Beruflich Dokumente

Kultur Dokumente

Asdasdasdsad

Hochgeladen von

Iqbal YusufOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Asdasdasdsad

Hochgeladen von

Iqbal YusufCopyright:

Verfügbare Formate

Discount Rate

1. The discount rate you use is the rate of return of the best investment opportunity that is currently

available to you.

- u/fwtony

2. Whatever you'd like to earn. If you want to earn 10%, then discount future cash flows by 10% and

if you can find a stock price that makes sense, buy it.

-- u/CanYouPleaseChill

3. For the risk free rate just use the 10 year bond rate of the country's currency you want to do your

dcf in. Substract the default risk premium from it using country's CDS and you get a risk free rate.

- u/alberlovag

4. My main man Damadoran suggests using the risk free rate + the equity risk premium for a given

country.

- u/jiggzycoco

Expected return

Required rate of return

Rate of return for other investment

I would focus more on understanding the quality of business and earnings rather than get hung up

on whether or not you use a 9% or 10% discount rate. Truth be told is that if your decision comes

down to what discount rate you use then its a bad idea in the first place.

If you really want to get granular then you can calculate the rate yourself based on the company's

financials.

The traditional method I've seen for discount rate analysis when it comes to company valuation is to

throw together a sensitivity analysis chart where you show the effect on your DCF value if you

change your discount rate by 50bps - 100bps.

Usually the analysis commentary goes something like this: "When I apply an 8% discount rate the

Company is worth $20. However, using my sensitivity analysis I can see that if I use a 7%, or even 6%,

discount rate the shares are worth $30-$40!. Therefore, My valuation range is $20 - $40".

The problem with this sort of thinking (that is taught in valuation textbooks), is that it ignores the fact

that for you to have a 50bps - 100bps shift in your discount rate requires a MASSIVE change in the

capital structure. Your discount rate is basically a derivative of your capital structure. Changing your

capital structure like that has implications for your operating model...how much interest you pay,

what your retained earnings look like, etc. So the way I look at it is that its wrong to assume a 1%

move in your discount rate in your DCF without correcting your operating model (through which the

cash flows your discounting are derived from) to reflect the change in capital structure.

Does that make sense?

The reason I advise not to give so much thought to the discount rate is because I think you'll be

better off if you ignore it and just focus on the operating model. I can guarantee you Buffett and

Greenblatt don't lose sleep over the discount rate. Buffett says he doesn't even use discount rates

because the way its calculated leave room for large errors as a result of small input errors. Garbage

in, garbage out.

Higher discount rate implies more leveraged capital structure. That means between the current

structure and the implied higher discount rate structure, the company issued more debt.

Einhorn uses a 20% discount rate as an arbitrary reason, the idea being he wants a 20% return.

Boom.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Dokument20 Seiten0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Iqbal YusufNoch keine Bewertungen

- Choo Bee Metal Industries Berhad (10587-A)Dokument18 SeitenChoo Bee Metal Industries Berhad (10587-A)Iqbal YusufNoch keine Bewertungen

- SiTime Third Quarter 2020 Financial Results-Transcript (Web)Dokument12 SeitenSiTime Third Quarter 2020 Financial Results-Transcript (Web)Iqbal YusufNoch keine Bewertungen

- Unaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Dokument21 SeitenUnaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Iqbal YusufNoch keine Bewertungen

- Supermax Corp (SUCB MK) : Regional Morning NotesDokument5 SeitenSupermax Corp (SUCB MK) : Regional Morning NotesIqbal YusufNoch keine Bewertungen

- First Supplementary Information Memorandum Dated 8 April 2021 in Respect of Amchina A-SharesDokument75 SeitenFirst Supplementary Information Memorandum Dated 8 April 2021 in Respect of Amchina A-SharesIqbal YusufNoch keine Bewertungen

- JHM Consolidation: MalaysiaDokument6 SeitenJHM Consolidation: MalaysiaIqbal YusufNoch keine Bewertungen

- Configuration: Getting Started GuDokument24 SeitenConfiguration: Getting Started GuIqbal YusufNoch keine Bewertungen

- MISC Berhad Outperform : Weaker Core Earnings in 1QFY21Dokument5 SeitenMISC Berhad Outperform : Weaker Core Earnings in 1QFY21Iqbal YusufNoch keine Bewertungen

- Public Investment Bank: Publicinvest Research DailyDokument9 SeitenPublic Investment Bank: Publicinvest Research DailyIqbal YusufNoch keine Bewertungen

- Johore Tin (Johotin-Ku) : Average ScoreDokument11 SeitenJohore Tin (Johotin-Ku) : Average ScoreIqbal YusufNoch keine Bewertungen

- FCFE CalculationDokument23 SeitenFCFE CalculationIqbal YusufNoch keine Bewertungen

