Beruflich Dokumente

Kultur Dokumente

Morning Market Snapshot - 12 Nov 2018

Hochgeladen von

BALMERCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Morning Market Snapshot - 12 Nov 2018

Hochgeladen von

BALMERCopyright:

Verfügbare Formate

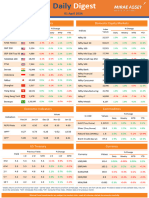

12-Nov-2018

FX

Closing Price Change (Day) Change (MTD) Change (YTD) Closing Price Change (Day) Change (MTD) Change (YTD)

USD Index 96.9050 0.19% -0.23% 5.19% USD-ASIA Index 103.8900 -0.29% 0.64% -5.37%

USD-CNH 6.9480 0.10% -0.38% 6.66% USD-INR 72.4950 -0.70% -1.97% 13.50%

USD-JPY 113.8300 -0.21% 0.79% 1.01% JPY-INR 0.6369 -1.27% -2.57% 12.19%

GBP-USD 1.2972 0.69% -1.61% 4.00% GBP-INR 94.3834 -0.85% -0.11% 9.40%

EUR-USD 1.1336 0.24% -0.21% 5.57% EUR-INR 82.2900 -1.09% -1.96% 7.52%

* Changes are for USD against the other currency, FCY against the INR in other cases

Rates

Closing Price Change (Day) Change (MTD) Change (YTD) Closing Price Change (Day) Change (MTD) Change (YTD)

India 10 YR GSEC (Generic) 7.76% -3.60 -9.00 43.70 Implied USD-INR Frwd (1 Mth) 4.10% / 24.75 0.72 -40.59 -22.43

India 5 YR OIS 7.37% -7.00 -9.50 62.00 Implied USD-INR Frwd (1 Yr) 4.04% / 292.75 -5.40 -17.46 -33.77

US Treasury (10 YR) 3.18% -5.54 3.84 77.65 USD IRS (5 YR) 3.17% -4.47 4.36 92.56

German Bund (10 YR) 0.41% -5.00 2.20 -1.73 EUR IRS (5 YR) 0.21% -1.60 1.90 6.30

Japan Treasury (10 YR) 0.12% -0.20 -0.60 7.30 JPY IRS (5 YR) 0.11% -0.75 -1.63 0.75

* Changes are values in basis points

Equities & Commodities

Closing Price Change (Day) Change (MTD) Change (YTD) Closing Price Change (Day) Change (MTD) Change (YTD)

Brent (ICE;USD/bbl.) 70.18 -0.67% -7.01% 4.95% NIFTY 10,585.20 0.52% 1.91% 0.52%

WTI (NYM;USD/bbl.) 60.19 -0.79% -7.84% -0.38% S&P 2,781.01 -0.92% 2.55% 4.02%

Copper (CMX;USD/lb) 268.45 -1.88% 0.96% -18.66% DAX 11,529.16 0.02% 0.71% -10.75%

Gold (CMX;USD/t oz.) 1,208.60 -1.35% -0.53% -7.69% NIKKEI 22,250.25 -1.05% 1.50% -2.26%

1. Dollar strength continues post FOMC spurred by a stronger-than-expected PPI print on Friday with DXY at 97.00. Treasuries rallied as well however U.S. equities fell, led by a slump in tech shares

levels. US markets are closed today, Veteran’s day holiday

2. USDINR has opened higher today at 72.72 given the dollar strength. We expect the pair to trade sideways today due to absence of cash activity on account of US holiday

3. GBP opened weaker in early Asia trading today over a report that four U.K. ministers are on the brink of resigning over Prime Minister. UK Q3 GDP met expectations, while business investment

fell sharply according to data releases on Friday. EURUSD also edged down to 1.1325 levels with additional pressure given standoff between Italy and EU over budget

4. Oil prices rose by a percent after Saudi Arabia announced supply cuts by 0.5 million barrels per day in December after a slump in oil prices in October. Major Asian indices including the local

equities trade cautiously in green

Key Data Today

Time (IST) Country Event Previous Consensus

14:30 Italy Industrial Output s.a. (MoM) 1.7%

17:30 India Manufacturing Output 4.6%

17:30 India Industrial Output 4.3% 4.3%

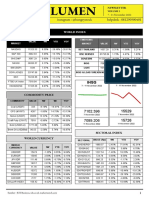

FX Commodity Equity

% USD against the CCY (YTD) % Change (YTD) % Change (YTD)

