Beruflich Dokumente

Kultur Dokumente

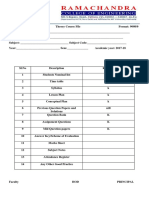

SFM 2nd Unit New

Hochgeladen von

Gangadhara RaoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SFM 2nd Unit New

Hochgeladen von

Gangadhara RaoCopyright:

Verfügbare Formate

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.

OF MANAGEMENT STUDIES

Unit-2

CORPORATE FINANCIAL STRATEGY

Corporate Financial Strategy presents a practical guide to how corporate finance can be used to add value to a

business. A company's financial strategy requires simultaneous decisions about capital structure, dividend and capital management,

cash levels, financial risk profile and target credit rating. All of these decisions must be made in the context of the company's

operating performance and growth strategies.

Corporate financial strategy is a business approach in which financial tools and instruments are used to assess and

evaluate the likely success and outcomes of proposed business strategies and projects. In the twenty-first century, corporate leaders

and decision makers use corporate financial strategy to:

Actively enhance shareholder value

Fundraise

Attain venture capital

Promote corporate growth.

Steps for Developing Successful Corporate Financial Strategy:

Corporate financial strategy is most successful when the strategy is maintained internally and aligned with the

operations of the corporation. Fully integrated corporate financial strategies can be developed using the following steps:

Build a Sufficient Capital Structure: Capital structure refers to the means through which a company finances itself.

Financing may come from long term-debt, common stock, and retained earnings. Corporations can determine the best

capital structure for its purposes through the use of three forms of analyses: Downside cash flow scenario modeling, peer

group analysis, and bond rating analysis. Downside cash flow scenario modeling is a process in which a capital structure is

taken from a set of downside cash flow scenarios. Peer group analysis is a process in which common capital structures and

fads of peer businesses are evaluated for insight into operating features. Bond rating analysis is a process in a review of the

debt capacity within certain debt ratings.

Determine The Correct Market Valuation: Correct market valuation evaluates whether the corporation is undervalued or

overvalued in the marketplace. Market valuation refers to a measure of how much the business is worth in the marketplace.

Review financial measures such as investor expectations for growth, margins, and investments. Compare investors'

expectations and managements' expectations to check for disparity.

Establish The Optimum Corporate Financial Strategy: Develop an optimum strategy for value creation that provides

sufficient funding, financial balance, and a growing cash reserve.

Capital Structure Planning or Management:

Introduction:

Estimation of capital requirements for current and future needs is important for a firm. Equally important

is the determining of capital mix. Equity and debt are the two principle sources of finance of a business. But, what should

be the proportion between debt and equity in the capital structure of a firm how much financial leverage should a firm

employ? This is a very difficult question. To answer this question, the relationship between the financial leverage and the

value of the firm or cost of capital has to be studied. Capital structure planning, which aims at the maximization of profits

and the wealth of the shareholders, ensures the maximum value of a firm or the minimum cost of the shareholders. It is

very important for the financial manager to determine the proper mix of debt and equity for his firm. In principle every

firm aims at achieving the optimal capital structure but in practice it is very difficult to design the optimal capital structure.

The management of a firm should try to reach as near as possible of the optimum point of debt and equity mix.

Definition:

“Capital Structure refers to the composition of a firm’s financing consists of equity, preference and debt.”

----------- Prasanna Chandra.

Ramachandra College of Engg.-Eluru 1

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

Optimum Capital Structure: It means capital structure that maximizes the value of the firm and minimizes the cost of

capital. The financial manager must try to obtain the best financing mix or the optimum capital structure for his / her firm.

The firm’s capital structure is considered optimum when the market value of the share is maximized.

Pattern of Capital Structure (Form of Capital Structure):

1. Capital Structure with equity shares only.

2. Capital Structure with both equity shares and preference shares.

3. Capital Structure with equity and debt.

4. Capital Structure with equity, preference shares and debt.

Factors Affecting Capital Structure:

1. Cost of Capital: Cost is an important consideration in capital structure decision. The capital structure should provide the

minimum cost of capital i.e., the cost of capital should be less than the rate of return.

