Beruflich Dokumente

Kultur Dokumente

MCO (P) 94: MCOP94 (SIM Scheme) Commerce Course IV: Accounting Theory and Practice

Hochgeladen von

Mustafa PendariOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MCO (P) 94: MCOP94 (SIM Scheme) Commerce Course IV: Accounting Theory and Practice

Hochgeladen von

Mustafa PendariCopyright:

Verfügbare Formate

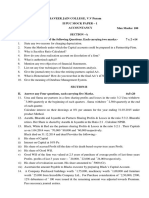

*MCOP94* MCO (P) 94

M.Com. (Previous) Examination, June 2013

(SIM Scheme)

COMMERCE

Course IV : Accounting Theory and Practice

Time : 3 Hours Max. Marks : 90

PART A

Answer any three questions. Each question carries 15 marks : (15×3=45)

1. Describe the objectives of financial statement analysis. Explain the various

techniques of financial statement analysis.

2. Discuss the assumptions underlying accounting measurement and explain their

significance.

3. Define human resource accounting. Explain the techniques that can be used for

human resource accounting.

4. XYZ Ltds Balance Sheet position as at the end of just concluded financial year

and previous year are as under.

Balance Sheet as at the end of March

2010 2011

Liabilities : (Rs. in Thousands)

Equity shares 100 100

Reserves and surplus 40 44

Secured loans 80 90

Bank overdraft 60 80

Creditors 30 40

Unsecured loans from promoters 16

Assets :

Fixed assets (excluding depreciation) 150 180

Stock 76 132

Debtors 60 54

Cash in hand 24 04

Additional information about the company is given below :

Particulars 2010 2011

(Rs. in Thousands)

Sales 400 350

PAT 30 17

Compute the possible ratios and assess the financial efficiency of the company.

P.T.O.

MCO (P) 94 -2- *MCOP94*

5. Following is the Balance Sheet of a company for the year 2011 and 2012

Liabilities 2011 2012 Assets 2011 2012

Rs. Rs. Rs. Rs.

Share capital 2,00,000 2,40,000 Goodwill 56,000 40,000

Share premium 20,000 24,000 Building 1,60,000 2,40,000

General reserve 40,000 50,000 Machinery 1,20,000 1,60,000

P/L A/c 60,000 70,000 Furniture 20,000 24,000

Creditors 60,000 80,000 Patents 12,000 10,000

Bills payables 20,000 16,000 Stock 80,000 60,000

Debentures 1,00,000 80,000 Debtors 40,000 36,000

Tax reserve 24,000 40,000 Bills receivable 20,000 30,000

O/S expenses 8,000 16,000 Cash 24,000 16,000

5,32,000 6,16,000 5,32,000 6,16,000

Additional Information :

a) A machine whose book value was Rs. 24,000 was sold for Rs. 20,000 during

the year.

b) Depreciation written off on building Rs. 10,000 and Machinery Rs. 16,000.

c) Income tax paid during the year Rs. 30,000.

d) Interim dividends paid Rs. 10,000

Prepare :

i) Schedule of changes in Working Capital.

ii) Funds Flow Statement.

PART B

Answer any three questions. Each question carries 10 marks : (10×3=30)

6. Explain the conditions that must exist for effective responsibility accounting.

7. Give an account of institutions that influence the development of Indian GAAP.

8. Distinguish between cash and accrual basis of accounting. Illustrate with an

example.

*MCOP94* -3- MCO (P) 94

9. The following data are available from the books of Customer Care Ltd. as on

31st March, 2003.

1st April, 2002 31st March, 2003

(Rs.) (Rs.)

Cash 7,000 9,000

Book debts 50,000 60,000

Creditors 36,000 44,000

Loan 80,000 80,000

You are required to work out the net monetary result of the company as at

31st March, 2003 considering retail price index numbers.

1st April, 2002 : 240

31st March, 2003 : 360

Average Index for the year : 300

10. Following is an incomplete Balance Sheet given to you

Liabilities Rs. Assets Rs.

Equity Capital 3,00,000 Fixed Assets ----

Retained Earnings 3,00,000 Inventories ----

Creditors ---- Debtors ----

Cash ----

10,00,000 10,00,000

You are given the additional information :

a) Total Debt is 2/3 of the Net Worth

b) Turnover of total assets is 1.8

c) 30 days sales are in the form of Debtors

d) Turnover of inventory is 2

e) Cost of goods sold in the year is Rs. 9,00,000

f) Acid Test Ratio is 1 : 1

Complete the Balance Sheet using the additional information.

