Beruflich Dokumente

Kultur Dokumente

It 000084699522 2019 09

Hochgeladen von

Hassan MirOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

It 000084699522 2019 09

Hochgeladen von

Hassan MirCopyright:

Verfügbare Formate

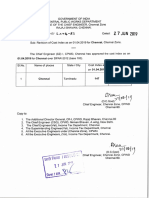

INCOME TAX PAYMENT CHALLAN

PSID # : 34194962

RTO-II LAHORE 6 5 2019

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year 09 18

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 236K Purchase / Transfer of Immovable Property Payment Section Code 64151101

u/s 236K

(Section) (Description of Payment Section) Account Head (NAM) B01131

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

NTN CNIC/Reg./Inc. No.

Taxpayer's Name Status

Business Name

Address

FOR WITHHOLDING TAXES ONLY

NTN/FTN of Withholding agent 9020000-4 CNIC/Reg./Inc. No.

Name of withholding agent GOVERNMENT OF PUNJAB. - M/S GOVERNMENT OF THE PUNJAB

Total no. of Taxpayers 1 Total Tax Deducted 11,600

Amount of tax in words: Eleven Thousand Six Hundred Rupees And No Paisas Only Rs. 11,600

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 Cash 11,600

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor

Name of Depositor GOVERNMENT OF PUNJAB.

Date

Stamp & Signature

PSID-IT-000084699522-092019

Prepared By : guest_user - Guest_User Date: 02-Sep-2019 03:13 PM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Introduction To Income TaxDokument8 SeitenIntroduction To Income TaxKartikNoch keine Bewertungen

- Paycheck 20201230 001387 Pravallika 202101241910Dokument1 SeitePaycheck 20201230 001387 Pravallika 202101241910Prabhakar AenugaNoch keine Bewertungen

- US v. Lamon Indictment PDFDokument6 SeitenUS v. Lamon Indictment PDFAaron BrecherNoch keine Bewertungen

- Form PDFDokument1 SeiteForm PDFKanha SatyaranjanNoch keine Bewertungen

- Hotel Bills OCRDokument1 SeiteHotel Bills OCRNishantNoch keine Bewertungen

- Vasavi Sheath Inv No 754Dokument1 SeiteVasavi Sheath Inv No 754Sowmya MNoch keine Bewertungen

- Sri Chowdeshwari Rice TradersDokument2 SeitenSri Chowdeshwari Rice Tradershemanth1234Noch keine Bewertungen

- CPWD Circular 270619 1Dokument1 SeiteCPWD Circular 270619 1JaslinrajsrNoch keine Bewertungen

- Nov2019 60013470 PDFDokument1 SeiteNov2019 60013470 PDFParvinder SinghNoch keine Bewertungen

- Rajasthan Housing Board, Circle - Ii, JaipurDokument3 SeitenRajasthan Housing Board, Circle - Ii, Jaipurrakshit_2000Noch keine Bewertungen

- Taxable and NontaxableDokument11 SeitenTaxable and NontaxableKhym Jie Purisima100% (1)

- 81-23-AGRI Revised Bindaas Extra 6 WG Booking Policy - 2023 (November-1-2023)Dokument2 Seiten81-23-AGRI Revised Bindaas Extra 6 WG Booking Policy - 2023 (November-1-2023)rai shahzebNoch keine Bewertungen

- F 211Dokument2 SeitenF 211Bogdan PraščevićNoch keine Bewertungen

- PGBPDokument9 SeitenPGBPYandex PrithuNoch keine Bewertungen

- 6months Salary SlipDokument2 Seiten6months Salary Slipstalin kNoch keine Bewertungen

- Cir Vs Dlsu FACTS: in 2004, The BIR Issued An LOA Covering The Tax Audit of DLSU's Fiscal Year 2003 andDokument1 SeiteCir Vs Dlsu FACTS: in 2004, The BIR Issued An LOA Covering The Tax Audit of DLSU's Fiscal Year 2003 andlawstud0322Noch keine Bewertungen

- Obillos V CIRDokument1 SeiteObillos V CIRAce Gregory AceronNoch keine Bewertungen

- Year-End Adjustment NewDokument27 SeitenYear-End Adjustment NewKyrzen Novilla0% (1)

- State of Georgia G-4 PDFDokument2 SeitenState of Georgia G-4 PDFJames BoyerNoch keine Bewertungen

- Tax Invoice: Gstin Drug Licence NoDokument1 SeiteTax Invoice: Gstin Drug Licence NoRohit BansalNoch keine Bewertungen

- Suggested Strategies To Improve RPT CollectionDokument2 SeitenSuggested Strategies To Improve RPT CollectionKrisanne BunyiNoch keine Bewertungen

- 02475792798Dokument1 Seite02475792798Edwin Zamora PastorNoch keine Bewertungen

- Donor's Tax - 1Dokument3 SeitenDonor's Tax - 1Crayon LloydNoch keine Bewertungen

- BIR Ruling 133-13Dokument2 SeitenBIR Ruling 133-13Kyra DiolaNoch keine Bewertungen

- 25th June - Sampa VideoDokument6 Seiten25th June - Sampa VideoAmol MahajanNoch keine Bewertungen

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Dokument1 SeitePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNoch keine Bewertungen

- Application For Registration: Kawanihan NG Rentas InternasDokument1 SeiteApplication For Registration: Kawanihan NG Rentas InternasGorgeousNoch keine Bewertungen

- Passive IncomeDokument14 SeitenPassive IncomeJeannie de leonNoch keine Bewertungen

- Chap001 2016Dokument13 SeitenChap001 2016Puneet GoelNoch keine Bewertungen

- BBA IV Taxation & AuditingDokument3 SeitenBBA IV Taxation & Auditingsubash pandeyNoch keine Bewertungen