Beruflich Dokumente

Kultur Dokumente

Orca Share Media1523026232654

Hochgeladen von

Twinie MendozaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Orca Share Media1523026232654

Hochgeladen von

Twinie MendozaCopyright:

Verfügbare Formate

Republic of the Philippines

POLYTECHNIC UNIVERSITY OF THE PHILIPPINES

COLLEGE OF ACCOUNTANCY AND FINANCE

ACCO 3026: Financial Accounting and Reporting Part 2

Final Departmental Examination

February 26, 2017

General Instructions: Believe in yourself! Have faith in your own abilities! Without a humble but reasonable

confidence in your own power you cannot be successful or happy. Have faith that you can answer everything to

the best that you can. You must shade the scannable answer sheet properly and show your computations in a

separate worksheet. Always observe HONESTY during the examination. GODBLESS!

THEORIES (30%)

1. These are all forms of consideration given by an entity in exchange for service rendered by employees.

A. Employee benefits C. Fringe benefits

B. Employee compensation D. Salaries and wages

2. These are employee benefits that are not conditional on future employment.

A. Contingent B. Unvested C. Vested D. Absolute

3. Short-term employee benefits include all the following except

A. wages, salaries and social security contribution

B. short-term compensated absences

C. profit sharing and bonuses payable in more than twelve months after the end of the reporting period

in which the employee rendered the related services

D. non-monetary benefits such as medical care, housing, cars and free or subsidized goods

4. These are compensated absences that are carried forward and can be used in future periods and the employees

are entitled to a cash payment for unused entitlement on leaving the entity.

A. Accumulating and vesting C. Non-accumulating and vesting

B. Accumulating and non-vesting D. Non-accumulating and non-vesting

5. The cumulative balance of the Remeasurement of Define Benefit Liability is presented as part of

A. non-current Liability C. expenses under Income Statement

B. shareholders’ Equity D. disclosed to the notes

6. Accounting by an entity for define benefit plan involves the following steps per Paragraph 57 of IAS 19

except:

A. determining the deficit or surplus

B. determining the amount of the gross defined benefit liability

C. determining the amounts to be recognized in profit or loss

D. determining the remeasurements of the net defined benefit liability (asset) to be recognized in other

comprehensive income.

7. A temporary difference which would result in a deferred tax liability is

A. interest revenue on municipal bond C. excess of tax depreciation over accrual

B. accrual of warranty expense D. subscription received in advance

8. Recognizing tax benefits in a loss year due to carryforward requires

A. only a footnote disclosure C. creating a deferred tax asset

B. creating a new carryforward for next year D. creating a deferred tax liability

9. An item that is considered a nondeductible item in taxable income is the

A. insurance premiums paid on a life insurance policy where the entity is the designated beneficiary.

B. accrual of warranty costs recognized for financial accounting purposes and actual warranty

expenditures paid recognized for tax purposes.

C. recognition of estimated bad debts expense for financial accounting purposes and direct write off

method for tax purposes.

D. recognition of rent income on a time proportion basis for financial accounting purposes and cash

basis for tax purposes.

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 1- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

10. Which of the following situations will result to a future deductible amount?

A. Carrying amount of the asset > tax base of the asset

B. Tax base of the asset > carrying amount of the asset

C. Carrying amount of the liability < tax base of the liability

D. Financial income > Taxable income

11. A deferred tax asset is computed using

A. the current tax laws, regardless of expected or enacted future tax laws.

B. expected future tax laws, regardless of whether those expected laws have been enacted.

C. current tax laws, unless enacted future tax laws are different.

D. either current or expected future tax laws, regardless of whether those expected laws have been

enacted.

12. Statement 1: IAS 12 par. 70 states that when an enterprise makes a distinction between current and non-

current assets and liabilities in its financial statements, it should classify deferred tax assets (liabilities) as current

assets (liabilities).

Statement 2: Corporation is obliged to pay to BIR the higher between the Basic Corporate Income Tax

(BCIT) and Minimum Corporate Income Tax (MCIT).

A. Only statement 1 is correct C. Both statements are correct

B. Only statement 2 is correct D. Both statements are incorrect

13. It is a contract that transfers substantially all the risk and rewards incidental to the ownership of an asset,

although title may or may not eventually transferred.

A. Lease B. Finance lease C. Operating lease D. Lease purchase

14. It is the portion of the lease payments that is not fixed in amount but is the based on future amount of a factor

that changes other than the passage of time, (e.g. percentage of future sales).

A. Contingent rent C. Bargain purchase option

B. Executory cost D. Accrued rent

15. The primary difference between a direct finance lease and a dealer’s lease is the

A. manner in which rental receipts are recorded as rental income.

B. amount of depreciation recorded each year by the lessor.

C. recognition of the manufacturer’s or dealer’s profit at the inception of the lease.

D. allocation of initial direct costs by the lessor to periods benefited by the lease arrangements.

16. Which of the following is not an indicator of a finance lease?

A. The lease transfers ownership of the asset to the lessee by the start of the lease term.

B. The lease term is for the major part of the economic life of the asset ever if the title is not transferred.

C. At the inception of the lease, the PV of lease payments amounts to at least substantially all the FV of

the leased asset.

D. The underlying asset is of such a specialized nature that only the lessee can use them without major

modification.

17. Initial direct costs incurred by the lessor in an operating lease should be

A. expensed in the year of the incurrence by including them in the cost of goods sold or by treating them

as selling expense.

B. deferred and recognized as a reduction in the interest rate implicit in the lease.

C. capitalized as part of asset cost and depreciated them over the lease term.

D. deferred and carried on the statement of financial position until the end of the lease term.

18. Par. 53, IAS 16 requires that lessee shall disclose the following information in its financial statement except:

A. depreciation charges for right-of-use asset C. income from subleasing

B. interest expense on lease liabilities D. total cash inflow for leases.

19. The right-of-use asset shall be initially recognized at cost, which shall be comprise of the following except:

A. present value of lease payments not yet paid at commencement.

B. lease payments made to the lessor at or after commencement date, less any lease incentive received.

C. initial direct costs incurred by the lessee.

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 2- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

D. any estimated costs for dismantling and removing the asset, or restoring the site on which the asset is

located or restoring the underlying site on which the asset is required by the terms of the lease, to the

extent that the lessee incurs an obligation for those costs.

