Beruflich Dokumente

Kultur Dokumente

Fund Allocation Investment Objective: Pami Equity Index Fund, Inc

Hochgeladen von

Ramil MontealtoOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fund Allocation Investment Objective: Pami Equity Index Fund, Inc

Hochgeladen von

Ramil MontealtoCopyright:

Verfügbare Formate

June 30, 2019

PAMI EQUITY INDEX FUND, INC.

FUND FACT SHEET

Investment Objective Fund Allocation

The investment objective is to achieve returns that will track the performance of

the Philippine Stock Exchange Index (PSEi). The recommended timeframe for

the fund is 10 years or more. This fund is suitable for investors who: have a long-

term term investment horizon; want a diversified portfolio of investment in stock Cash &

companies comprising the Philippine Stock Exchange; and/or are willing to take Equivalents

Equities 1.1%

aggressive risk for potentially high capital return over the long term.

98.9%

Historical Performance1

3

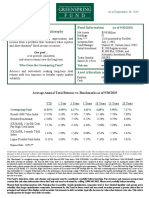

FUND 1 MO 1 YR 3 YRS S.I.

Cumulative 0.33% 10.71% 1.11% 4.12%

Annualized 10.71% 0.37% 1.01%

YTD 2018 2017 2016

7.24% -12.74% 24.27% -2.86%

Top Ten Equity Holdings

SM INVESTMENTS CORP 12.78%

Benchmark2 1 MO 1 YR 3 YRS S.I.3 AYALA LAND INC 10.05%

Cumulative 0.49% 13.19% 7.72% 13.90% SM PRIME HOLDINGS INC 8.53%

Annualized 13.19% 2.51% 3.28% BDO UNIBANK INC 6.86%

YTD 2018 2017 2016 AYALA CORPORATION 6.77%

8.52% -11.33% 27.13% -0.63% JG SUMMIT HOLDINGS INC 5.02%

1. Returns are net of fees. Past performance is not indicative of future returns. BANK OF THE PHILIPPINE ISLAN 4.35%

2. Philippine Stock Exchange Index (Total Return) as of06/30/2019

3. Since Inception (June 16, 2015)

UNIVERSAL ROBINA CORP 3.93%

INTL CONTAINER TERM SVCS INC 3.74%

METROPOLITAN BANK & TRUST 3.51%

Key Figures and Statistics

Net Asset Value per Share (NAVPS) PHP 52.77

NAVPS Graph

Total Fund Size (in Millions) PHP 10,786.01

Inception Date June 16, 2015

Fund Classification Equity Fund 60

Risk Profile Moderately Aggressive

6/30/2019

Fund Currency Philippine Peso

Domicile Philippines

50

Min. Initial Investment PHP 1,000.00

Min. Transaction PHP 500.00

Min. Holding Period Six Months

Redemption Notice Period Five Days 40

Valuation Method Marked-to-Market

Custodian Bank Citibank N.A.

Transfer Agent Philam Asset Management, Inc.

Commentary

PCOMP Index 7999.71, MOM : +0.4%, YTD : +7.14%

Local Market Review

A flat June saw the market closed just at the 8000 level, gaining 30 pts (0.4%) with foreigners selling $139Mn (Php 7.1Bn) worth of shares. PCOMP Index also ended the first half of the year with a price

appreciation of 7.15%. Uncertainties over the US-China Trade War and the Persian Gulf tensions dominated global sentiment. On the domestic front, company buybacks and placement were the major

news for the month. First was the sale of 1.27Bn shares (Php 2.22Bn) of Filinvest Land by Invesco Hong Kong, for which the shares were bought by the parent company, Filinvest Development Corp.

Next we had the sale of 83Mn BDO shares by Khazanah Nasional Berhad in the amount of $220Mn (Php 11.3Bn), half of which was bought by SM Group. The last is the buyback made by First

Philippine Holdings of its own shares in the amount of Php 1.4Bn. The administration also passed HB 2233 that increases tobacco excise tax on a staggered basis from July 1, 2019 to Jan 2023.

