Beruflich Dokumente

Kultur Dokumente

Cash Return On Invested Capital

Hochgeladen von

Michael JacopinoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cash Return On Invested Capital

Hochgeladen von

Michael JacopinoCopyright:

Verfügbare Formate

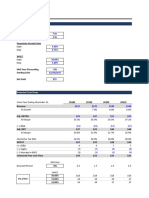

Cash Converstion Cycle 48.7 Lower Better need to compare to similar companies Days Inventory Outstanding 1.

11

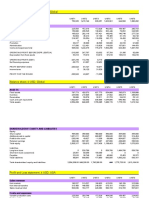

Cash Return on Invested Capital 9.09% >13% Days Sales Outstanding 0 Skechers USA Inc. (SKX) 2010 2011 2012 2013 2014 2015 TTM

EV/EBIT 15.5944584410x Days Payables Outstanding 33.2 Revenue ($1,205.4) ($1,394.2) ($1,440.7) ($1,438.1) ($2,011.4) ($1,613.6) ($1,455.6)

FCF to Sales 4.25% Higer Better >10% Free Cash Flow 870 mil EBT ($ 112.6) ($ 118.3) ($ 60.7) ($ 71.1) ($ 196.6) ($ (131.0) ($ (91.7)

FCF to Short Term Debt 7.219917012Ratio >1 Invested Captial 4670 mil Shareholders Equity EBIT ($ 121.9) ($ 123.1) ($ 65.3) ($ 74.2) ($ 199.6) ($ (123.2) ($ (79.6)

Inventory Turnover 6.245876604Compare to Same Industry higher better Enterprise Value 24764 Intrest Bearing Debt Interest Expense ($ 9.2) ($ 4.8) ($ 4.6) ($ 3.0) ($ 3.0) ($ 7.9) ($ 12.1)

EBIT/Enterprise Value 6.41% >=10% Earnings Before Interest & Tax 1588 Short Term Debt Income Tax ($ 41.7) ($ 42.6) ($ 7.3) ($ 20.2) ($ 60.2) ($ (63.5) ($ (40.5)

Price to Intrinsic Value 0.9587122143

<1 Sales 20449 Long Term Debt Net Income ($ 71.0) ($ 75.7) ($ 55.4) ($ 54.7) ($ 136.1) ($ (67.5) ($ (52.1)

Short Term Debt 120.5 Total Assets ($ 737.1) ($ 828.0) ($ 876.3) ($ 995.6) ($1,304.8) ($1,281.9) ($1,316.1)

Inventory 3274 Shareholders Equity ($ 449.1) ($ 626.7) ($ 668.7) ($ 745.9) ($ 908.2) ($ 852.6) ($ 872.8)

Price 78.02

Intrinsic Value 81.38 Three-Step DuPont Model:

Net Profit Margin (Net Income ÷ Sales) 5.9% 5.4% 3.8% 3.8% 6.8% -4.2% -3.6%

Asset Turnover (Sales ÷ Total Assets) 1.64 1.68 1.64 1.44 1.54 1.26 1.11

Equity Multiplier (Total Assets ÷ Shareholders Equity) 1.64 1.32 1.31 1.33 1.44 1.50 1.51

Return on Equity 15.8% 12.1% 8.3% 7.3% 15.0% -7.9% -6.0%

Five-Step DuPont Model:

Tax Burden (Net Income ÷ EBT) 0.63 0.64 0.91 0.77 0.69 0.51 0.57

Interest Burden (EBT ÷ EBIT) 0.92 0.96 0.93 0.96 0.98 1.06 1.15

Operating Income Margin (EBIT ÷ Sales) 10.1% 8.8% 4.5% 5.2% 9.9% -7.6% -5.5%

Asset Turnover (Sales ÷ Total Assets) 1.64 1.68 1.64 1.44 1.54 1.26 1.11

Equity Multiplier (Total Assets ÷ Shareholders Equity) 1.64 1.32 1.31 1.33 1.44 1.50 1.51

