Beruflich Dokumente

Kultur Dokumente

Tax Rates For Individuals: Fast Moving Consumer Goods

Hochgeladen von

Hakim Jan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

27 Ansichten1 SeiteFBR Tax Sheet

Originaltitel

Taxes 2019-20

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFBR Tax Sheet

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

27 Ansichten1 SeiteTax Rates For Individuals: Fast Moving Consumer Goods

Hochgeladen von

Hakim JanFBR Tax Sheet

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

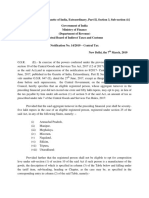

TAX CARD FOR TAX YEAR 2020

Tax Rates for Individuals

Salary / Business Income (Rs) Tax Rates Sale of goods Filer Non- filer

Up to 600,000 0% By company 4% 8%

600,001 to 1200,000 5% exceeding 600,000 By Individual and AOP 4.5% 9%

1200,001 to 1,800,000 30,000 + 10% exceeding 1,200,000

1,800,001 to 2,500,000 90,000 + 15% exceeding 1,800,000 Fast moving consumer goods

2,500,001 to 3,500,000 195,000 + 17.5% exceeding 2,500,000 By company 2% 4%

3,500,001 to 5,000,000 370,000 + 20% exceeding 3,500,000 By Individual and AOP 2.5% 5%

5,000,001 to 8,000,000 670,000 + 22.5% exceeding 5,000,000 Minimum limit on tax deduction for payments against goods Rs. 75,000

8,000,001 to 12,000,000 1,345,000 + 25% exceeding 8,000,000 and on services Rs. 30,000

12,000,001 to 30,000,000 2,345,000 + 27.5% exceeding 12,000,000 Services Filer Non- filer

30,000,001 to 50,000,000 7,295,000 + 30% exceeding 30,000,000 By company 8% 16%

50,000,001 to 75,000,000 13,295,000 + 32.5% exceeding 50,000,000 By Individual and AOP 10% 20%

Above 75,000,000 21,420,000 + 35% exceeding 75,000,000 By export houses for services rendered 1% 2%

Tax Rates for AOPs And Non-Salaried Individuals Advertisement Services (Electronic/print media) 1.5% 3%

Business Income (Rs) Tax Rates Advertisement Services Other than (Electronic/print media)

Up to 400,000 Nil Transport services

400,001 to 600,000 5% exceeding 400,000 Freight forwarding services

600,001 to 1,200,000 10,000 + 10% exceeding 600,000 Air cargo services

1,200,001 to 2,400,000 70,000 + 15% exceeding 1,200,000 Courier services

2,400,001 to 3,000,000 250,000 + 20% exceeding 2,400,000 Manpower outsourcing services

3,000,001 to 4,000,000 370,000 + 25% exceeding 3,000,000 Hotel services

4,000,001 to 6,000,000 620,000 + 30% exceeding 4,000,000 Security guard services

Above 6,000,000 1,220,000 + 35% exceeding 6,000,000 Software development services

4% 8%

Tax Rates for rent of immovable property- Individual and AOP's IT services and IT enabled services

Business Income (Rs) Tax Rates- Individual Tracking services

Up to 200,000 Nil Share registered services

200,001 to 600,000 5% exceeding 200,000 Engineering services

600,001 to 1,000,000 20,000+ 10% exceeding 600,000 Car rental services

1,000,001 to 2,000,000 60,000 + 15% exceeding 1,000,000 Building maintenance services

