Beruflich Dokumente

Kultur Dokumente

BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and Instructions

Hochgeladen von

dreaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and Instructions

Hochgeladen von

dreaCopyright:

Verfügbare Formate

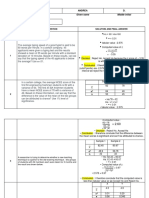

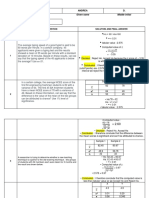

BIR Form 2550M – Monthly Value-Added Tax Declaration

GUIDELINES AND INSTRUCTIONS

Who shall file Definition of Terms

This return/declaration shall be filed in triplicate by the following taxpayers: Input Tax means the value-added tax due from or paid by a VAT-

1. A VAT-registered person; and registered person in the course of his trade or business on importation of goods,

2. A person required to register as a VAT taxpayer but failed to register. or local purchase of goods or services, including lease or use of property, from

This return/declaration must be filed by the aforementioned taxpayers for as a VAT-registered person. It shall also include the transitional input tax

long as the VAT registration has not yet been cancelled, even if there is no taxable determined in accordance with Section 111 of the National Internal Revenue

transaction during the month or the aggregate sales/receipts for any 12-month period Code, presumptive input tax and deferred input tax from previous period.

did not exceed the P1,500,000.00 threshold.

A person who imports goods shall use the form prescribed by the Bureau of Output Tax means the value-added tax due on the sale or lease

Custom. of taxable goods or properties or services by any person registered

or required to register under Section 236 of the National Internal Revenue

When and Where to file Code.

The returns/declarations must be filed not later than the 20 th day following the Penalties

close of the month.

The returns/declarations must be filed with any Authorized Agent Bank There shall be imposed and collected as part of the tax:

(AAB) within the jurisdiction of the Revenue District Office where the taxpayer is 1. A surcharge of twenty five percent (25%) for each of the following violations:

required to register. In places where there are no Authorized Agent Bank (AAB), a. Failure to file any return and pay the amount of tax or installment due

the returns/declarations shall be filed with the Revenue Collection Officer or duly on or before the due date;

Authorized City or Municipal Treasurer located within the revenue district where b. Unless otherwise authorized by the Commissioner, filing a return with a

the taxpayer is required to register. person or office other than those with whom it is required to be filed;

c. Failure to pay the full or part of the amount of tax shown on the return,

Taxpayers with branches shall file only one consolidated return/declaration for or the full amount of tax due for which no return is required to be filed

his principal place of business or head office and all branches. on or before the due date;

d. Failure to pay the deficiency tax within the time prescribed for its

When and Where to Pay payment in the notice of assessment.

2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case

Upon filing this return/declaration, the total amount payable shall be paid to any payment has been made on the basis of such return before

the Authorized Agent Bank (AAB) where the return/declaration is filed. In places the discovery of the falsity or fraud, for each of the following violations:

where there are no AABs, payment shall be made to the Revenue Collection Officer a. Willful neglect to file the return within the period prescribed by the Code

or duly Authorized City or Municipal Treasurer who shall issue a Revenue Official or by rules and regulations; or

Receipt (ROR) therefor. b. In case a false or fraudulent return is willfully made.

3. Interest at the rate of twenty percent (20%) per annum, or such higher

Where the return is filed with an AAB, taxpayer must accomplish and submit rate as may be prescribed by rules and regulations, on any unpaid amount

BIR-prescribed deposit slip, which the bank teller shall machine validate as evidence of tax, from the date prescribed for the payment until the amount is fully

that payment was received by the AAB. The AAB receiving the tax return shall paid.

stamp mark the word “Received” on the return and also machine validate the return 4. Compromise penalty.

as proof of filing the return and payment of the tax by the taxpayer, respectively.

