Beruflich Dokumente

Kultur Dokumente

Basel Disclosure DEC312018

Hochgeladen von

Archana HarishankarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Basel Disclosure DEC312018

Hochgeladen von

Archana HarishankarCopyright:

Verfügbare Formate

ALLAHABAD BANK

CONSOLIDATED DISCLOSURES UNDER BASEL-III CAPITAL REGULATIONS

FOR THE YEAR ENDED 31st DECEMBER 2018

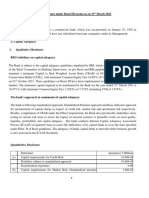

2. CAPITAL ADEQUACY

The Bank is subject to the capital adequacy guidelines stipulated by RBI vide its master

circular on Basel-III. As per the said guidelines, the Bank is required to maintain a

minimum Capital to Risk Weighted Assets Ratio (CRAR) of 9% {10.875% including Capital

Conservation Buffer (CCB)}, with minimum Common Equity Tier I (CET1) of 5.5% (7.375%

including CCB) as on 31st March 2019. These guidelines on Basel III have been

implemented since 1st April 2013 in a phased manner. The minimum capital required to be

maintained by the Bank for the quarter ended 31st December 2018 is 10.875% with

minimum Common Equity Tier 1 (CET1) of 7.375% (including CCB of 1.875%)

The Bank carries out regular assessment of its Capital requirements to maintain a

comfortable Capital to Risk Weighted Assets Ratio (CRAR) and to cushion against the risk

of losses against any unforeseen events so as to protect the interest of all stakeholders. The

Bank conducts exercise of Capital Planning on an annual basis to review the capital

required to carry out its activities smoothly in the future. Also, the Bank has well defined

Internal Capital Adequacy Assessment Process (ICAAP) under which the Bank also assesses

the adequacy of capital under stress to comprehensively assess all risks and maintain

necessary additional capital.

The Bank has adopted Standardized Approach for Credit Risk, Basic Indicator Approach for

Operational Risk and Standardized Duration Approach for Market Risk for computing

CRAR, as per the guidelines of RBI.

A summary of the Bank’s capital requirement for credit, market and operational risk and

the capital adequacy ratio as on 31st December 2018 is presented below:

(Rs. in Millions)

S.No. Capital Requirements for Various Risks Capital Requirement*

A CREDIT RISK 108,722

A.1 For non- securitized portfolio 108,722

A.2 For Securitized portfolio -

B MARKET RISK 13,194

B.1 For Interest Rate Risk 8,848

B.2 For Equity Risk 4,258

B.3 For Forex Risk (including gold) 88

B.4 For Commodities Risk -

B.5 For Options risk -

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 1 of 14

ALLAHABAD BANK

S.No. Capital Requirements for Various Risks Capital Requirement*

C OPERATIONAL RISK 15,690

C.1 Basic Indicator Approach 15,690

C.2 Standardized Approach if applicable -

D TOTAL CAPITAL REQUIREMENT 137,605

Consolidated Capital requirement is computed at 10.875% of RWA.

PARTICULARS STANDALONE CONSOLIDATED

COMMON EQUITY TIER I (CET 1) 7.06% 7.23%

TIER 1 CRAR 7.15% 7.32%

TOTAL CRAR 10.42% 10.59%

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 2 of 14

ALLAHABAD BANK

3. CREDIT RISK: GENERAL DISCLOSURE

A. RISK MANAGEMENT: OBJECTIVES AND ORGANISATION STRUCTURE

A.1. The Bank identifies, measures, control, monitor and report risk effectively. The key

parameters of the Bank’s risk management activities rely on the risk governance

architecture, comprehensive processes and internal control mechanism based on

Board approved policies and guidelines.

B. ARCHITECTURE AND SYSTEMS OF THE BANK

B.1. The Bank has nominated Chief Risk Officer, who reports to the Managing Director

and CEO.

B.2. A Sub-Committee of Board of Directors termed as Risk Management Committee

(RMC) has been constituted to specifically oversee and co-ordinate Risk

Management functions in the bank.

B.3. A Credit Risk Management Committee of executives has been set up to formulate

and implement various credit risk strategies including lending policy and to

monitor Bank’s Credit Risk Management functions on a regular basis.

B.4. A Market Risk Management Committee of executives has been set up for

management and to monitor Bank’s Market Risk Management functions on a

regular basis.

B.5. An Operational Risk Management Committee of executives has been set up for

control and monitoring of Bank’s Operational Risk Management functions on a

regular basis.

C. CREDIT RISK

Credit risk is defined as the possibility of losses associated with default by or diminution in

the credit quality of Borrowers or Counterparties arising from outright default due to

inability or unwillingness of a borrower or counterparty to meet commitments in relation

to lending, trading, settlement and other financial transactions; or Reduction in portfolio

value arising from actual or perceived deterioration in credit quality of borrowers or

counterparties. Credit Risk emanates from a bank’s dealings with an individual, non-

corporate, corporate, bank, financial institution or sovereign.