- Country GDP (In Billions) Moody's Rating Adj. Default Spread Malaysia 314.5 A3 1.35% United Kingdom 2622.43 Aa2 0.56% United States 19390.6 Aaa 0.00%Dokument2 SeitenCountry GDP (In Billions) Moody's Rating Adj. Default Spread Malaysia 314.5 A3 1.35% United Kingdom 2622.43 Aa2 0.56% United States 19390.6 Aaa 0.00%Iqbal YusufNoch keine Bewertungen

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Dokument14 SeitenUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNoch keine Bewertungen

- Debate: Abortion: Should Abortions of Any Kind Be Permitted? Background and ContextDokument39 SeitenDebate: Abortion: Should Abortions of Any Kind Be Permitted? Background and ContextIqbal YusufNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Investment AppraisalDokument18 SeitenInvestment AppraisalKwasi MmehNoch keine Bewertungen

- Presentation-Advanced Organizer Quick PlanDokument2 SeitenPresentation-Advanced Organizer Quick Planapi-273088531Noch keine Bewertungen

- CitiGroup 2002Dokument34 SeitenCitiGroup 2002Coco CiaoNoch keine Bewertungen

- CIVABTech66829BrEstrAP - Valuation NumericalsDokument3 SeitenCIVABTech66829BrEstrAP - Valuation NumericalsAditiNoch keine Bewertungen

- Pertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanDokument20 SeitenPertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanTawang Deni WijayaNoch keine Bewertungen

- Introduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011Dokument5 SeitenIntroduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011adnanNoch keine Bewertungen

- Accountancy 12th SPSDokument4 SeitenAccountancy 12th SPSMahesh TandonNoch keine Bewertungen

- Accounting 9 Final Term 1Dokument9 SeitenAccounting 9 Final Term 1Mike ChindaNoch keine Bewertungen

- Chapter 2-GST Part B - Value of SupplyDokument7 SeitenChapter 2-GST Part B - Value of SupplyPooja D AcharyaNoch keine Bewertungen

- E StatementDokument3 SeitenE StatementVarun Kumar BawaNoch keine Bewertungen

- 04 2013-2014 Financial AgreementDokument2 Seiten04 2013-2014 Financial Agreementapi-234678525Noch keine Bewertungen

- Collection of ChequesDokument7 SeitenCollection of Cheques28-RPavan raj. BNoch keine Bewertungen

- Fintech Insights Q2 2022 Quarterly: FT Partners ResearchDokument110 SeitenFintech Insights Q2 2022 Quarterly: FT Partners ResearchngothientaiNoch keine Bewertungen

- Chapter 8: Cash and Bank Management Daily Procedures: ObjectivesDokument26 SeitenChapter 8: Cash and Bank Management Daily Procedures: ObjectivesArturo GonzalezNoch keine Bewertungen

- 2 - Afraseab Aor Umro Ky KarnamayDokument390 Seiten2 - Afraseab Aor Umro Ky KarnamaySaim Younis100% (1)

- Eco401 Final Term NotesDokument5 SeitenEco401 Final Term NotesLALANoch keine Bewertungen

- GU215RG Post To Home Address: SurreyDokument1 SeiteGU215RG Post To Home Address: SurreyhelikacarvalhoNoch keine Bewertungen

- Sample MCQsDokument6 SeitenSample MCQsRubal GargNoch keine Bewertungen

- Caiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiousDokument223 SeitenCaiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiouselliaCruzNoch keine Bewertungen

- FX Get DoneDokument2 SeitenFX Get DoneDev GogoiNoch keine Bewertungen

- The Fall of The House of Credit PDFDokument382 SeitenThe Fall of The House of Credit PDFRichard JohnNoch keine Bewertungen

- Tutorial Letter 108/0/2023: TAX4861 NTA4861Dokument75 SeitenTutorial Letter 108/0/2023: TAX4861 NTA4861ByouNoch keine Bewertungen

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDokument6 SeitenThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureSachinNoch keine Bewertungen

- Nps One PagerDokument2 SeitenNps One PagerldorayaNoch keine Bewertungen

- Chapter 3 Economic Study MethodsDokument62 SeitenChapter 3 Economic Study MethodsJohn Fretz AbelardeNoch keine Bewertungen

- UntitledDokument8 SeitenUntitledRae SlaughterNoch keine Bewertungen

- The Performance of Diversified Emerging Market Equity FundsDokument16 SeitenThe Performance of Diversified Emerging Market Equity FundsMuhammad RoqibunNoch keine Bewertungen

- CR Ma 21Dokument22 SeitenCR Ma 21Sharif MahmudNoch keine Bewertungen

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Dokument55 Seiten23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNoch keine Bewertungen

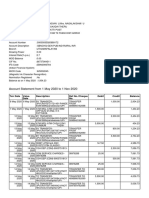

- Account Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument9 SeitenAccount Statement From 1 May 2020 To 1 Nov 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChellapandiNoch keine Bewertungen