Beruflich Dokumente

Kultur Dokumente

Guidelines On The Livestock Mortality Insurance Program: Iv. Insurable Age

Hochgeladen von

Rtr DucksOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Guidelines On The Livestock Mortality Insurance Program: Iv. Insurable Age

Hochgeladen von

Rtr DucksCopyright:

Verfügbare Formate

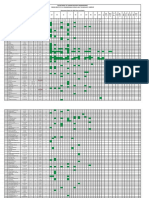

Sum Insured and Premium Rate as Sum Insured Premium Rate as

GUIDELINES ON THE LIVESTOCK MORTALITY IV. INSURABLE AGE Animal/ Age Upon

Percentage (%) of Sum Insured Deduct-

ible %

Animal Purpose (PhP) per Head/ % of Sum Insured

Deductible

% of SI

Batch - Poultry (SI)

INSURANCE PROGRAM Insurable Age Purpose Acceptance

PhP 7,000

PhP

9,001 -

PhP

11,001 -

PhP

13,001 -

of Sum

Horse Draft

Animal Purpose Remarks Insured

From To - 9,000 11,000 13,000 15,000

70% market value 3 to 6

The Philippine Crop Insurance Corporation (PCIC) provides insurance Animals over 5 years but not over 12 Swine TSI shall be 70% of the value of swine at selling/ Breeder

cover to livestock such as cattle, carabao, horse, swine, goat, sheep, Cattle and

Draft, Dairy,

years old can be accepted for coverage Fattener slaughter time in the locality but not to exceed Swine 70% market value 4 to 8

Breeder, 7 mos. 5 yrs

poultry, and game fowls and animals. Carabao

Fattener

subject to additional premium up to PhP8,000/head. 10-30% of TSI

age 12 The premium rate per raising period is: Fattener 70% market value 0.50 per month

45 days 10

Covered Diseases Typhoon & Flood

Animals over 5 years but not over 12 Total Breeder 20,000 12

I. TYPES OF INSURANCE COVER Horse Draft/Working 1 yr. 5 yrs

years old can be accepted for coverage

(Normal Cover) (Rider Perils)

Goat & Sheep

1. Non-Commercial Mortality Insurance Cover for cattle, carabao, horse, subject to additional premium up to 1.50 0.25 1.75 Fattener 1,000 10

swine, goat, sheep and poultry. age 12

0.24% for typhoon, 2.5% of TSI

TSI shall be 70% of the value of swine at time of

2. Commercial Mortality Insurance Cover for cattle, carabao, horse, swine, Goat and Breeder 4 mos. 1 yr Renewable annually up to 5 years old purchase but not to exceed the following:

Poultry flood, lightning & fire per event, one

goat, sheep and poultry. Sheep Fattener 4 mos. 1 yr Until sold whichever comes earlier F1 (first generation): PhP 12,500; Chicken Broilers 70% market value loss event

0.5% to 1.05% for limited to one

3. Special Cover for livestock dispersal. Parent Stock: PhP 31,500; and

regular disease cover

Can be renewed annually up to 4th year Grand Parent Stock: PhP 52,000 (1) week

4. Special Cover for game fowls and animals such as fighting cocks and Breeder 6 mos. 2 yrs

of life Breeder 6 mos. 10 2.5% of TSI

race horses. Swine The applicable premium rate is: 2.60% for regular

disease and natural per event, one

Fattener 45 days 6 mos Until sold whichever comes earlier Chicken Pullets/

Covered Diseases Typhoon & Flood 70% market value calamities (typhoon, loss event to

Total Ducks Layers flood, lightning and

II. INSURANCE COVER Chicken

Broilers 1 day 8 wks (Normal Cover) (Rider Perils)

fire) cover

72 hours or as

agreed

These policies cover death due to accidents and/or diseases, and/or Pullets/Layers 1 day 75 wks Or insurable age could be agreed upon

3.0 0.50 3.50

other covered risks affecting the livestock. Notes:

Duck Pullets/Layers 12 wks 65 wks Or insurable age could be agreed upon Goat and PhP 1,000 PhP 2,500 PhP 6,000 1. The above premium rates are subject to change by the PCIC; and

