Beruflich Dokumente

Kultur Dokumente

Growth of Islamic Banking in Pakistan

Hochgeladen von

Urooj Fatima0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten4 SeitenThe passage discusses the progress and growth of Islamic banking in Pakistan. It states that state banks in Pakistan are playing an important role in developing Islamic banking and making it a priority in the banking system. Islamic banking in Pakistan has seen increasing trends in total assets, deposits, financing, investments, number of branches, profits, and other financial indicators, showing its financial growth. The Islamic banking sector in Pakistan has expanded from 11.6% to 12.9% of the overall banking industry and has seen year-over-year growth of 23.8% in total assets and 22.5% in total deposits.

Originalbeschreibung:

report on islamic banking

Originaltitel

Islamic Banking Bulletin

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe passage discusses the progress and growth of Islamic banking in Pakistan. It states that state banks in Pakistan are playing an important role in developing Islamic banking and making it a priority in the banking system. Islamic banking in Pakistan has seen increasing trends in total assets, deposits, financing, investments, number of branches, profits, and other financial indicators, showing its financial growth. The Islamic banking sector in Pakistan has expanded from 11.6% to 12.9% of the overall banking industry and has seen year-over-year growth of 23.8% in total assets and 22.5% in total deposits.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten4 SeitenGrowth of Islamic Banking in Pakistan

Hochgeladen von

Urooj FatimaThe passage discusses the progress and growth of Islamic banking in Pakistan. It states that state banks in Pakistan are playing an important role in developing Islamic banking and making it a priority in the banking system. Islamic banking in Pakistan has seen increasing trends in total assets, deposits, financing, investments, number of branches, profits, and other financial indicators, showing its financial growth. The Islamic banking sector in Pakistan has expanded from 11.6% to 12.9% of the overall banking industry and has seen year-over-year growth of 23.8% in total assets and 22.5% in total deposits.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Assignment

Q: Discuss the progress and growth of Islamic

banking sector in Pakistan?

Introduction:-

State banks of Pakistan are playing very important

role in the development of Islamic banking and make

Islamic banking as the first priority in the banking

system.

Islamic banking generally shows an increasing

trend in the total assets, total deposits, total

financing, total investment, total no of branches,

profits, earnings per shares, shareholder equity and

other financial indicators which shows the financial

growth and development of the Islamic financial

institutions.

Definition:-

Islamic banking system is a system which is

established on the basis of the philosophy of Islamic

laws (called shariah) and directed by Islamic

economics.

Growth of Islamic banking in Pakistan:-

Islamic banking in the world wide has established

itself and is growing at very fast pace. The Islamic

banking size is expected to reach an estimated USD

1300 billion in the near future. Across the globe

1100 Islamic financial institutions are offering their

services, which are attached with devoted Islamic

academic, legal, regulatory and supervisory

institutions.

Industry progress and Market share:-

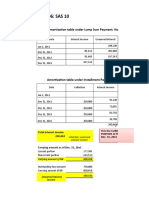

Particulars Industry progress YOY Share in overall

Growth (%) banking industry (%)

Jun-17 Mar-18 Jun- Mar- Jun- Jun- Mar- Jun-

18 18 18 17 18 18

Total assets 2035 2334 2482 23.8 21.9 11.6 13.5 12.9

Deposits 1720 1916 2033 22.5 18.2 13.7 14.6 14.8

Islamic 21 21 21 ---- ---- ---- --- ---

banks

Branches 2320 2589 2585 11.7 15.7 ---- --- ---

Region wise Branches:-

Provinces Total number Total number Share Mar- Share Jun-

Mar-18 Jun -18 18 18

Punjab 1239 1278 47.9 47.6

Sindh 750 795 29.0 29.6

KPK 298 300 11.5 11.2

Baluchistan 106 108 4.1 4.0

Federal 135 141 5.2 5.3

capital

AJK 40 42 1.5 1.6

Gilgit 12 12 0.5 0.4

Balistan

FATA 9 9 0.3 0.3

Total 2589 2685 100.0 100.0

Asset Quality Ratio:-

Jun-17 Mar-18 Jun-18 industry

NPF to 3.7 2.8 2.7 7.9

financing(gross)

