Beruflich Dokumente

Kultur Dokumente

Health Care Reform

Hochgeladen von

Statesman JournalOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Health Care Reform

Hochgeladen von

Statesman JournalCopyright:

Verfügbare Formate

EFFECTIVE NOW NEXT YEAR

LOW INCOME, THOSE WITH

PRE-EXISTING ILLNESSES,

AND THE DISABLED

percent of the employer’s

contribution to employees’

health insurance; this ceiling HEALTH CARE THE DISABLED beneficiaries

REFORM

will increase to 50 percent in Home care Reducing payments

States can cover more 2014. Also, small non-profit for the disabled to Medicare

people through Medicaid organizations now may re- The new Community First Advantage insurers

States can choose to receive ceive up to a 25 percent Choice Option allows state The law gradually eliminates

federal matching funds to child- credit, increasing to 35 per- Medicaid programs to offer the extra amount that

less adults with incomes up to 133 cent in 2014. home- and community-based Medicare pays per person to

percent of the federal poverty Who benefits: Small busi- The Democrats’ overhaul of the nation’s health care services to disabled individu- private insurers’ Medicare

level, a higher threshold than nesses with fewer than 25 system will unfold over the next 10 years. Here are the als rather than nursing-home Advantage plans compared

before. employees care. with outlays under tradition-

Who benefits: Low-income Who pays more: Federal changes taking place now and in the next few years. When: Effective Oct. 1, 2011 al Medicare. The law also

childless adults government Who benefits: Disabled prohibits Medicare Ad-

individuals vantage plans from impos-

Coverage for uninsured ing higher cost-sharing

SENIORS Who pays more: Federal requirements than tradition-

people with pre-existing government and states al Medicare for some cov-

conditions Expand coverage for ered services.

A new temporary program pro- early retirees SENIORS When: Effective Jan. 1, 2011

vides coverage for people with A $5 billion reinsurance

pre-existing medical conditions Who benefits: The Medi-

program helps employment- Prescription drug care budget

who have been uninsured for at based plans extend coverage discounts

least six months. States may set to people who retire between Who pays more: In effect,

up their own programs; if they Drug manufacturers must health insurers because

the ages of 55 and 65, as well

don’t, residents can apply for provide a 50% discount on they’ll receive less

as their spouses and depen-

coverage through a national plan. brand-name prescriptions for

dents.

When: National program is in

seniors with Medicare drug Cuttings costs to

Who benefits: Early retirees plans who reach the “dough- preserve Medicare

effect now Thinkstock photos nut hole” coverage gap. Also,

Who benefits: Uninsured people “Doughnut hole” The Independent Payment

federal subsidies begin for

with pre-existing conditions $250 rebate Advisory Board will propose

generic prescriptions filled

Right to appeals Rebuild primary during that coverage gap.

ways to reduce the growth

Seniors who reach the in Medicare spending and

“Doughnut Hole” in Medicare

claims denials care workforce When: Effective Jan. 1, 2011. extend the life of the Medi-

prescription coverage this year Consumers have the right Expand the number Over the next 10 years, dis- care Trust Fund.

— after their drug costs for to appeal coverage claims of primary care counts will increase until the

denials to their insurance doctors, nurses and When: Funding available

the year reaches $2,840 — coverage gap is closed in

company and then, if physician assistants Oct. 1, 2011

receive a $250 rebate. 2020.

necessary, to an external through incentives Who benefits: Medicare

Who benefits: Seniors in the Who benefits: Medicare

reviewer. such as scholarships recipients

Medicare prescription gap drug-plan members who

When: Effective for some and loan repayments reach the “doughnut hole”

Who pays: Federal govern- health plans now for primary care

ment Who pays more: Drug SHORING UP THE

Who benefits: People doctors and nurses HEALTH CARE SYSTEM

manufacturers, federal gov-

with private health insur- working in under-

ernment

SHORING UP THE ance (Employer sponsored served areas. Minimum medical

CHILDREN AND ADULTS HEALTH CARE SYSTEM or individual plans) Free preventive care spending by insurers

UNDER 26 YEARS OLD Strengthen for seniors The law requires health

Free preventive care, No lifetime health centers plans to report the propor-

Kids with pre-existing wellness initiative The law provides certain free

dollar limits New funding will pay preventive services for Medi- tion of premium dollars

conditions can’t be All new health plans must Health plans can no longer for construction and care recipients, such as spent on clinical services

denied coverage cover preventive services such impose lifetime dollar limits service expansions of annual wellness visits and and quality measures, as