Sheep 2. The sum insured and premium rate for commercial cover of horse will be

III. ELIGIBILITY V. ACCEPTANCE AGE; SUM INSURED AND PREMIUM RATE Buck-Breeder 4 mos. 10 10 10 10 to 20 supplied by PCIC.

The following animals are insurable: Doe-Breeder

a. Non-Commercial 4 mos. 10 10 N.I. 10 to 20

Fattener 4 mos. 10 N.I. N.I. 10 to 20

VI. COVERED RISKS

Insurance No. of Heads/ Sum Insured and Premium Rate as Percentage

Animal Purpose Remarks Insurance

Cover Birds per Farmer (%) of Sum Insured Chicken Animal Covered Risks

Animal/ Age Upon Cover

Cattle and Draft, Dairy, Purpose Acceptance PhP PhP Broilers 1 day TSI shall be 70% of the prevailing market value

2 to 10 7,000 - PhP 9,001 11,001 - PhP 13,001 in the locality. 1. Diseases like Liver Fluke, Verminous, Bronchitis, all

Carabao Breeder, Fattener other parasitic diseases, Leptospirosis, Swine Enzootic

9,000 - 11,000 13,000 - 15,000 Premium rate is 0.76% to 1.29% depending

on the number of days per rearing or growing Pneumonia, Colibacillosis, Streptococcosis, Tetanus,

Horse Draft/Working 2 to 10 Aflatoxicosis, Cancerous Diseases, Footrot, Rabies,

Cattle & 7 mos. - period. Poisoning, Heat Stroke, Heart Attack and all other diseases

Goat and Sheep Breeder, Fattener 10 to 25 Max total sum 5.00 5.50 6.00 6.50

Carabao 5 yrs. except those appearing in the exclusions in the policy;

Non-

insured of less Layers TSI shall be 70% of the prevailing market value

Cattle,

Breeder 2 to 10 than Draft, 6 yrs. 5.25 5.75 6.25 6.75 1 day in the locality.

Commercial Swine Carabao, 2. Accidental drowning, strangulation, snakebites and other

PhP 110,000 Dairy, Premium rate is 2.60% per annum. Non-Commercial Horse, events of accidental nature except those caused by

Mortality Fattener 7 to 20 7 yrs. 5.50 6.00 6.50 7.00

or PhP 15,000 Breeder, Swine, Goat vehicular accidents;

Insurance Notes: For cattle, carabao, and horse: and Sheep

Poultry or less per Fattener 8 yrs. 5.75 6.25 6.75 7.25 a. Above premium rates are applicable for the first/initial coverage; 3. Fire and/or lightning;

head b. For continued annual renewal of the policy (including those renewed

Chicken Broilers > 5,000 (minimum) 9 yrs. 6.00 6.50 7.00 7.50 4. Dog bites (for goat and sheep only); and

within 30 days from date of expiry, up to the age of 12 years), the

Pullets/Layers > 1,000 (minimum) 10 yrs. 6.25 6.75 7.25 N.I. assured shall be entitled to the premium rate similar to that of the first/ 5. Accidents arising from the transport of animals to and from

Duck Pullets/Layers > 1,000 (minimum)

initial coverage, based on the age the animal was first insured; and the farm and place of treatment.

11 yrs. 6.50 7.00 N.I. N.I. c. However, if the renewal of the policy was beyond 30 days after

Cattle and Draft, Dairy, 11 and > (or 12 yrs. 6.75 N.I. N.I. N.I. expiry of the policy, the premium rate to be applied shall be based Poultry Diseases, typhoon, flood, lightning and fire.

Carabao Breeder, Fattener at least one (1) on the age of the animal upon acceptance of the latest application. 1. All diseases covered in Non-Commercial Cover;

animal involving Horse PhP PhP PhP PhP The coverage will then be treated as if accepted for the first time. Cattle,

coverage of at least Draft/ 9,000 or 9,001 - 11,001 - 13,001 - Carabao, 2. All accidents covered in Non-Commercial Cover except for

PhP15,001) Working less 11,000 13,000 15,000 Horse, fire and lightning; and

b. Commercial Cover Commercial Swine, Goat

Horse Draft/Working 11 (minimum) 1 yr.-5yr. 5.00 5.50 6.00 6.50 and Sheep 3. Accidents arising from the transport of animals to and from

Sum Insured Premium Rate as the farm and place of treatment.

Goat and Sheep Breeder, Fattener 26 (minimum) A minimum 6 yrs. 5.25 5.75 6.25 6.75 Deductible

Commercial Animal Purpose (PhP) per Head/ % of Sum Insured

total sum % of SI Poultry Diseases, typhoon, flood, lightning and fire.

