Beruflich Dokumente

Kultur Dokumente

Preference Shares - August 19 2019

Hochgeladen von

Lisle Daverin Blyth0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

3 Ansichten1 SeitePreference Shares - August 19 2019

Originaltitel

Preference Shares - August 19 2019

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPreference Shares - August 19 2019

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

3 Ansichten1 SeitePreference Shares - August 19 2019

Hochgeladen von

Lisle Daverin BlythPreference Shares - August 19 2019

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

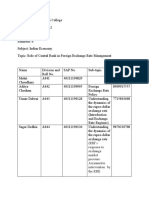

Markets and Commodity figures

19 August 2019

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 2410000 -20000 -0.8 2410000 2410000 0 39.3 2510000 1661000 0 0 0 0

KRHALF 805001 0 0 0 0 0 0.6 850000 800000 0 0 0 0

KRQRTR 400000 0 0 0 0 0 -3.6 400000 400000 0 0 0 0

KRTENTH 160000 0 0 0 0 0 0 160000 160000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

2YRDOLLARCST 154165 1595 1 154165 153450 0 6.6 155690 132510 70.2 0 0 0.8

AFRICAGOLD 22740 128 0.6 22740 22681 1 32.9 23383 16385 158.3 0 0 0

AFRICAPALLAD 22268 600 2.8 22438 21787 4 69.9 22900 12022 2847.2 0 0 0

AFRICAPLATIN 12942 349 2.8 12942 12753 50 13.4 16000 10620 1970.8 0 0 0

AFRICARHODIU 59295 1673 2.9 59622 56673 1 76.2 59622 22222 328.8 0 0 0

AGLSBR 28 -4 -12.5 28 28 0 0 33 13 32 0 0 0

AMIBIG50EX-S 1338 32 2.5 1368 1298 4 -4.8 3232 1195 22.5 0 0 0

AMIRLSTTEX-S 4121 185 4.7 4121 4121 0 -8.9 6900 1998 1.1 0 0 0

AMSSBQ 6 -1 -14.3 6 6 0 -79.3 34 4 7 0 0 0

ANGSBV 4 0 0 4 4 0 -84 25 3 4 0 0 0

ANGSBW 10 0 0 10 9 100 0 29 9 10 0 0 0

ASHBURTONGBL 4811 106 2.3 4830 4729 6 4.1 4987 3754 557.5 0 0 1.4

ASHBURTONINF 2030 -4 -0.2 2045 2026 7 0.9 2143 1918 326.2 0 0 2.6

ASHBURTONMID 668 6 0.9 675 663 30 -2.5 759 651 337.6 0 0 2.2

ASHBURTONTOP 4887 54 1.1 4908 4878 155 -4.6 5576 4367 1512.2 0 0 1.9

ASHBURTONWOR 791 4 0.5 791 785 7 10.5 796 603 127 0 0 0.5

BHPSBP 12 -2 -14.3 12 12 0 -61.3 31 10 14 0 0 0

CORE DIVTRAX 2363 13 0.6 2384 2360 18 -15.1 3009 2309 271.6 0 0 1.3

CORE GLPROP 4109 82 2 4142 4040 38 9.4 4142 3330 505.1 0 0 2.5

CORE PREF 926 1 0.1 935 913 109 13.1 965 816 336.2 0 0 6.6

CORE S&P500 4520 113 2.6 4530 4450 20 6.9 4579 3500 859.4 0 0 1.2

CORE SAPY 4781 13 0.3 4838 4781 14 -11.4 5530 4716 149.1 0 0 8.7