Top Sector for the month was the Conglomerates while the Property Sector continued its strong run from last month. GTCAP (+8.9%), JGS (+7.7%), MPI (+6.7%) and SM (+2.9%) were the leaders

here. While Property saw 3 strong performers in MEG (+3.4%), ALI (+2.6%) and RLC (+1.3%). FGEN (+16%), ICT (+7.6%) and SCC (+5.2%) were the other strong performers.

There were no major trends on the laggards but more liquidity and company specific news. Stocks that performed poorly were: SMPH (-6.8%), SMC (-6.6%), AP (-4.7%) and AC (-2.7%).

Inflation continued its downward line with June inflation coming in at 2.7%, reversing the uptick in May of 3.2%. First Half inflation is now at 3.4%, comfortably within the BSP target of 2-4%. Declines in

the CPI were from rice (-0.5% mom) and transport (-1.5% mom). The BSP also decided to pause in cutting rates further during their monthly meeting. The attitude from monetary authorities was to

wait and see how the recent monetary actions would affect loan growth and money supply. The rhetoric on a US rate cut, now almost certain for a 25bps end of July, would also be a consideration by

the BSP if only to maintain a level of interest rate differential. This expectation of a US rate cut has benefited the Peso which appreciated by 1.8% during the month to Php51.235 / US$.

Outlook and Strategy

Our outlook and stance continue to be risk on. We are bullish on the recovery of equities as the economy shifts out of the soft patch during H2 of 2018. Our funds continue to be overweight on equities

since May when we flagged a turnaround. Our current target of PCOMP Index continues to be the 8200-8500 range with the potential for overshoot should earnings perform stronger than our

expectations.

This is going to be an exciting second half for 2019.

Das könnte Ihnen auch gefallen

- Investment Objective Historical Performance: Philam Fund, IncDokument1 SeiteInvestment Objective Historical Performance: Philam Fund, IncWeas ChuckNoch keine Bewertungen

- Ffs Pfi Jun 30 2019Dokument1 SeiteFfs Pfi Jun 30 2019Ramil MontealtoNoch keine Bewertungen

- Investment Objective Historical Performance: Pami Horizon Fund, IncDokument1 SeiteInvestment Objective Historical Performance: Pami Horizon Fund, IncRamil MontealtoNoch keine Bewertungen

- ASTM C129 2011 Non Load Bearing Concrete MasonryDokument1 SeiteASTM C129 2011 Non Load Bearing Concrete MasonryKamille Anne GabaynoNoch keine Bewertungen

- Equity Fund: % Top 10 Holding As On 31st March 2019Dokument1 SeiteEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNoch keine Bewertungen

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Dokument2 SeitenPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNoch keine Bewertungen

- Peso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Dokument3 SeitenPeso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Jayr LegaspiNoch keine Bewertungen

- GSIS Mutual Fund, Inc. (GMFI) : Historical PerformanceDokument1 SeiteGSIS Mutual Fund, Inc. (GMFI) : Historical Performanceapi-25886697Noch keine Bewertungen

- Peso Emperor Fund - Fund Fact Sheet - October - 2020Dokument2 SeitenPeso Emperor Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNoch keine Bewertungen

- ATRAM Phil Equity Smart Index Fund Fact Sheet Jan 2022Dokument2 SeitenATRAM Phil Equity Smart Index Fund Fact Sheet Jan 2022jvNoch keine Bewertungen

- Peso Emperor Fund - Fund Fact Sheet - December - 2020Dokument2 SeitenPeso Emperor Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNoch keine Bewertungen

- Shinhan Supreme Balance FundDokument1 SeiteShinhan Supreme Balance FundhhhahaNoch keine Bewertungen

- MP - 3 - Peso Growth FundDokument2 SeitenMP - 3 - Peso Growth FundFrank TaquioNoch keine Bewertungen