The machine validation shall reflect the date of payment, amount paid and Attachments

transactions code, the name of the bank, branch code, teller’s code and teller’s

initial. Bank debit memo number and date should be indicated in the return for

taxpayers paying under the bank debit system. 1. Duly issued Certificate of Creditable VAT Withheld at Source, if applicable;

2. Summary Alphalist of Withholding Agents of Income Payments Subjected to

For Electronic Filing and Payment System (EFPS) Taxpayer Withholding Tax at Source (SAWT), if applicable;

3. Duly approved Tax Debit Memo, if applicable;

The deadline for electronically filing and paying the taxes due thereon shall 4. Duly approved Tax Compliance Certificate, if applicable.

be in accordance with the provisions of existing applicable revenue issuances. 5. Authorization letter, if return is filed by authorized representative.

Rates and Bases of Tax Note: All background information must be properly filled up.

A. On Sale of Goods and Properties – twelve percent (12%) of the gross selling

price or gross value in money of the goods or properties sold, bartered or All returns filed by an accredited tax representative on behalf of a taxpayer

exchanged. shall bear the following information:

A. For CPAs and others (individual practitioners and members of GPPs);

B. On Sale of Services and Use or Lease of Properties – twelve percent (12%) of a.1 Taxpayer Identification Number (TIN); and

gross receipts derived from the sale or exchange of services, including the use a.2 Certificate of Accreditation Number, Date of Issuance,

or lease of properties. and Date of Expiry.

C. On Importation of Goods – twelve percent (12%) based on the total value used B. For members of the Philippine Bar (individual practitioners, members of

by the Bureau of Customs in determining tariff and customs duties, plus GPPs);

customs duties, excise taxes, if any, and other charges, such tax to be paid by b.1 Taxpayer Identification Number (TIN); and

importer prior to the release of such goods from customs custody: Provided, b.2 Attorney’s Roll number or Accreditation Number, if any.

Box No. 1 refers to transaction period and not the date of filing this return.

That where the customs duties are determined on the basis of quantity or The last 3 digits of the 12-digit TIN refers to the branch code.

volume of the goods, the value added tax shall be based on the landed cost plus TIN = Taxpayer Identification Number

excise taxes, if any. ENCS

D. On Export Sales and Other Zero-rated Sales - 0%.

Das könnte Ihnen auch gefallen

- CPALE Primer 2.5Dokument13 SeitenCPALE Primer 2.5JarvelNoch keine Bewertungen

- (People v. Macasling, GM, No. 90342, May 27,1993Dokument7 Seiten(People v. Macasling, GM, No. 90342, May 27,1993TrexPutiNoch keine Bewertungen

- Tax BT Introduction To VATDokument5 SeitenTax BT Introduction To VATJoshua Phillip TorcedoNoch keine Bewertungen

- Recommended Books for Intermediate Accounting 1, Cost Accounting, and Conceptual FrameworkDokument4 SeitenRecommended Books for Intermediate Accounting 1, Cost Accounting, and Conceptual FrameworksfsdfsdfNoch keine Bewertungen

- Taxation: General PrinciplesDokument34 SeitenTaxation: General PrinciplesKeziah A GicainNoch keine Bewertungen

- Accountig For Construction Type Contracts EditedDokument31 SeitenAccountig For Construction Type Contracts EditedEmey CalbayNoch keine Bewertungen

- Philippine auditing standards and audit typesDokument25 SeitenPhilippine auditing standards and audit typesAngelica DuarteNoch keine Bewertungen

- INCOME TAX BASICSDokument38 SeitenINCOME TAX BASICSElson TalotaloNoch keine Bewertungen

- 2012 08 NIRC Remedies TablesDokument8 Seiten2012 08 NIRC Remedies TablesJaime Dadbod NolascoNoch keine Bewertungen

- The Wellex Group Inc. V U-Land Airlines Co - G.R. No. 167519, January 14, 2015Dokument61 SeitenThe Wellex Group Inc. V U-Land Airlines Co - G.R. No. 167519, January 14, 2015Tris LeeNoch keine Bewertungen

- Criminal Law ReviewDokument267 SeitenCriminal Law ReviewMycor Castillo OpsimaNoch keine Bewertungen