INR 13.50%

S&P

WTI -0.38%

JPY 1.01% 4.02%

EUR 5.57% DOW 5.14%

BRENT 4.95%

GBP 4.00%

CAC -3.87%

CNH 6.66%

GOLD -7.69%

MYR 3.27% DAX -10.75%

PHP 6.10%

PLATINUM -8.37% NIKKEI -2.26%

TWD 3.37%

IDR 8.18% HANG SENG -14.43%

SILVER -17.53%

KRW 5.38%

SHANGHAI

RUB 15.88%

-21.42%

COPPER-18.66%

3.23%

BRL 12.75% SENSEX

MXN 2.43%

ALUMINUM -13.63%

NIFTY 0.52%

ZAR 15.95%

Disclaimer

© IDFC Bank Limited, 2018

■ This presentation (the “Presentation”) is prepared by IDFC Bank Limited, (“IDFC Bank”) and is provided on a strictly private and confidential basis for information purposes only. Without the express prior written consent of IDFC Bank, the Presentation and any

information contained within it may not be (I) reproduced (in whole or in part) or distributed (ii) copied at any time (iv) provided to or discussed with any other person, except those to whom copies have been distributed by IDFC Bank. By attending or reading this

Presentation, the recipient will be deemed to have agreed to the obligations and restrictions set out hereinabove and the recipient agrees to keep permanently confidential the information contained herein or which may be made available in connection thereof by IDFC

Bank to use it only for the specific purpose for which it is intended.

■ This Presentation does not constitute or form part of, and should not be construed as, an offer, invitation, inducement, recommendation or solicitation to the recipient of the Presentation or to any person to enter into any transaction or adopt any hedging, trading or

investment strategy nor shall it or any part of it form the basis of, or be relied on in connection with, any contract or commitment whatsoever. Neither this nor any other communication prepared by IDFC Bank is or should be construed as investment advice or a

recommendation to enter into a particular transaction or to pursue a particular strategy, or any statement as to the likelihood that a particular transaction or strategy will be effective in light of your business objectives or operations. The terms of any transaction entered

into will be recorded in a written/online confirmation or other document.

■ This Presentation does not purport to be all-inclusive or to contain all information that the recipient may desire or require and the terms are neither complete nor final and are subject to further discussion and negotiation. Recipients of this Presentation should each

make their own independent evaluation and analysis of the relevance and adequacy of the information provided herein and analysis of the opportunity, risks involved in the same and should obtain independent financial, legal, accounting and other advice so as to ensure

that the transactions are in compliance with applicable laws and regulatory requirements. In any event, any decision to enter into a transaction will be yours alone, not based on information provided herein or provided by IDFC Bank.

■ No representations, warranties or undertaking (expressed or implied) are made in, or in respect of this Presentation or with regard to the appropriateness or possible consequences of the prospective transaction and no responsibility is accepted by IDFC Bank as to the

accuracy, adequacy, completeness or reasonableness of this Presentation or any further information, notice or document at any time supplied in this connection.

■ IDFC Bank hereby disclaims any responsibility to you concerning the characterization or identification of terms, conditions, and legal or accounting or other issues or risks that may arise in connection with any particular transaction or business strategy. IDFC Bank has no

fiduciary duty towards you, and assumes no responsibility as an agent or otherwise to advise on the prospective transaction. IDFC Bank is IDFC Bank and /or their connected companies, may have a position in any of the instruments or currencies mentioned in this

document. IDFC Bank may have issued, and shall be entitled in the future to issue, other reports that are inconsistent with or that reach conclusions different from the information set forth herein. Such other reports, if any, reflect the different assumptions, views and/or

analytical methods of the analysts who prepared them, and IDFC Bank is under no obligation to ensure that such other reports are brought to your attention. In no circumstances will IDFC Bank, or any of its respective subsidiaries, shareholders, affiliates, representatives,

partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or damages arising from the use of this Presentation, its contents, its omissions, errors, reliance on the information contained therein, or on

opinions communicated in relation thereto or otherwise arising in connection therewith whether arising on account of IDFC Bank’s negligence or otherwise.