Return on Equity 15.8% 12.1% 8.3% 7.3% 15.0% -7.9% -6.0%

AAPL

Cash Converstion Cycle -51.98 Lower Better need to compare to similar companies

Cash Return on Invested Capital 44.00% >13%

EV/EBIT 11.49 10x

FCF to Revenue 24.00% Higer Better >10%

FCF to Short Term Debt 3.75 Ratio >1

Inventory Turnover 59.89 Compare to Same Industry higher better

EBIT/Enterprise Value 8.70% >=10% Tell is undervalued

Price to Intrinsic Value 0.8 <1

APOG

Cash Converstion Cycle 63 Lower Better need to compare to similar companies

Cash Return on Invested Capital 23.17% >13%

EV/EBIT 13.40163934

10x

FCF to Revenue 4.52% Higer Better >10%

FCF to Short Term Debt 5.95 Ratio >1

Inventory Turnover 2.84 Compare to Same Industry higher better

EBIT/Enterprise Value 7.46% >=10% Tell is undervalued

Price to Intrinsic Value 2 <1 Intrinsic Value: Projected FCF

Das könnte Ihnen auch gefallen

- JobimDokument69 SeitenJobimMichael Jacopino100% (2)

- Introduction To Business Valuation: February 2013Dokument66 SeitenIntroduction To Business Valuation: February 2013Nguyen Hoang Phuong100% (3)

- Intrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Dokument41 SeitenIntrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Clarence Ryan100% (2)

- Flash - Memory - Inc From Website 0515Dokument8 SeitenFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- IBIG 04 04 Equity Value Enterprise Value Metrics MultiplesDokument95 SeitenIBIG 04 04 Equity Value Enterprise Value Metrics MultiplesGabriel La MottaNoch keine Bewertungen

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDokument24 SeitenWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668Noch keine Bewertungen

- Harvard Case Study - Flash Inc - AllDokument40 SeitenHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- Copal Partners ModuleDokument210 SeitenCopal Partners ModulescribedheenaNoch keine Bewertungen

- DCF Model - Power Generation: Strictly ConfidentialDokument5 SeitenDCF Model - Power Generation: Strictly ConfidentialAbhishekNoch keine Bewertungen

- Ferrari Case - C4Dokument7 SeitenFerrari Case - C4George KangasNoch keine Bewertungen

- Ch11 Tool KitDokument368 SeitenCh11 Tool KitRoy HemenwayNoch keine Bewertungen

- NBA Happy Hour Co - DCF Model - Task 4 - Revised TemplateDokument10 SeitenNBA Happy Hour Co - DCF Model - Task 4 - Revised Templateww weNoch keine Bewertungen

- The Complete Investment Banker ExtractDokument19 SeitenThe Complete Investment Banker ExtractJohn MathiasNoch keine Bewertungen

- Millions of Dollars Except Per-Share DataDokument17 SeitenMillions of Dollars Except Per-Share DataWasp_007_007Noch keine Bewertungen

- Assumptions: DCF ModelDokument3 SeitenAssumptions: DCF Modelniraj kumarNoch keine Bewertungen

- Project NPV Sensitivity AnalysisDokument54 SeitenProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- 101 Investment Banking Interview Questions & Answers: Ca Monk'SDokument27 Seiten101 Investment Banking Interview Questions & Answers: Ca Monk'Smanish bhardwajNoch keine Bewertungen

- Dcf-Analysis Calculator (Edit Items in Blue)Dokument4 SeitenDcf-Analysis Calculator (Edit Items in Blue)Christopher GuidryNoch keine Bewertungen

- Financial-Forecast AFN FinMgmt 13e BrighamDokument19 SeitenFinancial-Forecast AFN FinMgmt 13e BrighamRimpy SondhNoch keine Bewertungen

- Financial Statements Analysis Case StudyDokument15 SeitenFinancial Statements Analysis Case StudyNelly Yulinda50% (2)

