Beruflich Dokumente

Kultur Dokumente

FY08 09BudgetChecklist

Hochgeladen von

Nathan BenefieldOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FY08 09BudgetChecklist

Hochgeladen von

Nathan BenefieldCopyright:

Verfügbare Formate

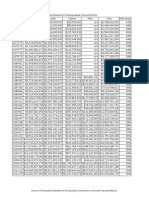

FY 2008-09 Budget Checklist

Meets

Budgetary Goals Explanation

goal?

As defined by the Taxpayer Protection Act/Amendment, the FY 2008-09 General Fund budget

Keep spending growth within

should not exceed 3.29% (which is three-year average rate of inflation + population growth).

taxpayers' ability to pay -- the

NO This measure is a better predictor of future inflation than a one-year change based on monthy

average rate of inflation and

data (a 4.17% increase from May 2007 to May 2008) or annual average (a 2.84% increase

population growth

from 2006 to 2007).

The Commonwealth Foundation identified over $4 billion in cuts in the report Government on a

Reduce or eliminate corporate Diet. The budget agreement contains virtually no cuts of corporate welfare or wasteful

NO

welfare and wasteful spending spending programs, including the notorious "Walking Around Money" or the Opportunity Grant

Program, which audits found to be lax and ineffective.

Although families will not receive a tax rate reduction in this budget, the continued phase-out of

Reduce the tax burden on

YES & NO the Corporate Stock and Franchise Tax will offer modest reductions for Pennsylvania job

families and businesses

creators and consumers.

Any increase in spending in what is shaping up to be a down year in terms of tax revenue

Protect against the need for

NO growth puts taxpayers in jeopardy of tax increases in FY 2009-10. Some reports indicate the

future tax increases

the state will face a $1 to $2 billion deficit by next year.

The Energy Indepence Fund and related policies provide a new corporate welfare program, and

Limit the role of government to increase regulation on Pennsylvania businesses and families. This program, along with many

NO

its core functions others in the budget, represent a expansion of government beyond its proper function and role

in the economy and our lives.

Although limited information is available to fully evaluate the increase in the $60 billion+

Accurately represent the true

NO operating budget, at least $50 million in Public Welfare costs are being shifted from the

increase in spending

General Fund to the Lottery Fund.

The budget agreement authorizes $2.9 billion in new borrowing (in addition to $700 million in

Reduce the overall debt burden

NO recurring borrowing), while paying off approximately $1 billion in interest on old debt. The new

on taxpayers

borrowing represents an annual cost of nearly $300 million.

225 State Street, Suite 302 | Harrisburg, PA 17101

717.671.1901 phone | 717.671.1905 fax

CommonwealthFoundation.org | info@commonwealthfoundation.org

Das könnte Ihnen auch gefallen

- PSEA Political MailerDokument2 SeitenPSEA Political MailerNathan BenefieldNoch keine Bewertungen

- Gov. Wolf's Tax ProposalsDokument7 SeitenGov. Wolf's Tax ProposalsNathan BenefieldNoch keine Bewertungen

- Benefield Testimony AttachmentsDokument18 SeitenBenefield Testimony AttachmentsNathan BenefieldNoch keine Bewertungen

- Testimony To PA Funding Reform CommissionDokument8 SeitenTestimony To PA Funding Reform CommissionNathan BenefieldNoch keine Bewertungen

- Charter Testimony (Benefield)Dokument5 SeitenCharter Testimony (Benefield)Nathan BenefieldNoch keine Bewertungen

- Benefield Testimony AttachmentsDokument18 SeitenBenefield Testimony AttachmentsNathan BenefieldNoch keine Bewertungen

- Constitutionality of School Choice in PennsylvaniaDokument2 SeitenConstitutionality of School Choice in PennsylvaniaNathan BenefieldNoch keine Bewertungen

- Bleeding GreenDokument1 SeiteBleeding GreenNathan BenefieldNoch keine Bewertungen

- PSEA Mailer For Tom WolfDokument2 SeitenPSEA Mailer For Tom WolfNathan BenefieldNoch keine Bewertungen