■ The detailed terms and conditions applicable to the transaction would be subject to inter alia, validation of assumptions, legal review, and all necessary internal approvals, as the case may be. This summary of indicative terms does not constitute an offer or a

commitment by IDFC Bank, and is intended to serve only as a basis for discussion of the major prospective terms that would apply to the transaction. IDFC Bank’s decision to undertake the transaction is contingent on IDFC Bank’s Management, internal policies, as well as

the execution of final documentation in form and substance satisfactory to IDFC Bank.

■ The prices are indicative and for discussion purpose only. All figures, terms and conditions are subject to change. The final agreements will also contain terms and conditions customary for such transactions, including representations and warranties, conditions of

effectiveness, affirmative and restrictive covenants, events of default including cross-default provisions, insolvency, provisions for the payment of additional costs and fees (e.g. late payment charges, legal costs, increased cost of funding, prepayment fees, etc.) and the

governing law and jurisdiction provisions.

Das könnte Ihnen auch gefallen

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketVon EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Asian Construction Dispute Denied ReviewDokument2 SeitenAsian Construction Dispute Denied ReviewJay jogs100% (2)

- MsgSpec v344 PDFDokument119 SeitenMsgSpec v344 PDFqweceNoch keine Bewertungen

- Royal Enfield Market PositioningDokument7 SeitenRoyal Enfield Market PositioningApoorv Agrawal67% (3)

- Basic Electrical Design of A PLC Panel (Wiring Diagrams) - EEPDokument6 SeitenBasic Electrical Design of A PLC Panel (Wiring Diagrams) - EEPRobert GalarzaNoch keine Bewertungen

- Bernardo Corporation Statement of Financial Position As of Year 2019 AssetsDokument3 SeitenBernardo Corporation Statement of Financial Position As of Year 2019 AssetsJean Marie DelgadoNoch keine Bewertungen

- Morning Cuppa 11-MayDokument2 SeitenMorning Cuppa 11-MayShashank MisraNoch keine Bewertungen

- INVPRD-EQTY-DEBT-COMM-CURR-INTLDokument2 SeitenINVPRD-EQTY-DEBT-COMM-CURR-INTLSaroNoch keine Bewertungen

- Morning Cuppa 12-DecDokument2 SeitenMorning Cuppa 12-DecSaroNoch keine Bewertungen

- Morning Cuppa 20-DecDokument3 SeitenMorning Cuppa 20-DecSaroNoch keine Bewertungen

- Morning Cuppa 17-AugDokument2 SeitenMorning Cuppa 17-AugSourav PalNoch keine Bewertungen

- Morning Cuppa 12-JanDokument2 SeitenMorning Cuppa 12-JanSaroNoch keine Bewertungen

- Morning Cuppa 31-OctDokument2 SeitenMorning Cuppa 31-OctKeshavNoch keine Bewertungen

- Morning Cuppa 06-JanDokument2 SeitenMorning Cuppa 06-JanSaroNoch keine Bewertungen

- Morning Cuppa 08-Oct-202110080838430715214Dokument2 SeitenMorning Cuppa 08-Oct-202110080838430715214flying400Noch keine Bewertungen

- Morning Cuppa 14-JulyDokument2 SeitenMorning Cuppa 14-JulyAjish CJ 2015Noch keine Bewertungen

- EconomyDokument7 SeitenEconomypresencabNoch keine Bewertungen

- Morning Cuppa 30-OctDokument2 SeitenMorning Cuppa 30-OctKeshavNoch keine Bewertungen

- Morning Cuppa 09-JanDokument2 SeitenMorning Cuppa 09-JanWhaosidqNoch keine Bewertungen

- Morning Cuppa 14-DecDokument2 SeitenMorning Cuppa 14-DecKeshav KhetanNoch keine Bewertungen

