Beruflich Dokumente

Kultur Dokumente

BIR Form 2551 - PDF

Hochgeladen von

Michael LaquianOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BIR Form 2551 - PDF

Hochgeladen von

Michael LaquianCopyright:

Verfügbare Formate

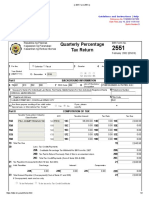

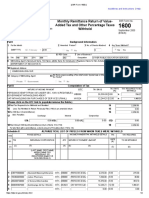

|| BIR Form 2551 || https://efps.bir.gov.ph/faces/EFPSWeb_war/forms/2551/2551.

xhtml

Guidelines and Instructions | Help

Reference No:111900031377083

Date Filed:July 22, 2019 10:02 AM

Batch Number:0

PSOC: PSIC:

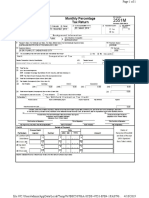

Republika ng Pilipinas BIR Form No.

Kagawaran ng Pananalapi Quarterly Percentage

Kawanihan ng Rentas Internas

Tax Return 2551

February 2002 (ENCS)

Calendar Fiscal No. of Sheets

1 For the 3 Quarter 4 Amended Return 5 Attached

Year Ended

2 (MM/YYYY) 12 - December Yes No

1st 2nd 3rd 4th

Part I BACKGROUND INFORMATION

Line of Business/

6 TIN 158 134 957 000 7 RDO Code 059 8 Occupation SERVICE ACTIVITIES RELATED TO PRINTING

9 Taxpayer's Name (For Individual) Last Name, First Name, Middle Name/ (For Non-individual) Registered Name 10 Telephone Number

PERCE, TITO DELOS SANTOS 5625-209

11 Registered Address 12 Zip Code

null null LIPA CITY BATANGAS 4217

Are there payees availing of tax relief under

13 Special Law or International Tax Treaty? Yes No If yes, please specify

Part II COMPUTATION OF TAX

Taxable Transaction / Industry

ATC Taxable Amount Tax Rate Tax Due

Classification

14A 14B 14C 1,344,394.29 14D 3.00 14E 40,331.83

15A 15B 15C 0.00 15D 0.00 15E 0.00

16A 16B 16C 0.00 16D 0.00 16E 0.00

17A 17B 17C 0.00 17D 0.00 17E 0.00

18A 18B 18C 0.00 18D 0.00 18E 0.00

19 Total Tax Due 19 40,331.83

20 Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 20A 15,869.38

20B Tax Paid in Return Previously Filed, if this is an amended return 20B 0.00

20C Total Tax Credit/Payments (Sum of Items 20A & 20B) 20C 15,869.38

21 Tax Payable (Overpayment) (Item 19 less Item 20C) 21 24,462.45

Add: Penalties Surcharge Interest Compromise

22

22A 0.00 22B 0.00 22C 0.00 22D 0.00

23 Total Amount Payable / (Overpayment) (Sum of Items 21 and 22D) 23 24,462.45

If Overpayment, mark one box only

To be Refunded To be issued a Tax Credit Certificate

Attachments

[ BIR Main | Tax Return Inquiry | User Menu | Guidelines and Instructions | Help ]

1 of 1 7/22/2019, 10:36 AM

Das könnte Ihnen auch gefallen

- MarioeFPS Home - EFiling and Payment SystemDokument2 SeitenMarioeFPS Home - EFiling and Payment SystemEdward Roy “Ying” AyingNoch keine Bewertungen

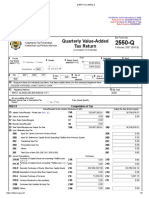

- Quarterly Value-Added Tax ReturnDokument2 SeitenQuarterly Value-Added Tax ReturnFrancis M. TabajondaNoch keine Bewertungen

- Test PDFDokument2 SeitenTest PDFLulu Adaro VillanuevaNoch keine Bewertungen

- EFPS Home - EFiling and Payment SystemDokument2 SeitenEFPS Home - EFiling and Payment Systemmelanie venturaNoch keine Bewertungen

