Beruflich Dokumente

Kultur Dokumente

Money and The Myth

Hochgeladen von

Vanshica SahniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Money and The Myth

Hochgeladen von

Vanshica SahniCopyright:

Verfügbare Formate

8/22/2019 Money and the Myth.

xlsx

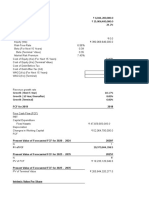

Dewan Housing Finance Limited

Country India Repor ng Currency INR Market Capitaliza on 8634.00 Date of Valua on

The Myth

Dewan Housing Finance Limited (DHFL) is one of the oldest Housing Finance companies in the country, second only to Housing Deveopment Fina

distribu on advantages over the numerous smaller HFCs which seems to have mushroomed over the past decade. Of course, the on-going credit

firm. Unlike other firms, rumors do affect the business of BFSI firms, punishing them with increasing yields and decreasing trust. Then there is

per nently in the news these days a er the drama c failure of ILFS. We should also keep in mind the fact that the fortunes of a BFSI firm can shi

having more than 35 years of industry presence can handle these issues and more.

The Money

Net Income 1346.67 Previous Net Income ₹ 1,045.72 Dividends ₹ 230.95 Net Worth

Risk-free Rate 8.34% Company Beta 1.74 Indexed Returns 14.22% Convergence Period

Cash 1549.72 Investments 6195.77 Average Return on Equity 17.02% Loan Book Size

The Capital Conversions

Opera ng Lease

Lease Expenses 50.39 Cost of Debt 11.00% Value of Lease ₹ 5.50 Number of SOPs

Year Lease Commitment PV (Lease) Time to Expiry

2019 ₹ 3.58 ₹ 3.23 Dividend Yield

2020 ₹ 0.55 ₹ 0.44 Adjusted Price

2021 ₹ 0.55 ₹ 0.40 d1

2022 ₹ 0.55 ₹ 0.36 d2

2023 ₹ 0.55 ₹ 0.32 S.N(d1)

2023 - ∞ ₹ 1.40 ₹ 0.74 Value of Equity

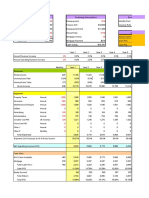

The Assump ons

Value Drivers Base Year High Growth Period Terminal Period

High Growth Period 20 Years Years 1-5 Years 6-10 Years 11-15 Years 16-20 A er 25 Years DHFL

