Beruflich Dokumente

Kultur Dokumente

Sammut Bonnicijointventures

Hochgeladen von

tom light0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

64 Ansichten4 Seitenpebonaki

Originaltitel

sammut-bonnicijointventures

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenpebonaki

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

64 Ansichten4 SeitenSammut Bonnicijointventures

Hochgeladen von

tom lightpebonaki

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/272352896

Joint Ventures

Chapter · January 2015

DOI: 10.1002/9781118785317.weom120048

CITATIONS READS

0 8,298

2 authors, including:

Tanya Sammut-Bonnici

University of Malta

94 PUBLICATIONS 175 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Bologna Process View project

Wiley Encyclopedia of Management - Vol 12 Strategic Management View project

All content following this page was uploaded by Tanya Sammut-Bonnici on 30 October 2017.

The user has requested enhancement of the downloaded file.

joint ventures holdings can vary substantially in size, although

it is usually important to establish clear lines of

Derek F. Channon and Tanya management decision-making control in order

Sammut-Bonnici to achieve success.

A lesser form of participation, which may or

Joint ventures are a form of cooperative strategy may not involve equity participation, involves

where firms create an alliance in order to strategic alliances. Joint ventures do tend to have

combine their resources and capabilities. The a relatively high failure rate. Nevertheless, they

objective is to establish a stronger competi- also enjoy a number of specific advantages.

tive position. Firms can diminish the negative

effects of competitive rivals by building higher ADVANTAGES OF JOINT VENTURES

barriers to entry through amalgamating financial

resources, research and development, produc- First, for the smaller organization with insuf-

tion, and distribution channels. Joint ventures ficient finance and/or specialist management

increase the profitability of an industry by skills, the joint venture can prove an effective

reducing competition in markets where both method of obtaining the necessary resources

firms are present. to enter a new market. This can be especially

The most common entry strategy for global true in attractive developing country markets,

firms to enter international markets is through where local contacts, access to distribution, and

joint ventures with local firms, followed by political requirements may make a joint venture

acquisitions. The supermarket chain Groupe the preferred, or even legally required, solution.

Auchan created the joint venture Sun Art Retail Second, joint ventures can be used to reduce

Group with Taiwan conglomerate Ruentex to political friction and local nationalist prejudice

establish China’s largest hypermarket chain. against foreign-owned corporations. More-

Global rivals Carrefour and Wal-Mart Stores, over, political rules may discriminate against

United Kingdom’s Tesco, and Germany’s Metro subsidiaries that are fully foreign-owned, and

had to slow down plans in the country in view in favor of local firms, through the placing

of the strength of the venture. Auchan recently of government contracts or through discrim-

restructured its stake in the joint venture with inating taxes and restrictions against foreign

Ruentex, leading to the acquisition of a majority firms importing key materials, machinery, and

stake in Sun Art Retail Group. components. With the development of trading

Microsoft and General Electric set up blocs such as the European Union and NAFTA,

Caradim, a joint venture aimed at helping the intergovernmental negotiations have seen the

health industry use online medical records to introduction of tariff walls to protect the partic-

improve health services. Google and Motorola ipants. As a result, despite the development, the

joined forces to satisfy Google’s strategy to

use of joint ventures to gain access to trading

acquire patents and Motorola’s efforts to

bloc markets has increased.

compete with Apple’s iPhone. Volkswagen

Third, joint ventures may provide specialist

Group and GM Motors have set up joint

ventures with corporations in China, Mexico, knowledge of local markets, entry to required

Taiwan, Turkey, and India, among others. The channels of distribution, access to supplies

objective was to establish manufacturing pres- of raw materials, government contracts, and

ence and distribution chains in the respective local production facilities. Japanese companies

countries. have actively exploited joint ventures for these

Joint ventures may well prove to be a useful, purposes. Triad alliances have, thus, often led

and indeed necessary, way to enter some new to Japanese manufacturers linking with Euro-

markets, especially for multinational firms. In pean and/or North American manufacturers

some markets, which restrict inward investment, to provide badge engineered products, which

joint ventures may be the only way to achieve have enhanced the global volume production of

market access. Within joint ventures, the partic- the Japanese suppliers and gained them access

ipants usually take clear equity positions. Such to Western developed country markets without

Wiley Encyclopedia of Management, edited by Professor Sir Cary L Cooper.

Copyright © 2014 John Wiley & Sons, Ltd.

