Beruflich Dokumente

Kultur Dokumente

Stocks

Hochgeladen von

praveen rajCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stocks

Hochgeladen von

praveen rajCopyright:

Verfügbare Formate

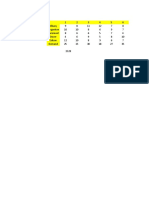

Average ROI of each stock

Stock AXP HD BNS SBUX

Average Return 0.014203 0.017352 0.010136 0.023866

Standard deviation 0.150373 0.072249 0.081659 0.100447

Correlation matrix

Stock/Stock AXP HD BNS SBUX

AXP 1.000000 0.487866 0.573871 0.629386

HD 0.487866 1.000000 0.392180 0.549479

BNS 0.573871 0.392180 1.000000 0.595575

SBUX 0.629386 0.549479 0.595575 1.000000

Co-variance matrix

Stock/Stock AXP HD BNS SBUX

AXP 0.022612 0.005300 0.007047 0.009507

HD 0.005300 0.005220 0.002314 0.003988

BNS 0.007047 0.002314 0.006668 0.004885

SBUX 0.009507 0.003988 0.004885 0.010090

a) When $25000 is invested in each stock

Expected return = 1.6389308058

Variance = 2.9425602747

Standard Deviation = 1.7153892487

CV= 1.0466514161

Sharpe Ratio= 0.3724698673

b) When 10,20,30,40k are invested in each stock

Expected return = 1.7478045842

Variance = 3.1298070656

Standard Deviation = 1.769126074

CV= 1.0121990124

Sharpe Ratio= 0.4226971697

c) When 10,50,20,20 are invested in each stock

Expected return = 1.6896876967

Variance = 2.9693550189

Standard Deviation = 1.7231816558

CV= 1.0198225738

Sharpe Ratio= 0.4002408535

Choice/Parameter Expected Retrun S.D CV

Choice 1 1.6389308058 1.7153892487 1.0466514161

Choice 2 1.7478045842 1.769126074 1.0121990124

Choice 3 1.6896876967 1.7231816558 1.0198225738

wa wb wc wd

0.1 0.2 0.3 0.4 0.017478

wa^2*sda wb^2*sdb wc^2*sdc wd^2*sdd

0.00150373 0.00289 0.007349 0.0160716

wa*wb 0.00021201 wb*wc 0.000278 wc*wd 0.001172

wa*wc 0.00042281 wb*wd 0.000638

wa*wd 0.00076053

0.03129807

0.000212 0.000278 0.0011724

0.0004228 0.000638

0.0007605

0.0312981

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Law of Agency CasesDokument10 SeitenLaw of Agency CasesAndrew Lawrie75% (4)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Ob AssigmentDokument2 SeitenOb Assigmentpraveen rajNoch keine Bewertungen

- MCQ in Engg EcoDokument8 SeitenMCQ in Engg EcoHeralynn BaloloyNoch keine Bewertungen

- Unit - 4: Amalgamation and ReconstructionDokument54 SeitenUnit - 4: Amalgamation and ReconstructionAzad AboobackerNoch keine Bewertungen

- UmaliDokument2 SeitenUmaliTrem GallenteNoch keine Bewertungen

- Infosys 268 ShraddhaDokument2 SeitenInfosys 268 Shraddhapraveen rajNoch keine Bewertungen

- Residential Valuation Sydney SampleDokument6 SeitenResidential Valuation Sydney SampleRandy JosephNoch keine Bewertungen

- Learnings From DJ SirDokument94 SeitenLearnings From DJ SirHare KrishnaNoch keine Bewertungen

- Case Study On Google GlassDokument4 SeitenCase Study On Google Glasspraveen rajNoch keine Bewertungen

- OS Assignment 1Dokument9 SeitenOS Assignment 1praveen rajNoch keine Bewertungen

- 1 2 3 4 5 6 Albany 9 8 11 12 7 8 Bingamton 10 10 8 6 9 7 Claremont 8 6 6 5 7 4 Dover 4 6 9 5 8 10 Edison 12 10 8 9 6 7 Demand 25 15 30 18 27 35 1528Dokument2 Seiten1 2 3 4 5 6 Albany 9 8 11 12 7 8 Bingamton 10 10 8 6 9 7 Claremont 8 6 6 5 7 4 Dover 4 6 9 5 8 10 Edison 12 10 8 9 6 7 Demand 25 15 30 18 27 35 1528praveen rajNoch keine Bewertungen

- Who Is AccountableDokument3 SeitenWho Is Accountablepraveen rajNoch keine Bewertungen

