Beruflich Dokumente

Kultur Dokumente

Bài Tập Tự Luận Cá Nhân - Số 2

Hochgeladen von

Trang LêCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bài Tập Tự Luận Cá Nhân - Số 2

Hochgeladen von

Trang LêCopyright:

Verfügbare Formate

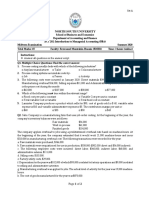

Bài tập cá nhân 2 (individual assignment 2):

(1) Exercises 2-1, 2, 4, 11 sách Garrison. Làm trong tập, sau đó chụp hình và upload

lên LMS

(2) Tóm tắt (summary) chương 2 sách Garrison. Dịch sang tiếng việt đoạn summary vào

tập và upload LMS

Cách lưu file khi upload trên LMS:

<STT sinh viên- btcn X- giảng đường>

Ví dụ: sinh viên số thứ tự 5, học giảng đường B110, nộp bài tập cá nhân số 2 thì file nộp có

tên như sau: STT 05-btcn 2-B110

2-1: Classifying manufacturing costs

The PC works assembles custom computers from components supplied by various

manufaturers. The Company is very small and its assembly shop and retail sales store are

housed in a single facility in a Redmond, Washington, industrial park. Listed below are some

of the costs that are incurred at the company.

Required:

For each cost, indicate whether it would most likely be classified as direct labor, direct

materials, manufacturing overheads, selling, or an administrative cost.

1. The cost of a hard drive installed in a computer

2. The cost of advertising in the Puget Sound Computer User newspaper

3. The wages of employees who assemble computers from components

4. Sales commissions paid to the company’s salespeople.

5. The wages of the company’s accountant

6. Depreciation on equipment used to test assembled computers before release to

customers

7. Rent on the facility in the industrial park

2-2: Cost Terminology for Manufacturers

Arden Company reported the following costs and expenses for the most recent month:

Direct materials 80.000

Direct labor 42.000

Manufacturing overhead 19.000

Selling expenses 22.000

Administrative expenses 35.000

Required

1. That is the total amount of product costs?

2. What is the total amount of period costs?

3. What is the total amount of conversion costs?

4. What is the total amount of prime costs?

2-4: Constructing an income statement

Last month CyberGame, a computer game retailer, had total sales of $1.450.000 , selling

expenses of $210.000, and administrative expense of $180.000. The company had

beginning merchandise inventory of $240.000, purchased additional merchandise inventory

for $950.000, and had ending merchandise inventory of $170.000

Required

Prepare an income statement for the company for the month

2-11: Preparing a Schedule of Costs of Goods Manufactured and Cost of Goods Sold

The following cost and inventory data are taken from the accounting records of Mason

Company for the year just completed.

Cost incurred:

Direct labor cost $70.000

Purchases of raw materials $118.000

Manufacturing overhead $80.000

Advertising expense $90.000

Sales salaries $50.000

Depreciation, office equipment $3.000

Beginning of the year End of the year

Inventories

Raw materials $7.000 $15.000

Work in process $10.000 $5.000

Finished goods $20.000 $35.000

Required

1. Prepare a schedule of cost of goods manufactured

2. Prepare the cost of goods sold section of Mason Company’s income statement for

the year.

Das könnte Ihnen auch gefallen

- Accy211: Management Accounting Ii: Elearning Assignment Question: (A-2)Dokument1 SeiteAccy211: Management Accounting Ii: Elearning Assignment Question: (A-2)Bella SeahNoch keine Bewertungen

- Brewer Chapter 2 Alt ProbDokument6 SeitenBrewer Chapter 2 Alt ProbAtif RehmanNoch keine Bewertungen

- Accountancy and Auditing-2017Dokument5 SeitenAccountancy and Auditing-2017Jassmine RoseNoch keine Bewertungen

- Practice Problem Set 01Dokument7 SeitenPractice Problem Set 01priya bhagwatNoch keine Bewertungen

- Assignment CH 2Dokument30 SeitenAssignment CH 2Svetlana50% (2)

- KisikisiDokument7 SeitenKisikisijalunasaNoch keine Bewertungen

- Chapter 02 and 04 Extra ProblemsDokument4 SeitenChapter 02 and 04 Extra ProblemsElvan Mae Rita ReyesNoch keine Bewertungen

