SeitenFringe Benefit TaxMjhayeNoch keine Bewertungen

- Consolidation PDFDokument3 SeitenConsolidation PDFMjhayeNoch keine Bewertungen

- Midterm Quiz 1 Gross IncomeDokument3 SeitenMidterm Quiz 1 Gross IncomeMjhayeNoch keine Bewertungen

- Subsequent Events PDFDokument1 SeiteSubsequent Events PDFMjhayeNoch keine Bewertungen

- DarDokument1 SeiteDarMjhayeNoch keine Bewertungen

- Edw BiDokument22 SeitenEdw BiAjay Kumar UppalNoch keine Bewertungen

- CLO Summit 2013Dokument20 SeitenCLO Summit 2013saurs2Noch keine Bewertungen

- Price List Software - Updated 11 Okt 21Dokument6 SeitenPrice List Software - Updated 11 Okt 21Rokan PipelineNoch keine Bewertungen

- Human Resource Management at HCLDokument69 SeitenHuman Resource Management at HCLPallavi MeghnaNoch keine Bewertungen

- Uber Pricing Strategies and Marketing Communications: Brian RavennaDokument7 SeitenUber Pricing Strategies and Marketing Communications: Brian RavennarakshaNoch keine Bewertungen

- Final EtechDokument21 SeitenFinal EtechApril AguigamNoch keine Bewertungen

- MAGNA Global Forecast - Spring Update PDFDokument14 SeitenMAGNA Global Forecast - Spring Update PDFIsneha DussaramNoch keine Bewertungen

- SUPPLY CHAIN MANAGEMENT IN HOSPITALITY INDUSTRY-Module PreLimDokument11 SeitenSUPPLY CHAIN MANAGEMENT IN HOSPITALITY INDUSTRY-Module PreLimArmand Padernos100% (18)

- GL Bajaj Institute of Management and Research Greater Noida: Abhishek Srivastava ROLL NO: GM19010 Section: BDokument6 SeitenGL Bajaj Institute of Management and Research Greater Noida: Abhishek Srivastava ROLL NO: GM19010 Section: Brahul singhNoch keine Bewertungen

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDokument6 SeitenDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNoch keine Bewertungen

- Nonimmigrant Treaty Trader/Investor Visa Application InstructionsDokument4 SeitenNonimmigrant Treaty Trader/Investor Visa Application Instructionsroberto perezNoch keine Bewertungen

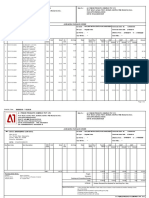

- InvoiceDokument1 SeiteInvoiceGhanapathi RamanathanNoch keine Bewertungen

- Documentation Assistant (Theory Exam) : Signature of The CandidateDokument4 SeitenDocumentation Assistant (Theory Exam) : Signature of The CandidateOsmania MbaNoch keine Bewertungen

- A-1 Fence Products Company Pvt. LTDDokument2 SeitenA-1 Fence Products Company Pvt. LTDDeepak PawarNoch keine Bewertungen

- AA ERP ProjectDokument12 SeitenAA ERP ProjectAgnel AranhaNoch keine Bewertungen

- 10 - Variance AnalysisDokument48 Seiten10 - Variance AnalysisLuba27Noch keine Bewertungen

- Focus On ICICI BankDokument6 SeitenFocus On ICICI BankArvind KannanNoch keine Bewertungen

- Company Overview: Accenture HierarchyDokument32 SeitenCompany Overview: Accenture HierarchyKhaled KalamNoch keine Bewertungen

- External and Industry Environment Analysis: Dr. K. RangarajanDokument17 SeitenExternal and Industry Environment Analysis: Dr. K. Rangarajansanghamitra20012Noch keine Bewertungen

- Philippine Framework For Assurance Engagement (PFAE) - Provides A Frame of Reference ForDokument2 SeitenPhilippine Framework For Assurance Engagement (PFAE) - Provides A Frame of Reference Forjhaeus enajNoch keine Bewertungen

- Pakistan Company Requirement 1: Journal EntryDokument4 SeitenPakistan Company Requirement 1: Journal EntryPrincessNoch keine Bewertungen

- About Quality ManagementDokument2 SeitenAbout Quality Managementsaloni3122Noch keine Bewertungen

- Partnership Workbook 2019Dokument49 SeitenPartnership Workbook 2019Miki TYNoch keine Bewertungen

- SAP FICO & Best PracticesDokument12 SeitenSAP FICO & Best PracticesAaditya Gautam100% (1)

- Unit IDokument40 SeitenUnit IVeronica SafrinaNoch keine Bewertungen

- Case Study On Piramal Healthcare Acquiring 5.5% Stake in VodafoneDokument10 SeitenCase Study On Piramal Healthcare Acquiring 5.5% Stake in Vodafonegilchrist123Noch keine Bewertungen

- An Introduction To Integrated Marketing CommunicationsDokument18 SeitenAn Introduction To Integrated Marketing CommunicationsSaurabh SharmaNoch keine Bewertungen

- Chapter 9 - Blue Ocean StrategyDokument19 SeitenChapter 9 - Blue Ocean Strategyminorona2409Noch keine Bewertungen

- KFLA Sort Cards - DigitalDokument67 SeitenKFLA Sort Cards - DigitalNicholas AngNoch keine Bewertungen

- Acknowledgement Receipt - 20190331 - 205351Dokument1 SeiteAcknowledgement Receipt - 20190331 - 205351jay-ar barangay100% (1)