Beruflich Dokumente

Kultur Dokumente

10 Portfolio Returns

Hochgeladen von

Manali PadaleCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

10 Portfolio Returns

Hochgeladen von

Manali PadaleCopyright:

Verfügbare Formate

MBA 19-21

IMD / OPTS501

Suresh Venkatraman

Pre Reading for class of 14th August

Sunday, August 11, 2019 Portfolio Returns 1 of 10

Portfolio Returns MBA 19-21

IMD / OPTS501

Suresh Venkatraman

◼ Investment opportunities often use both:

❑ Expected return as a measure of reward.

Pre Reading for class of 14th August

❑ Variance or standard deviation of return as a measure of risk.

◼ Portfolio is defined as a collection of assets such as stocks and bonds.

❑ Let X and Y represent two random variables, denoting, say, the

returns of two assets.

❑ Since an investor may have invested in both assets, we would like

to evaluate the portfolio return formed by a linear combination of

X and Y.

Sunday, August 11, 2019 Portfolio Returns 2 of 10

Portfolio Returns MBA 19-21

IMD / OPTS501

Suresh Venkatraman

◼ Properties of random variables useful in evaluating portfolio

returns.

Pre Reading for class of 14th August

❑ Given two random variables X and Y,

◼ The expected value of X + Y is

E ( X + Y ) = E ( X ) + E (Y )

◼ The variance of X + Y is

Var ( X + Y ) = Var ( X ) + Var (Y ) + 2Cov ( X ,Y )

where Cov(X,Y) is the covariance between X and Y.

Sunday, August 11, 2019 Portfolio Returns 3 of 10

Portfolio Returns MBA 19-21

IMD / OPTS501

Suresh Venkatraman

◼ Properties of random variables useful in evaluating portfolio

returns.

Pre Reading for class of 14th August

❑ Given two random variables X and Y, and the constants a, and b

◼ The expected value of aX + bY is

E ( aX + bY ) = aE ( X ) + bE (Y )

◼ The variance of aX + bY is

Var ( aX + bY ) = a2Var ( X ) + b2Var (Y ) + 2abCov ( X ,Y )

where Cov(X,Y) is the covariance between X and Y

Sunday, August 11, 2019 Portfolio Returns 4 of 10

Portfolio weights MBA 19-21

IMD / OPTS501

Suresh Venkatraman

❑ Given a portfolio with two assets, Asset A and Asset B,

❑ the expected return of the portfolio E(Rp) is computed as:

Pre Reading for class of 14th August

E ( Rp ) = w AE ( RA ) + w B E ( RB )

◼ wA and wB are the portfolio weights

◼ such that wA + wB = 1

◼ E(RA) and E(RB) are the expected returns on assets A and B,

respectively.

Sunday, August 11, 2019 Portfolio Returns 5 of 10

Portfolio weights MBA 19-21

IMD / OPTS501

Suresh Venkatraman

❑ Using the covariance or the correlation coefficient of the two

returns, the portfolio variance of return is:

Pre Reading for class of 14th August

Var ( Rp ) = w A 2s A 2 + w B 2s B 2 + 2w Aw B r ABs As B

❑ where s2A and s2B are the variances of the returns for Asset A and

Asset B, respectively,

❑ rAB is the correlation coefficient between the returns for Asset A

and Asset B.

❑ the term rAB σA σB is the covariance between the returns for

Asset A and Asset B

Sunday, August 11, 2019 Portfolio Returns 6 of 10

Stock market problem MBA 19-21

IMD / OPTS501

Suresh Venkatraman

◼ Example: Consider an investment portfolio of $40,000 in

Stock A and $60,000 in Stock B.

Pre Reading for class of 14th August

❑ Given the following information, calculate the expected

return of this portfolio.

Sunday, August 11, 2019 Portfolio Returns 7 of 10

Solution to Stock market MBA 19-21

IMD / OPTS501

problem Suresh Venkatraman

Pre Reading for class of 14th August

Sunday, August 11, 2019 Portfolio Returns 8 of 10

Solution to Stock market MBA 19-21

IMD / OPTS501

problem Suresh Venkatraman

◼ Consider an investment portfolio of $40,000 in Stock A and $60,000 in

Stock B.

Pre Reading for class of 14th August

Calculate the portfolio variance.