Insurers cannot deny coverage to as mammograms and co- on what they will pay for community health personalized prevention plans. opposed to administrative

children under the age of 19 due lonoscopies with no deducti- essential benefits, like centers, enabling It also waives the Medicare costs. If that proportion is

to a pre-existing medical condi- ble, co-pay or coinsurance. A hospital stays. Annual these centers to deductible for colorectal less than 85% for large-

tion. $15 billion Prevention and dollar limits will also be serve some 20 cancer screening tests. employer plans and 80% for

Public Health Fund will pay for restricted. million new patients. plans sold to individuals and

Who benefits: Children with When: Effective Jan. 1, 2011

programs to help people get When: Now. Annual dollar Who benefits: small employers, consumers

pre-existing conditions healthy — from quitting Who benefits: Medicare

limits will be phased out by Uninsured and low- would be due rebates.

Who pays more: Insurance smoking to fighting obesity. recipients

2014, with some excep- income people. When: The rebate program

companies Who pays more: Federal

Who benefits: People tions. Who pays more: takes effect Jan. 1, 2011.

government

Extend coverage for enrolled in job-related health Who benefits: People Federal government Who benefits: Consumers

young adults plans or individual health with private health insur- Medicare premiums with health insurance

plans created after March 23, ance More pay for Who pays more: Health

Young adults can stay on their 2010. rural health for higher-income

parents’ plan until they turn 26 beneficiaries insurance companies

Curb rate hikes care providers

years old. Restrictions on The income threshold for

States that require insur- Sixty-eight percent of Improving Medicare,

Who benefits: Adults under 26 canceling sick person’s ance companies to justify medically under-

higher Medicare Part B premi- Medicaid

who can’t get insurance at work coverage their premium increases ums will be frozen at 2010

served communities A new Center for Medicare

Who pays more: Insurance will be eligible for $250 levels for 2011 through 2019,

In the past, insurance compa- in the U.S. are in rural & Medicaid Innovation will

companies million in new grants. resulting in more people

nies could search for any error areas. Increased test new ways to deliver

Insurance companies with paying the higher premiums.

on a consumer’s application payments to rural care and pay providers. The

unjustified premium in- Also, the premium subsidy for

SMALL BUSINESSES and use the error to deny health-care providers goal is to reduce the growth

creases may not be able to Medicare prescription drug

payment for services or could help attract in costs for Medicare,

participate in the new coverage will be reduced for

Tax credits for buying cancel coverage when the and retain medical Medicaid, and the Children’s

health insurance exchanges those with incomes above

coverage insured got sick. Now insurers professionals to Health Insurance Program

in 2014. $85,000/individual and

must prove the effort was these areas. while maintaining or improv-

Up to 4 million small businesses $170,000/couple.

fraudulent. When: Grants are awarded Who benefits: Rural ing the quality of care.

could get tax credits to help now. When: Effective Jan. 1, 2011

Who benefits: People with residents and health- When: Effective Jan. 1, 2011

provide health coverage to their Who benefits: The Medicare

individual health insurance Who benefits: People care professionals. Who benefits: Medicare,

employees. budget

Who pays more: Health- with private health Who pays more: Medicaid and CHIP

When: Starting now the first insurance Who pays more:

insurance companies Federal government recipients

phase provides a credit up to 35 Higher-income Medicare

2012 LATER YEARS

THE DISABLED Who benefits: Medicare SHORING UP THE Who benefits: The federal

patients, high-quality HEALTH CARE SYSTEM budget

Providing new, hospitals Who pays more: Mid-size and

voluntary options Medicare tax increase large employers that don’t

for long-term care SHORING UP Increases the Medicare Part A provide health coverage

The law creates a volun- THE HEALTH CARE (hospital insurance) tax rate on

tary long-term care SYSTEM wages, to 2.35% from 1.45%, on Health insurance

insurance program to earnings over $200,000 for exchanges

provide cash benefits to Electronic health individual taxpayers and New state-based health insur-

disabled adults. records $250,000 for married couples ance marketplaces called ex-

When: Government must filing jointly; imposes a 3.8% changes will be established,

A series of gradual LOW INCOME AND More access assessment on unearned in-

designate a benefit plan changes will require THOSE WITH PRE- through which individuals and

to Medicaid come for higher-income taxpay- small businesses can choose

by Oct. 1, 2012 health plans to keep and EXISTING ILLNESSES Americans who earn less than ers. from among health plans meet-

Who benefits: Disabled exchange records elec- 133 percent of the poverty

individuals tronically. The goal is to Extend preventive care When: Effective Jan. 1, 2013 ing benefit and cost standards.

level (about $14,000 for an Who benefits: The Medicare Members of Congress will be

reduce medical errors and for state Medicaid individual and $29,000 for a

paperwork costs. budget getting their health coverage

programs family of four) will be eligible through these exchanges.