2,000,001 to 4,000,000 210,000+ 20% exceeding 2,000,000 Inspection services

4,000,001 to 6,000,000 610,000+ 25% exceeding 4,000,000 Certification services

6,000,001 to 8,000,000 1,110,000+ 30% exceeding 6,000,000 Testing services

Above 8,000,000 1,710,000+ 35% exceeding 8,000,000 Training services

Tax Rates for rent of immovable property-Companies Contracts Filer Non- filer

15% of gross rent By Company 7% 14%

Other important tax rates By Individual and AOP 7.5% 15%

Companies- general Tax Rates Brokerage and Commission Filer Non- filer

Small Company 25% Advertisement agents 10% 20%

Banking Company 35% Life insurance agents (Less than 0.5 M) 8% 16%

All other Companies 29% Other cases 12% 24%

Alternate Corporate Tax (ACT) 17% Tax at Import stage Filer Non- filer

Minimum Turnover Tax 1.50% Coal Import by manufacturer & comm. importer 4% 8%

Super Tax Tax Rates Companies / Industrial Undertaking 5.5% 11%

Banking Company 3% Other tax payers 6% 12%

Persons other than BC where income > Rs 500 M 2% Ship breaker on import of ships 4.5% 9%

Tax on undistributed profits (for public companies if 5% Profit on debt Filer Non- filer

distribution <20%) charged on a/c profit Up to 5 M 15% 30%

Tax on sale- specified sector Filer Non- filer From 5 M TO 25 M 17.5% 35%

Sale to distributors, dealers and wholesalers 0.1% 0.2% From 25 M TO 36 M 20% 40%

Tax on sale to retailers- Electronics 1% 2% Above 36 M Normal tax regime

Tax on sale to retailers- Others 0.5% 1% Dividend Filer Non- filer

(Electronics, sugar, cement, iron, steel products, Received by Company 15% 30%

Gain on immovable property Inter-corporate dividend within the group companies

0%

covered under group taxation

Constructed properties Received by an individual or an AOP, if the profit is more 13% 25%

than Rs. 1 Million

Sold after 1 year but not exceeding 5 years of purchase Received by an individual or an AOP, if the profit is less 10% 20%

75% taxable

than Rs. 1 Million

Sold after 5 years of purchase 0%

Open Plots Immovable Property Filer Non- filer

Sold after 1 year but not exceeding 10 years of purchase

75% taxable

On buyer 1% 2%

Sold after 10 years of purchase Non-filer not permitted to purchase new motor vehicles

0%

and immovable

Filer Non- filer property having declared value above 5 M

Purchase of air ticket- domestic 5% On seller holding period within 5 years 1% 2%

Purchase of air ticket- international On seller holding period after 5 years 0%

Economy class 0% On sale by auctions 10% 20%

Executive/ first class Rs 16,000 per person On function and gatherings- major cities Higher of 5% or 20,000

Other excluding economy Rs 12,000 per person On function and gatherings- remaining cities Higher of 5% or 10,000

CNG business 4% 8% Charge by local educational institutions 5% 5%

General Insurance premium 0% 4% Charge by foreign educational institutions 5% 5%

Life Insurance premium over 0.3 M 0% 1% Royalty and technical services (resident) 15% 30%

Offshore digital services from non-resident 5% 10% Royalty and technical services (non-resident) 15% 30%

Online advertising including digital advertising space, On prize bonds 15% 30%

designing, creating, hosting or

maintenance of website. Mineral extraction 0% 5%

TAXATION SERVICES PROVIDER

ZIA UDDIN

0345-3141741

Das könnte Ihnen auch gefallen

- List of Accounting Standards (AS 1-32) SummaryDokument7 SeitenList of Accounting Standards (AS 1-32) SummaryMahipal GadhaviNoch keine Bewertungen

- Limitations On The Power of TaxationDokument2 SeitenLimitations On The Power of TaxationApril Anne Costales100% (1)

- How to Act as an Agent under a Power of Attorney and Stay Out of TroubleDokument3 SeitenHow to Act as an Agent under a Power of Attorney and Stay Out of TroubleBenne JamesNoch keine Bewertungen

- TRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseDokument64 SeitenTRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseAnonymous 0cdKGOBB100% (1)

- Chapter 6Dokument24 SeitenChapter 6Hakim JanNoch keine Bewertungen

- Tax Reform for Acceleration and Inclusion (TRAIN) Act ExplainedDokument187 SeitenTax Reform for Acceleration and Inclusion (TRAIN) Act ExplainedJanna GunioNoch keine Bewertungen