2. Control: The control of a company is hold in the hands of a board of directors elected by the equity shareholders. If

they wish to retain control over the company, they should not permit to issue further equity shares to the public. In such

a case, debt financing is recommended.

3. Legal Requirements: A company should also fulfill the legal requirement when its capital structure is framed. For e.g.

the banking companies are permitted to issue only equity shares as per the Banking Companies Regulation Act.

4. 4. Size of the Company: Small companies depend heavily on owners’ funds while large companies are generally

considered to be less risky by the investors and therefore, they can issue different types of securities.

5. Period of Financing: When the company requires funds for permanent investment, it should prefer equity share

capital. Otherwise, it may issue redeemable preference shares and debentures.

6. Requirement of Investors: Different types of securities are issued to different classes of investors according to their

requirement.

7. Provision for Future: While planning capital structure the provision for future requirement of capital is also to be

considered.

8. Government Policies: Govt. policies are a major factor in determining capital structure. For example, a change in the

lending policies of financial institutions may mean a complete change in the financial pattern to be followed in the

companies. Monetary and fiscal policies of the government also affect the capital structure decisions.

Approaches of Capital Structure Planning:

Introduction:

The use of fixed cost sources of finance, such as debt and preference share capital to finance the assets of the

company, is known as financial leverage or trading on equity. If the assets financed with the use of debt yield a return greater

than the cost of debt, the EPS also increases without an increase in the owners’ investment. The EPS also increase when the

preference share capital is used to acquire assets. But the leverage impact is more pronounced in case of debt because:

The cost of debits usually lower than the cost of preference share capital and

The interest paid on debt is tax deductible.

Ramachandra College of Engg.-Eluru 2

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

Because of its effect on the EPS, financial leverage is an important consideration in planning the capital structure

of a company. The companies with high level of the earnings before interest and taxes (EBIT) can make profitable use of the

high degree of leverage to increase return on the shareholders’ equity.

There are three most common approaches to determine a firm’s capital structure. They are:

A. EBIT-EPS Analysis

B. Cost of Capital / Valuation Approach

C. Cash Flow Analysis

A. EBIT – EPS Analysis: It is one common method of examining the impact of leverage is to analyze the relationship

between EPS and various possible levels of EBIT under alternative methods of financing. It explains the sensitivity of

EPS to the changes in EBIT under different financial plans / capital structure.

This approach is helpful to analyze the impact of debt on earning per share (EPS). The EBIT-

EPS analysis is a very potential tool in the hands of the financial manager to get an insight (knowledge) into the

company’s capital structure management.

Limitations of EBIT-EPS Analysis: If maximization of the EPS is the only criterion for selecting the particular debt-

equity mix, then that capital structure which is expected to result in the highest EPS will always be selected by all the

firms. However, achieving the highest EPS need not be the only goal of the firm. The main shortcomings of the EBIT-

EPS analysis may be noted as follows:

(i) The EPS criterion ignore the risk dimension: The EBIT-EPS analysis ignores as to what is the effect of

leverage on the overall risk of the firm. With every increase in financial leverage, the risk of the firm and

therefore that of investors also increase. The EBIGT-EPS analysis fails to deal with the variability of EPS

and the risk return trade-off.

(ii) EPS is more of a performance measure: The EPS basically, depends upon the operating profit which in

turn, depends upon the operating efficiency of the firm. It is a resultant figure and it is more a measure of

performance rather than a measure of decision-making.

Exercise-1:

Let us suppose firm X has a capital structure consisting of equity capital only. It-has 50,000 equity shares of Rs. 10 each. Now the

firm wants to raise a fund for Rs. 1,25,000 for its various investment purposes after considering the following three alternative

methods of financing:

(i) If it issues 12,500 equity shares of Rs. 10 each;

(ii) If it borrows Rs. 1,25,000 at 8% interest; and

(iii) If it issues 1,250, 8% Preferences Shares of Rs. 100 each.

