Beruflich Dokumente

Kultur Dokumente

Capital Budgeting

Hochgeladen von

shik171294Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Budgeting

Hochgeladen von

shik171294Copyright:

Verfügbare Formate

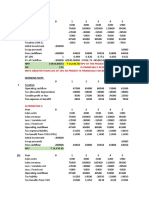

Captial Budgeting

Q1

Year 0 1 2 3 4 5

Cost of machine -500000

Cost saving 200000 200000 200000 200000 200000

Depreciation 100000 100000 100000 100000 100000

EBIT 100000 100000 100000 100000 100000

Taxes @40% 40000 40000 40000 40000 40000

EBAT 60000 60000 60000 60000 60000

Add: Depreciation 100000 100000 100000 100000 100000

Operating CF 160000 160000 160000 160000 160000

Sale price of machine 75000

Tax on profit/loss on sale -30000

Tax Rate*(Book value-Sale price)

Free Cash Flow -500000 160000 160000 160000 160000 205000

Depreciation 85000

But for maximizing Depreciation We can take salvage value as 0

Captial Budgeting

Q2

Year 0 1 2 3 4 5 6

Cost of machine -480000

Sale of old machine 100000

Tax on profit/loss on sale 56000

Cost saving 135000 135000 135000 135000 135000 135000

Out of pocket saving 25000 25000 25000 25000 25000 25000

Saving in annual charge 0 0 0 0 0 0

Depreciation on new machine - 40000 40000 40000 40000 40000 40000

Depreciation on old machine + 20000 20000 20000 20000 20000 20000

EBIT 140000 140000 140000 140000 140000 140000

Taxes @40% 56000 56000 56000 56000 56000 56000

EBAT 84000 84000 84000 84000 84000 84000

Add: Depreciation 20000 20000 20000 20000 20000 20000

Operating CF 104000 104000 104000 104000 104000 104000

Sale price of new machine

Tax on profit/loss on sale(new)

Tax Rate*(Book value-Sale price)

Free Cash Flow -324000 104000 104000 104000 104000 104000 104000

Net present value @7% ₹ 502,039.37

IRR(Internal rate of return) 31%

Payback period

Cummilative cash flow -324000 -220000 -116000 -12000 92000

Payback period (undiscounted cash flow) 3.115385 Years

Lowest payback (Hurdle period)

Discounted payback period

Use PV of CF to compute cummilative CF

-324000

7 8 9 10 11 12

135000 135000 135000 135000 135000 135000

25000 25000 25000 25000 25000 25000

0 0 0 0 0 0

40000 40000 40000 40000 40000 40000

20000 20000 20000 20000 20000 20000

140000 140000 140000 140000 140000 140000

56000 56000 56000 56000 56000 56000

84000 84000 84000 84000 84000 84000

20000 20000 20000 20000 20000 20000

104000 104000 104000 104000 104000 104000

104000 104000 104000 104000 104000 104000

Sneakers 2013

Year 2012 2013 2014 2015 2016 2017 2018

Quantity 1.2 1.6 1.4 2.4 1.8 0.9

Price/unit 115 115 115 115 115 115

Gross Revenue 138 184 161 276 207 103.5

Lost Sale 35 15

Net sale 103 169 161 276 207 103.5

VC 56.65 92.95 88.55 151.8 113.85 56.925

SG&A 7 7 7 7 7 7

Endorsement 2 2 2 2 2 2

Advt and promotion 25 15 10 30 25 15

R&D 0 0 0 0 0 0

Cost of factory -150

Depreciation 3.9 7.5 7.05 6.75 6.45 6

Cost of equipment 15

Installation cost 5

Depreciation on equipment

EBIT

Cannebalization

Sunk Cost

Das könnte Ihnen auch gefallen

- Raising FinanceDokument26 SeitenRaising FinanceChris WallaceNoch keine Bewertungen

- NPV Profile ConstructionDokument6 SeitenNPV Profile ConstructionTimothy Gikonyo0% (1)

- DSIJ3407Dokument84 SeitenDSIJ3407sharma.hansrajNoch keine Bewertungen

- Financial ToolsDokument112 SeitenFinancial ToolsckingpacNoch keine Bewertungen

- Project Cocacola by Hassan ShahzadDokument85 SeitenProject Cocacola by Hassan Shahzadahmad frazNoch keine Bewertungen

- Market Profile - Trading Strategies 1 2-2Dokument26 SeitenMarket Profile - Trading Strategies 1 2-2Jay Steele100% (1)