D. BANK’S CREDIT RISK MANAGEMENT POLICY

D.1.The Bank has put in place a well-structured Credit Risk Management Policy duly

approved by the Board. The Policy document defines organizational structure, role

and responsibilities and the processes whereby the Credit Risks carried by the

Bank can be identified, quantified, managed and controlled within the framework

which the Bank considers consistent with its mandate and risk tolerance limits.

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 3 of 14

ALLAHABAD BANK

D.2.Credit Risk is monitored by the Bank account wise and compliance with the risk

limits / exposure cap approved by the Board is ensured. The quality of internal

control system is also monitored and in-house expertise has been built up to tackle

all the facets of Credit Risk.

D.3.The Bank has taken earnest steps to put in place best Credit Risk Management

practices. In addition to Credit Risk Management Policy, the Bank has also framed

Board approved Lending Policy, Investment Policy, Country Risk Management

Policy, Credit Monitoring Policy, Recovery Management Policy etc. which form

integral part in monitoring of credit risk and ensures compliance with various

regulatory requirements, more particularly in respect of Exposure norms, Priority

Sector norms, Income Recognition and Asset Classification guidelines, Capital

Adequacy, Credit Risk Management guidelines etc. of RBI/other Statutory

Authorities.

D.4.Besides, the Bank has also put in place a Board approved policy on Credit Risk

Mitigation & Collateral Management which lays down the details of securities and

administration of such securities to protect the interests of the Bank. These

securities act as mitigants against the credit risk to which the Bank is exposed.

E. CREDIT APPRAISAL / INTERNAL RATING

E.1. The Bank manages its credit risk by continuously measuring and monitoring of

risks at each obligor (borrower) and portfolio level. The Bank has robust internally

developed credit risk grading / rating modules and well-established credit

appraisal / approval processes.

E.2. The internal risk rating / grading modules capture quantitative and qualitative

issues relating to management risk, business risk, industry risk, financial risk and

project risk. The data on industry risk is constantly updated based on market

conditions.

E.3. The rating for every borrower is reviewed. As a measure of robust credit risk

management practices, the bank has implemented a four-tier system of credit

rating process for the loan proposals sanctioned at Head Office Level, three tier

systems at FGM office/ Zonal Office level. Validation of rating for proposals

sanctioned at Branch level is done at Zonal office level. For the proposals falling

under the powers of Bank’s Head Office, the validation of ratings is done at Risk

Management Department.

E.4. The Bank follows a well-defined multi layered discretionary power structure for

sanction of loans. Various committees have been formed at ZO, FGMO & HO Level.

ZLCC AGM/DGM headed by Zonal Head, FGMLCC headed by Field General Manager,

HLCC GM headed by GM (Credit), HLCC ED headed by ED (Executive Director), CAC

headed by MD & CEO and MCBOD (Management Committee of the Board) headed

by MD& CEO. A structure named New Business Group (NBG) headed by MD& CEO

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 4 of 14

ALLAHABAD BANK

has been constituted at Head Office level for considering in-principle approval for

taking up fresh credit proposals above a specified cut-off point.

F. DEFINITION OF PAST DUE AND IMPAIRED (FOR ACCOUNTING PURPOSES)

The Bank follows Reserve Bank of India regulations, which are summed up below.

F.1. NON-PERFORMING ASSETS

An asset, including a leased asset, becomes non-performing when it ceases to generate

income for the bank.

A non-performing asset (NPA) is a loan or an advance where;

I. Either Interest and/ or installment of principal dues remain 'overdue' for a period of

more than 90 days in respect of a term loan,

II. The account remains ‘out of order’ for 90 days as indicated below at paragraph F.2,

in respect of an Overdraft/Cash Credit (OD/CC). Besides this CC/OD accounts can

also be declared NPA in undernoted condition.

a. If the regular/ad-hoc limits are not reviewed/ renewed within 180 days from

the due date of review/renewal or sanctioning of adhoc limit,

b. If the stock statements are not submitted continuously for a period of 90

days and limits/ drawings are allowed on such irregular drawing power

continuously for 90 days.

III. The bill remains overdue and unpaid for a period of more than 90 days in the case of

bills purchased and discounted,

IV. The installment of principal or interest thereon remains unpaid for two crop

seasons beyond the due date for short duration crops,

V. The installment of principal or interest thereon remains unpaid for one crop season

beyond the due date for long duration crops.

VI. The amount of liquidity facility remains outstanding for more than 90 days, in

respect of a securitization transaction undertaken in terms of guidelines on

securitization dated February 1, 2006.

VII. An account is classified as NPA only if the interest due &charged during any quarter

is not serviced fully within 90 days from the end of the quarter.

F.2. 'OUT OF ORDER' STATUS

An account is treated as 'out of order' if the outstanding balance remains continuously in

excess of the sanctioned limit/drawing power for 90 days. In cases where the outstanding

balance in the principal operating account is less than the sanctioned limit/drawing power,

but there are no credits continuously for 90 days as on the date of Balance Sheet or credits

are not enough to cover the interest debited during the same period, these accounts are

treated as 'out of order'.