When: First regulation The law provides a one- for Medicaid. States will Who pays more: Higher-

effective Oct. 1, 2012 income taxpayers. When: Effective Jan. 1, 2014

percentage-point increase in receive 100 percent federal

Who benefits: Health federal matching Medicaid funding for the first three Who benefits: Individuals and

care system, patients funds for preventive services years to support this expan-

Individual requirement small businesses needing more

to states that cover certain sion, phasing to 90 percent in to have insurance affordable coverage

Fees from preventive services at little or subsequent years. Most individuals who can afford

drug makers no cost to patients. it will be required to obtain Apply employers’ funds

When: Effective Jan. 1, 2014 to other coverage

The law imposes new When: Effective Jan. 1, 2013 Who benefits: Low-income basic health insurance coverage

annual or biennial fees on or pay a fee to help offset the Some workers who can’t afford

Who benefits: Medicaid individuals and families

the pharmaceutical manu- costs of caring for uninsured the coverage offered at work

recipients Who pays more: Federal

facturing industry. Americans. If affordable cov- will be able to take whatever

SENIORS Who pays more: Federal government erage is not available to an amount their employer would

When: Beginning with government individual, he or she will be have paid toward their insurance

Medicare hospital

$2.8 billion in 2012-2013 Help for health care eligible for an exemption. and use it to buy a more afford-

Who benefits: Taxpayers Guaranteed availability costs able plan though the new health

quality incentives of insurance When: Effective Jan. 1, 2014

Who pays more: Phar- Tax credits will be available for insurance exchanges.

Hospitals’ Medicare pay Who benefits: Uninsured

maceutical manufacturers Insurers cannot refuse to sell people with incomes above 133 When: Effective Jan. 1, 2014

will be based on perform- people, health-care providers

coverage or renew policies percent but below 400 per- Who benefits: Low- and

ance on certain quality Reduce health Who pays more: Previously

because of an individual’s cent of poverty (about moderate-income workers

measures. Hospitals’ disparities uninsured individuals

pre-existing medical condi- $43,000 for an individual and

performance must be

The law requires the tion. Also, in the individual $88,000 for a family of four in Fees from health

publicly reported, begin-

and small-employer markets, 2010) to help them buy insur-

Employer requirements

ning with measures collection and reporting of insurers

patients’ racial, ethnic, it will be illegal to charge ance, if they not eligible for or Employers with more than 50

relating to heart attacks, employees that don’t offer The law imposes new annual or

language, and gender data higher rates because of offered other affordable cov-

heart failure, pneumonia, health coverage will be as- biennial fees on the health

to identify and address gender or health status. erage.

surgical care, health-care sessed per-employee fees if insurance industry.

associated infections, and health disparities. When: Effective Jan. 1, 2014 When: Effective Jan. 1, 2014

they have at least one full-time When: Beginning with $8

patients’ perception of When: Effective March Who benefits: Individuals Who benefits: Low-income employee who receives a tax billion in 2014

care. 2012 with pre-existing conditions individuals, families credit for buying his or her own

or poor health Who benefits: The federal

When: Effective Oct. 1, Who benefits: Patients Who pays more: Federal health coverage. budget

2012 Who pays more: Insurance government When: Effective Jan. 1, 2014

companies Who pays more: Health

insurers

Das könnte Ihnen auch gefallen

- Social Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionVon EverandSocial Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionNoch keine Bewertungen

- Owners Manual Rev0Dokument2 SeitenOwners Manual Rev0Vinicius FainaNoch keine Bewertungen

- 10 Reasons To Support The Health Care Reform BillsDokument8 Seiten10 Reasons To Support The Health Care Reform BillsjrodascNoch keine Bewertungen

- Health in Reform 2010: Understanding The Patient Protection and Affordability Act and Its Impact On YouDokument18 SeitenHealth in Reform 2010: Understanding The Patient Protection and Affordability Act and Its Impact On YouDennis AlexanderNoch keine Bewertungen

- Xiii. The Economics of Healthcare Economics of Healthcare: Private Health InsuranceDokument3 SeitenXiii. The Economics of Healthcare Economics of Healthcare: Private Health InsuranceGwyneth MalagaNoch keine Bewertungen

