Beruflich Dokumente

Kultur Dokumente

Affidavit of Property Value: Sale Price: $ 00

Hochgeladen von

vaishnav bridOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Affidavit of Property Value: Sale Price: $ 00

Hochgeladen von

vaishnav bridCopyright:

Verfügbare Formate

Print Clear Form

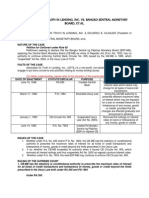

AFFIDAVIT OF PROPERTY VALUE FOR RECORDER’S USE ONLY

1. ASSESSOR’S PARCEL IDENTIFICATION NUMBER(S)

Primary Parcel: _______ - _____ - _______ - ______

BOOK MAP PARCEL SPLIT

Does this sale include any parcels that are being split / divided?

Check one: Yes No

How many parcels, other than the Primary Parcel, are included

in this sale? ______________

Please list the additional parcels below (attach list if necessary):

(1) ________________________ (3) ________________________

(2) ________________________ (4) ________________________ 9. TYPE OF DEED OR INSTRUMENT (Check Only One Box):

2. SELLER’S NAME AND ADDRESS: a. Warranty Deed d. Contract or Agreement

b. Special Warranty Deed e. Quit Claim Deed

________________________________________________________

c. Joint Tenancy Deed f. Other:

________________________________________________________

10. SALE PRICE: $ 00

________________________________________________________

3. (a) BUYER’S NAME AND ADDRESS: 11. DATE OF SALE (Numeric Digits): ____________

Month / Year

________________________________________________________

________________________________________________________ 12. DOWN PAYMENT $ 00

________________________________________________________ 13. METHOD OF FINANCING:

a. Cash (100% of Sale Price) e. New loan(s) from

(b) Are the Buyer and Seller related? Yes No financial Institution:

If Yes, state relationship: b. Barter or trade (1) Conventional

4. ADDRESS OF PROPERTY: (2) VA

c. Assumption of existing loan(s) (3) FHA

________________________________________________________

f. Other financing; Specify:

________________________________________________________ d. Seller Loan (Carryback) _______________________

________________________________________________________ 14. PERSONAL PROPERTY (see reverse side for definition):

5. (a) MAIL TAX BILL TO: (Taxes due even if no bill received) (a) Did the Sale Price in Item 10 include Personal Property that

impacted the Sale Price by 5 percent or more? Yes No

________________________________________________________ (b) If Yes, provide the dollar amount of the Personal Property:

________________________________________________________ $ 00 AND

________________________________________________________ briefly describe the Personal Property: _________________________

(b) Next tax payment due ______________________ 15. PARTIAL INTEREST: If only a partial ownership interest is being sold,

6. PROPERTY TYPE (for Primary Parcel): NOTE: Check Only One Box briefly describe the partial interest:___________________________

a. Vacant Land f. Commercial or Industrial Use 16. SOLAR / ENERGY EFFICIENT COMPONENTS:

b. Single Family Residence g. Agricultural (a) Did the Sale Price in Item 10 include solar energy devices, energy

efficient building components, renewable energy equipment or

c. Condo or Townhouse h. Mobile or Manufactured Home combined heat and power systems that impacted the Sale Price by

Affixed Not Affixed 5 percent or more? Yes No

d. 2-4 Plex i. Other Use; Specify:

If Yes, briefly describe the solar / energy efficient components:

e. Apartment Building _____________________

______________________________________________________

7. RESIDENTIAL BUYER’S USE: If you checked b, c, d or h in Item 6

above, please check one of the following: _______________________________________________________

a. To be used as a primary residence. 17. PARTY COMPLETING AFFIDAVIT (Name, Address, Phone Number):

b. To be rented to someone other than a "qualified family member." _________________________________________________________

c. To be used as a non-primary or secondary residence.