20. Which of the following statement(s) is(are) false?

Statement 1: Under IAS 17, defines leases as a contract, or part of the contract, that conveys the right to use

an asset for a period of time in exchange for consideration.

Statement 2: Under IFRS 16, a lessor shall classify each of its leases as either an operating or finance lease.

Statement 3: Under IAS 17, a combined lease on land and building must be split into the land component and

building component, generally based on the fair value of the lease interest of each component.

Statement 4: The entries for the subsequent collection of periodic rental are similar under both direct finance

lease and dealer’s lease.

A. Statement 1 only C. Statement 3 only

B. Statement 2 only D. All of the statements are false

21. The ledger of Canton Inc. shows ordinary share, ordinary treasury share and no preference share. For this

company, the formula for computing the book value per share is

A. Total paid-in capital and retained earnings divided by the number of ordinary shares issued.

B. Total shareholders’ equity divided by number of ordinary shares outstanding.

C. Total shareholders’ equity divided by number of ordinary shares issued.

D. Ordinary share outstanding divided by number of ordinary share issued.

22. When accounting for two or more classes of securities issued in a single “package” transaction, the value of

each class may be determined in all of the following except by

A. assigning the known market value to one class and the remainder of the selling price to the other

security.

B. allocating the selling price to each class based upon the individual relative market value of each class.

C. arbitrarily assigning a value to each class if the market value of only one class is known.

D. arbitrarily assigning a value to each class if no market value are known.

23. Which of the following statement is not true concerning quasi-reorganization?

A. Assets are written down below cost.

B. New management may be selected.

C. Assets may be valued at a fair but conservative value.

D. Any adjustments to the accounts are charged first to additional paid-in capital.

24. Non-market based performance conditions include vesting based on achieving all of the following except

A. achieving a specific growth in revenue C. achieving a specific increase in EPS

B. achieving a specific growth in net profit D. achieving a specific target share price

25. When a business is organized as a corporation, which of the following is true?

A. Fluctuations in the market value of outstanding share capital do not affect the amount of shareholders’

equity shown in the balance sheet.

B. Shareholders do not have to pay personal income taxes on dividends received because the corporation

is subject to income tax on earnings.

C. Stockholders are liable for the debts of the business in proportion to their percentage of ownership of

share capital.

D. Each shareholder has the right to bind the corporation contracts and to make other managerial

decisions.

26. Bonds issued at a discount always have

A. interest expense greater than the interest payments.

B. interest expense less than the interest payments.

C. interest expense equal to the interest payments

D. None of the above.

27. Burger Corporation issued bonds payable on August 1. Burger’s bonds were dated July 1. Which statement

is true of Burger’s journal entry record issuance of the bonds payable?

A. Burger will pay five month’s interest on the next interest date.

B. Burger will collect five month’s accrued interest in advance.

C. Burger will collect one months’ accrued interest in advance.

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 3- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

D. Burger must pay one month’s accrued interest.

28. FishBall Company is a defendant in a lawsuit that claims damages if P800,000. On the balance sheet date,

it appears likely that the court will render a judgment against the company. How should FishBall report this

event in the financial statement?

A. Report the loss on the income statement and liability on the balance sheet.

B. Omit mention because no judgment has been rendered.

C. Disclose the contingent liability in a note.

D. Use a short presentation only.

29. A financial liability is any liability that is a contractual obligation

I. to deliver cash or another financial asset to another entity

II. to exchange financial asset or financial liability with another entity under conditions that are

potentially favorable to the entity.

A. I only B. II only C. Both I and II D. Neither I nor II

30. Which of the following is/are non-current liabilities?

I. Current portion of long-term debt

II. Long-term liability due in three months from the end of the reporting period and refinanced on a long-

term basis between at the end of the reporting period and the issuance date of the financial statements.

III. Long-term liability due in three months from the end of the reporting period and refinanced on a

long-term basis on or before the end of the reporting period.

IV. Currently maturing obligation where the entity has the discretion and ability to refinance or roll over

the obligation for more than twelve months after the end of the reporting period under an existing loan

facility.

A. I only B. I and II only C. III and IV only D. II, III and IV only

PROBLEMS (70%)

31. Hotdog Company’s employees earn two weeks of paid vacation for each year of employment and vacation

time can be accumulated and carried forward to succeeding year and will be paid at the salary in effect when the

vacation is taken. As of December 31, 2016, when Frank’s salary was P6,000 per week, he had earned 18 weeks’

vacation time and had used 12 weeks of accumulated vacation time. At December 31, 2016, how much should

Hotdog carry as liability for Frank’s accumulated vacation time?

A. P72,000 B. P36,000 C. P12,000 D. P-0-

32. At the beginning of the current year, Embotido Co. announced the decision to close the factory located in

Cebu and terminate all 200 employees as a result of economic downturn. The entity shall pay P20,000 per

employee upon termination. However, to ensure that the windup of the factory occurs smoothly and all

remaining customer orders are completed, the entity needs to retain at least 20% of the employee until closure

of the factory until three months. As a result, the entity announced the employee who agree to stay until the

closing of the factory shall receive P60,000 payment at the end of third month in addition to receiving their

current wage throughout the period of closure instead of the P20,000. Based on this offer, the entity expected to

retain 50 employees until the factory is close. What is the amount of termination benefit?

A. P2,000,000 B. P3,000,000 C. P4,000,000 D. P6,000,000

Data for nos. 33 to 35

The following relates to the define benefit obligation plan for Tokwa’t Baboy Inc. in 2016:

Accrued benefit obligation, January 1 4,600,000

Accrued benefit obligation, December 31 4,929,000

FV of plan assets, January 1 5,035,000

FV of plan assets, December 31 5,565,000

Actuarial gain due to remeasurement of benefit obligation 32,500

Employer contributions 425,000

Benefits paid to retirees 390,000

Discount rate 10%

33. The service cost for current year would be

A. P219,500 B. P226,500 C. P262,500 D. P291,500

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 4- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

34. The actual return on plan assets for the year is

A. P105,000 B. P495,000 C. P503,500 D. P512,000

35. What is the retirement benefit expense reported in profit or loss for the year 2016?

A. P224,000 B. P242,000 C. P248,000 D. P284,000

36. The following are the employee benefits transactions of Tocino Corp. for 2016:

Short-Term Benefit

Tocino Corp. reported that the company employees are each entitled to two weeks paid vacation leave. During

the current year, the employees earned 1,500 weeks of vacation leave and used 1,000 weeks. The current salary

of the employees is an average of P3,000 per week and the salary is expected to increase by P300 per week for

a future weekly salary of P3,300. Unused leaves are considered as accumulating and vesting.