CORE TOP50 2169 28 1.3 2175 2164 5 -7.7 2464 2041 1230.7 0 0 2.2

CORESHARESGL 1294 19 1.5 1300 1285 88 6.3 1310 1065 439.2 0 0 1.3

CORESHARESPR 1494 9 0.6 1506 1486 23 -11.8 1732 1459 251.6 0 0 9.4

CORESHARESSC 4317 38 0.9 4338 4317 1 -7.8 4970 4208 115.8 0 0 1.9

DOLLARCSTDL 157865 1630 1 157865 156260 0 15.1 157865 125465 132.8 0 0 1.3

EXXSBT 16 -2 -11.1 16 16 0 -48.4 32 7 18 0 0 0

FSRSBV 23 -4 -14.8 23 23 100 -23.3 38 12 27 0 0 0

FSRSBW 36 -2 -5.3 36 36 0 16.1 43 20 38 0 0 0

GFISBR 20 -2 -9.1 20 20 0 -37.5 34 12 22 0 0 0

GFISBU 6 2 50 6 6 0 -81.8 33 1 4 0 0 0

HARSBT 2 0 0 2 2 0 -93.5 31 2 2 0 0 0

HARSBU 4 0 0 4 4 0 -86.2 29 4 4 0 0 0

IMPSBS 5 -1 -16.7 5 5 0 -84.4 32 5 6 0 0 0

IMPSBT 33 -2 -5.7 33 33 0 6.5 35 31 35 0 0 0

KIOSBV 5 0 0 5 5 0 -83.9 32 4 5 0 0 0

KIOSBW 23 -2 -8 23 23 50 -28.1 44 16 25 0 0 0

KRCSTDLCRTFC 2386700 12700 0.5 2386700 2386700 0 30.9 2424500 1730300 789.7 0 0 0

MTNSBQ 22 1 4.8 22 22 0 -31.3 34 17 21 0 0 0

NEWFUNDSEQUI 3392 38 1.1 3397 3383 2 18.8 3632 2500 177.4 0 0 2.9

NEWFUNDSGOVI 6525 -12 -0.2 6590 6498 36 9.4 6999 5790 877.6 0 0 8.6

NEWFUNDSILBI 6861 4 0.1 6896 6825 0 3.7 6988 6555 61.7 0 0 2.6

NEWFUNDSMAPP 2091 11 0.5 2106 2091 0 -3.1 2300 1610 37.6 0 0 2.8

NEWFUNDSNEWS 4582 23 0.5 4611 4582 0 -8.5 5356 4258 35.2 0 0 1.9

NEWFUNDSS&P 2843 19 0.7 2864 2843 0 -21 3774 2798 37.3 0 0 4.9

NEWFUNDSSHAR 305 5 1.7 305 303 2 -5.6 350 228 46.7 0 0 2.5

NEWFUNDSSWIX 1639 12 0.7 1652 1639 1 -6.2 1952 1517 16.3 0 0 1.3

NEWFUNDSTRAC 2571 6 0.2 2571 2561 5 7.4 2571 2370 213.3 0 0 6

NEWGOLD 12876 389 3.1 12900 12600 14 13.4 13000 10536 13211.2 0 0 0

NEWGOLDISSUE 21751 72 0.3 21839 21616 63 32.3 22500 15742 14433.4 0 0 0

NEWGOLDPLLDM 22203 602 2.8 22222 21654 1 69.2 22838 12810 990.3 0 0 0

NFEQUITYVALU 897 5 0.6 897 897 0 -8.9 1038 882 107.2 0 0 2.9

NFLOWVLTLTY 1034 9 0.9 1034 1034 0 0.2 1062 907 119.4 0 0 2.1

NFVMDFNSV 950 5 0.5 950 950 0 0 997 944 49 0 0 1.4

NFVMHIGH 971 8 0.8 971 971 0 2.2 1025 917 51.8 0 0 1.3

NFVMMDRT 917 7 0.8 923 917 2 0 968 879 50.6 0 0 1.3

NPNSBX 9 -1 -10 9 9 0 -74.3 37 8 10 0 0 0

NPNSBY 21 -2 -8.7 21 21 0 -34.4 44 18 23 0 0 0

SATRIX40PRTF 4883 53 1.1 4903 4840 345 -4.6 5425 4400 8196.1 0 0 1.7

SATRIXDIVIPL 235 1 0.4 238 232 265 -2.9 267 226 1582.8 0 0 1.3

SATRIXFINI 1480 2 0.1 1499 1473 60 -9.5 1811 1437 711.5 0 0 4.4