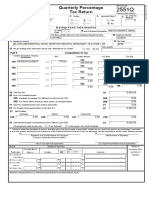

- Quarterly Percentage Tax Return - 1st QuarterDokument2 SeitenQuarterly Percentage Tax Return - 1st QuarterJo HernandezNoch keine Bewertungen

- 3rd Quarter TaxDokument1 Seite3rd Quarter Taxmiguel tinsayNoch keine Bewertungen

- 2550-M August-2022Dokument2 Seiten2550-M August-2022Jing ReyesNoch keine Bewertungen

- 2550-M February-2022Dokument2 Seiten2550-M February-2022Jing ReyesNoch keine Bewertungen

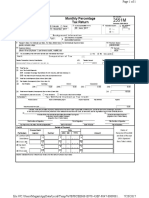

- Monthly Percentage Tax Return: 12 - December 04 - AprilDokument1 SeiteMonthly Percentage Tax Return: 12 - December 04 - AprilTamara HamiltonNoch keine Bewertungen

- 2550-M October-2022Dokument2 Seiten2550-M October-2022Jing ReyesNoch keine Bewertungen

- Quarterly Value-Added Tax ReturnDokument2 SeitenQuarterly Value-Added Tax ReturnjoshuaNoch keine Bewertungen

- Gts 1stDokument2 SeitenGts 1stGOLDEN TOPSTEEL CONSTRUCTION SUPPLYNoch keine Bewertungen

- Easterbloom 2550M - 082022Dokument2 SeitenEasterbloom 2550M - 082022Reyes Accounting Law OfficeNoch keine Bewertungen

- 2550-M November-2022Dokument2 Seiten2550-M November-2022Jing ReyesNoch keine Bewertungen

- 1702Q FhcsiDokument2 Seiten1702Q FhcsiRaffy Enix DavisNoch keine Bewertungen

- e Efps Bir Form PDFDokument2 Seitene Efps Bir Form PDF沈华仁Noch keine Bewertungen

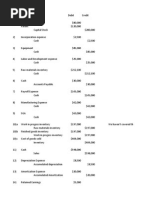

- Quarterly Income Tax Return: Schedule 1Dokument3 SeitenQuarterly Income Tax Return: Schedule 1Ja'maine ManguerraNoch keine Bewertungen

- Monthly Percentage Tax Return: 12 - December 06 - JuneDokument1 SeiteMonthly Percentage Tax Return: 12 - December 06 - JuneDana PardeNoch keine Bewertungen

- Quarterly Income Tax Return: 12 - December 056Dokument2 SeitenQuarterly Income Tax Return: 12 - December 056Cha GomezNoch keine Bewertungen

- Quarterly Percentage Tax Return: 12 - DecemberDokument1 SeiteQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNoch keine Bewertungen

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12Dokument2 SeitenMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12PingLomaadEdulanNoch keine Bewertungen

- ZetkjretkjzrtkrzDokument2 SeitenZetkjretkjzrtkrzHyacinth BalmacedaNoch keine Bewertungen

- Monthly Percentage Tax ReturnDokument4 SeitenMonthly Percentage Tax ReturnromarcambriNoch keine Bewertungen

- Bir GinaDokument1 SeiteBir GinaApril ManjaresNoch keine Bewertungen

- CSSM 0605 2023Dokument1 SeiteCSSM 0605 2023PAULA TVNoch keine Bewertungen

- 0605 SLSP Non FilingDokument1 Seite0605 SLSP Non FilingbertlaxinaNoch keine Bewertungen

- 1701qjuly2008 (ENCS) q22019Dokument5 Seiten1701qjuly2008 (ENCS) q22019Andrew AndalNoch keine Bewertungen

- Quarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Dokument2 SeitenQuarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Francis M. TabajondaNoch keine Bewertungen

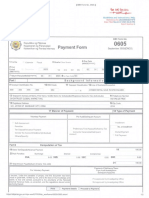

- Payment Form: Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas Internas BIR Form NoDokument2 SeitenPayment Form: Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas Internas BIR Form NoRonald varrie BautistaNoch keine Bewertungen