- WI Issue Area Employer Insurance 071510 RRDokument3 SeitenWI Issue Area Employer Insurance 071510 RRnchc-scribdNoch keine Bewertungen

- Trumpcare Vs ObamacareDokument1 SeiteTrumpcare Vs ObamacareionutburceaNoch keine Bewertungen

- 11 Best Part-Time Jobs With Health Insurance BenefitsDokument11 Seiten11 Best Part-Time Jobs With Health Insurance BenefitsYuvraj KaranNoch keine Bewertungen

- Health InsuranceDokument53 SeitenHealth InsuranceRazan AldabousNoch keine Bewertungen

- 2010-04-02 - Health Care Reform ArticleDokument4 Seiten2010-04-02 - Health Care Reform ArticleTerry PetersonNoch keine Bewertungen

- Glossary of Health Insurance Terms: Benefits For Plan Years Beginning After Sept. 23, 2010Dokument5 SeitenGlossary of Health Insurance Terms: Benefits For Plan Years Beginning After Sept. 23, 2010api-27631527Noch keine Bewertungen

- Anthony Olvera - Psa Brochure Assignment - 4682908Dokument5 SeitenAnthony Olvera - Psa Brochure Assignment - 4682908api-501232916Noch keine Bewertungen

- 02018-HealthCredit Feb02wpDokument14 Seiten02018-HealthCredit Feb02wplosangelesNoch keine Bewertungen

- Employee BenefitsDokument26 SeitenEmployee BenefitsSaad SaeedNoch keine Bewertungen

- The Pluralistic Reform Model: The Patient Protection and Affordable Care Act of 2010Dokument4 SeitenThe Pluralistic Reform Model: The Patient Protection and Affordable Care Act of 2010Ben HsuNoch keine Bewertungen

- Perspective: New England Journal MedicineDokument3 SeitenPerspective: New England Journal MedicineSuwandi ChangNoch keine Bewertungen

- Obamacare Basics: Understanding The Affordable Care ActDokument3 SeitenObamacare Basics: Understanding The Affordable Care ActFindLaw100% (1)

- Medicaid's Unseen Costs, Cato Policy Analysis No. 548Dokument24 SeitenMedicaid's Unseen Costs, Cato Policy Analysis No. 548Cato InstituteNoch keine Bewertungen

- Different Types of Medicare Insurance PlanDokument7 SeitenDifferent Types of Medicare Insurance PlanGetmy PolicyNoch keine Bewertungen

- As Bandhan - Brochure - GAHP 1Dokument2 SeitenAs Bandhan - Brochure - GAHP 1Chandu SwarnkarNoch keine Bewertungen

- ACA White PaperDokument4 SeitenACA White PaperTom GaraNoch keine Bewertungen

- Health Care Code of ConductDokument4 SeitenHealth Care Code of ConductSteve Levine100% (2)

- The Next Steps For Medicare Reform, Cato Policy AnalysisDokument24 SeitenThe Next Steps For Medicare Reform, Cato Policy AnalysisCato InstituteNoch keine Bewertungen

- Chapt 15 1-11 Tax Advantages of LTC InsuranceDokument11 SeitenChapt 15 1-11 Tax Advantages of LTC InsuranceallenhammNoch keine Bewertungen

- 004 ENG CCHI Mini Glossary ACA InsuranceDokument6 Seiten004 ENG CCHI Mini Glossary ACA InsuranceSaira TorresNoch keine Bewertungen

- Health Financing ModelDokument7 SeitenHealth Financing ModelPrashant NathaniNoch keine Bewertungen

- 2021 Property Benefits SummaryDokument30 Seiten2021 Property Benefits SummaryTracy BonannoNoch keine Bewertungen

- Obamacare IMPACT On MAINEDokument13 SeitenObamacare IMPACT On MAINELevitatorNoch keine Bewertungen

- Health Companion Health Insurance Plan - Health CompanionDokument2 SeitenHealth Companion Health Insurance Plan - Health CompanionANAND MLNoch keine Bewertungen

- A Win-Win Approach To Financing Health Care ReformDokument2 SeitenA Win-Win Approach To Financing Health Care ReformanggiNoch keine Bewertungen

- Hi KCDokument59 SeitenHi KCmiracaronsNoch keine Bewertungen

- Shraddha InsuranceDokument12 SeitenShraddha Insurancepokale.yuvrajNoch keine Bewertungen

- HRM648 Chapter 13Dokument28 SeitenHRM648 Chapter 132021485676Noch keine Bewertungen

