Beruflich Dokumente

Kultur Dokumente

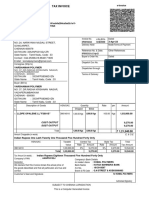

Challan NO./ ITNS 280: Details of Payments For Use in Receiving Bank

Hochgeladen von

DEEPAK BHERWAN0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

86 Ansichten1 SeiteCHALLAM

Originaltitel

CHALLAN 280

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCHALLAM

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

86 Ansichten1 SeiteChallan NO./ ITNS 280: Details of Payments For Use in Receiving Bank

Hochgeladen von

DEEPAK BHERWANCHALLAM

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

* Important : Please see notes overleaf before Single Copy (to be sent to the ZAO)

filling up the challan

CHALLAN Tax Applicable (Tick One)*

NO./ (0020) INCOME-TAX ON COMPANIES Assessment Year

ITNS 280 (CORPORATION TAX) 2 0 1 9 - 2 0

(0021) INCOME TAX (OTHER THAN ✔

COMPANIES)

Permanent Account Number

B D X P S 4 3 0 5 P

Full Name

B H O O P S I N G H

Complete Address with City & State

G A L I N o 3 N E A R M A N I R A M K I D H A N

H I S A R

Tel. No. 8 5 7 1 0 0 5 2 9 3 Pin 1 2 5 0 0 7

Type of Payment (Tick One)

Advance Tax (100) Surtax (102)

Self Assessment Tax (300) ✔ Tax on Distributed Profits of Domestic Companies (106)

Tax on Regular Assessment (400) Tax on Distributed Income to Unit Holders (107)

DETAILS OF PAYMENTS Amount (in Rs. Only) FOR USE IN RECEIVING BANK

Income Tax 1 1 0 2 0 Debit to A/c / Cheque credited on

Surcharge - -

Education Cess D D M M Y Y

Interest SPACE FOR BANK SEAL

Penalty

Others

Total 1 1 0 2 0

Total (in words) Eleven Thousand Twenty only

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

ELEVEN TWO

Paid in Cash/Debit to A/c /Cheque No. Dated

Drawn on

(Name of the Bank and Branch)

Date:

Signature of person making payment Rs. 11020.00

Taxpayers Counterfoil (To be filled up by tax payer) SPACE FOR BANK SEAL

PAN B D X P S 4 3 0 5 P

Received from BHOOP S I NGH

(Name)

Cash/ Debit to A/c /Cheque No. For Rs. 11020

Rs. (in words) Eleven Thousand Twenty only

Drawn on

(Name of the Bank and Branch)

on account of BDXPS4305P Companies/Other than Companies/Tax

Income Tax on (Strike out whichever is not applicable)

Type of Payment (To be filled up by person making the payment)

for the Assessment Year 2 0 1 9 - 2 0 Rs. 11020.00

maxutils.com/fdn/

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Mother Courage and Her ChildrenDokument11 SeitenMother Courage and Her ChildrenAnonymous s0LhehR7nNoch keine Bewertungen

- Diamond Farms, Inc. v. Southern Philippines Federation of Labor WorkersDokument4 SeitenDiamond Farms, Inc. v. Southern Philippines Federation of Labor WorkersEnric AlcaideNoch keine Bewertungen

- Membership Application FormDokument2 SeitenMembership Application FormVishal WasnikNoch keine Bewertungen

- Mining LawsDokument40 SeitenMining LawsMatthew RayNoch keine Bewertungen

- Pune Ticket PDFDokument3 SeitenPune Ticket PDFChandan NemadeNoch keine Bewertungen

- SS12, SS13, SS14, SS15, SS16: Vishay General SemiconductorDokument5 SeitenSS12, SS13, SS14, SS15, SS16: Vishay General SemiconductorRiiandaArifSNoch keine Bewertungen

- Section 8.5 - Production and Service ProvisionDokument3 SeitenSection 8.5 - Production and Service Provisionturkih_1988100% (1)

- Tax InvoiceDokument2 SeitenTax InvoiceTechnetNoch keine Bewertungen

- United States District Court For The District of ColumbiaDokument4 SeitenUnited States District Court For The District of ColumbiaLaw&CrimeNoch keine Bewertungen