Show the effect of EPS under various methods of financing if EBIT (after additional investment) is Rs. 1,56,250 and rate of taxation

is @ 50%.

Ramachandra College of Engg.-Eluru 3

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

Thus, from the above table it becomes quite clear that the EPS is maximum when the firm uses debt-financing

although the rate of preference dividend and the rate of debt financing is the same. These happened due to the most significant role

played by Income Tax as preference dividend is not a deductible item from taxation while the interest on debt is deductible item.

It has already been stated above that EPS will increase with a high degree of leverage with the corresponding

increase in EBIT. But if the firm fails to earn a rate of return in its assets higher than the rate of debt financing, or preference share

financing, it will have to experience an opposite effect on EPS.

This can be shown with the help of the following illustration: Let us suppose the EBIT is Rs. 40,000 instead of Rs. 1,56,250.

The EPS under various methods of financing is shown:

Exercise -2:

Suppose that a firm has an all equity capital structure consisting of 100,000 ordinary shares of Rs.10 per share. The firm wants to

raise Rs.250,000 to finance its investments and is considering three alternative methods of financing – (i) to issue 25,000 ordinary

shares at Rs.10 each, (ii) to borrow Rs.2,50,000 at 8 per cent rate of interest, (iii) to issue 2,500 preference shares of Rs.100 each at

an 8 per cent rate of dividend. If the firm’s earnings before interest and taxes after additional investment are Rs.3,12,500 and the tax

rate is 50 per cent, the effect on the earnings per share under the three financing alternatives will be as follows:

Table: EPS under alternative financing favourable EBIT:

Equity Debt Preference

Financing Financing Financing

Rs. Rs. Rs.

EBIT 3,12,500 3,12,550 3,12,550

Less: Interest 0 20,000 0

PBT 3,12,500 2,92,500 3,12,500

Less: Taxes 1,56,250 1,46,250 1,56,250

PAT 1,56,250 1,46,250 1,56,250

Less: Preference dividend 0 0 20,000

Earnings available to ordinary shareholders 1,56,250 1,46,250 1,36,250

Shares outstanding 1,25,000 1,00,000 1,00,000

EPS 1.25 1.46 1.36

The firm is able to maximize the earnings per share when it uses debt financing. Though the rate of preference dividend is equal to

the rate of interest, EPS is high in case of debt financing because interest charges are tax deductible while preference dividends are

not. With increasing levels of EBIT, EPS will increase at a faster rate with a high degree of leverage. However, if a company is not

able to earn a rate of return on its assets higher than the interest rate (or the preference dividend rate), debt (or preference financing)

will have an adverse impact on EPS. Suppose the firm in illustration above has an EBIT of Rs.75,000/- EPS under different methods

will be as follows:

Table: EPS under alternative financing methods: Unfavourable EBIT:

Equity Debt Preference

Ramachandra College of Engg.-Eluru 4

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

Financing Financing Financing

Rs. Rs. Rs.

EBIT 75,000 75,000 75,000

Less: Interest 0 20,000 0

PBT 75,000 55,000 75,000

Less: Taxes 37,000 27,500 37,500

PAT 37,500 1,46,250 1,56,250

Less: Preference dividend 0 0 20,000

Earnings available to ordinary shareholders 27,500 17,500

1,56,250

Shares outstanding 1,00,000 1,00,000

1,25,000

EPS 0.27 0.17

0.30

It is obvious that under Unfavourable conditions, i.e. when the rate of return on the total assets is less

than the cost of debt, the earnings per share will fall with the degree of leverage.

