Beruflich Dokumente

Kultur Dokumente

Case Study-501 On ITR-5 DR SB Rathore, Associate Professor, Shyam Lal College

Hochgeladen von

shreya126Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Study-501 On ITR-5 DR SB Rathore, Associate Professor, Shyam Lal College

Hochgeladen von

shreya126Copyright:

Verfügbare Formate

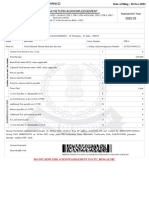

B.Com.

(Hons) II yr, Semester-IV, Academic Year 2018-19 SEC Paper: E-Filing of Returns

Case Study-501 on ITR-5 Dr SB Rathore, Associate Professor, Shyam Lal College

Generate income Tax Return for AY 2018-19 in ITR-5 from the data given below

Name Rathore and Associates

Date of formation 19-Nov-86

Address 25, Saakshara, A-3, Paschim Vihar, New Delhi-110063

PAN AAAFR6835H

Mobile No. 9811116835

Landline number 011-45023899

Residential Status Resident

e-mail ID rathore_incometax@yahoo.co.in

Status Partnership firm (not being LLP)

Return to be filed under which section 139(1), Original Return

Liable to maintain accounts u/s 44AA and Audit u/s 44AB Yes

CA Kapil Singhania, PAN-AAAPS8160R;

Audit u/s 44AB done by

Membership No 986835

Ward/Circle Ward 40(2), Civic Centre, New Delhi-110002

Partners' information

Name of partners Mohd Sajid Shyam Singh Varun Panwar

Date of admission 19-Nov-86 19-Nov-86 19-Nov-86

Percentage of Share 50% 25% 25%

84-A, Gali Shatara, 45/9, Kucha 1129, Asaf Ali

Chawri Bazar, Rehman, Chandni Road, New Delhi-

Residential Address Delhi-110006 Chowk, Delhi- 110002

110006

PAN AANPS5842G AASPS8752C AAXPP4521E

Partner who will verify return Mohd Sajid

Father's Name of Partner to verify return M.A. Ansari

No. of bank accounts held by firm during the previous year Two

Details of bank accounts Punjab National Bank State Bank of India

Account No. 25478963254 32568457824

IFS Code PUNB0466400 SBIN0006623

Type of account Current Current

Refund (if any) to be credited Yes

Date of Filing 30-Sep-18

Place of filing return New Delhi

Income / Expenditure / Investment Details:

Income From House Property

Address of property: 15/25, Kamla Nagar, Delhi-110007. Fully owned by the Firm, Name of the Tenant:

Harish Technology Ltd, Kamla Nagar. Delhi-110007; PAN: AHECH3899K

Rent received from Tenant 18,00,000

Municipal taxes paid by the Firm (Owner) during the previous year 90,000

Interest on capital borrowed for Purchase of property 4,50,000

Tax deducted by the Tenant (DELH16835A) as per section 194I 180000

Capital Gain

Sale of Plot of Land CII (FY 2017-18) 272 31/10/2017 60,00,000

Stamp duty value 61,80,000

Expenditure on transfer 60,000

Plot was purchased during FY 1989-90 1,50,000

FMV of the Plot as on 01-04-01 CII (FY 2001-02) 100 3,00,000

Investment in NHAI's Capital Gain Bonds 05/03/2018 36,00,000

Income from other sources

Birthday Gift to Sajid (Partner) by Varun (Partner) 1,20,000

Interest on Fixed Deposits 12,000

Donation to Opposition Political party (Included in other expenses in P & L A/c ) 1,20,000

Advance tax / Self assessment tax paid by the Firm

Tax paid on 10-09-2017 (BSR Code of SBI 0006623 ,Challan No.: 00001 3,00,000

Tax paid on 31-03-2018 (BSR Code of SBI 0006623 ,Challan No.: 00011 3,75,000

Income from Trading Business (Books of account maintained) Code No. 09010

Profit and Loss Account for the year ending 31-03-2018

Opening stock 16,83,000 Gross Turnover 1,50,00,000

Purchases 78,75,000 Excise duty Received 1,50,000

Excise duty on goods purchased 83,750 IGST Received 1,72,500

IGST in respects of goods 92,125 Closing Stock 15,30,000

Freight 43,125

Power and Fuel 8,625

Rent of office and Godown 51,750

Repair (Building) 47,438

Repair (Machinery) 75,000

Salary to employees 22,50,000

General insurance 10,625

Entertainment 1,26,750

Sales Promotion expenses 1,20,000

Newspaper/ Advertisement 2,70,000

Commission 37,500

Domestic Travel 1,57,500

Telephone/internet 60,000

Festival expenses 33,750

Gift to distributors 2,40,000

Audit fees 22,500

Depreciation 3,28,860

Intt on capital to partners(@ 14% 4,20,000

Remuneration to Partners (Rs 50,000

per partner per month) 18,00,000

Other expenses 8,65,000

Net Profit 1,50,202

1,68,52,500 1,68,52,500

Other Information

(1) Other expenses include a cash payment to a supplier 45,000

(2) Tax is not deducted at source in respect of payment of rent of office and godown 51,750