- Morning Cuppa 22-FebDokument2 SeitenMorning Cuppa 22-FebNitin ChauhanNoch keine Bewertungen

- Date: 2023-05-04: Corporate G SecDokument3 SeitenDate: 2023-05-04: Corporate G SecRonit SinghNoch keine Bewertungen

- Morning Cuppa 15-AprDokument2 SeitenMorning Cuppa 15-AprAkshay ChaudhryNoch keine Bewertungen

- INVESTMENT PRODUCTS: Equity, Debt, Commodities UpdatesDokument2 SeitenINVESTMENT PRODUCTS: Equity, Debt, Commodities UpdatesSaroNoch keine Bewertungen

- Live Currency Market TrendDokument5 SeitenLive Currency Market TrendRahul SolankiNoch keine Bewertungen

- Import Dropped Due To Covid-19 Disruption 16 Mar 2020Dokument3 SeitenImport Dropped Due To Covid-19 Disruption 16 Mar 2020botoy26Noch keine Bewertungen

- Morning Cuppa 27-OctDokument2 SeitenMorning Cuppa 27-OctKeshavNoch keine Bewertungen

- Morning Cuppa 30-MayDokument2 SeitenMorning Cuppa 30-MayAkshay ChaudhryNoch keine Bewertungen

- DailyNewsLetter - 20 Oct 10Dokument3 SeitenDailyNewsLetter - 20 Oct 10checrucifixNoch keine Bewertungen

- Currency Trading Tips For Real TraderDokument5 SeitenCurrency Trading Tips For Real TraderRahul SolankiNoch keine Bewertungen

- FX Snapshot: Major Currencies Performance and Important Economic DataDokument9 SeitenFX Snapshot: Major Currencies Performance and Important Economic DataDaniel NicolauNoch keine Bewertungen

- INVESTMENT PRODUCTS MORNING CUPPADokument2 SeitenINVESTMENT PRODUCTS MORNING CUPPASaroNoch keine Bewertungen

- Calendar 09 19 2010Dokument3 SeitenCalendar 09 19 2010oliver_gonzalez694Noch keine Bewertungen

- Westpack JUN 22 Mornng ReportDokument1 SeiteWestpack JUN 22 Mornng ReportMiir ViirNoch keine Bewertungen

- Westpack AUG 10 Mornng ReportDokument1 SeiteWestpack AUG 10 Mornng ReportMiir ViirNoch keine Bewertungen

- Fund Performance MetlifeDokument11 SeitenFund Performance MetlifeDeepak DharmarajNoch keine Bewertungen

- Daily Market Update May 2022Dokument3 SeitenDaily Market Update May 2022Dheeraj JhunjhunwalaNoch keine Bewertungen

- Slumped, Again: Revenues in Billions of Dollars Earnings Per ShareDokument5 SeitenSlumped, Again: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanNoch keine Bewertungen

- Daily Digest - 01 April, 2024Dokument2 SeitenDaily Digest - 01 April, 2024saraonahembram3Noch keine Bewertungen

- Sucor Sunrise: Jakarta Composite Index UpdateDokument6 SeitenSucor Sunrise: Jakarta Composite Index UpdateyolandaNoch keine Bewertungen

- Crunch: CommodityDokument5 SeitenCrunch: CommodityAndre SetiawanNoch keine Bewertungen

- Calendar 12 05 2010Dokument5 SeitenCalendar 12 05 2010Naufal SanaullahNoch keine Bewertungen

- Morning Cuppa 21-NovDokument2 SeitenMorning Cuppa 21-NovSarvjeet KaushalNoch keine Bewertungen

- Market Highlights: Week Ended January 29, 2010Dokument5 SeitenMarket Highlights: Week Ended January 29, 2010adeoyedanielNoch keine Bewertungen

- Fundamental Outlook Market Highlights: Indian RupeeDokument2 SeitenFundamental Outlook Market Highlights: Indian Rupeesaran21Noch keine Bewertungen

- Year Beginning Balance Contributions Withdrawals Interest ExpenseDokument7 SeitenYear Beginning Balance Contributions Withdrawals Interest ExpensePho6Noch keine Bewertungen