- Company Valuation Based On Ev/ebitda and Ev/ebit Multiples: A Case Study of A Brazilian Mining CompanyDokument55 SeitenCompany Valuation Based On Ev/ebitda and Ev/ebit Multiples: A Case Study of A Brazilian Mining CompanyRicardo AlvesNoch keine Bewertungen

- Ch02 Tool KitDokument18 SeitenCh02 Tool KitPopsy AkinNoch keine Bewertungen

- Skechers USA Inc. (SKX) : (Net Income ÷ Sales) (Sales ÷ Total Assets) (Total Assets ÷ Shareholders Equity)Dokument2 SeitenSkechers USA Inc. (SKX) : (Net Income ÷ Sales) (Sales ÷ Total Assets) (Total Assets ÷ Shareholders Equity)AndrianaAndina100% (1)

- 2019-09-21T174353.577Dokument4 Seiten2019-09-21T174353.577Mikey MadRat100% (1)

- Chapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesDokument14 SeitenChapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesAnshumaan SinghNoch keine Bewertungen

- Sea Limited NYSE SE FinancialsDokument36 SeitenSea Limited NYSE SE FinancialsAdrian KurniaNoch keine Bewertungen

- Latihan Bab 3Dokument19 SeitenLatihan Bab 3Noura AdriantyNoch keine Bewertungen

- ESTI - Annual Report 2012Dokument127 SeitenESTI - Annual Report 2012Liem Linda100% (1)

- Safari - 26-Feb-2018 at 3:42 PM-1Dokument1 SeiteSafari - 26-Feb-2018 at 3:42 PM-1Hesamuddin KhanNoch keine Bewertungen

- Nerolac - On Ratio - SolvedDokument6 SeitenNerolac - On Ratio - Solvedricha krishnaNoch keine Bewertungen

- Stitch Fix Inc NasdaqGS SFIX FinancialsDokument41 SeitenStitch Fix Inc NasdaqGS SFIX FinancialsanamNoch keine Bewertungen

- Nerolac - Solution PDFDokument5 SeitenNerolac - Solution PDFricha krishnaNoch keine Bewertungen

- The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94Dokument3 SeitenThe Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94NarinderNoch keine Bewertungen

- Inputs: If No, Enter The Inputs For The CAPMDokument7 SeitenInputs: If No, Enter The Inputs For The CAPMTheris FlorenciaNoch keine Bewertungen

- Tool Kit For Advanced Issues in Financial Forecasting: Income Statement (In Millions of Dollars)Dokument3 SeitenTool Kit For Advanced Issues in Financial Forecasting: Income Statement (In Millions of Dollars)Thiện NhânNoch keine Bewertungen

- Discounted Cash Flow Model (TEMPLATE)Dokument1 SeiteDiscounted Cash Flow Model (TEMPLATE)Ignacio de DiegoNoch keine Bewertungen

- ANS #3 Ritik SehgalDokument10 SeitenANS #3 Ritik Sehgaljasbir singhNoch keine Bewertungen

- Inputs: FCFF Stable Growth ModelDokument12 SeitenInputs: FCFF Stable Growth ModelKojiro FuumaNoch keine Bewertungen

- Cash Return On Invested CapitalDokument8 SeitenCash Return On Invested CapitalMichael JacopinoNoch keine Bewertungen

- Practice Exercise - Berger PaintsDokument8 SeitenPractice Exercise - Berger PaintsKARIMSETTY DURGA NAGA PRAVALLIKANoch keine Bewertungen

- Barry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Dokument11 SeitenBarry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Akuw AjahNoch keine Bewertungen

- Standalone Profit & Loss Account: Profitability On Stock Price With Reference To NiftyDokument3 SeitenStandalone Profit & Loss Account: Profitability On Stock Price With Reference To Niftyneekuj malikNoch keine Bewertungen

- FM and Dupont of GenpactDokument11 SeitenFM and Dupont of GenpactKunal GarudNoch keine Bewertungen