Return on Equity:

Return on Equity is also known as Return on Net Worth. Return on Equity shows how many rupees

of earnings result from each rupee of equity. Return on equity is calculated by taking a year’s net incomes dividing them by the

average shareholder equity for that year, and is expressed as a percentage:

Definition:

“The return on equity ratio or ROE is a profitability ratio that measures the ability of a firm to generate

profits from its shareholders investments in the company.”

This is an important for potential investors because they want to see how efficiently a company will use

their money to generate net income. ROE is also an indicator of how effective management is at using equity financing to fund

operations and grow the company.

Formula: The return on equity ratio formula is calculated by dividing net income by shareholder's equity.

Most of the time, ROE is computed for common shareholders. In this case, preferred dividends are not

included in the calculation because these profits are not available to common stockholders. Preferred dividends are then taken

out of net income for the calculation. Also, average common stockholder's equity is usually used, so an average of beginning

and ending equity is calculated.

Return on Equity Analysis: Return on equity measures how efficiently a firm can use the money from shareholders to

generate profits and grow the company. Unlike other return on investment ratios, ROE is a profitability ratio from the

investor's point of view—not the company. In other words, this ratio calculates how much money is made based on the

investors' investment in the company, not the company's investment in assets or something else.

That being said, investors want to see a high return on equity ratio because this indicates that the

company is using its investors' funds effectively. Higher ratios are almost always better than lower ratios, but have to be

compared to other companies' ratios in the industry. Since every industry has different levels of investors and income, ROE

can't be used to compare companies outside of their industries very effectively.

Many investors also choose to calculate the return on equity at the beginning of a period and the end of a

period to see the change in return. This helps track a company's progress and ability to maintain a positive earnings trend.

Example:

Tammy's Tool Company is a retail store that sells tools to construction companies across the country. Tammy reported net

income of Rs.1,00,000 and issued preferred dividends of Rs.10,000 during the year. Tammy also had 10,000, Rs.5 par

common shares outstanding during the year. Tammy would calculate her return on common equity like this:

Ramachandra College of Engg.-Eluru 5

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

As you can see, after preferred dividends are removed from net income Tammy's ROE is 180%. This means that every rupee of

common shareholder's equity earned about Rs.1.80 this year. In other words, shareholders saw a 180 percent return on their

investment. Tammy's ratio is most likely considered high for her industry. This could indicate that Tammy's is a growing company.

An average of 5 to 10 years of ROE ratios will give investors a better picture of the growth of this company.

Example 1: Company A earned net income of $1,722,000 during the year ending march 31, 2011. The

shareholders' equity on April 30, 2010 and March 31, 2011 was $14,587,000 and $16,332,000 respectively.

Calculate its return on equity for the year ending March 31, 2011.

Solution

Average Shareholders' Equity = ( $14,587,000 + $16,332,000 ) / 2 = $15,459,500

Return On Equity = $1,722,000 / $15,459,500 ≈ 0.11 or 11%

Example 2: Total assets and total liabilities of Company B on Jan 1, 2010 were $2,342,000 and $1,383,000.

During the year ended December 31, 2011 it made a net profit of $242,000 and its shareholders' equity

increased by $302,000. Calculate ROE of Company B.

Solution

Step 1: Beginning Shareholders' Equity = $2,342,000 − $1,383,000 = $959,000

Step 2: Ending Shareholders' Equity = $959,000 + $302,000 = $1,261,000

Step 3: Average Shareholders' Equity = ( $959,000 + $1,261,000 ) / 2 = $1,110,000

Step 4: Return On Equity = $242,000 / $1,110,000 ≈ 0.22 or 22%

Ramachandra College of Engg.-Eluru 6

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

Dividend Policy and Value of the Firm:

Dividend decision of the firm is a crucial area of financial management. The important aspect of

dividend policy is to determine the amount of earnings to be distributed to shareholders and the amount to be

retained in the firm. Shareholders’ return consists of two components. They are dividends and capital gains.

Dividend policy has a direct influence on these two components.