Post-Employment Benefit

The company provides retirement benefits to employees through defined contribution plan. The plan provides

that Tocino shall contribute annually 4% of gross payroll to Tosilog, a funding agency. In addition, the entity is

also require to contribute 5% of annual sales exceeding P20,000,000. During the year, gross payroll of the

company was P12,000,000 and the total sales amounted to P45,000,000.

Other Long-Term Benefit

Other long-term benefit cost during the year is amounting to P4,000,000.

Termination Benefit

At the middle of the current year, Tocino Corp. announced the decision to close one of its branch located in

Pampanga and terminate all 60 employees as a result of continuous loss in that branch. The entity shall pay

P8,000 per employee upon termination. However, to ensure that the windup of the branch occurs smoothly and

all remaining orders are completed, the entity needs to retain at least 30% of the employee until closure of the

branch until one month. As a result, the entity announced the employee who agree to stay until the closing of

the branch shall receive P12,000 payment at the end of month. There are 20 employees remained until the branch

is closed.

How much is the total employee benefits expense to be reported in 2016 income statement?

A. P10,000,000 B. P10,790,000 C. P10,940,000 D. P11,240,000

37. Sinigang Company reported pretax financial income of P8,000,000 for the current year. The taxable income

was P7,000,000 for the current year. The difference is due to accelerated depreciation for income tax purposes.

The income tax rate is 30% and the entity made an actual payment of P500,000 during the year. What amount

should be reported as the total tax expense for the current year?

A. P2,400,000 B. P2,100,000 C. P1,900,000 D. 1,600,000

38.The Menudo Corp. had a taxable income of P1,200,000 during 2016. Menudo uses sum-of-the-years

depreciation for tax purposes (P340,000) and straight-line method for financial accounting purposes (P200,000).

Assuming Menudo had no other temporary difference, what is the company’s pre-tax accounting income for

2016?

A. 1,000,000 B. P1,060,000 C. P1,200,00 D. P1,340,000

39. On January 1, 2016, Bagnet Co. purchased investment securities for P1,500,000. The securities are classified

as investment in equity securities at fair value through other comprehensive income. At December 31, 2016, the

securities had a fair value of P2,100,000 but not yet been sold. The company also recognized a P200,000

restructuring charge during the year. The restructuring charge is composed of an impairment write down of

manufacturing facility. Tax rules do not allow a deduction for the write down unless the facility is sold. The

facility was not sold by the end of the year. After including the unrealized gain on the EI@FVOCI and the

restructuring charge, the accounting income before tax for the year was P5,000,000. The income tax rate for the

current and future years is 30%. What is Bagnet’s current tax expense?

A. P1,380,000 B. P1,440,000 C. P1,500,000 D. P1,560,000

40. Analysis of the assets and liabilities of Meatballs Corp. on December 31, 2016 disclosed assets with a tax

basis of P1,000,000 and a book basis of P1,300,000. There was no difference in the liability basis. The difference

in the asset basis arose from temporary difference that would reverse in the following years:

2017- P80,000 2019- P72,000 2021 - P38,000

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 5- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

2018 - 70,000 2020- 40,000

The enacted tax rates are 30% for 2016- 2019 and 32% for the years 2020-2021. What is the total deferred tax

liability at December 31, 2016?

A. P90,000 B. P91,560 C. P96,000 D. P99,000

41. Kaldereta Company’s income statement for the year ended December 31, 2016 shows pretax income of

P2,000,000. The company’s tax rate for 2016 is 30%. The following items are treated differently on the tax

return and in the accounting records:

Tax Return Accounting Records

Rent revenue P140,000 P240,000

Depreciation expense 560,000 440,000

Premium on officers' life insurance 180,000

The records also show that the gross sales is P60,000,000; cost of goods sold is P29,000,000; sales returns and

allowances, P450,000; and sales discounts, P550,000. What is the income tax payable for 2016?

A. P534,000 B. P588,000 C. P600,000 D. P720,000

42. Sisig Inc. had a pretax accounting income of P2,400,000 while the net income before charitable contribution

is P2,560,000 during the year. Below are items seen on the records of Sisig Inc. for 2016:

Gain from settlement of life insurance of officers and employees where the corporation is named the

beneficiary, P50,000;

Dividend revenue received from a Bopis Corp., a domestic corporation, P78,000;

Dividend revenue received from a Sizzling Beef Co., a foreign corporation, P56,000;

Interest on bank deposits, P4,500;

Capital gain on sale of land, P138,000;

Fines and penalties for violation of law, P90,000;

Premiums on life insurance for officers and employees (the company is the beneficiary), P50,000;

Impairment on Goodwill, P45,000; and

Actual charitable contributions, P160,000.

If there are no temporary differences, how much is Sisig’s total income tax expense during the year?

A. P2,314,500 B. P2,346,500 C. P2,418,500 D. P2,474,500

43. On July 1, 2016, Siomai Company leased a delivery truck from Siopao Company under a four-year operating

lease. Total rent for the term of the lease will be P2,700,000, payable as follows: First 6 months at P120,000 per

month; next 18 months at P60,000 per month; next 12 months at P50,000 per month; last 12 months at P25,000

per month. What is the amount reported in Siopao’ balance sheet on December 31, 2016 as a result of the

lease?

