Beruflich Dokumente

Kultur Dokumente

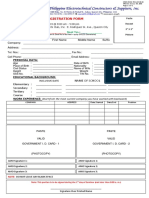

WHT4.2 Sin Tax PDF

Hochgeladen von

Maria roxanne HernandezOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

WHT4.2 Sin Tax PDF

Hochgeladen von

Maria roxanne HernandezCopyright:

Verfügbare Formate

Urgency of Another Sin Tax Reform

by Lindsay M. Orsolino and Frances Claire C. Onagan, MPH

AHEAD Fellows, Health Policy and Systems Research Track

Why support Sin Tax Reform now?

1. Curb burden for non-communicable diseases 2. Raise additional revenues for the health sector

(NCDs), especially among the poor. is needed.

• Maintaining status quo will result to 200,000 • Even with Sin Tax Law of 2012, per capita

new smokers a year, most of whom are poor public spending for health is still below the $90

• Tobacco use exposes these smokers to 47 threshold set by the WHO.

life-threatening diseases including stroke, • UHC reforms proposed under the UHC bill is

heart attack, lung cancer and chronic lung expected to require additional revenues of at

disease, resulting in 150,000 deaths a year least Php 50B a year particularly to sustain

and 210B pesos in annual losses. 100% population coverage and build a strong

primary care system.

History of the Philippine’s Sin Tax Reform

1996 2004 2012 2017

RA 8240 RA 9334 RA 10351 RA 10963

Act on Tobacco Act Increasing the Excise Tax Act Restructuring the Excise Section 42 - Tax Reform for

and Alcohol Taxation Rates Imposed on Alcohol and Tax on Alcohol and Tobacco Inclusion and Acceleration

Tobacco Products Products or the STL (TRAIN Law)

Gains after RA 10351

Decrease in smoking Decrease in smoking Increase in health budget Increase in health service

prevalence among adults prevalence among the coverage, expansion

Current smoker of youth and the poor- and provision of health

any tobacco products: Among youth services

28.3% (2009) 5.7% (2013)

22.7% (2007) 4.2% (2015)

Current smoker of Among poor 68% of the DOH Health

manufactured cigarettes: 38% (2012) Budget for 2018

27.00% (2009)

31% (2015) contributed by Sin Tax

21.50% (2015) 27% (2016)

However, challenges remain

Smoking prevalence is still greatest in the poor who Compared to ASEAN neighbors, cigarette prices in the

smoke cheap tobacco. Philippines continue to be cheap (Southeast Asia Tobacco

Control Alliance, 2014)

Figure 1. Prevalence of Current Smokers by Income Quintile, NNHeS

Figure 2. Price per pack of most popular local and foreign brands

2014 (in USD)

Sin Tax Rate Update From RA 10963

After five (5) years, minimal increase in tobacco excise tax was introduced through the TRAIN Law.

Tax Rate (Php) Net Price/Pack Net Price/Stick

Jan. 1, 2018 - Jun. 30, 2018 2.50 32.50 1.63

Jul. 1, 2018 - Dec. 31, 2018 5.00 35.00 1.75

Jan. 1, 2020 - Dec. 31, 2021 7.50 37.50 1.88

Jan. 1, 2022 - Dec. 31, 2022 10.00 40.00 2.00

2024 onwards 4% annual increase

The updated P2.50 tax rate per pack is very low and does not lead to health benefits and generate enough funds to

support health reforms.