- Vijay Fpm17017Dokument16 SeitenVijay Fpm17017Vijay SinghNoch keine Bewertungen

- Lesson 3Dokument29 SeitenLesson 3Anh MinhNoch keine Bewertungen

- Fin 465 Case 45Dokument10 SeitenFin 465 Case 45MuyeedulIslamNoch keine Bewertungen

- DCF Template: Start StepDokument11 SeitenDCF Template: Start StepBrian DongNoch keine Bewertungen

- This Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementDokument74 SeitenThis Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementRikhabh DasNoch keine Bewertungen

- BREIT Monthly Performance - February 2020Dokument26 SeitenBREIT Monthly Performance - February 2020MAYANK AGGARWALNoch keine Bewertungen

- Group 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Dokument20 SeitenGroup 2: Mr. Sandeep Bhabal 104 Mr. Shailesh Devadiga 114 Mr. Natraj Korgaonkar 128 Mr. S. Mathivannan 145 Mr. Vinit N Shah 150 Mr. Anoop Warrier 159Reeja Mariam MathewNoch keine Bewertungen

- Financial HighlightsDokument4 SeitenFinancial HighlightsmomNoch keine Bewertungen

- Qualitative BasicsDokument17 SeitenQualitative BasicsJosé Manuel EstebanNoch keine Bewertungen

- Financial Statements Analysis Case StudyDokument15 SeitenFinancial Statements Analysis Case Studyดวงยี่หวา จิระวงศ์สันติสุขNoch keine Bewertungen

- High GrowthDokument30 SeitenHigh GrowthAbhinav PandeyNoch keine Bewertungen

- LORL Write UpDokument5 SeitenLORL Write UpAIGswap100% (1)

- 4Q FY 2015 Press Release FinancialsDokument4 Seiten4Q FY 2015 Press Release Financialspedro_noiretNoch keine Bewertungen

- Final Project 2 ExcelDokument18 SeitenFinal Project 2 Excelapi-254922565Noch keine Bewertungen

- Module-9and10 Additional Material FSA Template - Session-11and12 1yTJNk93rUDokument9 SeitenModule-9and10 Additional Material FSA Template - Session-11and12 1yTJNk93rUBhavya PatelNoch keine Bewertungen

- DCF Template: Exit MultipleDokument11 SeitenDCF Template: Exit MultipleShane BrooksNoch keine Bewertungen

- Lady M ValuationDokument3 SeitenLady M Valuationsairaj bhatkarNoch keine Bewertungen

- Fin Ratio AnalysisDokument43 SeitenFin Ratio AnalysisMadiha ZamanNoch keine Bewertungen

- 1Q23 - Trending SchedulesDokument11 Seiten1Q23 - Trending SchedulesStephano Gomes GabrielNoch keine Bewertungen

- Ratio and Income and Balance SheetDokument12 SeitenRatio and Income and Balance SheetJerry RodNoch keine Bewertungen

- Group2 - Assignment 1Dokument9 SeitenGroup2 - Assignment 1RiturajPaulNoch keine Bewertungen

- Cash FlowDokument1 SeiteCash FlowZhane Ann TizonNoch keine Bewertungen

- Input Page: Market Inputs For Your Company From The Balance SheetDokument20 SeitenInput Page: Market Inputs For Your Company From The Balance SheetLevy ANoch keine Bewertungen

- Pine Valley Funiture Economic Feasibility Analysis Customer Tracking System ProjectDokument5 SeitenPine Valley Funiture Economic Feasibility Analysis Customer Tracking System ProjectliorklaNoch keine Bewertungen

- Enph EstimacionDokument38 SeitenEnph EstimacionPablo Alejandro JaldinNoch keine Bewertungen

- Valuation+ +excel+ +students+Dokument4 SeitenValuation+ +excel+ +students+snigdha.sanaboinaNoch keine Bewertungen