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 5 of 14

ALLAHABAD BANK

F.3. OVERDUE

Any amount due to the bank under any credit facility is ‘overdue’ if it is not paid on the due

date fixed by the bank.

As per Reserve Bank of India guidelines dated 12th February 2018 bank identifies Special

Mention Accounts (SMA) having principal or interest payment or any other amount wholly

or partly overdue even for one day.

F.4. NON-PERFORMING INVESTMENTS

In respect of securities, where interest/ principal is in arrears, the Bank does not reckon

income on the securities and makes appropriate provisions for the depreciation in the

value of the investment.

A non-performing investment (NPI), similar to a non-performing advance (NPA), is

one where:

I. Interest/ installment (including maturity proceeds) is due and remains unpaid for

more than 90 days.

II. This applies mutatis-mutandis to preference shares where the fixed dividend is not

paid.

III. In the case of equity shares, in the event the investment in the shares of any

company is valued at Re.1 per company on account of the non-availability of the

latest balance sheet in accordance with the Reserve Bank of India instructions, those

equity shares are also reckoned as NPI.

IV. If any credit facility availed by the issuer is NPA in the books of the bank, the

investments in any of the securities issued by the same issuer is also treated as NPI

and vice versa.

V. The investments in debentures / bonds, which are deemed to be in the nature of

advance, are subjected to NPI norms as applicable to investments.

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 6 of 14

ALLAHABAD BANK

QUANTITATIVE DISCLOSURES

A. GROSS CREDIT RISK EXPOSURE Including Geographic Distribution of Exposure

(Rs. in Millions)

**Funded Exposure include Credit exposure and investment exposure

#Non-Funded Exposure includes Bank Guarantee, LC and Forward Contract

Sl. No. Exposure* Type Domestic Overseas Total

1. Fund Based 2,107,271 48,587 2,155,858

2. Non-Fund Based 235,348 619 235,967

3. Total 2,342,619 49,206 2,391,825

B. RESIDUAL CONTRACTUAL MATURITY BREAKDOWN OF ASSETS

(Rs. in Millions)

Cash & Bank

Fixed Other Grand

Buckets RBI Balances Advances Investments

Assets Assets Total

Balances #

Next day 9842 4214 6769 133208 - 94 154127

2 – 7 days 1211 3698 17462 8762 - 330 31463

8 –14 days 541 6280 7399 2639 - 254 17113

15 – 30 days 582 4535 12957 3149 - 541 21764

Over 1 month

1044 0 20809 8671 - 979 31503

– 2 months

Over 2

months – 3 779 0 78449 4083 - 1560 84871

months

Over 3

months – 6 3772 0 58018 32057 - 2893 96740

months

Over 6

months – 1 5419 3072 139829 28683 - 6025 183028

year

Over 1 year –

29242 28726 445316 163754 - 23209 690247

3 years

Over 3 years –

14956 13182 175602 81151 - 19959 304850

5 years

Over 5 years 27620 0 448097 234052 31066 27465 768300

Total 95008 63707 1410707 700209 31066 83309 2384006

#Includes Balances with other banks and money at call & short notice.

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 7 of 14

ALLAHABAD BANK

C. NON-PERFORMING ASSETS (NPA) AND ITS MOVEMENT

S. No. Particulars Amount in Millions

A. Amount of Gross NPA 282188

A. 1 Substandard 65218

A. 2 Doubtful 1 43412

A. 3 Doubtful 2 102833

A. 4 Doubtful 3 32744

A. 5 Loss 37981

B Net NPA 108653

C NPA Ratios

C. 1 Gross NPAs to Gross Advances 17.81%

C. 2 Net NPAs to Net Advances 7.70%

D Movement of Gross NPA

D. 1 Opening balance at the beginning of the year 2,65,628

D. 2 Additions during the period 79005

D. 3 Reductions during the period 62445

D. 4 Closing balance as at end of the period 2,82,188

D. NON-PERFORMING INVESTMENTS (NPI) AND MOVEMENT OF PROVISION FOR

DEPRECIATION ON INVESTMENTS

(Rs. in Millions)

S. No. Particulars Amount

A. Amount of Non-Performing Investments 6,999

B Amount of Provision held for Non-Performing Investments 6,158

C Movement of provisions for depreciation on investments

C. 1 Opening balance at the beginning of the year 13,221

C. 2 Provisions made during the period 7,590

C. 3 Write-off during the period -

C. 4 Write-back of excess provisions during the period 3,488

C. 5 Closing balance as at end of the period 17,323

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 8 of 14

ALLAHABAD BANK

E. MOVEMENT OF SPECIFIC & GENERAL PROVISION

(Rs. in Millions)

Movement of provisions Specific Provisions# General Provisions@

Opening balance at the beginning of the year 1,43,081 7512

Provisions made during the period 64823 -

Write-off during the period 10332 -

Write-back of excess provisions during the (1587)

period 20

Adjustments/Transfers between provisions 33

24910

during the period*

Closing Balance as at end of the period 1,72,642 5958

#Represents provisions for NPA, @Represents provisions for Standard Advances

*Amount utilized towards sale of NPAs and transfer to PWO account.