(3) Income tax paid as advance tax is included in other expenses. 6,75,000

(4) During the year, the firm paid Excise Duty of FY 2015-16. It was not allowed then

as per u/s 43B on account of non payment. 10,000

(5) Following information in regard to depreciation on the Assets

Plant & Machinery Computer

Depreciated value 01/04/2017 12,00,000 1,80,000

Add: Original cost of assets acquired 01/05/2017 2,40,000 36,000

Less: Sale proceeds of assets 31/05/2017 72,000 10,800

Add: Original cost of assets acquired 23/10/2017 1,44,000 21,600

Written down value 31/03/2018 15,12,000 2,26,800

(7) New Plant & Machinery (if any) purchased by 15-08-17 is qualified for additional depreciation @ 20% .

This additional depreciation is not available in respect of Computer.

Balance Sheet as on 31-03-2018

Capital account of Closing Stock 15,30,000

Mohd Sajid 15,00,000 Sundry debtors 52,50,000

Shyam Singh 7,50,000 Depreciable assets 17,38,800

Varun Panwar 7,50,000 Investment in Shares 22,50,000

Sundry Creditors 1,50,84,175 Bank Balance 68,05,000

Cash balance 5,10,375

1,80,84,175 1,80,84,175

Compiled by Dr SB Rathore 9811116835 rathore_incometax@yahoo.co.in www.taxclasses.in

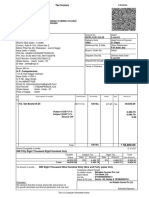

Tax Calculations -Case Study 501 (ITR-5) Dr SB Rathore, Associate Professor, SLC

Income from House Property

Rent Received GAV 18,00,000

Less Local Taxes paid 90,000

NAV 17,10,000

Less Repairs 5,13,000

Less Intt on Loan 4,50,000 9,63,000 7,47,000

Capital Gains

272 Sale of Plot 31-Oct-17 61,80,000

Less Exp -60,000

100 FMV as on 01-04-01 01-Apr-01 -8,16,000

53,04,000

Less Exemption u/s 54EC 36,00,000 17,04,000

Other Sources

Birthday Gift to Sajid (Partner's ITR)

FDR Intt (Taxable) 12,000

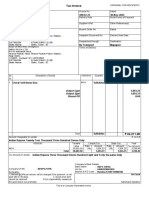

Income from Business / Profession

Book Profit as per P & L A/c 28,18,662

Partners' Remuneration Allowed as per

40(b) on Book Profit First Rs. 300000 (90%

or 150000); Balance @ 60%

17,81,197 10,37,465

NP as per P & L A/c 1,50,202

OI-8Ae Exps Disallowed (Tax) 6,75,000 Auto BP-16

OI-9b Exps Disallowed (Cash) 45,000 Auto BP-17

OI-8B Excise Duty of FY 15-16 -10,000 Auto BP-30

BP-11 Depreciation Added 3,28,860 Auto from P & L

BP-12(i) Dep Allowed -3,50,400 Auto from DEP

OI-7c Donation Political 1,20,000 Auto BP-15

OI-8Ah Excess Intt on Cap 60,000 Auto BP-16

Adjusted profit 10,18,662

Add Remu paid 18,00,000

Book profit 28,18,662

Sec 40(b)

First Rs. 300000 2,70,000

Balance @ 60% 15,11,197

Remu Allowed u/s 40(b) 17,81,197

Gross Total Income 35,00,465

Less 80GGC 1,20,000

Total Income Rounded by 10 33,80,470

Normal Tax 30% 5,02,941

Special Tax (LTCG) 20% 3,40,800

8,43,741

Add Edu Cess 3% 25,312

Tax Liability 8,69,053

TDS by Tenant 1,80,000

Advance Tax 6,75,000 8,55,000

Bal Tax Payable 14,053

Late Fees u/s 234F 10000

Rounded by 10 Total Tax Payable 24,050

15% 40%

Plant & Mach Computer

Dep Full 2,05,200 82,080

Dep Half 10,800 4,320

Add Dep 20% 48,000

2,64,000 86,400 3,50,400

1 Intt on Capital to Partners

Manually- P & L A/c at 44(ii)(a)