- Assignment No 1 - Cost ClassificationDokument7 SeitenAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- Cost Concepts Class ExercisesDokument7 SeitenCost Concepts Class ExercisesAngel Alejo AcobaNoch keine Bewertungen

- Accountancy and Auditing Papers 2017 - CSS Forums PDFDokument7 SeitenAccountancy and Auditing Papers 2017 - CSS Forums PDFFawad ShahNoch keine Bewertungen

- 6e Brewer Ch02 B EocDokument10 Seiten6e Brewer Ch02 B EocHa Minh0% (1)

- Department of Accounting and Information SystemDokument8 SeitenDepartment of Accounting and Information SystemLabib SafeenNoch keine Bewertungen

- AC17-602P-REGUNAYAN-End of Chapter 2 ExercisesDokument12 SeitenAC17-602P-REGUNAYAN-End of Chapter 2 ExercisesMarco RegunayanNoch keine Bewertungen

- AC17-602P-REGUNAYAN-End of Chapter 2 ExercisesDokument12 SeitenAC17-602P-REGUNAYAN-End of Chapter 2 ExercisesMarco RegunayanNoch keine Bewertungen

- Worksheet1-Basics & COGSDokument5 SeitenWorksheet1-Basics & COGSmohsinmustafa.2001Noch keine Bewertungen

- 6e Brewer CH02 B EOCDokument12 Seiten6e Brewer CH02 B EOCLiyanCenNoch keine Bewertungen

- Cost Accounting 1 ACT201 InstructorsDokument4 SeitenCost Accounting 1 ACT201 InstructorsAdhamNoch keine Bewertungen

- Chap 2 - ActivitiesDokument2 SeitenChap 2 - ActivitiesDuyên HồNoch keine Bewertungen

- EXERCISECHAPTER2Dokument8 SeitenEXERCISECHAPTER2Bạch ThanhNoch keine Bewertungen

- Bai Tap On Tap QTDNDokument4 SeitenBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNoch keine Bewertungen

- Assignment 1Dokument2 SeitenAssignment 1Betheemae R. MatarloNoch keine Bewertungen

- Financial Statements ER Problem 2 SolutionDokument11 SeitenFinancial Statements ER Problem 2 SolutionSYED ALI SHAH SYED MUKHTIYAR ALINoch keine Bewertungen

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDokument7 SeitenDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNoch keine Bewertungen

- MACP.L II Question April 2019Dokument5 SeitenMACP.L II Question April 2019Taslima AktarNoch keine Bewertungen

- Exam161 10Dokument7 SeitenExam161 10Rabah ElmasriNoch keine Bewertungen

- ACT 202 AssignmentDokument3 SeitenACT 202 AssignmentFahim AnjumNoch keine Bewertungen

- Job Order in Class Practice QuestionsDokument5 SeitenJob Order in Class Practice QuestionsBisma ShahabNoch keine Bewertungen

- Jamil - 1418 - 2494 - 1 - Cost and Management Accounting (Summer 2021)Dokument2 SeitenJamil - 1418 - 2494 - 1 - Cost and Management Accounting (Summer 2021)kashif aliNoch keine Bewertungen

- Joc ProbDokument10 SeitenJoc ProbSoothing BlendNoch keine Bewertungen

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDokument4 SeitenProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresNoch keine Bewertungen

- Practice Questions Chapter 5Dokument8 SeitenPractice Questions Chapter 5Abdul Wajid Nazeer CheemaNoch keine Bewertungen

- Module 4 Inclass QuestionsDokument3 SeitenModule 4 Inclass QuestionsPhát GamingNoch keine Bewertungen

- End of Chapter 2 Exercises - TORALDE, MA - KRISTINE EDokument7 SeitenEnd of Chapter 2 Exercises - TORALDE, MA - KRISTINE EKristine Esplana ToraldeNoch keine Bewertungen

- MGT 308Dokument2 SeitenMGT 308HasnainNoch keine Bewertungen

- Session 1 ProblemsDokument5 SeitenSession 1 ProblemsdonjazonNoch keine Bewertungen

