Beruflich Dokumente

Kultur Dokumente

Tax Declaration Form (Image Infotainment LTD)

Hochgeladen von

ramakotiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Declaration Form (Image Infotainment LTD)

Hochgeladen von

ramakotiCopyright:

Verfügbare Formate

IMAGE INFOTAINMENT LIMITED

# 61/32 T.T.K.Road, Alwarpet, Chennai 600 018.

1 Name : Dept :

( As per PAN Card) Designation :

2 Present Address :

Contact No:

e-mail id:

3 PAN No:

(Attach PAN Card photo Copy)

4 Tax Savings / Investment Particulars for the Financial Year 2018 - 19 [ April '2018 - March '2019 ]

5 Exemption Under Section 10. Rent / Mth Attached Proof

Amount

(i) HRA Yes No

(Rent Receipt & Agreement Copy mandatory)

PAN No. of landlord

Pan No. of landlord is must if rent paid exceeds Rs. 1,00,000/- per year [ (i.e.) Rs.8,333/- per month ]

If PAN not available, then declaration letter from landlord ( NO PAN Declaration

format attached )

( ii) Interest on Housing Loan (Maximum deduction available - Rs.2,00,000/-) Total Amount

(Interest & Principal repayment Certificate mandatory) Yes No

6 Deduction Under Section 80C (Maximum deduction available - Rs.1,50,000/-)

Policy No Term Total Amount Attached Proof

(i) Insurance Premium Yes No

L I C (Self, spouse, children) Yes No

Insurance Premium Yes No

Insurance Premium Yes No

Insurance Premium Yes No

( ii) Mutual Funds (Tax Free ) Yes No

(iii) Tuition Fees paid in Schools/Colleges Yes No

( iv) PPF / NSC Yes No

( v) Tax Saving Term Deposit in Bank Yes No

(vi) Housing Loan Principal Repayment Yes No

(vii) Others any ( Pl specify ) Yes No

7 Deduction Under Section 80D

Medical Insurance premium (Max Rs.25000/75000) Total Amount Attached Proof

(i) Yes No

8 Deduction Under Section 80CCC

Insurance premium - Pension plan Total Amount Attached Proof

(i) LIC Yes No

( ii) Any other Insurer under IRDA Yes No

9 Deduction Under Section 80E Total Amount Attached Proof

(i) Interest on Loan - Higher Education of the Employee (or) Yes No

his / her spouse (or) children

( Interest repayment certificate to be attached)

I hereby declare that the above said informations and proof documents enclosed alongwith this

statement, is true / correct to my knowledge.

Date : Signature of the Employee

Name:

Note:

1) All the employees must submit the duly signed hard copy of the filled in Tax Declaration Form to the Accounts Dept.,

on (or) before 31.08.2018. (Soft copy of the Tax declaration Form will not be accepted.)

Tax workings will be prepared on the basis of information / details submitted.

2) All the employees must submit the supportings documents for Investments particulars for the F.Y:2018 -19 on or before

28.02.2019 - ( No reminders will be sent for submission of supportings.)

3) Total Tax Liability will be computed and it will be deducted in equal installments from your Sep-18 Salary onwards.

4) All investment proofs are to be submitted on or before 28 Feb 2019. Beyond due date any documents from the

employee will not be accepted for tax computation purpose.

5) For New joinees - Please declare / submit your previous employers Salary certificate / form 16 for Tax computation

for the F.Y.: 2018 -19.

INCOME TAX SLAB RATES FOR THE FINANCIAL YEAR 2018-19:

For Individuals below 60 years age (including Woman Assessees):

Taxable Total Income Tax Rate

Upto 250,000 Nil

250,001 to 500,000 5%

500,001 to 1,000,000 20%

1,000,001 & above 30%

Less: Rebate u/s. 87A

Plus: Health & Education Cess @ 4%

Rebate u/s. 87A - The rebate is available to a resident individual if his total income does not exceed Rs. 3,50,000. The amount of rebate shall be

100% of income-tax or Rs. 2,500, whichever is less.