A. Unearned rent of P382,500 C. Unearned rent of P405,000

B. Rent receivable of P382,500 D. Rent receivable of P405,000

44. On January 1, 2019, Carbonara Inc. leased a machine by signing a four-year lease contract. Annual payments

of P1,000,000 are payable at the beginning of each year starting January 1, 2019. Carbonara is given the bargain

option to buy the machine for P250,000 at December 31, 2022. The asset’s useful life is five years, at the end of

which the asset’s scrap value is expected to be P400,000. Carbonara uses straight-line method to depreciate this

asset. The lessor’s implicit rate is 10%, which is known to Carbonara. At what amount should the right-of-use

asset be recorded on January 1, 2019? (use four decimal places for PV factor)

A. P2,657,650 B. P3,657,650 C. P4,000,000 D. P4,170,750

45. Sweet N’ Sour entered into a manufacturer’s lease to lease Pork N’ Beans an asset that cost Sweet N’ Sour

P1,200,000. The lease agreement requires five annual year-end rentals of P400,000 each. The company used a

15% interest rate to compute the rentals. The dealer’s profit (or loss) that Sweet N’ Sour recognized was

A. P140,860 loss B. P140,860 gain C. P180,000 gain D. P180,000 loss

46. On January 1, 2019, Torta Corporation signed a ten-year non-cancelable lease for certain machinery. The

terms of the lease called for Torta to make annual payments of P100,000 at the end of each year for ten years

with title to pass to Torta at the end of this period. The machinery has an estimated useful life of 15 years and

no salvage value. Torta uses the straight-line method of depreciation for all of its fixed assets. The lease

payments were determined to have a present value of P671,008 at an effective interest rate of 8%. With respect

to this capitalized lease, Torta should record for 2019

A. rent expense of P100,000

B. interest expense of P44,734 and depreciation expense of P38,068

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 6- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

C. interest expense of P53,681 and depreciation expense of P44,734

D. interest expense of P45,681 and depreciation expense of P67,101

47. Corned Beef Machineries, dealer of machinery and equipment, leased equipment to Meatloaf Products on

July 1, 2019. The lease is appropriately accounted for as a sale by Corned Beef and as a purchase by Meatloaf.

The lease is for 10-year period (the useful life of the asset) expiring on July 1, 2029. The first ten equal annual

payments of P250,000 was made on July 1, 2019. Corned Beef purchased the equipment for P1,337,500 on

January 1, 2019 and established a list selling price of P1,687,500 on the equipment. Assume that the present

value at July 1, 2019 of the payments over the lease term discounted at 12% was P1,582,500. What amount of

gross profit on the sale and the amount of interest income that Corned Beef should record for the year ended

December 31, 2019?

A. P245,000 and P94,950 C. P350,000 and P79,950

B. P245,000 and P79,950 D. P350,000 and P94,950

48. On July 1, 2019, the Chicken Feet Corp., signs a 10-year non-cancelable lease agreement for a storage

building owned by Helmet, Inc. The following information pertains to the lease agreement.

Annual rental payment is P750,000 beginning July 1, 2019. The rental payment includes P50,000 for

taxes and insurance.

The fair value of the building on July 1, 2019 is P4,478,000.

The building has an estimated economic life of 12 years. Unguaranteed residual value at the end of 10

years is P150,000.

Implicit rate is 12%.

How much is the impact of the lease transaction to the income statement of Chicken Feet Corp. dated

December 31, 2019?

A. P408,357 B. P433,357 C. P470,271 D. P495,271

49. On Jan. 1, 2017, Takoyaki Company sold machinery costing P600,000 with an accumulated depreciation of

P250,000 for P807,460, which is also its fair value. The remaining life of the machine is five years, Takoyaki

immediately leased the machine back for P200,000 yearly, payable in advance for five years. The implicit

interest rate is 12%. Using IAS 17, how much is the revenue on sale-leaseback for 2017?

A. P72,895.20 B. P91,492 C. P161,492 D. P200,000

Data for nos. 50 and 51 (Apply IFRS 16)

On January 1, 2019, Lydio’s Lechon Corp. signed a five-year non-cancelable lease for machine with Dinuguan

Company. The terms of the lease called for Lydio to make annual payments of P86,680 at the beginning of each

year starting January 1, 2019. The machine has an estimated useful life of 6 years and a P50,000 unguaranteed

residual value at the end of the five-year lease term. The machine reverts to the lessor at the end of five-year

lease term. Lydio uses sum-of-the-years method of depreciation for all of its fixed assets. The implicit rate of

the contract which is known by Lydio is 10%. The fair value of the machine on January 1, 2019 is P392,490.

Lydio incurred P20,000 to install the machine and P5,000 for painting it because the owner doesn’t want the

color of the machine. Lydio has an obligation to restore the machine to a condition suitable for use at the end of

the lease term. Estimated cost of restoration is P25,000. (Use four decimal places for the PV factor)

50. How much is the current and the non-current portion to be presented on December 31, 2019?

Current Non-Current

A. P59,203.30 P 215,563.70

B. P86,680.00 P215,563.70

C. P86,680.00 P232,639.00

D. P103,755.30 P234,346.20

51. How much is the total expense to be presented at Lydio’s income statement on December 31, 2020?

A. P102,502.67 B. P102,657.90 C. P109,888.47 D. P110,059.22

52. Crispy Pata Company’s accounts payable per general ledger amounted to P5,440,000, net of P240,000 debit

balances in suppliers’ accounts. The unpaid voucher file included the following items that not had been recorded

as of December 31, 2016:

Mang Tomas Company – P224,000 merchandise shipped on December 31, 2016, FOB destination;

received on January 10, 2017.

Ketchup, Inc. – P192,000 merchandise shipped on December 26, 2016, FOB shipping point; received

on January 16, 2017.

Toyo Super Services – P144,000 janitorial services for the three-month period ending January 31, 2017.

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 7- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

MERALCO – P67,200 electric bill covering the period December 16, 2016 to January 15, 2017.

On December 28, 2016, a supplier authorized Crispy Pata to return goods billed at P160,000 and shipped on

December 20, 2016. The goods were returned by Crispy Pata on December 28, 2016, but the P160,000 credit

memo was not received until January 6, 2017. What is the correct balance of Accounts Payable on Dec. 31,

2016?

A. P5,923,200 B. P5,841,600 C. P5,712,000 D. P5,601,600

53. Batchoy Co. started business in 2016. It sells printer with a three-year warranty. Batchoy estimates its

warranty cost as a percentage of peso sales. Based on experience, it is estimated that 2% will be repaired during

the first year of warranty, 4% will be repaired during the second year of warranty and 6% will be repaired in the

third year. In 2016 and 2017, the company was able to sell 7,500 units and 8,400 units, respectively at the selling

price of P5,000 per unit. The company also incurred actual repair costs of P530,000 and P1,176,000 in 2016 and

2017. If sales and repair occurs evenly throughout the period, how much would be predicted warranty expense

covering 2016 and 2017 sales still under warranty?