_________________________________________________________

See reverse side for definition of a “primary residence,

secondary residence” and “family member.” _________________________________________________________

8. If you checked e or f in Item 6 above, indicate the number of units: _____ 18. LEGAL DESCRIPTION (attach copy if necessary):

For Apartments, Motels / Hotels, Mobile Home / RV Parks, etc.

THE UNDERSIGNED BEING DULY SWORN, ON OATH, SAYS THAT THE FOREGOING INFORMATION IS A TRUE AND CORRECT STATEMENT OF

THE FACTS PERTAINING TO THE TRANSFER OF THE ABOVE DESCRIBED PROPERTY.

____________________________________________________________ __________________________________________________________

Signature of Seller / Agent Signature of Buyer / Agent

State of ______________________, County of ______________________ State of ______________________, County of ____________________

Subscribed and sworn to before me on this ____day of ____________ 20 __ Subscribed and sworn to before me on this ____day of ___________20 __

Notary Public _________________________________________________ Notary Public _______________________________________________

Notary Expiration Date _________________________________________ Notary Expiration Date ________________________________________

DOR FORM 82162 (02/2019)

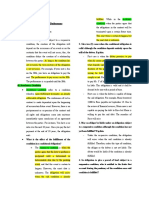

STATUTES AND EXEMPTIONS

A.R.S. §§ 11-1133 and 11-1137(B) require all buyers and sellers of real property or their agents to complete and attest to this

Affidavit. Failure to do so constitutes a class 2 misdemeanor and is punishable by law.

The County Assessors and the Department of Revenue use data obtained from the affidavits to develop tables and schedules

for the uniform valuation of properties based on fair market value. Data supplied for an individual property will not directly

affect the assessment or taxes of that property.

A.R.S. § 11-1134 exempts certain transfers from completion of the Affidavit of Property Value and the $2.00 filing fee.

See the list of exemption codes below. If the transfer meets the criteria for an exemption, do not complete the Affidavit.

Instead, please post the Statute Number and Exemption Code on the face of the Deed, in the area beneath the Legal

Description. For example, if Exemption Code B3 is applicable, the proper exemption notation would be A.R.S. 11-1134 B3.

Unless exempt, carefully complete the Affidavit, sign, notarize and submit it to the County Recorder.

LIST OF EXEMPTION CODES (A.R.S. § 11-1134)

A1. A deed that represents the payment in full or forfeiture of a recorded contract for the sale of real property.

A2. A lease or easement on real property, regardless of the length of the term.

A3. Sales to or from government: “A deed, patent or contract for the sale or transfer of real property in which an agency or

representative of the United States , this state, a county, city or town of this state or any political subdivision of this state

is the named grantor, and authorized seller, or purchaser.”

A4. A quitclaim deed to quiet title as described in A.R.S. § 12-1103, subsection B.

A5. A conveyance of real property that is executed pursuant to a court order.

A6. A deed to an unpatented mining claim.

A7. A deed of gift.

B1. A transfer solely in order to provide or release security for a debt or obligation, including a trustee’s deed pursuant

to power of sale under a deed of trust.

B2. A transfer that confirms or corrects a deed that was previously recorded.

B3. A transfer of residential property between family members as defined below with only nominal actual consideration for

the transfer.

B4. A transfer of title on a sale for delinquent taxes or assessments.

B5. A transfer of title on partition.

B6. A transfer of title pursuant to a merger of corporations.

B7. A transfer between related busines entities for no consideration or nominal consideration.

B8. A transfer from a person to a trustee or from a trustee to a trust beneficiary with only nominal consideration for the transfer.

B9. A transfer of title to and from an intermediary for the purpose of creating a joint tenancy estate or some other form of ownership.

B10. A transfer from a husband and wife or one of them to both husband and wife to create an estate in community

property with right of survivorship.

B11. A transfer from two or more persons to themselves to create an estate in joint tenancy with right of survivorship.

B12. A transfer pursuant to a beneficiary deed with only nominal actual consideration for the transfer.