Net NPF 0.8 0.5 0.4 1.1

Provision to 79.6 82.7 84.4 87.1

NPF

Capital to total 6.6 6.2 6.3 7.1

assets

Net capital to 6.1 6.1 6.1 6.8

total assets

Financing Mix

Jun-17 Mar-18 Jun-18

Murabaha 17.0 13.1 13.4

Ijarah 6.8 6.4 6.6

Musharaka 17.9 21.2 20.0

Diminishing 29.6 32.4 33.7

Musharaka

Salam 5.2 2.5 2.8

Istsina 7.2 7.7 6.4

Others 16.3 16.7 17.1

Conclusion:-

Islamic banks operate under the shariah principles

(Islamic Law) and that is why Islamic banking is also

appreciated by the Muslim countries. The main reason

behind the appreciation of Islamic banking is the

prohibition of interest in the financial transactions.

In Pakistan, the growth rate of Islamic banking is at very

fast pace as compared to the other countries of the world.

That’s why state bank of Pakistan established a separate

Islamic banking department to support the Islamic banking

to make it as the first choice of the banking.

Das könnte Ihnen auch gefallen

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesVon EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNoch keine Bewertungen

- Jul Sep BulletinDokument19 SeitenJul Sep Bulletinjavedamfd5397Noch keine Bewertungen

- Jan Mar 2007 BulletinDokument17 SeitenJan Mar 2007 BulletinAyeshaJangdaNoch keine Bewertungen

- July 2016 PDFDokument17 SeitenJuly 2016 PDFSalman ArshadNoch keine Bewertungen

- 1) Different Financial Data: Profit and Loss TableDokument2 Seiten1) Different Financial Data: Profit and Loss Tablenav randhawaNoch keine Bewertungen

- Promising Outlook for Pakistan Stock MarketDokument20 SeitenPromising Outlook for Pakistan Stock MarketSalman ArshadNoch keine Bewertungen

- Market in Consolidation! No Reason To Get Stressed!: From The Cio'S DeskDokument17 SeitenMarket in Consolidation! No Reason To Get Stressed!: From The Cio'S DeskSalman ArshadNoch keine Bewertungen

- Al Meezan Investment Management - Fund Manager Report - March, 2019Dokument23 SeitenAl Meezan Investment Management - Fund Manager Report - March, 2019muddasir1980Noch keine Bewertungen

- From The Cio'S Desk: Good Times! and The Market Has Probably Just Warmed Up Yet!Dokument19 SeitenFrom The Cio'S Desk: Good Times! and The Market Has Probably Just Warmed Up Yet!Salman ArshadNoch keine Bewertungen

- Capital MarketDokument19 SeitenCapital MarketFast TrackNoch keine Bewertungen

- IBB BuletinDokument27 SeitenIBB Buletindaily liveNoch keine Bewertungen

- Publication3 PDFDokument12 SeitenPublication3 PDFBerihun AddisNoch keine Bewertungen

- Country Paper Pakistan (Implementation Explanation)Dokument13 SeitenCountry Paper Pakistan (Implementation Explanation)Azam AliNoch keine Bewertungen

- Pakistan Islamic Banking Bulletin Nov 2007/TITLEDokument20 SeitenPakistan Islamic Banking Bulletin Nov 2007/TITLEAyeshaJangdaNoch keine Bewertungen

- TFM Final Project - Mutual FundsDokument11 SeitenTFM Final Project - Mutual FundsSyed HammadNoch keine Bewertungen

- Debt and Economic Growth in South Asia: Pakistan Development Review February 2001Dokument13 SeitenDebt and Economic Growth in South Asia: Pakistan Development Review February 2001Engr. Madeeha SaeedNoch keine Bewertungen