Growth in Net Income 28.78% 19.24% 18.28% 17.36% 17.19% 4.17%

Payout Ra o 17.15% 17.15% 18.87% 20.75% 22.83% 70.67% Pa

Company Beta 18.57% 18.57% 18.57% 18.57% 14.22%

The Dividends

Year Growth in Net Income Net Income EPS DPR DPS Cost of Equity Cumu

2019 19.24% ₹ 1,605.77 ₹ 51.30 17.15% ₹ 8.80 18.57%

2020 19.05% ₹ 1,911.63 ₹ 61.07 17.49% ₹ 10.68 18.57%

2021 18.86% ₹ 2,272.07 ₹ 72.59 17.84% ₹ 12.95 18.57%

2022 18.66% ₹ 2,696.10 ₹ 86.14 18.18% ₹ 15.66 18.57%

2023 18.47% ₹ 3,194.08 ₹ 102.05 18.52% ₹ 18.90 18.57%

2024 18.28% ₹ 3,777.90 ₹ 120.70 18.87% ₹ 22.77 18.57%

2025 18.10% ₹ 4,461.52 ₹ 142.54 19.24% ₹ 27.43 18.57%

2026 17.91% ₹ 5,260.69 ₹ 168.07 19.62% ₹ 32.98 18.57%

2027 17.73% ₹ 6,193.39 ₹ 197.87 20.00% ₹ 39.57 18.57%

2028 17.55% ₹ 7,280.13 ₹ 232.59 20.37% ₹ 47.39 18.57%

2029 17.36% ₹ 8,544.26 ₹ 272.98 20.75% ₹ 56.65 18.57%

https://www.dropbox.com/s/ute6l7t1h602wyu/Money and the Myth.xlsx?dl=0 1/2

8/22/2019 Money and the Myth.xlsx

2030 17.33% ₹ 10,024.96 ₹ 320.29 21.17% ₹ 67.79 18.57%

2031 17.30% ₹ 11,758.80 ₹ 375.68 21.58% ₹ 81.08 18.57%

2032 17.26% ₹ 13,788.47 ₹ 440.53 22.00% ₹ 96.90 18.57%

2033 17.23% ₹ 16,163.74 ₹ 516.41 22.41% ₹ 115.74 18.57%

2034 17.19% ₹ 18,942.62 ₹ 605.20 22.83% ₹ 138.15 18.57%

2035 16.38% ₹ 22,045.33 ₹ 704.32 27.61% ₹ 194.47 18.57%

2036 15.57% ₹ 25,477.14 ₹ 813.97 32.40% ₹ 263.69 18.57%

2037 14.75% ₹ 29,236.17 ₹ 934.06 37.18% ₹ 347.29 18.57%

2038 13.94% ₹ 33,312.29 ₹ 1,064.29 41.96% ₹ 446.63 18.57%

2039 13.13% ₹ 37,686.04 ₹ 1,204.03 46.75% ₹ 562.87 17.85%

2040 11.34% ₹ 41,958.78 ₹ 1,340.54 51.53% ₹ 690.83 17.12%

2041 9.55% ₹ 45,964.13 ₹ 1,468.50 56.32% ₹ 827.03 16.40%

2042 7.75% ₹ 49,528.25 ₹ 1,582.37 61.10% ₹ 966.87 15.67%

2043 5.96% ₹ 52,481.27 ₹ 1,676.72 65.89% ₹ 1,104.74 14.95%

2043 - ∞ 4.17% ₹ 54,670.00 ₹ 1,746.65 70.67% ₹ 1,234.38 14.22%

The Value The S

Value of the Firm ₹ 12,369.04 Sensi vity

(+) Cash and Investments ₹ 7,745.49

Terminal Cost of Equity

(-) Value of Equity Op ons ₹ 258.91 3.01%

(-) Value of Opera ng Leases ₹ 5.50 8.73% ₹ 547.19

NPA Recovery Rate 40.00% 10.27% ₹ 516.85

(-) Non-performing Assets ₹ 495.01 12.09% ₹ 491.06

Value of Equity ₹ 19,355.12 14.22% ₹ 469.15

Value of Equity per Share ₹ 618.37 16.35% ₹ 452.95

(-) Expected Margin of Safety 30.00% 18.81% ₹ 438.86

Expected Purchase Price of Equity per Share ₹ 432.86 21.63% ₹ 426.61

Market Price of Equity per Share ₹ 275.85 Probable Purchase Price

"Money and the Myth" is a simple Dividend Discount Model built and improvised by Dinesh Sairam, inspired by Prof. Aswath Damodaran (Dea

For more Valua on-related content, visit www.valua oninmo on.blogspot.in or write to dineshssairam@gmail.c

https://www.dropbox.com/s/ute6l7t1h602wyu/Money and the Myth.xlsx?dl=0 2/2

Das könnte Ihnen auch gefallen

- Money and The MythDokument11 SeitenMoney and The MythpankajsinhaNoch keine Bewertungen

- FB ValuationDokument10 SeitenFB ValuationRogelio RodriguezNoch keine Bewertungen

- Tata Technologies FinancialsDokument22 SeitenTata Technologies FinancialsRitvik DuttaNoch keine Bewertungen

- Infosys LTD 774.60: Nse: InfyDokument5 SeitenInfosys LTD 774.60: Nse: InfybezirksvorNoch keine Bewertungen

- KRBL Limited DCF ValuationDokument15 SeitenKRBL Limited DCF ValuationPravin AwalkondeNoch keine Bewertungen

- Titan Financial ModelDokument15 SeitenTitan Financial Modelyadhu krishnaNoch keine Bewertungen

- BAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTDokument1 SeiteBAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTVivek NambiarNoch keine Bewertungen

- Central Depository Services (India) Limited: Nilay Rajendra ShahDokument26 SeitenCentral Depository Services (India) Limited: Nilay Rajendra Shahकुमोद गुप्ताNoch keine Bewertungen

- Forward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Dokument19 SeitenForward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Wahid Arief AuladyNoch keine Bewertungen