SATRIXILBI 580 0 0 583 580 7 3.6 601 552 92.9 0 0 2.9

SATRIXINDI 6869 72 1.1 6918 6848 7 -7.8 7900 6090 1848 0 0 1.3

SATRIXMMNTM 990 7 0.7 990 990 0 4.2 1095 906 22.7 0 0 0.2

SATRIXMSCI 4376 101 2.4 4377 4341 52 6.8 4395 3350 1978 0 0 0

SATRIXMSCIEM 4038 71 1.8 4063 4000 9 1.1 4248 3557 562.2 0 0 0

SATRIXNASDAQ 6653 167 2.6 6653 6534 10 11 6653 4896 435.9 0 0 0

SATRIXPRTFL 1431 8 0.6 1435 1424 51 -20.6 1900 1405 225.9 0 0 5.5

SATRIXQLTY 778 7 0.9 784 774 10 -7.2 963 756 128.3 0 0 3.2

SATRIXRAFI40 1395 16 1.2 1400 1386 38 -2.2 1554 1261 958.1 0 0 1.8

SATRIXRESI 4362 90 2.1 4363 4302 7 1.7 5002 3709 349.8 0 0 1.4

SATRIXS&P500 4447 103 2.4 4448 4408 71 9.6 4496 3406 663.5 0 0 0

SATRIXSWIXTO 1027 10 1 1033 1023 6 -8.2 1252 954 359.2 0 0 1.8

SBKSBQ 24 0 0 24 24 0 -33.3 37 14 24 0 0 0

SGLSBQ 5 0 0 5 5 0 -89.1 63 4 5 0 0 0

SGLSBR 5 0 0 5 5 0 -79.2 24 4 5 0 0 0

SGLSBS 14 0 0 14 14 0 -48.1 29 10 14 0 0 0

SGLSBT 37 1 2.8 37 37 0 5.7 37 35 36 0 0 0

SHPSBR 47 -1 -2.1 47 47 0 46.9 48 22 48 0 0 0

SOLSBS 58 -8 -12.1 62 58 57 107.1 76 24 66 0 0 0

STANLIB 4641 31 0.7 4688 4625 0 -11.7 6485 4567 92.9 0 0 9.2

STANLIBBOND 6987 -25 -0.4 6987 6987 0 1.2 7200 6887 7 0 0 0

STANLIBG7GOV 8761 52 0.6 8792 8730 3 13.3 8841 7125 9.3 0 0 1.5

STANLIBGLOBA 2117 39 1.9 2154 2110 33 9.3 2154 1658 39.8 0 0 3.9

STANLIBMSCI 4362 87 2 4381 4348 1 6.5 4545 3473 66.3 0 0 0

STANLIBS&P50 22316 554 2.5 22331 22062 0 9.9 23098 15318 18.5 0 0 0

STANLIBSWIX4 1025 8 0.8 1025 1025 0 -8.5 1193 905 1746.5 0 0 1.5

STANLIBTOP40 4879 54 1.1 4893 4870 0 -4.7 5415 4305 668.4 0 0 2.2

SYGNIAITRIX 2737 71 2.7 2741 2719 6 7.5 2997 1985 704.8 0 0 0.1

SYGNIAITRIXG 4282 96 2.3 4282 4265 16 11 4282 3400 307.8 0 0 1.1

SYGNIAITRIXS 4555 104 2.3 4738 4533 4 8.6 4738 3505 1074.5 0 0 1.4

SYGNIAITRIXT 4897 54 1.1 4897 4897 0 -4.4 5420 4218 203.4 0 0 2.9

TOPSBS 4 -2 -33.3 4 4 0 -88.9 40 3 6 0 0 0

TOPSBT 34 -5 -12.8 34 32 313 47.8 46 15 39 0 0 0

TOPSBU 20 -2 -9.1 20 19 150 -16.7 24 10 22 0 0 0

TOPSBV 37 -3 -7.5 37 37 0 68.2 45 20 40 0 0 0

TOPSKR 1266 -88 -6.5 1266 1266 0 101.9 1383 585 1354 0 0 0

TOPSKS 1451 -88 -5.7 1451 1451 0 79.1 1569 772 1539 0 0 0

TOPSKX 17 0 0 0 0 0 0 1666 17 17 0 0 0

TOPSKZ 1139 -93 -7.5 1139 1139 0 0 1289 32 1232 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