- EFPS Home - EFiling and Payment SystemDokument2 SeitenEFPS Home - EFiling and Payment SystemJinkieNoch keine Bewertungen

- Nilda 1Dokument1 SeiteNilda 1Mary Lynn Sta PriscaNoch keine Bewertungen

- Monthly Value-Added Tax DeclarationDokument2 SeitenMonthly Value-Added Tax DeclarationJa'maine ManguerraNoch keine Bewertungen

- Drafted BIR Form No. 2000Dokument2 SeitenDrafted BIR Form No. 2000Kevin Besa100% (1)

- 2000 XHTMLDokument2 Seiten2000 XHTMLJanniza RoceroNoch keine Bewertungen

- 1pg Itr SMIIDokument2 Seiten1pg Itr SMIIRic Dela CruzNoch keine Bewertungen

- eFPS Home - Efiling and Payment SystemDokument1 SeiteeFPS Home - Efiling and Payment SystemPAULA TVNoch keine Bewertungen

- UYLC Income Tax Return For 2022 (1702RT 2018C) - DraftDokument4 SeitenUYLC Income Tax Return For 2022 (1702RT 2018C) - DraftVirgelio AbarquezNoch keine Bewertungen

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Dokument2 SeitenMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)JEREMY WILLIAM COZENS-HARDYNoch keine Bewertungen

- 0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022Dokument1 Seite0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022graceNoch keine Bewertungen

- 0605 Certification FeeDokument1 Seite0605 Certification FeePAULA TVNoch keine Bewertungen

- 1601CDokument2 Seiten1601CRoldan Agad SarenNoch keine Bewertungen

- 2551Dokument2 Seiten2551Mariluz BeltranNoch keine Bewertungen

- 2551Q Jan 2018 ENCS Final Rev 3Dokument2 Seiten2551Q Jan 2018 ENCS Final Rev 3MIS MijerssNoch keine Bewertungen

- Monthly Remittance Return of Income Taxes Withheld On CompensationDokument2 SeitenMonthly Remittance Return of Income Taxes Withheld On CompensationCeejay Pagdanganan RosalesNoch keine Bewertungen

- 02 2551 UnlockedDokument3 Seiten02 2551 Unlockedvg.aspirinNoch keine Bewertungen

- 2551MDokument2 Seiten2551MAlexiss Mace JuradoNoch keine Bewertungen

- BIR Form No. 2551MDokument1 SeiteBIR Form No. 2551MLorraine Steffany BanguisNoch keine Bewertungen

- 2020 With PenaltiesDokument1 Seite2020 With PenaltiesKashato BabyNoch keine Bewertungen

- BIR Form 1702-RTDokument4 SeitenBIR Form 1702-RTAljohn Sechico BacolodNoch keine Bewertungen

- Payment FormDokument4 SeitenPayment FormRodel Rivera VelascoNoch keine Bewertungen

- BIR Form No. 0605 2Dokument2 SeitenBIR Form No. 0605 2Ronald varrie BautistaNoch keine Bewertungen

- BIR Form 2551M Monthly Percentage TaxDokument3 SeitenBIR Form 2551M Monthly Percentage TaxBaby BoyNoch keine Bewertungen

- Bir Form No. 0605Dokument2 SeitenBir Form No. 0605Ronald varrie Bautista50% (2)

- BIR Form No. 0605Dokument2 SeitenBIR Form No. 0605Ronald varrie BautistaNoch keine Bewertungen

- eFPS Home - Efiling and Payment System PDFDokument2 SeiteneFPS Home - Efiling and Payment System PDFRegs AccountingTaxNoch keine Bewertungen

- Monthly Remittance Return of Income Taxes Withheld On CompensationDokument4 SeitenMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNoch keine Bewertungen

- 1701Q BIR Form PDFDokument3 Seiten1701Q BIR Form PDFJihani A. SalicNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- Philippine Taxation Under American PeriodDokument4 SeitenPhilippine Taxation Under American PeriodRalph Jayson82% (28)