- Regulatory Framework For Islamic BankingDokument68 SeitenRegulatory Framework For Islamic BankingAllauddinaghaNoch keine Bewertungen

- Jan FileDokument1 SeiteJan FileAshwin GophanNoch keine Bewertungen

- Central BankDokument56 SeitenCentral BankSweekar HamalNoch keine Bewertungen

- South Indian Bank Share Price AnalysisDokument28 SeitenSouth Indian Bank Share Price AnalysisANKIT YADAVNoch keine Bewertungen

- Managing Money and Financial SystemsDokument12 SeitenManaging Money and Financial Systemsarvind krishnanNoch keine Bewertungen

- Fundamental Analysis Syllabus BreakdownDokument19 SeitenFundamental Analysis Syllabus BreakdownPraveshMalikNoch keine Bewertungen

- Mutual Fund Faysal Bank Asignment 3Dokument10 SeitenMutual Fund Faysal Bank Asignment 3Zohaib Jamil WahajNoch keine Bewertungen

- Comparison Islamic Vs Conventional BankingDokument15 SeitenComparison Islamic Vs Conventional BankingWaleed KhalidNoch keine Bewertungen

- Best Practices 2 Sindhu Durg DCCB PDFDokument13 SeitenBest Practices 2 Sindhu Durg DCCB PDFPRALHADNoch keine Bewertungen

- Robust Asset Growth Growing Lending and Deposit Higher ATM PenetrationDokument6 SeitenRobust Asset Growth Growing Lending and Deposit Higher ATM PenetrationRaza MuradNoch keine Bewertungen

- Chapter Three: Capital Marker Analysis of BangladeshDokument31 SeitenChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNoch keine Bewertungen

- National Bank of Pakistan: ChairmanDokument32 SeitenNational Bank of Pakistan: ChairmanfarrukhNoch keine Bewertungen

- A Report On Balance of Payments of Pakistan and Their ProblemsDokument37 SeitenA Report On Balance of Payments of Pakistan and Their ProblemsAbrar Ahmed Qazi79% (33)

- Financial Sector Development and Economic Growth in EthiopiaDokument11 SeitenFinancial Sector Development and Economic Growth in EthiopiaAbdi ÀgeNoch keine Bewertungen

- Role of Government in Developing Bond MarketsDokument9 SeitenRole of Government in Developing Bond MarketsFahid SaleemNoch keine Bewertungen

- IDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Dokument28 SeitenIDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Essantio DeniraNoch keine Bewertungen

- Project Report- Original ReportDokument38 SeitenProject Report- Original ReportAlly ImamNoch keine Bewertungen

- Banking Impasse Merger StrategyDokument10 SeitenBanking Impasse Merger StrategyKanav GuptaNoch keine Bewertungen

- Chapter Three: Capital Marker Analysis of BangladeshDokument29 SeitenChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNoch keine Bewertungen

- Peer Group Focused 3 1Dokument1 SeitePeer Group Focused 3 1Jinesh JadavNoch keine Bewertungen

- Banking Sector Performance and RegulationDokument20 SeitenBanking Sector Performance and RegulationMithun MohaiminNoch keine Bewertungen

- Fund Managers' Report Feb 2017 Performance SummaryDokument20 SeitenFund Managers' Report Feb 2017 Performance SummarySaad Liaquat DojkiNoch keine Bewertungen

- Performance of Mutual Funds in Pakistan 2Dokument4 SeitenPerformance of Mutual Funds in Pakistan 2Muhammad WasifNoch keine Bewertungen

- Practical Fundamentals of Organization of Private Capital Accounts in The Republic of UzbekistanDokument7 SeitenPractical Fundamentals of Organization of Private Capital Accounts in The Republic of UzbekistanCentral Asian StudiesNoch keine Bewertungen

