Beruflich Dokumente

Kultur Dokumente

BR Practice

Hochgeladen von

Rocelyn OrdoñezOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BR Practice

Hochgeladen von

Rocelyn OrdoñezCopyright:

Verfügbare Formate

University of Perpetual Help System Dalta

INTERMEDIATE ACCOUNTING I RJ CARASCO

PRACTICE SET

Problem 1

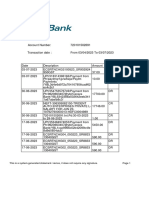

The books of Manila's Service, Inc. disclosed a cash balance of P687,570 on December 31,

2006. The bank statement as of December 31 showed a balance of P547,800. Additional

information that might be useful in reconciling the two balances follows:

(a) Check number 748 for P30,000 was originally recorded on the books as P45,000.

(b) A customer's note dated September 25 was discounted on October 12. The note was

dishonored on December 29 (maturity date). The bank charged Manila's account for

P142,650, including a protest fee of P2,650.

(c) The deposit of December 24 was recorded on the books as P28,950, but it was actually a

deposit of P27,000.

(d) Outstanding checks totaled P98,850 as of December 31.

(e) There were bank service charges for December of P2,100 not yet recorded on the books.

(f) Manila's account had been charged on December 26 for a customer's NSF check for

P12,960.

(g) Manila properly deposited P6,000 on December 3 that was not recorded by the bank.

(h) Receipts of December 31 for P134,250 were recorded by the bank on January 2.

(i) A bank memo stated that a customer's note for P45,000 and interest of P1,650 had been

collected on December 27, and the bank charged a P360 collection fee.

1. Adjusted cash in bank balance

2. Net adjustment to cash as of December 31, 2006

Problem 2.

Balance per bank, Nov. 30, P150,000

2006

Add: Deposits in transit 24,000

Total 174,000

Less: Outstanding checks P28,000

Bank credit

recorded in error 10,000 38,000

Cash balance per books, Nov.

30, 2006 P136,000

The bank statement for

December 2006 contains the

following data:

Total deposits P110,000

Total charges, including an

NSF check of P8,000 and a

service charge of P400 96,000

All outstanding checks on November 30, 2006, including the bank credit, were cleared in the

bank 1n December 2006.

There were outstanding checks of P30,000 and deposits in transit of P38,000 on December

31, 2006.

Questions:

Based on the above and the result of your audit, answer the following:

1. How much is the cash balance per bank on December 31, 2006?

2. How much is the December receipts per books?

3. How much is the December disbursements per books?

4. How much is the cash balance per books on December 31, 2006?

5. The adjusted cash in bank balance as of December 31, 2006 is

Problem 3

The cash books of Grace Corporation show the following entries during the month of June

2016.

Cash Receipts Journal Check Register

Date Amount Date Check No. Amount

June 1 Balance 762,000 June2 801 15,625

4 Deposit 113,000 3 802 7,526

4 Deposit 811,000 5 803 229,205

7 Deposit 152,200 7 804 169,555

10 Deposit 11,300 8 805 74,936

10 Deposit 12,700 10 806 274,600

11 Deposit 73,000 11 807 34,842

17 Deposit 110,075 13 808 250,000

18 Deposit 3,725 14 809 1,070,000

18 Deposit 65,000 17 810 167,300

19 Deposit 26,463 19 811 3,130

20 Deposit 133,037 21 812 82,730

27 Deposit 273,628 23 813 127,200

30 Deposit 92,400 25 814 93,080

30 815 720

The bank statement for the month of June 2016 shows:

Checks No. Deposits Date Amount

Balance May 31 798,000

924,000 June 5 1,722,000

800 36,000 6 1,686,000

804 169,555 7 1,516,445

805 74,936 217,200 8 1,658,709

801 16,525

803 229,205 9 1,412,979

807 34,842 97,000 12 1,475,137

924 75,000

200 40,400 CM 13 1,440,337

(collection charge)

809 1,070,000 14 370,337

808 250,000 15 120,337

198,000 CM 16 318,337

810 167,300 113,800 19 264,837

812 82,730 159,500 21 341,607

806 274,600 24 67,007

273,628 28 340,635

811 3,130

DM 300 30 337,205

Upon investigation, the following are discovered:

CM - Represents a 60-day, 6% note for P40,000 collected by the bank for the account of

Grace Company.

CM - Represents a 60-day, 6% own note for P200,000 discounted by Grace Corporation with

the bank and not yet recorded in the books.