- MM SAP AssignmentDokument3 SeitenMM SAP Assignmentpraveen rajNoch keine Bewertungen

- OB Group C Job SuitabilityDokument7 SeitenOB Group C Job Suitabilitypraveen rajNoch keine Bewertungen

- Summer Internship Programme 2018-19: National Aluminum Company Limited NalcoDokument59 SeitenSummer Internship Programme 2018-19: National Aluminum Company Limited Nalcoanon_849519161Noch keine Bewertungen

- Cashflow Management PracticesDokument38 SeitenCashflow Management PracticesPaul cruzNoch keine Bewertungen

- 06 Rajashree Foods AAR OrderDokument6 Seiten06 Rajashree Foods AAR OrderanupNoch keine Bewertungen

- Auditing Gray 2015 CH 13 Final Work Spesific Problems Related To Inventories Contruction Contract Trade Payables Financial LiabilitiesDokument29 SeitenAuditing Gray 2015 CH 13 Final Work Spesific Problems Related To Inventories Contruction Contract Trade Payables Financial LiabilitiesSani AuroraNoch keine Bewertungen

- MainMenuEnglishLevel-3 RLD2014016Dokument291 SeitenMainMenuEnglishLevel-3 RLD2014016Asif RafiNoch keine Bewertungen

- Clarification Regarding Service Tax On Delayed Payment Charges CollectedDokument2 SeitenClarification Regarding Service Tax On Delayed Payment Charges Collectedpr_abhatNoch keine Bewertungen

- HPPWD FORM No 7Dokument2 SeitenHPPWD FORM No 7Ankur SheelNoch keine Bewertungen

- Account Activity: Transaction Date Value Date Reference Description Debit Credit BalanceDokument9 SeitenAccount Activity: Transaction Date Value Date Reference Description Debit Credit BalanceAmin KhanNoch keine Bewertungen

- HP Analyst ReportDokument11 SeitenHP Analyst Reportjoycechan879827Noch keine Bewertungen

- Final - Adv Accounting2 - July 19 - 2021Dokument3 SeitenFinal - Adv Accounting2 - July 19 - 2021Eleonora VinessaNoch keine Bewertungen

- PDFDokument4 SeitenPDFAhmad SulaimanNoch keine Bewertungen

- Tflow®-Course-Level-1-Final-19Oct2015-Binni OngDokument48 SeitenTflow®-Course-Level-1-Final-19Oct2015-Binni Ongchen mlNoch keine Bewertungen

- UAS Bahasa Inggris Menengah 2022 02SMJM001Dokument4 SeitenUAS Bahasa Inggris Menengah 2022 02SMJM001Nikita Pina RahmadaniNoch keine Bewertungen

- Finc 610 QPDokument15 SeitenFinc 610 QPSam Sep A SixtyoneNoch keine Bewertungen

- 1103 - Bidding Document - Hardware For HHIMS Project - ICTA-GOODS-GOSL-NCB-125 - FinalDokument113 Seiten1103 - Bidding Document - Hardware For HHIMS Project - ICTA-GOODS-GOSL-NCB-125 - Finalrajja_sulecoNoch keine Bewertungen

- Abhishek ReportDokument67 SeitenAbhishek ReportAbhishek KarNoch keine Bewertungen

- Final Presentationon SharekhanDokument15 SeitenFinal Presentationon SharekhanRajat SharmaNoch keine Bewertungen

- Cash and Proof of Cash ProblemsDokument2 SeitenCash and Proof of Cash ProblemsDivine MungcalNoch keine Bewertungen

- 2021 BEA1101 Study Unit 5 SolutionsDokument13 Seiten2021 BEA1101 Study Unit 5 SolutionsKhanyisileNoch keine Bewertungen

- Deed of Conditional Sale-1Dokument3 SeitenDeed of Conditional Sale-1Prince Rayner Robles100% (1)

- Standard Chartered Bank PakistanDokument19 SeitenStandard Chartered Bank PakistanMuhammad Mubasher Rafique100% (1)

- Books of Prime Entry: The Cash BookDokument11 SeitenBooks of Prime Entry: The Cash Bookأحمد عبد الحميدNoch keine Bewertungen

- Sbi & HDFC MBA PROJECTDokument7 SeitenSbi & HDFC MBA PROJECTKartik PahwaNoch keine Bewertungen

- Various Time Value Situations Answer Each of These Unrelated QueDokument1 SeiteVarious Time Value Situations Answer Each of These Unrelated QueM Bilal SaleemNoch keine Bewertungen