F. Details of write offs and recoveries that have been booked directly to the

income statement

(Rs. in Millions)

Write offs that have been booked directly to the income statement -

Recoveries (in written-off) that have been booked directly to the income statement 4924

G. GEOGRAPHIC DISTRIBUTION OF NPA & PROVISIONS

(Rs. in Millions)

SL No Particulars Domestic Overseas Total

1. Gross NPA 2,80,539 1,649 2,82,188

2. Provisions for NPA 1,71,935 707 1,72,642

3. Provisions for Standard Advances 5,983 329 6,312

H. AGEING OF PAST DUE LOANS

(Rs. in Millions)

SL No Particulars as on 30th Sep, 2018 Domestic Overseas Total

1.1 31-90 days - - -

1.2 91-365 days 64,184 1,035 65,219

1.3 1-2 years 43,412 - 43,412

1.4 2-4 years 1,02,219 614 1,02,833

1.5 Over 4 years 70,724 - 70,724

1.6 Total 2,80,539 1,649 2,82,188

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 9 of 14

ALLAHABAD BANK

I. INDUSTRY TYPE DISTRIBUTION OF EXPOSURES

(Rs. in Millions)

For quarter ended

As on 31.12.2018

31st Dec 2018

Industry Exposure Provisions for

Gross Write Provisions

Non- Standard

Funded* NPA NPA -offs for NPA

Funded# Advances

Advances against Fixed

59234 0 5 3 96 0 1

Deposits

Advances to Individuals 17 0 3 0 0 0 0

against Shares, Bonds, etc.

Agriculture & Allied

293738 0 27562 8046 599 766 1602

activities

Telecom 87 970 0 0 0 0 0.00

Power 112777 20413 18920 12748 488 0 1587

Iron & Steel 73905 15421 40871 27231 153 0 2878

Textiles 47435 3694 14788 11964 105 22 640

Construction 27340 74532 20061 11555 36 1149 1214

Infrastructure Road & Port 82291 3919 10047 3445 342 0 837

Infrastructure Other 62824 17494 3795 2816 238 5 39

Fertilizer 3768 105 3 1 0 0 0

Pharmaceutical 15450 1176 8790 7892 31 266 464

Engineering & Electronics 13369 568 11687 8848 7 0 410

Gems & Jewellery 13441 3080 7487 6510 24 0 1833

Aviation & Shipping 8505 0 0 0 36 0 0

Commercial Real State 27705 0 5872 2665 189 2042 127

Cement 11842 0 1308 561 43 9 6

NBFC (excluding HFC) 101615 0 0 0 373 0 0

Retail Trade 96627 0 6256 1813 183 206 289

Wholesale Trade 98755 204 15819 14671 677 78 2265

Tea 340 38 1 0 0 0 0

Housing Direct 154387 0 4713 961 467 10 174

Housing Indirect 60480 0 0 0 263 0 0

Leather & Leather Products 1761 76 89 44 4 1 14

Wood & Wood Products 3294 1246 188 45 12 2 14

Paper & Paper Products 10241 1391 2973 1956 30 370 279

Petrochemical, Other

18176 3236 145 43 58 1 3

Chemical & their Products

Petroleum,Coal & Nuclear

705 3758 614 261 1 0 0

Fuel

Rubber, Plastics and their

6301 1 983 694 12 9 156

product

Glass & Glassware 1282 283 9 2 3 2 1

Other Metal & Products 13042 8024 3208 1379 39 5 17

Beverage & Toboacco 4021 163 451 157 10 22 5

Edible Oil & Vanaspati 4882 15803 2274 2217 7 218 623

Food Processing (other) 21721 821 5066 2722 68 90 867

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 10 of 14

ALLAHABAD BANK

For quarter ended

As on 31.12.2018

31st Dec 2018

Industry Exposure Provisions for

Gross Write Provisions

Non- Standard

Funded* NPA NPA -offs for NPA

Funded# Advances

Mining & Quarrying 20543 4413 11101 10395 38 0 402

Vehicl and Vehicle

10424 1883 7187 5166 9 7 2

Component

Other Industry/ sectors not

673535 53256 49912 25828 973 1836 4761

included above

Total 2,155,858 235,967 282,188 172,642 5,614 7,116 21,509

*Funded Exposure include Credit exposure and investment exposure

#Non-Funded Exposure includes Bank Guarantee, LC and Forward Contract

Exposures to industries in excess of 5% of total Funded & Non-Funded of the Bank as

on Dec 31, 2018

(Rs. in Millions)