Proposed TRAIN Package Plus 2 by the Department of Finance

• The proposed Package 2 Plus of the TRAIN aims to Presently, two senate bills are filed in support of these:

increase current excise taxes of alcohol and tobacco Proposed Price

products, and the mining tax. Status

Per Pack Rate

• The DOH and DOF jointly supports the proposed rate Senate Bill 1599

of PHP 60 per pack of cigarettes from the current rate Senator Manny

Pacquiao Pending

of Php 30 per pack, with a 9% annual increase in 2023

in the

onwards. This is expected to prevent 200,000 new

Php 60.00 per pack committee

smokers per year and avert 2000 deaths annually. (11/20/2017)

+ 9% inflationary

increase per annum

Senate Bill 1605

Senator JV Ejercito

with 9% annual Pending

increase from 2023 in the

onwards Php 90.00 per pack committee

+ 9% inflationary (11/20/2017)

increase per annum

© Department of Health - Philippines, 2018

The content of this publication does not reflect the official opinion of the Department of Health or Philippine Council for Health Research and Development. Responsibility

for the information and views expressed in this publication lies entirely with the author(s). Reproduction is authorized provided the source is acknowledged.

Advancing Health through Evidence- To access the full text of this article or other research Advisory Board

Assisted Decisions with Health Policy projects funded by the DOH, contact: Usec. Mario Villaverde, MD, MPH, MPM, CESO I

and Systems Research (AHEAD-HPSR) Dir. Kenneth Ronquillo, MD, MPHM, CESO III

operationalizes F1+ for Health’s Research Center for Health System Development

commitment to instill a culture of (RCHSD) Editors

research and strengthen internal analytic rlc.rchsd.doh@gmail.com Beverly Lorraine Ho, MD, MPH

capacity in the Department of Health 651-7800 loc 1326 Barbara Michelle de Guzman, MSN, RN

and build health policy systems research

capacity within the sector. Research Division - Health Policy Development and Publication Manager

Planning Bureau Juanita Valeza

AHEAD is a collaboration between the Department of Health

Department of Health and the Philippine Building 3 2/F San Lazaro Compound, Creative Director

Council for Health Research and Rizal Avenue, Sta. Cruz, Manila Jake Matthew Kho

Development

Das könnte Ihnen auch gefallen

- Criminal Law Notes KoDokument28 SeitenCriminal Law Notes KoMaria roxanne HernandezNoch keine Bewertungen

- Legal Writing Notes KoDokument28 SeitenLegal Writing Notes KoMaria roxanne HernandezNoch keine Bewertungen

- Legal Research Notes Ko2Dokument30 SeitenLegal Research Notes Ko2Maria roxanne HernandezNoch keine Bewertungen

- Legal Research Notes KoDokument14 SeitenLegal Research Notes KoMaria roxanne HernandezNoch keine Bewertungen

- FCM FinalsDokument3 SeitenFCM FinalsMaria roxanne HernandezNoch keine Bewertungen

- PFR Notes KoDokument114 SeitenPFR Notes KoMaria roxanne HernandezNoch keine Bewertungen

- 5.2 Renal Masses and Congenital AnomaliesDokument9 Seiten5.2 Renal Masses and Congenital AnomaliesMaria roxanne HernandezNoch keine Bewertungen

- Kalusugan - Pangkalahatan2010-2016 - An Assessment - Report - Compressed PDFDokument16 SeitenKalusugan - Pangkalahatan2010-2016 - An Assessment - Report - Compressed PDFMaria roxanne HernandezNoch keine Bewertungen

- Pressed PDFDokument8 SeitenPressed PDFmervin342Noch keine Bewertungen

- San Miguel Beer Purchase ReportDokument6 SeitenSan Miguel Beer Purchase ReportMaria roxanne HernandezNoch keine Bewertungen

- BUSINESS PLAN Catarman 2016 - APHDokument11 SeitenBUSINESS PLAN Catarman 2016 - APHMaria roxanne HernandezNoch keine Bewertungen

- BUSINESS PLAN Catarman 2016 - APHDokument11 SeitenBUSINESS PLAN Catarman 2016 - APHMaria roxanne HernandezNoch keine Bewertungen

- JB Al Khuwair In-Store CSAT Survey Consolidator Ver 3Dokument2.278 SeitenJB Al Khuwair In-Store CSAT Survey Consolidator Ver 3Maria roxanne HernandezNoch keine Bewertungen