- 15 December 2010 - Wednesday: Liquidity IndicatorsDokument8 Seiten15 December 2010 - Wednesday: Liquidity Indicatorskhaitan_malviyaNoch keine Bewertungen

- RBS Round Up: 09 August 2010Dokument10 SeitenRBS Round Up: 09 August 2010egolistocksNoch keine Bewertungen

- AUG 09 Danske IMM PositioningDokument8 SeitenAUG 09 Danske IMM PositioningMiir ViirNoch keine Bewertungen

- Weekly Report - 3 Aug 2007Dokument5 SeitenWeekly Report - 3 Aug 2007api-3840085Noch keine Bewertungen

- Daily Market ReportDokument7 SeitenDaily Market ReportPriya RathoreNoch keine Bewertungen

- G20 Summit and Indonesia's GDP Growth Highlighted in HungryStock NewsletterDokument6 SeitenG20 Summit and Indonesia's GDP Growth Highlighted in HungryStock NewsletterDaniel AldianNoch keine Bewertungen

- ICRA Analytics Daily Dossier - 24 Jul 2023Dokument4 SeitenICRA Analytics Daily Dossier - 24 Jul 2023Dhairya BuchNoch keine Bewertungen

- The Season Ends : EPS Estimates (Left) and Revenues Expectations (Right) On HD, WMT and HPQDokument4 SeitenThe Season Ends : EPS Estimates (Left) and Revenues Expectations (Right) On HD, WMT and HPQAndre SetiawanNoch keine Bewertungen

- Morning Brief - October 07, 2022Dokument1 SeiteMorning Brief - October 07, 2022ANKUR KIMTANINoch keine Bewertungen

- Daily Comm ME - bhr9sd5xDokument3 SeitenDaily Comm ME - bhr9sd5xThe red RoseNoch keine Bewertungen

- Morning Brief - October 07, 2022Dokument1 SeiteMorning Brief - October 07, 2022ANKUR KIMTANINoch keine Bewertungen

- Currency market report from AnuragDokument8 SeitenCurrency market report from AnuragAnurag SinghaniaNoch keine Bewertungen

- Simple Trend-Following Strategies in Currency TradDokument3 SeitenSimple Trend-Following Strategies in Currency TradAlwan AlkautsarNoch keine Bewertungen

- Daily Digest - 15 June, 2023Dokument2 SeitenDaily Digest - 15 June, 2023Anant VishnoiNoch keine Bewertungen

- Morning Brief - September 07, 2022Dokument1 SeiteMorning Brief - September 07, 2022ANKUR KIMTANINoch keine Bewertungen

- Market Commentary 05.04Dokument3 SeitenMarket Commentary 05.04Dewi_Setiowati_4514Noch keine Bewertungen

- Issue RsDokument47 SeitenIssue RsINR BondsNoch keine Bewertungen

- ABB GTC Goods and Services (2020-2 Standard)Dokument5 SeitenABB GTC Goods and Services (2020-2 Standard)BALMERNoch keine Bewertungen

- Real Estate T 1 August 2019Dokument11 SeitenReal Estate T 1 August 2019BALMERNoch keine Bewertungen

- Prime Urban ICRA April 17Dokument7 SeitenPrime Urban ICRA April 17BALMERNoch keine Bewertungen

- Q2FY20 Metals PreviewDokument14 SeitenQ2FY20 Metals PreviewBALMERNoch keine Bewertungen

- Health, Safety & E Nvironment (HSE) Manual: Doc No.: HSE/01 Rev No.: 00Dokument130 SeitenHealth, Safety & E Nvironment (HSE) Manual: Doc No.: HSE/01 Rev No.: 00Shubham Mishra100% (1)

- ICRA Comment On RBI Policy October 2019Dokument7 SeitenICRA Comment On RBI Policy October 2019BALMERNoch keine Bewertungen

- (Kotak) Economy, November 27, 2018Dokument6 Seiten(Kotak) Economy, November 27, 2018BALMERNoch keine Bewertungen

- Health, Safety & E Nvironment (HSE) Manual: Doc No.: HSE/01 Rev No.: 00Dokument130 SeitenHealth, Safety & E Nvironment (HSE) Manual: Doc No.: HSE/01 Rev No.: 00Shubham Mishra100% (1)