- PSEA Campaign Mailer 2012 PrimaryDokument2 SeitenPSEA Campaign Mailer 2012 PrimaryNathan BenefieldNoch keine Bewertungen

- Trans $ by State 2010Dokument1 SeiteTrans $ by State 2010Nathan BenefieldNoch keine Bewertungen

- Toomey Vs Sestak On JobsDokument1 SeiteToomey Vs Sestak On JobsNathan BenefieldNoch keine Bewertungen

- DPW Fact Sheet On Medicaid ExpansionDokument3 SeitenDPW Fact Sheet On Medicaid ExpansionNathan BenefieldNoch keine Bewertungen

- Fireproofing Pennsylvania'S Economy:: P L Isttbdt2012 Pennsylvania State Budget 2012Dokument25 SeitenFireproofing Pennsylvania'S Economy:: P L Isttbdt2012 Pennsylvania State Budget 2012Nathan BenefieldNoch keine Bewertungen

- PA Pension Reform PresentationDokument21 SeitenPA Pension Reform PresentationNathan BenefieldNoch keine Bewertungen

- PLCB Wine Kiosk Cover UpDokument7 SeitenPLCB Wine Kiosk Cover UpNathan BenefieldNoch keine Bewertungen

- Pennsylvania Government Structural ReformsDokument5 SeitenPennsylvania Government Structural ReformsNathan BenefieldNoch keine Bewertungen

- Letter To Pitt FamilyDokument2 SeitenLetter To Pitt FamilyNathan BenefieldNoch keine Bewertungen

- More Taxpayer Funded Lobbying Against School ChoiceDokument2 SeitenMore Taxpayer Funded Lobbying Against School ChoiceNathan BenefieldNoch keine Bewertungen

- Shippensburg Prevailing Wage ResolutionDokument1 SeiteShippensburg Prevailing Wage ResolutionNathan BenefieldNoch keine Bewertungen

- 2010 School Choice Poll - PADokument5 Seiten2010 School Choice Poll - PANathan BenefieldNoch keine Bewertungen

- Pennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationDokument22 SeitenPennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationNathan BenefieldNoch keine Bewertungen

- Cabot Oil and Gas Letter Sent To DEPDokument6 SeitenCabot Oil and Gas Letter Sent To DEPNathan BenefieldNoch keine Bewertungen

- 2011-12 PA Budget Deal SpreadsheetDokument17 Seiten2011-12 PA Budget Deal SpreadsheetNathan BenefieldNoch keine Bewertungen

- Pennsylvania State Union ContractsDokument2 SeitenPennsylvania State Union ContractsNathan BenefieldNoch keine Bewertungen

- Pennsylvania State Budget PresentationDokument20 SeitenPennsylvania State Budget PresentationNathan BenefieldNoch keine Bewertungen

- PA Transportation SpendingDokument1 SeitePA Transportation SpendingNathan BenefieldNoch keine Bewertungen

- Memo On AEPS ReportDokument1 SeiteMemo On AEPS ReportNathan BenefieldNoch keine Bewertungen

- Comparing States Severance TaxDokument1 SeiteComparing States Severance TaxNathan BenefieldNoch keine Bewertungen

- Gasland DebunkedDokument2 SeitenGasland DebunkedNathan BenefieldNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- National IncomeDokument4 SeitenNational IncomeLawrenceNoch keine Bewertungen

- The Budgetary Allocation On The Sgr-Influence On Ibm and AccountingDokument5 SeitenThe Budgetary Allocation On The Sgr-Influence On Ibm and AccountingAnonymous L7XrxpeI1zNoch keine Bewertungen

- Analysis of Income Tax in AfghanistanDokument47 SeitenAnalysis of Income Tax in Afghanistanmasoud_dostNoch keine Bewertungen

- African Economic OutlookDokument200 SeitenAfrican Economic Outlookintrepid6Noch keine Bewertungen

- Rural Road Maintenance Manual - CambodiaDokument82 SeitenRural Road Maintenance Manual - CambodiaJohn Chiv100% (1)

