Beruflich Dokumente

Kultur Dokumente

Capital Budgeting Activity

Hochgeladen von

Christian ZuluetaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Budgeting Activity

Hochgeladen von

Christian ZuluetaCopyright:

Verfügbare Formate

NAME: ______________________________________

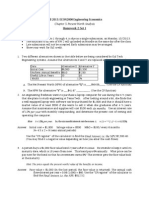

CAPITAL BUDGETING ACTIVITY

1. Texabonds Inc has decided to consider a project where they predict the annual cash flows to be $5,000,

$3,000 and $4,000, respectively for the next three years. At the beginning of the project, the

initial investment put into the project is $10,000. Use the Profitability Index Method and a discount rate of 12%

to determine if this is a good project to undertake.?

2. Company ABC Ltd which has decided to invest in a project where they estimate the following annual cash

flows:

• $5,000 in Year 1

• $3,000 in Year 2

• $4,000 in Year 3

At the beginning of the project, the initial investment required for the project is $10,000 and the discounting

rate is 10%. Use Profitability Index to determine if the project worth investing?

3. Let's say you have two machines in your warehouse. Machine A costs $20,000 and your firm expects payback

at the rate of $5,000 per year. Machine B costs $12,000 and the firm expects payback at the same rate as

Machine A. Calculate the two scenarios using payback period and which machine should be chosen?

4. The Delta company is planning to purchase a machine known as machine X. Machine X would cost $25,000

and would have a useful life of 10 years with zero salvage value. The expected annual cash inflow of the

machine is $10,000. Compute payback period of machine X and conclude whether or not the machine would

be purchased if the maximum desired payback period of Delta company is 3 years.

5. An initial investment of $8,320 thousand on plant and machinery is expected to generate net cash flows of

$3,411 thousand, $4,070 thousand, $5,824 thousand and $2,065 thousand at the end of first, second, third

and fourth year respectively. At the end of the fourth year, the machinery will be sold for $900 thousand.

Calculate the net present value of the investment if the discount rate is 18%.?

6. Company “Tianpogi” who is determining whether they should invest in a new project. Tianpogi will expect to

invest $500,000 for the development of their new product. The company estimates that the first year cash flow

will be $200,000, the second year cash flow will be $300,000, and the third year cash flow to be $200,000.

The expected return of 10% is used as the discount rate.

The following table provides each year's cash flow and looking for the present value of each cash flow.

Determine the NPV? (Show solution)

Year Cash Flow Present Value

0 -$500,000 -$500,000

1 $200,000 $_________

2 $300,000 $_________

3 $200,000 $_________ Net Present Value = _________________?

7. Tom’s Machine Shop is considering purchasing a new machine, but he is unsure if it’s the best use of company

funds at this point in time. With the new $100,000 machine, Tom will be able to take on a new order that will

pay $20,000, $30,000, $40,000, and $40,000 profit at the end of first, second, third and fourth year

respectively.

Calculate Tom’s minimum rate (IRR). Since it’s difficult to isolate the discount rate unless you use an excel

IRR calculator. You can start with an approximate rate and adjust from there. Let’s start with 7 percent and to

be followed by 8% up to 12%..

Das könnte Ihnen auch gefallen

- Assignment 01Dokument2 SeitenAssignment 01abdul saboorNoch keine Bewertungen

- Mba026 Corporate Finance - 895727188Dokument2 SeitenMba026 Corporate Finance - 895727188Bhupendra SoniNoch keine Bewertungen

- Problem Set 04 - Introduction To Excel Financial FunctionsDokument3 SeitenProblem Set 04 - Introduction To Excel Financial Functionsasdf0% (1)

- Question Bank - Economics For EngineersDokument3 SeitenQuestion Bank - Economics For EngineersAnurag AnandNoch keine Bewertungen

- Fin3n Cap Budgeting Quiz 1Dokument1 SeiteFin3n Cap Budgeting Quiz 1Kirsten Marie EximNoch keine Bewertungen

