Beruflich Dokumente

Kultur Dokumente

PAS 2 - Inventories Problem 1 Decide Whether The Item Is Included As Part of Inventories As of December 31, 2019

Hochgeladen von

Shaira Maguddayao0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten2 SeitenAnswer it

Originaltitel

Inventories

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAnswer it

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten2 SeitenPAS 2 - Inventories Problem 1 Decide Whether The Item Is Included As Part of Inventories As of December 31, 2019

Hochgeladen von

Shaira MaguddayaoAnswer it

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

PAS 2 - Inventories

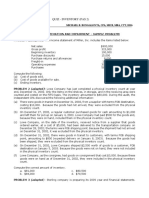

Problem 1 Decide whether the item is included as part of Inventories as of December 31, 2019:

Finished goods in the bodega, at cost including overhead of P400,000 P 4,000,000

Finished goods included in the count specifically segregated per sales contract 100,000

Goods in the receiving department, returned by customer, in good condition 50,000

Materials ordered and in the receiving department, invoice not recorded 400,000

Materials ordered, invoice received but goods not received. Freight is paid by seller 300,000

Finished goods shipped today, invoice mailed, FOB shipping point 250,000

Finished goods shipped today, invoice mailed, FOB Destination 150,000

Goods currently being used for window display 200,000

Goods on counter for sale 800,000

Materials in the receiving department, refused by us because of damage 180,000

Goods include in count, damaged and unsalable 50,000

Goods in the shipping department 250,000

Advance for materials ordered 200,000

Goods in process 650,000

Unexpired insurance on inventories 60,000

Advertising catalogues and shipping cartons 150,000

Finished goods in company-owned retail store, including 50% profit on cost 750,000

Finished goods still in transit through a vessel shipped FAS (free alongside) by our 500,000

company, including 50% profit on selling price

Finished goods still in transit through a vessel shipped ex-ship by our company, at cost 200,000

Finished goods in hands of consignees including 40% profit on sales, excluding freight 400,000

paid by the our company of P50,000 for delivery to the consignee

Freight cost paid by our company (consignee) for consigned goods sold to customers 50,000

Finished goods in transit to customers, shipping FOB destination at cost 250,000

Finished goods out on approval, at cost 100,000

Unsalable finished goods, at cost 50,000

Office supplies 40,000

Materials in transit shipped FOB Shipping point, excluding freight of P30,000 330,000

Goods held on consignment, at sales price, cost P150,000 200,000

Finished goods in transit, including freight charge of P20,000, FOB Shipping point 250,000

Finished goods held by salesmen, at selling price, cost P100,000 140,000

Defective materials returned to suppliers for replacement 100,000

Shipping supplies 20,000

Gasoline and oil for testing finished goods 110,000

Machine lubricants 60,000

Storage costs of finished goods 180,000

Delivery to customers 40,000

Irrecoverable import duties 60,000

Salaries of the accounting department 600,000

Brokerage commission paid to agents for arranging imports 200,000

Sales commission paid to sales agents 300,000

After-sales warranty costs 250,000

Insurance on shipment for materials purchased 5,000

Das könnte Ihnen auch gefallen

- Problem Solving QuizDokument2 SeitenProblem Solving QuizPaulo CoNoch keine Bewertungen

- NVENTORY PROBLEM Problem 1 20Dokument13 SeitenNVENTORY PROBLEM Problem 1 20SamihaNoch keine Bewertungen

- Problem 79Dokument2 SeitenProblem 79YukidoNoch keine Bewertungen

- Audit of Inventories (Done)Dokument19 SeitenAudit of Inventories (Done)Hasmin Saripada AmpatuaNoch keine Bewertungen

- Audit of InvDokument19 SeitenAudit of InvMae-shane SagayoNoch keine Bewertungen

- Audit of Inventories Problems SolvedDokument7 SeitenAudit of Inventories Problems SolvedwingNoch keine Bewertungen

- Pas 2 - Inventories (Continuation of Part 1)Dokument3 SeitenPas 2 - Inventories (Continuation of Part 1)Michelle Wing San TsangNoch keine Bewertungen

- Solutions For InventoriesDokument3 SeitenSolutions For InventoriesKyza Mae AlcontinNoch keine Bewertungen

- PAS 2 - Inventories (Chapter 7)Dokument3 SeitenPAS 2 - Inventories (Chapter 7)Monica MonicaNoch keine Bewertungen