- Ptmail m1219 Ss Two Stock Special Report PDFDokument18 SeitenPtmail m1219 Ss Two Stock Special Report PDFAaron MartinNoch keine Bewertungen

- Performance Analysis of Public Sector Banks in IndiaDokument10 SeitenPerformance Analysis of Public Sector Banks in IndiaSajna NadigaddaNoch keine Bewertungen

- RB Patel Financial Report Analysis 2015 - 2019Dokument25 SeitenRB Patel Financial Report Analysis 2015 - 2019Tea MatakibauNoch keine Bewertungen

- Department of Business AdministrationDokument57 SeitenDepartment of Business AdministrationaneescreativeNoch keine Bewertungen

- Bulletin Oct Dec 2008Dokument27 SeitenBulletin Oct Dec 2008AyeshaJangdaNoch keine Bewertungen

- Internship Arif FinalDokument58 SeitenInternship Arif Finalটিটন চাকমাNoch keine Bewertungen

- Banking Law ProjectDokument13 SeitenBanking Law Projectprithvi yadav100% (1)

- 5-Money and CreditDokument17 Seiten5-Money and CreditmudasserNoch keine Bewertungen

- Master Tile Internship UOGDokument54 SeitenMaster Tile Internship UOGAhsanNoch keine Bewertungen

- National Bank of Pakistan: Key Facts and Statistics - FY December 2017Dokument9 SeitenNational Bank of Pakistan: Key Facts and Statistics - FY December 2017Mahira KhanNoch keine Bewertungen

- Prospects Islamic BankingDokument9 SeitenProspects Islamic Bankingyousuf275Noch keine Bewertungen

- Complete PDFDokument102 SeitenComplete PDFShahid Ur RehmanNoch keine Bewertungen

- Banking Sector Contribution and Growth in IndiaDokument8 SeitenBanking Sector Contribution and Growth in IndiaarunimaNoch keine Bewertungen

- The State of Pakistan'S EconomyDokument110 SeitenThe State of Pakistan'S EconomyKhurram ShehzadNoch keine Bewertungen

- Financial Results – June 2018 Investor Presentation HighlightsDokument9 SeitenFinancial Results – June 2018 Investor Presentation HighlightsImran KhokharNoch keine Bewertungen

- Session 6 Financial Inclusion and MSMEs Access To Finance in NepalDokument26 SeitenSession 6 Financial Inclusion and MSMEs Access To Finance in NepalPrem YadavNoch keine Bewertungen

- Bank of AmericaDokument23 SeitenBank of AmericaAzər ƏmiraslanNoch keine Bewertungen

- Private Nifty Falls Over 2% On FII SellingDokument15 SeitenPrivate Nifty Falls Over 2% On FII Sellingnilesh garodiaNoch keine Bewertungen

- Financial sector analysis 2013-2017Dokument250 SeitenFinancial sector analysis 2013-2017I Tech Services Kamran0% (1)

- 6.0 Division of Revenue Bill Standoff Peter GichubaDokument13 Seiten6.0 Division of Revenue Bill Standoff Peter GichubaREJAY89Noch keine Bewertungen

- SE-401 (Minahel Noor Fatima)Dokument14 SeitenSE-401 (Minahel Noor Fatima)Urooj FatimaNoch keine Bewertungen

- Presentation EthicsDokument14 SeitenPresentation EthicsSadaf IftikharNoch keine Bewertungen

- SE-401 (Minahel Noor Fatima)Dokument14 SeitenSE-401 (Minahel Noor Fatima)Urooj FatimaNoch keine Bewertungen

- Vector SpaceDokument3 SeitenVector SpaceUrooj FatimaNoch keine Bewertungen

- T BillsDokument4 SeitenT BillsUrooj FatimaNoch keine Bewertungen

- Financial Anaylsis of Cement IndustryDokument65 SeitenFinancial Anaylsis of Cement IndustryUrooj FatimaNoch keine Bewertungen