- HW 2 Set 1 KeysDokument7 SeitenHW 2 Set 1 KeysIan SdfuhNoch keine Bewertungen

- PS01 MainDokument12 SeitenPS01 MainSumanth KolliNoch keine Bewertungen

- Group Assignment Fm2 A112Dokument15 SeitenGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- CH 08Dokument12 SeitenCH 08AlJabir KpNoch keine Bewertungen

- CBA AssignmentsDokument6 SeitenCBA AssignmentsBharath selvamNoch keine Bewertungen

- Financial Calculation QuestionsDokument2 SeitenFinancial Calculation QuestionspriyavlNoch keine Bewertungen

- Summer 2020 1Dokument1 SeiteSummer 2020 1Hossain AhmedNoch keine Bewertungen

- Corporate Valuation NumericalsDokument47 SeitenCorporate Valuation Numericalspasler9929Noch keine Bewertungen

- Cash Flow Estimation Question 1 (Answer: $ 544) : PAF - Karachi Institute of Economics and Technology Class ID: 110217Dokument3 SeitenCash Flow Estimation Question 1 (Answer: $ 544) : PAF - Karachi Institute of Economics and Technology Class ID: 110217Zaka HassanNoch keine Bewertungen

- Ps Capital Budgeting PDFDokument7 SeitenPs Capital Budgeting PDFcloud9glider2022Noch keine Bewertungen

- Tutorial 3a-Cash Flow EstimationDokument3 SeitenTutorial 3a-Cash Flow EstimationPrincessCC20Noch keine Bewertungen

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDokument3 Seiten3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNoch keine Bewertungen

- Cash Flow Estimation Chapter 11Dokument4 SeitenCash Flow Estimation Chapter 11Venus TumbagaNoch keine Bewertungen

- SFM Practice QuestionsDokument13 SeitenSFM Practice QuestionsAmmar Ahsan0% (1)

- Project Financial Appraisal - NumericalsDokument5 SeitenProject Financial Appraisal - NumericalsAbhishek KarekarNoch keine Bewertungen

- Financial SolutionDokument4 SeitenFinancial Solutionnilesh bharadwajNoch keine Bewertungen

- Cap BudgDokument5 SeitenCap BudgShahrukhNoch keine Bewertungen

- InvestmentDokument1 SeiteInvestmentelfi_bitzaNoch keine Bewertungen

- Ex.C.BudgetDokument3 SeitenEx.C.BudgetGeethika NayanaprabhaNoch keine Bewertungen

- Assignment For CB TechniquesDokument2 SeitenAssignment For CB TechniquesRahul TirmaleNoch keine Bewertungen

- HW 2Dokument3 SeitenHW 2Love MittalNoch keine Bewertungen

- Practice Questions On IRRDokument2 SeitenPractice Questions On IRRpareekrishika34Noch keine Bewertungen

- Soal Soal Ekonomi Teknik KimiaDokument2 SeitenSoal Soal Ekonomi Teknik KimiapratitatriasalinNoch keine Bewertungen

- C03 (Tugas Rumah)Dokument10 SeitenC03 (Tugas Rumah)Gerrard TammarNoch keine Bewertungen

- Ie151-2x - Eng Eco - PsDokument9 SeitenIe151-2x - Eng Eco - Psjac bnvstaNoch keine Bewertungen

- FIN922 - Corporate Finance - : Dr. Kashif Saleem E-Mail: Kashifsaleem@uowdubai - Ac.ae Office: Room 105, 1st FloorDokument8 SeitenFIN922 - Corporate Finance - : Dr. Kashif Saleem E-Mail: Kashifsaleem@uowdubai - Ac.ae Office: Room 105, 1st FloorHELENANoch keine Bewertungen

- Capital Budgeting Exercise1Dokument14 SeitenCapital Budgeting Exercise1Bigbi Kumar100% (1)

- Chapter - 7 - Pay Back PeriodDokument15 SeitenChapter - 7 - Pay Back PeriodAhmed freshekNoch keine Bewertungen