Mortality Batch - Poultry (SI)

Breeder 11 (minimum) insured of 7 yrs. 5.50 6.00 6.50 7.00

Insurance Swine Livestock

PhP110,000 Same risks under Non-Commercial Cover

Fattener 21 (minimum) 8 yrs. 5.75 6.25 6.75 7.25 10,000 to 15,000 5 to 7 Dispersal

Special Cover

Poultry 9 yrs. 6.00 6.50 7.00 N.I. 15,001 to 20,000 6 to 8 Game fowls Same risks under Commercial Cover

Draft, Dairy, and animals

Chicken Broilers 5,000 (minimum) 10 yrs. 6.25 6.75 N.I. N.I. Cattle & 20,001 to 25,000 7 to 9 10 to 30% of

Breeder,

Carabao

Fattener

TSI Notes:

Pullets/Layers 1,000 (minimum) 11 yrs. 6.50 N.I. N.I. N.I. 25,001 to 30,000 8 to 10

1. Please see Section VIII for conditions for extended coverage; and

Duck Pullets/Layers 1,000 (minimum) 12 yrs. 6.75 N.I. N.I. N.I. 30,001 to 50,000

Above 10% or as 2. The parameters for special cover shall be defined/supplied by the PCIC

agreed Regional Office(s) (ROs).

VII. EXCLUDED RISKS XII. CLAIM FOR INDEMNITY PROCEDURE

LIVESTOCK INSURANCE

Erysipelas 0.25

1. Destruction of the animals by administrative order of the government; Hog Cholera (Fattener/Breeder) 0.50 1. In case of death of the insured animal, the assured shall immediately

2. Unskillful treatment by the animal raiser, his agent and employees, send a pro-forma Notice of Loss (NL) to the PCIC RO or PEO within

overloading, improper use, willful or malicious injury; Hoof and Mouth Disease 0.25 TEN (10) calendar days from the death of the insured animal. The NL

3. Emergency slaughter/Government Slaughter Order;

4. Pillage, strike, or other labor disputes, war, rebellion, insurrection and

Salmonellosis

Swine Plague

0.25

0.25

can be in the form of telegram, fax, e-mail or any other form of written

statement containing the name of the assured, address, policy no.,

livestock insured, cause of death, and date of the occurrence of death.

GUIDELINES

radioactive contamination; Swine

5. Disease/s or injuries already existing at the commencement of insurance Fire and Lightning (For Fatteners) 0.25

For purposes of reckoning the ten-day period, the official date of filing shall

or developing during the waiting period; Fire and Lightning (for Breeders) 0.50 be:

6. Disappearance, theft, robbery, confiscation by order of the government; Porcine Epidemic Diarrhea Virus (PEDv) 0.50

a. Date of mailing postmarked on the envelope;

7. Earthquake, convulsions of nature, volcanic eruption, inundation, b. Date of transmission, if sent by telegram, fax or e-mail; or

immolation and atmospheric disturbance such as typhoon, hurricane, Typhoon and Flood (Fattener) 0.25 c. Date of receipt by the PCIC RO, if by personal delivery.

tornado & cyclone; Typhoon and Flood (Breeder) 0.50 per year 2. Within THIRTY (30) calendar days from the death of the insured animal, the

8. Losses occurring prior to and after the effectivity period of insurance assured shall submit to the PCIC RO or PEO the following documents:

coverage; Chicken/Broilers Typhoon, flood, lightning and fire 0.24 per growing period

a. Claim for Indemnity/Loss Report - this serves as the formal claim, if

9. Losses due to mismanagement; duly signed and accomplished by the assured;

10. Losses due to vehicular accidents; 5. For transport risk - the transport insurance cover is optional and can only b. Veterinary Disease Report- duly accomplished and signed by the

11. Fire, lightning, typhoon and flood under Commercial Cover; and be provided as an addition to the basic cover and limited only to inland authorized veterinarian or LGU Livestock Inspector/Technician;

transport at a rate of 0.75% to 1.50%, depending on physical distance, time c. Original Copy of the Certificate of Ownership/Transfer of Large Cattle

12. Other excluded risks: and road conditions, excluding risks associated with hijacking and theft; or Certified machine copy of Memorandum Receipt for government

6. The following are additional conditions for extended coverage for poultry dispersed animals;

Animal Other Excluded Risks (please see other applicable conditions above): d. Livestock Death Certificate;

a. Catastrophic losses arising from death of birds, pullets, or layers due e. Necropsy/Laboratory reports, if performed;

Cattle & Anaplasmosis, Anthrax, Babesiosis, Blackleg, Hemorrhagic Septicemia, Hoof and to accidents and/or diseases at all times, including epidemics, can be f. Photographs of the dead animal/s showing clearly the identifying marks

covered, provided that proper vaccination program has been carried out (eartags, earnotch, brand or tattoo); and

Carabao Mouth Disease, Johne’s Disease, Rinderpest, Leucosis, and Tuberculosis g. Other documents as may be required by the PCIC such as affidavit of

and a Veterinary Certificate about such vaccination has been submitted. two disinterested parties.