- Archipelago Equity Growth FactsheetDokument1 SeiteArchipelago Equity Growth FactsheetDaniel WijayaNoch keine Bewertungen

- Shinhan Balance Fund - Agustus - 2023 - enDokument1 SeiteShinhan Balance Fund - Agustus - 2023 - enwongjuliusNoch keine Bewertungen

- Debt FundDokument8 SeitenDebt Fundapi-3705377Noch keine Bewertungen

- First Metro Save and Learn Fixed Income FundDokument1 SeiteFirst Metro Save and Learn Fixed Income FundkimencinaNoch keine Bewertungen

- Fund Fact Sheets - Prosperity Bond FundDokument1 SeiteFund Fact Sheets - Prosperity Bond FundJeuz Llorenz Colendra-ApitaNoch keine Bewertungen

- HDFC Diversified Equity FundDokument1 SeiteHDFC Diversified Equity FundMayank RajNoch keine Bewertungen

- Hybrid Fund Completes 5 Years NoteDokument3 SeitenHybrid Fund Completes 5 Years NoteMohamed Rajiv AshaNoch keine Bewertungen

- Diversified JulyDokument1 SeiteDiversified JulyPiyushNoch keine Bewertungen

- Beware of Spurious Fraud Phone CallsDokument2 SeitenBeware of Spurious Fraud Phone Callsrajish2014Noch keine Bewertungen

- Annual Investment Report 2016-17Dokument15 SeitenAnnual Investment Report 2016-17DARSHANNoch keine Bewertungen

- Fund Fact Sheets - Prosperity Index FundDokument1 SeiteFund Fact Sheets - Prosperity Index FundJohh-RevNoch keine Bewertungen

- Fund Fact Sheets - Prosperity Bond FundDokument1 SeiteFund Fact Sheets - Prosperity Bond FundJohh-RevNoch keine Bewertungen

- Capital Growth FundDokument1 SeiteCapital Growth FundHimanshu AgrawalNoch keine Bewertungen

- Fund Fact Sheets - Prosperity Equity FundDokument1 SeiteFund Fact Sheets - Prosperity Equity FundJohh-RevNoch keine Bewertungen

- Rootstock SCI Worldwide Flexible Fund - Minimum Disclosure DocumentDokument4 SeitenRootstock SCI Worldwide Flexible Fund - Minimum Disclosure DocumentMartin NelNoch keine Bewertungen

- Conservative at Least Five (5) Years: Account of The ClientDokument2 SeitenConservative at Least Five (5) Years: Account of The ClientkimencinaNoch keine Bewertungen

- Peso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Dokument2 SeitenPeso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNoch keine Bewertungen

- Shinhan Balance Fund Factsheet PDFDokument1 SeiteShinhan Balance Fund Factsheet PDFjoecool87Noch keine Bewertungen

- Discovery Fund April 23Dokument1 SeiteDiscovery Fund April 23Satyajeet AnandNoch keine Bewertungen

- Product Snapshot: DSP Bond FundDokument2 SeitenProduct Snapshot: DSP Bond FundManoj SharmaNoch keine Bewertungen

- ALFM Peso Bond FundDokument2 SeitenALFM Peso Bond FundkimencinaNoch keine Bewertungen

- PIALEFDokument1 SeitePIALEFEileen LauNoch keine Bewertungen

- DebtDokument9 SeitenDebtapi-3705377Noch keine Bewertungen

- Fund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISDokument8 SeitenFund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISmuhammad taufikNoch keine Bewertungen

- India's No.1 Portfolio Management Services PortalDokument1 SeiteIndia's No.1 Portfolio Management Services Portalrahul patelNoch keine Bewertungen

- SAMShariaEquityFund 1402 PDFDokument1 SeiteSAMShariaEquityFund 1402 PDFMuhammad RafifNoch keine Bewertungen

- Welspun Enterprises LTD - Investor Presentation - 2Dokument36 SeitenWelspun Enterprises LTD - Investor Presentation - 2Dwijendra ChanumoluNoch keine Bewertungen