- Intrinsic Value Estimate of Telkom Indonesia Using DCF ValuationDokument19 SeitenIntrinsic Value Estimate of Telkom Indonesia Using DCF ValuationWahid Arief AuladyNoch keine Bewertungen

- Aircraft lease payment and depreciation figuresDokument4 SeitenAircraft lease payment and depreciation figuresbananahoverboardNoch keine Bewertungen

- Tax Rate Calculation and WACC for SignifyDokument9 SeitenTax Rate Calculation and WACC for SignifyShivam GoelNoch keine Bewertungen

- Fin 201 - SDokument10 SeitenFin 201 - SAhsanur HossainNoch keine Bewertungen

- HW 2 - Ch03 P15 Build A Model - HrncarDokument2 SeitenHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNoch keine Bewertungen

- Union Budget 2023-24 drives AtmanirbhartaDokument15 SeitenUnion Budget 2023-24 drives AtmanirbhartaVenky VenkyNoch keine Bewertungen

- Infosys Ltd. Financial Analysis and ValuationDokument14 SeitenInfosys Ltd. Financial Analysis and Valuationswaroop shettyNoch keine Bewertungen

- Learn2Invest Session 10 - Asian Paints ValuationsDokument8 SeitenLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNoch keine Bewertungen

- Module-9and10 Additional Material FSA Template - Session-11and12 1yTJNk93rUDokument9 SeitenModule-9and10 Additional Material FSA Template - Session-11and12 1yTJNk93rUBhavya PatelNoch keine Bewertungen

- SL2-Corporate Finance Ristk ManagementDokument17 SeitenSL2-Corporate Finance Ristk ManagementKrishantha WeerasiriNoch keine Bewertungen

- Hero Motocorp LTD Quantamental EquityDokument1 SeiteHero Motocorp LTD Quantamental EquityVivek NambiarNoch keine Bewertungen

- DownloadDokument22 SeitenDownloadAshwani KesharwaniNoch keine Bewertungen

- Airtel Financial StatmentsDokument7 SeitenAirtel Financial StatmentsAbhishek PatilNoch keine Bewertungen

- PE Exit AnalysisDokument5 SeitenPE Exit AnalysisgNoch keine Bewertungen

- Human Life Value CalculatorDokument4 SeitenHuman Life Value CalculatorOm UpadhyeNoch keine Bewertungen

- Indian Railway Finance Corporation LTD IPO: All You Need To Know AboutDokument7 SeitenIndian Railway Finance Corporation LTD IPO: All You Need To Know Aboutbest commentator barackNoch keine Bewertungen

- Kotak Mahindra Bank Limited Consolidated Financials FY18Dokument60 SeitenKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiNoch keine Bewertungen

- Valuation of Himadri Specialty Chemical LTD.: Presented byDokument11 SeitenValuation of Himadri Specialty Chemical LTD.: Presented byArnab ChakrabortyNoch keine Bewertungen

- UntitledDokument8 SeitenUntitledPravin AmirthNoch keine Bewertungen

- Nestle India - Financial Model-1Dokument17 SeitenNestle India - Financial Model-1Narendra WalujkarNoch keine Bewertungen

- Evaluating Reliance's Dividend Policy and ValuationDokument11 SeitenEvaluating Reliance's Dividend Policy and ValuationYash Aggarwal BD20073Noch keine Bewertungen

- Government Bonds Bond - IN0020190362 Bond - IN0020170026Dokument4 SeitenGovernment Bonds Bond - IN0020190362 Bond - IN0020170026Arif AhmedNoch keine Bewertungen

- Sample Financial PlanDokument12 SeitenSample Financial PlanSneha KhuranaNoch keine Bewertungen

- Maruti Suzuki FS AnalysisDokument14 SeitenMaruti Suzuki FS AnalysisChirag AggarwalNoch keine Bewertungen

- DCF Valuation-BDokument11 SeitenDCF Valuation-BElsaNoch keine Bewertungen

- DownloadDokument3 SeitenDownloadVenkatesh VenkateshNoch keine Bewertungen

- Nestle India Financial Model 1690555420Dokument24 SeitenNestle India Financial Model 1690555420Shrikant GuptaNoch keine Bewertungen

- Final Bob Analyst Presentation Q2fy24Dokument41 SeitenFinal Bob Analyst Presentation Q2fy24ksp200014Noch keine Bewertungen