- Introduction To Us Healthcare System: Trends in Premiums and Cost Sharing and Its Reasons and ImplicationsDokument9 SeitenIntroduction To Us Healthcare System: Trends in Premiums and Cost Sharing and Its Reasons and ImplicationsShruti SinghNoch keine Bewertungen

- MSA PresentationDokument50 SeitenMSA Presentationshahid aliNoch keine Bewertungen

- Group Life Insurance: Help Protect Loved Ones From Financial HardshipDokument13 SeitenGroup Life Insurance: Help Protect Loved Ones From Financial HardshipAnonymous i6rY3kG50oNoch keine Bewertungen

- Group B Presentation 2Dokument40 SeitenGroup B Presentation 2Doaa AwadNoch keine Bewertungen

- The Working Poor and Social Security Privatization: Restoring The Opportunity To Save, Cato Briefing PaperDokument14 SeitenThe Working Poor and Social Security Privatization: Restoring The Opportunity To Save, Cato Briefing PaperCato InstituteNoch keine Bewertungen

- 004 SPA CCHI Mini Glossary ACA Insurance RevDokument7 Seiten004 SPA CCHI Mini Glossary ACA Insurance RevfrangomezchirinoNoch keine Bewertungen

- AetnaDokument2 SeitenAetnaJay ChuNoch keine Bewertungen

- Financing Health ServicesDokument16 SeitenFinancing Health ServicesMahdi SwaidanNoch keine Bewertungen

- A Comparison and Contrast of Medicare and Medicaid BenefitsDokument6 SeitenA Comparison and Contrast of Medicare and Medicaid BenefitsLiam PaulNoch keine Bewertungen

- Healthpolicybrief 8 PDFDokument5 SeitenHealthpolicybrief 8 PDFfriska anjaNoch keine Bewertungen

- Health Financing ModelsDokument7 SeitenHealth Financing ModelsPrashant Nathani100% (1)

- SPR BHB Funding Fact Sheet May 2019Dokument5 SeitenSPR BHB Funding Fact Sheet May 2019BernewsAdminNoch keine Bewertungen

- Obamacare Fact SheetDokument1 SeiteObamacare Fact Sheetapi-254040217Noch keine Bewertungen

- Building Blocks For Reform: Achieving Universal Coverage With Private and Public Group Health InsuranceDokument2 SeitenBuilding Blocks For Reform: Achieving Universal Coverage With Private and Public Group Health Insurancesfgreer49Noch keine Bewertungen

- Mini Glossary ACA Insurance RevDokument8 SeitenMini Glossary ACA Insurance RevCaroline LiebigNoch keine Bewertungen

- Health Care Reform Bill SummaryDokument7 SeitenHealth Care Reform Bill Summaryg2gusc38Noch keine Bewertungen

- The HMO Act of 1973 Health Maintenance Organization Act of 1973Dokument3 SeitenThe HMO Act of 1973 Health Maintenance Organization Act of 1973Sai PrabhuNoch keine Bewertungen

- Health System Comparisons - UK Vs USA Vs AustraliaDokument8 SeitenHealth System Comparisons - UK Vs USA Vs AustraliaAdrian CastroNoch keine Bewertungen

- All Insurance Compiled PresentationDokument41 SeitenAll Insurance Compiled PresentationSomil GuptaNoch keine Bewertungen

- Parent Medical CoverageDokument9 SeitenParent Medical CoveragecampeonNoch keine Bewertungen

- Human Resources and Surviving Health Reform: by Mike TurpinDokument4 SeitenHuman Resources and Surviving Health Reform: by Mike TurpinMuhammad UsmanNoch keine Bewertungen

- Health Insurance in IndiaDokument6 SeitenHealth Insurance in Indiachhavigupta1689Noch keine Bewertungen

- Affordable Care ActDokument5 SeitenAffordable Care Actneha24verma3201Noch keine Bewertungen

- Billing GuidelinesDokument4 SeitenBilling GuidelinesSyali SasidharanNoch keine Bewertungen

- International Social Welfare ProgramsDokument10 SeitenInternational Social Welfare ProgramsZaira Edna JoseNoch keine Bewertungen

- The 6.2 Percent Solution: A Plan For Reforming Social Security, Cato Social Security Choice Paper No. 32Dokument16 SeitenThe 6.2 Percent Solution: A Plan For Reforming Social Security, Cato Social Security Choice Paper No. 32Cato InstituteNoch keine Bewertungen