- PMS Guide August 2019Dokument88 SeitenPMS Guide August 2019HetanshNoch keine Bewertungen

- Diversified Equity FundDokument1 SeiteDiversified Equity FundHimanshu AgrawalNoch keine Bewertungen

- Blue Chip JulyDokument1 SeiteBlue Chip JulyPiyushNoch keine Bewertungen

- HDFC Opportunities FundDokument1 SeiteHDFC Opportunities FundManjunath BolashettiNoch keine Bewertungen

- Philequity Peso Bond Fund: Navps As of Dec 27, 2019Dokument1 SeitePhilequity Peso Bond Fund: Navps As of Dec 27, 2019Marlon DNoch keine Bewertungen

- Fund Fact Sheets - Prosperity Balanced FundDokument1 SeiteFund Fact Sheets - Prosperity Balanced FundJohh-RevNoch keine Bewertungen

- HDFC Discovery FundDokument1 SeiteHDFC Discovery FundHarsh SrivastavaNoch keine Bewertungen

- Canara Robeco Emerging Equities: For Private CirculationDokument1 SeiteCanara Robeco Emerging Equities: For Private CirculationAadeesh JainNoch keine Bewertungen

- AD15 June11Dokument2 SeitenAD15 June11Alvin LimNoch keine Bewertungen

- HDFC BlueChip FundDokument1 SeiteHDFC BlueChip FundKaran ShambharkarNoch keine Bewertungen

- Investmentz AugustDokument11 SeitenInvestmentz AugustAnimesh PalNoch keine Bewertungen

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDokument2 SeitenAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNoch keine Bewertungen

- Greenspring Fund Philosophy Fund Information: (As of 9/30/2019)Dokument2 SeitenGreenspring Fund Philosophy Fund Information: (As of 9/30/2019)Anonymous TtkcZvPNoch keine Bewertungen

- PGPSFDokument2 SeitenPGPSFFabian NgNoch keine Bewertungen

- LiquiLoans - LiteratureDokument28 SeitenLiquiLoans - LiteratureNeetika SahNoch keine Bewertungen

- Portfolios Factsheet: Fund Objective Fund DetailsDokument1 SeitePortfolios Factsheet: Fund Objective Fund DetailsJ. BangjakNoch keine Bewertungen

- December Fund-Factsheets-Individual1Dokument2 SeitenDecember Fund-Factsheets-Individual1Navneet PandeyNoch keine Bewertungen

- ATRAM Phil Equity Smart Index Fund Fact Sheet Nov 2018Dokument2 SeitenATRAM Phil Equity Smart Index Fund Fact Sheet Nov 2018Roan Roan RuanNoch keine Bewertungen

- 6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Dokument3 Seiten6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Nonami AbicoNoch keine Bewertungen

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Von EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Noch keine Bewertungen

- Wachovia Case StudyDokument12 SeitenWachovia Case Studyvivekb67100% (1)

- Abel - 3 - A Review of Determinants of Financial Inclusion PDFDokument8 SeitenAbel - 3 - A Review of Determinants of Financial Inclusion PDFAbd Al-Rahman IIINoch keine Bewertungen

- Internship Report NiB BankDokument10 SeitenInternship Report NiB BankAbdul WaheedNoch keine Bewertungen

- Arabi Bin Hamzah No 521 Lot 6746 JLN Sultan Tengah Samariang Aman Phase 4 93050 KUCHING, SARDokument3 SeitenArabi Bin Hamzah No 521 Lot 6746 JLN Sultan Tengah Samariang Aman Phase 4 93050 KUCHING, SARcancalokNoch keine Bewertungen

- Closing Case Caterpillar IncDokument3 SeitenClosing Case Caterpillar InczaheerkhanafridiNoch keine Bewertungen

- First Direct: Group 9 Strategic PlaningDokument11 SeitenFirst Direct: Group 9 Strategic PlaningWasiq ImranNoch keine Bewertungen

