Beruflich Dokumente

Kultur Dokumente

RPGT Rates

Hochgeladen von

SarannRajSomasakaran0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten4 Seitencalculation of real property gain tax

Originaltitel

Rpgt Rates

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencalculation of real property gain tax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten4 SeitenRPGT Rates

Hochgeladen von

SarannRajSomasakarancalculation of real property gain tax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

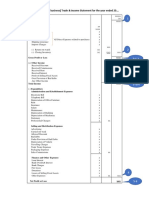

RPGT RATES

RPGT Rates Individuals Individuals Companies

(DISPOSAL) (Citizens & ( Non

Permanent Citizens &

Resident) Foriegners)

st

1 Year 30% 30% 30%

nd

2 Year 30% 30% 30%

rd

3 Year 30% 30% 30%

4th Year 20% 30% 20%

5th Year 15% 30% 15%

6th Year & beyond 5% 10% 10%

CALCULATION OF RPGT

(Disposal Price – Acquisition Price) x RPGT Rate

= RPGT

CALCULATION OF DISPOSAL PRICE

(RM)

Consideration Received (xx)

Less : Permitted Expenses:

Enhancement Cost (x)

Legal fees in defending (x)

title

Less: Incidental Cost:

Commission (x)

Legal Fees (x)

Advertisement Fees (x)

Disposal Price (xx)

RPGT RATES

CALCULATION OF ACQUISITION PRICE

(RM)

Consideration Paid (xx)

Plus : Incidental Costs:-

Interest (applicable only prior to 1 (x)

January 2010)

Stamp Duty (x)

Commission (x)

Legal Fees (x)

Advertisement Fees (x)

Less: Recoveries:-

Insurance Compensation (x)

Compensation for Damages (x)

Deposit forfeited (x)

Acquisition Price (xx)

- Not applicable if the disposal price is equal to the Acquisition Price or lower that.

Individuals

o Citizen, Non – Citizen & Foriegners /have to pay RPGT according to their

chargeable gain.

Company

o Generally, the selling of shares by company is not subjected to RPGT

except Real Property Companies (RPC) which carries out real property

business as their core business.

o RPC company – if it has a real property / share equivalent to 75% of the

company’s total tangible assets.

EXEMPTION / TAX RELIEF

Individuals

An exemption of 10% of profit OR RM10,000.00 (whichever is higher) for

the following four scenarios:-

a) If an asset is transferred as a gift by a donor who is a Malaysian

citizen and the acquirers are either husband and wife, parent and

RPGT RATES

children or grandparents and grandchildren. This exemption is not

applicable for transfers between siblings.

b) Once in a lifetime exemption on the chargeable gain on disposal

of 1 private residence by a Malaysian citizen or Permanent

Resident (PR).

Non- Citizen & Foreigner

c) If an asset is transferred between spouses, then the asset to be

disposed of must be owned by the husband or wife who is a

Malaysian citizen.

d) If an asset is transferred to a company, then the asset owner or

owner’s spouse must be a Malaysian citizen. If the asset is jointly

owned by 2 individuals, both need to be Malaysian citizens to

make the transfer.

- Homeowners who own low / medium cost house priced RM200,000.00

are exempted from the RPGT when disposing of their property.

COMPANIES

a) 10% or RM10,000 (whichever is higher) is exempted

b) Intercompany is exempted from RPGT as follows:-

RPGT RATES

Das könnte Ihnen auch gefallen

- Corporate Finance Formulas: A Simple IntroductionVon EverandCorporate Finance Formulas: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (8)

- Transfer and Business Taxation Accounting Methods and PeriodsDokument5 SeitenTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNoch keine Bewertungen

- Real Property Gains Tax 101Dokument4 SeitenReal Property Gains Tax 101sambasivammeNoch keine Bewertungen

- FormulasDokument5 SeitenFormulasKezNoch keine Bewertungen

- Chapter 10 RPGTDokument24 SeitenChapter 10 RPGTdiyana farhanaNoch keine Bewertungen