B13. From an owner to itself or a related entity for no or nominal consideration solely for the purpose of consolidating or

splitting parcels.

B14. Due to legal name change.

Any instrument describing a transaction exempted by A.R.S. § 11-1134 shall bear a notation thereof on the face of the

instrument at the time of recording, indicating the specific exemption that is claimed.

DEFINITION OF PRIMARY AND SECONDARY RESIDENCE

A Primary Residence is a residential property that is used by the owner or owners as their principal or usual place of

residence, or occupied by a qualified family member of the owner, as defined below, and used as the qualified family member’s

usual and principal residence. A Non-Primary or Secondary Residence is a second home that is not your primary residence;

or is unoccupied, or owned by a financial institution. If you have a homestead exemption for a home in another state, the listed

home cannot qualify as a primary residence.

DEFINITION OF QUALIFIED FAMILY MEMBER

A “Qualified Family Member” is defined as:

a) A natural or adopted son or daughter of the taxpayer or a descendent of either.

b) The father or mother of the taxpayer or an ancestor of either.

c) A stepson or stepdaughter or stepparent of the taxpayer.

d) A son-in-law, daughter-in-law, father-in-law, or mother-in-law of the taxpayer.

e) A natural or adopted sibling of the taxpayer.

DEFINITION OF PERSONAL PROPERTY

Personal Property is all other property that is not Real Property. In general, it is all property other than land, buildings and other

permanent structures. Personal Property can be tangible or intangible. Examples of tangible personal property are furniture,

equipment and inventory. Examples in the intangible category are franchises, business licenses, goodwill, and corporate stocks

and bonds.

Das könnte Ihnen auch gefallen

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Von EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Von EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Noch keine Bewertungen

- Express Private TrustsDokument7 SeitenExpress Private TrustsDv Debe Mavani100% (2)

- The Encyclopedia of Real Estate Forms & Agreements: A Complete Kit of Ready-to-Use Checklists, Worksheets, Forms, and ContractsVon EverandThe Encyclopedia of Real Estate Forms & Agreements: A Complete Kit of Ready-to-Use Checklists, Worksheets, Forms, and ContractsNoch keine Bewertungen

- Debt Collector Disclosure StatementDokument7 SeitenDebt Collector Disclosure Statementrooseveltkyle100% (5)

- Real Estate Purchase and Sale Agreement: PSA-L-V6-01052017Dokument3 SeitenReal Estate Purchase and Sale Agreement: PSA-L-V6-01052017Bradley BulifantNoch keine Bewertungen

- Gdfi Promissory NoteDokument2 SeitenGdfi Promissory NoteLy M. LumapagNoch keine Bewertungen

- Start A Business ChecklistDokument3 SeitenStart A Business ChecklistAtif Munir100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Michelle Jackson PDFDokument36 SeitenMichelle Jackson PDFBrianna0% (3)

- Contract of Purchase and Sale For The Province of British Columbia973137320180411Dokument4 SeitenContract of Purchase and Sale For The Province of British Columbia973137320180411kenzieNoch keine Bewertungen

- Exclusive Transaction Broker AgreementDokument1 SeiteExclusive Transaction Broker AgreementflorNoch keine Bewertungen

- Residential Real Estate Purchase AgreementDokument17 SeitenResidential Real Estate Purchase AgreementGeorge ElcombeNoch keine Bewertungen

- Business Equity Purchase AgreementDokument10 SeitenBusiness Equity Purchase AgreementH.I.M Dr. Lawiy ZodokNoch keine Bewertungen

- Financial Projections Guide Business SuccessDokument9 SeitenFinancial Projections Guide Business SuccessIndra Kusuma AdiNoch keine Bewertungen

- GCAAR Sales Contract (1301)Dokument7 SeitenGCAAR Sales Contract (1301)Mark Lyon100% (1)

- Real Estate Sales ContractDokument4 SeitenReal Estate Sales ContractJafar CaillouetNoch keine Bewertungen