S. No. Industry % of Funded &Non-Funded Exposure

1. Infrastructure 12.53%

1.1 Out of which: Power 5.57%

3. Non-Banking Finance Companies 6.77%

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 11 of 14

ALLAHABAD BANK

4. CREDIT RISK: DISCLOSURES FOR PORTFOLIOS SUBJECT TO THE STANDARDIZED

APPROACH

The Bank has used the Standardized Approach under the RBI’s Basel III capital regulations

for calculation of risk-weighted assets of its credit portfolio. The RBI guidelines require

banks to use ratings assigned by specified External Credit Rating Agencies (ECRA) namely

Brickworks, CARE, CRISIL, ICRA, India Ratings, SMERA and Infomerics for domestic

counterparties and Standard & Poor’s, Moody’s and Fitch for foreign counterparties.

The Bank is using issuer ratings and short-term and long-term instrument/bank facilities’

ratings which are assigned by the accredited rating agencies, i.e. ECRA, published in the

public domain to assign risk-weights in terms of RBI guidelines. In respect of claims on

non-resident corporates and foreign banks, ratings assigned by international rating

agencies i.e. Standard & Poor’s, Moody’s and Fitch is used.

QUANTITATIVE DISCLOSURES

The Bank’s exposure on its advance portfolio (rated and unrated) bifurcated in three major

risk buckets are as follows:

(Rs. in Millions)

Sl No Risk Weight Fund Based Non-Fund Based

1 Below 100% risk weight 1,459,040 114,188

2 100% risk weight 309,901 75,275

3 More than 100% risk weight 386,917 46,504

4 Deduction from capital funds - -

5 Total Exposure 2,155,858 235,967

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 12 of 14

ALLAHABAD BANK

18.LEVERAGE RATIO COMMON DISCLOSURE TEMPLATE

The leverage ratio act as a credible supplementary measure to the risk-based capital

requirement. The Bank is required to maintain a minimum leverage ratio of 4.5%. The

Bank’s leverage ratio, calculated in accordance with the RBI guidelines under consolidated

framework is as follows:

(Rs. in millions)

As on Dec 31,

Item

2018

On-balance sheet exposures

1 On-balance sheet items (excluding derivatives and SFTs, but including

2,387,380

collateral)

2 (Asset amounts deducted in determining Basel III Tier 1 capital) (21,041)

3 Total on-balance sheet exposures (excluding derivatives and SFTs)

2,366,338

(sum of lines 1 and 2)

Derivative exposures

4 Replacement cost associated with all derivatives transactions (i.e. net of

18,314

eligible cash variation margin

5 Add-on amounts for PFE associated with all derivatives

25,796

transactions

6 Gross-up for derivatives collateral provided where deducted from the

-

balance sheet assets pursuant to the operative accounting framework

7 (Deductions of receivables assets for cash variation

-

margin provided in derivatives transactions)

8 (Exempted CCP leg of client-cleared trade exposures) -

9 Adjusted effective notional amount of written credit derivatives -

10 (Adjusted effective notional offsets and add-on deductions for

-

written credit derivatives)

11 Total derivative exposures (sum of lines 4 to 10) 44,110

Securities financing transaction exposures

12 Gross SFT assets (with no recognition of netting), after adjusting for sale

-

accounting transactions

13 (Netted amounts of cash payables and cash receivables of

-

gross SFT assets)

14 CCR exposure for SFT assets -

15 Agent transaction exposures -

16 Total securities financing transaction exposures (sum of lines 12 to -

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 13 of 14

ALLAHABAD BANK

As on Dec 31,

Item

2018

15)

Other off-balance sheet exposures

17 Off-balance sheet exposure at gross notional amount 586,226

18 (Adjustments for conversion to credit equivalent amounts) (454,789)

19 Off-balance sheet items (sum of lines 17 and 18 131,437

Capital and total exposures

20 Tier 1 capital 92,745

21 Total exposures (sum of lines 3, 11, 16 and 19) 2,541,885

Leverage ratio

22 Basel III leverage ratio 3.65%

LEVERAGE RATIO DISCLOSURE

(Rs. in millions)

Particulars Dec 31, 2018 Sep 30, 2018 Jun 30, 2018 Mar 31, 2018

Tier 1 capital 92,745 67,519 65,623 99,095

Exposure Measure 2,542,779 2,606,228 2,552,193 2,722,651

Leverage Ratio 3.65% 2.59% 2.57% 3.64%

BASEL III DISCLOSURES AS ON DECEMBER’2018 Page 14 of 14

Das könnte Ihnen auch gefallen

- Disclosure Under Basel III For 31st March 2021Dokument54 SeitenDisclosure Under Basel III For 31st March 2021Nithin YadavNoch keine Bewertungen

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiVon EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNoch keine Bewertungen

- Basel Prime BankDokument10 SeitenBasel Prime BankHabib UllahNoch keine Bewertungen