Horse

African Horse Sickness, Infectious Anemia, Racing and/or Participation in b. Losses due to epidemic diseases such as Avian Diptheria, Avian Malaria,

Tournaments/Sports and Scab Avian Leucosis Complex, Avian Infectious Bronchitis, Coccidiosis, For poultry, the following shall be submitted to the PCIC RO or PEO:

Dysentery, Erysipelas, Hog Cholera, Hoof and Mouth Disease, Swine Plague, Porcine

Escherichia Coli, Infectious Coryza, Infectios Bursal Disease, Marek’s a. Weekly Loss Report;

Swine

Epidemic Diarrhea Virus (PEDv) and Salmonellosis

Disease, Newcasttle Disease (NCD) and Tuberculosis can be covered, b. Veterinary Report accomplished by his duly authorized veterinarian;

provided the insured broilers, pullets, layers are properly inoculated and c. Farm Management Chart or Daily Mortality Chart;

Poultry Avian or Bird Flu, Mycoplasma spp. Infection, and Salmonella vaccinated at proper times and all necessary preventive measures taken d. Photographs of dead birds; and

into consideration.

7. Losses due to fire, lightning, typhoon and flood under commercial cover of

e. Pertinent proof of proceeds. “Sa Paglaban sa Kahirapan at Gutom,

VIII. CONDITIONS FOR EXTENDED COVERAGE cattle, carabao and horse are excluded in the basic cover but can be covered

Additional risks and diseases excluded in the basic cover can be under special arrangement subject to additional premium loading. XIII. PERCENTAGE LOSS ASSESSMENT Crop Insurance, Katulong sa Pagbangon.”

covered as extended cover subject to the following conditions: IX. WAITING PERIOD Insurance Animal- Percentage (%) Loss Assessment/

The waiting period is the time elapsed between effectivity of the coverage and Cover Purpose Remarks

1. All animals subject for coverage shall be personally inspected by the the time of occurrence of the disease within which no insurance compensation

shall be paid. The waiting period shall not apply to losses due to accidents and

Cattle, Carabao, DEPARTMENT OF AGRICULTURE

PCIC Regional Office (RO) personnel; Swine - Breeder, 100% of Sum Insured at the time of loss less applicable

for renewed policies. In general, the waiting period is TWENTY ONE (21) calendar

2. All susceptible animals subject for coverage shall be vaccinated against

epidemic diseases and a Veterinary Certificate to that effect shall be

days except for the following diseases which is THREE (3) months:

Goat and Sheep - deductible and salvage value

Breeder

PHILIPPINE

Non-

submitted to the PCIC RO;

3. All losses caused by any epidemic disease, if covered, shall be indemnified

Animal Diseases Commercial

Swine - Fattener

100% of the value of animal at the time of loss, based on the

table of assessment less applicable deductible and salvage CROP INSURANCE

value

at a maximum of sixty percent (60%) of the sum insured; and

4. There shall be an additional premium loading per disease as shown below:

Cattle,Carabao, Goat

and Sheep

Leucosis, Liverfluke, Rickets and Verminous Bronchitis Goat and Sheep - 90% of the value of the animal at the time of loss, less CORPORATION

Fattener applicable deductible and salvage value

Cattle, Carabao,

Additional Premium Swine Brucellosis, Leucosis, Rickets and Tuberculosis

Swine, Goat and

Maximum of 100% of Sum Insured at the time of loss less

Animal Type of Disease/Allied Peril per Disease as % applicable deductible and salvage value

Sheep

of Sum Insured Horse Equine Encephalomyelitis, Hydrocephalus Tuberculosis and Rickets 80% of actual cash value of the insured animal at the time of Philippine Crop Insurance Corporation