PART C

Answer any three questions. Each question carries five marks : (5×3=15)

11. a) How do you compute cash from operations ?

b) What is bench marking ?

c) Write a note on Government system of accounting.

d) How are common-size statements useful to the analyst ?

e) What is inflation accounting ?

______________

Das könnte Ihnen auch gefallen

- 232 FM AssignmentDokument17 Seiten232 FM Assignmentbhupesh joshiNoch keine Bewertungen

- Question Bank - Management AccountingDokument7 SeitenQuestion Bank - Management Accountingprahalakash Reg 113Noch keine Bewertungen

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDokument4 SeitenLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNoch keine Bewertungen

- Accounting For Decision Making or Management AU Question Paper'sDokument41 SeitenAccounting For Decision Making or Management AU Question Paper'sAdhithiya dhanasekarNoch keine Bewertungen

- B.B.A., Sem.-IV CC-213: Corporate Financial StatementsDokument4 SeitenB.B.A., Sem.-IV CC-213: Corporate Financial StatementsJJ NayakNoch keine Bewertungen

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDokument43 SeitenMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNoch keine Bewertungen

- Financial AnalysisDokument47 SeitenFinancial Analysis20B81A1235cvr.ac.in G RUSHI BHARGAVNoch keine Bewertungen

- Assignment Financial AccountingDokument4 SeitenAssignment Financial AccountingJatin SinghalNoch keine Bewertungen

- Unit IIIDokument9 SeitenUnit IIIkuselvNoch keine Bewertungen

- CASH FLOW Revision-1 PDFDokument12 SeitenCASH FLOW Revision-1 PDFBHUMIKA JAINNoch keine Bewertungen

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Dokument17 SeitenManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNoch keine Bewertungen

- Practice Questions Set 3Dokument2 SeitenPractice Questions Set 3Akhil GargNoch keine Bewertungen

- 6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed AssetsDokument5 Seiten6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed Assetsvaibhav_kapoor_6Noch keine Bewertungen

- Management Accounitng - 104 (I)Dokument4 SeitenManagement Accounitng - 104 (I)Rudraksh PareyNoch keine Bewertungen

- Management Accounting Question BankDokument18 SeitenManagement Accounting Question BankDharshanNoch keine Bewertungen

- Management Programme: TH STDokument3 SeitenManagement Programme: TH ST19BAD007 Bendangsenla JamirNoch keine Bewertungen

- (CBCS) (Regular) Commerce Paper - 4.5: Innovations in AccountingDokument4 Seiten(CBCS) (Regular) Commerce Paper - 4.5: Innovations in AccountingSanaullah M SultanpurNoch keine Bewertungen

- Karnataka II PUC Accountancy Model Question Paper 17Dokument6 SeitenKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNoch keine Bewertungen

- Book Keeping and Accountancy July 2018 STD 12th Commerce HSC Maharashtra Board Question PaperDokument5 SeitenBook Keeping and Accountancy July 2018 STD 12th Commerce HSC Maharashtra Board Question PaperjaijaibambholeNoch keine Bewertungen

- MCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreeDokument3 SeitenMCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreepayalNoch keine Bewertungen

- Management Accounting QBDokument31 SeitenManagement Accounting QBrising dragonNoch keine Bewertungen

- Accountancy - Holiday Homework-Class12Dokument8 SeitenAccountancy - Holiday Homework-Class12Ahill sudershanNoch keine Bewertungen

- General Instructions: All The Questions Are CompulsoryDokument2 SeitenGeneral Instructions: All The Questions Are CompulsoryJatin ChaudharyNoch keine Bewertungen

- Accounting for Partnership Admission & DissolutionDokument5 SeitenAccounting for Partnership Admission & DissolutionPranit PanditNoch keine Bewertungen

- M B A PDFDokument169 SeitenM B A PDFAshwini ketkariNoch keine Bewertungen

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Dokument15 Seiten13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNoch keine Bewertungen

- Xii Acc Worksheetss-30-55Dokument26 SeitenXii Acc Worksheetss-30-55Unknown patelNoch keine Bewertungen