- Banque Saudi Fransi: Pillar 3-Qualitative Disclosures 31 DECEMBER 2009Dokument11 SeitenBanque Saudi Fransi: Pillar 3-Qualitative Disclosures 31 DECEMBER 2009Habib AntouryNoch keine Bewertungen

- Disclosure Under Basel Ii As On 31-12-2013: Disclosure Framework The General Qualitative Disclosure RequirementsDokument9 SeitenDisclosure Under Basel Ii As On 31-12-2013: Disclosure Framework The General Qualitative Disclosure RequirementsBijoy SalahuddinNoch keine Bewertungen

- Pillar 3 Consolidated & Solo Imp Ratios 31.12.19 PNBDokument24 SeitenPillar 3 Consolidated & Solo Imp Ratios 31.12.19 PNBYASHASVI SHARMANoch keine Bewertungen

- Credit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDDokument46 SeitenCredit & Liquidity Risk of A Financial Institution: Perspective of Dhaka Bank LTDzaman asadNoch keine Bewertungen

- Capital Earnings Funds and Investment Asset Securitisation HomeDokument7 SeitenCapital Earnings Funds and Investment Asset Securitisation HomeKumar PsnNoch keine Bewertungen

- Economics Glossary PDFDokument9 SeitenEconomics Glossary PDFSK PNoch keine Bewertungen

- Pillar 3 Disclosure31122017Dokument11 SeitenPillar 3 Disclosure31122017Anuja Kunie JainNoch keine Bewertungen

- 1.RISK CompediumDokument95 Seiten1.RISK CompediumyogeshthakkerNoch keine Bewertungen

- Capital Capital FundsDokument10 SeitenCapital Capital Fundsbhau_20Noch keine Bewertungen

- (Bank Policy) BASELDokument30 Seiten(Bank Policy) BASELprachiz1Noch keine Bewertungen

- Risk Based Capital Management For Banks: Janata Bank Staff College DhakaDokument39 SeitenRisk Based Capital Management For Banks: Janata Bank Staff College DhakaUdita GopalkrishnaNoch keine Bewertungen

- Glossary: Capital Earnings Funds and Investment Asset Securitisation Nds-Om Web HomeDokument16 SeitenGlossary: Capital Earnings Funds and Investment Asset Securitisation Nds-Om Web HomeSanjeet MohantyNoch keine Bewertungen

- Basel IV - Strengthening Regulatory Capital in The BanksDokument7 SeitenBasel IV - Strengthening Regulatory Capital in The BanksBiswajit SikdarNoch keine Bewertungen

- Risk Management in The Banking SectorDokument47 SeitenRisk Management in The Banking SectorGaurEeshNoch keine Bewertungen

- Basel 4Dokument7 SeitenBasel 4Raj shekhar PandeyNoch keine Bewertungen

- Capital Capital FundsDokument11 SeitenCapital Capital FundsSantosh Kumar BarikNoch keine Bewertungen

- Glossary PDFDokument8 SeitenGlossary PDFkumarsanjeev.net9511Noch keine Bewertungen

- Capital Capital FundsDokument12 SeitenCapital Capital FundsDrKhalid A ChishtyNoch keine Bewertungen

- Basel 3Dokument3 SeitenBasel 3NITIN PATHAKNoch keine Bewertungen

- Risk Management in Banks: Paper No XxviDokument26 SeitenRisk Management in Banks: Paper No XxviRadhika GuptaNoch keine Bewertungen

- Risk Management in Banks and Basel - II ComplianceDokument35 SeitenRisk Management in Banks and Basel - II ComplianceSrinivas AcharNoch keine Bewertungen

- Evaluation of The Risk Management System in Banking Sector of BangladeshDokument6 SeitenEvaluation of The Risk Management System in Banking Sector of BangladeshRizwana MiduryNoch keine Bewertungen

- Basel 1and 2 NewDokument28 SeitenBasel 1and 2 NewnipuntrikhaNoch keine Bewertungen

- What Is Basel IIDokument7 SeitenWhat Is Basel IIyosefmekdiNoch keine Bewertungen

- Pillar 3 Disclosure Under Basel Iii Consolidated 31.12.2017Dokument18 SeitenPillar 3 Disclosure Under Basel Iii Consolidated 31.12.2017anujNoch keine Bewertungen

- On Capital AdequacyDokument46 SeitenOn Capital Adequacymanishasain75% (8)

- Basel II Pilar 30 June 2019Dokument34 SeitenBasel II Pilar 30 June 2019Ketz NKNoch keine Bewertungen

- U 3: C A N: NIT Apital Dequacy OrmsDokument12 SeitenU 3: C A N: NIT Apital Dequacy OrmsJaldeep MangawaNoch keine Bewertungen

- Prudential Norms On Capital Adequacy - Basel I Framework PDFDokument106 SeitenPrudential Norms On Capital Adequacy - Basel I Framework PDFKamalakar GudaNoch keine Bewertungen