- Candlestick Pattern Full PDFDokument25 SeitenCandlestick Pattern Full PDFM Try Trader Kaltim80% (5)

- Final Exam Key Answer FarDokument3 SeitenFinal Exam Key Answer FarComedy Royal Philippines100% (1)

- ILPA Best Practices Capital Calls and Distribution NoticeDokument23 SeitenILPA Best Practices Capital Calls and Distribution NoticeMcAlpine PLLCNoch keine Bewertungen

- MA2 Pocket Notes 2020 21Dokument169 SeitenMA2 Pocket Notes 2020 21ReyilNoch keine Bewertungen

- The Bones of Phosphate Technology PDFDokument50 SeitenThe Bones of Phosphate Technology PDFGuido LarcherNoch keine Bewertungen

- K S Oils LTD.: Unsecured LoanDokument51 SeitenK S Oils LTD.: Unsecured Loanshilpatiwari1989Noch keine Bewertungen

- Flexituff International Limited: Loan FundsDokument41 SeitenFlexituff International Limited: Loan FundsVaishali WadhwaNoch keine Bewertungen

- Biscuit PlantDokument6 SeitenBiscuit PlantChandrashekar MettuNoch keine Bewertungen

- FM Project Latest 123456Dokument9 SeitenFM Project Latest 123456rushikesh28Noch keine Bewertungen

- One Stop Shop Unsolicited Proposal AnalysisDokument18 SeitenOne Stop Shop Unsolicited Proposal AnalysisDavid SeligNoch keine Bewertungen

- Government of Andhra Pradesh: White Paper ONDokument41 SeitenGovernment of Andhra Pradesh: White Paper ONAmarnath ReddyNoch keine Bewertungen

- Group Assignment Entrepreneurship Program of Diploma in Administrative Management Business Plan: ProposalDokument8 SeitenGroup Assignment Entrepreneurship Program of Diploma in Administrative Management Business Plan: ProposalMuhammad ShafiqNoch keine Bewertungen

- Maximize Your Effective Time - Mirza Yawar BaigDokument4 SeitenMaximize Your Effective Time - Mirza Yawar BaigEmdad YusufNoch keine Bewertungen

- 15 Kyrgyzstan Project Business Model ProposalDokument15 Seiten15 Kyrgyzstan Project Business Model ProposalsidoshNoch keine Bewertungen

- Star Africa CorpDokument5 SeitenStar Africa CorpBusiness Daily ZimbabweNoch keine Bewertungen

- Ethiopian National Blindness and Trachoma SurveyDokument66 SeitenEthiopian National Blindness and Trachoma Surveybersabeh abayNoch keine Bewertungen

- Gypsum Mining and Manufacturing ProcessesDokument18 SeitenGypsum Mining and Manufacturing ProcessesminingnovaNoch keine Bewertungen

- Project of Manufacture of Embroidery Saree PDFDokument12 SeitenProject of Manufacture of Embroidery Saree PDFRanaHassanNoch keine Bewertungen

- Total Project Cost Infrastructure CapitalDokument39 SeitenTotal Project Cost Infrastructure CapitalAshish SinghNoch keine Bewertungen

- Capital Budgeting AnalysisDokument25 SeitenCapital Budgeting AnalysisMuhammad M BhattiNoch keine Bewertungen

- Business PlanDokument131 SeitenBusiness PlanMikha BorcesNoch keine Bewertungen

- Gef SGP Project Proposal Template and GuidelinesDokument21 SeitenGef SGP Project Proposal Template and GuidelinesmbostofNoch keine Bewertungen

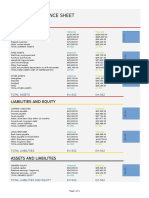

- Vertical Balance SheetDokument3 SeitenVertical Balance Sheetamit2201Noch keine Bewertungen

- Eastern Rubber Recyclers BusinessDokument30 SeitenEastern Rubber Recyclers BusinessSouad SaadeNoch keine Bewertungen

- Proposal For A New Adminstrative Restructuring of EthiopiaDokument95 SeitenProposal For A New Adminstrative Restructuring of EthiopiaTWWNoch keine Bewertungen

- GGJan 2014 NsDokument44 SeitenGGJan 2014 NsfahmyazizNoch keine Bewertungen

- Project ProposalDokument7 SeitenProject ProposalRaja Fahd SultanNoch keine Bewertungen

- Final ProjectDokument73 SeitenFinal ProjectMuhammad Jawad AsifNoch keine Bewertungen