AECI5,5% 1275 0 0 0 0 0 -1.9 1400 1275 38.3 0 0 8

AFRICANOVER 1000 0 0 0 0 0 -4.9 1000 1000 2.8 0 0 1.2

BARWORLD6%PR 123 0 0 0 0 0 1.7 123 123 0.5 0 0 9.8

CAPITEC-P 9850 0 0 9850 9850 0 14.5 10990 8350 89 0 0 8.5

CAXTON-P 18055 0 0 0 0 0 -2.4 19000 16000 9 0 0 2.7

DISC-B-P 9650 50 0.5 9650 9500 2 10.9 10000 8090 768 0 0 10.5

FIRSTRANDB-P 8650 -30 -0.3 8700 8600 35 10.2 9100 7500 3906 0 0 8.8

FOSCHINI 126 0 0 0 0 0 1.6 126 124 0.3 0 0 10.3

GRINDRODPREF 8000 0 0 8000 8000 1 8.5 9000 6960 592 0 0 11.1

IBRDMBLPRF1 100767 46 0 100767 100767 0 0 101723 100279 344.2 0 0 5.6

INVESTEC 8450 30 0.4 8450 8420 0 14.2 9500 7151 1300.7 0 0 9.9

INVESTECPREF 8500 0 0 0 0 0 -15 11100 8500 234.1 0 0 3.6

INVICTA-P 8225 -175 -2.1 8225 8225 0 9.1 9450 7475 630 0 0 13.3

LIBERTY11C 101 0 0 101 101 1 -6.5 145 98 15.2 0 0 10.9

NAMPAK6%PREF 126 0 0 0 0 0 4.1 126 120 0.5 0 0 9.5

NAMPAK6,5%PR 131 0 0 0 0 0 18 131 121 0.1 0 0 9.9

NEDBANKPREF 950 -10 -1 955 945 139 6.7 1000 840 3439.5 0 0 8.8

NETCAREPREF 8000 0 0 8150 8000 5 14.3 8350 6902 520 0 0 10.4

PSGSERV 8300 280 3.5 8300 8200 5 15.3 9500 6900 1396.7 0 0 10.1

RECMANDCLBR 1600 -5 -0.3 1600 1600 52 -15.8 1999 1584 760.8 0 0 0

REXTRFRM 130 0 0 0 0 0 -35 130 121 0.2 0 0 9.2

SASFIN-P 7815 285 3.8 7815 7815 0 8.5 8000 6900 135.3 0 0 10.6

STANDARD-P 8800 -75 -0.8 8875 8650 4 8.9 8983 7815 4702.2 0 0 8.8

STD 100 0 0 0 0 0 44.9 308 68 8 0 0 6.5

STEINHOFF-P 4401 0 0 0 0 0 0 0 0 660.2 0 0 9.5

ZAMBEZIRF 7201 -199 -2.7 7400 7201 0 18 7400 5750 11833 0 0 0

OTHER 0 0 0 0 0 0 0 0 0 0 0 0 0

ABSA 92164 1898 2.1 92164 92164 0 0 96387 80210 23.2 0 0 0

DBNPBC 81018 0 0 81018 81018 50 0 99709 73879 8326.5 0 0 0

INVLTD 1075250 9144 0.9 1075250 1075250 0 -4.8 1165866 1021254 11.7 0 0 0

UBNPNC 99792 0 0 99792 99792 50 169.7 99792 28272 113.1 0 0 0

UBSELECA01NV 8739 -179 -2 8739 8739 0 -12.6 10361 8622 445.9 0 0 0

UBSELECB01NV 8644 -241 -2.7 8644 8644 0 -13.6 10428 8644 133.3 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBMSCIAFETN 11325 75 0.7 11325 11325 0 3.4 12250 10745 2250 0 0 0

DBMSCICHETN 7623 88 1.2 7623 7450 1 16 41275 6022 1507 0 0 0

DBMSCIEMETN 6347 22 0.3 6347 6250 0 7 47325 5700 1265 0 0 0