- Sanket PDFDokument15 SeitenSanket PDFSnehalNoch keine Bewertungen

- RP SarderAzizurDokument21 SeitenRP SarderAzizurZakaria SakibNoch keine Bewertungen

- Finance Notes For RBI Grade B - Phase 2Dokument106 SeitenFinance Notes For RBI Grade B - Phase 2abinash67% (3)

- 2016 Pillar III DisclosureDokument13 Seiten2016 Pillar III Disclosureahsan habibNoch keine Bewertungen

- Assignment Report On: Basel'S NormsDokument8 SeitenAssignment Report On: Basel'S NormsDeepa SharmaNoch keine Bewertungen

- Basel IiDokument26 SeitenBasel IipallavivyasNoch keine Bewertungen

- A Presentation On: A Presentation On Basel Committee Norms As Regards To Financial Sector Reforms in IndiaDokument23 SeitenA Presentation On: A Presentation On Basel Committee Norms As Regards To Financial Sector Reforms in Indiavidha_s23Noch keine Bewertungen

- Credit Risk Management With Reference of State Bank of IndiaDokument85 SeitenCredit Risk Management With Reference of State Bank of IndiakkvNoch keine Bewertungen

- ShradhaDokument19 SeitenShradhakkvNoch keine Bewertungen

- BaselDokument37 SeitenBaselRohit BeheraNoch keine Bewertungen

- Assessment of Capital AdequacyDokument9 SeitenAssessment of Capital AdequacylokeshNoch keine Bewertungen

- Credit Apprisal Method in SBIDokument19 SeitenCredit Apprisal Method in SBISahil BeighNoch keine Bewertungen

- Master Circular - Prudential Norms On Capital Adequacy - Basel I FrameworkDokument124 SeitenMaster Circular - Prudential Norms On Capital Adequacy - Basel I FrameworkMayur JainNoch keine Bewertungen

- Special Issues in Indian Banking SectorDokument78 SeitenSpecial Issues in Indian Banking SectorAli AttarwalaNoch keine Bewertungen

- Insights - A Journey From Basel II To Basel IVDokument12 SeitenInsights - A Journey From Basel II To Basel IV0399shubhankarNoch keine Bewertungen

- Cbo Credit Manual Jul 21Dokument295 SeitenCbo Credit Manual Jul 21prashanth100% (1)

- Cherian Varghese SpeechDokument10 SeitenCherian Varghese Speechaquarianmansi2212Noch keine Bewertungen

- Basel II Norms: Sunday, March 02, 2014Dokument23 SeitenBasel II Norms: Sunday, March 02, 2014Amit Kumar JhaNoch keine Bewertungen

- Capital Adequacy and Market Discipline-New Capital Adequacy Framework (Ncaf) Basel IiDokument13 SeitenCapital Adequacy and Market Discipline-New Capital Adequacy Framework (Ncaf) Basel IiBarun Kumar SinghNoch keine Bewertungen

- Semester-III Comprehensive Examinations Class of 2009 SLBK605 - Overview of Banking Part-ADokument22 SeitenSemester-III Comprehensive Examinations Class of 2009 SLBK605 - Overview of Banking Part-AChandni BhargavaNoch keine Bewertungen

- Assignment Basal Norm Analysis (Dhanlaxmi Bank)Dokument18 SeitenAssignment Basal Norm Analysis (Dhanlaxmi Bank)amisha saxenaNoch keine Bewertungen

- Basel PDFDokument24 SeitenBasel PDFGaurav0% (1)

- College ProjectDokument72 SeitenCollege Projectcha7738713649Noch keine Bewertungen

- 22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewDokument33 Seiten22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewKotchapornJirapadchayaropNoch keine Bewertungen

- Guidelines On IcaapDokument15 SeitenGuidelines On Icaaprashed03nsu100% (1)

- BASLE II A Simplified ExplanationDokument5 SeitenBASLE II A Simplified ExplanationmanaskaushikNoch keine Bewertungen

- BFM-CH - 10 - Module BDokument20 SeitenBFM-CH - 10 - Module BSantosh Saroj100% (1)

- Mrs India™ 2019: Rules and Regulations To Participate in Mrs IndiaDokument1 SeiteMrs India™ 2019: Rules and Regulations To Participate in Mrs IndiaArchana HarishankarNoch keine Bewertungen

- Sample Paper-Bank Promotion Exams-2016Dokument191 SeitenSample Paper-Bank Promotion Exams-2016Archana HarishankarNoch keine Bewertungen

- Canara Bank Service CodeDokument32 SeitenCanara Bank Service CodeArchana HarishankarNoch keine Bewertungen

- STAFF WELFARE SCHEME - 01012016-Latest-1-1 PDFDokument13 SeitenSTAFF WELFARE SCHEME - 01012016-Latest-1-1 PDFArchana HarishankarNoch keine Bewertungen

- A Guide To Probationary Officers 2018Dokument24 SeitenA Guide To Probationary Officers 2018Karthick RamasamyNoch keine Bewertungen