2 joint ventures

political friction. Similarly, after the first oil- multinationals that generate joint ventures may

price shock, the Japanese moved swiftly to use do so outside a policy of global strategy integra-

joint ventures in order to gain access to secure tion, making use of such operations to service

supplies of oil. restricted geographic territories or countries

Fourth, in a growing number of countries, in which wholly owned subsidiaries are not

joint ventures with host governments have permitted.

become increasingly important. These may be A third serious problem occurs when the

formed directly with state-owned enterprises objectives of the partners are, or become, incom-

or directed toward national champions. Such patible. For example, a global firm may have

ventures are common in the extractive and a very different attitude to risk than its local

defense industries, where the foreign partner is partner and may be prepared to accept short-

expected to provide the necessary technology to term losses in order to build market share, to

aid the developing country partner. take on higher levels of debt, or to spend more

Fifth, there has been growth in the creation of on advertising. Similarly, the objectives of the

temporary consortium companies and alliances participants may well change over time, espe-

to undertake particular projects that are consid- cially when wholly owned subsidiary alternatives

ered to be too large for individual companies to may occur for the global firm with access to the

handle alone. Such cooperations include new joint venture market.

major defense initiatives, major civil engineering Fourth, problems occur with regard to

projects, new global technological ventures, and management structures and staffing of joint

the like. ventures. This is especially true in countries in

Finally, exchange controls may prevent a which nepotism is common and in which jobs

company from exporting capital and, thus, make have to be found for members of the partner’s

the funding of new overseas subsidiaries diffi- families, or when employment is given to family

cult. The supply of know-how may, therefore, members of local politicians or other locals in

be used to enable a company to obtain an equity positions of influence. From the perspective of

stake in a joint venture, where the local partner the global firm, seconded personnel may also be

may have access to the required funds. subject to conflicts of interest, in which the best

actions for the joint venture might conflict with

DISADVANTAGES OF JOINT VENTURES the strategy and objectives of the global firm

Despite the advantages of joint ventures, there shareholder.

remain substantial dangers that need to be Finally, many joint ventures fail because of a

carefully considered before embarking on a joint conflict in tax interests between the partners.

venture strategy. Many of these could actually be overcome

The first major problem is that joint ventures if they were thought through in advance;

are very difficult to integrate into a global however, such problems are rarely foreseen. One

strategy that involves substantial cross-border common problem occurs as a result of start-up

trading. In such circumstances, there are almost losses. Owing to past write-offs, accelerated

inevitable problems concerning inward and depreciation, and the like, it is common for

outward transfer pricing and the sourcing of capital-intensive businesses to report operating

exports, in particular in favor of wholly owned losses in their first few years. It is, therefore,

subsidiaries in other countries. possibly more attractive for the local partner

Second, the trend toward an integrated system if these losses can be used to offset against

of global cash management, via a central trea- other locally derived profits. To obtain such tax

sury, may lead to conflict with local partners advantages, however, certain minimum levels of

when the corporate headquarters endeavor shareholdings may be necessary, and this may

to impose limits or even guidelines on cash be in conflict with the aspirations of an MNC

and working capital usage, foreign exchange partner. The precise nature of the shareholding

management, and the amount, and means, of structure of joint ventures, therefore, needs to

paying remittable profits. As a result, many be considered at the formation stage in order to

joint ventures 3

maximize fiscal efficiency and avoid this form of • Arbitration clause indicating how disputes

conflict. between partners are to be resolved.

• Conditions under which the articles of the

JOINT VENTURE joint venture agreement may be changed.

Because of the potential difficulties that can • Consideration of how the joint venture can

occur with joint ventures, they should be formu- be terminated.

lated carefully and the Articles of Association

only drawn up after consideration of the objec- See also acquisition strategy; complex adap-

tives and strategies of the participants, both tive systems; conglomerate strategy; cooperative

at the time of formation, and as they might strategies; coopetition; corporate venturing; lever-

reasonably be expected to evolve in the future. aged buy-outs; joint ventures; strategic alliances;

Furthermore, such an agreement should set out, strategic networks

in clear language, the rights and obligations of

the participants, taking care that differences in

interpretation due to translation are not intro- Bibliography

duced when more than one language is used.

The country of jurisdiction under which any Chung, C.C. and Beamish, P.W. (2010) The trap

disputes would be settled also needs to be clearly of continual ownership change in international

stated. The joint venture agreement should then equity joint ventures. Organization Science, 21 (5),

cover the following points: 995–1015.