- Mortgage Loan Disclosure Statement - GFEDokument3 SeitenMortgage Loan Disclosure Statement - GFEafncorpNoch keine Bewertungen

- XYZ Project Bid Documents SummaryDokument8 SeitenXYZ Project Bid Documents SummaryJeff GrebeNoch keine Bewertungen

- House Contract PDFDokument8 SeitenHouse Contract PDFShannonBradenNoch keine Bewertungen

- Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesVon EverandWealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesNoch keine Bewertungen

- Bank refuses to release car despite paymentDokument12 SeitenBank refuses to release car despite paymentKrister VallenteNoch keine Bewertungen

- The Balanced Scorecard and Strategy Map 181013 255Dokument136 SeitenThe Balanced Scorecard and Strategy Map 181013 255Nurul Muthaqin100% (3)

- Policyloanapplicationform PDFDokument2 SeitenPolicyloanapplicationform PDFEdgar Compala100% (1)

- RERA Form IDokument1 SeiteRERA Form IRahNoch keine Bewertungen

- Official Form Proof of Claim Corte Fed. QuiebraDokument3 SeitenOfficial Form Proof of Claim Corte Fed. QuiebraEmily RamosNoch keine Bewertungen

- Emperor Crude Oil SalesDokument17 SeitenEmperor Crude Oil Salesnurashenergy100% (1)

- Labor ComplaintDokument2 SeitenLabor ComplaintMayra MerczNoch keine Bewertungen

- Rule 131-133Dokument20 SeitenRule 131-133Natasha MilitarNoch keine Bewertungen

- Advocates of Til vs. BSPDokument3 SeitenAdvocates of Til vs. BSPIrene RamiloNoch keine Bewertungen

- Distinction Subrogation From Assignment of CreditsDokument5 SeitenDistinction Subrogation From Assignment of CreditsPilacan KarylNoch keine Bewertungen

- PREAPV137468 20230915-Approved Fund Transfer - EG Healthcare, Inc. (Head Office)Dokument5 SeitenPREAPV137468 20230915-Approved Fund Transfer - EG Healthcare, Inc. (Head Office)Eniger CaspeNoch keine Bewertungen

- 282 B-CR NewDokument4 Seiten282 B-CR Newwrite2ashishmalik6269100% (1)

- Form B: Province of British Columbia Page 1 of - PagesDokument17 SeitenForm B: Province of British Columbia Page 1 of - PagesAndrew federNoch keine Bewertungen

- HOM INC Damage ClaimDokument2 SeitenHOM INC Damage ClaimJenny MendozaNoch keine Bewertungen

- GEN008 ENHANCEMENT SUBJECT FOR BAM242 GROUP WORKDokument16 SeitenGEN008 ENHANCEMENT SUBJECT FOR BAM242 GROUP WORKerica lamsenNoch keine Bewertungen

- Additional Provision AddendumDokument3 SeitenAdditional Provision AddendumlmariellayNoch keine Bewertungen

- Application To Rent/Screening FeeDokument2 SeitenApplication To Rent/Screening FeeAna CastroNoch keine Bewertungen

- PBC Disclosure StatementDokument2 SeitenPBC Disclosure StatementJugger AfrondozaNoch keine Bewertungen

- Bank of Baroda Education Form 135Dokument3 SeitenBank of Baroda Education Form 135umesh78% (9)

- HM 59Dokument4 SeitenHM 59glenNoch keine Bewertungen

- Neg OfferDokument1 SeiteNeg OfferFRAULIEN GLINKA FANUGAONoch keine Bewertungen

- Annex B - Negotiated Offer To Purchase FormDokument1 SeiteAnnex B - Negotiated Offer To Purchase FormcandiceNoch keine Bewertungen

- Addendum Correction-2020Dokument1 SeiteAddendum Correction-2020Rose Ann DuqueNoch keine Bewertungen