- Day 06Dokument8 SeitenDay 06Cy PenalosaNoch keine Bewertungen

- Managerial Accounting Practice Problems2 PDFDokument9 SeitenManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- Comp ExamsDokument28 SeitenComp ExamsTomoko KatoNoch keine Bewertungen

- MGMT 30B Chapter 2 HomeworkDokument9 SeitenMGMT 30B Chapter 2 HomeworkhoshixnanaNoch keine Bewertungen

- Chap 2 - ActivitiesDokument3 SeitenChap 2 - ActivitiesPhuoc Tran Ba LocNoch keine Bewertungen

- 2 21Dokument2 Seiten2 21প্রদীপ হালদারNoch keine Bewertungen

- Accounting QuestionDokument8 SeitenAccounting QuestionMusa D Acid100% (1)

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokument43 SeitenBasic Cost Management Concepts and Accounting For Mass Customization OperationsSoumik NagNoch keine Bewertungen

- Sample Questions Job Costing CH4Dokument8 SeitenSample Questions Job Costing CH4angelbear2577100% (1)

- Exam 1 - VI SolutionsDokument9 SeitenExam 1 - VI SolutionsZyraNoch keine Bewertungen

- Job Order QuestionsDokument6 SeitenJob Order Questionsإبراهيم الشيخيNoch keine Bewertungen

- Management Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsDokument9 SeitenManagement Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsRan CastiloNoch keine Bewertungen

- Acctg15 Job-Order QuizDokument3 SeitenAcctg15 Job-Order QuizJemar Murillo DalaganNoch keine Bewertungen

- Ma. Acctng.Dokument7 SeitenMa. Acctng.Kaname KuranNoch keine Bewertungen

- Mock Exam MG T Acct 2022Dokument2 SeitenMock Exam MG T Acct 2022Bình AnNoch keine Bewertungen

- Week 52Dokument7 SeitenWeek 52Mariola AlkuNoch keine Bewertungen

- ACT202 Midterm ExamDokument2 SeitenACT202 Midterm ExamSalahuddin BadhonNoch keine Bewertungen

- Job Order Costing Difficult RoundDokument8 SeitenJob Order Costing Difficult RoundsarahbeeNoch keine Bewertungen

- Job Order QuizDokument6 SeitenJob Order QuizJohn Elly Cadigoy CoproNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)Von EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Bewertung: 3 von 5 Sternen3/5 (1)

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)Von EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)Noch keine Bewertungen

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Von EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Noch keine Bewertungen

- Date 31/07/x1 3.85 1800 (1,800) 0 31/8/x1 3.75 1600 (1,600) 0 30/09/x1 3.55 (500) 500 500 Choose D Gain in 31/7-Loss in 30/9 1800-500 1300Dokument1 SeiteDate 31/07/x1 3.85 1800 (1,800) 0 31/8/x1 3.75 1600 (1,600) 0 30/09/x1 3.55 (500) 500 500 Choose D Gain in 31/7-Loss in 30/9 1800-500 1300Trang LêNoch keine Bewertungen

- E10 7Dokument1 SeiteE10 7Trang LêNoch keine Bewertungen

- Illustration 1: Debt Component Equity ComponentDokument10 SeitenIllustration 1: Debt Component Equity ComponentTrang LêNoch keine Bewertungen

- Illustration 1: Debt Component Equity ComponentDokument10 SeitenIllustration 1: Debt Component Equity ComponentTrang LêNoch keine Bewertungen

- Amy Cuddy: Your Body Language Shapes Who You AreDokument6 SeitenAmy Cuddy: Your Body Language Shapes Who You Aregloria9oliNoch keine Bewertungen

- Bài Tập Tự Luận Cá Nhân - Số 2Dokument2 SeitenBài Tập Tự Luận Cá Nhân - Số 2Trang LêNoch keine Bewertungen

- 1 FirstFileDokument3 Seiten1 FirstFileMarysun TlengrNoch keine Bewertungen

- FM 415 Money MarketsDokument50 SeitenFM 415 Money MarketsMarc Charles UsonNoch keine Bewertungen

- Hercules Poirot WorksheetDokument6 SeitenHercules Poirot WorksheetvaldaNoch keine Bewertungen