- (Trading) Fibonacci Trader - The Professional Gann Swing Plan 2002 - Robert KrauszDokument15 Seiten(Trading) Fibonacci Trader - The Professional Gann Swing Plan 2002 - Robert Krauszdiglemar67% (3)

- Survey Master LLC Group focuses on larger projectsDokument8 SeitenSurvey Master LLC Group focuses on larger projectsBalaji ArunNoch keine Bewertungen

- Cost Accounting Solved MCQsDokument39 SeitenCost Accounting Solved MCQsRaJa84% (43)

- Comprehensive Problems Solution Answer Key Mid TermDokument5 SeitenComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNoch keine Bewertungen

- Destin Brass Faces Pricing Pressure and Needs Costing InsightsDokument2 SeitenDestin Brass Faces Pricing Pressure and Needs Costing InsightsGlenn HengNoch keine Bewertungen

- ACCA F6 Taxation Solved Past PapersDokument235 SeitenACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- HAMEED ASSOCIATES TAX CARD 2019Dokument1 SeiteHAMEED ASSOCIATES TAX CARD 2019zohaib shahNoch keine Bewertungen

- Tax Card 2021Dokument1 SeiteTax Card 2021MA AttariNoch keine Bewertungen

- Tax Card For Tax Year 2021 (TSP)Dokument1 SeiteTax Card For Tax Year 2021 (TSP)Muhammad Usama SheikhNoch keine Bewertungen

- Tax 2020Dokument1 SeiteTax 2020Afreen MasoodNoch keine Bewertungen

- Tax Card 2020-21Dokument2 SeitenTax Card 2020-21Lahore TaxationsNoch keine Bewertungen

- TAX CARD 2019Dokument1 SeiteTAX CARD 2019Kinglovefriend100% (1)

- Dexter Consultants: Updated Through Finance Act 2022Dokument1 SeiteDexter Consultants: Updated Through Finance Act 2022fahid aslamNoch keine Bewertungen

- Income Tax Rates and Deductions for Tax Year 2015Dokument3 SeitenIncome Tax Rates and Deductions for Tax Year 2015Sardar Shahid KhanNoch keine Bewertungen

- Income Tax Card 2023-24 (Finance Act 2023)Dokument1 SeiteIncome Tax Card 2023-24 (Finance Act 2023)shahidNoch keine Bewertungen

- Tax Card 2024 (Updated)Dokument2 SeitenTax Card 2024 (Updated)Mansoor AhmadNoch keine Bewertungen

- Tax Card 2019Dokument1 SeiteTax Card 2019Waqas AtharNoch keine Bewertungen

- Income Tax WHT Rates Card 2016-17Dokument8 SeitenIncome Tax WHT Rates Card 2016-17Sami SattiNoch keine Bewertungen

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDokument1 SeiteTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNoch keine Bewertungen

- Tax Rates - For The Tax Year - 2019Dokument5 SeitenTax Rates - For The Tax Year - 2019nomanjavid88Noch keine Bewertungen

- Tax Rates for the Tax Year 2018 in PakistanDokument1 SeiteTax Rates for the Tax Year 2018 in PakistanBADER MUNIRNoch keine Bewertungen

- 2019 Tax Card PakistanDokument9 Seiten2019 Tax Card PakistanRaja Hamza rasgNoch keine Bewertungen

- Tax Card TY 2022Dokument8 SeitenTax Card TY 2022princecharming14Noch keine Bewertungen

- WHT Tax Card - 2024Dokument1 SeiteWHT Tax Card - 2024shahid100% (1)

- Tax Rates for Individuals and Companies in Pakistan for Tax Year 2019Dokument1 SeiteTax Rates for Individuals and Companies in Pakistan for Tax Year 2019Mubashir RiazNoch keine Bewertungen

- Tax Rates For Tax Year 2020Dokument5 SeitenTax Rates For Tax Year 2020Ghulam MuhiuddinNoch keine Bewertungen