- This Form Recommended and Approved For, But Not Restricted To Use By, The Members of The Pennsylvania Association of Realtors (PAR)Dokument13 SeitenThis Form Recommended and Approved For, But Not Restricted To Use By, The Members of The Pennsylvania Association of Realtors (PAR)Kanitra FitzpatrickNoch keine Bewertungen

- Claimform CityatasDokument2 SeitenClaimform CityatasKathleen DearingerNoch keine Bewertungen

- Joint Application for Sale and Transfer of Passenger or Household Goods AuthorityDokument5 SeitenJoint Application for Sale and Transfer of Passenger or Household Goods AuthoritySujith Raj SNoch keine Bewertungen

- Hertz BankruptcyDokument27 SeitenHertz BankruptcyZerohedgeNoch keine Bewertungen

- Preliminary Change of Ownership (Rev. 10-2005)Dokument2 SeitenPreliminary Change of Ownership (Rev. 10-2005)Juxv9dTct8Noch keine Bewertungen

- Osprey Unit 111 Rental ApplicationDokument6 SeitenOsprey Unit 111 Rental ApplicationrileyscottthompsonNoch keine Bewertungen

- Exefuted ContractDokument17 SeitenExefuted ContractlmariellayNoch keine Bewertungen

- Form RealestateDokument8 SeitenForm RealestateSamuel DoyleNoch keine Bewertungen

- Yr CW Credit AppDokument2 SeitenYr CW Credit AppYolanda LewisNoch keine Bewertungen

- Utah Rental ApplicationDokument2 SeitenUtah Rental Applicationjbscribd123321Noch keine Bewertungen

- Form B 106cDokument2 SeitenForm B 106cchwenonNoch keine Bewertungen

- F40 Residential Lease AgreementDokument10 SeitenF40 Residential Lease AgreementPedro JayNoch keine Bewertungen

- Request For Mortgage Assistance - RMADokument7 SeitenRequest For Mortgage Assistance - RMAClara Maria Quispe CéspedesNoch keine Bewertungen

- Addendum - Inspection Request 516 Swallum-DigiSignDokument1 SeiteAddendum - Inspection Request 516 Swallum-DigiSignMorenita ParelesNoch keine Bewertungen

- Chelsea Villas Contact Fillable Form 104 10150 121 AveDokument1 SeiteChelsea Villas Contact Fillable Form 104 10150 121 AveNick HazelwoodNoch keine Bewertungen

- Form 135Dokument4 SeitenForm 135TechnetNoch keine Bewertungen

- Home Insurance Claim FormDokument5 SeitenHome Insurance Claim FormRickyNoch keine Bewertungen

- Motor Claim Form NEW INDIA ASSURANCE CO. LTD.Dokument4 SeitenMotor Claim Form NEW INDIA ASSURANCE CO. LTD.rajiv.surveyor7145Noch keine Bewertungen

- Bankruptcy Court FilingDokument4 SeitenBankruptcy Court FilingjjNoch keine Bewertungen

- MSB A Office PackageDokument2 SeitenMSB A Office Packageanara.aidNoch keine Bewertungen

- Dealership FormDokument4 SeitenDealership FormYuvraj KumarNoch keine Bewertungen

- Notice of Commencement: NotaryDokument1 SeiteNotice of Commencement: NotaryShivamNoch keine Bewertungen

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesVon EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNoch keine Bewertungen

- AssignmentDokument3 SeitenAssignmentvaishnav bridNoch keine Bewertungen

- Chapter 1: Introduction: Section 4 of The Negotiable Instruments Act, 1881 Defines "Promissory Note"Dokument12 SeitenChapter 1: Introduction: Section 4 of The Negotiable Instruments Act, 1881 Defines "Promissory Note"vaishnav bridNoch keine Bewertungen

- Affidavit of Property Value: Sale Price: $ 00Dokument2 SeitenAffidavit of Property Value: Sale Price: $ 00vaishnav bridNoch keine Bewertungen