FRKBONDGOLD 1720600 -22900 -1.3 1720600 1720600 0 1.3 1942200 1612300 2434.3 0 0 0

FRSFRPT9JUN1 115500 500 0.4 115500 115500 0 -6.3 138800 110700 846 0 0 0

GOLDCMMDTY-L 17986 -194 -1.1 18079 17939 0 -0.6 20534 16911 181.8 0 0 0

IBLUSDZAROCT 134740 -1916 -1.4 134740 134740 0 3.3 145570 116000 478.3 0 0 0.9

IBSWX40TR2ET 18655 281 1.5 18655 18655 0 -0.8 20256 1 918.7 0 0 0

IBTOP40CLIQU 123962 -74 -0.1 123962 123962 0 4.1 130581 119103 1.2 0 0 0

IBTOP40TR2ET 7360 112 1.5 7360 7360 0 0.1 7819 1 924.1 0 0 0

IBVR1ETN 127893 22 0 127893 127893 10 6.8 127893 119796 2129.1 0 0 0

NEWWAVEETN 11088 66 0.6 11088 11088 0 -6.4 13515 10267 23 0 0 0

NEWWAVEEUROE 1560 -22 -1.4 1565 1554 0 3.2 1706 1422 51.5 0 0 0

NEWWAVEGBPET 1752 -21 -1.2 1752 1752 0 3.6 1911 1615 128.7 0 0 0.1

ZA084 77700 0 0 0 0 0 0 0 0 108.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 4815 -80 -1.6 4895 4815 2 45.8 5200 3100 1265 0 0 0

DBGLOBE 19739 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 31452 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11274 6 0.1 11274 11274 0 2.9 55585 8018 2253.6 0 0 0

DBMSCICHETN 6894 47 0.7 6894 6880 0 26.8 7497 5038 1369.4 0 0 0

DBMSCIEMETN 6027 5 0.1 6027 6005 0 16.3 6300 4237 1204.4 0 0 0

FRKBONDGOLD 1774000 -13800 -0.8 1774000 1774000 0 -5.4 1988900 1611900 2496.1 0 0 0

FRSFRPT9JUN1 132050 -400 -0.3 132050 132050 0 -12.1 155600 65901 974.4 0 0 0

GOLDCMMDTY-L 18889 -134 -0.7 18946 18889 0 13 21485 16711 190.2 0 0 0

IBETNT1CT46 1389135 0 0 0 0 0 0.1 1403037 1385563 48.6 0 0 0

IBGOLDENETN 12654 -25 -0.2 12654 12654 0 -18.6 17000 1 352.2 0 0 0

IBLUSDZAROCT 132475 -725 -0.5 132475 132475 0 -1.2 144142 125059 466.2 0 0 0

IBSWX40TRI 17697 32 0.2 17697 17697 0 5.7 17941 12618 883.3 0 0 0

SILVERCOMMOD 14894 -77 -0.5 14894 14894 0 -26.2 22935 13989 74.9 0 0 0

SBCOPPERETN 1329 -4 -0.3 1329 1329 0 8 1439 911 133.3 0 0 0

SBCORNETN 820 -46 -5.3 820 820 0 -16.2 979 765 43.3 0 0 0

SBWHEATETN 764 -41 -5.1 764 764 0 -10.7 856 618 40.3 0 0 0

SBWTIOIL 830 -1 -0.1 830 830 0 -20 1124 750 290.9 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Das könnte Ihnen auch gefallen