Das könnte Ihnen auch gefallen

- IT Declaration Format-05-12-2023Dokument6 SeitenIT Declaration Format-05-12-2023somaNoch keine Bewertungen

- Tax Regime - FAQs DocumentDokument4 SeitenTax Regime - FAQs DocumentShashank JainNoch keine Bewertungen

- Draft Proposal 587694358Dokument22 SeitenDraft Proposal 587694358UJJWAL EKKANoch keine Bewertungen

- Final-Investment Declaration Form FY 19 - 20Dokument12 SeitenFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNoch keine Bewertungen

- Income Tax Declaration Form FY 22 23 AY 23 24Dokument2 SeitenIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNoch keine Bewertungen

- Income Tax Option Cum Declaration Form (2022 2023)Dokument4 SeitenIncome Tax Option Cum Declaration Form (2022 2023)kkkNoch keine Bewertungen

- Tax Calculator FASTDokument20 SeitenTax Calculator FASTdamani.manojNoch keine Bewertungen

- Income-Tax Declaration FormDokument5 SeitenIncome-Tax Declaration FormGanesh MaddipotiNoch keine Bewertungen

- Summary of Payment Details: Details of The Policy Premium Paid For Financial Year 2021 - 2022Dokument2 SeitenSummary of Payment Details: Details of The Policy Premium Paid For Financial Year 2021 - 2022Santosh SrNoch keine Bewertungen

- IllustrationDokument2 SeitenIllustrationbalaghatjobsNoch keine Bewertungen

- 18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Dokument3 Seiten18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Mohamad FadzliNoch keine Bewertungen

- Gsquare Income Tax Declaration FormDokument1 SeiteGsquare Income Tax Declaration FormMaheshNoch keine Bewertungen

- Employees Proof Submission Form (EPSF) - 2010-11Dokument1 SeiteEmployees Proof Submission Form (EPSF) - 2010-11amararenaNoch keine Bewertungen

- Tax Calculator 7.1 (T) 2012 13Dokument17 SeitenTax Calculator 7.1 (T) 2012 13karthickNoch keine Bewertungen

- 2019 09 18 22 09 59 689 - Aovpb3846g - 2018Dokument5 Seiten2019 09 18 22 09 59 689 - Aovpb3846g - 2018varahalutulugu1980Noch keine Bewertungen

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Dokument4 SeitenOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNoch keine Bewertungen

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Dokument5 SeitenFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNoch keine Bewertungen

- Form8 2007 08Dokument5 SeitenForm8 2007 08api-3850174Noch keine Bewertungen

- Tax Checklist (Interview) - Individuals 2022Dokument4 SeitenTax Checklist (Interview) - Individuals 2022gfhn9hvv5nNoch keine Bewertungen

- 2018 07 26 08 12 24 532 - 1926212275 - PDFDokument6 Seiten2018 07 26 08 12 24 532 - 1926212275 - PDFRAKESHNoch keine Bewertungen

- FormsDokument16 SeitenFormsSujeet kumarNoch keine Bewertungen

- Tax Computation 2023-24Dokument6 SeitenTax Computation 2023-24aarthir88Noch keine Bewertungen

- Health Claim FormDokument2 SeitenHealth Claim FormtharunNoch keine Bewertungen

- Itr2022 23Dokument7 SeitenItr2022 23Debabrata pahariNoch keine Bewertungen

- Income Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountDokument3 SeitenIncome Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountNihit SandNoch keine Bewertungen

- Form-No.12bb 2020-21Dokument1 SeiteForm-No.12bb 2020-21Sk SerafatNoch keine Bewertungen

- IT Declaration Form 2020-21Dokument1 SeiteIT Declaration Form 2020-21Akshay AcchuNoch keine Bewertungen

- Form PDF 457810310271221Dokument6 SeitenForm PDF 457810310271221Pankaj GuptaNoch keine Bewertungen

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Dokument8 SeitenItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Manish MishraNoch keine Bewertungen

- Employee Tax Declaration - AY 2019-20Dokument4 SeitenEmployee Tax Declaration - AY 2019-20mathuNoch keine Bewertungen

