Beruflich Dokumente

Kultur Dokumente

Name: - Score

Hochgeladen von

Ivy MercadoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Name: - Score

Hochgeladen von

Ivy MercadoCopyright:

Verfügbare Formate

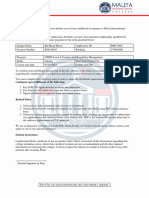

Tarlac State University – College of Business & Accountancy FAR 1 – Q1 (Final_Term)

Name: ____________________________________________ Score: _______________

1. Shares received in lieu of cash dividends are recognized as income and are measured equal to the [A] original amount of

cash dividends intended to be declared and paid [B] fair value of the shares received [C] par value of the shares received

[D] higher between the fair value of the shares received and the original amount of cash dividends intended to be declared

and paid received

2. Bonds held as trading securities are initially measured at [A] price paid for the bonds plus accrued interest if acquired

between interest dates [B] price paid for the bonds plus accrued interest less any transaction costs related to the acquisition

[C] price paid for the bonds without regard to accrued interest and any transaction costs related to the acquisition [D] price

paid for the bonds plus transaction costs related to the acquisition less any accrued interest

3. An investor owns 25% of the outstanding preference shares of the investee. At the end of the year, the investor held

inventories acquired from the investee at a gross profit rate of 20% above cost. How would the profit on ending

inventories affect the investment income and investment account respectively? [A] increase, decrease [B] decrease,

increase [C] decrease, decrease [D] no effect, no effect

4. The cost of the new investment acquired through the exercise of stock rights that are not accounted for separately is equal

to the [A] total of the cost of stock rights exercised plus the subscription price for the new shares [B] subscription price for

the new shares [C] excess of the subscription price for the new shares over the cost of the stock rights exercised [D] higher

between the subscription price of the shares and its par value

5. The amortization of the excess of acquisition price over the carrying amount of the net assets acquired by an investor over

an associate that was allocated to an undervalued depreciable asset will [A] increase the investment income [B] decrease

the investment balance [C] have no effect on investment income and investment balance [D] increase both investment

income and investment balance

6. If bonds are acquired between interest dates, the accrued interest [A] must be included in the cost of the bonds [B] must be

recorded separately as bond premium [C] will increase the total cash to be paid upon acquisition [D] must be deducted

from the amount of premium or discount resulting from the acquisition of the bonds.

(Problem No. 1) JAMES BONDS Co. acquired 12%, Php 4,000,000 face value bonds maturing on December 31, 2020 for Php

3,740,000 on January 1, 2017. The bonds are dated January 1, 2017 and pay interest annually every December 31.

Transaction costs amounting to Php 26,900 were excluded from the aforementioned acquisition price. The bonds were

acquired to yield 14%. The bonds were classified as financial assets at amortized cost. On July 01, 2019, the investor sold all

of the bonds at 115.

Required:

1. How much is the carrying amount of the bonds as at December 31, 2017?

2. How much interest income should be recognized for the year 2018?

3. How much is the carrying amount of the bonds as at the date of sale?

4. How much is the gain or loss on the sale of the bonds?

(Problem No. 2) On January 1, 2017, SIGNIFICANT Corp. acquired 25% of the outstanding ordinary shares of INFLUENCE

Corp. by paying Php 1,260,000 cash when the carrying amount of the net assets of INFLUENCE Corp. equaled Php 6,000,000.

The difference was attributed to an equipment which had a carrying amount of Php 2,000,000 and a fair market value of Php

1,600,000, and to a building with a carrying amount of Php 1,000,000 and a fair market value of Php 1,200,000. The

remaining useful life of the equipment and building was 4 years and 10 years respectively. On June 30, 2017, INFLUENCE

Corp. sold furniture to SIGNIFICANT Corp. at a loss of Php 20,000. On the date of the sale, the furniture had a remaining life

of 5 years. At year end, the investor held inventory which it acquired from the investee for Php 50,000. The goods had a cost

of Php 40,000. INFLUENCE Corp. reported net income of Php 1,000,000 in 2017 and Php 1,500,000 and paid dividends of

Php 300,000 in 2017 and Php 500,000 in 2018.