A. P8,790,000 B. P7,834,000 C. P7,620,000 D. P6,450,000

54. On January 1, Dinuguan Company issued P1,500,000, 14%, 5-year bond with interest payable on July 1 and

January 1.The bonds was sold for P1,647,610. The market rate of interest for these bonds was 12%. On the first

interest date, using the effective interest method, the debit to Bonds Interest Expense amounts to

A. P197,713 B. P115,333 C. P105,000 D. P98,857

55. On July 1, 2016, Biko Company issued P2,500,000 of its 10%, 7-year bonds with one detachable share

warrant attached to each P1,000 bond. Each warrant provides for the right to purchase 20 shares of P15 par

ordinary for P20 each. The market value of each ordinary share was P25 at July 1, 2016. The detachable warrant

has a market price of P70 each and each bond, without warrants attached, is quoted at 97. The bonds were sold

at 104. What are the values assigned to bonds and warrants, respectively?

A. P2,600,000 and 0 C. P2,500,000 and P100,000

B. P2,575,000 and P25,000 D. P2,425,000 and P175,000

56. On December 31, 2016, Banana Crepe Inc. issued P3,000,000, 12% serial bonds to be repaid in the amount

of P750,000 each year. Interest is payable annually on December 31. The bonds were issued to yield 10% a year.

The bond proceeds were P3,124,500 based on the present values on December 31, 2016. In its December 31,

2017 balance sheet, at what is the carrying value of the bond?

A. P3,124,500 B. P3,076,950 C. P2,297,550 D. P2,326,950

57. Leche Flan Corp. is a manufacturer and retailer of household fixtures. The company’s financial statements

for the year ended December 31, 2016 discloses the following debt obligations. Leche Flan’s financial

statements are authorized for issuance on March 6, 2017.

1. A P150,000 short-term obligation due on March 1, 2017. Its maturity could be extended to March 1,

2019, provided that Leche Flan agrees to provide additional collateral On February 12, 2017, an

agreement is reached to extend the loan’s maturity to March 1, 2019.

2. A short-term obligation of P3,600,000 in form of notes payable was due on February 5, 2017. The

company issued 75,000 ordinary shares for P36 per share on January 25, 2017. The proceeds of the

issuance, plus P900,000 cash, were use used to fully settle the debt on February 5, 2017.

3. A long-term obligation of P2,500,000 on December 1, 2016. On December10, 2016, Leche Flan

breaches a covenant on its debt obligation and the loan becomes payable on demand. An agreement

reached to provide a waiver of the breach on December 11, 2016.

4. A long-term obligation of P4,000,000. The loan is maturing over 4 years in the amount of P1,000,000

per year. The loan is dated September 1, 2016, and the first maturity date is September 1, 2017.

5. A debt obligation of P1,000,000 maturing on December 31, 2019. The debt is callable on demand by the

lender at any time.

What amount of current and noncurrent liabilities, respectively, should be reported on December 31, 2016

balance sheet?

A. P8,250,000; P3,000,000 C. P4,750,000; P6,500,000

B. P5,750,000; P5,500,000 D. P3,750,000; P7,500,000

58. On July 1, 2016, Tiramisu Corp. issued 2,000 shares of its P10 par ordinary and 4,000 shares of its P10 par

preference for lump-sum of P80,000. At this date, Tiramisu’s ordinary share was selling at P18 per share and

the preference share for P13.50 per share. The amount of proceeds allocated to preference share should be

A. P60,000 B. P54,000 C. P48,000 D. P40,000

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 8- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

59. The shareholders’ equity section of Cheese Cake Co. as of Dec.31, 2016, contained the following accounts:

Ordinary share, 25,000 shares authorized, 10,000 shares outstanding P30,000

Capital contributed in excess of par 40,000

Retained earnings 80,000

Cheese Cake’s board of directors declared a 10% bonus issue on April 1, 2017, when the market value of the

share was P7 per share. Accordingly, 1,000 new shares were issued. Cheese Cake’s entire share has a par value

of P3. Assuming Cheese Cake sustained a net loss of P12,000 for the quarter ended March 31, 2017, what

amount shall be reported as retained earnings on April 1, 2017?

A. P73,000 B. P68,000 C. P64,000 D. P61,000

60. On January 1, 2016, the shareholders’ of Sundae Company, a calendar year corporation, approved a plan

and granted the company’s three executives options to purchase a total of 3,000 shares of the company’s P100

par value ordinary shares. The option may be exercised for one year effective January 1, 2019. Based on an

option pricing model, the fair value of the option is P60. The option price per share is P120. On February 14,

2018, one of the executives who was granted an option to purchase 800 shares, decided to resign from the

organization. On January 1, 2019, the remaining executives exercised their options. How much is the

compensation expense for 2018?

A. P60,000 B. P44,000 C. P12,000 D. P-0-

61. Kikiam Inc. reported the following amounts in the shareholders’ equity section of its December 31, 2016

statement of financial position:

Preference shares, 10%, P10 par (100,000 shares authorized, 20,000 shares issued) P 200,000.00

Ordinary shares, P5 par (50,000 shares authorized, 10,000 shares issued) 50,000.00

Share premium 96,000.00

Retained earnings 600,000.00

Total 946,000.00

The following transactions occurred during 2017:

1. Paid the annual 2016 P1 per share dividend on preference shares and P0.50 per share dividend on

ordinary shares. These dividends have been declared on December 31, 2017.

2. Purchased 2,000 shares of its own outstanding ordinary shares for P20 per share.

3. Reissued 700 treasury shares for equipment value at P25,000.

4. Issued 5,000 preference shares at P15 per share.

5. Declared a 10% stock dividend on the outstanding ordinary shares when the shares were selling for

P12 per share.

6. Issued the stock dividend.

7. Declared the annual 2016 P1 per share dividend on preference shares and the P0.50 per share dividend

on ordinary shares. These dividends are payable in 2018.

8. Appropriated retained earnings for plant expansion, P300,000.

9. Appropriated retained earnings for treasury shares.

10. The net income for 2017 was P470,000.

How much is the unappropriated retained earnings as of December 31, 2017?

A. P703,775 B. P709,775 C. P714,775 D. P729,775

62. On January 1, 2016, Cheese Stick Company issued share appreciation rights to its CFO exercisable for one

year beginning January 1, 2018 if the officer is still in the employ of the company at the date of exercise. Each

rights provides for a cash payment equal to the excess of Cheese Stick’s share price over P50. The equivalent

number of shares for the share appreciation rights will be based on the level the company at the date of exercise

as follows:

Level of sales Equivalent shares granted

P100 million to P300 million 10,000

over P300 million 12,000

Actual sales achieved by Cheese Stick and the share price at the end of each year are as follows:

Year Sales Share Price

2016 P120 million P75

2017 P350 million P82

How much is the compensation expense recognized for the year ended December 31, 2016?