- Tax Rates and Rules for Individuals, AOPs, Companies in PakistanDokument3 SeitenTax Rates and Rules for Individuals, AOPs, Companies in PakistanThe MaximusNoch keine Bewertungen

- Tax Rates 2021Dokument6 SeitenTax Rates 2021Muazam memonNoch keine Bewertungen

- RLA Rate Card 2020 2021Dokument13 SeitenRLA Rate Card 2020 2021Muhammad EjazNoch keine Bewertungen

- Taxation (CHN) - Dec 2020 FinalDokument3 SeitenTaxation (CHN) - Dec 2020 FinalALEX TRANNoch keine Bewertungen

- WHT-Card - (TY 2024)Dokument1 SeiteWHT-Card - (TY 2024)yahya zafarNoch keine Bewertungen

- Tax Card Global Tax Consultants Tax Year 2019Dokument3 SeitenTax Card Global Tax Consultants Tax Year 2019AqeelAhmadNoch keine Bewertungen

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanDokument18 SeitenIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanNoch keine Bewertungen

- SWHCC Tax Card - Ty 2019Dokument1 SeiteSWHCC Tax Card - Ty 2019Muhammad HaseebNoch keine Bewertungen

- Taxation Tax AdministrationDokument234 SeitenTaxation Tax AdministrationmahmoudfatahabukarNoch keine Bewertungen

- Bangladesh - Highlights of Finance Bill 2021Dokument10 SeitenBangladesh - Highlights of Finance Bill 2021sihalim17Noch keine Bewertungen

- Tax Rates 2022-23Dokument6 SeitenTax Rates 2022-23zeeshanNoch keine Bewertungen

- f6vnm 2007 Dec QDokument9 Seitenf6vnm 2007 Dec QPhạm Hùng DũngNoch keine Bewertungen

- F6 (CHN) Taxation PaperDokument11 SeitenF6 (CHN) Taxation PaperALEX TRANNoch keine Bewertungen

- Prepare For The 2019 Tax SeasonDokument6 SeitenPrepare For The 2019 Tax SeasonWilliam BenjaminNoch keine Bewertungen

- Tax Rate Card For Tax Year 2023 24Dokument10 SeitenTax Rate Card For Tax Year 2023 24srismailNoch keine Bewertungen

- WHT Rate Card 2018-19Dokument2 SeitenWHT Rate Card 2018-19taqi1122Noch keine Bewertungen

- Financial Statment Model-CompleteDokument27 SeitenFinancial Statment Model-CompleteSalman AhmadNoch keine Bewertungen

- Withholding Tax For 2020-21Dokument2 SeitenWithholding Tax For 2020-21Rana InamNoch keine Bewertungen

- Tax Changes You Need To Know Under RA 10963Dokument25 SeitenTax Changes You Need To Know Under RA 10963Charry BaximenNoch keine Bewertungen

- (Train) : Taxchanges U Need To KnowDokument27 Seiten(Train) : Taxchanges U Need To KnowNoel DomingoNoch keine Bewertungen

- Highlights of Budgetary Changes 2022 - TAXDokument41 SeitenHighlights of Budgetary Changes 2022 - TAXRoyNoch keine Bewertungen

- Individual & Corporate Tax Rates in PakistanDokument2 SeitenIndividual & Corporate Tax Rates in PakistanFrantsForum DiscussionNoch keine Bewertungen

- Tax Rates For The Tax Year 2016Dokument1 SeiteTax Rates For The Tax Year 2016Ghulam HaiderNoch keine Bewertungen

- Rates of Estate Tax If Net Taxable Estate Is Over But Not Over Tax Shall Be Plus of The Excess OverDokument1 SeiteRates of Estate Tax If Net Taxable Estate Is Over But Not Over Tax Shall Be Plus of The Excess OverKj BanalNoch keine Bewertungen

- TaxRates2021 22Dokument2 SeitenTaxRates2021 22Amir NazirNoch keine Bewertungen

- Tax Rates For The Tax Year 2015Dokument1 SeiteTax Rates For The Tax Year 2015Ghulam HaiderNoch keine Bewertungen

