Beruflich Dokumente

Kultur Dokumente

Exercise 21

Hochgeladen von

Ruth UtamiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exercise 21

Hochgeladen von

Ruth UtamiCopyright:

Verfügbare Formate

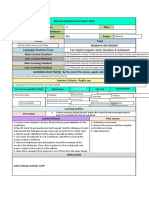

EXERCISE 21-10 (Computation of Rental, Journal Countries for Lessor)

Fieval Leassing Company signs an agreement on January 1,2011, to lease equipment to Reid

Company. The following information relates to the agreement.

1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an

estimated economic life og 6 years

2. the cost and fair value of the asset at January 1, 2010, is £343,000

3. The asset will revert to the lessor at the end of the lease term, at which time the asset is

expected to have a residual value of £61,071, none of which is guaranteed

4. Reid Company assumes direct responsibility for all executor costs

5. The agreement requires equal annual rental payments, beginning on January 1, 2010

Instructions

(a) Fair value of leased asset to lessor £343,000.00

Less: Present value of unguaranteed

residual value £61,071 X .56447

(present value of 1 at 10% for 6 periods) 34,472.75

Amount to be recovered through lease payments £308,527.25

Six periodic lease payments £308,527.25 ÷ 4.79079* £ 64,400.00**

*Present value of annuity due of 1 for 6 periods at 10%.

**Rounded to the nearest pound.

(b) FIEVAL LEASING COMPANY (Lessor)

Lease Amortization Schedule

Annual Lease

Interest (10%) on Recovery

Date Payment Plus Lease Receivable

Lease Receivable of Lease Receivable

URV

1/1/10 - - - £343,000

1/1/10 £ 64,400 £ 64,400 278,600

1/1/11 64,400 £ 27,860 36,540 242,060

1/1/12 64,400 24,206 40,194 201,866

1/1/13 64,400 20,187 44,213 157,653

1/1/14 64,400 15,765 48,635 109,018

1/1/15 64,400 10,902 53,498 55,520

12/31/15 61,071 5,551 55,520 0

£447,471 £104,471 £343,000

(c) 1/1/10 Lease Receivable 343,000

Equipment 343,000

1/1/10 Cash 64,400

Lease Receivable 64,400

12/31/10 Interest Receivable 27,860

Interest Revenue 27,860

1/1/11 Cash 64,400

Lease Receivable 36,540

Interest Receivable 27,860

12/31/11 Interest Receivable 24,206

Interest Revenue 24,206

EXERCISE 21-12 (Accounting for an Operating Lease)

On January 1, 2011, Secada Co. leased a building to Ryker Inc. The relevant information related to

the lease is as follows.

1. The lease arrangement is for 10 years

2. The leased building cost €3,600,000 and was purchased for cash on January 1,2011

3. The building is depreciated on a straight-line basis. Its estimated economic life is 50 years with

no residual value.

4. Lease payments are €220,000 per year and are made at the end of the year

5. Property tax expense of €85,000 and insurance expense of €10,000 on the building were

incurred by Secada in the first year. Payment on these two items was made at the end of the

year.

6. Both the lessor and the lessee are on a calendar-year basis

Intructions

a) Prepare the journal entries that Secada Co. should make in 2011

b) Prepare the journal entries that Ryker Inc. should make in 2011

c) If Secada paid €30,000 to a real estate broker on January 1, 2011, as a fee for finding the lesse,

how much should be reported as an expense for this item in 2011 by Secada Co.?

Solutions

(a) Entries for Secada are as follows:

1/1/11 Building 3,600,000

Cash 3,600,000

12/31/11 Cash 220,000

Rental Revenue 220,000

Depreciation Expense 72,000

Accumulated Depreciation—

Building (€3,600,000 ÷ 50) 72,000

Property Tax Expense 85,000

Insurance Expense 10,000

Cash 95,000

(b) Entries for Ryker are as follows:

12/31/11 Rent Expense 220,000

Cash 220,000

(c) The real estate broker’s fee should be capitalized and amortized equally over the 10-year period. As

a result, real estate fee expense of $3,000 (€30,000 ÷ 10) should be reported in each period.