- Management Accounting AssignmentDokument13 SeitenManagement Accounting AssignmentDipabali NahaNoch keine Bewertungen

- Analysis of Financial StatementsDokument7 SeitenAnalysis of Financial StatementsThakur Anmol RajputNoch keine Bewertungen

- College Business Exam Covers Key Accounting ConceptsDokument9 SeitenCollege Business Exam Covers Key Accounting ConceptsNicole TaylorNoch keine Bewertungen

- Corporate Strategic Financial Decisions 120675525Dokument17 SeitenCorporate Strategic Financial Decisions 120675525Anushka GuptaNoch keine Bewertungen

- Financial Statement Analysis Funds FlowDokument15 SeitenFinancial Statement Analysis Funds FlowSAITEJA ANUGULANoch keine Bewertungen

- 591617884861 (1)Dokument9 Seiten591617884861 (1)YashviNoch keine Bewertungen

- 13. INCOMPLETE RECORDSDokument32 Seiten13. INCOMPLETE RECORDSSunil KumarNoch keine Bewertungen

- GOVERNMENT COLLEGE MANAGEMENT ACCOUNTING EXAMDokument5 SeitenGOVERNMENT COLLEGE MANAGEMENT ACCOUNTING EXAMJayaprakash JayathNoch keine Bewertungen

- Holding Company ProblemsDokument22 SeitenHolding Company ProblemsYashodhan MithareNoch keine Bewertungen

- ACMA Unit 5 Problems - CFS PDFDokument3 SeitenACMA Unit 5 Problems - CFS PDFPrabhat SinghNoch keine Bewertungen

- VELLORE, CHENNAI-632 002: Answer The Following QuestionsDokument5 SeitenVELLORE, CHENNAI-632 002: Answer The Following QuestionsJayanthiNoch keine Bewertungen

- MCS-035 June2009Dokument4 SeitenMCS-035 June2009Anishia KuriakoseNoch keine Bewertungen

- Accounting For Managers Trimester 1 Mba Ktu 2016Dokument3 SeitenAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNoch keine Bewertungen

- Internal Question Bank MA 2022Dokument7 SeitenInternal Question Bank MA 2022singhalsanchit321Noch keine Bewertungen

- MTP Nov 16 Grp-2 (Series - I)Dokument58 SeitenMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNoch keine Bewertungen

- Tutorial On Ratio AnalysisDokument4 SeitenTutorial On Ratio AnalysisRajyaLakshmiNoch keine Bewertungen

- Mock TestDokument7 SeitenMock TestShivaji hariNoch keine Bewertungen

- Fin Mang 2020Dokument3 SeitenFin Mang 2020vinayakraj jamreNoch keine Bewertungen

- 2BBL311 SEE IR Financial Accounting Dec 2017Dokument3 Seiten2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaNoch keine Bewertungen

- Ratio Analysis Guide for Financial Statement CalculationsDokument5 SeitenRatio Analysis Guide for Financial Statement CalculationsAnu PriyaNoch keine Bewertungen

- Book Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperDokument5 SeitenBook Keeping & Accountancy March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperBhavin MamtoraNoch keine Bewertungen

- MA Sem-4 2018-2019Dokument23 SeitenMA Sem-4 2018-2019Akki GalaNoch keine Bewertungen

- WORKSHEET - 5 On CFSDokument6 SeitenWORKSHEET - 5 On CFSNavya KhemkaNoch keine Bewertungen

- MBA Managerial Accounting TestDokument3 SeitenMBA Managerial Accounting TestasdeNoch keine Bewertungen

- Corporate Accounting Ii 2020Dokument4 SeitenCorporate Accounting Ii 2020joe josephNoch keine Bewertungen

- RatioDokument24 SeitenRatioSadika KhanNoch keine Bewertungen

- Ratio Analysis-1Dokument4 SeitenRatio Analysis-1Aakash RamakrishnanNoch keine Bewertungen

- r7 Mba Financial Accounting and Analysis Set1Dokument3 Seitenr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNoch keine Bewertungen

- Accounts Mock Test May 2019Dokument18 SeitenAccounts Mock Test May 2019poojitha reddyNoch keine Bewertungen