Theories of Dividend Policy: Dividend policy determines the division of earnings between shareholders and retained

earnings. According to some authors the dividend decision affects value of the firm and to some it is not. So, dividend

theories are broadly classified into two categories. They are:

Theories of Dividend Policy

Relevance Theories Irrelevance Theories

Walter’s Gordon’s Modigliani Miller Traditional

Approach Approach Approach Approach

A. Relevance Theories: Relevance theories which consider dividend decision to be relevant as it affect the value of the firm.

I. Walter’s Approach: According to him dividend policy affects the value of the firm. Walter’s model is based on the

relationship between the firm’s a) return on investment / internal rate of return(r) and b) cost of capital / required rate of

return (k).

o Classification of Firms: In order to explain the relationship between dividend policy and the market value of the firm

Walter classified into three categories. They are:

1. Growth Firm: If r > k i.e., the firm earns higher returns than the cost of capital, it is known as growth firm. In the

growth firm optimum dividend policy would be to retaining the entire earnings. In this case:

the dividend pay-out ratio = 0 and

retention ratio = 100%

2. Normal Firm: In the case of firm where r = k, it is a normal firm. In this case there are no fluctuations in the market

share value with the changes in dividend rates. Therefore, there is no optimum dividend policy for such firms.

3. Declining Firm: In case of firms where r < k, it is declining firm. The optimum dividend policy for them would be

distributing the entire earnings as dividends. 100% dividend payout ratio in their cases would result in maximizing

the value of the firm.

Assumptions:

i. The firm does the entire financing through retained earnings. It does not use external sources of funds.

ii. The firm return on investment should be constant.

iii. The firm cost of capital should be constant.

iv. The firm has a very long life.

v. All earnings are either distributed or retained immediately.

Formula: James Walter has presented the following formula for determining the market value of a share.

Where, P = Market Value of an equity share

D = Dividend per Share

Ramachandra College of Engg.-Eluru 7

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

r = Internal rate of return

E = Earnings per Share

K = Cost of Capital

The criticisms on the model are as follows:

1. Investments are through internal finance is not true. Both internal and external funds are needed.

2. The return and cost of capital are constant is not true, as investment goes up return and cost of capital also goes up.

3. The firm has a long life. How one can predict?

Exercise - 1: The details regarding three companies A ltd, B Ltd and C Ltd are as follows:

A Ltd. B Ltd. C Ltd.

R = 15% R = 5% R = 10%

k = 10% k = 10% k = 10%

E = Rs. 8 E = Rs. 8 E = Rs. 8

Calculate the value of an equity share of each of these companies applying Walter’s Approach when

dividend payment ratio is: 1) 75%, 2) 50%, 3)25%. What conclusion do you draw?

Excercise - 2:

A company has the following facts:

Cost of capital (k) = 0.10

Earnings per share (E) = Rs.10

Rate of return on investments ( r) = 8%

Dividend payout ratio: Case A: 50% Case B: 25%

Show the effect of the dividend policy on the market price of the shares.

Exercise – 3:The following information is available for Avanti Corporation . (Prasanna Chandra 535, Walters)

Earnings purchase = Rs. 4/-; Rate of return on investment = 18%; Rate of return required by share

holders = 15%; What will be the price per share as per the Walter model. If the payout ratio is 40%;

50% & 60%?

Exercise – 4:The following data is available for Parkson company (Prasanna Chandra 537, Exercise Problem;

Walters) Earnings per share = Rs. 3/-; Internal rate of return = 15%; Cost of capital = 12%. If Walter’s

valuation formula holds what will be the price per share. If dividend payout ratio is 50%; 75% & 100%?

II. Gordon’s Model: This theory was given by Myron Gordon. Gordon’s theory on dividend policy is one of the theories

believing in the ‘relevance of dividends’ concept. It is also called as ‘Bird-in-the-hand’ theory that states that the current

dividends are important in determining the value of the firm. Gordon’s model is one of the most popular mathematical

models to calculate the market value of the company using its dividend policy.