❑ Solution:

Sunday, August 11, 2019 Portfolio Returns 9 of 10

Solution to Stock market MBA 19-21

IMD / OPTS501

problem Suresh Venkatraman

◼ Example: Consider an investment portfolio of $40,000 in

Stock A and $60,000 in Stock B.

Pre Reading for class of 14th August

❑ Calculate the portfolio standard deviation.

❑ Solution:

Sunday, August 11, 2019 Portfolio Returns 10 of 10

Das könnte Ihnen auch gefallen

- 2019-20 State Assessments CalendarsDokument1 Seite2019-20 State Assessments Calendarsapi-327671708Noch keine Bewertungen

- Definition of Work: Engineering MechanicsDokument12 SeitenDefinition of Work: Engineering MechanicsJAYNoch keine Bewertungen

- ITM Universe, Vadodara AUTOMOBILE Engg. Department: Room-EB - 13 Time TableDokument3 SeitenITM Universe, Vadodara AUTOMOBILE Engg. Department: Room-EB - 13 Time TableEr Samkit ShahNoch keine Bewertungen

- 5 Portfolio TheoryDokument15 Seiten5 Portfolio TheoryUtkarsh BhalodeNoch keine Bewertungen

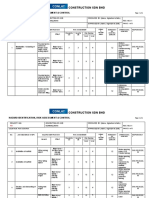

- Construction SDN BHD: Hazard Identification, Risk Assessment & ControlDokument4 SeitenConstruction SDN BHD: Hazard Identification, Risk Assessment & Controlsafety_hunterNoch keine Bewertungen

- Risk and Return NewDokument34 SeitenRisk and Return NewTushar AroraNoch keine Bewertungen

- EE124 Lecture 27 Stability and Review May 11 Spring 2020 Annotated PDFDokument14 SeitenEE124 Lecture 27 Stability and Review May 11 Spring 2020 Annotated PDFSabeeq KarimNoch keine Bewertungen

- ACFI2070 Module 3 Part 1 SlidesDokument35 SeitenACFI2070 Module 3 Part 1 SlidesJacx 'sNoch keine Bewertungen

- Financial Management I (ACFN 3041) : Risk and ReturnDokument55 SeitenFinancial Management I (ACFN 3041) : Risk and ReturnLakachew GetasewNoch keine Bewertungen

- Economics 2010c - Lecture 7 Asset Pricing PDFDokument15 SeitenEconomics 2010c - Lecture 7 Asset Pricing PDFSiwon C.Noch keine Bewertungen

- 2020week 5a ch11 12Dokument64 Seiten2020week 5a ch11 12Cecile KotzeNoch keine Bewertungen

- ASTLec b15 ASymmetricBending HDokument4 SeitenASTLec b15 ASymmetricBending HParth GaikwadNoch keine Bewertungen

- Board of Intermediate & Secondary Education Rawalpindi NotificationDokument1 SeiteBoard of Intermediate & Secondary Education Rawalpindi NotificationadilNoch keine Bewertungen

- Steel YardDokument6 SeitenSteel YardAtiq ShaikhNoch keine Bewertungen

- Finance ReviewDokument18 SeitenFinance ReviewZahidul IslamNoch keine Bewertungen

- Basics of Algebraic Geometry.Dokument17 SeitenBasics of Algebraic Geometry.anjan samantaNoch keine Bewertungen

- Portfolio Risk and Return Part 1Dokument34 SeitenPortfolio Risk and Return Part 1Frédé AmouNoch keine Bewertungen

- 01 Why Probability Distributions PDFDokument6 Seiten01 Why Probability Distributions PDFManali PadaleNoch keine Bewertungen

- Building An Organisation's Information SystemDokument28 SeitenBuilding An Organisation's Information SystemManali PadaleNoch keine Bewertungen

- Building An Organisation's Information SystemDokument28 SeitenBuilding An Organisation's Information SystemManali PadaleNoch keine Bewertungen

- Eileen FisherDokument3 SeitenEileen FisherManali Padale50% (2)

- In Search of The Hybrid IdealDokument7 SeitenIn Search of The Hybrid IdealHob DuNoch keine Bewertungen

- Advanced AccountsDokument90 SeitenAdvanced Accountsaryac4Noch keine Bewertungen

