Beruflich Dokumente

Kultur Dokumente

Liabilites 2000 2001 Assets 2000 2001: Balance Sheet

Hochgeladen von

Giri SukumarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Liabilites 2000 2001 Assets 2000 2001: Balance Sheet

Hochgeladen von

Giri SukumarCopyright:

Verfügbare Formate

Balance Sheet

Liabilites 2000 2001 Assets 2000 2001

Share capital 200000 200000 Good will 24000 24000

General Reserve 28000 36000 Buildings 80000 72000

P&L a/c 32000 26000 Plant 74000 72000

Creditors 16000 10800 Investments 20000 22000

Bills Payable 2400 1600 Stock 60000 46800

Provision for Tax 32000 36000 Bills receivable 4000 6400

Provision for Doubtful debts 800 1200 Debtors 36000 38000

Cash &Bank Balances 13200 30400

311200 311600 311200 311600

Income Statement

Particulars Rs Rs

Sales 200000

less: Cost of goods sold 10000

Opening stock 40000

Add: Purchase 50000

Less: Closing stock 15000

35000

Gross Profit 165000

Less: Operating Expenses 12000

Operating profit 153000

Less : Non Operating Expenses 4000

Profit Before Tax 149000

Less: Income Tax (50%) 74500

Net Profit After Tax 74500

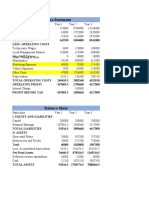

Company Name:

AUDITED STATEMENT OF FINANCIAL RESULTS

FOR THE QUARTER ENDED JUNE 30,2010

Ouater ended Year ended

Particulars June 30,2010 June 30,2009 March 31,2010

Income from Operations 5280.41 4422.22 21589.59

Other Income 105.44 107.6 415.01

Total Income 5385.85 4529.82 22004.6

Expenditure

Consumption of Raw Materials 606.58 548.78 2402.8

Staff Cost 955.77 827.07 3679.08

Fuel,Power,&Light 386.43 336.5 1367.57

Depreciation 310.43 290.06 1259.95

Other Expenditure 1544.21 1478.4 6607.9

Total 3803.42 3480.81 15317.3

Profit before interest and Tax 1582.43 1049.01 6687.3

Interest 1.4 4.34 29.7

Profit before Tax 1581.03 1044.67 6657.6

Provision for Tax(Including Deferred Tax) 536.57 355.43 2264.24

Provision for Fringe Benefit Tax 11 8 44

Net Profit after Tax 1033.46 681.24 4349.36

Paid -up Equity Share Capital 1785.99 1785.99 1785.99

Reserve Excluding Revaluation Reserves 24246.61

Basis and Diluted Earnings Per share-

In Rupees - not annualised 5.79 3.81 24.35

Aggregate of Public Shareholding

-Number of Shares 6000151 6013831 6016002

- Percentage of Shareholding 33.60% 33.67% 33.68%

ASHOK LTDIncrease

(+)

Comparative Income Statement for the yearsDecrease(

ending 2008 and 2009

-) Increase(+)

Amount(R Decrease(-)

particulars 2008 2009 s) Percentages

Sales 360728 417125 56397 15.63

Less: Sales returns 5794 6952 1158 19.99

354934 410173 55239 15.56

Less:Cost of goods sold 231625 241950 10325 4.46

Gross profit (A) 123309 168223 44914 36.42

Operating Expenses

Office Expenses 23266 27068 3802 16.34

Selling Expenses 45912 57816 11904 25.93

Total operating Expenses ( B ) 69178 84884 15706 22.70

Operating Profit (A - B ) = C 54131 83339 29208 53.96

Add: Other Incomes 5523 3206 -2317 (41.95)

(D) 59654 86545 26891 45.08

Less: Other Expenses ( E ) 2764 1925 -839 (30.35)

Profit before Tax ( D -E ) =F 56890 84620 27730 48.74

Less: Income Tax ( G ) 21519 40195 18676 86.79

Net profit after tax ( F - G ) = H 35371 44425 9054 25.60

Increase

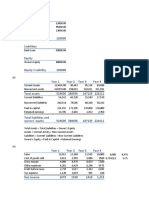

Comparative Balance Sheet

(+)

Decrease

(-) Increase (+)

31st Dec 31st Dec Amount Decrease (-)

2000 2001 (Rs) Percentages

Particulars Rs. Rs. %

ASSETS :