Harrigan, K.R. (1988) Joint ventures and competi-

• Legal nature of the joint venture and the tive strategy. Strategic Management Journal, 9 (2),

terms under which it can be dissolved. 141–158.

• Constitution of the board of directors and Li, J., Zhou, C. and Zajac, E.J. (2009) Control, collabora-

the voting power of the partners. tion, and productivity in international joint ventures:

• Managerial rights and responsibilities of the theory and evidence. Strategic Management Journal,

30 (8), 865–884.

partners.

Kumar, M.V. (2011) Are joint ventures positive sum

• Constitution of the management and

games? The relative effects of cooperative and non

appointment of the managerial staff. cooperative behavior. Strategic Management Journal,

• Conditions under which the capital can be 32 (1), 32–54.

increased. Sammut-Bonnici, T. and McGee, J. (2002) Network

• Constraints on the transfer of shares or strategies for the new economy. European Business

subscription rights to nonpartners. Journal, 14, 174–185.

• Responsibilities of each of the partners in Sammut-Bonnici, T. and Paroutis, S. (2013) Developing

respect of assets, finance, personnel, R&D, a dominant logic of strategic innovation. Management

and the like. Research Review, 36 (10), 924–938.

• Financial rights of the partners with respect Yao, Z., Yang, Z., Fisher, G. et al. (2013) Knowl-

to dividends and royalties. edge complementarity, knowledge absorption effec-

• Rights of the partners with respect to the tiveness, and new product performance: the explo-

ration of international joint ventures in China. Inter-

use of licenses, know-how, and trademarks

national Business Review, 22, 216–227.

in third countries.

• Limitations, if any, on sales of the joint

venture’s products to certain countries or

regions.

View publication stats

Das könnte Ihnen auch gefallen

- Joint Ventures: January 2015Dokument4 SeitenJoint Ventures: January 2015Hanish ChiraniaNoch keine Bewertungen

- Managerial Finance in a Canadian Setting: Instructor's ManualVon EverandManagerial Finance in a Canadian Setting: Instructor's ManualNoch keine Bewertungen

- Sammut BonnicijointventuresDokument4 SeitenSammut Bonnicijointventuresadityaupreti2003Noch keine Bewertungen

- A Joint VentureDokument4 SeitenA Joint Venturesadaf mustafaNoch keine Bewertungen

- Business Combination and Partnership Lecture 2 BDokument5 SeitenBusiness Combination and Partnership Lecture 2 BFahad HassanNoch keine Bewertungen

- Fdi Without& With AllianceDokument10 SeitenFdi Without& With AlliancemiarahmadinaNoch keine Bewertungen

- Strategic AllianceDokument5 SeitenStrategic Alliancesuse2037Noch keine Bewertungen

- Mejik CH 9 Dan 10Dokument5 SeitenMejik CH 9 Dan 10Daffa NurohimNoch keine Bewertungen

- Why Companies Decide To Participate in Mergers andDokument6 SeitenWhy Companies Decide To Participate in Mergers andMeghaNoch keine Bewertungen

- Chapter 13 SUMMARYDokument11 SeitenChapter 13 SUMMARYHamza AlBulushiNoch keine Bewertungen

- Chap 8Dokument5 SeitenChap 8Sinthya Chakma RaisaNoch keine Bewertungen

- Case Study 1Dokument4 SeitenCase Study 1Naomi ChanNoch keine Bewertungen

- A Multinational OrganisationDokument6 SeitenA Multinational Organisationanyainsanally08Noch keine Bewertungen

- Itroduction Investement Entry ModesDokument6 SeitenItroduction Investement Entry Modesally jumanneNoch keine Bewertungen

- Investment Entry Modes: Wholly Owned Subsidiaries, Joint Ventures, and Strategic AlliancesDokument8 SeitenInvestment Entry Modes: Wholly Owned Subsidiaries, Joint Ventures, and Strategic AlliancesSang Ayu JuniariNoch keine Bewertungen

- Global Market Entry Strategies: Licensing, Investment, and Strategic AlliancesDokument7 SeitenGlobal Market Entry Strategies: Licensing, Investment, and Strategic AlliancesGautam BhallaNoch keine Bewertungen

- The Competitive Advantage of Strategic AlliancesDokument9 SeitenThe Competitive Advantage of Strategic Alliancesnimbusmyst100% (2)

