Beruflich Dokumente

Kultur Dokumente

Mas

Hochgeladen von

Raquel Villar Dayao0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10 Ansichten3 Seitengg

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldengg

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

10 Ansichten3 SeitenMas

Hochgeladen von

Raquel Villar Dayaogg

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

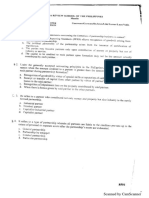

Initial cash outlay + Additional cash outlay related

to asset + Additional working capital - Cash inflow

NET INITIAL INVESTMENT OR PROJECT COST

arising from sale of old asset being replaced -

Avoidable costs = Net investment

Annual incremental revenue from project - Cash

operating costs = Annual net cash inflow before

taxes - Taxes = Annual net cash inflow after taxes

NET CASH RETURNS - BASIC

Taxes = Tax rate (Annual net cash inflow before

taxes - Incremental depreciation)

Annual cash operating costs if old asset or

method is used - Annual cash operating costs if

new asset or method is used = Annual cash

NET CASH RETURNS - COST REDUCTION savings before taxes - Taxes = Annual cash

PROJECT savings after taxes

Taxes = Tax rate (Annual net cash inflow before

taxes - Incremental depreciation)

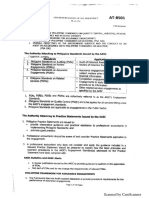

COST OF CAPITAL - DEBT Cost of debt = Interest rate (1 - Corporate tax rate)

Cost of preference shares = Dividends per share /

COST OF CAPITAL - PREFERENCE SHARES

Market value per share of preference shares

Stock price based cost of ordinary shares =

COST OF CAPITAL - ORDINARY SHARES (Expected cash dividends per share / Current price

(STOCK PRICE BASED) per share of ordinary shares) + Dividend growth

rate

Book value based cost of ordinary shares = Net

COST OF CAPITAL - ORDINARY SHARES

year’s projected earnings per share / Current price

(BOOK VALUE BASED)

per share of ordinary shares

COST OF CAPITAL - RETAINED EARNINGS Same as cost of ordinary shares

Weighted average cost of capital

= Summation of (Cost of each type of capital *

Respective weight)

WEIGHTED AVERAGE COST OF CAPITAL

Respective weight = Amount of each type of

capital / Total capital structure

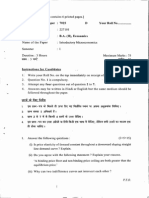

Uniform periodic cash flows: Payback period =

Net investment / Annual cash returns

Non-uniform periodic cash flows: Determining the

PAYBACK PERIOD

point in time at which the cumulative estimated

annual cash inflows equal the investment outlay

Decision rule: Minimize

Bail-out payback period = Point in time at which

the cumulative cash earnings plus the salvage

BAIL-OUT PAYBACK PERIOD

value at the end of a particular year equals the

original investment

Accounting rate of return = Average annual net

ACCOUNTING RATE OF RETURN OR SIMPLE RATE income / Initial investment or average investment

OF RETURN - BASIC

Decision rule: Maximize

Accounting rate of return = (Cost savings -

Depreciation on new equipment) / Initial

ACCOUNTING RATE OF RETURN OR SIMPLE RATE

investment or Average investment

OF RETURN - COST REDUCTION PROJECT

Decision rule: Maximize

Average investment = (Initial investment +

AVERAGE INVESTMENT Salvage value of the asset at the end of economic

life) / 2

Present value of cash inflows computed based on

minimum desired discount rate or cost of capital

NET PRESENT VALUE - Present value of investment = Net present value

Decision rule: Accept if zero or positive

Net investment / Annual cash returns = Present

DISCOUNTED RATE OF RETURN OR INTERNAL

value factor

RATE OF RETURN OR TIME-ADJUSTED RATE OF

“Use interpolation to get the exact IRR” “Decision

RETURN - UNIFORM CASH INFLOWS

rule: Maximize”

Net investment / Average annual cash returns =

Present value factor “Use interpolation to get the

DISCOUNTED RATE OF RETURN OR INTERNAL

exact IRR” “Decision rule: Maximize //

RATE OF RETURN OR TIME-ADJUSTED RATE OF

Summation of returns to be received during the

RETURN - UNIFORM CASH INFLOWS

life of the project / Economic life of project =

Average annual cash returns

Payback reciprocal = Annual cash inflows / Net

investment “Or”

Payback reciprocal = 1 / Payback period

PAYBACK RECIPROCAL

“Used to estimate the discounted rate of return

when the project is at least twice the payback

period”

Present value index = Present value of cash

PROFITABILITY INDEX OR PRESENT VALUE

inflows / Present value of net investment

INDEX OR BENEFIC-COST RATE OR DESIRABILITY

“Used as a measure of ranking projects in a

INDEX

descending order of desirability”

“Payback period is computed using discounted

DISCOUNTED PAYBACK PERIOD cash flows using an appropriate cost of capital

rate.”

“Compares projects of unequal lives which

REPLACEMENT CHAIN (COMMON LIFE) assumes that each project can be repeated as

APPROACH many times as necessary to reach a common life

span.”