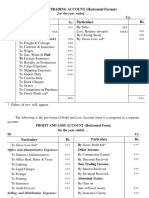

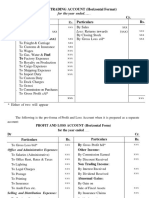

- General Format For Final AccountsDokument2 SeitenGeneral Format For Final AccountsGokulCj GroveNoch keine Bewertungen

- Direct Financing & Sales Type LeaseDokument1 SeiteDirect Financing & Sales Type LeaseKent Raysil PamaongNoch keine Bewertungen

- CGT Notes - AnnotatedDokument54 SeitenCGT Notes - AnnotatedDr SafaNoch keine Bewertungen

- Chapter 6 SOPL-SOFP-FormatDokument3 SeitenChapter 6 SOPL-SOFP-FormatShowenah ThiruNoch keine Bewertungen

- Preparation of Financial Statements-PartnershipsDokument7 SeitenPreparation of Financial Statements-PartnershipsHeavens MupedzisaNoch keine Bewertungen

- Net Sale: Gross Profit / LossDokument1 SeiteNet Sale: Gross Profit / Lossabo776100% (1)

- LEASES 2 - Lessor AccountingDokument7 SeitenLEASES 2 - Lessor AccountingMia CasasNoch keine Bewertungen

- Final Account FormatDokument4 SeitenFinal Account FormatHasdanNoch keine Bewertungen

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Dokument18 SeitenChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNoch keine Bewertungen

- Partnership Final Accounts PDFDokument97 SeitenPartnership Final Accounts PDFKaushik Patel75% (4)

- Final Account of Sole TradersDokument16 SeitenFinal Account of Sole Tradersheena mohnaniNoch keine Bewertungen

- Capital Gains Tax Calculation GuideDokument9 SeitenCapital Gains Tax Calculation GuideAffan AliNoch keine Bewertungen

- 5.consolidated SOCI - AAFRDokument11 Seiten5.consolidated SOCI - AAFRAli OptimisticNoch keine Bewertungen

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Dokument17 SeitenChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNoch keine Bewertungen

- Readme JumboDokument4 SeitenReadme JumboJulzNoch keine Bewertungen

- Modu Taxes: Gift and Estate: X XX XXDokument2 SeitenModu Taxes: Gift and Estate: X XX XXEl-Sayed MohammedNoch keine Bewertungen

- Secondary Book of Account: Prof. S. Y. ShewaleDokument10 SeitenSecondary Book of Account: Prof. S. Y. Shewalesneharsh2370Noch keine Bewertungen

- Gross Estate: Common Shares - Book Value Preference Shares - Par ValueDokument3 SeitenGross Estate: Common Shares - Book Value Preference Shares - Par ValueMichael AquinoNoch keine Bewertungen

- Balance SheetDokument1 SeiteBalance Sheetabo776Noch keine Bewertungen

- Capital Gains Tax Computation: Exempt AssetsDokument15 SeitenCapital Gains Tax Computation: Exempt AssetsGayathri SudheerNoch keine Bewertungen

- Alternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIDokument4 SeitenAlternative Treatment To SLPSAS 11 - Addendum To SLPSAS Volume IIIgeethNoch keine Bewertungen

- ACC 1112 Format Sole TraderDokument3 SeitenACC 1112 Format Sole TraderTran Tan Trong HieuNoch keine Bewertungen

- Tax3702 Exam Quick NotesDokument8 SeitenTax3702 Exam Quick NotesnhlakaniphoNoch keine Bewertungen

- Unit - Iii Final Account: I.e., All Manufacturing Expenses, Carriage, Cartage, Freight, Duty EtcDokument9 SeitenUnit - Iii Final Account: I.e., All Manufacturing Expenses, Carriage, Cartage, Freight, Duty EtcWelcome 1995Noch keine Bewertungen

- Final Account Format - VerticalDokument2 SeitenFinal Account Format - VerticalTan Shu YuinNoch keine Bewertungen

- Limited Liability Partnership (LLP)Dokument10 SeitenLimited Liability Partnership (LLP)sejal ambetkarNoch keine Bewertungen