Das könnte Ihnen auch gefallen

- Be16 P16 2aDokument7 SeitenBe16 P16 2aLisa Hammerle ClarkNoch keine Bewertungen

- Pertemuan 11 - Dividen PDFDokument30 SeitenPertemuan 11 - Dividen PDFayu utamiNoch keine Bewertungen

- ch04 PDFDokument4 Seitench04 PDFMosharraf HussainNoch keine Bewertungen

- Problem 21.3Dokument3 SeitenProblem 21.3Fayed Rahman MahendraNoch keine Bewertungen

- Tugas Latihan Soal EPSDokument4 SeitenTugas Latihan Soal EPSNaoya FaldinyNoch keine Bewertungen

- Soal Latihan Leasing 2020Dokument2 SeitenSoal Latihan Leasing 2020Fatwa XI-Adam SmithNoch keine Bewertungen

- Chapter 19 SolutionsDokument13 SeitenChapter 19 SolutionsreginaNoch keine Bewertungen

- Latihan Soal Sesi 3 - Nastiti Kartika DewiDokument26 SeitenLatihan Soal Sesi 3 - Nastiti Kartika DewiNastiti KartikaNoch keine Bewertungen

- 3 Cash - Assignment PDFDokument6 Seiten3 Cash - Assignment PDFCatherine RiveraNoch keine Bewertungen

- CrockerDokument6 SeitenCrockersg31Noch keine Bewertungen

- Jawaban BE15 - AKMDokument3 SeitenJawaban BE15 - AKMMazz BadruezNoch keine Bewertungen

- Benefits AccountingDokument4 SeitenBenefits AccountingJulian Christopher Torcuator50% (2)

- SolutionDokument14 SeitenSolutionRishiaendra Cool100% (1)

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDokument7 SeitenCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNoch keine Bewertungen

- Ujian Akhir Semester Genap Tahun Akademik 2020-2021: .Ekonomi Dan Bisnis Akuntansi S1Dokument2 SeitenUjian Akhir Semester Genap Tahun Akademik 2020-2021: .Ekonomi Dan Bisnis Akuntansi S1mzulfikar3031Noch keine Bewertungen

- Soal UTS Financial AuditDokument4 SeitenSoal UTS Financial AuditIkhsan Uiandra Putra SitorusNoch keine Bewertungen

- Forum 6Dokument1 SeiteForum 6cecillia lissawatiNoch keine Bewertungen

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDokument1 SeiteBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNoch keine Bewertungen

- Calculus Company Makes Calculators For StudentsDokument2 SeitenCalculus Company Makes Calculators For StudentsElliot RichardNoch keine Bewertungen

- Sesi 9 & 10 Praktikum - SharedDokument9 SeitenSesi 9 & 10 Praktikum - SharedDian Permata SariNoch keine Bewertungen

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123Dokument3 SeitenFinancial Accounting - Tugas 5 - 18 Sep - REVISI 123AlfiyanNoch keine Bewertungen

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsDokument22 SeitenAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaNoch keine Bewertungen

- Latihan 3Dokument3 SeitenLatihan 3Radit Ramdan NopriantoNoch keine Bewertungen

- Jawaban No 1 Pam Corporation Journal Entries in Thousand Rupiah) Date Journal DebitDokument4 SeitenJawaban No 1 Pam Corporation Journal Entries in Thousand Rupiah) Date Journal DebitDaniel cristoferNoch keine Bewertungen

- Advanced Accounting Solutions Chapter-6Dokument2 SeitenAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- ACY4001 Individual Assignment 2 SolutionsDokument7 SeitenACY4001 Individual Assignment 2 SolutionsMorris LoNoch keine Bewertungen

- Nurul Aryani - Quis 2Dokument3 SeitenNurul Aryani - Quis 2Nurul AryaniNoch keine Bewertungen

- Tugas Pertemuan 13 - Alya Sufi Ikrima - 041911333248Dokument3 SeitenTugas Pertemuan 13 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNoch keine Bewertungen

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDokument3 SeitenMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNoch keine Bewertungen

- Consolidated Financial Statement Practice 3-2Dokument2 SeitenConsolidated Financial Statement Practice 3-2Winnie TanNoch keine Bewertungen

- Ch15 EquityDokument8 SeitenCh15 EquityNur MuhammadNoch keine Bewertungen

- Kumpulan Soal UTS AKL IIDokument19 SeitenKumpulan Soal UTS AKL IIAlessandro SitopuNoch keine Bewertungen