- Milwaukee 4203 838a PB CatalogaciónDokument2 SeitenMilwaukee 4203 838a PB CatalogaciónJuan carlosNoch keine Bewertungen

- I. ICT (Information & Communication Technology: LESSON 1: Introduction To ICTDokument2 SeitenI. ICT (Information & Communication Technology: LESSON 1: Introduction To ICTEissa May VillanuevaNoch keine Bewertungen

- ECON Value of The FirmDokument4 SeitenECON Value of The FirmDomsNoch keine Bewertungen

- Deed of Sale - Motor VehicleDokument4 SeitenDeed of Sale - Motor Vehiclekyle domingoNoch keine Bewertungen

- Marketing ManagementDokument14 SeitenMarketing ManagementShaurya RathourNoch keine Bewertungen

- 1990-1994 Electrical Wiring - DiagramsDokument13 Seiten1990-1994 Electrical Wiring - Diagramsal exNoch keine Bewertungen

- 1LE1503-2AA43-4AA4 Datasheet enDokument1 Seite1LE1503-2AA43-4AA4 Datasheet enAndrei LupuNoch keine Bewertungen

- 3) Stages of Group Development - To StudsDokument15 Seiten3) Stages of Group Development - To StudsDhannesh SweetAngelNoch keine Bewertungen

- AHP for Car SelectionDokument41 SeitenAHP for Car SelectionNguyên BùiNoch keine Bewertungen

- Impact of Coronavirus On Livelihoods of RMG Workers in Urban DhakaDokument11 SeitenImpact of Coronavirus On Livelihoods of RMG Workers in Urban Dhakaanon_4822610110% (1)

- CST Jabber 11.0 Lab GuideDokument257 SeitenCST Jabber 11.0 Lab GuideHải Nguyễn ThanhNoch keine Bewertungen

- Novirost Sample TeaserDokument2 SeitenNovirost Sample TeaserVlatko KotevskiNoch keine Bewertungen

- Database Chapter 11 MCQs and True/FalseDokument2 SeitenDatabase Chapter 11 MCQs and True/FalseGauravNoch keine Bewertungen

- Gattu Madhuri's Resume for ECE GraduateDokument4 SeitenGattu Madhuri's Resume for ECE Graduatedeepakk_alpineNoch keine Bewertungen

- Area Access Manager (Browser-Based Client) User GuideDokument22 SeitenArea Access Manager (Browser-Based Client) User GuideKatherineNoch keine Bewertungen

- An Overview of Tensorflow + Deep learning 沒一村Dokument31 SeitenAn Overview of Tensorflow + Deep learning 沒一村Syed AdeelNoch keine Bewertungen

- Gaspardo Operation Manual Campo 22-32-2014 01 f07011089 UsaDokument114 SeitenGaspardo Operation Manual Campo 22-32-2014 01 f07011089 UsaМихайленко МиколаNoch keine Bewertungen

- Diana's Innermost House: MagazineDokument42 SeitenDiana's Innermost House: MagazinealexgoagaNoch keine Bewertungen

- Erp and Mis Project - Thanks To PsoDokument31 SeitenErp and Mis Project - Thanks To PsoAkbar Syed100% (1)

- DSA NotesDokument87 SeitenDSA NotesAtefrachew SeyfuNoch keine Bewertungen

- Continuation in Auditing OverviewDokument21 SeitenContinuation in Auditing OverviewJayNoch keine Bewertungen

- WitepsolDokument21 SeitenWitepsolAnastasius HendrianNoch keine Bewertungen

- C.C++ - Assignment - Problem ListDokument7 SeitenC.C++ - Assignment - Problem ListKaushik ChauhanNoch keine Bewertungen

- Business Case - Uganda Maize Export To South SudanDokument44 SeitenBusiness Case - Uganda Maize Export To South SudanInfiniteKnowledge33% (3)

- Create A Gmail Account in Some Simple StepsDokument9 SeitenCreate A Gmail Account in Some Simple Stepsptjain02Noch keine Bewertungen