- Auditing InventoryDokument5 SeitenAuditing InventoryRodwin DeunaNoch keine Bewertungen

- What Is The Correct Amount of Inventory?: SolutionDokument3 SeitenWhat Is The Correct Amount of Inventory?: SolutionSofia LaoNoch keine Bewertungen

- Intermediate Accounting Inventory ProblemsDokument37 SeitenIntermediate Accounting Inventory ProblemsMicko LagundinoNoch keine Bewertungen

- 01.1 Sample Problems InventoriesDokument10 Seiten01.1 Sample Problems InventoriesAlissa NavarroNoch keine Bewertungen

- Inventory Quizzer - 101Dokument4 SeitenInventory Quizzer - 101Juliet Leron MediloNoch keine Bewertungen

- FA1 InventoriesDokument80 SeitenFA1 InventoriesFatima VillalobosNoch keine Bewertungen

- Ho4 Inventories PDFDokument13 SeitenHo4 Inventories PDFYamyam ZehcnasNoch keine Bewertungen

- INVENTORIES2Dokument18 SeitenINVENTORIES2Katherine MagpantayNoch keine Bewertungen

- Inventory ExercisesDokument9 SeitenInventory ExercisesJo KeNoch keine Bewertungen

- Inventory Sample ExerciseDokument13 SeitenInventory Sample ExercisejangjangNoch keine Bewertungen

- Far 03 - InventoryDokument7 SeitenFar 03 - InventoryMark Domingo MendozaNoch keine Bewertungen

- Ae 13 Inventories: InventoryDokument11 SeitenAe 13 Inventories: InventorySaclao John Mark GalangNoch keine Bewertungen

- Lesson 2C. Inventories - Please PrintDokument18 SeitenLesson 2C. Inventories - Please PrintHail DeityNoch keine Bewertungen

- HehehueDokument56 SeitenHehehueNeighvest94% (16)

- INVENTORY PROBLEMS AND CONCEPTS QUE and ANSDokument11 SeitenINVENTORY PROBLEMS AND CONCEPTS QUE and ANSMALICDEM, CharizNoch keine Bewertungen

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDokument4 SeitenActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNoch keine Bewertungen

- Chapter 16 30 Valix Practical Accounting 2011Dokument429 SeitenChapter 16 30 Valix Practical Accounting 2011Charlene De PedroNoch keine Bewertungen

- Chapter 16-30 Valix Practical Accounting 2011Dokument429 SeitenChapter 16-30 Valix Practical Accounting 2011Mary Rose Mendoza78% (110)

- Non Financial AssetsDokument156 SeitenNon Financial AssetsPeter Banjao100% (1)

- Inventories (Problems)Dokument6 SeitenInventories (Problems)IAN PADAYOGDOGNoch keine Bewertungen

- INVENTORY COSTS TITLEDokument429 SeitenINVENTORY COSTS TITLEJINKY TOLENTINONoch keine Bewertungen

- Inventories QuizDokument4 SeitenInventories QuizIvy Salise100% (1)

- Audit of Inventories - Part 1Dokument5 SeitenAudit of Inventories - Part 1Mark Lawrence YusiNoch keine Bewertungen

- ProblemsDokument368 SeitenProblemsAnne EstrellaNoch keine Bewertungen

- Chapter 16 30 Valix Practical Accounting 2011Dokument492 SeitenChapter 16 30 Valix Practical Accounting 2011Joselito S. MalaluanNoch keine Bewertungen

- InventoryDokument7 SeitenInventorymoreNoch keine Bewertungen

- Chap10 ProblemsDokument18 SeitenChap10 ProblemsNikki GarciaNoch keine Bewertungen

- Applied Auditing InventoryDokument2 SeitenApplied Auditing InventoryKimberly PermisonNoch keine Bewertungen

- SDokument18 SeitenSdebate dd0% (1)

- InventoryDokument8 SeitenInventoryDianna DayawonNoch keine Bewertungen

- M4.1-M4.5 Exercise ProblemsDokument5 SeitenM4.1-M4.5 Exercise ProblemsMerecci Angela De ChavezNoch keine Bewertungen

- Income Statement - ProblemsDokument4 SeitenIncome Statement - ProblemsKatlene JoyNoch keine Bewertungen

- Understanding Inventory Valuation and ReportingDokument57 SeitenUnderstanding Inventory Valuation and ReportingA. MagnoNoch keine Bewertungen