- Amo - Registration Form.7.18.19Dokument1 SeiteAmo - Registration Form.7.18.19Maria roxanne HernandezNoch keine Bewertungen

- Amo - Registration Form.7.18.19Dokument1 SeiteAmo - Registration Form.7.18.19Maria roxanne HernandezNoch keine Bewertungen

- UST Golden Notes - Criminal Procedure PDFDokument80 SeitenUST Golden Notes - Criminal Procedure PDFAngel Deiparine100% (3)

- Kalusugan - Pangkalahatan2010-2016 - An Assessment - Report - Compressed PDFDokument16 SeitenKalusugan - Pangkalahatan2010-2016 - An Assessment - Report - Compressed PDFMaria roxanne HernandezNoch keine Bewertungen

- How To Answer EssayDokument2 SeitenHow To Answer EssayNicolo GarciaNoch keine Bewertungen

- UST Golden Notes - Criminal Procedure PDFDokument80 SeitenUST Golden Notes - Criminal Procedure PDFAngel Deiparine100% (3)

- (HPB) 3 (1) Protecting Consumers Through Improved Pharmacovigilance PDFDokument2 Seiten(HPB) 3 (1) Protecting Consumers Through Improved Pharmacovigilance PDFMaria roxanne HernandezNoch keine Bewertungen

- Garcia CRIMDokument86 SeitenGarcia CRIMViene CanlasNoch keine Bewertungen

- UST Golden Notes - Criminal Procedure PDFDokument80 SeitenUST Golden Notes - Criminal Procedure PDFAngel Deiparine100% (3)

- (HRB) 3 (2) Effects of Donor Proliferation in Development Aid in Health PDFDokument2 Seiten(HRB) 3 (2) Effects of Donor Proliferation in Development Aid in Health PDFMaria roxanne HernandezNoch keine Bewertungen

- WHT4.2 Sin Tax PDFDokument1 SeiteWHT4.2 Sin Tax PDFMaria roxanne HernandezNoch keine Bewertungen

- WHRB4.2 Service DeliveryDokument1 SeiteWHRB4.2 Service DeliveryMaria roxanne HernandezNoch keine Bewertungen

- (HRB) 3 (2) Effects of Donor Proliferation in Development Aid in Health PDFDokument2 Seiten(HRB) 3 (2) Effects of Donor Proliferation in Development Aid in Health PDFMaria roxanne HernandezNoch keine Bewertungen

- (HPB) 3 (1) Protecting Consumers Through Improved Pharmacovigilance PDFDokument2 Seiten(HPB) 3 (1) Protecting Consumers Through Improved Pharmacovigilance PDFMaria roxanne HernandezNoch keine Bewertungen

- (HPB) 3 (1) Protecting Consumers Through Improved Pharmacovigilance PDFDokument2 Seiten(HPB) 3 (1) Protecting Consumers Through Improved Pharmacovigilance PDFMaria roxanne HernandezNoch keine Bewertungen

- WHRB4.1 FinancingDokument1 SeiteWHRB4.1 FinancingMaria roxanne HernandezNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDokument5 SeitenFIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesGoutham Kumar'sNoch keine Bewertungen

- Fco GCV Adb 55-53 Nie-RrpDokument3 SeitenFco GCV Adb 55-53 Nie-RrpZamri MahfudzNoch keine Bewertungen

- Pricing Analysis For Merrill Lynch Integrated ChoiceDokument15 SeitenPricing Analysis For Merrill Lynch Integrated ChoiceHealth & WellnessNoch keine Bewertungen

- Business Process Management Journal: Article InformationDokument24 SeitenBusiness Process Management Journal: Article InformationAnys PiNkyNoch keine Bewertungen

- Reflection Paper About Global MigrationDokument5 SeitenReflection Paper About Global MigrationRochelle Ann CunananNoch keine Bewertungen