A. P125,000 B. P250,000 C. P375,000 D. P750,000

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 9- NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

63. The stockholders’ equity of Hopia Ni Classmate Company on Dec. 31, 2016 consists of the following

accounts:

Preference share capital, 10%, cumulative, P100 par P 5,000,000

Ordinary share capital, P100 par 20,000,000

Subscribed ordinary shares, net of Subscription receivable of

P4,000,000 (100,000 shares) 6,000,000

Treasury ordinary shares at cost (50,000 shares) 4,000,000

Share premium 10,000,000

Retained earnings 8,000,000

Preference dividends have not been paid for three years and have a liquidation value of P110. The book value

of ordinary share is

A. P210 B. P168 C. P166 D. P152

64. Gulaman Ni Badjang Company had sustained heavy losses over long period and conditions warrant that the

company should undergo a quasi-reorganization on December 31, 2016.

Inventory with cost of P6,500,000 was recorded on December 31, 2016 at the market value of

P6,000,000.

Fixed assets were recorded on December 31, 2016 at P12,000,000, net of accumulated depreciation. The

fair value was P8,000,000

On December 31, 2016, the share capital is P7,000,000 consisting of 700,000 shares with par value of

P10, the share premium is P1,600,000 and the deficit in retained earnings is P900,000.

The par value of the share is to be reduced from P10 to P5.

Immediately after the quasi-reorganization, what is the total shareholders’ equity?

A. P3,300,000 B. P3,500,000 C. P3,700,000 D. P4,200,000

65. The following selected accounts were taken from the Dec. 31, 2016, trial balance of Fewa Corporation:

Subscribed share capital P 1,250,000

Treasury shares, 600 shares at cost 90,000

Unissued share capital 6,000,000

Share premium 180,000

Appropriation for plant expansion 500,000

Retained earnings 1,200,000

Authorized share capital - 100,000 shares 10,000,000

Subscriptions receivable 320,000

The minutes of the meeting of the board of directors reveal that on December 31, 2016, the company’s board

declared a 10% cash dividend payable to shareholders and subscribers of record on December 20, 2016. The

dividend check are to be distributed on January 10, 2017. Virgin, the company’s accountant, has not recorded

this dividend declaration. What is the amount of unrecorded dividend payable?

A. P519,000 B. P516,000 C. P487,000 D. P394,000

- END OF EXAMINATION -

Be blessed!

This maybe one of the toughest semester of your college life- departmental exams, incoming S.Q.E., low

grades, disappointments, pressure, etc. - you feel like giving up and set your self-esteem to the lowest. The

struggle is real but do not forget GOD is also real and according to Matthew 7:7 “Ask and it will be given to

you; seek and you will find; knock and the door will be opened.” Do your best, ask for guidance and trust

Him, and everything that you do will not be in vain!

#RoadToBSAThirdYear

#HGAWFA2SeasonFinale

Concentrate === Pray === Achieve

/NABergonia2017

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 10-

NAB

February 26, 2017 ACCO 3026: FINANCIAL ACCOUNTING AND REPORTING PART 2

POLYTECHNIC UNIVERSITY OF THE PHILIPPINES

College of Accountancy and Finance

ACCO 3026 - Financial Accounting & Reporting P2

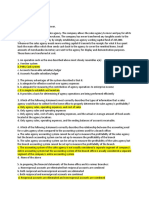

Table of Specification for Final Examination

2nd Sem AY. 2016- 2017

PROBLEMS (2 pts.

THEORIES (1 pt each)

TOPICS each) Total

Easy Average Difficult Easy Average Difficult

35% 50% 15% 35% 50% 15%

Current Liabilities 1 1 1 1 6

1 1

Non-Current Liabilities 1 1 1 2 5

Shareholders' Equity 1 3 1 3 4 1 13

Leases 3 4 1 3 5 1 17

Income Taxes 2 3 1 2 3 1 12

Employee Benefits 2 3 1 2 3 1 12

Total 10 15 5 12 18 5 65

35 35

2nd Semester A.Y. 2016-2017 FINAL DEPARTMENTAL EXAMINATION 11-

NAB

Das könnte Ihnen auch gefallen

- ACCO 3026 Final ExamDokument11 SeitenACCO 3026 Final ExamClarisseNoch keine Bewertungen

- 1617 2ndS FX NBergoniaDokument11 Seiten1617 2ndS FX NBergoniaJames Louis BarcenasNoch keine Bewertungen

- Ac3a Qe Oct2014 (TQ)Dokument15 SeitenAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNoch keine Bewertungen

- (LAW1-LAW4) AnswersDokument20 Seiten(LAW1-LAW4) AnswersAeyjay ManangaranNoch keine Bewertungen

- Seatwork On LeasesDokument1 SeiteSeatwork On Leasesmitakumo uwuNoch keine Bewertungen

- Summit Professional Review Center: Auditing Problems Shareholders' EquityDokument6 SeitenSummit Professional Review Center: Auditing Problems Shareholders' EquityKris Van HalenNoch keine Bewertungen

- Seatwork in Audit 2-3Dokument8 SeitenSeatwork in Audit 2-3Shr BnNoch keine Bewertungen

- Ap 59 PW - 5 06 PDFDokument18 SeitenAp 59 PW - 5 06 PDFJasmin NgNoch keine Bewertungen

- ToaDokument5 SeitenToaGelyn CruzNoch keine Bewertungen

- Module 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonDokument3 SeitenModule 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonJoshua Daarol0% (1)

- 4083 EvalDokument11 Seiten4083 EvalPatrick ArazoNoch keine Bewertungen

- Afar IcpaDokument6 SeitenAfar IcpaAndrea Lyn Salonga CacayNoch keine Bewertungen

- Single Entry and Cash and AccrualDokument7 SeitenSingle Entry and Cash and AccrualRinna LegaspiNoch keine Bewertungen

- BAC 318 Final Examination With AnswersDokument10 SeitenBAC 318 Final Examination With Answersjanus lopez100% (1)

- Auditing FinalMockBoard ADokument11 SeitenAuditing FinalMockBoard ACattleyaNoch keine Bewertungen