- ABC CorporationDokument2 SeitenABC CorporationAA BB MMNoch keine Bewertungen

- Full Format of RPGTDokument1 SeiteFull Format of RPGTfarahNoch keine Bewertungen

- Format Sopl and SofpDokument3 SeitenFormat Sopl and SofpMuhammad Faaiz IzzeawanNoch keine Bewertungen

- Format of The BalancesheetDokument2 SeitenFormat of The BalancesheetRanu Games100% (1)

- Direct MethodDokument2 SeitenDirect MethodZazaBasriNoch keine Bewertungen

- Financial Statements: Statement of Profit or Loss and Other Comprehensive Income DR CRDokument8 SeitenFinancial Statements: Statement of Profit or Loss and Other Comprehensive Income DR CRTawanda Tatenda HerbertNoch keine Bewertungen

- Preparation of Financial Statements-Sole TradersDokument5 SeitenPreparation of Financial Statements-Sole TradersHeavens Mupedzisa100% (1)

- FranchiseDokument6 SeitenFranchiseDivina SalazarNoch keine Bewertungen

- Lecture CHAPTER 10 LESSEE ACCOUNTINGDokument7 SeitenLecture CHAPTER 10 LESSEE ACCOUNTINGLady Pila0% (1)

- Chapter 5 Real Propperty Gains TaxDokument27 SeitenChapter 5 Real Propperty Gains TaxZuraida YusoffNoch keine Bewertungen

- TX-301 Vat Subject Trans PDFDokument12 SeitenTX-301 Vat Subject Trans PDFDea LingaoNoch keine Bewertungen

- Chapter 7: Real Property Gain TaxDokument17 SeitenChapter 7: Real Property Gain TaxNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)Noch keine Bewertungen

- Transfer Taxes (Estate and Donor'S Taxation) Estate Tax ModelDokument4 SeitenTransfer Taxes (Estate and Donor'S Taxation) Estate Tax ModelJohn Karlo CamineroNoch keine Bewertungen

- ACC 2208 FORMAT FS - Sole TraderDokument3 SeitenACC 2208 FORMAT FS - Sole TraderHAHAHA100% (1)

- SUMMARY - Working Capital ManagementDokument4 SeitenSUMMARY - Working Capital ManagementAccounting MaterialsNoch keine Bewertungen

- Format of Trading Profit Loss Account Balance Sheet PDFDokument6 SeitenFormat of Trading Profit Loss Account Balance Sheet PDFsonika7100% (1)

- Midterms TaxDokument4 SeitenMidterms TaxPrincess Dianne CamachoNoch keine Bewertungen

- Partnership LiquidationDokument4 SeitenPartnership LiquidationMelanie RuizNoch keine Bewertungen

- S.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDokument11 SeitenS.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDheer BhanushaliNoch keine Bewertungen

- 801 Value Added TaxDokument4 Seiten801 Value Added TaxHarold Cedric Noleal OsorioNoch keine Bewertungen

- 5 PigovianTax2Dokument38 Seiten5 PigovianTax2api-3709940Noch keine Bewertungen

- Final - Accounts Format PDFDokument13 SeitenFinal - Accounts Format PDFajaychatta100% (1)

- Final - Accounts Format 234 PDFDokument13 SeitenFinal - Accounts Format 234 PDFajaychattaNoch keine Bewertungen

- Computation of Income Tax LiabilityDokument6 SeitenComputation of Income Tax LiabilityMahnoor KamranNoch keine Bewertungen

- Scope of CGT For StudentsDokument5 SeitenScope of CGT For StudentsattiqullahmalikNoch keine Bewertungen

- Final Account - PDF FormatDokument8 SeitenFinal Account - PDF Formatpranaylanjewar644Noch keine Bewertungen

- Format of Income StatementDokument2 SeitenFormat of Income StatementForam VasaniNoch keine Bewertungen

- Tax Credits - TY 2022 (Taweez)Dokument3 SeitenTax Credits - TY 2022 (Taweez)Taaha JanNoch keine Bewertungen

- Click To Edit Master Title StyleDokument5 SeitenClick To Edit Master Title StyleThoha Ferana RocherNoch keine Bewertungen