- Exercise 1 - TVM & Equivalence 2.0Dokument5 SeitenExercise 1 - TVM & Equivalence 2.0Bayu PurnamaNoch keine Bewertungen

- Tutorial Problems - Capital BudgetingDokument6 SeitenTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Chapter 3 - Economic Evaluation of AlternativesDokument21 SeitenChapter 3 - Economic Evaluation of Alternativessam guptNoch keine Bewertungen

- Practice Test MidtermDokument6 SeitenPractice Test Midtermrjhuff41Noch keine Bewertungen

- Spring2022 (July) Exam-Fin Part2Dokument4 SeitenSpring2022 (July) Exam-Fin Part2Ahmed TharwatNoch keine Bewertungen

- Assignment 2 EEPCDokument2 SeitenAssignment 2 EEPCMuizzuddin SalehNoch keine Bewertungen

- Practice Test MidtermDokument6 SeitenPractice Test Midtermzm05280Noch keine Bewertungen

- Activity - Capital Investment AnalysisDokument5 SeitenActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENoch keine Bewertungen

- Engineering Economics - Practice ProblemsDokument5 SeitenEngineering Economics - Practice ProblemsSai Krish PotlapalliNoch keine Bewertungen

- ACF 103 Exam Revision Qns 20151Dokument5 SeitenACF 103 Exam Revision Qns 20151Riri FahraniNoch keine Bewertungen

- Sample Cases 1-11 With SolutionsDokument10 SeitenSample Cases 1-11 With SolutionsJenina Rose SalvadorNoch keine Bewertungen

- Assignment#2Dokument3 SeitenAssignment#2Wuhao KoNoch keine Bewertungen

- Tutorial Capital BudgetingDokument4 SeitenTutorial Capital Budgetingmi luNoch keine Bewertungen

- Tutorial 1 - Sp16Dokument3 SeitenTutorial 1 - Sp16Abir AllouchNoch keine Bewertungen

- Final Review Questions SolutionsDokument5 SeitenFinal Review Questions SolutionsNuray Aliyeva100% (1)

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Dokument8 SeitenNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNoch keine Bewertungen

- FDHDFGSGJHDFHDSHJDDokument8 SeitenFDHDFGSGJHDFHDSHJDbabylovelylovelyNoch keine Bewertungen

- Question of Capital BudgetingDokument7 SeitenQuestion of Capital Budgeting29_ramesh170100% (2)

- Engineering Economy Problem1Dokument11 SeitenEngineering Economy Problem1frankRACENoch keine Bewertungen

- International Financial Management V1Dokument13 SeitenInternational Financial Management V1solvedcareNoch keine Bewertungen

- NPV & Capital Budgeting QuestionsDokument8 SeitenNPV & Capital Budgeting QuestionsAnastasiaNoch keine Bewertungen

- Annual Worth IRR Capital Recovery CostDokument30 SeitenAnnual Worth IRR Capital Recovery CostadvikapriyaNoch keine Bewertungen

- Test Bank For Accounting For Decision Making and Control 8th 0078025745Dokument38 SeitenTest Bank For Accounting For Decision Making and Control 8th 0078025745fishintercur1flsg5100% (15)

- Assigment 6 - Managerial Finance Capital BudgetingDokument5 SeitenAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenNoch keine Bewertungen

- Capital Budgeting Techniques (1st Week)Dokument18 SeitenCapital Budgeting Techniques (1st Week)Jebeth RiveraNoch keine Bewertungen

- Management Accounting - CASE 3,1Dokument6 SeitenManagement Accounting - CASE 3,1Maisa Dini Nois100% (1)

- A Project On Store Operation of Big BazaarDokument25 SeitenA Project On Store Operation of Big BazaarSalman AghaNoch keine Bewertungen

- Andreessen Horowitz FinalDokument4 SeitenAndreessen Horowitz FinalYuqin ChenNoch keine Bewertungen

- Meetings and ProceedingsDokument11 SeitenMeetings and ProceedingssreeNoch keine Bewertungen