- AAAAACompiled Poli DigestDokument774 SeitenAAAAACompiled Poli DigestVeah CaabayNoch keine Bewertungen

- 01 - Managerial Accounting An OverviewDokument15 Seiten01 - Managerial Accounting An OverviewSa LaNoch keine Bewertungen

- RFBT1 Oblico Lecture NotesDokument24 SeitenRFBT1 Oblico Lecture NotesTrina Rose FandiñoNoch keine Bewertungen

- Lectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Dokument106 SeitenLectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Zaira Gem GonzalesNoch keine Bewertungen

- Vat With TrainDokument16 SeitenVat With TrainElla QuiNoch keine Bewertungen

- INCOME TAXATION REVIEWER-Fundamentals of TaxationDokument7 SeitenINCOME TAXATION REVIEWER-Fundamentals of TaxationEli PinesNoch keine Bewertungen

- 2nd Semester Income Taxation Module 9 CPAR Fringe Benefits TaxDokument13 Seiten2nd Semester Income Taxation Module 9 CPAR Fringe Benefits Taxnicole tolaybaNoch keine Bewertungen

- Module 1 Introduction To TaxationDokument9 SeitenModule 1 Introduction To TaxationKristian Karl Bautista Kiw-is100% (1)

- Tariff and Customs CodeDokument30 SeitenTariff and Customs CodeJulius AnthonyNoch keine Bewertungen

- Mnemonics for Philippine Persons and Family LawDokument11 SeitenMnemonics for Philippine Persons and Family LawcasieNoch keine Bewertungen

- II. Tax RemediesDokument2 SeitenII. Tax Remediesggg10Noch keine Bewertungen

- Unit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516Dokument9 SeitenUnit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - Final - t31516mimi96Noch keine Bewertungen

- Main 3 - Claveria, Jenny PDFDokument18 SeitenMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNoch keine Bewertungen

- (Type Text) (Type Text) Michele Ann R. SamsonDokument4 Seiten(Type Text) (Type Text) Michele Ann R. SamsonMicheleNoch keine Bewertungen

- Local Gov't Code Tax2 FinalDokument3 SeitenLocal Gov't Code Tax2 FinalJenny JspNoch keine Bewertungen

- Corporation CodeDokument55 SeitenCorporation CodemarizenocNoch keine Bewertungen

- Air France Case Part BDokument3 SeitenAir France Case Part Bleftywildthing22Noch keine Bewertungen

- Basic Concepts of TaxationDokument5 SeitenBasic Concepts of TaxationRhea Javed100% (1)

- Bir Rao 01 03Dokument3 SeitenBir Rao 01 03Benedict Jonathan BermudezNoch keine Bewertungen

- False True True True TrueDokument16 SeitenFalse True True True TrueArt B. EnriquezNoch keine Bewertungen

- Oblligation and Contracts Reviewer SummarizeDokument9 SeitenOblligation and Contracts Reviewer SummarizeMaryBalezaNoch keine Bewertungen

- Labor Law Review NOTES for Midterms 2015-2016Dokument15 SeitenLabor Law Review NOTES for Midterms 2015-2016MichaelNoch keine Bewertungen

- Vanishing DeductionsDokument3 SeitenVanishing DeductionsCyrell AsidNoch keine Bewertungen

- Chapter 9: Court Tax Appeals: Tax Reviewer: Law of Basic Taxation in The PhilippinesDokument3 SeitenChapter 9: Court Tax Appeals: Tax Reviewer: Law of Basic Taxation in The PhilippinesBuenavista Mae BautistaNoch keine Bewertungen

- Special Rules On Capital Transactions (Capital Gains and Losses)Dokument40 SeitenSpecial Rules On Capital Transactions (Capital Gains and Losses)AngeliqueGiselleCNoch keine Bewertungen

- Taxation (Basic Principles)Dokument8 SeitenTaxation (Basic Principles)Mariah Jans SasumanNoch keine Bewertungen