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Month To Go Moving ChecklistDokument9 SeitenMonth To Go Moving ChecklistTJ MehanNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Valeant Case SummaryDokument2 SeitenValeant Case Summaryvidhi100% (1)

- Afar 01Dokument11 SeitenAfar 01Raquel Villar DayaoNoch keine Bewertungen

- 6978 - Government Grant and Borrowing CostDokument2 Seiten6978 - Government Grant and Borrowing CostRaquel Villar DayaoNoch keine Bewertungen

- Cost Analysis of NestleDokument8 SeitenCost Analysis of NestleKiran Virk75% (4)

- LEVI's SWOT and TOWS AnalysisDokument13 SeitenLEVI's SWOT and TOWS AnalysisRakeysh Coomar67% (3)

- CA FirmsDokument5 SeitenCA FirmsbobbydebNoch keine Bewertungen

- Cpa Review School of The Philippines ManilaDokument2 SeitenCpa Review School of The Philippines ManilaRaquel Villar DayaoNoch keine Bewertungen

- Cpa Review School of The Philippines ManilaDokument2 SeitenCpa Review School of The Philippines ManilaRaquel Villar DayaoNoch keine Bewertungen

- Cpa Review School of The Philippines ManilaDokument2 SeitenCpa Review School of The Philippines ManilaRaquel Villar DayaoNoch keine Bewertungen

- Afar 8501-8504Dokument14 SeitenAfar 8501-8504Raquel Villar DayaoNoch keine Bewertungen

- Far 01aDokument9 SeitenFar 01aRaquel Villar DayaoNoch keine Bewertungen

- Mas 01Dokument8 SeitenMas 01Raquel Villar DayaoNoch keine Bewertungen

- At 8501 PDFDokument10 SeitenAt 8501 PDFRaquel Villar DayaoNoch keine Bewertungen

- Continue or Eliminate AnalysisDokument3 SeitenContinue or Eliminate AnalysisMaryNoch keine Bewertungen

- Project Budget WBSDokument4 SeitenProject Budget WBSpooliglotaNoch keine Bewertungen

- Fashion and StatusDokument11 SeitenFashion and StatusDiana ScoriciNoch keine Bewertungen

- DI and LRDokument23 SeitenDI and LRVarsha SukhramaniNoch keine Bewertungen

- VademecumDokument131 SeitenVademecumElizabeth DavidNoch keine Bewertungen

- Ananda KrishnanDokument4 SeitenAnanda KrishnanKheng How LimNoch keine Bewertungen

- Chp14 StudentDokument72 SeitenChp14 StudentChan ChanNoch keine Bewertungen

- Accounting For Income Tax-NotesDokument4 SeitenAccounting For Income Tax-NotesMaureen Derial PantaNoch keine Bewertungen

- 3 Sem EcoDokument10 Seiten3 Sem EcoKushagra SrivastavaNoch keine Bewertungen

- B.A. (Hons.) Economics Introductory Microeconomics SEM-I (7025)Dokument6 SeitenB.A. (Hons.) Economics Introductory Microeconomics SEM-I (7025)Gaurav VermaNoch keine Bewertungen

- Godrej Presentation FinalDokument21 SeitenGodrej Presentation FinalAkshay MunotNoch keine Bewertungen

- Joint Product PricingDokument2 SeitenJoint Product PricingAmit Manhas100% (1)

- HZL 4100070676 Inv Pay Slip PDFDokument12 SeitenHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNoch keine Bewertungen

- B1342 SavantICDokument3 SeitenB1342 SavantICSveto SlNoch keine Bewertungen

- COMP2230 Introduction To Algorithmics: A/Prof Ljiljana BrankovicDokument18 SeitenCOMP2230 Introduction To Algorithmics: A/Prof Ljiljana BrankovicMrZaggyNoch keine Bewertungen

- Annual Report of Bajaj Finance NBFC PDFDokument308 SeitenAnnual Report of Bajaj Finance NBFC PDFAnand bhangariya100% (1)

- 2016 04 1420161336unit3Dokument8 Seiten2016 04 1420161336unit3Matías E. PhilippNoch keine Bewertungen

- RSKMGT NIBM Module Operational Risk Under Basel IIIDokument6 SeitenRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaNoch keine Bewertungen

- Ficci Ey M and e Report 2019 Era of Consumer Art PDFDokument309 SeitenFicci Ey M and e Report 2019 Era of Consumer Art PDFAbhishek VyasNoch keine Bewertungen

- FRBM Act: The Fiscal Responsibility and Budget Management ActDokument12 SeitenFRBM Act: The Fiscal Responsibility and Budget Management ActNaveen DsouzaNoch keine Bewertungen

- Problem Set3Dokument4 SeitenProblem Set3Jack JacintoNoch keine Bewertungen

- FCE Letter SampleDokument3 SeitenFCE Letter SampleLeezukaNoch keine Bewertungen

- AUD THEO BSA 51 Mr. LIMHEYADokument137 SeitenAUD THEO BSA 51 Mr. LIMHEYAMarie AzaresNoch keine Bewertungen

- BCPC 204 Exams Questions and Submission InstructionsDokument5 SeitenBCPC 204 Exams Questions and Submission InstructionsHorace IvanNoch keine Bewertungen

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDokument2 SeitenInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNoch keine Bewertungen