Beruflich Dokumente

Kultur Dokumente

Chicago Corp stock will pay a dividend of $1.32 next year. Its current price is $24.625 per share. The beta for the stock is 1.35 and the expected return on the market is 13.5%. If the riskless rate is 8.2%, what is the expected growth rate of Chicago?

Hochgeladen von

Noman KhosaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chicago Corp stock will pay a dividend of $1.32 next year. Its current price is $24.625 per share. The beta for the stock is 1.35 and the expected return on the market is 13.5%. If the riskless rate is 8.2%, what is the expected growth rate of Chicago?

Hochgeladen von

Noman KhosaCopyright:

Verfügbare Formate

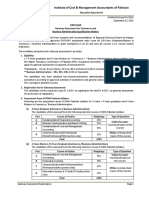

Question:

Chicago Corp stock will pay a dividend of $1.32 next year. Its current price is $24.625 per share. The beta

for the stock is 1.35 and the expected return on the market is 13.5%. If the riskless rate is 8.2%, what is

the expected growth rate of Chicago?

Solution:

Using the capital asset pricing model (CAPM),

E( Ri ) = r + βi (E (Rm ) – r)

We first find the expected rate of return as

E( Ri ) = 0.082 + 1.35[0.135 − 0.082]

= 0.082 + 1.35(0.053)

= 0.082 + 0.07155

= 0.082 + 0.07155

= 0.15355 = R

The expected rate of return E(Ri), for a security is also its required rate of return R by the

investors. Using the growth model for a stock, equation

D1

po = R−g

We get

R – g = D1/ Po

Or

g = R – D1/Po

𝟏. 𝟑𝟐

𝐠 = 𝟎. 𝟏𝟓𝟑𝟓𝟓 −

𝟐𝟒. 𝟔𝟐𝟓

𝐠 = 𝟎. 𝟏 Thus the rate of growth is 10%.

Das könnte Ihnen auch gefallen

- Financial Statement Analysis Chapter 15Dokument13 SeitenFinancial Statement Analysis Chapter 15April N. Alfonso100% (1)

- DocxDokument19 SeitenDocxJhon Lester SahagunNoch keine Bewertungen

- Assignment 2 PDFDokument10 SeitenAssignment 2 PDFvamshiNoch keine Bewertungen

- Given An Actual Demand of 60 For A Period When Forecast of 70Dokument17 SeitenGiven An Actual Demand of 60 For A Period When Forecast of 70arjunNoch keine Bewertungen

- Ch09 Resource Allocation CrashcostDokument25 SeitenCh09 Resource Allocation Crashcostndc6105058Noch keine Bewertungen

- Capital BudgetingDokument44 SeitenCapital Budgetingrisbd appliancesNoch keine Bewertungen

- QueueDokument14 SeitenQueueZharlene SasotNoch keine Bewertungen

- Acot103 Assignment 1Dokument3 SeitenAcot103 Assignment 1Jomer FernandezNoch keine Bewertungen

- Chapter 18 ForecastingDokument2 SeitenChapter 18 ForecastingAzwan de Ryekaieyz100% (1)

- Chapter 6 Discounted Cash Flow ValuationDokument27 SeitenChapter 6 Discounted Cash Flow ValuationAhmed Fathelbab100% (1)

- Capital Budgeting Decisions: Solutions To QuestionsDokument65 SeitenCapital Budgeting Decisions: Solutions To QuestionsblahdeblehNoch keine Bewertungen

- CFA560Dokument20 SeitenCFA560goyalabhiNoch keine Bewertungen

- FinMan CompreDokument15 SeitenFinMan CompreDetox FactorNoch keine Bewertungen

- Vertical Analysis To Financial StatementsDokument8 SeitenVertical Analysis To Financial StatementsumeshNoch keine Bewertungen

- Introduction To Production and Operations ManagementDokument20 SeitenIntroduction To Production and Operations ManagementJehad MahmoodNoch keine Bewertungen

- (Answer Keys) : Multiple Choice Exercise QuestionsDokument3 Seiten(Answer Keys) : Multiple Choice Exercise QuestionsCharlyn Jewel Olaes100% (1)

- 7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFDokument32 Seiten7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFPrasanna SharmaNoch keine Bewertungen

- Chap 006Dokument68 SeitenChap 006Koki KatoNoch keine Bewertungen

- Accounting AnalysisDokument15 SeitenAccounting AnalysisMonoarul IslamNoch keine Bewertungen