- Best Revised ORDA Charity Water Project Main Doc. (Dec 6)Dokument18 SeitenBest Revised ORDA Charity Water Project Main Doc. (Dec 6)Mengistu BirhanuNoch keine Bewertungen

- GypsumDokument19 SeitenGypsumRajeev MaheshwariNoch keine Bewertungen

- Company Services ProfileDokument14 SeitenCompany Services ProfilempdharmadhikariNoch keine Bewertungen

- The Geology of Somalia: A Selected Bibliography of Somalian Geology, Geography and Earth ScienceDokument431 SeitenThe Geology of Somalia: A Selected Bibliography of Somalian Geology, Geography and Earth ScienceAlone wolfNoch keine Bewertungen

- Honey Processing Plant & Honey HouseDokument2 SeitenHoney Processing Plant & Honey HouseJerish SolomonNoch keine Bewertungen

- AB CementDokument26 SeitenAB CementIrfan AhmedNoch keine Bewertungen

- @ Company Profile - R00 (영문)Dokument54 Seiten@ Company Profile - R00 (영문)Jaeyoung LeeNoch keine Bewertungen

- Profile On International/ Tourist Standard HotelDokument44 SeitenProfile On International/ Tourist Standard HotelBetel AbeNoch keine Bewertungen

- Ambuja CementDokument113 SeitenAmbuja Cementrohit_cmpn0% (1)

- Volume IDokument280 SeitenVolume Ibig johnNoch keine Bewertungen

- Manfacturing of Cement 2006Dokument13 SeitenManfacturing of Cement 2006Bersisa TolaNoch keine Bewertungen

- Acc Limited Final - Final ProjectDokument55 SeitenAcc Limited Final - Final ProjectVimal XNNoch keine Bewertungen

- Projected Balance SheetDokument1 SeiteProjected Balance SheetChristian CelesteNoch keine Bewertungen

- Net Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BDokument23 SeitenNet Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BNaila FaradilaNoch keine Bewertungen

- Plumpy'nut: Plumpy'Nut Is A Peanut-Based Paste in A PlasticDokument5 SeitenPlumpy'nut: Plumpy'Nut Is A Peanut-Based Paste in A PlasticAdriano RafaelNoch keine Bewertungen

- Plan Bee Project To Empower 20 Women in Chitral Proposal - 10!12!2016Dokument17 SeitenPlan Bee Project To Empower 20 Women in Chitral Proposal - 10!12!2016Cristal Montanez100% (1)

- Updated Guidelines Unsolicited Proposals ReportingDokument152 SeitenUpdated Guidelines Unsolicited Proposals ReportingSandeep Baghel100% (1)

- Humanitarian Relief Interventions in Somalia The Economics of ChaosDokument25 SeitenHumanitarian Relief Interventions in Somalia The Economics of ChaosElizabeth AllenNoch keine Bewertungen

- @somalilibarary - Astaamaha Qofka Hanka SareDokument135 Seiten@somalilibarary - Astaamaha Qofka Hanka Sarelako karoNoch keine Bewertungen

- Gypsum Board AADokument26 SeitenGypsum Board AAJohn100% (1)

- A Brief Account On FADAKDokument20 SeitenA Brief Account On FADAKحاجى صاحبNoch keine Bewertungen

- Feasibility Carton and Plastic Container DUKEM - PAZALODokument72 SeitenFeasibility Carton and Plastic Container DUKEM - PAZALOAbreham and DerejeNoch keine Bewertungen

- Market Structure, Conduct and Performances of Some Selected Large and Medium Scale Food Manufacturing CompaniesDokument94 SeitenMarket Structure, Conduct and Performances of Some Selected Large and Medium Scale Food Manufacturing Companiessociology7Noch keine Bewertungen

- Delivering Nutritional Care Through Food Beverage ServicesDokument72 SeitenDelivering Nutritional Care Through Food Beverage ServicesManika Sharma Prashar0% (2)

- Cup Pa Mania ProjectDokument4 SeitenCup Pa Mania ProjectDurgaprasad VelamalaNoch keine Bewertungen

- Alternative 1Dokument10 SeitenAlternative 1Sreyas S KumarNoch keine Bewertungen

- Session-8 Capital BudgetingDokument11 SeitenSession-8 Capital BudgetingKishan TCNoch keine Bewertungen

- Capital Budgeting of Sneakers and PersistanceDokument8 SeitenCapital Budgeting of Sneakers and Persistancesaifullahlatif2018Noch keine Bewertungen

