Beruflich Dokumente

Kultur Dokumente

REVENUE REGULATIONS NO. 9-2018 Issued On February 26, 2018 Prescribes The Rules and

Hochgeladen von

jomari ian simando0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten1 SeiteRevenue Regulation 9-2018

Originaltitel

RR 9-2018

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRevenue Regulation 9-2018

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten1 SeiteREVENUE REGULATIONS NO. 9-2018 Issued On February 26, 2018 Prescribes The Rules and

Hochgeladen von

jomari ian simandoRevenue Regulation 9-2018

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

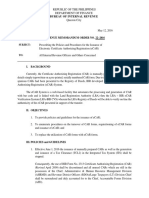

REVENUE REGULATIONS NO.

9-2018 issued on February 26, 2018 prescribes the rules and

regulations implementing the increase in the Stock Transfer Tax pursuant to Republic Act No.

10963 (Tax Reform for Acceleration and Inclusion [TRAIN] Law).

The Percentage Tax on the sale, barter or exchange of shares of stock listed and traded

through the local stock exchange has been increased from one-half of one percent (1/2 of 1%) to

six-tenths of one percent (6/10 of 1%).

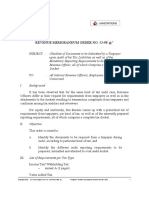

The following are the work-around filing and payment procedures which shall be

followed while BIR Form No. 2552 is being updated:

Tax Type ATC

A. eFPS Filers

1. File and pay ½ of 1% online using existing ST Percentage Tax - PT 200

BIR Form No. 2552 Stocks

2. File and pay the deficiency tax of 1/10 of 1% ST Percentage Tax - MC 031-

using BIR Form No. 0605 Stocks Deficiency Tax

B. eBIR Forms Filers

1. File ½ of 1% online using existing BIR Form ST Percentage Tax - PT 200

in the eBIRForms Package, and pay: Stocks

a. Online via GCASH, LBEPS, or BDPTO

b. Manually via Over-the-Counter (OTC) of

Authorized Agent Banks (AABs) under the

jurisdiction of the Revenue District Office

(RDO) where taxpayer is registered

2. File the deficiency tax of 1/10 of 1% using BIR ST Percentage Tax - MC 031-

Form No. 0605, and pay via the same options Stocks Deficiency Tax

above

C. Manual Filers

1. Fill-in applicable BIR Form No. 2552 (pre- ST Percentage Tax - PT 200

printed or downloaded from BIR website) Stocks

using the new tax rate of 6/10 of 1%

2. File and pay manually via OTC of AABs under

the jurisdiction of the RDO where the taxpayer

is registered

Das könnte Ihnen auch gefallen

- TRAIN Law tax rate transition proceduresDokument2 SeitenTRAIN Law tax rate transition proceduresAnonymous HQymOK61Noch keine Bewertungen

- RMC 3-2018 (DST)Dokument2 SeitenRMC 3-2018 (DST)sanNoch keine Bewertungen

- 68120RR 1-2013 PDFDokument6 Seiten68120RR 1-2013 PDFandrew estimoNoch keine Bewertungen

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDokument3 SeitenRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNoch keine Bewertungen

- 68120RR 1-2013Dokument6 Seiten68120RR 1-2013Allan AlcantaraNoch keine Bewertungen

- BIR Forms transition procedures TRAIN law revised excise tax ratesDokument1 SeiteBIR Forms transition procedures TRAIN law revised excise tax ratesAnonymous c19rbKRNoch keine Bewertungen

- RMO No. 5-2002Dokument13 SeitenRMO No. 5-2002lantern san juanNoch keine Bewertungen

- Bureau of Internal RevenueDokument8 SeitenBureau of Internal RevenueDianne EvardoneNoch keine Bewertungen

- RR No. 02-2006Dokument10 SeitenRR No. 02-2006odessaNoch keine Bewertungen

- Rmo 13-12Dokument60 SeitenRmo 13-12Kris CalabiaNoch keine Bewertungen

- Rmo 28-07Dokument31 SeitenRmo 28-07nathalie velasquezNoch keine Bewertungen

- RMC No. 73-2018Dokument3 SeitenRMC No. 73-2018Madi KomoaNoch keine Bewertungen

- RMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsDokument2 SeitenRMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsphilippinecpaNoch keine Bewertungen

- 1 - TRAIN On Govt Agencies - NMT - 03.06.2018Dokument26 Seiten1 - TRAIN On Govt Agencies - NMT - 03.06.2018NISREEN WAYANoch keine Bewertungen

- BIR Regulations Expand eFPS Coverage to Include NGA Tax FilingsDokument7 SeitenBIR Regulations Expand eFPS Coverage to Include NGA Tax FilingsJerwin DaveNoch keine Bewertungen

- Revenue Regulations No. 9-2001Dokument6 SeitenRevenue Regulations No. 9-2001Anonymous GMUQYq8Noch keine Bewertungen

- Rmo No. 22 2016 PDFDokument6 SeitenRmo No. 22 2016 PDFjtf1898Noch keine Bewertungen

- RMO No. 6-2023Dokument11 SeitenRMO No. 6-2023Anostasia NemusNoch keine Bewertungen

- 0605Dokument6 Seiten0605Ivy TampusNoch keine Bewertungen

- Rmo 32-05Dokument8 SeitenRmo 32-05nathalie velasquezNoch keine Bewertungen

- Rmo 53-98Dokument23 SeitenRmo 53-98Kriza Matro-FloresNoch keine Bewertungen

- April 2010 Tax BriefDokument10 SeitenApril 2010 Tax BriefAna MergalNoch keine Bewertungen