- Banking Laws Cases Part 1Dokument181 SeitenBanking Laws Cases Part 1Keisha Yna V. RamirezNoch keine Bewertungen

- Vat Rate (Up To Finance Act 2013-2014)Dokument38 SeitenVat Rate (Up To Finance Act 2013-2014)Sakib Ahmed AnikNoch keine Bewertungen

- Credit Appraisal in Sbi Bank Project6 ReportDokument106 SeitenCredit Appraisal in Sbi Bank Project6 ReportVenu S100% (1)

- Bismillah Group ScandalDokument3 SeitenBismillah Group ScandalAhmad HNoch keine Bewertungen

- PERE - Private Equity Real EstateDokument1 SeitePERE - Private Equity Real EstatePereNoch keine Bewertungen

- Collateral Document Delivery Request Form v2Dokument1 SeiteCollateral Document Delivery Request Form v2Teena BarrettoNoch keine Bewertungen

- Module 4 - Double Entry Bookkeeping System and The Accounting EquationDokument9 SeitenModule 4 - Double Entry Bookkeeping System and The Accounting EquationMark Christian BrlNoch keine Bewertungen

- FM - 1 - Accounts of Professional PersonsDokument15 SeitenFM - 1 - Accounts of Professional Personsyagnesh trivedi100% (1)

- Guthrie-Jensen - Corporate ProfileDokument8 SeitenGuthrie-Jensen - Corporate ProfileRalph GuzmanNoch keine Bewertungen

- I. Convertible Currencies With Bangko Sentral:: Run Date/timeDokument1 SeiteI. Convertible Currencies With Bangko Sentral:: Run Date/timeLucito FalloriaNoch keine Bewertungen

- Inbt Finals ReviewerDokument11 SeitenInbt Finals ReviewerQuenie SagunNoch keine Bewertungen

- Disbursement Voucher Disbursement Voucher: Classificat Ion of Disbursement Classificat Ion of DisbursementDokument8 SeitenDisbursement Voucher Disbursement Voucher: Classificat Ion of Disbursement Classificat Ion of DisbursementErica Dizon100% (1)

- Order FormDokument1 SeiteOrder FormFirasNoch keine Bewertungen

- Office of The PO Cum DWO, PURULIA District: Government of West BengalDokument3 SeitenOffice of The PO Cum DWO, PURULIA District: Government of West BengalJharna RoyNoch keine Bewertungen

- SYNOPSIS HDFC BankDokument4 SeitenSYNOPSIS HDFC BanksargunkaurNoch keine Bewertungen

- Carana BankDokument26 SeitenCarana BankRakesh Kolasani NaiduNoch keine Bewertungen

- Rail Ticket 12 M WouDokument2 SeitenRail Ticket 12 M WouTiyyagura RoofusreddyNoch keine Bewertungen

- Defining General Options AddendumDokument16 SeitenDefining General Options AddendumchinnaNoch keine Bewertungen

- Daily Cash Flow Template ExcelDokument60 SeitenDaily Cash Flow Template ExcelPro ResourcesNoch keine Bewertungen

- Accounting Systems For Thrift Co-Operatives Promoted by Co-OperativeDokument42 SeitenAccounting Systems For Thrift Co-Operatives Promoted by Co-OperativemadhanagopalNoch keine Bewertungen

- BOC Main Branch ContactDokument3 SeitenBOC Main Branch ContactshakecokeNoch keine Bewertungen

- FactSet Bank TrackerDokument9 SeitenFactSet Bank TrackerBrianNoch keine Bewertungen

- Deposit SlipDokument2 SeitenDeposit SlipLalit PardasaniNoch keine Bewertungen

- Pelzer Company Reconciled Its Bank and Book Statement Balances ofDokument2 SeitenPelzer Company Reconciled Its Bank and Book Statement Balances ofAmit PandeyNoch keine Bewertungen