- Test 2 HomeworkDokument12 SeitenTest 2 HomeworkMiguel CortezNoch keine Bewertungen

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Dokument6 SeitenZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNoch keine Bewertungen

- Jawaban P5-6 Intermediate AccountingDokument3 SeitenJawaban P5-6 Intermediate AccountingMutia WardaniNoch keine Bewertungen

- Contoh Dan Soal Cash FlowDokument9 SeitenContoh Dan Soal Cash FlowAltaf HauzanNoch keine Bewertungen

- AKL 1 Tugas 1Dokument3 SeitenAKL 1 Tugas 1Dwi PujiNoch keine Bewertungen

- Kementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisDokument2 SeitenKementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisAntique NariswariNoch keine Bewertungen

- $20 To Acquire PT Sumber Tbk. The Fair Value of The Stock at The Time Was $40 Per Share. PTDokument4 Seiten$20 To Acquire PT Sumber Tbk. The Fair Value of The Stock at The Time Was $40 Per Share. PTBryan LukeNoch keine Bewertungen

- Problems Chapter 7Dokument9 SeitenProblems Chapter 7Trang Le0% (1)

- Chapter 8 HomeworkDokument4 SeitenChapter 8 HomeworkJones RamosNoch keine Bewertungen

- Intermediate Accounting III Homework Chapter 18Dokument15 SeitenIntermediate Accounting III Homework Chapter 18Abdul Qayoum Awan100% (1)

- Pertemuan 14 - Investasi Saham (20% - 50%) PDFDokument17 SeitenPertemuan 14 - Investasi Saham (20% - 50%) PDFayu utamiNoch keine Bewertungen

- Tugas Uts (Irmawati Datu Manik) 176602083Dokument39 SeitenTugas Uts (Irmawati Datu Manik) 176602083Klopo KlepoNoch keine Bewertungen

- Tugas 2 AklDokument3 SeitenTugas 2 Akledit andraeNoch keine Bewertungen

- E10 16Dokument1 SeiteE10 16september manisNoch keine Bewertungen

- Excel RevenueDokument44 SeitenExcel RevenueromaricheNoch keine Bewertungen

- Jawaban TugasDokument7 SeitenJawaban TugasRani AdhirasariNoch keine Bewertungen

- Practice Class2Dokument1 SeitePractice Class2Mutahher MuzzammilNoch keine Bewertungen

- Advanced Accounting Chapter 7Dokument26 SeitenAdvanced Accounting Chapter 7Shealalyn1Noch keine Bewertungen

- Partnership - FormationDokument16 SeitenPartnership - Formationnaufal bimoNoch keine Bewertungen

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Dokument6 SeitenYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNoch keine Bewertungen

- E22 3Dokument2 SeitenE22 3bellaNoch keine Bewertungen

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldDokument2 SeitenKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- Jawaban Intermedit Kieso s21-1 Dan s21-2Dokument5 SeitenJawaban Intermedit Kieso s21-1 Dan s21-2muhammad ridwan dudutNoch keine Bewertungen

- The Size of Government: Measurement, Methodology and Official StatisticsVon EverandThe Size of Government: Measurement, Methodology and Official StatisticsNoch keine Bewertungen

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Dokument8 SeitenBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNoch keine Bewertungen

- Tugas AKM P21.12 - Kelompok 6Dokument4 SeitenTugas AKM P21.12 - Kelompok 6Adrian PashaNoch keine Bewertungen

- Intacc2-Quiz ExamDokument10 SeitenIntacc2-Quiz ExamCmNoch keine Bewertungen

- Jeoparty Fraud Week 2022 EditableDokument65 SeitenJeoparty Fraud Week 2022 EditableRhea SimoneNoch keine Bewertungen

- Citibank Vs Hon ChuaDokument12 SeitenCitibank Vs Hon ChuaJA BedrioNoch keine Bewertungen

- Chronology of Events:: Account: North Davao Mining Corp (NDMC)Dokument2 SeitenChronology of Events:: Account: North Davao Mining Corp (NDMC)John Robert BautistaNoch keine Bewertungen