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 804939620180718 Assessment Year: 2018-19Dokument5 SeitenItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 804939620180718 Assessment Year: 2018-19CHRISTY JOSENoch keine Bewertungen

- Employer's QUARTERLY Federal Tax Return: Report For This Quarter of 2007Dokument4 SeitenEmployer's QUARTERLY Federal Tax Return: Report For This Quarter of 2007IRS100% (1)

- Consumer Decision MakingDokument7 SeitenConsumer Decision MakingUtkarsh GurjarNoch keine Bewertungen

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Dokument8 SeitenItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNoch keine Bewertungen

- NSB Audit PerformaDokument2 SeitenNSB Audit PerformaChand Khan Rajbana100% (3)

- Loan Summary: 3908015333 Contract Number Mo X Ramajan MRDokument1 SeiteLoan Summary: 3908015333 Contract Number Mo X Ramajan MRSajid MotiwalaNoch keine Bewertungen

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Dokument12 SeitenPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNoch keine Bewertungen

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Dokument10 SeitenSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevNoch keine Bewertungen

- Yes4G Termination FormDokument1 SeiteYes4G Termination FormSimfong LowNoch keine Bewertungen

- Wa0005Dokument86 SeitenWa0005Deepu DeepNoch keine Bewertungen

- Monthly Remittance Return of Income Taxes Withheld On CompensationDokument3 SeitenMonthly Remittance Return of Income Taxes Withheld On CompensationJonNoch keine Bewertungen

- RC ColaDokument2 SeitenRC ColaMi MiNoch keine Bewertungen

- 2307 FORM - WITHHOLDING 2021 - VanDokument46 Seiten2307 FORM - WITHHOLDING 2021 - VanHraid MundNoch keine Bewertungen

- 2022 10 28 180618 Ycsl5 Financial BidDokument7 Seiten2022 10 28 180618 Ycsl5 Financial BidRahul HanumanteNoch keine Bewertungen

- Form GST Rfd11Dokument63 SeitenForm GST Rfd11forbooksNoch keine Bewertungen

- Illustration - 2024-02-20T135207.449Dokument2 SeitenIllustration - 2024-02-20T135207.449vaniganchannelNoch keine Bewertungen

- IT Declaration Form 2016-17Dokument11 SeitenIT Declaration Form 2016-17JoooNoch keine Bewertungen

- Form PDF 500708580110315Dokument31 SeitenForm PDF 500708580110315Tarak Sarkar AdminNoch keine Bewertungen

- 1601 CDokument6 Seiten1601 CJose Venturina Villacorta100% (1)

- Form PDF 401621100220322Dokument6 SeitenForm PDF 401621100220322Aravai BDONoch keine Bewertungen

- COR19982 Nat 5367 FormDokument3 SeitenCOR19982 Nat 5367 Formishtee894Noch keine Bewertungen

- Income Tax Calculator Fy 2020 21 v2Dokument12 SeitenIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1Noch keine Bewertungen

- Form 27 QDokument4 SeitenForm 27 QPradeep JainNoch keine Bewertungen

- KFD New21102022134713238 E34Dokument5 SeitenKFD New21102022134713238 E34Manish BhojaniNoch keine Bewertungen

- BIR Form 1601 c1Dokument2 SeitenBIR Form 1601 c1Clarysse Faye VidalloNoch keine Bewertungen

- Income Tax Proof Guidelines FY. 2023-24.cleanedDokument11 SeitenIncome Tax Proof Guidelines FY. 2023-24.cleanedGaurav SharmaNoch keine Bewertungen

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyVon EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNoch keine Bewertungen

- Confirmation 1 PDFDokument2 SeitenConfirmation 1 PDFENAD TBISHATNoch keine Bewertungen

- Week 2 Quarter 2 GenmathDokument83 SeitenWeek 2 Quarter 2 Genmathjohn umiponNoch keine Bewertungen

- Financial LiteracyDokument5 SeitenFinancial LiteracylaluaNoch keine Bewertungen