- British Commercial Computer Digest: Pergamon Computer Data SeriesVon EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNoch keine Bewertungen

- Preference Shares - September 1 2019Dokument1 SeitePreference Shares - September 1 2019Anonymous 6g229lSxNoch keine Bewertungen

- Preference Shares - August 14 2019Dokument1 SeitePreference Shares - August 14 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - August 28 2019Dokument1 SeitePreference Shares - August 28 2019Lisle Daverin BlythNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares PDFDokument1 SeitePreferenceShares PDFTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - August 19 2019Dokument1 SeitePreference Shares - August 19 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - August 6 2019Dokument1 SeitePreference Shares - August 6 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - August 7 2019Dokument1 SeitePreference Shares - August 7 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - August 5 2019Dokument1 SeitePreference Shares - August 5 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - August 12 2019Dokument1 SeitePreference Shares - August 12 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 17 2019Dokument1 SeitePreference Shares - September 17 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - June 11 2018Dokument1 SeitePreference Shares - June 11 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - May 29 2019Dokument1 SeitePreference Shares - May 29 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - August 27 2019Dokument1 SeitePreference Shares - August 27 2019Lisle Daverin BlythNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 2 2019Dokument1 SeitePreference Shares - October 2 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - August 13 2019Dokument1 SeitePreference Shares - August 13 2019Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - April 5 2018Dokument1 SeitePreferenceShares - April 5 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 2 2019Dokument1 SeitePreference Shares - September 2 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 23 2018Dokument1 SeitePreference Shares - October 23 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - June 3 2019Dokument1 SeitePreference Shares - June 3 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - September 18 2019Dokument1 SeitePreference Shares - September 18 2019Anonymous MPsxhBNoch keine Bewertungen

- Preference Shares - October 18 2018Dokument1 SeitePreference Shares - October 18 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - March 28 2019Dokument1 SeitePreference Shares - March 28 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 19 2018Dokument1 SeitePreference Shares - July 19 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - June 19 2017Dokument1 SeitePreference Shares - June 19 2017Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 25 2018Dokument1 SeitePreference Shares - October 25 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 27 2018Dokument1 SeitePreference Shares - July 27 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - April 10 2019Dokument1 SeitePreference Shares - April 10 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - April 11 2018Dokument1 SeitePreference Shares - April 11 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - May 26 2019Dokument1 SeitePreference Shares - May 26 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - March 17 2019Dokument1 SeitePreference Shares - March 17 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 25 2019Dokument1 SeitePreference Shares - October 25 2019Anonymous MZp9gEGg6Noch keine Bewertungen

- Preference Shares - March 24 2019Dokument1 SeitePreference Shares - March 24 2019Anonymous 7A1d7fjj3Noch keine Bewertungen

- Preference Shares - July 23 2018Dokument1 SeitePreference Shares - July 23 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 8 2019Dokument1 SeitePreference Shares - July 8 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - October 29 2018Dokument1 SeitePreference Shares - October 29 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - March 14 2018Dokument1 SeitePreference Shares - March 14 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 15 2019Dokument1 SeitePreference Shares - September 15 2019Anonymous yid6usiNNoch keine Bewertungen