- ICMO 2024 Form ConstructionDokument2 SeitenICMO 2024 Form Constructionjonathankarta.hdkNoch keine Bewertungen

- EOI Kalyan Mandap Sec10Dokument22 SeitenEOI Kalyan Mandap Sec10ganeswagh4343Noch keine Bewertungen

- Term Paper Financial Management On: Submitted To Submitted by L.S.BDokument34 SeitenTerm Paper Financial Management On: Submitted To Submitted by L.S.BavinoorharishNoch keine Bewertungen

- Experience Letter LayoutDokument1 SeiteExperience Letter Layoutscribdaj08Noch keine Bewertungen

- Cma p1 Mock Exam 2 A4-2Dokument34 SeitenCma p1 Mock Exam 2 A4-2july jees33% (3)

- Sachin Tomar-Iciob MietDokument3 SeitenSachin Tomar-Iciob MietSachin TomarNoch keine Bewertungen

- MIS at McDonaldsDokument17 SeitenMIS at McDonaldsOsamaNoch keine Bewertungen

- Earnings Per Share (Eps)Dokument11 SeitenEarnings Per Share (Eps)Faisal khanNoch keine Bewertungen

- Automatic Car Wash Project Report FinalDokument20 SeitenAutomatic Car Wash Project Report FinalTahina Randrianirina100% (1)

- HCS-341-Human Resource Management RolesDokument4 SeitenHCS-341-Human Resource Management RolesJulia A. SkahanNoch keine Bewertungen

- Definations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007Dokument24 SeitenDefinations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007rimolahaNoch keine Bewertungen

- Joint Optimization NewDokument6 SeitenJoint Optimization NewAbdur Rauf ShaikhNoch keine Bewertungen

- CFA Scholarship 2015 Dec NotificationDokument1 SeiteCFA Scholarship 2015 Dec NotificationZihad Al AminNoch keine Bewertungen

- Economics Chapter 6-7 Guided NotesDokument2 SeitenEconomics Chapter 6-7 Guided NotesTookieNoch keine Bewertungen

- IMG Menu: Controlling Profitability Analysis Structures Define Operating Concern Maintain Operating ConcernDokument25 SeitenIMG Menu: Controlling Profitability Analysis Structures Define Operating Concern Maintain Operating ConcernMarceloNoch keine Bewertungen

- PTCL Annual Report 2020Dokument124 SeitenPTCL Annual Report 2020syed ammad aliNoch keine Bewertungen

- 2 1 Charting BasicsDokument11 Seiten2 1 Charting BasicsEzequiel RodriguezNoch keine Bewertungen

- BCM Risk MatrixDokument8 SeitenBCM Risk Matrixgarry_CNoch keine Bewertungen

- Critical Success Factors For RetailDokument1 SeiteCritical Success Factors For RetailHarzamir BamoreNoch keine Bewertungen

- 1812 Growing Revenues Through Commercial Excellence LEK Executive InsightsDokument5 Seiten1812 Growing Revenues Through Commercial Excellence LEK Executive InsightsNguyễn Duy LongNoch keine Bewertungen

- SD User ExitsDokument21 SeitenSD User ExitsHuseyn IsmayilovNoch keine Bewertungen

- Effective SME Family Business Succession StrategiesDokument9 SeitenEffective SME Family Business Succession StrategiesPatricia MonteferranteNoch keine Bewertungen

- Lundin Oilgate War Crimes Carl Bildt (Company Propaganda)Dokument108 SeitenLundin Oilgate War Crimes Carl Bildt (Company Propaganda)mary engNoch keine Bewertungen

- Annual Report 2014Dokument249 SeitenAnnual Report 2014BETTY ELIZABETH JUI�A QUILACHAMINNoch keine Bewertungen

- Module 4 - Statement of Comprehensive Income PDFDokument18 SeitenModule 4 - Statement of Comprehensive Income PDFSandyNoch keine Bewertungen

- (PPT) QuinnsModel PDFDokument8 Seiten(PPT) QuinnsModel PDFSomchai ChuananonNoch keine Bewertungen