- InventoryDokument3 SeitenInventoryJowai BenaningNoch keine Bewertungen

- ReSA AP Quiz 5B43Dokument42 SeitenReSA AP Quiz 5B43Rafael Bautista75% (4)

- Review of Financial Accounting Theory and PracticeDokument6 SeitenReview of Financial Accounting Theory and PracticeChristine Anne PostradoNoch keine Bewertungen

- Ronald Company 2019 Costs, Sales, IncomeDokument3 SeitenRonald Company 2019 Costs, Sales, IncomeKean Brean GallosNoch keine Bewertungen

- Module 2Dokument11 SeitenModule 2Deanne LumakangNoch keine Bewertungen

- Myco Paque InventoriesDokument5 SeitenMyco Paque InventoriesMYCO PONCE PAQUENoch keine Bewertungen

- Intermediate Accounting I - Inventories 2Dokument2 SeitenIntermediate Accounting I - Inventories 2Joovs JoovhoNoch keine Bewertungen

- Intermediate Accounting I Inventory ProblemsDokument2 SeitenIntermediate Accounting I Inventory ProblemsJoovs JoovhoNoch keine Bewertungen

- InventoryDokument10 SeitenInventoryGirlie Ann JimenezNoch keine Bewertungen

- Unit II Cost Terms, Concepts, Classification, Behavior, Cost Flows in A Trading and Manufacturing BusinessDokument5 SeitenUnit II Cost Terms, Concepts, Classification, Behavior, Cost Flows in A Trading and Manufacturing BusinessKiana Lyndel Mancanes MolinaNoch keine Bewertungen

- PDF Chapter 16 30 Valix Practical Accounting 2011 DLDokument429 SeitenPDF Chapter 16 30 Valix Practical Accounting 2011 DLChristabel Lecita PuigNoch keine Bewertungen

- INVENTORY COSTSDokument271 SeitenINVENTORY COSTSshiwoshiwoNoch keine Bewertungen

- Inventory Quiz ProblemsDokument9 SeitenInventory Quiz Problemspenny coronado100% (1)

- At Quizzer (CPAR) - Audit PlanningDokument9 SeitenAt Quizzer (CPAR) - Audit Planningparakaybee100% (3)

- P7Dokument2 SeitenP7Andreas Brown0% (1)

- Requirement (A) : Moore, Inc Notes Receivables December 31, 2019 Maker Date of Note Due Date Interest RateDokument5 SeitenRequirement (A) : Moore, Inc Notes Receivables December 31, 2019 Maker Date of Note Due Date Interest RateShaira MaguddayaoNoch keine Bewertungen

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsDokument7 SeitenBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaNoch keine Bewertungen

- Exercises On Trade Receivables and Sales PDFDokument8 SeitenExercises On Trade Receivables and Sales PDFShaira MaguddayaoNoch keine Bewertungen

- Ragos C Tumbangpreso PDFDokument4 SeitenRagos C Tumbangpreso PDFShaira MaguddayaoNoch keine Bewertungen

- EconDokument16 SeitenEconShaira MaguddayaoNoch keine Bewertungen

- SwimmingDokument18 SeitenSwimmingShaira MaguddayaoNoch keine Bewertungen

- Pas 2 - Inventories (Continuation of Part 1)Dokument3 SeitenPas 2 - Inventories (Continuation of Part 1)Michelle Wing San TsangNoch keine Bewertungen

- LOLDokument2 SeitenLOLShaira MaguddayaoNoch keine Bewertungen

- SwimmingDokument18 SeitenSwimmingShaira MaguddayaoNoch keine Bewertungen

- Other Long Term InvestmentsDokument1 SeiteOther Long Term InvestmentsShaira MaguddayaoNoch keine Bewertungen

- Partnership Notes Chapter 1 General ProvDokument6 SeitenPartnership Notes Chapter 1 General ProvHazel Jane AbaygarNoch keine Bewertungen

- Other Long Term InvestmentsDokument1 SeiteOther Long Term InvestmentsShaira MaguddayaoNoch keine Bewertungen

- Week 8: Social Media Tools and Applications: ADT102 Introduction To New Media StudiesDokument15 SeitenWeek 8: Social Media Tools and Applications: ADT102 Introduction To New Media StudiesDetya Erning MahaputriNoch keine Bewertungen

- On June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDokument63 SeitenOn June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDachell Chiva SantiagoNoch keine Bewertungen