- Diploma in Treasury, Investement and Risk Management Paper I Financial Markets - An OverviewDokument22 SeitenDiploma in Treasury, Investement and Risk Management Paper I Financial Markets - An OverviewhvenkiNoch keine Bewertungen

- Etm Table of Contents PDFDokument12 SeitenEtm Table of Contents PDFArchana Harishankar100% (1)

- CeCOC or CeCP-Low-240518 PDFDokument9 SeitenCeCOC or CeCP-Low-240518 PDFArchana HarishankarNoch keine Bewertungen

- 1 T1TOL - Overview - R10.1Dokument55 Seiten1 T1TOL - Overview - R10.1Tanaka Machana100% (1)

- Comparing InvestmentsDokument59 SeitenComparing InvestmentsKondeti Harsha VardhanNoch keine Bewertungen

- Hybrid SecurityDokument3 SeitenHybrid SecurityTahmidul HaqueNoch keine Bewertungen

- 1.false 2. True 3. False 4. True 5. False 6. False 7. True 8. False 9. False 10. FALSEDokument9 Seiten1.false 2. True 3. False 4. True 5. False 6. False 7. True 8. False 9. False 10. FALSEHazel Kaye EspelitaNoch keine Bewertungen

- World Islamic Mint: NewsletterDokument16 SeitenWorld Islamic Mint: NewsletterNurindah 'indah' SariiNoch keine Bewertungen

- Tutorial 3Dokument4 SeitenTutorial 3Nguyễn Quan Minh PhúNoch keine Bewertungen

- Money PadDokument15 SeitenMoney PadSubhash PbsNoch keine Bewertungen

- Case Analysis I American Chemical CorporationDokument13 SeitenCase Analysis I American Chemical CorporationamuakaNoch keine Bewertungen

- The Pony Express: Read The Article Below Then Answer The Questions That FollowDokument12 SeitenThe Pony Express: Read The Article Below Then Answer The Questions That FollowHower XuNoch keine Bewertungen

- Target Accrual Redemption Notes (Tarns)Dokument4 SeitenTarget Accrual Redemption Notes (Tarns)Quentin Van Der BoucheNoch keine Bewertungen

- Final Project NPA MANAGEMENT IN BANKSDokument88 SeitenFinal Project NPA MANAGEMENT IN BANKSmanish223283% (18)

- Audit Reviewaudit of CashDokument14 SeitenAudit Reviewaudit of CashAndy LaluNoch keine Bewertungen

- 4ef1c - HDT - Sebi - Sharemarket - 2020B1 @ PDFDokument21 Seiten4ef1c - HDT - Sebi - Sharemarket - 2020B1 @ PDFMohan DNoch keine Bewertungen

- Bank Reconciliation Statement 70Dokument6 SeitenBank Reconciliation Statement 70xyzNoch keine Bewertungen

- Spot Exchange Markets. Quiz QuestionsDokument14 SeitenSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Dokument2 SeitenAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNoch keine Bewertungen

- Chapter 6 Accounting For Foreign Currency TransactionDokument21 SeitenChapter 6 Accounting For Foreign Currency TransactionMisganaw DebasNoch keine Bewertungen

- 1620053718MBA Syllabus 2019-20Dokument17 Seiten1620053718MBA Syllabus 2019-20Shaade91Noch keine Bewertungen

- HW 3 SolutionsDokument4 SeitenHW 3 SolutionsJohn SmithNoch keine Bewertungen

- SeitelDokument10 SeitenSeitelSehar Salman AdilNoch keine Bewertungen

- Federal Ex Vs Antonio DIgestDokument4 SeitenFederal Ex Vs Antonio DIgestgrurocketNoch keine Bewertungen

- Set For Life 10pay Sales Illustration: Celebrate LivingDokument11 SeitenSet For Life 10pay Sales Illustration: Celebrate LivingJane NavarezNoch keine Bewertungen

- Project Finance MethodologyDokument35 SeitenProject Finance MethodologySky walkingNoch keine Bewertungen

- Pepsico Inc 2019 Annual ReportDokument1 SeitePepsico Inc 2019 Annual ReportToodley DooNoch keine Bewertungen

- Reuters Islamic Finance Development Report2018Dokument44 SeitenReuters Islamic Finance Development Report2018Rehan Farhat100% (1)

- SynopsisDokument12 SeitenSynopsisVINIT RATANNoch keine Bewertungen

- Applied EconomicsDokument9 SeitenApplied EconomicsJanisha RadazaNoch keine Bewertungen

- CMA B4.8 FactoringDokument7 SeitenCMA B4.8 FactoringZeinabNoch keine Bewertungen

- CHAPTER 1-Semester 2-Capital Market. Investment & ConsumptionDokument49 SeitenCHAPTER 1-Semester 2-Capital Market. Investment & ConsumptionYohana Ray100% (10)

- Final Sip Mba Project PDFDokument87 SeitenFinal Sip Mba Project PDFDisha JAINNoch keine Bewertungen