Assumptions:

i. The firm is an all-equity firm; only the retained earnings are used to finance the investments, no external source

of financing is used.

ii. The rate of return (r) and cost of capital (k) are constant.

iii. The life of a firm is indefinite.

iv. Retention ratio once decided remains constant.

Formula: Myron Gordon has presented the following formula for determining the market value of a share.

Where, P0 = Market value of an equity share

E1= Earnings per Share

K = Cost of Capital

B = Retention Ratio

R = Rate of Return

Ramachandra College of Engg.-Eluru 8

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

(1-b) = Dividend Payout Ratio

Criticism of Gordon’s Model:

i. It is assumed that firm’s investment opportunities are financed only through the retained earnings and no

external financing viz. Debt or equity is raised. Thus, the investment policy or the dividend policy or both can

be sub-optimal.

ii. The Gordon’s Model is only applicable to all equity firms. It is assumed that the rate of returns is constant, but,

however, it decreases with more and more investments.

iii. It is assumed that the cost of capital (K) remains constant but, however, it is not realistic in the real life

situations, as it ignores the business risk, which has a direct impact on the firm’s value.

Thus, Gordon model posits that the dividend plays an important role in determining the share price of the firm.

Exercise - 1: From the following information calculate the values of an equity share of the companies by using

Gordon’s model when dividend pay-out ratio is 40%, 60%, 90%.

A Ltd. B Ltd. C Ltd.

R =0.15 R =0.10 R =0.08

k = 0.10 k = 0.10 k = 0.10

E = Rs. 10 E = Rs. 10 E = Rs. 10

Exercise – 2:The following information is available for Kavitha Musicals. (Prasanna Chandra 536)

EPS=Rs. 5/-

Rate of return required by share holders=16%

Assuming that the Gordon valuation model holds, what rate of return should be earned on investment ensure that

the market price is Rs. 50/- When the dividend payout is 40%.

Exercise – 3: The following data are available for Rajdhani Corporation.

EPS=Rs. 8/-

Internal rate of return =16%; Cost of capital = 12%

If Gordon’s valuation formula holds what will be the price per share when the D.P.O is 25%; 50% & 100%.

B. Relevance Theories: Irrelevance theories which consider dividend decision to be irrelevant as it does not affect the value of

the firm.

I. Modigliani-Miller Model: Modigliani – Miller theory is a major proponent of ‘Dividend Irrelevance’ notion.According

to this approach, the dividend policy of a firm is irrelevent; as it does not affect the value of the firm. According to this

thoery the value of the firm depends on solely on its earnings power resulting from the investment policy. This theory is

in direct contrast to the ‘Dividend Relevance’ theory which believes dividends to be important in the valuation of a

company.

Assumptions: Modigliani – Miller theory is based on the following assumptions:

o Perfect Capital Markets: Capital markets are perfect. Investors are rational as information is freely available,

transaction costs are nil.

o No Taxes: There is no existence of taxes. Alternatively, both dividends and capital gains are taxed at the

same rate.

o Fixed Investment Policy: The company does not change its existing investment policy. This means that new

investments that are financed through retained earnings do not change the risk and the rate of required rate of

return of the firm.

Formula: According to M-M model the market price of a share is calculated by the following formula:

Ramachandra College of Engg.-Eluru 9

SFM U.GANGADHAR - ASSOC. PROFESSOR - DEPT.OF MANAGEMENT STUDIES

Where, P0= Market Price of a share at beginning of a period.

P1= Market price of a share at the end of the period.

D1=Dividend received at the end of period.

Ke = Cost of equity capital.

15) (MM, SKG 9.23) ABC Ltd has a capital of Rs 10 lakhs in equity shares of Rs 100 each. The shares are currently

quoted at par. The company proposes declaration f a dividend of Rs 10 per share at the end of the current financial

year. The capitalisation rate for the risk class to which the company belongs is 12%.