Required:

1. Goodwill/ (Income from acquisition)

2. Investment income for the year 2017

3. Investment balance, December 31, 2017

4. Investment income for the year 2018

5. Investment balance, December 31, 2018

(Problem No. 3) The following transactions for Dibby Dean Corp. transpired in the following chronological order:

a. Dibby Dean Corp. bought 20,000 unquoted ordinary shares of NaperFek Co at Php 30 per share.

b. Received 50% stock dividend from NaperFek Co.

c. Received stock rights from NaperFek Co. enabling shareholders to buy a share for Php 30 plus 4 rights. The shares were

selling Php 42 – ex right as at the date of granting of the rights. Rights are accounted for separately.

d. Received from NaperFek a cash dividend of Php 5 per share.

e. Exercised all the rights received in item “C”.

f. Received a dividend in kind of 1 ordinary share of Gaga-Lingan Co. with a market price of Php 5 per share for every five

(5) NaperFek ordinary shares held.

g. Sold 5,000 ordinary shares of NaperFek Co at Php 65 per share.

Required:

1. Amount debited to stock rights in transaction “C”

2. Amount credited to dividend income in transaction “D”

3. Cost of the new investment in transaction “E”

4. Amount credited to dividend income in transaction “F”

5. Gain / (loss) on the sale of NaperFek Co. ordinary shares in transaction “G”

Das könnte Ihnen auch gefallen

- ACC 226 Investment in Associate COPYDokument3 SeitenACC 226 Investment in Associate COPYJAYBIE ENDAYANoch keine Bewertungen

- 07 Investment in AssociatesDokument5 Seiten07 Investment in AssociatesAllegria AlamoNoch keine Bewertungen

- Investment in Equity Securities Theories and ProblemsDokument18 SeitenInvestment in Equity Securities Theories and ProblemsAndrei GoNoch keine Bewertungen

- ACC 603 Advanced Accounting Theory ExamDokument7 SeitenACC 603 Advanced Accounting Theory ExamSteph Stevens0% (1)

- Midterm FarDokument7 SeitenMidterm FarShannen D. CalimagNoch keine Bewertungen

- P3 SW 1 PDFDokument7 SeitenP3 SW 1 PDFAldwin Jake O. PulgadoNoch keine Bewertungen

- Prac 1 Final PreboardDokument10 SeitenPrac 1 Final Preboardbobo kaNoch keine Bewertungen

- Chapter 4Dokument31 SeitenChapter 4Kristina Kitty100% (1)

- Investment Income and GainsDokument9 SeitenInvestment Income and GainsRex AdarmeNoch keine Bewertungen

- 6 AfarDokument24 Seiten6 AfarJM SonidoNoch keine Bewertungen

- App DDokument16 SeitenApp DJulious CaalimNoch keine Bewertungen

- Audit of InvestmentsDokument4 SeitenAudit of InvestmentsKy DulzNoch keine Bewertungen

- Investment Theories and CalculationsDokument9 SeitenInvestment Theories and CalculationsChester GuioguioNoch keine Bewertungen

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDokument3 SeitenIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAbigail Ann PasiliaoNoch keine Bewertungen

- Investments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsDokument3 SeitenInvestments That Do Not Normally Change in Value Are Disclosed On The Balance Sheet As Cash and Cash EquivalentsHussainNoch keine Bewertungen

- Questionnaire IntactDokument10 SeitenQuestionnaire Intact?????Noch keine Bewertungen

- FAR CPA Exam Practice QuestionsDokument8 SeitenFAR CPA Exam Practice QuestionsDarlene JacaNoch keine Bewertungen

- Exercise InvestmentsDokument14 SeitenExercise InvestmentsAlizah Lariosa Bucot43% (7)

- Acc423 Final Exam 100+ Questions Included 2 ExamsDokument102 SeitenAcc423 Final Exam 100+ Questions Included 2 ExamsMaria Aguilar0% (1)

- 2nd Long Quiz StudentDokument8 Seiten2nd Long Quiz StudentDumb MushNoch keine Bewertungen

- Pindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Dokument43 SeitenPindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Pindi Yulinar100% (5)

- Microsoft Word - FAR02 - Accounting For Debt InvestmentsDokument4 SeitenMicrosoft Word - FAR02 - Accounting For Debt InvestmentsDisguised owl0% (1)

- Dlsu Exam 2nd Quiz Acccob2Dokument4 SeitenDlsu Exam 2nd Quiz Acccob2Chelcy Mari GugolNoch keine Bewertungen

- Quiz in Shareholders' EquityDokument12 SeitenQuiz in Shareholders' EquityYou're WelcomeNoch keine Bewertungen

- Ia Long Exam AprDokument16 SeitenIa Long Exam AprChristy HabelNoch keine Bewertungen

- Ebook Corporate Partnership Estate and Gift Taxation 2013 7Th Edition Pratt Test Bank Full Chapter PDFDokument47 SeitenEbook Corporate Partnership Estate and Gift Taxation 2013 7Th Edition Pratt Test Bank Full Chapter PDFselenatanloj0xa100% (8)

- ACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Dokument10 SeitenACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Marriel Fate Cullano100% (1)

- Current LiabilitiesDokument3 SeitenCurrent LiabilitiesAhlaya Lyrica Cadence SadoresNoch keine Bewertungen

- Investment in AssociateDokument33 SeitenInvestment in AssociateKimivy BusaNoch keine Bewertungen

- Fa2 Tut 5Dokument5 SeitenFa2 Tut 5Truong Thi Ha Trang 1KT-19Noch keine Bewertungen

- FTME Key To CorrectionDokument12 SeitenFTME Key To CorrectionABMAYALADANO ,ErvinNoch keine Bewertungen

- Notes Receivable ExplainedDokument22 SeitenNotes Receivable ExplainedYassi Curtis100% (1)

- ACT15 Intermediate Accounting 1 Pre-Final Quiz ReviewDokument9 SeitenACT15 Intermediate Accounting 1 Pre-Final Quiz ReviewJan MarcosNoch keine Bewertungen

- Pre Quali 2019Dokument9 SeitenPre Quali 2019Haidie DiazNoch keine Bewertungen

- QuestionsDokument4 SeitenQuestionsAloha Bu-ucan0% (1)

- 3rd Midterm Quiz QuestionnaireDokument9 Seiten3rd Midterm Quiz QuestionnaireAthena Fatmah AmpuanNoch keine Bewertungen

- Activity 3-4 SB CompensationDokument3 SeitenActivity 3-4 SB CompensationNhel Alvaro0% (1)

- SQE - Financial Accounting and Reporting - Second Year - March 31, 2011Dokument11 SeitenSQE - Financial Accounting and Reporting - Second Year - March 31, 2011Jerimiah MirandaNoch keine Bewertungen

- Acc QuizDokument3 SeitenAcc QuizRey Joyce AbuelNoch keine Bewertungen

- Investment Intangible Wasting Assets 1 PDFDokument8 SeitenInvestment Intangible Wasting Assets 1 PDFMeldwin C. Gutierrez50% (2)

- Chapter 15 Practice QuizDokument7 SeitenChapter 15 Practice QuizLara Lewis AchillesNoch keine Bewertungen

- IA2 Finals Retake Reviewer For PracticeDokument5 SeitenIA2 Finals Retake Reviewer For PracticeLoro AdrianNoch keine Bewertungen

- Auditing Problems: Audit of InvestmentsDokument3 SeitenAuditing Problems: Audit of InvestmentsMarinel AbrilNoch keine Bewertungen

- Practice Final (New Material Only)Dokument12 SeitenPractice Final (New Material Only)Bree JiangNoch keine Bewertungen

- Debt Securities PDFDokument7 SeitenDebt Securities PDFChin-Chin Alvarez SabinianoNoch keine Bewertungen

- ACC 107 Practice ExamDokument29 SeitenACC 107 Practice ExamAJ Jahara GapateNoch keine Bewertungen

- F2 March2014 AnswersDokument16 SeitenF2 March2014 AnswerswardahtNoch keine Bewertungen

- UntitledDokument25 SeitenUntitledAditya ChavanNoch keine Bewertungen

- Acccob2 Quiz 2Dokument7 SeitenAcccob2 Quiz 2John Eliel Baladjay100% (1)

- Activity 1 (Shareholder's Equity)Dokument9 SeitenActivity 1 (Shareholder's Equity)NikkiFabelloMalicatNoch keine Bewertungen

- Calculating paid-in capital from bonds with detachable warrantsDokument10 SeitenCalculating paid-in capital from bonds with detachable warrantssamuelkishNoch keine Bewertungen

- QUIZ7 Audit of LiabilitiesDokument3 SeitenQUIZ7 Audit of LiabilitiesCarmela GulapaNoch keine Bewertungen

- Invest in Equity SecuritiesDokument3 SeitenInvest in Equity SecuritiesGIRLNoch keine Bewertungen

- Wassim Zhani Income Taxation of Corporations (Chapter 9)Dokument38 SeitenWassim Zhani Income Taxation of Corporations (Chapter 9)wassim zhaniNoch keine Bewertungen

- ACCT 412 Chapter 7 SolutionsDokument13 SeitenACCT 412 Chapter 7 SolutionsJose T100% (2)

- Module 4 - Notes ReceivableDokument22 SeitenModule 4 - Notes ReceivableJennalyn S. GanalonNoch keine Bewertungen