- Obligations and Contracts: By: Atty. Wilfred Francis B. MartinezDokument28 SeitenObligations and Contracts: By: Atty. Wilfred Francis B. MartinezAgatha PeterNoch keine Bewertungen

- Obl IconDokument21 SeitenObl Iconmimi96Noch keine Bewertungen

- Chapter 4: General Principles in Taxation Lesson 1 Power of Taxation TaxationDokument22 SeitenChapter 4: General Principles in Taxation Lesson 1 Power of Taxation TaxationJeeren PepitoNoch keine Bewertungen

- Updates From The PRBoADokument68 SeitenUpdates From The PRBoAJofritz ValleNoch keine Bewertungen

- Revised Rules of Criminal ProcedureDokument24 SeitenRevised Rules of Criminal ProcedureShara Mae Buen GonzalesNoch keine Bewertungen

- 05 2016 0037Dokument4 Seiten05 2016 0037abraham h. bioNoch keine Bewertungen

- Extinguishment of ObligationsDokument89 SeitenExtinguishment of ObligationsLLYOD FRANCIS LAYLAYNoch keine Bewertungen

- RMO No 19-2015Dokument10 SeitenRMO No 19-2015gelskNoch keine Bewertungen

- Revised Ortega Notes Book I General Provisions: Criminal LawDokument63 SeitenRevised Ortega Notes Book I General Provisions: Criminal LawHaniel GANoch keine Bewertungen

- Reviewer Taxation Modules 1 - 3Dokument11 SeitenReviewer Taxation Modules 1 - 3afeiahnaniNoch keine Bewertungen

- Assignment in Civil Law Review 2 Feb. 16, 2021Dokument19 SeitenAssignment in Civil Law Review 2 Feb. 16, 2021Lielet MatutinoNoch keine Bewertungen

- Quantitative Techniques (OK Na!)Dokument9 SeitenQuantitative Techniques (OK Na!)Fabrienne Kate LiberatoNoch keine Bewertungen

- Assessment & AuditDokument17 SeitenAssessment & AuditRam SewakNoch keine Bewertungen

- Notes in Organization and Functions of The BirDokument5 SeitenNotes in Organization and Functions of The BirNinaNoch keine Bewertungen

- RPT and Local Business TaxDokument48 SeitenRPT and Local Business TaxGeng SimbolNoch keine Bewertungen

- RFBT MidtermDokument27 SeitenRFBT MidtermShane CabinganNoch keine Bewertungen

- Atty. Cleo D. Sabado-Andrada, Cpa, Mba, LLMDokument374 SeitenAtty. Cleo D. Sabado-Andrada, Cpa, Mba, LLMIra Francia AlcazarNoch keine Bewertungen

- Activity PrefinalDokument2 SeitenActivity PrefinalRoNnie RonNie100% (1)

- Part I: Concept of Tax AdministrationDokument22 SeitenPart I: Concept of Tax AdministrationShiela Marie Sta AnaNoch keine Bewertungen

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDokument1 SeiteBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNoch keine Bewertungen

- 2550Q InstructionsDokument1 Seite2550Q InstructionsMay RamosNoch keine Bewertungen

- 2550Q Guidelines 2023 - FinalDokument1 Seite2550Q Guidelines 2023 - Finallorenzo ejeNoch keine Bewertungen

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDokument1 SeiteBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNoch keine Bewertungen

- Post NegoDokument46 SeitenPost NegodreaNoch keine Bewertungen

- Adjusted Adjusted Trial Balance Income Statement BalanceDokument1 SeiteAdjusted Adjusted Trial Balance Income Statement BalancedreaNoch keine Bewertungen

- FINALNSTPDokument29 SeitenFINALNSTPdreaNoch keine Bewertungen

- GAAP Fundamentals ExplainedDokument6 SeitenGAAP Fundamentals ExplaineddreaNoch keine Bewertungen