- Preference Shares - September 16 2019Dokument1 SeitePreference Shares - September 16 2019Lisle Daverin BlythNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 30 2018Dokument1 SeitePreference Shares - July 30 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - April 4 2018Dokument1 SeitePreferenceShares - April 4 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - April 1 2019Dokument1 SeitePreference Shares - April 1 2019Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 24 2018Dokument1 SeitePreference Shares - October 24 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 16 2018Dokument1 SeitePreference Shares - October 16 2018Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceSharesDokument1 SeitePreferenceSharesTiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - October 10 2018Dokument1 SeitePreference Shares - October 10 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - July 23 2019Dokument1 SeitePreference Shares - July 23 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - May 10 2018Dokument1 SeitePreference Shares - May 10 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - September 11 2019Dokument1 SeitePreference Shares - September 11 2019Tiso Blackstar GroupNoch keine Bewertungen

- PreferenceShares - April 10 2018Dokument1 SeitePreferenceShares - April 10 2018Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - March 25 2019Dokument1 SeitePreference Shares - March 25 2019Lisle Daverin BlythNoch keine Bewertungen

- Preference Shares - March 26 2019Dokument1 SeitePreference Shares - March 26 2019Tiso Blackstar GroupNoch keine Bewertungen

- Preference Shares - March 19 2019Dokument1 SeitePreference Shares - March 19 2019Tiso Blackstar GroupNoch keine Bewertungen

- Fuel Prices - December 11 2022Dokument1 SeiteFuel Prices - December 11 2022Lisle Daverin BlythNoch keine Bewertungen

- Fuel Prices - December 9 2022Dokument1 SeiteFuel Prices - December 9 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - December 11 2022Dokument3 SeitenBonds - December 11 2022Lisle Daverin BlythNoch keine Bewertungen

- Liberty - December 11 2022Dokument1 SeiteLiberty - December 11 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - December 9 2022Dokument3 SeitenBonds - December 9 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - December 6 2022Dokument3 SeitenBonds - December 6 2022Lisle Daverin BlythNoch keine Bewertungen

- Fuel Prices - December 6 2022Dokument1 SeiteFuel Prices - December 6 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - December 1 2022Dokument3 SeitenBonds - December 1 2022Lisle Daverin BlythNoch keine Bewertungen

- Sanlam Stratus Funds - December 6 2022Dokument2 SeitenSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNoch keine Bewertungen

- Fairbairn - December 5 2022Dokument2 SeitenFairbairn - December 5 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - December 5 2022Dokument3 SeitenBonds - December 5 2022Lisle Daverin BlythNoch keine Bewertungen

- Sanlam Stratus Funds - December 1 2022Dokument2 SeitenSanlam Stratus Funds - December 1 2022Lisle Daverin BlythNoch keine Bewertungen

- Fuel Prices - December 1 2022Dokument1 SeiteFuel Prices - December 1 2022Lisle Daverin BlythNoch keine Bewertungen

- Liberty - December 1 2022Dokument1 SeiteLiberty - December 1 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - November 30 2022Dokument3 SeitenBonds - November 30 2022Lisle Daverin BlythNoch keine Bewertungen

- Fuel Prices - November 29 2022Dokument1 SeiteFuel Prices - November 29 2022Lisle Daverin BlythNoch keine Bewertungen

- Fairbairn - November 29 2022Dokument2 SeitenFairbairn - November 29 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - November 23 2022Dokument3 SeitenBonds - November 23 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - November 22 2022Dokument3 SeitenBonds - November 22 2022Lisle Daverin BlythNoch keine Bewertungen

- Bonds - November 29 2022Dokument3 SeitenBonds - November 29 2022Lisle Daverin BlythNoch keine Bewertungen

- Fuel Prices - November 21 2022Dokument1 SeiteFuel Prices - November 21 2022Lisle Daverin BlythNoch keine Bewertungen

- Fuel Prices - November 22 2022Dokument1 SeiteFuel Prices - November 22 2022Lisle Daverin BlythNoch keine Bewertungen

- Fuel Prices - November 23 2022Dokument1 SeiteFuel Prices - November 23 2022Lisle Daverin BlythNoch keine Bewertungen

- The Meadow DanceDokument22 SeitenThe Meadow DancemarutishNoch keine Bewertungen