- Bataan P2Dokument9 SeitenBataan P2Jasmine ActaNoch keine Bewertungen

- Acctg630 - ICMA 1st Sem SY2013-14 - With AnswerDokument35 SeitenAcctg630 - ICMA 1st Sem SY2013-14 - With AnswerJasper Andrew AdjaraniNoch keine Bewertungen

- OncaDokument6 SeitenOncaVinylcoated ClipsNoch keine Bewertungen

- Chapter 4Dokument17 SeitenChapter 4Mary MarieNoch keine Bewertungen

- Chapter 11: Allocation of Joint Costs and Accounting For By-ProductsDokument100 SeitenChapter 11: Allocation of Joint Costs and Accounting For By-Productsmoncarla lagonNoch keine Bewertungen

- 08 InvestmentquestfinalDokument13 Seiten08 InvestmentquestfinalAnonymous l13WpzNoch keine Bewertungen

- B. Cost, Being The Purchase PriceDokument5 SeitenB. Cost, Being The Purchase Priceaj dumpNoch keine Bewertungen

- Long-Term Construction Contracts and FranchisingDokument16 SeitenLong-Term Construction Contracts and FranchisingAlexis SosingNoch keine Bewertungen

- Theory - Part 2 PDFDokument21 SeitenTheory - Part 2 PDFBettina OsterfasticsNoch keine Bewertungen

- EXERCISES On EARNINGS PER SHAREDokument4 SeitenEXERCISES On EARNINGS PER SHAREChristine AltamarinoNoch keine Bewertungen

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDokument5 SeitenColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNoch keine Bewertungen

- This Study Resource Was: FAR Ocampo/Cabarles/Soliman/Ocampo Quiz No. 3 Set A OCTOBER 2019Dokument3 SeitenThis Study Resource Was: FAR Ocampo/Cabarles/Soliman/Ocampo Quiz No. 3 Set A OCTOBER 2019ChjxksjsgskNoch keine Bewertungen

- MODULE 2 CVP AnalysisDokument8 SeitenMODULE 2 CVP Analysissharielles /Noch keine Bewertungen

- Scheduler's ImpressiveDokument7 SeitenScheduler's Impressivemaria ronoraNoch keine Bewertungen

- LTCC QuizDokument3 SeitenLTCC QuizKiel SorrosaNoch keine Bewertungen

- Attachments - Rainbow RowellDokument29 SeitenAttachments - Rainbow RowellAlvin Yerc0% (1)

- ULOa-Let's CheckDokument1 SeiteULOa-Let's Checkalmira garciaNoch keine Bewertungen

- MasDokument20 SeitenMasMarie AranasNoch keine Bewertungen

- Department of Accountancy: Page - 1Dokument16 SeitenDepartment of Accountancy: Page - 1NoroNoch keine Bewertungen

- p1 QuizDokument3 Seitenp1 QuizEvita Faith LeongNoch keine Bewertungen

- Partnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionDokument18 SeitenPartnership Accounting Table of Contents: Partnership Formation, Operation & DissolutionGuinevereNoch keine Bewertungen

- ADV2 Chapter12 QADokument4 SeitenADV2 Chapter12 QAMa Alyssa DelmiguezNoch keine Bewertungen

- At PDF FreeDokument15 SeitenAt PDF FreemaekaellaNoch keine Bewertungen

- Q - Process Further Scarce ResourceDokument2 SeitenQ - Process Further Scarce ResourceIrahq Yarte TorrejosNoch keine Bewertungen

- Long Problems For Prelim'S Product: Case 1Dokument7 SeitenLong Problems For Prelim'S Product: Case 1Mae AstovezaNoch keine Bewertungen

- Special Revenue Recognition Special Revenue RecognitionDokument4 SeitenSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNoch keine Bewertungen

- 10 X08 BudgetingDokument13 Seiten10 X08 Budgetingjenna hannahNoch keine Bewertungen

- Sample Problems in PartnershipDokument6 SeitenSample Problems in PartnershipAina OracionNoch keine Bewertungen

- Definition and Purposes of Internal ControlDokument18 SeitenDefinition and Purposes of Internal Controlnur_haryantoNoch keine Bewertungen

- Multiple Choice ProblemsDokument3 SeitenMultiple Choice ProblemsZvioule Ma FuentesNoch keine Bewertungen

- Chapter 15Dokument56 SeitenChapter 15idm284100% (1)

- Quiz - iCPA PDFDokument14 SeitenQuiz - iCPA PDFCharlotte Canabang AmmadangNoch keine Bewertungen

- Acctg 100C 01Dokument6 SeitenAcctg 100C 01Jose Magallanes100% (1)

- POST-TEST 1 - Auditing and The Audit Process - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSDokument6 SeitenPOST-TEST 1 - Auditing and The Audit Process - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONSDonise Ronadel SantosNoch keine Bewertungen

- Auditing Theory Ch1-Guide Questions With AnswerDokument8 SeitenAuditing Theory Ch1-Guide Questions With AnswerElaineNoch keine Bewertungen

- De La Salle Araneta UniversityDokument7 SeitenDe La Salle Araneta UniversityBryent GawNoch keine Bewertungen

- AFAR ProblemDokument27 SeitenAFAR ProblemCj BarrettoNoch keine Bewertungen

- Op Aud Quizzes 9 Files MergedDokument166 SeitenOp Aud Quizzes 9 Files MergedAlliahDataNoch keine Bewertungen

- Lyceum First Preboard 2020Dokument3 SeitenLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Final Departmental Examination: College of Accountancy and FinanceDokument11 SeitenFinal Departmental Examination: College of Accountancy and FinancecmaeNoch keine Bewertungen

- ACCOUNTING 3B HomeworkDokument11 SeitenACCOUNTING 3B HomeworkRheu Reyes75% (4)

- Quiz UFSDokument3 SeitenQuiz UFSZoey Alvin EstarejaNoch keine Bewertungen

- Finacc5 LQ1Dokument6 SeitenFinacc5 LQ1by ScribdNoch keine Bewertungen

- Acctexam - Current Liabilities and ContingenciesDokument7 SeitenAcctexam - Current Liabilities and ContingenciesAsheNoch keine Bewertungen

- EXAM - IA2 ReviewerDokument17 SeitenEXAM - IA2 ReviewerMohammad Raffe GuroNoch keine Bewertungen

- Practice Examination IIIDokument13 SeitenPractice Examination IIITwinie MendozaNoch keine Bewertungen