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDokument1 SeiteBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNoch keine Bewertungen

- Copernican Revolution: Intellectual RevolutionsDokument6 SeitenCopernican Revolution: Intellectual RevolutionsdreaNoch keine Bewertungen

- Negotiable Instruments CharacteristicsDokument34 SeitenNegotiable Instruments CharacteristicsdreaNoch keine Bewertungen

- Characteristics (Abcd Vip)Dokument8 SeitenCharacteristics (Abcd Vip)dreaNoch keine Bewertungen

- NSTPTWODokument12 SeitenNSTPTWOdreaNoch keine Bewertungen

- Copernican Revolution: Intellectual RevolutionsDokument6 SeitenCopernican Revolution: Intellectual RevolutionsdreaNoch keine Bewertungen

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDokument1 SeiteBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNoch keine Bewertungen

- Process Costing: Discussion QuestionsDokument53 SeitenProcess Costing: Discussion QuestionsDissa ElvarettaNoch keine Bewertungen

- Copernican Revolution: Intellectual RevolutionsDokument6 SeitenCopernican Revolution: Intellectual RevolutionsdreaNoch keine Bewertungen

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDokument1 SeiteBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNoch keine Bewertungen

- Business Taxation CalculationsDokument13 SeitenBusiness Taxation CalculationsdreaNoch keine Bewertungen

- PDFDokument11 SeitenPDFdreaNoch keine Bewertungen

- Stats PDFDokument7 SeitenStats PDFdreaNoch keine Bewertungen

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6Dokument44 SeitenSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6jasperkennedy094% (17)

- Tan, Andrea PDFDokument9 SeitenTan, Andrea PDFdreaNoch keine Bewertungen

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDokument1 SeiteBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNoch keine Bewertungen

- Submitted By:: Last Name Given Name Middle InitialDokument9 SeitenSubmitted By:: Last Name Given Name Middle InitialdreaNoch keine Bewertungen

- Rationale: Fiscal Agency. The Senate Fiscal Agency Neither Supports Nor Opposes Legislation.)Dokument2 SeitenRationale: Fiscal Agency. The Senate Fiscal Agency Neither Supports Nor Opposes Legislation.)dreaNoch keine Bewertungen

- Proof of Cash Worksh1Dokument1 SeiteProof of Cash Worksh1Akomismo ToNoch keine Bewertungen

- GroupDokument4 SeitenGroupdreaNoch keine Bewertungen

- Purcom 1Dokument3 SeitenPurcom 1dreaNoch keine Bewertungen

- Stats PDFDokument7 SeitenStats PDFdreaNoch keine Bewertungen

- Stats PDFDokument7 SeitenStats PDFdreaNoch keine Bewertungen

- FFDokument2 SeitenFFdreaNoch keine Bewertungen

- StatsDokument14 SeitenStatsdreaNoch keine Bewertungen

- Carrots-And-Sticks - Sustainability Reporting Policies Worldwide Today's Best Practice, Tomorrow's TrendsDokument96 SeitenCarrots-And-Sticks - Sustainability Reporting Policies Worldwide Today's Best Practice, Tomorrow's TrendsElbaNereidaAlvarezNoch keine Bewertungen

- Tourism and Bandarban Hill DistrictDokument5 SeitenTourism and Bandarban Hill DistrictS. Sh UNoch keine Bewertungen

- Blue BookDokument171 SeitenBlue BookJohn KupchaNoch keine Bewertungen

- I. Ra 7076 People's Small Scale Mining Act of 1991Dokument12 SeitenI. Ra 7076 People's Small Scale Mining Act of 1991Wolf DenNoch keine Bewertungen

- Appointment Letter Fresher During ProbationDokument4 SeitenAppointment Letter Fresher During ProbationSuchi PattnaikNoch keine Bewertungen

- Guide to Evaluating Consultant ProposalsDokument47 SeitenGuide to Evaluating Consultant ProposalsGurisha AhadiNoch keine Bewertungen