- Letter To Judge Hernandez From Rural Oregon LawmakersDokument4 SeitenLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNoch keine Bewertungen

- Matthieu Lake Map and CampsitesDokument1 SeiteMatthieu Lake Map and CampsitesStatesman JournalNoch keine Bewertungen

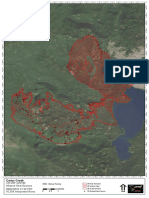

- Cedar Creek Vegitation Burn SeverityDokument1 SeiteCedar Creek Vegitation Burn SeverityStatesman JournalNoch keine Bewertungen

- Cedar Creek Fire Soil Burn SeverityDokument1 SeiteCedar Creek Fire Soil Burn SeverityStatesman JournalNoch keine Bewertungen

- Roads and Trails of Cascade HeadDokument1 SeiteRoads and Trails of Cascade HeadStatesman JournalNoch keine Bewertungen

- Windigo Fire ClosureDokument1 SeiteWindigo Fire ClosureStatesman JournalNoch keine Bewertungen

- Mount Hood National Forest Map of Closed and Open RoadsDokument1 SeiteMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNoch keine Bewertungen

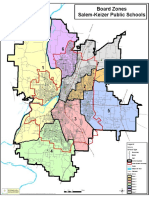

- School Board Zones Map 2021Dokument1 SeiteSchool Board Zones Map 2021Statesman JournalNoch keine Bewertungen

- Cedar Creek Fire Sept. 3Dokument1 SeiteCedar Creek Fire Sept. 3Statesman JournalNoch keine Bewertungen

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Dokument4 SeitenComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNoch keine Bewertungen

- 2021 Ironman 70.3 Oregon Traffic ImpactDokument2 Seiten2021 Ironman 70.3 Oregon Traffic ImpactStatesman JournalNoch keine Bewertungen

- Oregon Annual Report Card 2020-21Dokument71 SeitenOregon Annual Report Card 2020-21Statesman JournalNoch keine Bewertungen

- Revised Closure of The Beachie/Lionshead FiresDokument4 SeitenRevised Closure of The Beachie/Lionshead FiresStatesman JournalNoch keine Bewertungen

- LGBTQ Proclaimation 2022Dokument1 SeiteLGBTQ Proclaimation 2022Statesman JournalNoch keine Bewertungen

- SIA Report 2022 - 21Dokument10 SeitenSIA Report 2022 - 21Statesman JournalNoch keine Bewertungen

- Salem-Keizer Discipline Data Dec. 2021Dokument13 SeitenSalem-Keizer Discipline Data Dec. 2021Statesman JournalNoch keine Bewertungen

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDokument1 SeiteSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNoch keine Bewertungen

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDokument1 SeiteProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNoch keine Bewertungen

- Resource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeDokument3 SeitenResource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeStatesman JournalNoch keine Bewertungen

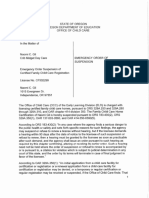

- Crib Midget Day Care Emergency Order of SuspensionDokument6 SeitenCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNoch keine Bewertungen

- Gcab - Personal Electronic Devices and Social Media - StaffDokument2 SeitenGcab - Personal Electronic Devices and Social Media - StaffStatesman JournalNoch keine Bewertungen

- Statement From Marion County Medical Examiner's Office On Heat-Related DeathsDokument1 SeiteStatement From Marion County Medical Examiner's Office On Heat-Related DeathsStatesman JournalNoch keine Bewertungen

- Schools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramDokument3 SeitenSchools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramStatesman Journal100% (1)

- Op Ed - Anthony MedinaDokument2 SeitenOp Ed - Anthony MedinaStatesman JournalNoch keine Bewertungen

- SB Agenda 20210415 EnglishDokument1 SeiteSB Agenda 20210415 EnglishStatesman JournalNoch keine Bewertungen

- School Board Zone MapDokument1 SeiteSchool Board Zone MapStatesman JournalNoch keine Bewertungen

- Zone Resolution PDFDokument2 SeitenZone Resolution PDFStatesman JournalNoch keine Bewertungen

- City of Salem Photo Red Light Program 2021 Legislative ReportDokument8 SeitenCity of Salem Photo Red Light Program 2021 Legislative ReportStatesman JournalNoch keine Bewertungen

- EPI Scorecard - Sudan - Q1 - 2018Dokument1 SeiteEPI Scorecard - Sudan - Q1 - 2018محمد أبو القاسم عليNoch keine Bewertungen