- At 1 PDFDokument20 SeitenAt 1 PDFTwinie MendozaNoch keine Bewertungen

- Polytechnic University of The PhilippinesDokument7 SeitenPolytechnic University of The PhilippinesTwinie Mendoza100% (1)

- Corporation: Additional Important NotesDokument1 SeiteCorporation: Additional Important NotesTwinie MendozaNoch keine Bewertungen

- Practice Examination II. Questions.Dokument6 SeitenPractice Examination II. Questions.Twinie MendozaNoch keine Bewertungen

- Tax EvalsDokument7 SeitenTax EvalsTwinie MendozaNoch keine Bewertungen

- Acco 4113 Management Advisory Services 2Nd Evaluation Exam January 21, 2018 RcroqueDokument1 SeiteAcco 4113 Management Advisory Services 2Nd Evaluation Exam January 21, 2018 RcroqueTwinie MendozaNoch keine Bewertungen

- Compiled Questions Group 2Dokument9 SeitenCompiled Questions Group 2Twinie MendozaNoch keine Bewertungen

- Compiled Wriitten Reports Group 2Dokument122 SeitenCompiled Wriitten Reports Group 2Twinie MendozaNoch keine Bewertungen

- 2016 4083 4th Evaluation ExamDokument8 Seiten2016 4083 4th Evaluation ExamPatrick ArazoNoch keine Bewertungen

- Chapter 1 CSR Arianne EsmenaDokument11 SeitenChapter 1 CSR Arianne EsmenaTwinie MendozaNoch keine Bewertungen

- Penalties PDFDokument12 SeitenPenalties PDFTwinie MendozaNoch keine Bewertungen

- Government AccountingDokument106 SeitenGovernment AccountingTwinie Mendoza100% (2)

- Basic Accounting For HM and TM SyllabusDokument2 SeitenBasic Accounting For HM and TM Syllabusjune dela cernaNoch keine Bewertungen

- Leave of Absence Authorisation 2.0Dokument3 SeitenLeave of Absence Authorisation 2.0灭霸Noch keine Bewertungen

- Good MoralDokument8 SeitenGood MoralMary Grace LemonNoch keine Bewertungen

- Lawsuit Filed Against River City FirearmsDokument39 SeitenLawsuit Filed Against River City FirearmsJulia HuffmanNoch keine Bewertungen

- Case Name Topic Case No. ǀ Date Ponente Doctrine: USA College of Law Sobredo-1FDokument1 SeiteCase Name Topic Case No. ǀ Date Ponente Doctrine: USA College of Law Sobredo-1FAphrNoch keine Bewertungen

- Final Managerial AccountingDokument8 SeitenFinal Managerial Accountingdangthaibinh0312Noch keine Bewertungen

- Tectabs Private: IndiaDokument1 SeiteTectabs Private: IndiaTanya sheetalNoch keine Bewertungen

- Legal Research BOOKDokument48 SeitenLegal Research BOOKJpag100% (1)

- Case 20Dokument6 SeitenCase 20Chelle Rico Fernandez BONoch keine Bewertungen

- Engine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Dokument9 SeitenEngine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Akmal NizametdinovNoch keine Bewertungen

- Isa 620Dokument15 SeitenIsa 620baabasaamNoch keine Bewertungen

- M1-06 - Resultant ForcesDokument9 SeitenM1-06 - Resultant ForcesHawraa HawraaNoch keine Bewertungen

- ARTADokument1 SeiteARTAAron Paul Morandarte RulogNoch keine Bewertungen

- HMB FX Trade Portal User Manual: Back GroundDokument28 SeitenHMB FX Trade Portal User Manual: Back GroundMuhammad AliNoch keine Bewertungen

- Sample Blogger Agreement-14Dokument3 SeitenSample Blogger Agreement-14api-18133493Noch keine Bewertungen

- 08 Albay Electric Cooperative Inc Vs MartinezDokument6 Seiten08 Albay Electric Cooperative Inc Vs MartinezEYNoch keine Bewertungen

- Nicoleta Medrea - English For Law and Public Administration.Dokument57 SeitenNicoleta Medrea - English For Law and Public Administration.gramadorin-10% (1)

- Account Summary Contact Us: Ms Angela Munro 201 3159 Shelbourne ST Victoria BC V8T 3A5Dokument4 SeitenAccount Summary Contact Us: Ms Angela Munro 201 3159 Shelbourne ST Victoria BC V8T 3A5Angela MunroNoch keine Bewertungen

- JEEVAN LABH 5k-10k 21-15Dokument1 SeiteJEEVAN LABH 5k-10k 21-15suku_mcaNoch keine Bewertungen

- Jetblue PresentationDokument38 SeitenJetblue Presentationpostitman33% (3)

- DeviceHQ Dev User GuideDokument13 SeitenDeviceHQ Dev User GuidekediteheNoch keine Bewertungen

- ANNEX A-Final For Ustad InputDokument15 SeitenANNEX A-Final For Ustad Inputwafiullah sayedNoch keine Bewertungen

- Auditing Gray 2015 CH 15 Assurance Engagements Internal AuditDokument46 SeitenAuditing Gray 2015 CH 15 Assurance Engagements Internal AuditAdzhana AprillaNoch keine Bewertungen

- Powerpoint For Chapter Four of Our Sacraments CourseDokument23 SeitenPowerpoint For Chapter Four of Our Sacraments Courseapi-344737350Noch keine Bewertungen

- Dell EMC Partner Training GuideDokument23 SeitenDell EMC Partner Training GuideDuško PetrovićNoch keine Bewertungen

- 00 Introduction ATR 72 600Dokument12 Seiten00 Introduction ATR 72 600destefani150% (2)

- Cash and Cash EquivalentDokument2 SeitenCash and Cash EquivalentJovani Laña100% (1)

- Accounting Fraud Auditing and The Role of Government Sanctions in China 2015 Journal of Business ResearchDokument10 SeitenAccounting Fraud Auditing and The Role of Government Sanctions in China 2015 Journal of Business ResearchAquamarine EmeraldNoch keine Bewertungen

- Tumang V LaguioDokument2 SeitenTumang V LaguioKarez MartinNoch keine Bewertungen

- Ronnie Garner Victim StatementDokument12 SeitenRonnie Garner Victim StatementMagdalena WegrzynNoch keine Bewertungen