2 Remuneration to Partners

Auto from Gen (2) to P & L A/c at S No. 38 but Editable

3 Excess Intt on Capital Self-Calculation

Manually- OI at S.No. 8A (h) u/s 40(b)

4 Excess - Partners' Remuneration Self-Calculation

Manually- OI at S.No. 8A (h) u/s 40(b)

Das könnte Ihnen auch gefallen

- The Birth Certificate - Definition of Certificate - Freedom DocumentsDokument11 SeitenThe Birth Certificate - Definition of Certificate - Freedom DocumentsKeke LeBron100% (6)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNoch keine Bewertungen

- 1 1 PDFDokument6 Seiten1 1 PDFKarthik Clinical LabNoch keine Bewertungen

- Aug PDFDokument1 SeiteAug PDFRNoch keine Bewertungen

- Oi Pulse Manual FileDokument257 SeitenOi Pulse Manual FileManish BarnwalNoch keine Bewertungen

- ColgateDokument1 SeiteColgatekokila infraltdNoch keine Bewertungen

- March PDFDokument1 SeiteMarch PDFRNoch keine Bewertungen

- Cash BookDokument2 SeitenCash BookfelixmuyoveNoch keine Bewertungen

- Receipt Doc PDFDokument1 SeiteReceipt Doc PDFPraveen Cyssan0% (1)

- TAX 1 - Income Tax - 1Dokument8 SeitenTAX 1 - Income Tax - 1Yella Mae Pariña RelosNoch keine Bewertungen

- Bill Sample of CementDokument2 SeitenBill Sample of Cementshadanjamia96Noch keine Bewertungen

- Gannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadDokument1 SeiteGannon Dunkerley & Co., LTD.: Civil Engineering Division, HyderabadNaga GeeNoch keine Bewertungen

- Ind AS 36Dokument37 SeitenInd AS 36rajan tiwariNoch keine Bewertungen

- Ponugoti Manga Itr 2022Dokument4 SeitenPonugoti Manga Itr 2022Neduri Kalyan SrinivasNoch keine Bewertungen

- (CB MODULE) Module 3 - Problem 3.1 To 3.20 Answer Keys (Pages 156 To 167)Dokument29 Seiten(CB MODULE) Module 3 - Problem 3.1 To 3.20 Answer Keys (Pages 156 To 167)Grace Alipoyo Fortuito-tanNoch keine Bewertungen

- Buyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryDokument1 SeiteBuyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryPAPPU RANJITH KUMARNoch keine Bewertungen

- Maharashtra State Electricity Distribution Co. LTDDokument2 SeitenMaharashtra State Electricity Distribution Co. LTDsumedhshetyeNoch keine Bewertungen

- Case Study 22 - Question - PDFDokument3 SeitenCase Study 22 - Question - PDFDivya MalooNoch keine Bewertungen

- Rajesh DwivediDokument25 SeitenRajesh Dwivediblack kobraNoch keine Bewertungen

- Color Sac-0025-1Dokument1 SeiteColor Sac-0025-1krishnaNoch keine Bewertungen

- Incomw Tax Practical QuestionDokument2 SeitenIncomw Tax Practical Questionnikhilnexus22Noch keine Bewertungen

- Set VIDokument2 SeitenSet VIArihant DagaNoch keine Bewertungen

- Digitally Signed Tender Document Non Working Relative Undertaking ESIC EPFO RegistrationDokument288 SeitenDigitally Signed Tender Document Non Working Relative Undertaking ESIC EPFO RegistrationOkram RishiNoch keine Bewertungen

- Airconsystems (I) : PVT - LTDDokument1 SeiteAirconsystems (I) : PVT - LTDDinesh VallechaNoch keine Bewertungen

- Poonam Bharti 21-22 (2 Files Merged)Dokument4 SeitenPoonam Bharti 21-22 (2 Files Merged)Abhay AnkitNoch keine Bewertungen

- Computation Revised DeepakDokument3 SeitenComputation Revised DeepakRaghav SharmaNoch keine Bewertungen

- J Compu 2022-23Dokument2 SeitenJ Compu 2022-23prabhjeet singh antalNoch keine Bewertungen