- Week 1 COMMERCIAL LAW - Introduction & Chapter 1Dokument28 SeitenWeek 1 COMMERCIAL LAW - Introduction & Chapter 1Fadhilah Abdul Ghani100% (2)

- Week 1 COMMERCIAL LAW - Introduction & Chapter 1Dokument28 SeitenWeek 1 COMMERCIAL LAW - Introduction & Chapter 1Fadhilah Abdul Ghani100% (2)

- Company Transformation Receivership and Winding UpDokument26 SeitenCompany Transformation Receivership and Winding UpKomathy SomasakaranNoch keine Bewertungen

- Click To Edit Master Title StyleDokument5 SeitenClick To Edit Master Title StyleThoha Ferana RocherNoch keine Bewertungen

- Recovery of ArrearsDokument4 SeitenRecovery of ArrearsSarannRajSomasakaranNoch keine Bewertungen

- Webminar Will ProbateDokument80 SeitenWebminar Will ProbateSarannRajSomasakaranNoch keine Bewertungen

- Unlawful Occupation of Land in MalaysiaDokument78 SeitenUnlawful Occupation of Land in MalaysiaSarannRajSomasakaranNoch keine Bewertungen

- Steps Flowchart of Subsale With Title RedemptionDokument5 SeitenSteps Flowchart of Subsale With Title RedemptionSarannRajSomasakaran100% (1)

- Checklist For Transfer Involving CompanyDokument2 SeitenChecklist For Transfer Involving CompanySarannRajSomasakaranNoch keine Bewertungen

- Guidebook On Registering Property in Malaysia - 3Dokument86 SeitenGuidebook On Registering Property in Malaysia - 3Sixd Waznine100% (1)

- Yeo Ann Kiat & 238 Ors V Hong Leong Bank BHD & AnorDokument13 SeitenYeo Ann Kiat & 238 Ors V Hong Leong Bank BHD & AnorSarannRajSomasakaranNoch keine Bewertungen

- Case Study Research: Foundations and Methodological OrientationsDokument17 SeitenCase Study Research: Foundations and Methodological OrientationsAsha JornalNoch keine Bewertungen

- Discharge FrustrationDokument24 SeitenDischarge FrustrationSarannRajSomasakaranNoch keine Bewertungen

- Force India Formula One Team LTD V 1 Malaysia Racing TeDokument124 SeitenForce India Formula One Team LTD V 1 Malaysia Racing TeSarannRajSomasakaranNoch keine Bewertungen

- Prohibitory Orders: Nature Creation Duration Power To Amend CaveatDokument1 SeiteProhibitory Orders: Nature Creation Duration Power To Amend CaveatSarannRajSomasakaranNoch keine Bewertungen

- Malayan Banking BHD V Marilyn Ho Siok LinDokument19 SeitenMalayan Banking BHD V Marilyn Ho Siok LinAnonymous VoAWuOhnNoch keine Bewertungen

- Appeals An AnalysisDokument3 SeitenAppeals An AnalysisSarannRajSomasakaranNoch keine Bewertungen

- Aids For Visual ImpairmentDokument5 SeitenAids For Visual ImpairmentSarannRajSomasakaranNoch keine Bewertungen

- Nature of Fiduciary RelationshipDokument7 SeitenNature of Fiduciary RelationshipSarannRajSomasakaranNoch keine Bewertungen

- 2018 1 Amr 456Dokument11 Seiten2018 1 Amr 456SarannRajSomasakaranNoch keine Bewertungen

- 2015 Amej 1772Dokument86 Seiten2015 Amej 1772SarannRajSomasakaranNoch keine Bewertungen

- Curriculum - Application (Solution) Consultant SAP SCM - SAP ERP - Order Fulfillment (Sales Order Management)Dokument3 SeitenCurriculum - Application (Solution) Consultant SAP SCM - SAP ERP - Order Fulfillment (Sales Order Management)fiestamixNoch keine Bewertungen

- Business Growth Strategy AnalysisDokument6 SeitenBusiness Growth Strategy AnalysisGeraldine AguilarNoch keine Bewertungen