- 2018 PaymatrixDokument7 Seiten2018 PaymatrixTanmoy ChakrabortyNoch keine Bewertungen

- 2012 Towers Watson Global Workforce StudyDokument24 Seiten2012 Towers Watson Global Workforce StudySumit RoyNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax Returnapi-310622354Noch keine Bewertungen

- Sep Pay SlipDokument1 SeiteSep Pay SlipSharma SkNoch keine Bewertungen

- CIR Vs IsabelaDokument3 SeitenCIR Vs Isabelajleo1Noch keine Bewertungen

- Decr EmentDokument36 SeitenDecr EmentirsadNoch keine Bewertungen

- 34 - G R - No - 213486-DigestDokument2 Seiten34 - G R - No - 213486-DigestNaomi InotNoch keine Bewertungen

- Itemized Deductions - Taxes Paid 2021Dokument2 SeitenItemized Deductions - Taxes Paid 2021Finn KevinNoch keine Bewertungen

- Unit 2 Tax NotesDokument49 SeitenUnit 2 Tax NotesP RajputNoch keine Bewertungen

- SAF Withdrawal FORMSDokument1 SeiteSAF Withdrawal FORMSdine2kNoch keine Bewertungen

- Chapter 10 (Calculation If Premium)Dokument34 SeitenChapter 10 (Calculation If Premium)Khan AbdullahNoch keine Bewertungen

- Oregon Public Employees Retirement (PERS) 2007Dokument108 SeitenOregon Public Employees Retirement (PERS) 2007BiloxiMarxNoch keine Bewertungen

- Policy Loans Including Foreclosure Revival Alteration Duplicate Policy RepositoryDokument23 SeitenPolicy Loans Including Foreclosure Revival Alteration Duplicate Policy Repositorykushal patilNoch keine Bewertungen

- 18, 20,26, 139-141, 143, 145,146, 148-150. CCS (Pension) Rules, 1972 As From DoPT Website PDFDokument457 Seiten18, 20,26, 139-141, 143, 145,146, 148-150. CCS (Pension) Rules, 1972 As From DoPT Website PDFAjay KantNoch keine Bewertungen

- Effects of UnemploymentDokument2 SeitenEffects of UnemploymentAnonymous F8XVAxNoch keine Bewertungen

- PTCL Accounts 2009 (Parent)Dokument48 SeitenPTCL Accounts 2009 (Parent)Najam U SaharNoch keine Bewertungen

- Teacher PensionDokument1 SeiteTeacher PensionRick KarlinNoch keine Bewertungen

- New Pension FormDokument29 SeitenNew Pension FormMayil VananNoch keine Bewertungen

- Insurance LawsDokument158 SeitenInsurance LawsmattiepNoch keine Bewertungen

- Tax Sheltered SchemesDokument13 SeitenTax Sheltered SchemesVivek DwivediNoch keine Bewertungen

- June Salry PDFDokument1 SeiteJune Salry PDFomkassNoch keine Bewertungen

- F. HTAX230-1-Jan-June2024-FA1-AP-V2-23012024Dokument12 SeitenF. HTAX230-1-Jan-June2024-FA1-AP-V2-23012024kashmeerpunwasiNoch keine Bewertungen

- 2022-09-19 Assignment 3 Life Insurance MathsDokument2 Seiten2022-09-19 Assignment 3 Life Insurance MathshimeshNoch keine Bewertungen

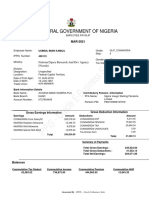

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDokument1 SeiteIPPIS - Oracle E-Business Suite: Federal Government of NigeriaKamil Usman100% (1)

- Tax 3Dokument1 SeiteTax 3Rakesh KumarNoch keine Bewertungen

- 009 BisDokument8 Seiten009 BisMax EneaNoch keine Bewertungen

- Principles and Practice of Taxation Lecture NotesDokument20 SeitenPrinciples and Practice of Taxation Lecture NotesSony Axle100% (11)