Beruflich Dokumente

Kultur Dokumente

Funding Pension Liability at New Mumbai Assurance

Hochgeladen von

Mounika KandukuriCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Funding Pension Liability at New Mumbai Assurance

Hochgeladen von

Mounika KandukuriCopyright:

Verfügbare Formate

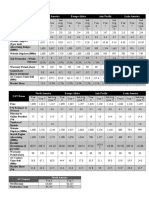

FUNDING PENSION LIABILITY AT NEW MUMBAI ASSURANCE

New Mumbai Assurance needs to make total payments worth Rs 32.6 lakhs on January 1 st

each year for the next 15 years. How must they fund these payments? They are

considering three corporate bonds. All three have a coupon rate of 10%. Bond 1 has a

maturity date of three years, Bond 2 has a maturity date of 13 years and Bond 3 has a

maturity date of 15 years. Assume that the face value of each unit of bond purchased is

Rs 10,000.0. Assume for now, that at the time of purchase the yield for all three bonds is

10%. Hence the bonds are at par.

Supposing that the pension liabilities are to be funded by Bond 1 alone, how many units

of Bond 1 need to be purchased initially? If they are to be funded by Bond 3 alone, how

many units need to be purchased?

Assume that immediately after the purchase of Bond 1, its yield dips to 9%. Can the

payments obligations be fulfilled?

Similarly, if Bond 3 alone were purchased, and the yield dips to 9%, can the payment

obligations be fulfilled?

Assume that the change in the interest rate follows a normal distribution with a mean of

zero and a standard deviation of 3% (a highly volatile scenario!). What impact will this

have on the company’s ability to fulfill the payment obligations? Answer this question for

the case where Bond 1 alone is used, and Bond 2 alone is used.

If you were to immunize the company’s portfolio, what will it look like?

What will be the impact if the company were to use the immunized portfolio?

Accompanying Excel File: Bonds.xls

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- USA State-Wise Email Leads PDFDokument6 SeitenUSA State-Wise Email Leads PDFSimeon Dwight100% (1)

- Case Study of Miss Amber Royal Mail PLC Cost of CapitalDokument4 SeitenCase Study of Miss Amber Royal Mail PLC Cost of CapitalRendy Mardiansyah Arsyavin100% (1)

- Procurement PolicyDokument61 SeitenProcurement PolicyValber Santos SantosNoch keine Bewertungen

- DRHP PDFDokument430 SeitenDRHP PDFShaik NooreeNoch keine Bewertungen

- Call Outs For Blade HQDokument73 SeitenCall Outs For Blade HQSnöBer GardenNoch keine Bewertungen

- EverArc Holdings Limited - Final Prospectus 12 December 2019Dokument123 SeitenEverArc Holdings Limited - Final Prospectus 12 December 2019ollieNoch keine Bewertungen

- AC CameraDokument2 SeitenAC Cameranguyen nganNoch keine Bewertungen

- Jet Airways ProjectDokument28 SeitenJet Airways ProjectAmit SinghNoch keine Bewertungen

- Parle Products Presentation On FMCGDokument14 SeitenParle Products Presentation On FMCGManas KumarNoch keine Bewertungen

- Tesco Case StudyDokument4 SeitenTesco Case StudyHassan ZulqernainNoch keine Bewertungen

- Risk & Return: Risk of A Portfolio-Uncertainty Main View Two AspectsDokument36 SeitenRisk & Return: Risk of A Portfolio-Uncertainty Main View Two AspectsAminul Islam AmuNoch keine Bewertungen

- Finance pt2 QB NEWDokument71 SeitenFinance pt2 QB NEWBharath BMNoch keine Bewertungen

- Assignment - 1 - MarketingDokument18 SeitenAssignment - 1 - MarketingAnchal TyagiNoch keine Bewertungen

- CHAPTER 10 - Inventory ManagementDokument15 SeitenCHAPTER 10 - Inventory ManagementAaminah BeathNoch keine Bewertungen

- 5 Important Principles of Modern AccountingDokument2 Seiten5 Important Principles of Modern AccountingBilal SiddiqueNoch keine Bewertungen

- Tata Motors - The Tata Ace PDFDokument22 SeitenTata Motors - The Tata Ace PDFalNoch keine Bewertungen

- PK08 NotesDokument32 SeitenPK08 NotesadbscorpioNoch keine Bewertungen

- The Theory of Consumer Choice The Theory of Consumer Choice: MicroeconomicsDokument28 SeitenThe Theory of Consumer Choice The Theory of Consumer Choice: MicroeconomicsTannu RadhaNoch keine Bewertungen

- Citi InsightDokument16 SeitenCiti InsightPopeye AlexNoch keine Bewertungen

- Price Elasticity of Demand (PED) : Price. PED (Of A Product) % Change in Quantity Demanded / % Change in PriceDokument4 SeitenPrice Elasticity of Demand (PED) : Price. PED (Of A Product) % Change in Quantity Demanded / % Change in PriceHmzaa Omer PuriNoch keine Bewertungen

- Vodacoin Is The Product Selected To Implement in The Rwandese MarketDokument3 SeitenVodacoin Is The Product Selected To Implement in The Rwandese MarketHamza ZainNoch keine Bewertungen

- Proposal For Property Investment & Sales ServicesDokument3 SeitenProposal For Property Investment & Sales ServicesMuhammad AsifNoch keine Bewertungen

- 2010 Macro FRQDokument8 Seiten2010 Macro FRQKripansh GroverNoch keine Bewertungen

- Characteristics of Entrepreneurs: VersatileDokument2 SeitenCharacteristics of Entrepreneurs: VersatileYenifer HuertaNoch keine Bewertungen

- 312 MKT Business To Business MarketingDokument2 Seiten312 MKT Business To Business MarketingRaj PatilNoch keine Bewertungen

- Stock PresentationDokument2 SeitenStock PresentationLionel RogersNoch keine Bewertungen

- NMS COMPLEX EpgDokument12 SeitenNMS COMPLEX EpgVishnu KhandareNoch keine Bewertungen

- BA5203 Financial ManagementDokument20 SeitenBA5203 Financial Managements.muthuNoch keine Bewertungen

- Satluj Senior Secondary School Half Yearly Examination CLASS-12 Subject-Economics Time - 3 Hrs M.M-80Dokument2 SeitenSatluj Senior Secondary School Half Yearly Examination CLASS-12 Subject-Economics Time - 3 Hrs M.M-80sachin1065Noch keine Bewertungen

- BRM AssignmentDokument10 SeitenBRM AssignmentusamaNoch keine Bewertungen