- Paramount Textile PLC Ratio Analysis FinalDokument16 SeitenParamount Textile PLC Ratio Analysis Finalraufun huda dipNoch keine Bewertungen

- Valuation of Tata SteelDokument3 SeitenValuation of Tata SteelNishtha Mehra100% (1)

- Goodwill Finance FM FinalDokument231 SeitenGoodwill Finance FM Finalmeenal_smNoch keine Bewertungen

- Basic Rental Analysis WorksheetDokument8 SeitenBasic Rental Analysis WorksheetGleb petukhovNoch keine Bewertungen

- Birdie Golf - Hybrid Gold Merger - Cash CowsDokument8 SeitenBirdie Golf - Hybrid Gold Merger - Cash Cowsivan pelayoNoch keine Bewertungen

- Jyoti Resins Stock Price, Financials, News & ComparisonDokument4 SeitenJyoti Resins Stock Price, Financials, News & ComparisonROOPDIP MUKHOPADHYAYNoch keine Bewertungen

- Antero Resources Corp $36.74 Rating: Positive Positive Very PositiveDokument3 SeitenAntero Resources Corp $36.74 Rating: Positive Positive Very Positivephysicallen1791Noch keine Bewertungen

- Intacc2-Quiz ExamDokument5 SeitenIntacc2-Quiz ExamCmNoch keine Bewertungen

- Msft-Clean 1Dokument13 SeitenMsft-Clean 1api-580098249Noch keine Bewertungen

- Mergers Mid TermDokument4 SeitenMergers Mid Termsuraj nairNoch keine Bewertungen

- WorkbookDokument7 SeitenWorkbookHarshit GoyalNoch keine Bewertungen

- ICICI Pru Gold One PagerDokument3 SeitenICICI Pru Gold One PagerRetro WavNoch keine Bewertungen

- Finance and Operating Lease Exercise (Solution)Dokument10 SeitenFinance and Operating Lease Exercise (Solution)Emnet AbNoch keine Bewertungen

- EMI Calculator For SaidaDokument2 SeitenEMI Calculator For SaidaSuresh varma AkulaNoch keine Bewertungen

- Adiwibowo 021122264Dokument36 SeitenAdiwibowo 021122264wadi7188Noch keine Bewertungen

- Adani Enterprises LTD: Nse: AdanientDokument4 SeitenAdani Enterprises LTD: Nse: AdanientHimanshu SinghNoch keine Bewertungen

- AccretionDilution AnalysisDokument14 SeitenAccretionDilution AnalysisJayash KaushalNoch keine Bewertungen

- Data FeasibDokument13 SeitenData FeasibPau SantosNoch keine Bewertungen

- PT Agung Podomoro Land TBK Statement of Financial Position: Current AssetDokument10 SeitenPT Agung Podomoro Land TBK Statement of Financial Position: Current Assetadis salsabilaNoch keine Bewertungen

- High Management Efficiency Poor Growth in Long Term Net SalesDokument18 SeitenHigh Management Efficiency Poor Growth in Long Term Net SalesAbdul SamadNoch keine Bewertungen

- Valution ModelDokument10 SeitenValution ModelVivek WaradeNoch keine Bewertungen

- MP2 Savings CalculatorDokument9 SeitenMP2 Savings CalculatorJohn VillanuevaNoch keine Bewertungen

- 2024 Predictions - by Luke Belmar - by Luke Belmar - Dec, 2023 - MediumDokument3 Seiten2024 Predictions - by Luke Belmar - by Luke Belmar - Dec, 2023 - MediumAshish RaiNoch keine Bewertungen

- Country Risk: Determinants, Measures and Implications - The 2015 EditionDokument40 SeitenCountry Risk: Determinants, Measures and Implications - The 2015 EditionBunker BopsNoch keine Bewertungen

- Jawaban Soal Latihan LKK1-BondsDokument21 SeitenJawaban Soal Latihan LKK1-Bondszahra calista armansyahNoch keine Bewertungen

- Technical Analysis of Indian Stock Market and SharesDokument42 SeitenTechnical Analysis of Indian Stock Market and Sharessarangdhar100% (14)