Current Assets :

Cash at bank and in hand 50000 83000 33000 66

Bills Receivable 20000 60000 40000 200

Debtors 100000 125000 25000 25

Stock 40000 50000 10000 25

Perpaid Expenses 10000 12000 2000 20

Total Current Asset (A) 220000 330000 110000 50

Fixed Assets (B) 240000 350000 110000 46

Total Assets A+B=C 460000 680000 220000 48

LIABILITIES

Current Liabilites

Bank Overdraft 50000 50000 0 -

Creditors 40000 50000 10000 25

Proposed dividend 15000 25000 10000 67

Proposed for taxation 20000 25000 5000 25

Total current Liabilites (D) 125000 150000 25000 20

Capital Reserve :

Equity share capital 200000 330000 130000 65

Preference Share capital 100000 150000 50000 50

Reserves 20000 30000 10000 50

Profit and loss a/c 15000 20000 5000 33

(E) 335000 530000 195000 58

Total Liabilites (D+E) 460000 680000 220000 48

Commen Size Balance Sheet of XYZ LTD.., as at 31st March ,2008

Particulars Amount(Rs) % to Total

ASSETS

Fixed Assets :

Land 50000 5.3

Buildings 110000 11.7

Plant and machinery 250000 26.6

410000 43.6

Current Assets :

Inventory

Raw materials 80000 8.5

Work in progress 50000 5.3

Finished goods 160000 17.0

Sundry debtors 210000 22.3

cash at bank 30000 3.2

TOTAL 940000 100.0

Capital and Liabilties :

Equity share Capital 250000 26.6

preference share capital 100000 10.6

General Reserve 160000 17.0

Debentures 80000 8.5

Current Liabilties :

Sundry creditors 220000 23.4

Creditors for Expenses 40000 4.3

Bills payable 90000 9.6

TOTAL 940000 100.0

Company Name :

Statement showing Changes in working Capital

Increase Decrease

in in

Working Working

Particulars 2000 2001 Capital Capital

Current Assets

Cash & Bank Balances 13200 30400 17200

debtors 36000 38000 2000

Bills receivable 4000 6400 2400

stock 60000 46800 13200

113200 121600

Current liabilities

Provision for doubtful debts 800 1200 400

Bills payable 2400 1600 800

Creditors 16000 10800 5200

19200 13600

Working Capital 94000 108000

Increase in Working capital 14000 14000

TOTAL 108000 108000 27600 27600

Funds Flow Statement

Soures Amount Applications Amount

Funds from Operations 72000 Purchase of Plant 6000

Tax Paid 34000

Purchase of investments 2000

Interim dividend Paid 16000

Increase in Working Capital 14000

72000 72000

Das könnte Ihnen auch gefallen

- Financial WorksheetDokument4 SeitenFinancial WorksheetCarla GonçalvesNoch keine Bewertungen

- In The Books of Nil Kamal Ltd. Particulars 2012 2013 Change % ChangeDokument21 SeitenIn The Books of Nil Kamal Ltd. Particulars 2012 2013 Change % ChangeRaj KamaniNoch keine Bewertungen

- FM2 Assignment 4 - Group 5Dokument7 SeitenFM2 Assignment 4 - Group 5TestNoch keine Bewertungen

- Microtech Company Blance Sheet - (HW2) : Year 1 Year 2Dokument4 SeitenMicrotech Company Blance Sheet - (HW2) : Year 1 Year 2Vemuri SudheerNoch keine Bewertungen

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDokument6 SeitenModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNoch keine Bewertungen

- BodieDokument8 SeitenBodieLinh NguyenNoch keine Bewertungen

- Estimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Dokument5 SeitenEstimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Somlina MukherjeeNoch keine Bewertungen

- BTVN Chap 03Dokument14 SeitenBTVN Chap 03Nguyen Phuong Anh (K16HL)Noch keine Bewertungen

- Data Bodie Industrial Supply V1Dokument10 SeitenData Bodie Industrial Supply V1Giovani R. Pangos RosasNoch keine Bewertungen

- Pooja & Pooja Team Profit-and-Loss-StatementDokument5 SeitenPooja & Pooja Team Profit-and-Loss-StatementPOOJA SUNKINoch keine Bewertungen

- Havells Income STMT 2009-2013Dokument11 SeitenHavells Income STMT 2009-2013K.GayathiriNoch keine Bewertungen