- Revision On Managerial Accounting: by Isb Academic TeamDokument99 SeitenRevision On Managerial Accounting: by Isb Academic TeamThe FacesNoch keine Bewertungen

- Moyer FINANZAS CUESTIONARIODokument26 SeitenMoyer FINANZAS CUESTIONARIOMariana Cordova100% (2)

- Assignment # 1Dokument2 SeitenAssignment # 1hamad0% (1)

- Current Cost Accounting (CCA) Technique - Inflation Accounting - Play AccountingDokument2 SeitenCurrent Cost Accounting (CCA) Technique - Inflation Accounting - Play AccountingVikas Singh0% (1)

- Chapter 3 - IllustrationsDokument97 SeitenChapter 3 - IllustrationsAccounting Materials0% (1)

- Chapter 6 Financial AssetsDokument6 SeitenChapter 6 Financial AssetsJoyce Mae D. FloresNoch keine Bewertungen

- Act08 Inventory ManagementDokument3 SeitenAct08 Inventory ManagementJomar Villena100% (1)

- Factors Affecting Cost of CapitalDokument40 SeitenFactors Affecting Cost of CapitalKartik AroraNoch keine Bewertungen

- Hurwicz Criterion in Decision TheroryDokument11 SeitenHurwicz Criterion in Decision TherorysubinNoch keine Bewertungen

- Chapter 16: Hybrid and Derivative SecuritiesDokument70 SeitenChapter 16: Hybrid and Derivative SecuritiesJoreseNoch keine Bewertungen

- Financial ManagementDokument13 SeitenFinancial ManagementEliNoch keine Bewertungen

- CH 3 and 4Dokument44 SeitenCH 3 and 4zeyin mohammed aumer100% (4)

- Additional Topic 6-Capital RationingDokument25 SeitenAdditional Topic 6-Capital RationingJon Loh Soon WengNoch keine Bewertungen

- ABC and Standard CostingDokument16 SeitenABC and Standard CostingCarlo QuinlogNoch keine Bewertungen

- WC Management Sample ProblemsDokument2 SeitenWC Management Sample ProblemsGreys Maddawat MasulaNoch keine Bewertungen

- Chapter 22, 23, 24, 25, 26Dokument29 SeitenChapter 22, 23, 24, 25, 26Elie Bou GhariosNoch keine Bewertungen

- Strategic ManagementDokument12 SeitenStrategic ManagementDinesh DubariyaNoch keine Bewertungen

- The Conceptual Framework of Accounting and Its Relevance To Financial ReportingDokument24 SeitenThe Conceptual Framework of Accounting and Its Relevance To Financial Reportingmartain maxNoch keine Bewertungen

- Independent University, Bangladesh: Kluuvin Apteekki Pharmacy Case StudyDokument10 SeitenIndependent University, Bangladesh: Kluuvin Apteekki Pharmacy Case StudyAmira kittyNoch keine Bewertungen

- Markov AnalysisDokument37 SeitenMarkov AnalysisRohit RajanNoch keine Bewertungen

- 2.PPT On Intangible AssetsDokument10 Seiten2.PPT On Intangible AssetsBhuvaneswari karuturiNoch keine Bewertungen

- Network Models - Operations ResearchDokument11 SeitenNetwork Models - Operations Researchneerubanda100% (1)

- Module 11 Unit 3 Multiple Linear RegressionDokument8 SeitenModule 11 Unit 3 Multiple Linear RegressionBeatriz LorezcoNoch keine Bewertungen

- Answer For Number 6. Mutually Exclusive Projects: RequiredDokument8 SeitenAnswer For Number 6. Mutually Exclusive Projects: RequiredWiz SantaNoch keine Bewertungen

- CH 12 Cash Flow Estimatision and Risk AnalysisDokument39 SeitenCH 12 Cash Flow Estimatision and Risk AnalysisRidhoVerianNoch keine Bewertungen

- Financial Statements Analysis, Part 1 - ExercisesDokument4 SeitenFinancial Statements Analysis, Part 1 - ExercisesMark Angelo BustosNoch keine Bewertungen

- Queuing Theory1Dokument36 SeitenQueuing Theory1Pavan Kumar Irrinki0% (1)

- Session 10: Using Financial Results Controls in The Presence of Uncontrollable FactorsDokument16 SeitenSession 10: Using Financial Results Controls in The Presence of Uncontrollable FactorsEka AdjieNoch keine Bewertungen

- Waiting Line ModelsDokument30 SeitenWaiting Line ModelsPinky GuptaNoch keine Bewertungen