Anaplasmosis 0.25 Horse loss but not to exceed 80% of the Sum Insured less deductible

and salvage value

HEAD OFFICE

Commercial

Anthrax 0.25 X. APPLICATION PROCEDURE Indemnity shall be based on the remaining loss after 7F Building A, NIA Complex, EDSA,

Poultry Diliman, Quezon City

Babesiosis 0.25 The insurance client shall: deductible of the policy deductible

1. Submit filled-out application form for PCIC Livestock Mortality Insurance; Deductible shall be reckoned on a per farm per event basis on Phone: (02) 441-1324

Blackleg 0.25 2. Submit Veterinary Health Certificate as to the health of the animal, if All animals varying percentages depending on type of animal and cause/

Contagious Bovine Pleuro-pneumonia 0.25 required; and Fax: (02) 361-8983

nature of loss

3. Pay the corresponding premium and other charges (e.g., premium tax, Email Address: rmg@pcic.gov.ph

Johnne’s Disease 0.25

Cattle & Carabao cost of documentary stamps, etc.). XIV. PAYMENT OF CLAIM

Hemorrhagic Septicemia 0.25 The claim shall be settled expeditiously not later than forty-five (45) calendar

Hoof and Mouth Disease 0.25 XI. ISSUANCE OF POLICY days from receipt of complete claim documents.

For insurance business solicited/underwritten by the Insurance Underwriter

Rinderpest 0.25 (IU), Official Receipt (OR) shall be issued to the client by the IU upon receipt XV. FINALITY OF PCIC DECISION ON CLAIMS

Tubercolosis 0.25 of insurance premium and other charges. Copy of Insurance Policy/Contract Unless proven otherwise, PCIC decision on claim settlement is final and

shall be immediately released by the PCIC RO to the client upon remittance of unappealable sixty (60) calendar days after the release of indemnity payment

Fire and Lightning 0.25

the premium and other charges by the IU to the PCIC RO Cashier. or transmittal of the notice of disapproval. Visit us at:

Typhoon and Flood 0.50 http://pcic.gov.ph

REVISED NOVEMBER 2018

Das könnte Ihnen auch gefallen

- 01 Livestock April 12 2019 Final Printing APRIL 15 2019Dokument2 Seiten01 Livestock April 12 2019 Final Printing APRIL 15 2019Era Mae Fabian SabanganNoch keine Bewertungen

- October AccomplishmentDokument17 SeitenOctober AccomplishmentReyma GalingganaNoch keine Bewertungen

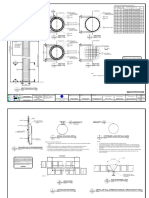

- ROB DATA To CBE KANWAR PH-30 Work As On 17.07.2020Dokument21 SeitenROB DATA To CBE KANWAR PH-30 Work As On 17.07.2020mchkppNoch keine Bewertungen

- Caso Mano de Obra CocadasDokument3 SeitenCaso Mano de Obra CocadasNatalia Jauregui GumucioNoch keine Bewertungen

- Shmula Hoshin X Matrix Template 2021Dokument15 SeitenShmula Hoshin X Matrix Template 2021Romy WidjajaNoch keine Bewertungen

- Hoshin X Matrix Template OpEx 2021Dokument14 SeitenHoshin X Matrix Template OpEx 2021Manuel MoutinhoNoch keine Bewertungen

- Corona Kavach Insurance BrochureDokument5 SeitenCorona Kavach Insurance Brochurekishore2648Noch keine Bewertungen

- Encobat-Hse Assuarance Master Inspection-Audit Schedule & PlanDokument1 SeiteEncobat-Hse Assuarance Master Inspection-Audit Schedule & PlanAinomugisha NormanNoch keine Bewertungen

- Digital Analytical Scale: Bilancia Analitica DigitaleDokument1 SeiteDigital Analytical Scale: Bilancia Analitica Digitalenoxy58Noch keine Bewertungen

- MD&I Industry Market View 2021 - Market Opportunity - EE&UDokument8 SeitenMD&I Industry Market View 2021 - Market Opportunity - EE&Uscribd1337Noch keine Bewertungen

- Pay Bill For The Month of For The Permanent Establishment of Teaching Staff, M.P BalayapalliDokument79 SeitenPay Bill For The Month of For The Permanent Establishment of Teaching Staff, M.P BalayapalligsreddyNoch keine Bewertungen

- Lean Management: Business ExcellenceDokument68 SeitenLean Management: Business Excellencesharma301100% (3)

- Placement Record 2021Dokument3 SeitenPlacement Record 2021KARRA ASHISH REDDYNoch keine Bewertungen

