Beruflich Dokumente

Kultur Dokumente

Schedule of Charges Version 21.0.0 Dated 1st June 19

Hochgeladen von

Rajiv0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten1 SeiteThis document outlines schedule of charges and applicable taxes for retail loans and deposits from PNB Housing Finance Ltd effective June 1, 2019. For home loans, charges include fees for income tax certificates, account statements, changing repayment modes, EMI payments, and prepayment of principal. For non-home loans, processing fees are higher and charges for prepayment of principal are an additional 1%. The minimum lock-in period for deposits is 3 months, with interest rates applying for premature withdrawals within 6 months. All fees are subject to change at the company's discretion.

Originalbeschreibung:

PNB housing finance

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document outlines schedule of charges and applicable taxes for retail loans and deposits from PNB Housing Finance Ltd effective June 1, 2019. For home loans, charges include fees for income tax certificates, account statements, changing repayment modes, EMI payments, and prepayment of principal. For non-home loans, processing fees are higher and charges for prepayment of principal are an additional 1%. The minimum lock-in period for deposits is 3 months, with interest rates applying for premature withdrawals within 6 months. All fees are subject to change at the company's discretion.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten1 SeiteSchedule of Charges Version 21.0.0 Dated 1st June 19

Hochgeladen von

RajivThis document outlines schedule of charges and applicable taxes for retail loans and deposits from PNB Housing Finance Ltd effective June 1, 2019. For home loans, charges include fees for income tax certificates, account statements, changing repayment modes, EMI payments, and prepayment of principal. For non-home loans, processing fees are higher and charges for prepayment of principal are an additional 1%. The minimum lock-in period for deposits is 3 months, with interest rates applying for premature withdrawals within 6 months. All fees are subject to change at the company's discretion.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Version 21.0.

0

Effective from 1st June, 2019

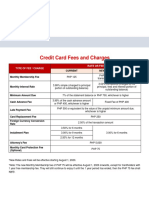

Schedule of Charges and Applicable Taxes for Retail Loans

Charge Type Home Loan (INR) Non Home Loan (INR)

Income Tax certificate for current financial year Free NA

Income Tax certificate for previous financial year Free NA

Statement of Account 200 + Applicable Taxes 200 + Applicable Taxes

Change of repayment mode - PDC to NACH Free Free

Change of repayment mode - PDC to PDC or NACH to NACH 500 + Applicable Taxes 500 + Applicable Taxes

EMI payment fee on account of non-submission of PDC/NACH

300 + Applicable Taxes 300 + Applicable Taxes

Mandate Form (per transaction)

Part or Full Prepayment of loan (on Floating Rate of Interest)

Free Free

by individual borrower(s)

Part or Full Prepayment of loan (on Floating Rate of Interest)

2% of principal prepaid + Applicable Taxes 3% of principal prepaid + Applicable Taxes

by non individual borrower(s) being applicant or co-applicant

3% of principal prepaid + Applicable Taxes. In case of

Part or Full Prepayment of loan (on Fixed Rate of Interest) by prepayment of loan is by own source (except borrowing

3% of principal prepaid + Applicable Taxes

individual borrower(s) from Bank/ HFC/ NBFC/ Any Financial Institution), no fee is

applicable.

Part or Full Prepayment of loan (on Fixed Rate of Interest) by

3% of principal prepaid + Applicable Taxes 3% of principal prepaid + Applicable Taxes

non individual borrower(s) being applicant or co-applicant

Loan Preclosure statement or List of original property

500 + Applicable Taxes 500 + Applicable Taxes

documents or Photocopy of original property documents

Cheque/NACH Mandate Form return 500 + Applicable Taxes 500 + Applicable Taxes

CERSAI Fees as per the rules of CERSAI for loans disbursed

100 + Applicable Taxes 100 + Applicable Taxes

after January 31, 2016

CERSAI Fees as per the rules of CERSAI for loans disbursed

500 + Applicable Taxes 500 + Applicable Taxes

prior to January 31, 2016

Processing Fee* 1% of the loan applied for + Applicable Taxes 2% of the loan applied for + Applicable Taxes

Fee for swap of property 25000 + Applicable Taxes 25000 + Applicable Taxes

Conversion of Rate of Interest (Floating to Floating Rate of 0.50% of principal outstanding + Applicable Taxes 1% of principal outstanding + Applicable Taxes

Interest or Floating to Fixed Rate of Interest) (Conversion to "fixed" rate of interest is not available) (Conversion to "fixed" rate of interest is not available )

Conversion of Rate of Interest (Fixed to Fixed Rate of Interest) Conversion to "fixed" rate of interest is not available.