- TallyDokument8 SeitenTallyHarsh GuptaNoch keine Bewertungen

- KP ComDokument1 SeiteKP ComAdvocate Harish KashyapNoch keine Bewertungen

- Indo PacksDokument1 SeiteIndo PacksChandan SharmaNoch keine Bewertungen

- Sys PC101 PDFDokument3 SeitenSys PC101 PDFRaj EevNoch keine Bewertungen

- Chaganti Maheswara Reddy 21-22Dokument5 SeitenChaganti Maheswara Reddy 21-22cherrylucky81Noch keine Bewertungen

- Computation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Dokument5 SeitenComputation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Yogesh SainiNoch keine Bewertungen

- Form 16: TLG India Private LimitedDokument9 SeitenForm 16: TLG India Private LimitedcagopalofficebackupNoch keine Bewertungen

- Taxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347Dokument11 SeitenTaxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347ashishchafle007Noch keine Bewertungen

- Scfo Pi .01Dokument1 SeiteScfo Pi .01RiaZ MoHamMaDNoch keine Bewertungen

- 0469 MihamaDokument1 Seite0469 Mihamasaurav royNoch keine Bewertungen

- ACT - NET BillDokument2 SeitenACT - NET Billsourav84Noch keine Bewertungen

- Garg JJ400276 - 9045101903Dokument2 SeitenGarg JJ400276 - 9045101903Sanju DhatwaliaNoch keine Bewertungen

- 7 AhplDokument1 Seite7 AhplRahul SahooNoch keine Bewertungen

- Dt. 07.07.2020Dokument2 SeitenDt. 07.07.2020DHANU DANGINoch keine Bewertungen

- Problems - Cash FlowDokument5 SeitenProblems - Cash FlowKevin JoyNoch keine Bewertungen

- Computation of Total Income Income From House Property (Chapter IV C) 372534 1Dokument4 SeitenComputation of Total Income Income From House Property (Chapter IV C) 372534 1ramanNoch keine Bewertungen

- ForwardInvoice ORD468822086Dokument2 SeitenForwardInvoice ORD468822086Vinay GautamNoch keine Bewertungen

- Item Material Qty Uom Customer Material No Material Description Hsn/Sac Unit Price Total Taxable Amt CGST Sgst/Utgst Igst GST Cess Discount Amt Rate (%) Rate (%) Rate (%) Rate (%)Dokument2 SeitenItem Material Qty Uom Customer Material No Material Description Hsn/Sac Unit Price Total Taxable Amt CGST Sgst/Utgst Igst GST Cess Discount Amt Rate (%) Rate (%) Rate (%) Rate (%)Jay ShahNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceANIME SHORTSNoch keine Bewertungen

- Lalit K. Gupta & Co: Chartered AccountantsDokument2 SeitenLalit K. Gupta & Co: Chartered Accountantssanjeev gargNoch keine Bewertungen

- Poonam Bharti 22-23 (2 Files Merged)Dokument4 SeitenPoonam Bharti 22-23 (2 Files Merged)Abhay AnkitNoch keine Bewertungen

- Soa L10181002077Dokument3 SeitenSoa L10181002077imranNoch keine Bewertungen

- Omar Muhktar Abusama Nov 19Dokument34 SeitenOmar Muhktar Abusama Nov 19Garpt Kudasai100% (1)

- 24 25Dokument7 Seiten24 25himrwt8017Noch keine Bewertungen

- September PayslipDokument1 SeiteSeptember Payslipmishrajipiano13Noch keine Bewertungen

- Sla034040157125Dokument4 SeitenSla034040157125umesh raneNoch keine Bewertungen

- B P Impex Inv-425Dokument2 SeitenB P Impex Inv-425aman.dubey.resNoch keine Bewertungen

- Shell Pilipinas - August 2023 Fuel DeliveriesDokument59 SeitenShell Pilipinas - August 2023 Fuel Deliveriesmatimaintenance.npci2024Noch keine Bewertungen

- Dharmbir Computation 23-24 (1) - 1Dokument2 SeitenDharmbir Computation 23-24 (1) - 1Ashish SehrawatNoch keine Bewertungen

- Original: N 0004898912 - Issue Date 19.10.2016Dokument1 SeiteOriginal: N 0004898912 - Issue Date 19.10.2016Soham ChaudhuriNoch keine Bewertungen

- Payslip June Upgrad (Talentedge)Dokument1 SeitePayslip June Upgrad (Talentedge)kartik.chahal.ug21Noch keine Bewertungen

- CII InvoiceDokument1 SeiteCII InvoicesambasivaNoch keine Bewertungen

- Accounting VoucherDokument1 SeiteAccounting VouchersysadminNoch keine Bewertungen