- Masters in FinanceDokument1 SeiteMasters in FinanceVarun BoonliaNoch keine Bewertungen

- Academic Performace Preforma For 3rd InstallmentDokument1 SeiteAcademic Performace Preforma For 3rd InstallmentZohaibShoukatBalochNoch keine Bewertungen

- At Least 30% Are Women Involved in The M & EDokument10 SeitenAt Least 30% Are Women Involved in The M & EleahtabsNoch keine Bewertungen

- Weekly Mutual Fund Update 9th June 2019Dokument5 SeitenWeekly Mutual Fund Update 9th June 2019Aslam HossainNoch keine Bewertungen

- Briess TypicalAnalysis Flyer MaltsDokument2 SeitenBriess TypicalAnalysis Flyer MaltsVitus BoeschNoch keine Bewertungen

- Construction Training MatrixDokument1 SeiteConstruction Training Matrixadec100% (1)

- RUBRIC ASSESSMENT 2008-2009 (SEM 1) Class: X-A Subject: TopicDokument63 SeitenRUBRIC ASSESSMENT 2008-2009 (SEM 1) Class: X-A Subject: Topicapi-19618227Noch keine Bewertungen

- Michele McLaughlin - A Beautiful DistractionDokument11 SeitenMichele McLaughlin - A Beautiful DistractionHernandes PerosaNoch keine Bewertungen

- Work of Financial Plan Feeding 2017Dokument5 SeitenWork of Financial Plan Feeding 2017Edita O Panuncio50% (2)

- Unreal Engine Blueprint Pipeline PartsDokument1 SeiteUnreal Engine Blueprint Pipeline PartsАлексей ГончаровNoch keine Bewertungen

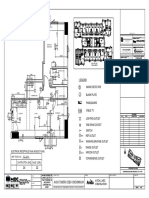

- The Wave Plaza Project: Mas ChartDokument1 SeiteThe Wave Plaza Project: Mas ChartshivakesarlaNoch keine Bewertungen

- Plans: Rehabilitation of Bad-As, Tres-De-Mayo, Amoslog Farm To Market RoadDokument1 SeitePlans: Rehabilitation of Bad-As, Tres-De-Mayo, Amoslog Farm To Market RoadAlbert Christian BesmanosNoch keine Bewertungen

- Vestas - Sustainability & Circular EconomyDokument1 SeiteVestas - Sustainability & Circular EconomyBoseSumantraaNoch keine Bewertungen

- FinaFTlito Recover ModelDokument1 SeiteFinaFTlito Recover ModelEduardo JesusNoch keine Bewertungen

- 20.COBIT5 For Assurance LaminateDokument2 Seiten20.COBIT5 For Assurance LaminateLuqman HakimNoch keine Bewertungen

- DN 040detourdrawingsDokument1 SeiteDN 040detourdrawingsmohammad alharahshehNoch keine Bewertungen

- A Beautiful Distraction - by Michele McLaughlinDokument11 SeitenA Beautiful Distraction - by Michele McLaughlinMarta Merino OdenaNoch keine Bewertungen

- English: Cooking Mode Default Cooking Time (Minute) Default Power Level/ Power Power Adjusting RangeDokument2 SeitenEnglish: Cooking Mode Default Cooking Time (Minute) Default Power Level/ Power Power Adjusting RangeBinod Apps SignupsNoch keine Bewertungen

- EXTRAIDokument1 SeiteEXTRAIwatchuengwNoch keine Bewertungen

- Resume File: Health Care Cert. Full-Time Part-Time Remote Worker Future HireDokument1 SeiteResume File: Health Care Cert. Full-Time Part-Time Remote Worker Future HireAbdullah FasehNoch keine Bewertungen

- D-440 To D-442 Boredpile P1-P15 GrpADokument3 SeitenD-440 To D-442 Boredpile P1-P15 GrpAChristian MendozaNoch keine Bewertungen

- Ayers Asia Goverment Bonds Fund Vs Infovesta Goverment Bond IndexDokument1 SeiteAyers Asia Goverment Bonds Fund Vs Infovesta Goverment Bond IndexSamuel TobsonNoch keine Bewertungen

- Bond DrawioDokument1 SeiteBond DrawioVishesh ManglaNoch keine Bewertungen

- Agriculture 2023116 172121Dokument1 SeiteAgriculture 2023116 172121imshivaniupadhyayNoch keine Bewertungen