- Copy of Create a Pictorial Representation on the Five C Principles of Lendi_20240401_110846_0000Dokument11 SeitenCopy of Create a Pictorial Representation on the Five C Principles of Lendi_20240401_110846_0000mohankumar12tha1Noch keine Bewertungen

- Role Play 20204 - Fin242Dokument2 SeitenRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNoch keine Bewertungen

- Adjust Your Perspective.: Bloomberg Professional ServicesDokument8 SeitenAdjust Your Perspective.: Bloomberg Professional ServicesGonzalo Ramírez VargasNoch keine Bewertungen

- Making Evidence Matter in Canadian Health PolicyDokument291 SeitenMaking Evidence Matter in Canadian Health PolicyEvidenceNetwork.ca100% (3)

- Matang BHD IPODokument377 SeitenMatang BHD IPOUNsangkarableNoch keine Bewertungen

- Common Test May2022 QDokument5 SeitenCommon Test May2022 QNur Anis AqilahNoch keine Bewertungen

- Lesson 2 - The Economic Analysis of Financial StructureDokument22 SeitenLesson 2 - The Economic Analysis of Financial StructureKieuVy PhanNoch keine Bewertungen

- Insurance Code Amended Insurers' Capital Raised: Michelle V. Remo Philippine Daily InquirerDokument1 SeiteInsurance Code Amended Insurers' Capital Raised: Michelle V. Remo Philippine Daily InquirerJonna Maye Loras CanindoNoch keine Bewertungen

- MAFS5030 hw3Dokument4 SeitenMAFS5030 hw3RajNoch keine Bewertungen

- PROJECT CASH FLOW ANALYSISDokument12 SeitenPROJECT CASH FLOW ANALYSISSaifiNoch keine Bewertungen

- Stock Index Data with NASDAQ, FTSE 100, Nifty 50 from 1980-2020Dokument24 SeitenStock Index Data with NASDAQ, FTSE 100, Nifty 50 from 1980-2020The HuntNoch keine Bewertungen

- NISM Mock 4 PDFDokument41 SeitenNISM Mock 4 PDFnewbie194767% (3)

- Globalization and Its ImpactDokument14 SeitenGlobalization and Its ImpactAkila FernandoNoch keine Bewertungen

- Venture Returns Outperform Public Markets-AVGDokument4 SeitenVenture Returns Outperform Public Markets-AVGAbhisekh ShahNoch keine Bewertungen

- DSP Multi Asset Fund - NFO PresentationDokument34 SeitenDSP Multi Asset Fund - NFO PresentationWealth Maker BuddyNoch keine Bewertungen

- Fundamentals of Financial Management Chapter 4 SlidesDokument83 SeitenFundamentals of Financial Management Chapter 4 SlidesMuhammad Usama IqbalNoch keine Bewertungen

- ACC3201Dokument7 SeitenACC3201natlyhNoch keine Bewertungen

- And: Management: 5.3 InvestmentDokument2 SeitenAnd: Management: 5.3 InvestmentLaya NeeleshNoch keine Bewertungen

- Review of Literature on Investor Behavior and Factors Influencing Investment DecisionsDokument8 SeitenReview of Literature on Investor Behavior and Factors Influencing Investment Decisionsammukhan khanNoch keine Bewertungen

- Working Capital Management at Bharat Coking Coal Limite1Dokument47 SeitenWorking Capital Management at Bharat Coking Coal Limite1Avinandan Kumar100% (1)

- 3 Seminario Elliott WaveDokument9 Seiten3 Seminario Elliott Wavebatraz79100% (2)

- Lecture 8 Metrics For Entrepreneurs and Startup Funding PDFDokument28 SeitenLecture 8 Metrics For Entrepreneurs and Startup Funding PDFBhagavan BangaloreNoch keine Bewertungen

- GRP B IndividualDokument1 SeiteGRP B Individualsuruth242Noch keine Bewertungen

- Chapter 3 Problems AnswersDokument11 SeitenChapter 3 Problems AnswersOyunboldEnkhzayaNoch keine Bewertungen

- Internship Report 5 SemDokument41 SeitenInternship Report 5 SemAayush SomaniNoch keine Bewertungen

- 12 x10 Financial Statement AnalysisDokument18 Seiten12 x10 Financial Statement AnalysisLouina YnciertoNoch keine Bewertungen