- SME Retailer Internationalisation: Case Study Evidence From British RetailersDokument29 SeitenSME Retailer Internationalisation: Case Study Evidence From British RetailersReel M. A. MahmoudNoch keine Bewertungen

- Biogas TypesDokument111 SeitenBiogas TypesSam BNoch keine Bewertungen

- Treasury BillsDokument18 SeitenTreasury BillsHoney KullarNoch keine Bewertungen

- Daily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayDokument5 SeitenDaily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayJovelyn Ignacio VinluanNoch keine Bewertungen

- MonmouthDokument25 SeitenMonmouthPerci LunarejoNoch keine Bewertungen

- Weekly Options Digital Guide PDFDokument48 SeitenWeekly Options Digital Guide PDFGaro Ohanoglu100% (4)

- Suplemen, Vitamin, Obat PenenangDokument6 SeitenSuplemen, Vitamin, Obat PenenangKeuangan primamedikaNoch keine Bewertungen

- CorporationDokument18 SeitenCorporationErika Mae IsipNoch keine Bewertungen

- Tybcom - A - Group No. - 5Dokument10 SeitenTybcom - A - Group No. - 5Mnimi SalesNoch keine Bewertungen

- This Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LDokument4 SeitenThis Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LRian RorresNoch keine Bewertungen

- Course Plan Part 1 PDFDokument19 SeitenCourse Plan Part 1 PDFmohamed100% (1)

- Csec Pob June 2015 p2Dokument17 SeitenCsec Pob June 2015 p2econlabttNoch keine Bewertungen

- What Is The Industry Life CycleDokument3 SeitenWhat Is The Industry Life Cycleyashpal sharmaNoch keine Bewertungen

- FMA - Tutorial 8 - Capital BudgetingDokument4 SeitenFMA - Tutorial 8 - Capital BudgetingPhuong VuongNoch keine Bewertungen

- Confluence Technique Be A Trader Road TourDokument163 SeitenConfluence Technique Be A Trader Road Toursani_ilpkuantan100% (2)

- Good Money After Bad Case AnalysisDokument3 SeitenGood Money After Bad Case AnalysisMichaelNoch keine Bewertungen

- Module 2 Conceptual Frameworks and Accounting Standards PDFDokument7 SeitenModule 2 Conceptual Frameworks and Accounting Standards PDFJonabelle DalesNoch keine Bewertungen

- Other Hedging Strategies With OptionsDokument3 SeitenOther Hedging Strategies With OptionsAnkush SharmaNoch keine Bewertungen

- Agreement To Organize A BankDokument3 SeitenAgreement To Organize A BankrotiliNoch keine Bewertungen

- CSC Vol I Study NotesDokument16 SeitenCSC Vol I Study NotesJeff Tr100% (1)

- Moony: Betting Model ResultsDokument3 SeitenMoony: Betting Model ResultsNikola KarnasNoch keine Bewertungen

- Chapter 14Dokument46 SeitenChapter 14Nguyen Hai Anh100% (1)

- Minor Project ReportDokument69 SeitenMinor Project ReportrimpaNoch keine Bewertungen

- Case StudyDokument10 SeitenCase Studysid50% (2)

- Managing Risk in International Business: Techniques and ApplicationsDokument20 SeitenManaging Risk in International Business: Techniques and ApplicationsManish NashaNoch keine Bewertungen

- Pre-Contract - Invitation For PrequalificationDokument54 SeitenPre-Contract - Invitation For PrequalificationDilanthaDeSilvaNoch keine Bewertungen

- Group 3 - Master Budget-Earrings UnlimitedDokument8 SeitenGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteNoch keine Bewertungen

- Shareholders' Equity - : Measure of The Consideration ReceivedDokument3 SeitenShareholders' Equity - : Measure of The Consideration ReceivedChinchin Ilagan DatayloNoch keine Bewertungen

- Imf & World BankDokument21 SeitenImf & World BankFachrizal AnshoriNoch keine Bewertungen