- Delta Project and Repco AnalysisDokument9 SeitenDelta Project and Repco AnalysisvarunjajooNoch keine Bewertungen

- 2016 PPDokument13 Seiten2016 PPumeshNoch keine Bewertungen

- Cash Flow EstimationDokument14 SeitenCash Flow Estimation0241ASHAYNoch keine Bewertungen

- MGT368 Final ProjectDokument12 SeitenMGT368 Final ProjectMd. Rakibul Hasan 1721132Noch keine Bewertungen

- Chapter 9Dokument4 SeitenChapter 9thinkestanNoch keine Bewertungen

- Data PreparationDokument2 SeitenData Preparationshik171294Noch keine Bewertungen

- 1fashion TVDokument5 Seiten1fashion TVshik171294Noch keine Bewertungen

- Regression: Variables Entered/RemovedDokument20 SeitenRegression: Variables Entered/Removedshik171294Noch keine Bewertungen

- Phelps IndustriesDokument6 SeitenPhelps Industriesshik1712940% (1)

- Group 3 - Investment Services (Mutual Funds) Industry AnalysisDokument20 SeitenGroup 3 - Investment Services (Mutual Funds) Industry AnalysisFERDYANTO TJHAINoch keine Bewertungen

- Debt InstrumentsDokument14 SeitenDebt InstrumentsAnubhav GoelNoch keine Bewertungen

- Calculation of Beta-InfosysDokument18 SeitenCalculation of Beta-InfosysNitish BhardwajNoch keine Bewertungen

- CHRLKW FinanceDokument132 SeitenCHRLKW FinancenargesNoch keine Bewertungen

- Kiri Industries - 2017 - HdfcsecDokument16 SeitenKiri Industries - 2017 - HdfcsecHiteshNoch keine Bewertungen

- Module 2 - Fs AnalysisDokument69 SeitenModule 2 - Fs AnalysisSkyler LeeNoch keine Bewertungen

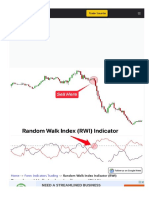

- Random Walk Index IndicatorDokument11 SeitenRandom Walk Index IndicatorMahid HasanNoch keine Bewertungen

- Industrial Economics Module IIDokument92 SeitenIndustrial Economics Module IIMoh YejuNoch keine Bewertungen

- Corporate GovernanceDokument15 SeitenCorporate GovernanceChristopher AiyapiNoch keine Bewertungen

- CH10 Finan Acc Long Term Liab LectDokument28 SeitenCH10 Finan Acc Long Term Liab LectAbdul KabeerNoch keine Bewertungen

- Ind Nifty PharmaDokument2 SeitenInd Nifty PharmaPrashant DalviNoch keine Bewertungen

- Mathematical Trading and FinanceDokument2 SeitenMathematical Trading and Financecharles luis100% (1)

- 7675 Dmgt405 Financial ManagementDokument318 Seiten7675 Dmgt405 Financial ManagementAnmol JandeNoch keine Bewertungen

- FT9ja Portrait V3.2Dokument16 SeitenFT9ja Portrait V3.2MadisonNoch keine Bewertungen

- Solutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsDokument12 SeitenSolutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsBiloni KadakiaNoch keine Bewertungen

- Suppose You Created A Two Stock Portfolio by Investing 50 000 IDokument1 SeiteSuppose You Created A Two Stock Portfolio by Investing 50 000 IAmit PandeyNoch keine Bewertungen

- Financial Accounting UpdatedDokument98 SeitenFinancial Accounting UpdatedbalagurudevNoch keine Bewertungen

- Case StudyDokument18 SeitenCase StudyalbertNoch keine Bewertungen

- SEC Money Market Reform - Final Rule PDFDokument893 SeitenSEC Money Market Reform - Final Rule PDFScott WrightNoch keine Bewertungen

- Marketing 11th Edition Lamb Test BankDokument25 SeitenMarketing 11th Edition Lamb Test BankMrScottPowelltgry100% (59)

- 1 Background To The StudyDokument3 Seiten1 Background To The StudyNagabhushanaNoch keine Bewertungen

- 10.1. Club de LondresDokument18 Seiten10.1. Club de Londresson goku super saiyan 99999Noch keine Bewertungen

- RAMACHANDRANDokument40 SeitenRAMACHANDRANYoges YogeswaranNoch keine Bewertungen