- Energy Crisis in Pakistan Minahel Noor Fatima 248Dokument9 SeitenEnergy Crisis in Pakistan Minahel Noor Fatima 248Urooj FatimaNoch keine Bewertungen

- Eng-301 (Group 3) Assignment Punctuation & Their UsesDokument9 SeitenEng-301 (Group 3) Assignment Punctuation & Their UsesUrooj FatimaNoch keine Bewertungen

- Energy Crisis in Pakistan Minahel Noor Fatima 248Dokument9 SeitenEnergy Crisis in Pakistan Minahel Noor Fatima 248Urooj FatimaNoch keine Bewertungen

- Impact of Capital Structure On Banking Performance (A Case Study of Pakistan)Dokument12 SeitenImpact of Capital Structure On Banking Performance (A Case Study of Pakistan)Urooj FatimaNoch keine Bewertungen

- Assignment ENG-301 Roll No 248Dokument4 SeitenAssignment ENG-301 Roll No 248Urooj FatimaNoch keine Bewertungen

- ProjectDokument2 SeitenProjectUrooj FatimaNoch keine Bewertungen

- BBA-410 (Assignment) Minahel Noor Fatima Roll #248Dokument18 SeitenBBA-410 (Assignment) Minahel Noor Fatima Roll #248Urooj FatimaNoch keine Bewertungen

- Financial Anaylsis of Cement IndustryDokument65 SeitenFinancial Anaylsis of Cement IndustryUrooj FatimaNoch keine Bewertungen

- Learning Derivatives - 1Dokument3 SeitenLearning Derivatives - 1vicky168Noch keine Bewertungen

- Financial Statement AnalysisDokument3 SeitenFinancial Statement AnalysisUrooj FatimaNoch keine Bewertungen

- National Bank of Pakistan Report SummaryDokument4 SeitenNational Bank of Pakistan Report SummaryUrooj FatimaNoch keine Bewertungen

- Assignment: Slavery in The Chocolate Industry Q.1Dokument4 SeitenAssignment: Slavery in The Chocolate Industry Q.1Urooj FatimaNoch keine Bewertungen

- RepoertDokument3 SeitenRepoertUrooj FatimaNoch keine Bewertungen

- Presentation 1Dokument17 SeitenPresentation 1Urooj FatimaNoch keine Bewertungen

- Financial Statement AnalysisDokument3 SeitenFinancial Statement AnalysisUrooj FatimaNoch keine Bewertungen

- Presentation 1Dokument17 SeitenPresentation 1Urooj FatimaNoch keine Bewertungen

- KseDokument1 SeiteKseUrooj FatimaNoch keine Bewertungen

- Learning Derivatives - 1Dokument3 SeitenLearning Derivatives - 1vicky168Noch keine Bewertungen

- Topic:-Submitted To: - Submitted From:-: National Bank of PakistanDokument4 SeitenTopic:-Submitted To: - Submitted From:-: National Bank of PakistanUrooj FatimaNoch keine Bewertungen

- Inclusive Economic GrowthDokument2 SeitenInclusive Economic GrowthUrooj FatimaNoch keine Bewertungen

- Kse 100Dokument20 SeitenKse 100Urooj FatimaNoch keine Bewertungen

- Urooj Fatima (2016-Ag-3712) Performance Measure RatiosDokument8 SeitenUrooj Fatima (2016-Ag-3712) Performance Measure RatiosUrooj FatimaNoch keine Bewertungen

- Bank and Types of BanksDokument9 SeitenBank and Types of BanksreshNoch keine Bewertungen

- Understanding Financial StatementDokument14 SeitenUnderstanding Financial StatementNHELBY VERAFLORNoch keine Bewertungen

- Tally Journal EntriesDokument11 SeitenTally Journal Entriessainimeenu92% (24)

- Banking Sector Performance AnalysisDokument73 SeitenBanking Sector Performance AnalysisNaveen Kumar GuptaNoch keine Bewertungen