- Bba Eim Group No 2Dokument13 SeitenBba Eim Group No 2hamidumajid033Noch keine Bewertungen

- Supply RiskDokument6 SeitenSupply RiskFARAI KABANoch keine Bewertungen

- Module 8 Strategic Management 2ND Sem 2021 2022Dokument4 SeitenModule 8 Strategic Management 2ND Sem 2021 2022Lady Lou Ignacio LepasanaNoch keine Bewertungen

- Global Alliances and Strategy Implementation Strategic AlliancesDokument7 SeitenGlobal Alliances and Strategy Implementation Strategic AlliancesMakmur PanjaitanNoch keine Bewertungen

- Joint Ventures and StrategicAlliancesDokument17 SeitenJoint Ventures and StrategicAlliancesnikunj1990Noch keine Bewertungen

- Non-Generic Competitive StrategiesDokument22 SeitenNon-Generic Competitive StrategiesShah Maqsumul Masrur TanviNoch keine Bewertungen

- MULTINATIONAL FINANCE chp1Dokument22 SeitenMULTINATIONAL FINANCE chp1Soninder KaurNoch keine Bewertungen

- Difference Between Strategic Alliance, Joint Venture and Strategic AllianceDokument7 SeitenDifference Between Strategic Alliance, Joint Venture and Strategic AllianceTadashi HamadaNoch keine Bewertungen

- BusinessDokument6 SeitenBusinessNGNoch keine Bewertungen

- 04 Intl Biz Entry Strategy Sess 8 & 9Dokument26 Seiten04 Intl Biz Entry Strategy Sess 8 & 9sarveshaNoch keine Bewertungen

- Joint Ventures Synergies and BenefitsDokument5 SeitenJoint Ventures Synergies and BenefitsleeashleeNoch keine Bewertungen

- 03 Intl Biz Entry Strategy Sess 5 & 6Dokument25 Seiten03 Intl Biz Entry Strategy Sess 5 & 6vishalNoch keine Bewertungen

- Mergers TransactionDokument5 SeitenMergers TransactionEnisa EniNoch keine Bewertungen

- Joint VentureDokument29 SeitenJoint VenturelabanijituNoch keine Bewertungen

- Strategic Alliance JitinDokument28 SeitenStrategic Alliance JitinShrishtiNarayaniNoch keine Bewertungen

- Tema 3. Collaborative StrategiesDokument7 SeitenTema 3. Collaborative Strategiesot2023juantinNoch keine Bewertungen

- International Strategic Alliances: After Studying This Chapter, Students Should Be Able ToDokument19 SeitenInternational Strategic Alliances: After Studying This Chapter, Students Should Be Able Toaidatabah100% (1)

- 2.8 External SourcesDokument21 Seiten2.8 External SourcesRosy GuptaNoch keine Bewertungen

- International Strategic AlliancesDokument19 SeitenInternational Strategic AlliancesAniket Chowdhury50% (2)

- Unit 4 International Market Entry Strategies: StructureDokument21 SeitenUnit 4 International Market Entry Strategies: Structuresathishar84Noch keine Bewertungen

- First AssignmentDokument5 SeitenFirst Assignmentমুহম্মদ কামরুল ইসলামNoch keine Bewertungen

- Pros and ConDokument10 SeitenPros and ConMaisie LaneNoch keine Bewertungen

- 04 Intl Biz Entry Strategy Sess 8 9Dokument31 Seiten04 Intl Biz Entry Strategy Sess 8 9sarveshaNoch keine Bewertungen

- Strategic AllianceDokument17 SeitenStrategic AllianceASWINI SUDHEERNoch keine Bewertungen

- Alliances 2009Dokument24 SeitenAlliances 2009tmaeimNoch keine Bewertungen

- Literature Review On Vertical Integration of RetailersDokument17 SeitenLiterature Review On Vertical Integration of RetailersNelum Shehzade100% (2)

- Spring 2022-2023 - PIM - Chapter 7 - Strategic Alliances and NetworksDokument36 SeitenSpring 2022-2023 - PIM - Chapter 7 - Strategic Alliances and NetworksArju LubnaNoch keine Bewertungen

- Global Corporate StrategyDokument40 SeitenGlobal Corporate StrategyAik Luen LimNoch keine Bewertungen

- The Importance of Mergers and Acquisitions in Today's EconomyDokument5 SeitenThe Importance of Mergers and Acquisitions in Today's EconomyHUONG TRAN THI SONGNoch keine Bewertungen