- Financial Plan BreakdownDokument7 SeitenFinancial Plan BreakdownMunashe MudaburaNoch keine Bewertungen

- Final J&COTax Card 2015-16Dokument1 SeiteFinal J&COTax Card 2015-16Mansoor JanjuaNoch keine Bewertungen

- ISCO Tax Card TY 2017 PDFDokument15 SeitenISCO Tax Card TY 2017 PDFRehan FarhatNoch keine Bewertungen

- Module 1 - Cherry Alfuerte - Train LawDokument41 SeitenModule 1 - Cherry Alfuerte - Train Lawgerry dacerNoch keine Bewertungen

- Taxation Paper F6 (PKNDokument13 SeitenTaxation Paper F6 (PKNMashhood AhmedNoch keine Bewertungen

- Tax Changes You Need To Know Under RA 10963Dokument20 SeitenTax Changes You Need To Know Under RA 10963Rosanno DavidNoch keine Bewertungen

- Pick and Drop Business PlanDokument23 SeitenPick and Drop Business Plananon_4856232670% (1)

- Tax Rates 2009-10Dokument2 SeitenTax Rates 2009-10Mansoor AhmadNoch keine Bewertungen

- KCO-Rate-Card 2021Dokument13 SeitenKCO-Rate-Card 2021Aqib SheikhNoch keine Bewertungen

- TXPKN 2018 Dec Q PDFDokument17 SeitenTXPKN 2018 Dec Q PDFYousuf khanNoch keine Bewertungen

- Director General Public Relations Baluchistan (DGPRB) Shortlisted Candidates For InterviewDokument1 SeiteDirector General Public Relations Baluchistan (DGPRB) Shortlisted Candidates For InterviewHakim JanNoch keine Bewertungen

- 20219172293046818sronos 1222and1223of2021bothdated17 09 2021Dokument2 Seiten20219172293046818sronos 1222and1223of2021bothdated17 09 2021Hakim JanNoch keine Bewertungen

- MS PHD Admission Form LUAWMSDokument3 SeitenMS PHD Admission Form LUAWMSHakim JanNoch keine Bewertungen

- Hat Ii WDokument1 SeiteHat Ii WHakim JanNoch keine Bewertungen

- 5 Accounting Problems On RoyaltiesDokument16 Seiten5 Accounting Problems On RoyaltiesHakim JanNoch keine Bewertungen

- Chapter 1427Dokument32 SeitenChapter 1427Hakim JanNoch keine Bewertungen

- Iris FAQsDokument74 SeitenIris FAQsHammad SalahuddinNoch keine Bewertungen

- Excel Based LOAN CalculatorDokument26 SeitenExcel Based LOAN Calculatorbasavaraj.m.mangalore1840Noch keine Bewertungen

- Chapter # 17: Valuation of Accounts ReceivableDokument24 SeitenChapter # 17: Valuation of Accounts ReceivableHakim JanNoch keine Bewertungen

- Balochistan Residential College, Lesbela at Utha.: WardenDokument4 SeitenBalochistan Residential College, Lesbela at Utha.: WardenHakim JanNoch keine Bewertungen

- Iris FAQsDokument74 SeitenIris FAQsHammad SalahuddinNoch keine Bewertungen

- 1 Af 101 FfaDokument4 Seiten1 Af 101 FfaHakim JanNoch keine Bewertungen

- Problems with Bank ReconciliationDokument4 SeitenProblems with Bank ReconciliationHakim JanNoch keine Bewertungen

- Consolidated Advertisement No. 13/2018 Don't Wait For The Last Date, Apply Online/submit Your Application TodayDokument6 SeitenConsolidated Advertisement No. 13/2018 Don't Wait For The Last Date, Apply Online/submit Your Application TodayHakim JanNoch keine Bewertungen

- Sardar Bahudar Khan Women's University (SBKWU) Pharm-D Test: Answer Key (Blue)Dokument2 SeitenSardar Bahudar Khan Women's University (SBKWU) Pharm-D Test: Answer Key (Blue)Hakim JanNoch keine Bewertungen