- MSU Accounting Departmental QuizDokument8 SeitenMSU Accounting Departmental QuizMica R.Noch keine Bewertungen

- ACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - INVESTMENTS IN ASSOCIATE QUIZDokument5 SeitenACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - INVESTMENTS IN ASSOCIATE QUIZMarilou Arcillas PanisalesNoch keine Bewertungen

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- Palak Jindal - Summer Internship ReportDokument40 SeitenPalak Jindal - Summer Internship ReportHarsh Kumar100% (2)

- Bond Pricing CalculatorDokument37 SeitenBond Pricing CalculatorFurqan Farooq Vadharia100% (1)

- Notes MBADokument46 SeitenNotes MBAAghora Siva100% (3)

- Admission of A New PartnerDokument36 SeitenAdmission of A New PartnerSreekanth DogiparthiNoch keine Bewertungen

- Commercial Bank of Ethiopia Shinile Branch Sales ReportDokument14 SeitenCommercial Bank of Ethiopia Shinile Branch Sales ReportDaniel AbrahamNoch keine Bewertungen

- Financial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionDokument50 SeitenFinancial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionNoor Ul Hussain MirzaNoch keine Bewertungen

- B 1 Bank TransactionsDokument16 SeitenB 1 Bank TransactionsMahima SherigarNoch keine Bewertungen

- Substantive Procedures For Evaluation of LoansDokument3 SeitenSubstantive Procedures For Evaluation of LoansChristian PerezNoch keine Bewertungen

- Enhanced Credit Report SummaryDokument9 SeitenEnhanced Credit Report Summaryarcman17100% (1)

- Audit Property Plant EquipmentDokument5 SeitenAudit Property Plant EquipmentMonica GarciaNoch keine Bewertungen

- Corporate Financial Management IntroDokument17 SeitenCorporate Financial Management IntroADEYANJU AKEEMNoch keine Bewertungen

- Foreign BanksDokument9 SeitenForeign Banks1986anuNoch keine Bewertungen

- Value Beat 121013Dokument3 SeitenValue Beat 121013zarr pacificadorNoch keine Bewertungen

- APT Literature Review: Arbitrage Pricing TheoryDokument11 SeitenAPT Literature Review: Arbitrage Pricing Theorydiala_khNoch keine Bewertungen

- Job Description - CashierDokument1 SeiteJob Description - CashierNilda AdadNoch keine Bewertungen

- Women Self Help Groups Empowerment StudyDokument0 SeitenWomen Self Help Groups Empowerment StudyDrKapil JainNoch keine Bewertungen

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Dokument23 SeitenThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNoch keine Bewertungen

- International Corporate FinanceDokument380 SeitenInternational Corporate FinanceBiju GeorgeNoch keine Bewertungen

- For The Love of MoneyDokument12 SeitenFor The Love of MoneyLayla S Yankle100% (1)

- Rek Koran Mandiri PT HAI Jan-April 2023Dokument14 SeitenRek Koran Mandiri PT HAI Jan-April 2023wahyu suhartonoNoch keine Bewertungen

- Philippine Bond MarketDokument30 SeitenPhilippine Bond MarketMARY JUSTINE PAQUIBOTNoch keine Bewertungen

- Handover Notes-Finance and Admin - 31 August 2021Dokument5 SeitenHandover Notes-Finance and Admin - 31 August 2021Liberty RuzvidzoNoch keine Bewertungen

- Financial Flexibility Framework AnalysisDokument9 SeitenFinancial Flexibility Framework AnalysisEdwin GunawanNoch keine Bewertungen

- Plastic MoneyDokument11 SeitenPlastic MoneyDILIP JAINNoch keine Bewertungen

- Partnership DissolutionDokument5 SeitenPartnership DissolutionKathleenNoch keine Bewertungen

- GGCADokument2 SeitenGGCAPrakash BaldaniyaNoch keine Bewertungen

- Teller Duties ResumeDokument7 SeitenTeller Duties Resumeafllxjwyf100% (1)

- Sign Verified Tax Invoice for GPON Fiber HD5 HYD 50Mbps Monthly SubscriptionDokument1 SeiteSign Verified Tax Invoice for GPON Fiber HD5 HYD 50Mbps Monthly SubscriptionShetkar GouthamNoch keine Bewertungen

- MIC15691-CAL-Md Riyad HasanDokument2 SeitenMIC15691-CAL-Md Riyad Hasanmonir.saseduNoch keine Bewertungen

- Bank service charge noticeDokument3 SeitenBank service charge noticeDr GoherNoch keine Bewertungen