- 2000 2001 2000 Liabilites Assets: Balance SheetDokument10 Seiten2000 2001 2000 Liabilites Assets: Balance SheetGuruswami PrakashNoch keine Bewertungen

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDokument17 SeitenACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNoch keine Bewertungen

- Financial Stuff (SME)Dokument14 SeitenFinancial Stuff (SME)Sana KhanNoch keine Bewertungen

- RatioDokument13 SeitenRatioKaren Joyce Sinsay50% (2)

- Assignment 2 (C)Dokument1 SeiteAssignment 2 (C)Linda YaacobNoch keine Bewertungen

- FAM Assignment - Rupasree Dey - 01-20-108Dokument10 SeitenFAM Assignment - Rupasree Dey - 01-20-108Rupasree DeyNoch keine Bewertungen

- Project HardDokument12 SeitenProject HardTalha Khan SherwaniNoch keine Bewertungen

- Financial Management Sums OnlyDokument17 SeitenFinancial Management Sums OnlybhuvaneswariNoch keine Bewertungen

- Urban Water Partners Group ADokument5 SeitenUrban Water Partners Group AAman jhaNoch keine Bewertungen

- Accounting Excel SheetsDokument8 SeitenAccounting Excel Sheetskokila amarasingheNoch keine Bewertungen

- STATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Dokument5 SeitenSTATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Fatima Ansari d/o Muhammad AshrafNoch keine Bewertungen

- Financial Statement Analysis: by Ghanendrafago Mba, M PhilDokument19 SeitenFinancial Statement Analysis: by Ghanendrafago Mba, M Philits4krishna3776Noch keine Bewertungen

- Assignment N3Dokument12 SeitenAssignment N3Maiko KopadzeNoch keine Bewertungen

- Assignment 6.1Dokument9 SeitenAssignment 6.1Abigail ConstantinoNoch keine Bewertungen

- Chapter 1 - Introduction To Published AccountsDokument20 SeitenChapter 1 - Introduction To Published AccountsParas VohraNoch keine Bewertungen

- Financials at GlanceDokument1 SeiteFinancials at Glancekanwal23Noch keine Bewertungen

- Latest Quarterly/Halfyearly As On (Months)Dokument3 SeitenLatest Quarterly/Halfyearly As On (Months)mansi07Noch keine Bewertungen

- NYSF Practice TemplateDokument22 SeitenNYSF Practice TemplaterapsjadeNoch keine Bewertungen

- Financials at GlanceDokument1 SeiteFinancials at GlanceSrikanth Marriboyanna MNoch keine Bewertungen

- Ratio Analysis - Team E - Last FinalDokument17 SeitenRatio Analysis - Team E - Last Finalyarsuthit279Noch keine Bewertungen

- Reformulated Comprehensive Income StatementDokument5 SeitenReformulated Comprehensive Income StatementXyzNoch keine Bewertungen

- Accounts AssignsmentDokument8 SeitenAccounts Assignsmentadityatiwari8303Noch keine Bewertungen

- AK Personal 1Dokument13 SeitenAK Personal 1erniNoch keine Bewertungen

- Homework N3Dokument24 SeitenHomework N3Maiko KopadzeNoch keine Bewertungen

- Chapter 13Dokument11 SeitenChapter 13MekeniMekeniNoch keine Bewertungen

- Bhimsen CaseDokument2 SeitenBhimsen CaseNikhil Gauns DessaiNoch keine Bewertungen

- Lecture - 5 - CFI-3-statement-model-completeDokument37 SeitenLecture - 5 - CFI-3-statement-model-completeshreyasNoch keine Bewertungen

- Case StudyDokument6 SeitenCase Studyrajan mishraNoch keine Bewertungen

- $ Million 2013 2012: Balance SheetDokument3 Seiten$ Million 2013 2012: Balance Sheetyash sarohaNoch keine Bewertungen

- Cash Flow and RatiosDokument8 SeitenCash Flow and RatiosAnindya BasuNoch keine Bewertungen

- North Mountain NurseryDokument1 SeiteNorth Mountain Nurserychandel08Noch keine Bewertungen

- ICRRS - Practice Sheet - Financials & Assumptions - ABC Textile Mills LimitedDokument4 SeitenICRRS - Practice Sheet - Financials & Assumptions - ABC Textile Mills LimitedOptimistic EyeNoch keine Bewertungen