- IBD Module 3 Rev RLDokument20 SeitenIBD Module 3 Rev RLGeorge BerberiNoch keine Bewertungen

- تجليات ثقافة المقاومة في فكر محمد البشير الإبراهيمي وأدبهDokument14 Seitenتجليات ثقافة المقاومة في فكر محمد البشير الإبراهيمي وأدبهجبالي أحمدNoch keine Bewertungen

- Brigada 2021 CommitteesDokument2 SeitenBrigada 2021 CommitteesBimbo Cuyangoan100% (2)

- A.C. Muthiah v. Board of Control For Cricket in India, (2011) 6 SCC 617Dokument1 SeiteA.C. Muthiah v. Board of Control For Cricket in India, (2011) 6 SCC 617kajkargroupNoch keine Bewertungen

- Guinea Tax 2Dokument6 SeitenGuinea Tax 2Onur KopanNoch keine Bewertungen

- CASE 5 Toyota Motors Phils V Toyota Labor UnionDokument3 SeitenCASE 5 Toyota Motors Phils V Toyota Labor UnionFrances Kaye CervezaNoch keine Bewertungen

- List of HDWOsDokument16 SeitenList of HDWOsrohanagarwalNoch keine Bewertungen

- Dionisio S. Almonte, Et Al., Petitioners v. People of The Philippines, Et Al., Respondents)Dokument9 SeitenDionisio S. Almonte, Et Al., Petitioners v. People of The Philippines, Et Al., Respondents)Ez MoneyNoch keine Bewertungen

- CHAPTER 1: Concept and Measurement of Development: Economic Growth Vs Economic DevelopmentDokument20 SeitenCHAPTER 1: Concept and Measurement of Development: Economic Growth Vs Economic DevelopmentAaron Justin Panganiban ArellanoNoch keine Bewertungen

- Jobs-865-Advertisement STA PDFDokument4 SeitenJobs-865-Advertisement STA PDFShalin NairNoch keine Bewertungen

- GGSR (Chapter 3-Business and Ethics)Dokument13 SeitenGGSR (Chapter 3-Business and Ethics)Erlinda NavalloNoch keine Bewertungen

- E-Certificate For Participation in WebinarDokument7 SeitenE-Certificate For Participation in Webinarjisha shajiNoch keine Bewertungen

- Cold War and VUCA No VidDokument14 SeitenCold War and VUCA No VidWedy Lorence L. CalabriaNoch keine Bewertungen

- Memorandum of Agreement Driver BokodDokument2 SeitenMemorandum of Agreement Driver BokodTrils InsuranceAgencyNoch keine Bewertungen

- Images In... Checklist and Template For AuthorsDokument4 SeitenImages In... Checklist and Template For Authorsanton MDNoch keine Bewertungen

- Patriotism - Yesterday/Tod AY: Made By: Harsh Schools Class: X School: Himalaya Public Sr. Sec. SchoolDokument15 SeitenPatriotism - Yesterday/Tod AY: Made By: Harsh Schools Class: X School: Himalaya Public Sr. Sec. SchoolHarsh VermaNoch keine Bewertungen

- Law As A System: False Positive in SystemsDokument68 SeitenLaw As A System: False Positive in SystemsLIU DANNoch keine Bewertungen

- Toni Morrison - Main ThemesDokument4 SeitenToni Morrison - Main ThemesVanessa RidolfiNoch keine Bewertungen

- PB NQZ K0 TACsopc DZ LW EKUEPf I6 A QRLVD OKWE4 VZKDokument91 SeitenPB NQZ K0 TACsopc DZ LW EKUEPf I6 A QRLVD OKWE4 VZKMuhammad Anees YousafNoch keine Bewertungen

- Encrypt SignedfinalDokument2 SeitenEncrypt SignedfinalRamNoch keine Bewertungen

- Technical Drawings - General Principles of Presentation - : Part 40: Basic Conventions For Cuts and SectionsDokument14 SeitenTechnical Drawings - General Principles of Presentation - : Part 40: Basic Conventions For Cuts and SectionsnikibrincatNoch keine Bewertungen