- IHM Lecture 3Dokument3 SeitenIHM Lecture 3Mariam AdelNoch keine Bewertungen

- Module 8 STRATEGIES OF FIRMS IN INTERNATIONAL TRADE PDFDokument8 SeitenModule 8 STRATEGIES OF FIRMS IN INTERNATIONAL TRADE PDFRica SolanoNoch keine Bewertungen

- SpringerDokument12 SeitenSpringerUYÊN PHAN THỊ THANHNoch keine Bewertungen

- Managing Across BoundariesDokument16 SeitenManaging Across BoundariesPam UrsolinoNoch keine Bewertungen

- Niharika IDPDokument8 SeitenNiharika IDPsamNoch keine Bewertungen

- 03 Intl Biz Entry Strategy Sess 5 & 6Dokument24 Seiten03 Intl Biz Entry Strategy Sess 5 & 6Kapil PrabhuNoch keine Bewertungen

- Imran Khan IBDokument12 SeitenImran Khan IBilyasNoch keine Bewertungen

- Global Alliances and Strategy ImplementationDokument7 SeitenGlobal Alliances and Strategy ImplementationBogdan Alexandru Dida100% (2)

- Alliances and PartnershipsDokument8 SeitenAlliances and PartnershipsbremarkicNoch keine Bewertungen

- Strategic Alliances & Joint Ventures, M & A's: Prof A K MitraDokument65 SeitenStrategic Alliances & Joint Ventures, M & A's: Prof A K MitravaibhavNoch keine Bewertungen

- Cooperative StrategyDokument6 SeitenCooperative StrategyMhaine Cui100% (1)

- Chapter 1 - An Introduction To Accounting TheoryDokument23 SeitenChapter 1 - An Introduction To Accounting TheoryelizabethNoch keine Bewertungen

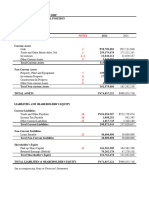

- FIMA 30013 FS Analysis Premium FSDokument4 SeitenFIMA 30013 FS Analysis Premium FSdcdeguzman.pup.pulilanNoch keine Bewertungen

- Groww Case StudyDokument4 SeitenGroww Case Studydurga workspotNoch keine Bewertungen

- Middl Le East Architect 201311Dokument68 SeitenMiddl Le East Architect 201311Nguyen BinhNoch keine Bewertungen

- Financial FreedomDokument3 SeitenFinancial FreedomErika AhumadaNoch keine Bewertungen

- Facility Location: by Shashikant H.Zarekar, PE (24), 091040031, B.Tech Prod, V.J.T.I MumbaiDokument17 SeitenFacility Location: by Shashikant H.Zarekar, PE (24), 091040031, B.Tech Prod, V.J.T.I MumbaiShashikant ZarekarNoch keine Bewertungen

- 01 - Forex-Question BankDokument52 Seiten01 - Forex-Question BankSs DonthiNoch keine Bewertungen

- Financial Ratio Analysis IDokument12 SeitenFinancial Ratio Analysis IManvi Jain0% (1)

- Exide IndustriesDokument236 SeitenExide IndustriesManas Kumar SahooNoch keine Bewertungen

- Asset Disposal & Statement of Cash FlowsDokument3 SeitenAsset Disposal & Statement of Cash FlowsShoniqua JohnsonNoch keine Bewertungen

- By LawsDokument8 SeitenBy LawsChrissy SabellaNoch keine Bewertungen

- Non Stationary Model For Statistical ArbitrageDokument17 SeitenNon Stationary Model For Statistical ArbitrageWill BertramNoch keine Bewertungen

- Quiz 5Dokument5 SeitenQuiz 5Lê Thanh ThủyNoch keine Bewertungen

- SMCH 05Dokument73 SeitenSMCH 05FratFool100% (1)

- Business Plan HotelDokument36 SeitenBusiness Plan Hoteldammika_077100% (7)

- Ma 1Dokument36 SeitenMa 1Project SiteNoch keine Bewertungen

- P16mba6 - Management Accounting PDFDokument184 SeitenP16mba6 - Management Accounting PDFSabari CaNoch keine Bewertungen

- Growth and DecayDokument8 SeitenGrowth and DecaySammy Ben MenahemNoch keine Bewertungen