- Sudan ProfileDokument19 SeitenSudan ProfileTsaalits MuharrorohNoch keine Bewertungen

- Oracle R12 MaterialDokument22 SeitenOracle R12 MaterialKarunakara Cheerla100% (2)

- Swaziland Kingdom of Eswatini Strategic Road Map 2018 To 2023 DraftDokument35 SeitenSwaziland Kingdom of Eswatini Strategic Road Map 2018 To 2023 DraftRichard Rooney100% (5)

- TaxDokument6 SeitenTaxChristian GonzalesNoch keine Bewertungen

- Financial Modelling and ValuationDokument5 SeitenFinancial Modelling and Valuationibshyd1100% (1)

- Tutorial Chapter 17 - 18 Accounting For Overhead Costs - Job Order and Process CostingDokument48 SeitenTutorial Chapter 17 - 18 Accounting For Overhead Costs - Job Order and Process CostingNaKib NahriNoch keine Bewertungen

- ALD India - Introduction PresentationDokument16 SeitenALD India - Introduction PresentationAbhishekRayNoch keine Bewertungen

- Final Magazine APRIL ISSUE 2016 Final Winth Cover PageDokument134 SeitenFinal Magazine APRIL ISSUE 2016 Final Winth Cover PagePrasanna KumarNoch keine Bewertungen

- BSBFIM501 Assessment 1Dokument15 SeitenBSBFIM501 Assessment 1Oh Oh Oh0% (1)

- Lecture 15 - Earned Value AnalysisDokument41 SeitenLecture 15 - Earned Value AnalysisDavid JohnNoch keine Bewertungen

- Implications of The SC Ruling On The Mandanas-GarciaDokument45 SeitenImplications of The SC Ruling On The Mandanas-GarciaNived Lrac Pdll SgnNoch keine Bewertungen

- G o Ms No. 27 DT 22.1.2002Dokument4 SeitenG o Ms No. 27 DT 22.1.2002Rajalakshmi A67% (3)

- Budget Process in The GovernmentDokument15 SeitenBudget Process in The GovernmentResti Rigonan0% (1)

- Set-22 Mba I Semester Assign QuestionsDokument10 SeitenSet-22 Mba I Semester Assign Questionsஇந்துமதி வெங்கடரமணன்Noch keine Bewertungen

- Ads653 Case StudyDokument14 SeitenAds653 Case StudyAnis NajwaNoch keine Bewertungen

- MA, CH 05Dokument16 SeitenMA, CH 05Nahom AberaNoch keine Bewertungen

- Rolling Budget and Forecast TemplateDokument2 SeitenRolling Budget and Forecast TemplateChinh Lê ĐìnhNoch keine Bewertungen

- Budget 2K19: Made By: 17BCS1907 17BCS1908 17BCS1909 17BCS1910 17BCS1911Dokument9 SeitenBudget 2K19: Made By: 17BCS1907 17BCS1908 17BCS1909 17BCS1910 17BCS1911Sameer KhullarNoch keine Bewertungen

- PMP Formula Pocket GuideDokument1 SeitePMP Formula Pocket Guidejindalyash1234100% (2)

- AA 4102 1st Hand OutDokument9 SeitenAA 4102 1st Hand OutMana XDNoch keine Bewertungen

- Demand Forecasting Model Dengan Pendekat D8d035e2Dokument14 SeitenDemand Forecasting Model Dengan Pendekat D8d035e2Tari Wahyuni LubisNoch keine Bewertungen

- Hamsta - Direct Labour and FOHDokument21 SeitenHamsta - Direct Labour and FOHHamstaNoch keine Bewertungen

- Chapter 3 McCannDokument39 SeitenChapter 3 McCannEvan TanNoch keine Bewertungen

- Formal Complaint - 15 March 14 RedactDokument7 SeitenFormal Complaint - 15 March 14 RedactGotnitNoch keine Bewertungen

- The Budgeting Framework For LGUsDokument50 SeitenThe Budgeting Framework For LGUsAh MhiNoch keine Bewertungen