- Agreed Upn Procedures Report 3 PDFDokument4 SeitenAgreed Upn Procedures Report 3 PDFirfanNoch keine Bewertungen

- Content Problem Sets 4. Review Test Submission: Problem Set 08Dokument8 SeitenContent Problem Sets 4. Review Test Submission: Problem Set 08gggNoch keine Bewertungen

- Afcqm QB 2013 PDFDokument99 SeitenAfcqm QB 2013 PDFHaumzaNoch keine Bewertungen

- Brand ExtensionDokument6 SeitenBrand Extensionmukhtal8909Noch keine Bewertungen

- Chapter - General Journal 4Dokument32 SeitenChapter - General Journal 4Israr AhmedNoch keine Bewertungen

- Deed of Absolute Sale of A Portion of LandDokument2 SeitenDeed of Absolute Sale of A Portion of LandmkabNoch keine Bewertungen

- Ch13 Case Novo IndustriesDokument11 SeitenCh13 Case Novo IndustriesAlfaRahmatMaulana100% (4)

- F&A Best - SAPOSTDokument23 SeitenF&A Best - SAPOSTsheikh arif khan100% (2)

- Od 226180983725961000Dokument2 SeitenOd 22618098372596100021Keshav C7ANoch keine Bewertungen

- Curriculum Vitae Anis Abidi: Membership in Professional SocietiesDokument3 SeitenCurriculum Vitae Anis Abidi: Membership in Professional SocietiesJalel SaidiNoch keine Bewertungen

- IRS Publication Form Instructions 2106Dokument8 SeitenIRS Publication Form Instructions 2106Francis Wolfgang UrbanNoch keine Bewertungen

- Advanced Accounting MCQ Part-IDokument8 SeitenAdvanced Accounting MCQ Part-ISavani KibeNoch keine Bewertungen

- Jurnal Tentang RibaDokument15 SeitenJurnal Tentang RibaMuhammad AlfarabiNoch keine Bewertungen

- Industrial Development Bank of India LimitedDokument29 SeitenIndustrial Development Bank of India LimitedJason RoyNoch keine Bewertungen

- ICPAK Speech - Critical National Strategies Towards Embracing Change & Transformation During & Post-PandemicDokument12 SeitenICPAK Speech - Critical National Strategies Towards Embracing Change & Transformation During & Post-PandemicOmarih K. HiramNoch keine Bewertungen

- 28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDokument4 Seiten28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteMatías PierottiNoch keine Bewertungen

- On Kingfisher AirwaysDokument22 SeitenOn Kingfisher AirwaysPratik Sukhani100% (5)

- What Is A Sales BudgetDokument5 SeitenWhat Is A Sales BudgetCyril Jean-BaptisteNoch keine Bewertungen

- Institutional Support For SSIDokument11 SeitenInstitutional Support For SSIRideRNoch keine Bewertungen

- Accounting ProjectDokument2 SeitenAccounting ProjectAngel Grefaldo VillegasNoch keine Bewertungen

- Capital Budgeting Test Bank Part 2Dokument167 SeitenCapital Budgeting Test Bank Part 2AnnaNoch keine Bewertungen

- GCG MC No. 2012-07 - Code of Corp Governance PDFDokument31 SeitenGCG MC No. 2012-07 - Code of Corp Governance PDFakalamoNoch keine Bewertungen

- LEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Dokument247 SeitenLEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Juan José Castro FrancoNoch keine Bewertungen

- At January 2008 IssueDokument68 SeitenAt January 2008 IssuejimfiniNoch keine Bewertungen

- Primer On Islamic FInanceDokument31 SeitenPrimer On Islamic FInanceGuiNoch keine Bewertungen

- HAJI ALI IMPORT EXPORT-Exim-Islampur-395Dokument8 SeitenHAJI ALI IMPORT EXPORT-Exim-Islampur-395Eva AkashNoch keine Bewertungen

- Comparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexDokument21 SeitenComparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexPlato KhisaNoch keine Bewertungen

- Fundamental & Technical Analysis: by Anup K. SuchakDokument53 SeitenFundamental & Technical Analysis: by Anup K. SuchakanupsuchakNoch keine Bewertungen