- Parachutepayments ExamplesDokument8 SeitenParachutepayments ExamplesaxispointdbNoch keine Bewertungen

- Gum Arabic Policy Note Final PDFDokument45 SeitenGum Arabic Policy Note Final PDFnazarmustafaNoch keine Bewertungen

- Forward Final MbaDokument35 SeitenForward Final MbaAmanNandaNoch keine Bewertungen

- Cvs Caremark Vs WalgreensDokument17 SeitenCvs Caremark Vs Walgreensapi-316819120Noch keine Bewertungen

- Definitive Shopper Marketing GuideDokument91 SeitenDefinitive Shopper Marketing GuideDemand Metric100% (2)

- Nature and Importance of Business PolicyDokument11 SeitenNature and Importance of Business PolicySanguine MurkNoch keine Bewertungen

- Share Based Payments - FARDokument87 SeitenShare Based Payments - FARChloe ChiongNoch keine Bewertungen

- Mba 4 Sem Banking and Insurance 2 849905 Summer 2013Dokument1 SeiteMba 4 Sem Banking and Insurance 2 849905 Summer 2013Hansa PrajapatiNoch keine Bewertungen

- Basic Bookkeeping For EntrepreneursDokument36 SeitenBasic Bookkeeping For EntrepreneursDanney EkaNoch keine Bewertungen

- Just DialDokument3 SeitenJust Dialrapols9Noch keine Bewertungen

- Capital Budgeting HDFCDokument68 SeitenCapital Budgeting HDFCKasiraju Saiprathap43% (7)

- Analisis Finansial Penggemukan Kambing Peranakan Boer F1 Di Perusahaan Peternakan CV. Agriranch Karangploso MalangDokument6 SeitenAnalisis Finansial Penggemukan Kambing Peranakan Boer F1 Di Perusahaan Peternakan CV. Agriranch Karangploso MalangIlhammNoch keine Bewertungen

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- System Error: Where Big Tech Went Wrong and How We Can RebootVon EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootNoch keine Bewertungen

- Generative AI: The Insights You Need from Harvard Business ReviewVon EverandGenerative AI: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Von EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Bewertung: 5 von 5 Sternen5/5 (2)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerVon EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerBewertung: 4 von 5 Sternen4/5 (121)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyVon EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyBewertung: 4 von 5 Sternen4/5 (51)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldVon EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldBewertung: 4.5 von 5 Sternen4.5/5 (107)

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldVon EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldBewertung: 4.5 von 5 Sternen4.5/5 (55)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyVon EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNoch keine Bewertungen

- AI Superpowers: China, Silicon Valley, and the New World OrderVon EverandAI Superpowers: China, Silicon Valley, and the New World OrderBewertung: 4.5 von 5 Sternen4.5/5 (399)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceVon EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceBewertung: 5 von 5 Sternen5/5 (5)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andVon EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andBewertung: 4.5 von 5 Sternen4.5/5 (709)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumVon EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumBewertung: 3 von 5 Sternen3/5 (12)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingVon EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingBewertung: 4.5 von 5 Sternen4.5/5 (41)

- Strategic Analytics: The Insights You Need from Harvard Business ReviewVon EverandStrategic Analytics: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (46)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Von EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Bewertung: 4.5 von 5 Sternen4.5/5 (11)

- Binary Option Trading: Introduction to Binary Option TradingVon EverandBinary Option Trading: Introduction to Binary Option TradingNoch keine Bewertungen

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffVon EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffBewertung: 4 von 5 Sternen4/5 (1)

- The Prosperity Paradox: How Innovation Can Lift Nations Out of PovertyVon EverandThe Prosperity Paradox: How Innovation Can Lift Nations Out of PovertyBewertung: 4.5 von 5 Sternen4.5/5 (5)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziVon Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNoch keine Bewertungen

- Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdVon EverandLean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Play Bigger: How Pirates, Dreamers, and Innovators Create and Dominate MarketsVon EverandPlay Bigger: How Pirates, Dreamers, and Innovators Create and Dominate MarketsBewertung: 4.5 von 5 Sternen4.5/5 (73)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffVon EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffBewertung: 5 von 5 Sternen5/5 (62)

- The Ruler's Guide: China's Greatest Emperor and His Timeless Secrets of SuccessVon EverandThe Ruler's Guide: China's Greatest Emperor and His Timeless Secrets of SuccessBewertung: 4.5 von 5 Sternen4.5/5 (14)