- MATAVIA - Research Paper On National SituationDokument4 SeitenMATAVIA - Research Paper On National SituationJuris Augustine MataviaNoch keine Bewertungen

- Health Policies and Vulnerable PopulationsDokument5 SeitenHealth Policies and Vulnerable PopulationsVENESSANoch keine Bewertungen

- NHS FPX 6008 Assessment 3 Business Case For ChangeDokument8 SeitenNHS FPX 6008 Assessment 3 Business Case For ChangeEmma WatsonNoch keine Bewertungen

- National Guidelines For Quality Obstetrics and Perinatal Care PDFDokument410 SeitenNational Guidelines For Quality Obstetrics and Perinatal Care PDFduncan100% (1)

- Resume in Film Nothing Spreads Like Fear Contagion Nama: M.Daffa Kelas: XI TKJ 1Dokument3 SeitenResume in Film Nothing Spreads Like Fear Contagion Nama: M.Daffa Kelas: XI TKJ 1Daffa AlqoisNoch keine Bewertungen

- Vaccination Centers On 13.09.2021Dokument7 SeitenVaccination Centers On 13.09.2021Chanu On CTNoch keine Bewertungen

- Arifni Arifin 1820322018Dokument9 SeitenArifni Arifin 1820322018NisuraNoch keine Bewertungen

- Australian Immunisation Handbook - 9th Edition 2008 (NHMRC)Dokument413 SeitenAustralian Immunisation Handbook - 9th Edition 2008 (NHMRC)wmross1100% (1)

- Framework, Scope and Trends of Nursing PracticeDokument7 SeitenFramework, Scope and Trends of Nursing PracticerinkuNoch keine Bewertungen

- Brochure For World Health Day 7 April 2011Dokument2 SeitenBrochure For World Health Day 7 April 2011Dody FirmandaNoch keine Bewertungen

- Rmnch+a SeminarDokument42 SeitenRmnch+a Seminarshivangi sharma100% (1)

- Reinventing Rural Health Care: A Case Study of Seven Upper Midwest StatesDokument44 SeitenReinventing Rural Health Care: A Case Study of Seven Upper Midwest StatesLyndaWaddingtonNoch keine Bewertungen

- CHNDokument8 SeitenCHNAziil LiizaNoch keine Bewertungen

- Tuscola County Health DepartmentDokument2 SeitenTuscola County Health DepartmentCourtney BennettNoch keine Bewertungen

- Eurohealth 26 2 2020 EngDokument112 SeitenEurohealth 26 2 2020 EngTON THAT MINHNoch keine Bewertungen

- Mental HealthDokument21 SeitenMental HealthTushar Mahmud SizanNoch keine Bewertungen

- Mapeh Mps Per ComponentDokument8 SeitenMapeh Mps Per ComponentRodolfo Esmejarda Laycano Jr.Noch keine Bewertungen

- ImmunizationDokument37 SeitenImmunizationVivian Bell-GamNoch keine Bewertungen

- DOH Program (EPI)Dokument6 SeitenDOH Program (EPI)Shaira GumaruNoch keine Bewertungen

- Filosofi Kesehatan MasyarakatDokument4 SeitenFilosofi Kesehatan MasyarakatJennilynn YusameNoch keine Bewertungen

- Vicp Fact SheetDokument2 SeitenVicp Fact SheetDaniela OpreaNoch keine Bewertungen

- Public Health: DefinitionDokument14 SeitenPublic Health: Definitionahmed mzoreNoch keine Bewertungen

- Final TPADokument40 SeitenFinal TPAkushal87100% (1)

- Argument Article Elc 231Dokument1 SeiteArgument Article Elc 231izzahNoch keine Bewertungen

- Irr Ra11332Dokument14 SeitenIrr Ra11332larisaserzoNoch keine Bewertungen

- K - 12 Grade: California Immunization Requirements ForDokument2 SeitenK - 12 Grade: California Immunization Requirements Forjulian14Noch keine Bewertungen

- Celine Delvi NatasyaP17321183011-1Dokument5 SeitenCeline Delvi NatasyaP17321183011-1Ninne GerdhaNoch keine Bewertungen

- List Journal Int Handelsblattliste Journals 2015Dokument50 SeitenList Journal Int Handelsblattliste Journals 2015Ferry PrasetyiaNoch keine Bewertungen

- Schemes (Part 4) - HealthDokument17 SeitenSchemes (Part 4) - HealthbwerNoch keine Bewertungen