DM - Represents bank service charge for the month.

Check No. 924 represents a check signed by Graciele Company.

Collection charge – represents collection fee charged by the bank.

Questions

1. The unadjusted cash ledger balance of GRACE CORPORATION at June 30, 2016

2. The unadjusted cash bank balance of GRACE CORPORATION at June 30, 2016 is:

3. The deposit in transit of GRACE CORPORATION at June 30, 2016 is:

4. The outstanding checks of GRACE CORPORATION at June 30, 2016 is:

5. The adjusted cash balance of GRACE CORPORATION at June 30, 2016 is:

END

‘’It’s not that I’m so smart, it’s just that I stay with problems longer’’

Das könnte Ihnen auch gefallen

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaVon EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNoch keine Bewertungen

- IAP ProblemsDokument6 SeitenIAP ProblemsBianca LizardoNoch keine Bewertungen

- CPAR AP - Audit of CashDokument9 SeitenCPAR AP - Audit of CashJohn Carlo CruzNoch keine Bewertungen

- Audit of CashDokument4 SeitenAudit of CashAivan De LeonNoch keine Bewertungen

- Auditing Problems2Dokument31 SeitenAuditing Problems2Kimberly Milante100% (1)

- Bank Recon SeatworkDokument2 SeitenBank Recon SeatworkhfjhdjhfjdehNoch keine Bewertungen

- Bank Recon Seatwork PDFDokument2 SeitenBank Recon Seatwork PDFhfjhdjhfjdeh100% (1)

- MTDrill 2Dokument17 SeitenMTDrill 2Cedric Legaspi TagalaNoch keine Bewertungen

- AP PrinciplesDokument8 SeitenAP PrinciplesLinh NguyễnNoch keine Bewertungen

- Prelim Exam ManuscriptDokument10 SeitenPrelim Exam ManuscriptJulie Mae Caling MalitNoch keine Bewertungen

- Auditing Problems v.1 - 2018Dokument18 SeitenAuditing Problems v.1 - 2018Christine Ballesteros Villamayor33% (3)

- Auditing Problems: Problem No. 1 - Audit of Property, Plant, and Equipment (Ppe)Dokument19 SeitenAuditing Problems: Problem No. 1 - Audit of Property, Plant, and Equipment (Ppe)Marco Louis Duval UyNoch keine Bewertungen

- 123123Dokument3 Seiten123123xjammerNoch keine Bewertungen

- Auditing-23 A 1Dokument5 SeitenAuditing-23 A 1Johnfree VallinasNoch keine Bewertungen

- Financial Accounting - Exercises Proof of Cash: Date Debit Credit BalanceDokument2 SeitenFinancial Accounting - Exercises Proof of Cash: Date Debit Credit BalanceStephany Joy M. MendezNoch keine Bewertungen

- PROBLEM 1: (CPAR Final Preboards October 2015 - Auditing Problems)Dokument5 SeitenPROBLEM 1: (CPAR Final Preboards October 2015 - Auditing Problems)Jessie J.Noch keine Bewertungen

- Problems For Proof of Cash and Bank ReconDokument2 SeitenProblems For Proof of Cash and Bank ReconTine Vasiana DuermeNoch keine Bewertungen

- Prelims Intermedaite AcctgDokument4 SeitenPrelims Intermedaite AcctgJohn Evan Raymund BesidNoch keine Bewertungen

- Nissan FinalDokument4 SeitenNissan FinalPrince Jayanmar BerbaNoch keine Bewertungen

- Cash ProblemsDokument5 SeitenCash ProblemsAnna AldaveNoch keine Bewertungen

- Auditing Practice Problem 6Dokument2 SeitenAuditing Practice Problem 6Jessa Gay Cartagena TorresNoch keine Bewertungen

- Audit of Cash and Cash Equivalents - Set BDokument5 SeitenAudit of Cash and Cash Equivalents - Set BZyrah Mae SaezNoch keine Bewertungen

- Statement of Account: Transaction Date Description DebitDokument2 SeitenStatement of Account: Transaction Date Description DebitIkramNoch keine Bewertungen

- A. Anggaran Pengumpulan PiutangDokument4 SeitenA. Anggaran Pengumpulan PiutangSafri SimabuaNoch keine Bewertungen

- Proof of Cash Simulated ProblemDokument3 SeitenProof of Cash Simulated ProblemephraimNoch keine Bewertungen