- Chapter 3 Fundamentals of Organization StructureDokument21 SeitenChapter 3 Fundamentals of Organization StructureKaye Adriana GoNoch keine Bewertungen

- Solution Manual For Cornerstones of Cost Management 4th Edition Don R Hansen Maryanne M MowenDokument46 SeitenSolution Manual For Cornerstones of Cost Management 4th Edition Don R Hansen Maryanne M MowenOliviaHarrisonobijq100% (78)

- Economics O LevelDokument9 SeitenEconomics O LevelClaudia GomesNoch keine Bewertungen

- Chapter 9Dokument2 SeitenChapter 9mmaNoch keine Bewertungen

- Annual Report 2015-2016: Our MissionDokument219 SeitenAnnual Report 2015-2016: Our MissionImtiaz ChowdhuryNoch keine Bewertungen

- Chapter 8 (Edt) Financial Management EventDokument25 SeitenChapter 8 (Edt) Financial Management EventplanetrafeeNoch keine Bewertungen

- Cape Elizabeth School Board Response To Citizens ConcernsDokument10 SeitenCape Elizabeth School Board Response To Citizens ConcernsJocelyn Van SaunNoch keine Bewertungen

- Regulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinerDokument33 SeitenRegulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinermarhelunNoch keine Bewertungen

- Term Sheet For Proposed Concession AgreementDokument3 SeitenTerm Sheet For Proposed Concession AgreementRahul K AwadeNoch keine Bewertungen

- Touch and GoDokument10 SeitenTouch and GoABDUL HADI ABDUL RAHMANNoch keine Bewertungen

- Engineering Management: PlanningDokument12 SeitenEngineering Management: PlanningDozdiNoch keine Bewertungen

- Innovation & Strategy FormulationDokument27 SeitenInnovation & Strategy Formulationstudent 13Noch keine Bewertungen

- Fusion Receivables Reconciliation TrainingDokument59 SeitenFusion Receivables Reconciliation Training林摳博Noch keine Bewertungen

- Igcse Economics Revision NotesDokument11 SeitenIgcse Economics Revision NotesJakub Kotas-Cvrcek100% (1)

- BSBTEC601 - Review Organisational Digital Strategy: Task SummaryDokument8 SeitenBSBTEC601 - Review Organisational Digital Strategy: Task SummaryHabibi AliNoch keine Bewertungen

- HI6028 Taxation Theory, Practice & Law: Student Name: Student NumberDokument12 SeitenHI6028 Taxation Theory, Practice & Law: Student Name: Student NumberMah Noor FastNUNoch keine Bewertungen

- MR Symposium Program7 NovemberDokument2 SeitenMR Symposium Program7 NovemberfatafattipsblogNoch keine Bewertungen

- Ratio Analysis: 1. Gross Profit PercentageDokument3 SeitenRatio Analysis: 1. Gross Profit PercentageNatalieNoch keine Bewertungen

- Fabm Quiz1Dokument1 SeiteFabm Quiz1Renelino SacdalanNoch keine Bewertungen

- Form Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalDokument2 SeitenForm Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalMohammed jawedNoch keine Bewertungen

- LW Lamb Weston Investor Day Deck Final Oct 2016Dokument85 SeitenLW Lamb Weston Investor Day Deck Final Oct 2016Ala Baster100% (1)

- Study Id55490 FurnitureDokument161 SeitenStudy Id55490 Furniturekavish jainNoch keine Bewertungen

- Module 1Dokument25 SeitenModule 1Gowri MahadevNoch keine Bewertungen

- Tata Consultancy Services Ltd. Company AnalysisDokument70 SeitenTata Consultancy Services Ltd. Company AnalysisPiyush ThakarNoch keine Bewertungen

- Flinder Valves and Controls Inc.: Case 50Dokument29 SeitenFlinder Valves and Controls Inc.: Case 50SzilviaNoch keine Bewertungen