- Previous Year Question Paper (FSA)Dokument16 SeitenPrevious Year Question Paper (FSA)Alisha ShawNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- International Valuation Standards - 2020 MCQDokument18 SeitenInternational Valuation Standards - 2020 MCQNikhil Tidke100% (2)

- Mini project analysis of top 50 companies in Nifty 50 indexDokument19 SeitenMini project analysis of top 50 companies in Nifty 50 indexcharan tejaNoch keine Bewertungen

- Keown 23 RP3Dokument24 SeitenKeown 23 RP3ausantNoch keine Bewertungen

- RBL Bank Ltd. BUYDokument7 SeitenRBL Bank Ltd. BUYpajadhavNoch keine Bewertungen

- CSLDokument4 SeitenCSLEnriqueNoch keine Bewertungen

- Regulatory Framework and Types of Depository ReceiptsDokument22 SeitenRegulatory Framework and Types of Depository ReceiptsJay PandyaNoch keine Bewertungen

- Edelweiss Project HRDokument45 SeitenEdelweiss Project HRMehak AggarwalNoch keine Bewertungen

- Where Vision Gets BuiltDokument100 SeitenWhere Vision Gets BuiltxaveoneNoch keine Bewertungen

- Due Diligence InvestmentsDokument6 SeitenDue Diligence InvestmentselinzolaNoch keine Bewertungen

- PT INDO PREMIER TRADE CONFIRMATIONDokument1 SeitePT INDO PREMIER TRADE CONFIRMATIONreza parlindunganNoch keine Bewertungen

- Ibf Bond Valuation .Dokument8 SeitenIbf Bond Valuation .Anas4253Noch keine Bewertungen

- QWR Short FormDokument5 SeitenQWR Short Formboytoy 9774Noch keine Bewertungen

- Practicum Report - FinalDokument71 SeitenPracticum Report - FinalDannyMViNoch keine Bewertungen

- MADPDokument32 SeitenMADPtejasNoch keine Bewertungen

- eDokument13 SeitenepeyockNoch keine Bewertungen

- GWEGWEDokument10 SeitenGWEGWECarlos AlphonceNoch keine Bewertungen

- Sample Questions:: Section I: Subjective QuestionsDokument8 SeitenSample Questions:: Section I: Subjective Questionsnaved katuaNoch keine Bewertungen

- A Comparison of Mean-Variance and Mean-Semivariance Optimisation On The JseDokument10 SeitenA Comparison of Mean-Variance and Mean-Semivariance Optimisation On The JseRodolpho Cammarosano de LimaNoch keine Bewertungen

- A Study On Accounting Policies Followed byDokument23 SeitenA Study On Accounting Policies Followed byhbkrakesh83% (12)

- Buyers PacketDokument10 SeitenBuyers PacketMark Coppola100% (2)

- Sharecerts 1Dokument1 SeiteSharecerts 1raouf bchNoch keine Bewertungen

- MCQ - Intro To AuditDokument13 SeitenMCQ - Intro To Auditemc2_mcv74% (27)

- Accounting Lecture 3Dokument5 SeitenAccounting Lecture 3Anabel PhamNoch keine Bewertungen

- DPT-3 filing deadline: What is not considered a depositDokument2 SeitenDPT-3 filing deadline: What is not considered a depositNiyati KamaniNoch keine Bewertungen

- Gmail - Proposed Initial Public Offering of The Equity Shares of Ujjivan Small Finance Bank LimitedDokument4 SeitenGmail - Proposed Initial Public Offering of The Equity Shares of Ujjivan Small Finance Bank LimitedManish BarnwalNoch keine Bewertungen

- Mergers and Acquisitions - A Beginner's GuideDokument8 SeitenMergers and Acquisitions - A Beginner's GuideFforward1605Noch keine Bewertungen

- ABM - BF12 IIIb 8Dokument4 SeitenABM - BF12 IIIb 8Raffy Jade SalazarNoch keine Bewertungen

- CJS INDEMNITY BOND SECTION 1 Draft Freedom DocumentsDokument44 SeitenCJS INDEMNITY BOND SECTION 1 Draft Freedom DocumentsAnonymous 23VuLx95% (21)

- Ic Exam Review: VariableDokument122 SeitenIc Exam Review: VariableJL RangelNoch keine Bewertungen

- 1 Financial MarketDokument35 Seiten1 Financial MarketSachinGoelNoch keine Bewertungen