- Corriendo Hacia El Kosen Rufu (Duo) - 2daDokument2 SeitenCorriendo Hacia El Kosen Rufu (Duo) - 2daRuben Huasupoma PascoNoch keine Bewertungen

- The Official Map of The Campus of The American University of BeirutDokument1 SeiteThe Official Map of The Campus of The American University of BeirutfdfdsafaNoch keine Bewertungen

- JAHRA FINISH LAYout-HAHC-JH-1-SH-AR-00-06DDokument1 SeiteJAHRA FINISH LAYout-HAHC-JH-1-SH-AR-00-06DNWA INT General Trading & ContractingNoch keine Bewertungen

- Asa Branca and L. Gonzaga chemical analysisDokument1 SeiteAsa Branca and L. Gonzaga chemical analysisandreteacherstudioNoch keine Bewertungen

- Payroll in Excel FormarDokument9 SeitenPayroll in Excel Formarcraig_antonioNoch keine Bewertungen

- Areal DASDokument1 SeiteAreal DASrahmanNoch keine Bewertungen

- Sample P&DDokument1 SeiteSample P&DinyongkiyeNoch keine Bewertungen

- Getting Paid Note Taking Guide 2.3.9.L1 PDFDokument3 SeitenGetting Paid Note Taking Guide 2.3.9.L1 PDFJulianna ChmielNoch keine Bewertungen

- Curva Desempeño - Folleto - Super Pump ProDokument1 SeiteCurva Desempeño - Folleto - Super Pump ProHenry MartinezNoch keine Bewertungen

- Bihar Rajya Pul Nirman Nigam LTD, Patna Progress Report of Ongoing Schemes For Projects Date:Jul - 2019Dokument11 SeitenBihar Rajya Pul Nirman Nigam LTD, Patna Progress Report of Ongoing Schemes For Projects Date:Jul - 2019mintu PatelNoch keine Bewertungen

- Kohort Dita PratDokument7 SeitenKohort Dita PratFitria VarishaNoch keine Bewertungen

- C0d38bfda05041 2006 2010 VIIIDokument2 SeitenC0d38bfda05041 2006 2010 VIIIRohit VermaNoch keine Bewertungen

- DR Manisha Kapse SEPT 2022 (1) .XLSX - TABLE CHO 2Dokument1 SeiteDR Manisha Kapse SEPT 2022 (1) .XLSX - TABLE CHO 2mailbot marketingNoch keine Bewertungen

- 15 Instrument AirDokument2 Seiten15 Instrument Airdaniel60Noch keine Bewertungen

- S Ms Am Xa /e o Co Ioooo Ati Ca Uc: ?BC D CCDokument4 SeitenS Ms Am Xa /e o Co Ioooo Ati Ca Uc: ?BC D CC9amar al zamanNoch keine Bewertungen

- Sheripally: Plan & Profile DrawingsDokument14 SeitenSheripally: Plan & Profile DrawingsRakibul JamanNoch keine Bewertungen

- S Ms Am Xa /e o Co Ioooo Ati Ca Uc: ?BC D CCDokument4 SeitenS Ms Am Xa /e o Co Ioooo Ati Ca Uc: ?BC D CC9amar al zamanNoch keine Bewertungen

- V1.1Dokument1 SeiteV1.1Thea Marie M HernandezNoch keine Bewertungen

- Legend: Smoke Detector Blank PlateDokument1 SeiteLegend: Smoke Detector Blank PlateGrazel MDNoch keine Bewertungen

- 04 - Fuel GasDokument3 Seiten04 - Fuel Gasdaniel60Noch keine Bewertungen

- New Asha Pbi Report April 2020Dokument1 SeiteNew Asha Pbi Report April 2020phc kallumarriNoch keine Bewertungen

- ST Wilfreds Institute Updated On 12 December-ModelDokument1 SeiteST Wilfreds Institute Updated On 12 December-ModelPoojaSalviNoch keine Bewertungen

- Teacher's DayDokument3 SeitenTeacher's DayArchdiocesan Value Education Centre100% (1)

- Exotic Sheep Breeds Information in India - Sheep FarmDokument6 SeitenExotic Sheep Breeds Information in India - Sheep Farmpraveen jNoch keine Bewertungen

- Animal Production Grade 10 - TG PDFDokument144 SeitenAnimal Production Grade 10 - TG PDFDepEdResources95% (20)