- FinancialDokument15 SeitenFinancialAdrià BurgellNoch keine Bewertungen

- Wip C.Dokument9 SeitenWip C.Never GonondoNoch keine Bewertungen

- Commonsize StatementDokument14 SeitenCommonsize StatementSimratpal SinghNoch keine Bewertungen

- FS Group 2Dokument5 SeitenFS Group 2Ge-Ann BonuanNoch keine Bewertungen

- Urban Water PartnersDokument2 SeitenUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- GraceDokument2 SeitenGraceRohan KulshresthaNoch keine Bewertungen

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDokument8 SeitenCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNoch keine Bewertungen

- Finance Quiz 2Dokument35 SeitenFinance Quiz 2Peak ChindapolNoch keine Bewertungen

- Vedanta DCFDokument50 SeitenVedanta DCFmba23subhasishchakrabortyNoch keine Bewertungen

- Financial Statement of DeliDokument5 SeitenFinancial Statement of DeliBishowraj PariyarNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Jet Airways UpdatedDokument18 SeitenJet Airways UpdatedJoseph ThomasNoch keine Bewertungen

- Financial AnalysisDokument24 SeitenFinancial AnalysisSwathi ShanmuganathanNoch keine Bewertungen

- Chapter AssignmentDokument3 SeitenChapter AssignmentSwati PorwalNoch keine Bewertungen

- Proforma Income and Expenditure StatementDokument14 SeitenProforma Income and Expenditure StatementKwame JavisNoch keine Bewertungen

- Surendra Sir BuscalcualtionDokument3 SeitenSurendra Sir BuscalcualtionPrasiddha PradhanNoch keine Bewertungen

- Charge OF GST: After Studying This Chapter, You Will Be Able ToDokument49 SeitenCharge OF GST: After Studying This Chapter, You Will Be Able ToGiri SukumarNoch keine Bewertungen

- Model Agreement of Sale of Immovable PropertyDokument3 SeitenModel Agreement of Sale of Immovable PropertyGiri SukumarNoch keine Bewertungen

- GST Entries For Every Month SalesDokument3 SeitenGST Entries For Every Month SalesGiri Sukumar100% (1)

- GST Free Class: View GST Lecture at My Youtube ChannelDokument18 SeitenGST Free Class: View GST Lecture at My Youtube ChannelGiri SukumarNoch keine Bewertungen

- Note On GST Input Tax Credit CA Yashwant KasarDokument32 SeitenNote On GST Input Tax Credit CA Yashwant KasarGiri SukumarNoch keine Bewertungen

- Basic Concept of Taxation: Created by Cs Rozy JainDokument20 SeitenBasic Concept of Taxation: Created by Cs Rozy JainGiri SukumarNoch keine Bewertungen

- Capsule It PDFDokument25 SeitenCapsule It PDFGiri SukumarNoch keine Bewertungen

- Bond For Export of Goods or Services Without Payment of Integrated TaxDokument1 SeiteBond For Export of Goods or Services Without Payment of Integrated TaxGiri SukumarNoch keine Bewertungen

- Input Tax Credit Under GSTDokument35 SeitenInput Tax Credit Under GSTGiri SukumarNoch keine Bewertungen

- Tax On Mutual Funds and SharesDokument6 SeitenTax On Mutual Funds and SharesGiri SukumarNoch keine Bewertungen

- Provisions of GST Effective From 1St April 2019Dokument3 SeitenProvisions of GST Effective From 1St April 2019Giri SukumarNoch keine Bewertungen

- Certificat: S Ent of Ivth M T R A Y S Fte O Ogy B NG Ore. H Und R On G N U Organ A Ion Durin The E A C 2 8Dokument71 SeitenCertificat: S Ent of Ivth M T R A Y S Fte O Ogy B NG Ore. H Und R On G N U Organ A Ion Durin The E A C 2 8Chetana YadawadNoch keine Bewertungen

- A Plan of Life - Scepter BookletDokument10 SeitenA Plan of Life - Scepter Bookletpeteatkinson@gmail.comNoch keine Bewertungen

- Strategic Cost Management: Questions For Writing and DiscussionDokument44 SeitenStrategic Cost Management: Questions For Writing and Discussionmvlg26Noch keine Bewertungen

- Way of St. LouiseDokument18 SeitenWay of St. LouiseMaryann GuevaradcNoch keine Bewertungen