- Proof of Cash - DiscussionDokument4 SeitenProof of Cash - DiscussionJoyce Anne GarduqueNoch keine Bewertungen

- Auditing ProblemsDokument17 SeitenAuditing ProblemsKathleenCusipagNoch keine Bewertungen

- Sweet Beginnings CoDokument11 SeitenSweet Beginnings CoJonalyn LodorNoch keine Bewertungen

- Sweet Beginnings Co PDFDokument11 SeitenSweet Beginnings Co PDFannica castroNoch keine Bewertungen

- Sweet Beginnings Co.Dokument11 SeitenSweet Beginnings Co.Andrew Farol67% (3)

- Pak Enings HTDokument15 SeitenPak Enings HTVincent SampianoNoch keine Bewertungen

- This Study Resource WasDokument3 SeitenThis Study Resource WasKyree VladeNoch keine Bewertungen

- DocxDokument25 SeitenDocxPhilip Castro67% (3)

- Debits and Credits - Bad DebtDokument25 SeitenDebits and Credits - Bad DebtRevilyn Grace Bangayan100% (1)

- Auditing Problems v1 2018 CompressDokument36 SeitenAuditing Problems v1 2018 CompressMr. CopernicusNoch keine Bewertungen

- Date Debit CreditDokument7 SeitenDate Debit CreditVincent SampianoNoch keine Bewertungen

- Institute of Accountancy Arusha Department of Accounting and Finance Principles of Accounts (Aft 05101) SEMINAR QUESTIONS - 2021/2022Dokument44 SeitenInstitute of Accountancy Arusha Department of Accounting and Finance Principles of Accounts (Aft 05101) SEMINAR QUESTIONS - 2021/2022AnithaNoch keine Bewertungen

- Bank Reconciliation Practice ProblemDokument2 SeitenBank Reconciliation Practice ProblemMikee RizonNoch keine Bewertungen

- Problem 1 - Dallas CorporationDokument6 SeitenProblem 1 - Dallas CorporationKatherine Cabading InocandoNoch keine Bewertungen

- Sweet Beginnings Co - XLSX CASE STUDY ANSWERDokument11 SeitenSweet Beginnings Co - XLSX CASE STUDY ANSWERYna AlfonsoNoch keine Bewertungen

- Lembar Kerja Pt. Aldenio Jurnal KhususDokument73 SeitenLembar Kerja Pt. Aldenio Jurnal KhususSalsabila Syifa AriesfiaNoch keine Bewertungen

- Lembar KerjaDokument70 SeitenLembar KerjaSalsabila Syifa AriesfiaNoch keine Bewertungen

- Aquarius Company Worksheet August 31, 2018: Unadjusted Trial Balance Debit CreditDokument35 SeitenAquarius Company Worksheet August 31, 2018: Unadjusted Trial Balance Debit CreditAdam Cuenca100% (1)

- Ms - MuffDokument17 SeitenMs - MuffDayuman LagasiNoch keine Bewertungen

- Parcial2 - Actividades de La Semana 4Dokument23 SeitenParcial2 - Actividades de La Semana 4Luis Eduardo Meunier MendezNoch keine Bewertungen

- LEMBAR KERJA PT. ALDENIO Sampai BALANCE SHEETDokument76 SeitenLEMBAR KERJA PT. ALDENIO Sampai BALANCE SHEETSalsabila Syifa AriesfiaNoch keine Bewertungen

- Enter Data in Yellow Fields Workings: 723,658 Slab Amount (Old)Dokument9 SeitenEnter Data in Yellow Fields Workings: 723,658 Slab Amount (Old)HarryNoch keine Bewertungen

- Parcial2 - Actividades de La Semana 4 KevvDokument23 SeitenParcial2 - Actividades de La Semana 4 KevvLuis Eduardo Meunier MendezNoch keine Bewertungen

- Lembar Kerja KosongDokument46 SeitenLembar Kerja Kosonglisa oktaviaNoch keine Bewertungen

- Assignment 1Dokument12 SeitenAssignment 1Ira YbanezNoch keine Bewertungen

- For The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsDokument5 SeitenFor The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsTanya SinghNoch keine Bewertungen

- Petty Cash FormDokument12 SeitenPetty Cash FormJustiniel JimenezNoch keine Bewertungen

- AnswerDokument23 SeitenAnswerYousaf BhuttaNoch keine Bewertungen

- Net Present ValueDokument6 SeitenNet Present ValueIshita KapadiaNoch keine Bewertungen