- NTS Book For GAT GeneralDokument142 SeitenNTS Book For GAT GeneralMuzaffar AhsanNoch keine Bewertungen

- Why Kalabagh Dam - (Complete Essay - Outline For CSS - PCS)Dokument5 SeitenWhy Kalabagh Dam - (Complete Essay - Outline For CSS - PCS)Hakim JanNoch keine Bewertungen

- Takehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Dokument3 SeitenTakehome - Quiz - Manac - Docx Filename - UTF-8''Takehome Quiz Manac-1Sharmaine SurNoch keine Bewertungen

- GCMA BookDokument524 SeitenGCMA BookZiaul Huq100% (5)

- Cost Benefit AnalysisDokument11 SeitenCost Benefit AnalysisTnek OrarrefNoch keine Bewertungen

- Tugas PT CIPUTRA DEVELOPMENT TBKDokument100 SeitenTugas PT CIPUTRA DEVELOPMENT TBKNiezar Sii Chaby-Chaby MayniezNoch keine Bewertungen

- Quiz 1 - Limited CompaniesDokument2 SeitenQuiz 1 - Limited CompaniesELIZABETH MARGARETHANoch keine Bewertungen

- KLBF LK TW Ii 2020Dokument150 SeitenKLBF LK TW Ii 2020Nida Maulida HaviyaNoch keine Bewertungen

- P&G's Transformation and Growth Under Lafley's LeadershipDokument7 SeitenP&G's Transformation and Growth Under Lafley's Leadershippallavbajaj88Noch keine Bewertungen

- Annual Report & Financial Statements 2017: Safari Lodges and Camps Hotels - ResortsDokument90 SeitenAnnual Report & Financial Statements 2017: Safari Lodges and Camps Hotels - ResortsajwadkhanNoch keine Bewertungen

- Marginal CostingDokument30 SeitenMarginal Costinganon_3722476140% (1)

- EV Equity Value ModelDokument6 SeitenEV Equity Value Modelkirihara95Noch keine Bewertungen

- Form 709 United States Gift Tax ReturnDokument5 SeitenForm 709 United States Gift Tax ReturnBogdan PraščevićNoch keine Bewertungen

- Corse Cod: ACT328 Section: 1 Name: Shaheed AhmedDokument3 SeitenCorse Cod: ACT328 Section: 1 Name: Shaheed AhmedSidad KurdistaniNoch keine Bewertungen

- GDP ExamplesDokument4 SeitenGDP ExamplesPRITEENoch keine Bewertungen

- Bank Audit Program-FRPDokument20 SeitenBank Audit Program-FRPHazel R. TanilonNoch keine Bewertungen

- Actual Costing enDokument8 SeitenActual Costing enRajanNoch keine Bewertungen

- PST311L Unit 1 - 3Dokument10 SeitenPST311L Unit 1 - 3ektha_nankoomar9190% (10)

- Chapter 6 - Time Value MoneyDokument40 SeitenChapter 6 - Time Value MoneymihNoch keine Bewertungen

- March 2010 Part 3 InsightDokument85 SeitenMarch 2010 Part 3 InsightLegogie Moses AnoghenaNoch keine Bewertungen

- 2016-17 - California YMCA Youth & Government Annual ReportDokument16 Seiten2016-17 - California YMCA Youth & Government Annual ReportRichard HsuNoch keine Bewertungen

- Ratio Analysis - Hayleys Fabric PLC: Assignment 01Dokument39 SeitenRatio Analysis - Hayleys Fabric PLC: Assignment 01shenali kavishaNoch keine Bewertungen

- Notfctn 14 Central Tax English 2019Dokument2 SeitenNotfctn 14 Central Tax English 2019sathishmrNoch keine Bewertungen

- HI6028 Taxation Theory, Practice & Law: Student Name: Student NumberDokument12 SeitenHI6028 Taxation Theory, Practice & Law: Student Name: Student NumberMah Noor FastNUNoch keine Bewertungen