What will be the market price of the share at the end of the year, if:

(i) a dividend is not declared?

(ii) a dividend is declared?

Assuming that the company pays the dividend and has net profits of Rs 5,00,000 and makes new investments of Rs 10

lakhs during the period, how many new shares must be issued. Use the MM model.

Ramachandra College of Engg.-Eluru 10

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- MS Assignment QuestionsDokument1 SeiteMS Assignment QuestionsGangadhara RaoNoch keine Bewertungen

- Unit-1: Conceptual Lesson Plan For Management ScienceDokument6 SeitenUnit-1: Conceptual Lesson Plan For Management ScienceGangadhara RaoNoch keine Bewertungen

- Management Science PrefaceDokument1 SeiteManagement Science PrefaceGangadhara RaoNoch keine Bewertungen

- SM 2nd UnitDokument8 SeitenSM 2nd UnitGangadhara RaoNoch keine Bewertungen

- MS Question BankDokument4 SeitenMS Question BankGangadhara RaoNoch keine Bewertungen

- LSCM Unit-VDokument28 SeitenLSCM Unit-VGangadhara RaoNoch keine Bewertungen

- Unit-Iv: The Sourcing DecisionsDokument31 SeitenUnit-Iv: The Sourcing DecisionsGangadhara Rao100% (1)

- Andhra Loyola Institute of Engineering and TechnologyDokument1 SeiteAndhra Loyola Institute of Engineering and TechnologyGangadhara RaoNoch keine Bewertungen

- Role of BanksDokument4 SeitenRole of BanksGangadhara RaoNoch keine Bewertungen

- SM 11st UnitDokument13 SeitenSM 11st UnitGangadhara RaoNoch keine Bewertungen

- LSCM Unit-IiDokument21 SeitenLSCM Unit-IiGangadhara RaoNoch keine Bewertungen

- Competency MappingDokument5 SeitenCompetency MappingGangadhara RaoNoch keine Bewertungen

- Entrepreneurial Life Skills in India: Dr.K.Kalyan Chakravarthy, Dr.B.Shanta KumarDokument6 SeitenEntrepreneurial Life Skills in India: Dr.K.Kalyan Chakravarthy, Dr.B.Shanta KumarGangadhara RaoNoch keine Bewertungen

- What Is Customer Knowledge?Dokument27 SeitenWhat Is Customer Knowledge?Gangadhara RaoNoch keine Bewertungen

- JNTUK R16 I Year MBA I SEMESTER SYLLABUS PDFDokument28 SeitenJNTUK R16 I Year MBA I SEMESTER SYLLABUS PDFGangadhara RaoNoch keine Bewertungen

- Theory Course File FormatDokument1 SeiteTheory Course File FormatGangadhara RaoNoch keine Bewertungen

- Proposed Topics For PH.DDokument2 SeitenProposed Topics For PH.DGangadhara RaoNoch keine Bewertungen

- SFM Course FileDokument14 SeitenSFM Course FileGangadhara RaoNoch keine Bewertungen

- New Krupararao Mini ProjectDokument38 SeitenNew Krupararao Mini ProjectGangadhara RaoNoch keine Bewertungen

- Risk Refers To The Uncertainty That Surrounds Future Events and OutcomesDokument2 SeitenRisk Refers To The Uncertainty That Surrounds Future Events and OutcomesGangadhara RaoNoch keine Bewertungen

- Financial Institution: U. Gangadhar - Assoc - Professor - Dept. of Management StudiesDokument16 SeitenFinancial Institution: U. Gangadhar - Assoc - Professor - Dept. of Management StudiesGangadhara RaoNoch keine Bewertungen

- PoseDokument1 SeitePoseGangadhara RaoNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Diff Between Normal & Islamic Banking in MaldeevDokument2 SeitenDiff Between Normal & Islamic Banking in MaldeevAfroza KhanNoch keine Bewertungen