- Final Daily Cash (AutoRecovered)Dokument47 SeitenFinal Daily Cash (AutoRecovered)Isabella MichelliaNoch keine Bewertungen

- Bac 204 - Cat 1Dokument4 SeitenBac 204 - Cat 1duncanmaina204Noch keine Bewertungen

- Current YearcurrDokument4 SeitenCurrent YearcurrSanjay SinghNoch keine Bewertungen

- Benefits Per EmployeeDokument4 SeitenBenefits Per Employeeapi-3740993Noch keine Bewertungen

- 740 BasisallotmentDokument1 Seite740 BasisallotmentzainalNoch keine Bewertungen

- Capital Budgeting Practices A Study of Companies Listed On The Colombo Stock Exchange Sri LankaDokument9 SeitenCapital Budgeting Practices A Study of Companies Listed On The Colombo Stock Exchange Sri LankamhldcnNoch keine Bewertungen

- Finex ServicesDokument3 SeitenFinex Servicesggn08Noch keine Bewertungen

- Cash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelDokument5 SeitenCash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelnarayanNoch keine Bewertungen

- Ssi FinancingDokument7 SeitenSsi FinancingAnanya ChoudharyNoch keine Bewertungen

- Perpetual Inventory SystemDokument8 SeitenPerpetual Inventory SystemChristianne Joyse MerreraNoch keine Bewertungen

- Recruitment Selection Process in HDFCDokument102 SeitenRecruitment Selection Process in HDFCaccord123100% (2)

- Global Risk Risk Methodology - Model Validation Risk Stress TestingDokument4 SeitenGlobal Risk Risk Methodology - Model Validation Risk Stress TestingRaj AgarwalNoch keine Bewertungen

- Insurance For Specific EventsDokument1 SeiteInsurance For Specific Eventsihsan nawawiNoch keine Bewertungen

- Midterm I 2022 KEYDokument17 SeitenMidterm I 2022 KEYkuo zoeNoch keine Bewertungen

- Far270 July2022Dokument8 SeitenFar270 July2022Nur Fatin AmirahNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raviNoch keine Bewertungen

- Desirable Corporate Governance: A CodeDokument16 SeitenDesirable Corporate Governance: A CodesiddharthanandNoch keine Bewertungen

- Pledge-Contract Act: Simar MakkarDokument8 SeitenPledge-Contract Act: Simar MakkarPearl LalwaniNoch keine Bewertungen

- Central Banking and Financial RegulationsDokument9 SeitenCentral Banking and Financial RegulationsHasibul IslamNoch keine Bewertungen

- Quote - Q2045201Dokument2 SeitenQuote - Q2045201makhanyasibusisiwe7Noch keine Bewertungen

- Econ282 F11 PS5 AnswersDokument7 SeitenEcon282 F11 PS5 AnswersVishesh GuptaNoch keine Bewertungen

- NPS BrochureDokument21 SeitenNPS BrochureEsther Leihang100% (1)

- INSURANCE TambasacanDokument80 SeitenINSURANCE Tambasacanlee50% (2)

- Tally PracticeDokument16 SeitenTally PracticeArko Banerjee100% (3)

- IB - 19 - PetitionerDokument30 SeitenIB - 19 - PetitionerKushagra TolambiaNoch keine Bewertungen

- Welcome To Presentation On Discharge of SuretyDokument18 SeitenWelcome To Presentation On Discharge of SuretyAmit Gurav94% (16)

- ILFS Briefing (April 2019)Dokument15 SeitenILFS Briefing (April 2019)Richard DierdreNoch keine Bewertungen

- Week 1 MSTA Notes PDFDokument93 SeitenWeek 1 MSTA Notes PDFMohd Najmi HuzaiNoch keine Bewertungen

- Solved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedDokument1 SeiteSolved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedAnbu jaromiaNoch keine Bewertungen

- Fin Ca2 FinalDokument6 SeitenFin Ca2 FinalVaishali SonareNoch keine Bewertungen

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDokument14 SeitenUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNoch keine Bewertungen

- Introduction To Asset Liability and Risk MGMTDokument147 SeitenIntroduction To Asset Liability and Risk MGMTMani ManandharNoch keine Bewertungen

- Statement 1688358203630Dokument3 SeitenStatement 1688358203630Chinmay RajNoch keine Bewertungen

- 705 - PGBP AdjustmentsDokument10 Seiten705 - PGBP AdjustmentsKumar SwamyNoch keine Bewertungen