- Affidavit of Property Value: Sale Price: $ 00Dokument2 SeitenAffidavit of Property Value: Sale Price: $ 00vaishnav bridNoch keine Bewertungen

- Chapter 1: Introduction: Section 4 of The Negotiable Instruments Act, 1881 Defines "Promissory Note"Dokument12 SeitenChapter 1: Introduction: Section 4 of The Negotiable Instruments Act, 1881 Defines "Promissory Note"vaishnav bridNoch keine Bewertungen

- 2008 Spring Audit State Developments 2Dokument285 Seiten2008 Spring Audit State Developments 2rashidsfNoch keine Bewertungen

- General Credit Corporation v. Alsons DevelopmentDokument5 SeitenGeneral Credit Corporation v. Alsons DevelopmentbearzhugNoch keine Bewertungen

- Abril Lagmay Alfiler Barawid (ALAB) Law Firm: Contract of LeaseDokument3 SeitenAbril Lagmay Alfiler Barawid (ALAB) Law Firm: Contract of LeaseStephen MallariNoch keine Bewertungen

- Sale Deed and Power of Attorney - 20200429165630Dokument14 SeitenSale Deed and Power of Attorney - 20200429165630harmanpreet kaurNoch keine Bewertungen

- WST 2019 12 03 PDFDokument28 SeitenWST 2019 12 03 PDFChing, Quennel YoenNoch keine Bewertungen

- GTAI Industry Overview Medical TechnologyDokument12 SeitenGTAI Industry Overview Medical TechnologyphilatusNoch keine Bewertungen

- Buslaw Reviewer Guide QuestionsDokument9 SeitenBuslaw Reviewer Guide QuestionsFrances Alandra SorianoNoch keine Bewertungen

- CLASS X - CHAPTER 3. Notes - MONEY AND CREDITDokument5 SeitenCLASS X - CHAPTER 3. Notes - MONEY AND CREDITSlick Life VlogsNoch keine Bewertungen

- BSP Circular 425Dokument3 SeitenBSP Circular 425G Ant Mgd100% (1)

- Republic of The Philippines Court of Tax Appeals Quezon: DecisionDokument10 SeitenRepublic of The Philippines Court of Tax Appeals Quezon: DecisionPGIN Legal OfficeNoch keine Bewertungen

- Listening Tips and ExercisesDokument10 SeitenListening Tips and ExercisesNadia VienurillahNoch keine Bewertungen

- R0404 BD040722 QuippDokument5 SeitenR0404 BD040722 QuippLovely Jane MorenoNoch keine Bewertungen

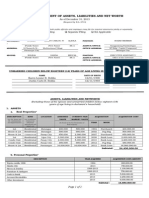

- Sworn Statement of Assets, Liabilities and Net WorthDokument3 SeitenSworn Statement of Assets, Liabilities and Net WorthJf ManejaNoch keine Bewertungen

- The Financial Crash - Who Was To BlameDokument4 SeitenThe Financial Crash - Who Was To BlameHuy NguyenNoch keine Bewertungen

- NIB Bank Internship ReportDokument41 SeitenNIB Bank Internship ReportAdnan Khan Alizai86% (7)

- Project ReportDokument4 SeitenProject ReportTarun ParmarNoch keine Bewertungen

- Mark Scheme (Results) January 2008: GCE O Level Bengali (7606)Dokument10 SeitenMark Scheme (Results) January 2008: GCE O Level Bengali (7606)munzarinNoch keine Bewertungen

- Forgery Case DigestsDokument4 SeitenForgery Case DigestsKim Arizala100% (1)

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Dokument7 SeitenACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Hire Purchase PDFDokument12 SeitenHire Purchase PDFliamNoch keine Bewertungen

- NPA Management: - Role of Asset Reconstruction CompaniesDokument6 SeitenNPA Management: - Role of Asset Reconstruction CompaniestapanrNoch keine Bewertungen