- Goat or Sheep Production and ManagementDokument42 SeitenGoat or Sheep Production and ManagementVictor Arrojo MirallesNoch keine Bewertungen

- Atlas of Goat Products PDFDokument384 SeitenAtlas of Goat Products PDFRaimundo FuenmayorNoch keine Bewertungen

- Livestock Sector in Zambia: Opportunities and LimitationsDokument3 SeitenLivestock Sector in Zambia: Opportunities and LimitationsJosephine ChirwaNoch keine Bewertungen

- K.g.sasi - The Book On The Portrait of The Christ With A BindhiDokument322 SeitenK.g.sasi - The Book On The Portrait of The Christ With A BindhiSasi KadukkappillyNoch keine Bewertungen

- Babylonian AriesDokument5 SeitenBabylonian Ariesmarijap7Noch keine Bewertungen

- Bornstein - 1989 - Sensitive Periods in DevelopmentDokument19 SeitenBornstein - 1989 - Sensitive Periods in DevelopmenttechnopsychNoch keine Bewertungen

- Sheep FarmingDokument40 SeitenSheep FarmingGOLLAVILLI GANESH100% (1)

- 2019 Barham Koondrook Show ScheduleDokument33 Seiten2019 Barham Koondrook Show ScheduleJulietNoch keine Bewertungen

- Fix PPT Penyakit Kambing DombaDokument52 SeitenFix PPT Penyakit Kambing DombaGaluh EnggarNoch keine Bewertungen

- LPM 121Dokument5 SeitenLPM 121Principal PolytechnicNoch keine Bewertungen

- English Language-Vocabulary-Book 1 PDFDokument840 SeitenEnglish Language-Vocabulary-Book 1 PDFNIkica BukaricaNoch keine Bewertungen

- Recommended Spelling Lists Class 6-8-230901 - 131503Dokument121 SeitenRecommended Spelling Lists Class 6-8-230901 - 131503qwdqwNoch keine Bewertungen

- Sheep's WoolDokument25 SeitenSheep's WoolKanika ChaturvediNoch keine Bewertungen

- War On Wildlife - The U.S. Department of Agriculture's "Wildlife Services"Dokument108 SeitenWar On Wildlife - The U.S. Department of Agriculture's "Wildlife Services"Our CompassNoch keine Bewertungen

- Introduction To Animal Science - 1Dokument14 SeitenIntroduction To Animal Science - 1Jesus Gomez Cortizzo100% (1)

- Principles of Range Management Lecture 3 NotesDokument4 SeitenPrinciples of Range Management Lecture 3 NotesPegNoch keine Bewertungen

- Enter Bassanio and ShylockDokument28 SeitenEnter Bassanio and ShylockAchintya BansalNoch keine Bewertungen

- Formulate Rations for Sheep and GoatsDokument27 SeitenFormulate Rations for Sheep and GoatsErica Arthur Auguste50% (4)

- Soal B.Inggris Kls 7 YulianaDokument3 SeitenSoal B.Inggris Kls 7 YulianaAbu Arshaka Fadhilah AlghifariNoch keine Bewertungen

- Jaba Brief FinalDokument43 SeitenJaba Brief FinalAdnan Qaiser100% (2)

- Sheep YardsDokument60 SeitenSheep YardsRia Heriawati100% (1)

- Muhamad Lutfi ParatuberculosisJournalDokument17 SeitenMuhamad Lutfi ParatuberculosisJournalLutfi AlkaNoch keine Bewertungen

- Bernat Alpacaweb2 KN Cowl - en USDokument2 SeitenBernat Alpacaweb2 KN Cowl - en USEva JanorNoch keine Bewertungen

- Leite de Ovelha - TrabalhoDokument30 SeitenLeite de Ovelha - Trabalhodorde1234Noch keine Bewertungen

- STD.: Xi Practice Test - 2016 Date: 0 14 - 10 - 2016 SUBJECT: Zoology Animal HusbandryDokument2 SeitenSTD.: Xi Practice Test - 2016 Date: 0 14 - 10 - 2016 SUBJECT: Zoology Animal HusbandryDr-Atin Kumar SrivastavaNoch keine Bewertungen

- Genetic Improvement of Farmed Animals (VetBooks - Ir)Dokument693 SeitenGenetic Improvement of Farmed Animals (VetBooks - Ir)CutlerBeckett90Noch keine Bewertungen

- Equity and The BibleDokument2 SeitenEquity and The BibleAnthony J. Fejfar0% (1)