- Computation 22-23 Buta SinghDokument2 SeitenComputation 22-23 Buta SinghSharn RamgarhiaNoch keine Bewertungen

- Dharmbir Computation 22-23 (1) - 1Dokument2 SeitenDharmbir Computation 22-23 (1) - 1Ashish SehrawatNoch keine Bewertungen

- Sayan InternationalDokument6 SeitenSayan InternationalSoumitraNoch keine Bewertungen

- Computation 1Dokument2 SeitenComputation 1Gaurav SinsinbarNoch keine Bewertungen

- Sales TEL 012 24-25Dokument1 SeiteSales TEL 012 24-25purchase.tel18Noch keine Bewertungen

- Order Confirmation - OC00001 - 2022-09-27Dokument1 SeiteOrder Confirmation - OC00001 - 2022-09-27Anil BiswalNoch keine Bewertungen

- Appu Yadav PDFDokument1 SeiteAppu Yadav PDFPrakash KolheNoch keine Bewertungen

- Appu Yadav PDFDokument1 SeiteAppu Yadav PDFPrakash KolheNoch keine Bewertungen

- 7 - Co-Operative AccountingDokument4 Seiten7 - Co-Operative AccountingGaurav Chandrakant100% (1)

- Pacalna - Accounting Cycle ActivityDokument35 SeitenPacalna - Accounting Cycle ActivityAnifahchannie PacalnaNoch keine Bewertungen

- MCQ On Guidance Note CARODokument63 SeitenMCQ On Guidance Note CAROUma Suryanarayanan100% (1)

- AnDokument5 SeitenAnPritesh ChaudhariNoch keine Bewertungen

- HUDCO - Term SheetDokument2 SeitenHUDCO - Term SheetSandy DheerNoch keine Bewertungen

- Tutorial 7 Chapter 6&7Dokument2 SeitenTutorial 7 Chapter 6&7Renee WongNoch keine Bewertungen

- Dupont Analysis of Asian PaintsDokument3 SeitenDupont Analysis of Asian PaintsOM JD100% (1)

- Session 1 - Describing The AOM and Its Linkages To ISSAI and The IARDokument44 SeitenSession 1 - Describing The AOM and Its Linkages To ISSAI and The IARmadalangin.coaNoch keine Bewertungen

- L.D BankDokument33 SeitenL.D BankSuhail88038Noch keine Bewertungen

- Sample Resume - FinanceDokument2 SeitenSample Resume - FinanceNiraj DeobhankarNoch keine Bewertungen

- Prakas On The Registration of Securities Registrar Securities Transfer Agent... EnglishDokument17 SeitenPrakas On The Registration of Securities Registrar Securities Transfer Agent... EnglishChou ChantraNoch keine Bewertungen

- Education and Qualifications: Address: Mobile: EmailDokument2 SeitenEducation and Qualifications: Address: Mobile: Emailahmad faidNoch keine Bewertungen

- Accounting For Corporate Combinations and Associations Australian 8th Edition Arthur Solutions ManualDokument12 SeitenAccounting For Corporate Combinations and Associations Australian 8th Edition Arthur Solutions Manualmaryturnerezirskctmy100% (27)

- Escott v. BarChris ConstructionDokument4 SeitenEscott v. BarChris ConstructionLynne SanchezNoch keine Bewertungen

- Sub: FIMMDA CBRICS Corporate Bond Reporting Platform Participant Application AgreementDokument4 SeitenSub: FIMMDA CBRICS Corporate Bond Reporting Platform Participant Application AgreementharikrishnanmscphysicsNoch keine Bewertungen

- Short Notes ABADDokument135 SeitenShort Notes ABADsing jotNoch keine Bewertungen

- 5Dokument2 Seiten5ABDUL WAHABNoch keine Bewertungen

- Cash and Cash Equivalents (Problems)Dokument9 SeitenCash and Cash Equivalents (Problems)IAN PADAYOGDOGNoch keine Bewertungen

- TLMDokument32 SeitenTLMsampada_shekharNoch keine Bewertungen

- Global Standards Mapping InitiativeDokument95 SeitenGlobal Standards Mapping InitiativesumititproNoch keine Bewertungen

- A Project Report On Taxation in IndiaDokument59 SeitenA Project Report On Taxation in IndiaYash Bhagat100% (1)

- FIN448-Final-Exam-Fall2020-Review - MCDokument85 SeitenFIN448-Final-Exam-Fall2020-Review - MCMay ChenNoch keine Bewertungen