- Country Risk Analysis Egypt Information 1Dokument46 SeitenCountry Risk Analysis Egypt Information 1kateNoch keine Bewertungen

- Train Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsDokument2 SeitenTrain Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsReynaldo YuNoch keine Bewertungen

- Fi FL FX SystemsDokument7 SeitenFi FL FX SystemsAnonymous btU0rk0pNNoch keine Bewertungen

- Benjamin J. Cohen, Bretton Woods SystemDokument11 SeitenBenjamin J. Cohen, Bretton Woods SystemVarun Kundal67% (3)

- Great Depression WorksheetsDokument3 SeitenGreat Depression Worksheetsmrkastl901Noch keine Bewertungen

- Lessons For NITI AayogDokument8 SeitenLessons For NITI AayogprobirparuiNoch keine Bewertungen

- VAT Act 2052Dokument8 SeitenVAT Act 2052Nirmal Shrestha100% (1)

- GATT ReportDokument28 SeitenGATT Reportpratik3331Noch keine Bewertungen

- Management Accountant 07 - 2008 PDFDokument59 SeitenManagement Accountant 07 - 2008 PDFHakeem Farhan TariqiNoch keine Bewertungen

- Monetary PolicyDokument23 SeitenMonetary PolicyPooja JainNoch keine Bewertungen

- Notes On The Lucas CritiqueDokument16 SeitenNotes On The Lucas CritiqueJuan Manuel Cisneros GarcíaNoch keine Bewertungen

- Offshore Shell Games 2014Dokument56 SeitenOffshore Shell Games 2014Global Financial IntegrityNoch keine Bewertungen

- Build Build Build Program of Duterte's AdministrationDokument6 SeitenBuild Build Build Program of Duterte's AdministrationjohnnyNoch keine Bewertungen

- Introduction To Asian EconomyDokument7 SeitenIntroduction To Asian EconomyPrince DesperadoNoch keine Bewertungen

- Chapter 1 Page 25Dokument25 SeitenChapter 1 Page 25Sangheethaa SukumaranNoch keine Bewertungen

- Devaluation - Case StudyDokument10 SeitenDevaluation - Case StudyRavneet KaurNoch keine Bewertungen

- IBT Midterms ReviewerDokument7 SeitenIBT Midterms ReviewerJhonica CabungcalNoch keine Bewertungen

- Aggregate Demand and Aggregate SupplyDokument66 SeitenAggregate Demand and Aggregate SupplyPrashant JainNoch keine Bewertungen

- International Economics 9th Edition Appleyard Test BankDokument10 SeitenInternational Economics 9th Edition Appleyard Test Banka159411610100% (1)

- Dispensers of California (Jeff)Dokument9 SeitenDispensers of California (Jeff)Jeffery KaoNoch keine Bewertungen

- Jasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentDokument5 SeitenJasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentSiRo WangNoch keine Bewertungen

- Statistics and The German State, 1900 1945: More InformationDokument14 SeitenStatistics and The German State, 1900 1945: More InformationAlejandro Reza RodríguezNoch keine Bewertungen

- Case StudyDokument2 SeitenCase Studyrachel nolascoNoch keine Bewertungen

- Test Bank For International Business, Global Edition, 7E Ch. 2Dokument38 SeitenTest Bank For International Business, Global Edition, 7E Ch. 2PattyNoch keine Bewertungen

- Problems For Practice - Portal Upload - 01 - Oct - 2019Dokument1 SeiteProblems For Practice - Portal Upload - 01 - Oct - 2019Yasir MalikNoch keine Bewertungen

- Reserve Bank of IndiaDokument40 SeitenReserve Bank of IndiahakecNoch keine Bewertungen

- MJC 2011 H1 Econs Marshall Lerner ConditionDokument6 SeitenMJC 2011 H1 Econs Marshall Lerner ConditiononnoezNoch keine Bewertungen

- 1841rmo04 05Dokument7 Seiten1841rmo04 05HarryNoch keine Bewertungen

- Chapters 1 - 13 Igcse BusinessDokument48 SeitenChapters 1 - 13 Igcse BusinessNirag Sanghavi60% (5)