- Handbook of Capital Recovery (CR) Factors: European EditionVon EverandHandbook of Capital Recovery (CR) Factors: European EditionNoch keine Bewertungen

- Cash Return On Invested CapitalDokument8 SeitenCash Return On Invested CapitalMichael JacopinoNoch keine Bewertungen

- ThermostatDokument1 SeiteThermostatMichael JacopinoNoch keine Bewertungen

- Emmanuel-Michael W SmithDokument5 SeitenEmmanuel-Michael W SmithMichael JacopinoNoch keine Bewertungen

- Precedent Transaction AnalysisDokument6 SeitenPrecedent Transaction AnalysisAli Gokhan KocanNoch keine Bewertungen

- Chapter12 - Estimating Cost of CapitalDokument29 SeitenChapter12 - Estimating Cost of CapitalAntonio Jose DuarteNoch keine Bewertungen

- Module 2 - Intrinsic ValuationDokument11 SeitenModule 2 - Intrinsic ValuationLara Camille CelestialNoch keine Bewertungen

- Round 2Dokument68 SeitenRound 2fereNoch keine Bewertungen

- Saudi Cement Sector - Cementing The Future - 2023 ReportDokument39 SeitenSaudi Cement Sector - Cementing The Future - 2023 Reportkhizar.zubairiNoch keine Bewertungen

- DCF Valuation Model (EV and PE) : Free Cash Flow (FCF)Dokument15 SeitenDCF Valuation Model (EV and PE) : Free Cash Flow (FCF)Jeniffer RayenNoch keine Bewertungen

- LBO Value Creation AnalysisDokument3 SeitenLBO Value Creation AnalysismikeNoch keine Bewertungen

- 01 Valuation ModelsDokument24 Seiten01 Valuation ModelsMarinaGorobeţchiNoch keine Bewertungen

- Pertanyaan InterviewDokument13 SeitenPertanyaan InterviewYusuf RaharjaNoch keine Bewertungen

- Valutazionestart Up (Def)Dokument32 SeitenValutazionestart Up (Def)Alberto CancliniNoch keine Bewertungen

- Arise AB (ARISE) : Financial and Strategic SWOT Analysis ReviewDokument34 SeitenArise AB (ARISE) : Financial and Strategic SWOT Analysis ReviewPartha SarathyNoch keine Bewertungen

- Educational Material - ICAI Valuation Standard 103 - Valuation Approaches and MethodsDokument172 SeitenEducational Material - ICAI Valuation Standard 103 - Valuation Approaches and MethodsJishnuNichinNoch keine Bewertungen

- Course Title: Value Investing: An Introduction Course Code: BUS 123 W Instructor Name: Kenneth Jeffrey MarshallDokument3 SeitenCourse Title: Value Investing: An Introduction Course Code: BUS 123 W Instructor Name: Kenneth Jeffrey MarshallSumit SagarNoch keine Bewertungen

- Mid Term Exam 20-10-2017 SolutionsDokument28 SeitenMid Term Exam 20-10-2017 SolutionsfabriNoch keine Bewertungen

- FIN924 Workshop Topic 1Dokument37 SeitenFIN924 Workshop Topic 1Yugiii YugeshNoch keine Bewertungen

- Case Study 15112019a TOFLDokument5 SeitenCase Study 15112019a TOFLSunny SouravNoch keine Bewertungen

- Running Head: RESEARCH PAPER 1: Name Institutional Affiliation DateDokument5 SeitenRunning Head: RESEARCH PAPER 1: Name Institutional Affiliation DateSana FarhanNoch keine Bewertungen

- Chapter 20 - MenbiDokument41 SeitenChapter 20 - MenbiMayadianaSugondo100% (1)

- Zooplus Research NoteDokument1 SeiteZooplus Research Noteapi-249461242Noch keine Bewertungen

- Corporate Presentation: Updated 1T15Dokument40 SeitenCorporate Presentation: Updated 1T15Yanelis AguilarNoch keine Bewertungen