- Assigment 3Dokument4 SeitenAssigment 3anita teshome100% (1)

- Cost of Capital Lecture Slides in PDF FormatDokument18 SeitenCost of Capital Lecture Slides in PDF FormatLucy UnNoch keine Bewertungen

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Dokument7 SeitenFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNoch keine Bewertungen

- Chap 004Dokument30 SeitenChap 004Tariq Kanhar100% (1)

- Afn 2 PDFDokument5 SeitenAfn 2 PDFLovely Ann ReyesNoch keine Bewertungen

- ACT1202.Case Study 1 - StudentDokument6 SeitenACT1202.Case Study 1 - StudentKeight NuevaNoch keine Bewertungen

- Managerial EconomicsDokument3 SeitenManagerial EconomicsbeaNoch keine Bewertungen

- Stevenson Chapter 3 - ForecastingDokument50 SeitenStevenson Chapter 3 - ForecastingSium Adnan Khan 1511153030Noch keine Bewertungen

- Chapter # 1 Risk Management & Leverage AnalysisDokument160 SeitenChapter # 1 Risk Management & Leverage AnalysisJerome MogaNoch keine Bewertungen

- Option Pricing With Applications To Real OptionsDokument77 SeitenOption Pricing With Applications To Real OptionsAbdullahRafiq100% (1)

- Financial Math 1tgtgtrDokument35 SeitenFinancial Math 1tgtgtrOmer MehmedNoch keine Bewertungen

- Chap7 - Stock Valuation - PPimanDokument18 SeitenChap7 - Stock Valuation - PPimanBẢO NGUYỄN QUỐCNoch keine Bewertungen

- Boundaries of Social EntrepreneurshipDokument2 SeitenBoundaries of Social EntrepreneurshipNoman KhosaNoch keine Bewertungen

- Business StrategyDokument6 SeitenBusiness StrategyNoman KhosaNoch keine Bewertungen

- Out Comes EnterprenuershipDokument1 SeiteOut Comes EnterprenuershipNoman KhosaNoch keine Bewertungen

- Tianjin UniversityDokument3 SeitenTianjin UniversityNoman KhosaNoch keine Bewertungen

- Ayub Khan (General)Dokument2 SeitenAyub Khan (General)Noman KhosaNoch keine Bewertungen

- Time For All 12 Printing Presses 750 × 7.227 5420.25Dokument1 SeiteTime For All 12 Printing Presses 750 × 7.227 5420.25Noman KhosaNoch keine Bewertungen

- QuestionDokument1 SeiteQuestionNoman Khosa100% (2)

- Human Resource ManagementDokument1 SeiteHuman Resource ManagementNoman KhosaNoch keine Bewertungen

- Business StrategyDokument4 SeitenBusiness StrategyNoman KhosaNoch keine Bewertungen

- Production and Operation ManagementDokument2 SeitenProduction and Operation ManagementNoman KhosaNoch keine Bewertungen

- Dimensions of Strategic ManagementDokument1 SeiteDimensions of Strategic ManagementNoman Khosa100% (1)

- Strategic Management ProcessDokument2 SeitenStrategic Management ProcessNoman KhosaNoch keine Bewertungen

- Institute of Cost & Management Accountants of Pakistan: CircularDokument2 SeitenInstitute of Cost & Management Accountants of Pakistan: CircularNoman KhosaNoch keine Bewertungen

- CAPMDokument3 SeitenCAPMNoman KhosaNoch keine Bewertungen

- Pakistan's Energy SectorDokument1 SeitePakistan's Energy SectorNoman KhosaNoch keine Bewertungen

- Definition:: Military Plan Goal Military Usage TacticsDokument2 SeitenDefinition:: Military Plan Goal Military Usage TacticsNoman KhosaNoch keine Bewertungen

- Building A Strategic Plan: External Issues Scanning and Client Segmentation AnalysisDokument1 SeiteBuilding A Strategic Plan: External Issues Scanning and Client Segmentation AnalysisNoman KhosaNoch keine Bewertungen

- Scope of Strategic ManagementDokument1 SeiteScope of Strategic ManagementNoman KhosaNoch keine Bewertungen

- Employment InterviewingDokument1 SeiteEmployment InterviewingNoman KhosaNoch keine Bewertungen

- Marketing Communication ProcessDokument2 SeitenMarketing Communication ProcessNoman KhosaNoch keine Bewertungen

- Net Profit Ratio and Quick RatioDokument1 SeiteNet Profit Ratio and Quick RatioNoman KhosaNoch keine Bewertungen