- Pls Print - 1998 RMO 53-98 - Checklist of Documents To Be Submitted by Taxpayer Upon AuditDokument25 SeitenPls Print - 1998 RMO 53-98 - Checklist of Documents To Be Submitted by Taxpayer Upon AuditJoyce CabatanNoch keine Bewertungen

- TAX2Dokument2 SeitenTAX2Nicolyn Rae EscalanteNoch keine Bewertungen

- Prakas 741 On Rule and Procedure For CMT EngDokument6 SeitenPrakas 741 On Rule and Procedure For CMT EngNak VanNoch keine Bewertungen

- Kind of Taxes Issuance/ Legal Basis/ Reasons ATCDokument3 SeitenKind of Taxes Issuance/ Legal Basis/ Reasons ATCchamp1909Noch keine Bewertungen

- Joint guidelines on tax remittanceDokument7 SeitenJoint guidelines on tax remittancefred_barillo09Noch keine Bewertungen

- Kind of Taxes Issuance/ Legal Basis/ Reasons ATCDokument3 SeitenKind of Taxes Issuance/ Legal Basis/ Reasons ATCHarryNoch keine Bewertungen

- Revenue Regulations No. 12-2002Dokument5 SeitenRevenue Regulations No. 12-2002Sy HimNoch keine Bewertungen

- Bir Form 0605Dokument2 SeitenBir Form 0605alona_245883% (6)

- Deductors Manual Qtrly Tds Tcs V 1Dokument35 SeitenDeductors Manual Qtrly Tds Tcs V 1api-3706890Noch keine Bewertungen

- Tax Advisory BIR Form Shall Be Used For VAT PDFDokument1 SeiteTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNoch keine Bewertungen

- 34036rmo 2-2007Dokument13 Seiten34036rmo 2-2007toniNoch keine Bewertungen

- THE Ministry of FinanceDokument19 SeitenTHE Ministry of FinancePhương Trần Đỗ NgọcNoch keine Bewertungen

- REVENUE MEMORANDUM CIRCULAR NO. 89 - 2007 Issued On December 18Dokument1 SeiteREVENUE MEMORANDUM CIRCULAR NO. 89 - 2007 Issued On December 18Cliff DaquioagNoch keine Bewertungen

- RMO No 19-2015Dokument10 SeitenRMO No 19-2015gelskNoch keine Bewertungen

- Module VIDokument13 SeitenModule VIRenz Joshua Quizon MunozNoch keine Bewertungen

- Guidelines for ROR Issuance During Tax DeadlinesDokument7 SeitenGuidelines for ROR Issuance During Tax DeadlinestoniNoch keine Bewertungen

- 2021326153532729circular13 2021Dokument4 Seiten2021326153532729circular13 2021Ahmad SafiNoch keine Bewertungen

- KNCCI Vihiga: enabling county revenue raising legislationVon EverandKNCCI Vihiga: enabling county revenue raising legislationNoch keine Bewertungen

- KNCCI Vihiga: enabling county revenue raising legislationVon EverandKNCCI Vihiga: enabling county revenue raising legislationNoch keine Bewertungen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesVon EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNoch keine Bewertungen

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesVon EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNoch keine Bewertungen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxVon EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Landlord Tax Planning StrategiesVon EverandLandlord Tax Planning StrategiesNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- 115 Sukhothai Cuisine Vs CADokument3 Seiten115 Sukhothai Cuisine Vs CAjomari ian simandoNoch keine Bewertungen

- Am 10-4-1-SCDokument20 SeitenAm 10-4-1-SCjomari ian simandoNoch keine Bewertungen

- 11 - G.R. No. 180651 - Nursery Care V AcevedoDokument6 Seiten11 - G.R. No. 180651 - Nursery Care V AcevedoRenz Francis LimNoch keine Bewertungen

- PLDT not liable for injuries from excavationDokument4 SeitenPLDT not liable for injuries from excavationjomari ian simandoNoch keine Bewertungen

- 4 Nuguid v. NuguidDokument4 Seiten4 Nuguid v. Nuguidjomari ian simandoNoch keine Bewertungen

- 6 Dy v. CADokument4 Seiten6 Dy v. CAjomari ian simandoNoch keine Bewertungen

- 7 Keng Hua Paper Products v. CADokument5 Seiten7 Keng Hua Paper Products v. CAjomari ian simandoNoch keine Bewertungen

- 6 - G.R. No. 187485 - CIR V San Roque PowerDokument4 Seiten6 - G.R. No. 187485 - CIR V San Roque PowerRenz Francis LimNoch keine Bewertungen

- Heirs of Purisima Nala v. CabansagDokument3 SeitenHeirs of Purisima Nala v. Cabansagjomari ian simandoNoch keine Bewertungen

- FATCA FaqsDokument6 SeitenFATCA FaqsCyruss Xavier Maronilla NepomucenoNoch keine Bewertungen

- Vda de Rosales v. RamosDokument4 SeitenVda de Rosales v. Ramosjomari ian simandoNoch keine Bewertungen

- Dela Cruz v. DimaanoDokument3 SeitenDela Cruz v. Dimaanojomari ian simandoNoch keine Bewertungen

- Northfront CaseDokument4 SeitenNorthfront Casejomari ian simandoNoch keine Bewertungen

- Amending Exchange of Information RegulationsDokument2 SeitenAmending Exchange of Information Regulationsjomari ian simandoNoch keine Bewertungen

- RR No. 8-2018Dokument27 SeitenRR No. 8-2018deltsen100% (1)

- RMO 2-2013 Phil. Tax TreatiesDokument0 SeitenRMO 2-2013 Phil. Tax TreatiesPeggy SalazarNoch keine Bewertungen

- Crim Law IDokument2 SeitenCrim Law Ijomari ian simandoNoch keine Bewertungen

- RR No. 8-2018Dokument27 SeitenRR No. 8-2018deltsen100% (1)