- How To Make A Million Dollars Selling Life Insurance: How To Achieve Financial SuccessVon EverandHow To Make A Million Dollars Selling Life Insurance: How To Achieve Financial SuccessBewertung: 5 von 5 Sternen5/5 (19)

- Social Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionVon EverandSocial Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionNoch keine Bewertungen

- Marine Insurance : Its Principles And PracticeVon EverandMarine Insurance : Its Principles And PracticeBewertung: 4 von 5 Sternen4/5 (2)

- Aircraft Leasing and Financing: Tools for Success in International Aircraft Acquisition and ManagementVon EverandAircraft Leasing and Financing: Tools for Success in International Aircraft Acquisition and ManagementBewertung: 4.5 von 5 Sternen4.5/5 (9)

- The Definitive Guide to Captive Insurance Companies: What Every Small Business Owner Needs to Know About Creating and Implementing a CaptiveVon EverandThe Definitive Guide to Captive Insurance Companies: What Every Small Business Owner Needs to Know About Creating and Implementing a CaptiveNoch keine Bewertungen

- Risky Business: An Insider's Account of the Disaster at Lloyd's of LondonVon EverandRisky Business: An Insider's Account of the Disaster at Lloyd's of LondonNoch keine Bewertungen

- The Social Security and Medicare Handbook What You Need to Know Explained SimplyVon EverandThe Social Security and Medicare Handbook What You Need to Know Explained SimplyNoch keine Bewertungen

- Insurance Made Easy: A Comprehensive Roadmap to the Coverage You NeedVon EverandInsurance Made Easy: A Comprehensive Roadmap to the Coverage You NeedBewertung: 5 von 5 Sternen5/5 (1)

- Civil Engineering Contracts: Practice and ProcedureVon EverandCivil Engineering Contracts: Practice and ProcedureBewertung: 4 von 5 Sternen4/5 (16)

- Investing Money in Your Retirement: The Secret Way that the Super Wealthy Use Life Insurance as a Tax Free Retirement FundVon EverandInvesting Money in Your Retirement: The Secret Way that the Super Wealthy Use Life Insurance as a Tax Free Retirement FundBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Get What's Yours for Medicare: Maximize Your Coverage, Minimize Your CostsVon EverandGet What's Yours for Medicare: Maximize Your Coverage, Minimize Your CostsBewertung: 3.5 von 5 Sternen3.5/5 (9)

- Money-Driven Medicine: The Real Reason Health Care Costs So MuchVon EverandMoney-Driven Medicine: The Real Reason Health Care Costs So MuchBewertung: 4.5 von 5 Sternen4.5/5 (11)

- Doctors, Hospitals, Insurers, Oh My! What You Need to know about Health Insurance and Health CareVon EverandDoctors, Hospitals, Insurers, Oh My! What You Need to know about Health Insurance and Health CareNoch keine Bewertungen

- Reimagining Healthcare: How the Smartsourcing Revolution Will Drive the Future of Healthcare and Refocus It on What Matters Most, the PatientVon EverandReimagining Healthcare: How the Smartsourcing Revolution Will Drive the Future of Healthcare and Refocus It on What Matters Most, the PatientNoch keine Bewertungen

- Guidelines for Increasing Access of Small-Scale Fisheries to Insurance Services in Asia: A Handbook for Insurance and Fisheries Stakeholders. In Support of the Implementation of the Voluntary Guidelines for Securing Sustainable Small-Scale FisheriesVon EverandGuidelines for Increasing Access of Small-Scale Fisheries to Insurance Services in Asia: A Handbook for Insurance and Fisheries Stakeholders. In Support of the Implementation of the Voluntary Guidelines for Securing Sustainable Small-Scale FisheriesNoch keine Bewertungen

- Construction Defect Claims: Handbook for Insurance, Risk Management, Construction/Design ProfessionalsVon EverandConstruction Defect Claims: Handbook for Insurance, Risk Management, Construction/Design ProfessionalsNoch keine Bewertungen

- Actuarial Finance: Derivatives, Quantitative Models and Risk ManagementVon EverandActuarial Finance: Derivatives, Quantitative Models and Risk ManagementNoch keine Bewertungen

- The Complete Guide to Medicaid and Nursing Home Costs: How to Keep Your Family Assets ProtectedVon EverandThe Complete Guide to Medicaid and Nursing Home Costs: How to Keep Your Family Assets ProtectedBewertung: 2 von 5 Sternen2/5 (1)

- National Underwriter Sales Essentials (Property & Casualty): The WedgeVon EverandNational Underwriter Sales Essentials (Property & Casualty): The WedgeNoch keine Bewertungen