- Part A: Personal InformationDokument2 SeitenPart A: Personal InformationpreethishNoch keine Bewertungen

- Acc 106 P3 LessonDokument6 SeitenAcc 106 P3 LessonRowella Mae VillenaNoch keine Bewertungen

- Educ 101Dokument38 SeitenEduc 101vladimir161Noch keine Bewertungen

- Bank Negara Malaysia Guidelines Related Party TransactionDokument12 SeitenBank Negara Malaysia Guidelines Related Party TransactionYan QingNoch keine Bewertungen

- Executive Summary 1Dokument82 SeitenExecutive Summary 1madihaijazkhanNoch keine Bewertungen

- Concept and Accounting of Depreciation: Learning OutcomesDokument30 SeitenConcept and Accounting of Depreciation: Learning OutcomesCA Kranthi Kiran100% (1)

- GST Challan PDFDokument2 SeitenGST Challan PDFNicks N NIckNoch keine Bewertungen

- FAQs HorizonsDokument5 SeitenFAQs HorizonsErwin Dela Cruz100% (1)

- Sample Qualified Written Request 1Dokument5 SeitenSample Qualified Written Request 1derrick1958100% (2)

- LN04 Rejda99500X 12 Principles LN04Dokument40 SeitenLN04 Rejda99500X 12 Principles LN04Wafaa NasserNoch keine Bewertungen

- CA FOUNDATION BILLS OF EXCHANGE GUIDEDokument13 SeitenCA FOUNDATION BILLS OF EXCHANGE GUIDEAshish VermaNoch keine Bewertungen

- Annual - Report - BNP PARIBUSDokument172 SeitenAnnual - Report - BNP PARIBUSHm VikramNoch keine Bewertungen

- Travel Agency RubisomethingDokument12 SeitenTravel Agency RubisomethingItsRenz YTNoch keine Bewertungen

- Account STDokument1 SeiteAccount STSadiq PenahovNoch keine Bewertungen

- Wipro Consolidated Balance SheetDokument2 SeitenWipro Consolidated Balance SheetKarthik KarthikNoch keine Bewertungen

- Socket Realty Acts As An Agent in Buying Selling RentingDokument1 SeiteSocket Realty Acts As An Agent in Buying Selling RentingM Bilal SaleemNoch keine Bewertungen

- CIC Uganda Smart SaverDokument2 SeitenCIC Uganda Smart SaverJOREM PATRICK ELUNGATNoch keine Bewertungen

- City Cash Flow StatementDokument2 SeitenCity Cash Flow StatementSharon CarilloNoch keine Bewertungen

- AE 121 Chapter 21 Summary NotesDokument3 SeitenAE 121 Chapter 21 Summary NotesmercyvienhoNoch keine Bewertungen

- Division of ProfitsDokument55 SeitenDivision of ProfitsMichole chin MallariNoch keine Bewertungen

- Joni Ernst Amended Personal Financial DisclosureDokument6 SeitenJoni Ernst Amended Personal Financial DisclosuredmronlineNoch keine Bewertungen

- Understanding CRISILs Ratings & Rating Scales PDFDokument12 SeitenUnderstanding CRISILs Ratings & Rating Scales PDFRoma ShahNoch keine Bewertungen

- HND 2 Accounting For Banking SyllabusDokument4 SeitenHND 2 Accounting For Banking Syllabusserge folegweNoch keine Bewertungen

- Audit of Intangible AssetsDokument4 SeitenAudit of Intangible AssetsTrayle HeartNoch keine Bewertungen

- Financial Inclusion Through India Post: Dr. Joji Chandran PHDDokument4 SeitenFinancial Inclusion Through India Post: Dr. Joji Chandran PHDJoji ChandranNoch keine Bewertungen

- Oblicon 2nd ExamDokument10 SeitenOblicon 2nd ExamKaren Joy MasapolNoch keine Bewertungen