- KCET MOCK TEST PHY Mock 2Dokument8 SeitenKCET MOCK TEST PHY Mock 2VikashNoch keine Bewertungen

- Bhaja Govindham LyricsDokument9 SeitenBhaja Govindham LyricssydnaxNoch keine Bewertungen

- Wa0009.Dokument14 SeitenWa0009.Pradeep SinghNoch keine Bewertungen

- Chapter 8 Supplier Quality ManagementDokument71 SeitenChapter 8 Supplier Quality ManagementAnh NguyenNoch keine Bewertungen

- ISCOM5508-GP (A) Configuration Guide (Rel - 02)Dokument323 SeitenISCOM5508-GP (A) Configuration Guide (Rel - 02)J SofariNoch keine Bewertungen

- Albert Einstein's Riddle - With Solution Explained: October 19, 2009 - AuthorDokument6 SeitenAlbert Einstein's Riddle - With Solution Explained: October 19, 2009 - Authorgt295038Noch keine Bewertungen

- Article On Financial PlanningDokument16 SeitenArticle On Financial PlanningShyam KumarNoch keine Bewertungen

- AP Online Quiz KEY Chapter 8: Estimating With ConfidenceDokument6 SeitenAP Online Quiz KEY Chapter 8: Estimating With ConfidenceSaleha IftikharNoch keine Bewertungen

- Snap Fasteners For Clothes-Snap Fasteners For Clothes Manufacturers, Suppliers and Exporters On Alibaba - ComapparelDokument7 SeitenSnap Fasteners For Clothes-Snap Fasteners For Clothes Manufacturers, Suppliers and Exporters On Alibaba - ComapparelLucky ParasharNoch keine Bewertungen

- Tropical Design Reviewer (With Answers)Dokument2 SeitenTropical Design Reviewer (With Answers)Sheena Lou Sangalang100% (4)

- Accaf3junwk3qa PDFDokument13 SeitenAccaf3junwk3qa PDFTiny StarsNoch keine Bewertungen

- United States Court of Appeals Fifth CircuitDokument4 SeitenUnited States Court of Appeals Fifth CircuitScribd Government DocsNoch keine Bewertungen

- Chessboard PDFDokument76 SeitenChessboard PDFAlessandroNoch keine Bewertungen

- Reflexive PronounsDokument2 SeitenReflexive Pronounsquely8343% (7)

- 47 Vocabulary Worksheets, Answers at End - Higher GradesDokument51 Seiten47 Vocabulary Worksheets, Answers at End - Higher GradesAya Osman 7KNoch keine Bewertungen

- Namagunga Primary Boarding School: Term I Holiday Work - 2020 Primary One - Literacy 1BDokument6 SeitenNamagunga Primary Boarding School: Term I Holiday Work - 2020 Primary One - Literacy 1BMonydit santino100% (1)

- Fire Safety Management - Traditional Building Part#2Dokument194 SeitenFire Safety Management - Traditional Building Part#2Yoyon Haryono100% (1)

- Women in IslamDokument22 SeitenWomen in Islamsayed Tamir janNoch keine Bewertungen

- Comparative Study of The Prison System in India, UK and USADokument12 SeitenComparative Study of The Prison System in India, UK and USAHarneet Kaur100% (1)

- UNIT VI. Gunpowder and ExplosivesDokument6 SeitenUNIT VI. Gunpowder and ExplosivesMariz Althea Jem BrionesNoch keine Bewertungen

- Marina AbramovićDokument2 SeitenMarina AbramovićTatiana AlbuNoch keine Bewertungen

- 3RD Last RPHDokument5 Seiten3RD Last RPHAdil Mohamad KadriNoch keine Bewertungen

- The Neuromarketing ConceptDokument7 SeitenThe Neuromarketing ConceptParnika SinghalNoch keine Bewertungen

- Hotel BookingDokument1 SeiteHotel BookingJagjeet SinghNoch keine Bewertungen

- FINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedDokument7 SeitenFINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedYou VeeNoch keine Bewertungen

- All-India rWnMYexDokument89 SeitenAll-India rWnMYexketan kanameNoch keine Bewertungen

- SAi Sankata Nivarana StotraDokument3 SeitenSAi Sankata Nivarana Stotrageetai897Noch keine Bewertungen