- Sec A - Group 9 - When A New Manager StumblesDokument13 SeitenSec A - Group 9 - When A New Manager StumblesVijay Krishnan100% (3)

- H.P. Elementary Education Code Chapter - 4 - 2012 SMC by Vijay Kumar HeerDokument7 SeitenH.P. Elementary Education Code Chapter - 4 - 2012 SMC by Vijay Kumar HeerVIJAY KUMAR HEERNoch keine Bewertungen

- El Poder de La Disciplina El Hábito Que Cambiará Tu Vida (Raimon Samsó)Dokument4 SeitenEl Poder de La Disciplina El Hábito Que Cambiará Tu Vida (Raimon Samsó)ER CaballeroNoch keine Bewertungen

- ADUtilitiesDokument4 SeitenADUtilitiesapi-3745837Noch keine Bewertungen

- A Comparative Study of Intelligence in Children of Consanguineous and Non-Consanguineous Marriages and Its Relationship With Holland's Personality Types in High School Students of TehranDokument8 SeitenA Comparative Study of Intelligence in Children of Consanguineous and Non-Consanguineous Marriages and Its Relationship With Holland's Personality Types in High School Students of TehranInternational Medical PublisherNoch keine Bewertungen

- Grimshaw v. Ford Motor CoDokument35 SeitenGrimshaw v. Ford Motor CozichenNoch keine Bewertungen

- 659.69 BM67 2018-02-06 02 Im Beu-UsaDokument88 Seiten659.69 BM67 2018-02-06 02 Im Beu-UsaIrakli JibladzeNoch keine Bewertungen

- Business Analytics Case Study - NetflixDokument2 SeitenBusiness Analytics Case Study - NetflixPurav PatelNoch keine Bewertungen

- MinimumEHS Standards For Projects-V3Dokument113 SeitenMinimumEHS Standards For Projects-V3Ammu KuttiyNoch keine Bewertungen

- TV Studio ChainDokument38 SeitenTV Studio ChainKalpesh Katara100% (1)

- Leaders Eat Last Key PointsDokument8 SeitenLeaders Eat Last Key Pointsfidoja100% (2)

- Walsh January Arrest Sherrif Records Pgs 10601-10700Dokument99 SeitenWalsh January Arrest Sherrif Records Pgs 10601-10700columbinefamilyrequest100% (1)

- Jaringan Noordin M. TopDokument38 SeitenJaringan Noordin M. TopgiantoNoch keine Bewertungen

- Wolfgang Tillmans - NoticeDokument74 SeitenWolfgang Tillmans - NoticeSusana Vilas-BoasNoch keine Bewertungen

- Fin - e - 178 - 2022-Covid AusterityDokument8 SeitenFin - e - 178 - 2022-Covid AusterityMARUTHUPANDINoch keine Bewertungen

- Financial Fitness ChecklistDokument4 SeitenFinancial Fitness Checklistcoach_22Noch keine Bewertungen

- Case Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022Dokument4 SeitenCase Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022ShravanNoch keine Bewertungen

- Homa Pump Catalog 2011Dokument1.089 SeitenHoma Pump Catalog 2011themejia87Noch keine Bewertungen

- Influence of Brand Experience On CustomerDokument16 SeitenInfluence of Brand Experience On Customerarif adrianNoch keine Bewertungen

- PRE-TEST (World Religion)Dokument3 SeitenPRE-TEST (World Religion)Marc Sealtiel ZunigaNoch keine Bewertungen

- Kanne Gerber Et Al Vineland 2010Dokument12 SeitenKanne Gerber Et Al Vineland 2010Gh8jfyjnNoch keine Bewertungen

- Episode 6: Deductive and Inductive Methods of Teaching: My Learning Episode OverviewDokument10 SeitenEpisode 6: Deductive and Inductive Methods of Teaching: My Learning Episode OverviewJustine Elle Vijar85% (13)

- Ingles V Eje 1 Week 2Dokument5 SeitenIngles V Eje 1 Week 2Cristhian Javier Torres PenaNoch keine Bewertungen

- Question Paper Code:: (10×2 20 Marks)Dokument2 SeitenQuestion Paper Code:: (10×2 20 Marks)Umesh Harihara sudan0% (1)

- Article 124-133Dokument14 SeitenArticle 124-133andresjosejrNoch keine Bewertungen

- AIPT 2021 GuidelineDokument4 SeitenAIPT 2021 GuidelineThsavi WijayasingheNoch keine Bewertungen