- 22-10-2010 Quiz Controlling) + AnswersDokument3 Seiten22-10-2010 Quiz Controlling) + AnswersRaymond Setiawan0% (1)

- Business Plan FINALDokument13 SeitenBusiness Plan FINALFrances BarenoNoch keine Bewertungen

- MTPDokument5 SeitenMTPNavyanth KalerNoch keine Bewertungen

- PAGCOR Site Regulatory ManualDokument4 SeitenPAGCOR Site Regulatory Manualstaircasewit4Noch keine Bewertungen

- Example Safe Work Method StatementDokument2 SeitenExample Safe Work Method StatementHamza NoumanNoch keine Bewertungen

- Tenet Healthcare Corporation 401 (K) Retirement Savings Plan 25100Dokument5 SeitenTenet Healthcare Corporation 401 (K) Retirement Savings Plan 25100anon-822193Noch keine Bewertungen

- Vsa PDFDokument7 SeitenVsa PDFGerrard50% (2)

- Sale DeedDokument9 SeitenSale DeedNafeesa KhanNoch keine Bewertungen

- Quality CertificatesDokument2 SeitenQuality Certificatesashfaqmemon2001Noch keine Bewertungen

- Quality Assurance ManualDokument25 SeitenQuality Assurance ManualArman RajuNoch keine Bewertungen

- AMULDokument39 SeitenAMULmohitNoch keine Bewertungen

- Managerial Finance: Article InformationDokument22 SeitenManagerial Finance: Article Informationlia s.Noch keine Bewertungen

- 3rd Grading Periodical Exam-EntrepDokument2 Seiten3rd Grading Periodical Exam-EntrepJoan Pineda100% (3)

- Promotional Campaign On JOLLYBEE in BangladeshDokument38 SeitenPromotional Campaign On JOLLYBEE in BangladeshTasnia Ahsan AnikaNoch keine Bewertungen

- Project Finance and Equator PrinciplesDokument8 SeitenProject Finance and Equator PrinciplesSushma Jeswani TalrejaNoch keine Bewertungen

- M 3. Process AnalysisDokument60 SeitenM 3. Process Analysishardlex313Noch keine Bewertungen

- Henkel: Building A Winning Culture: Group 09Dokument11 SeitenHenkel: Building A Winning Culture: Group 09sheersha kkNoch keine Bewertungen

- SME Bank, Inc. v. de GuzmanDokument16 SeitenSME Bank, Inc. v. de GuzmanKrisNoch keine Bewertungen

- University of LucknowDokument1 SeiteUniversity of LucknowDEVENDRA MISHRANoch keine Bewertungen

- Palm Beach County GOP Newsletter - May 2012Dokument13 SeitenPalm Beach County GOP Newsletter - May 2012chess_boxerNoch keine Bewertungen

- Activities Guide and Evaluation Rubric - Pre-TaskDokument4 SeitenActivities Guide and Evaluation Rubric - Pre-TaskAlvaro LopezNoch keine Bewertungen

- Compliance Calendar LLP Mandatory CompDokument4 SeitenCompliance Calendar LLP Mandatory Comphanif4800Noch keine Bewertungen

- All About Electronic Credit Reversal N Re-Claimed Statement - CA Swapnil MunotDokument4 SeitenAll About Electronic Credit Reversal N Re-Claimed Statement - CA Swapnil MunotkevadiyashreyaNoch keine Bewertungen

- Project Presentaa STUDY ON WORK LIFE BALANCE OF EMPLOYEES WITH REFERENCE TO RANE ENGINE VALVE LIMITEDtionDokument111 SeitenProject Presentaa STUDY ON WORK LIFE BALANCE OF EMPLOYEES WITH REFERENCE TO RANE ENGINE VALVE LIMITEDtionGaurav VermaNoch keine Bewertungen

- CBP New Audit Survey ProgramDokument32 SeitenCBP New Audit Survey Programged1821100% (1)

- SAL ReportDokument130 SeitenSAL ReportjlolhnpNoch keine Bewertungen

- A Tale of Two Electronic Components DistributorsDokument2 SeitenA Tale of Two Electronic Components DistributorsAqsa100% (1)