- DMLC Certificate Issuing Proc PDFDokument17 SeitenDMLC Certificate Issuing Proc PDFAnoop Anandan PayyappillyNoch keine Bewertungen

- MECA Operations Manual - Shuttle Rack SystemDokument27 SeitenMECA Operations Manual - Shuttle Rack SystemBen LyonNoch keine Bewertungen

- MpedaDokument10 SeitenMpedaVishnu VijayakumarNoch keine Bewertungen

- Template Apprentice ContractDokument2 SeitenTemplate Apprentice ContractGC NavarroNoch keine Bewertungen

- Consolidated Complaint EMS Union Versus PMT AmbulanceDokument8 SeitenConsolidated Complaint EMS Union Versus PMT AmbulanceJoshua BarkleyNoch keine Bewertungen

- Wolfsberg Questionnaire 2018Dokument4 SeitenWolfsberg Questionnaire 2018Georgio RomaniNoch keine Bewertungen

- CUSTOMER SERVICES AGREEMENT For Standard Form - July 2015 - Final (Fillable)Dokument2 SeitenCUSTOMER SERVICES AGREEMENT For Standard Form - July 2015 - Final (Fillable)Gustavo Uchoa AraripeNoch keine Bewertungen

- Lecture 1Dokument22 SeitenLecture 1Curtis HotateNoch keine Bewertungen

- Integrated Circuits Ordinance 2000Dokument8 SeitenIntegrated Circuits Ordinance 2000averos12Noch keine Bewertungen

- Department of Education: Lesson Plan in Applied Economics Grade 12Dokument2 SeitenDepartment of Education: Lesson Plan in Applied Economics Grade 12GLICER MANGARON100% (4)

- NDNCDokument3 SeitenNDNCErnest AboagyeNoch keine Bewertungen

- ThreatsDokument6 SeitenThreatsGlenn Patrick de Leon100% (1)

- RMC No. 92-102-2020Dokument5 SeitenRMC No. 92-102-2020nathalie velasquezNoch keine Bewertungen

- M.L.Dahanukar College of Commerce T.Y.B.Com (Banking and Insurance) Preliminary Examination Semester V- 2014Dokument2 SeitenM.L.Dahanukar College of Commerce T.Y.B.Com (Banking and Insurance) Preliminary Examination Semester V- 2014devikaNoch keine Bewertungen

- Philacor Credit Corporation V CIRDokument6 SeitenPhilacor Credit Corporation V CIRBettina Rayos del SolNoch keine Bewertungen

- Bir Form 1702Dokument16 SeitenBir Form 1702Christine Ann GamboaNoch keine Bewertungen

- Med - Berrag.esc@hotmail - FR - Amar@yahoo - FR Ane Gam: AbstractDokument14 SeitenMed - Berrag.esc@hotmail - FR - Amar@yahoo - FR Ane Gam: AbstractSo FìaneNoch keine Bewertungen

- RR 12-99 Full TextDokument5 SeitenRR 12-99 Full TextErmawoo100% (2)

- Dissolution PlanDokument4 SeitenDissolution PlanAnonymous IuZaAWAWNoch keine Bewertungen

- ADR Prudential Guarantee Assurance vs. Anscor Case DigestDokument2 SeitenADR Prudential Guarantee Assurance vs. Anscor Case DigestJessa MaeNoch keine Bewertungen

- Ds Primary Guide 2021 R3.1Dokument121 SeitenDs Primary Guide 2021 R3.1IanNoch keine Bewertungen

- Internal Controls 101Dokument25 SeitenInternal Controls 101Arcee Orcullo100% (1)

- Case Digest - Manila Prince Hotel V GSIS GR 122156, 3 February 1997Dokument3 SeitenCase Digest - Manila Prince Hotel V GSIS GR 122156, 3 February 1997Vic Rabaya100% (7)

- Smyth Law 14e PPT 02Dokument18 SeitenSmyth Law 14e PPT 02Hardeep KaurNoch keine Bewertungen