- FM Chapter 8 PDFDokument6 SeitenFM Chapter 8 PDFSuzanne AcostaNoch keine Bewertungen

- Parkson Retail Asia Limited - Prospectus (Dated 27 October 2011) (Clean)Dokument419 SeitenParkson Retail Asia Limited - Prospectus (Dated 27 October 2011) (Clean)janice_nus100% (2)

- Using Standard Cost-Direct Labor VariancesDokument14 SeitenUsing Standard Cost-Direct Labor VariancesAlvi RahmanNoch keine Bewertungen

- Credit Appraisal of Project Financing and Working CapitalDokument70 SeitenCredit Appraisal of Project Financing and Working CapitalSami ZamaNoch keine Bewertungen

- 12 Acc SP 01Dokument36 Seiten12 Acc SP 01ganeshNoch keine Bewertungen

- Evans BermanDokument24 SeitenEvans BermanUmarRR11Noch keine Bewertungen

- Marketing Plan Khalis Chali Atta by MubeenDokument11 SeitenMarketing Plan Khalis Chali Atta by MubeenKalhoro Ali ArslanNoch keine Bewertungen

- Paper4 Set1Dokument9 SeitenPaper4 Set1umang jaiswalNoch keine Bewertungen

- Final Exam Project - Amazon - Kholoud MohsenDokument19 SeitenFinal Exam Project - Amazon - Kholoud MohsenChristine EskanderNoch keine Bewertungen

- Haldiram Internship Presentation on Business DevelopmentDokument11 SeitenHaldiram Internship Presentation on Business DevelopmentARUNIKA GUNJAALNoch keine Bewertungen

- Acc 217 PDFDokument240 SeitenAcc 217 PDFisaac mazvanyaNoch keine Bewertungen

- Food World (A) Market Entry StrategyDokument17 SeitenFood World (A) Market Entry Strategyshish5125484Noch keine Bewertungen

- True/False Banking & Finance QuizDokument47 SeitenTrue/False Banking & Finance QuizJake Manansala100% (1)

- WWW Cboe ComDokument2 SeitenWWW Cboe ComCocoy Ryan TonogNoch keine Bewertungen

- Internet Enabled BusinessesDokument17 SeitenInternet Enabled BusinessesAnuj TanwarNoch keine Bewertungen

- Financial Economics Assignment OneDokument10 SeitenFinancial Economics Assignment OneAaron KuudzeremaNoch keine Bewertungen

- Privalia's Strategy for German Market EntryDokument3 SeitenPrivalia's Strategy for German Market EntryRahulNoch keine Bewertungen

- Form - II & III: Operating and Balance Sheet ProjectionsDokument22 SeitenForm - II & III: Operating and Balance Sheet Projectionsmadhukar sahayNoch keine Bewertungen

- Cement Industry in BDDokument24 SeitenCement Industry in BDAnonymous okVyZFmqqXNoch keine Bewertungen

- Mechanism For Acquisition of Shares Through Stock Exchange Pursuant To Tender-Offers Under Takeovers, Buy Back and DelistingDokument6 SeitenMechanism For Acquisition of Shares Through Stock Exchange Pursuant To Tender-Offers Under Takeovers, Buy Back and DelistingShyam SunderNoch keine Bewertungen

- March 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystDokument35 SeitenMarch 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystAnubhav Srivastava100% (1)

- Entrepreneurship12q2 Mod8 Computation of Gross Profit v3Dokument22 SeitenEntrepreneurship12q2 Mod8 Computation of Gross Profit v3Marc anthony Sibbaluca80% (10)

- Required:: TH STDokument2 SeitenRequired:: TH STChris - Ann Mae De LeonNoch keine Bewertungen

- CE - Final Exam - Spring 2006 - Version 4 - With Solutions-1Dokument18 SeitenCE - Final Exam - Spring 2006 - Version 4 - With Solutions-1Dirit SanghaniNoch keine Bewertungen

- Louis Vuitton enters IndiaDokument33 SeitenLouis Vuitton enters IndiaRangga BarranNoch keine Bewertungen

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Dokument13 SeitenFundamentals of Accountancy, Business and Management 1 (FABM 1)cindyNoch keine Bewertungen

- CRM Final PresentationDokument9 SeitenCRM Final PresentationKriztel CuñadoNoch keine Bewertungen

- Value Chain AnalysisDokument9 SeitenValue Chain Analysisaishwarya waghmareNoch keine Bewertungen