- Commonly Used Multiples in IndustryDokument24 SeitenCommonly Used Multiples in IndustryRishabh GuptaNoch keine Bewertungen

- Renko Chart Analysis - Part IDokument46 SeitenRenko Chart Analysis - Part IPriyesh Mandhanya100% (12)

- Comparative Ratio Analysis of Britannia and CadburymustafaDokument19 SeitenComparative Ratio Analysis of Britannia and CadburymustafaMustafa LokhandwalaNoch keine Bewertungen

- BIMBSec - Dayang Initial Coverage - 020412Dokument9 SeitenBIMBSec - Dayang Initial Coverage - 020412Bimb SecNoch keine Bewertungen

- Benefits of Cross Border ListingDokument5 SeitenBenefits of Cross Border ListingDharvesh KomulNoch keine Bewertungen

- FI-Training OverviewDokument78 SeitenFI-Training OverviewMajut AlenkNoch keine Bewertungen

- 16 Ways To Find Undervalued StocksDokument14 Seiten16 Ways To Find Undervalued Stockscurrygoat100% (1)

- Satyam: "Sinking Ship or Tip of Iceberg"Dokument22 SeitenSatyam: "Sinking Ship or Tip of Iceberg"sublaxmiNoch keine Bewertungen

- Chapter 1 - PretestDokument97 SeitenChapter 1 - PretestJuvy LagardeNoch keine Bewertungen

- Chartians Thread TivitikoDokument8 SeitenChartians Thread TivitikoPawan ChaturvediNoch keine Bewertungen

- Kuala Lumpur Stock Exchange KLSE MESDAQ - 11-Sep-08Dokument1 SeiteKuala Lumpur Stock Exchange KLSE MESDAQ - 11-Sep-08STTINoch keine Bewertungen

- PVB V CallanganDokument2 SeitenPVB V CallanganninaNoch keine Bewertungen

- Acc Assignment 2 Hasan Ahmed 321600 Bese10ADokument9 SeitenAcc Assignment 2 Hasan Ahmed 321600 Bese10AHasan AhmedNoch keine Bewertungen

- OTC Exchange of IndiaDokument2 SeitenOTC Exchange of Indiaarshad89057Noch keine Bewertungen

- By B.P.CHOUDHARY (Tax Consultant) (CA Associate)Dokument17 SeitenBy B.P.CHOUDHARY (Tax Consultant) (CA Associate)Hiren ShahNoch keine Bewertungen

- Phil. Blooming Mills. vs. CA DigestDokument3 SeitenPhil. Blooming Mills. vs. CA DigestJoan Tan-CruzNoch keine Bewertungen

- Wro Industry It (Updated)Dokument105 SeitenWro Industry It (Updated)Shikhar AgarwalNoch keine Bewertungen

- Vishwas's ProjectDokument71 SeitenVishwas's ProjectRAMJI VISHWAKARMANoch keine Bewertungen

- United States Court of Appeals, Ninth CircuitDokument9 SeitenUnited States Court of Appeals, Ninth CircuitScribd Government DocsNoch keine Bewertungen

- Procter Gamble AnalysisDokument37 SeitenProcter Gamble Analysisapi-115328034100% (2)

- Market EfficiencyDokument32 SeitenMarket Efficiencyrobi atmajayaNoch keine Bewertungen

- Enjoy Magazine - May 2019Dokument16 SeitenEnjoy Magazine - May 2019Stanley KellyNoch keine Bewertungen

- Print ChallanDokument1 SeitePrint ChallanAshishGuptaNoch keine Bewertungen

- Whittington Audit Chapter 17 Solutions ManualDokument16 SeitenWhittington Audit Chapter 17 Solutions ManualIam AbdiwaliNoch keine Bewertungen

- Bond Valuation: Case: Atlas InvestmentsDokument853 SeitenBond Valuation: Case: Atlas Investmentsjk kumarNoch keine Bewertungen

- ForexTradingStrategy PDFDokument39 SeitenForexTradingStrategy PDFshyam91% (11)

- MGMT3048 Course Outline SemII 2012Dokument4 SeitenMGMT3048 Course Outline SemII 2012Justine PowellNoch keine Bewertungen

- ADR and GDRDokument43 SeitenADR and GDRsurabhikhanna86675750% (4)