- Chapter 01Dokument10 SeitenChapter 01ShantamNoch keine Bewertungen

- Tourism DevelopmentDokument9 SeitenTourism DevelopmentPhil JayveNoch keine Bewertungen

- Has Finance Made The World RiskierDokument36 SeitenHas Finance Made The World RiskierbbarooahNoch keine Bewertungen

- Mba 4th Sem SyllabusDokument4 SeitenMba 4th Sem SyllabusRiyas ParakkattilNoch keine Bewertungen

- Tech EntrepreneurDokument7 SeitenTech EntrepreneurMark Romeo GalvezNoch keine Bewertungen

- RCBC: Issuance of Long Term Negotiable CDsDokument3 SeitenRCBC: Issuance of Long Term Negotiable CDsBusinessWorldNoch keine Bewertungen

- A172 Tutorial 2 QuestionDokument4 SeitenA172 Tutorial 2 QuestionZichun HoNoch keine Bewertungen

- CH 2 Some Economic and Cost Concepts 2011 1Dokument37 SeitenCH 2 Some Economic and Cost Concepts 2011 1Rodel BarnayjaNoch keine Bewertungen

- Distributor Conference SlobaDokument16 SeitenDistributor Conference SlobaИлија РадосављевићNoch keine Bewertungen

- Louis Vitton Case Study Assignment2Dokument10 SeitenLouis Vitton Case Study Assignment2Nesrine Youssef100% (1)

- Spanish Migration PlanDokument22 SeitenSpanish Migration PlannauizNoch keine Bewertungen

- Principle of AccountingDokument4 SeitenPrinciple of AccountingMahabub Alam100% (1)

- 45 ..Islamic BankingDokument47 Seiten45 ..Islamic BankingShaguftaNoch keine Bewertungen

- ch24 Presentation and Disclosure in FinancialReportingDokument74 Seitench24 Presentation and Disclosure in FinancialReportingIma Listyaningrum100% (1)

- Derivatives Market Forwarded To ClassDokument51 SeitenDerivatives Market Forwarded To ClassKaushik JainNoch keine Bewertungen

- Finmar Final Handouts 1 PDFDokument3 SeitenFinmar Final Handouts 1 PDFAcissejNoch keine Bewertungen

- STMT CASH 001 CANM002963 Feb2020-1Dokument10 SeitenSTMT CASH 001 CANM002963 Feb2020-1Beto Ventura75% (4)

- 7 Reasons To Avoid A ULIPDokument5 Seiten7 Reasons To Avoid A ULIPKandarp PandyaNoch keine Bewertungen

- MAIN PPT Stock Exchange of India - pptmATDokument42 SeitenMAIN PPT Stock Exchange of India - pptmATAnkit Jain100% (1)

- Monthly Price Data Between 1999 To 2012 of DSEDokument241 SeitenMonthly Price Data Between 1999 To 2012 of DSEKuraf NawzerNoch keine Bewertungen

- Legislative Backdrop of Companies ActDokument11 SeitenLegislative Backdrop of Companies ActMani KrishNoch keine Bewertungen

- HUL SuccessDokument2 SeitenHUL SuccessUjjval YadavNoch keine Bewertungen

- Review of LiteratureDokument7 SeitenReview of LiteratureAshish KumarNoch keine Bewertungen

- Brunai ReformDokument16 SeitenBrunai ReformPanji WinataNoch keine Bewertungen

- News of The Day: Attention To Our Distinguished SubscribersDokument13 SeitenNews of The Day: Attention To Our Distinguished Subscriberssmiley346Noch keine Bewertungen

- Foreign Direct Investment: Cemex'SDokument10 SeitenForeign Direct Investment: Cemex'Sjacklee1918Noch keine Bewertungen

- Strategic FinanceDokument72 SeitenStrategic FinanceNinu MolNoch keine Bewertungen

- Directives - Unified Directives 2067 EnglishDokument474 SeitenDirectives - Unified Directives 2067 EnglishAmit Khadka67% (3)