Conversion of Rate of Interest (Fixed to Floating Rate of

2% of principal outstanding + Applicable Taxes 3% of principal outstanding + Applicable Taxes

Interest)

ROC creation NA 500 + Applicable Taxes

2% per month on overdue payment + Applicable

Overdue Charge 2% per month on overdue payment + Applicable Taxes

Taxes

Recovery Fees As per actual As per actual

Legal Fees As per actual As per actual

Title Search Fees As per actual As per actual

1)*Minimum Processing Fee is INR 10,000 + Applicable Taxes. The entire fee has to be paid in full at the time of making a loan application. In case a loan application is not

approved, then PNB Housing Finance Ltd will retain processing fee for -

a) Home Loan - INR 3000 + Applicable Taxes collected out of full processing fee for each property evaluated by PNB Housing Finance Limited.

b) Non Home Loan - INR 5000 + Applicable Taxes collected out of full processing fee for each property evaluated by PNB Housing Finance Limited.

2) "Residential Plot Loan" is considered as "Non-Home Loan" till the time residential building, with all necessary regulatory approvals, is constructed on it.

3) The effect of reschedulement in loan account, i.e., part prepayment or rate of interest conversion, shall be given in the next installment cycle as per the mutually agreed

terms and conditions.

4) Customers are requested not to make any payment to third parties for services.

5) Part/Full pre-payment requests can be accepted on all days, except between 25th of the month and last day of the month (both days inclusive). Customers are requested

to schedule their plans for part payment (if any) accordingly.

Schedule of Charges and Applicable Taxes for Deposits

Particulars Deposit by Individual Deposit by Non-Individual

Pre-matured withdrawal is not permissible within 3 Pre-matured withdrawal is not permissible

Minimum lock in period of 3 months

months. within 3 months.

Interest payable @ 4% per annum for the period for which

Pre-matured withdrawal after 3 months but before 6 months No interest is payable.

deposit has run.

Pre-matured withdrawal after 6 months but before the date

Interest payable 1% lower than the interest rate applicable for the period for which the deposit has run.

of maturity

In case of premature withdrawal, the excess brokerage (total brokerage paid minus the brokerage for the

Pre-matured withdrawal

period which the deposit has actually run) will be recovered from the customer.

Note: The aforesaid fees/charges are subject to change at the Company’s discretion.

Das könnte Ihnen auch gefallen

- Most Important Terms and Conditions (Mitc) Loan Reference No.Dokument6 SeitenMost Important Terms and Conditions (Mitc) Loan Reference No.prashant gargNoch keine Bewertungen

- Schedule of Charges and Interest Rates PDFDokument5 SeitenSchedule of Charges and Interest Rates PDFAjju PodilaNoch keine Bewertungen

- SOC - Prime - Dec 10 2023 - V27Dokument1 SeiteSOC - Prime - Dec 10 2023 - V27sehgaNoch keine Bewertungen

- Schedule of Rates and ChargesDokument1 SeiteSchedule of Rates and ChargesSubham UpadhayayNoch keine Bewertungen

- Aadhar Tariff Schedule092021-2 PDFDokument2 SeitenAadhar Tariff Schedule092021-2 PDFSamNoch keine Bewertungen

- Schedule of Charges - Master - 16.3.23Dokument6 SeitenSchedule of Charges - Master - 16.3.23mk9778225Noch keine Bewertungen

- RI AnnexureDokument6 SeitenRI Annexurekaizen.hameshaNoch keine Bewertungen

- 1701075261076Dokument18 Seiten1701075261076rahulpavn01Noch keine Bewertungen

- ICICI Mortgage PACustomer 7727036138 7 29 2023Dokument5 SeitenICICI Mortgage PACustomer 7727036138 7 29 2023shubhamkumarrajput92Noch keine Bewertungen

- Schedule-Of-charges Master 27-10-23Dokument142 SeitenSchedule-Of-charges Master 27-10-23xtreameairtelNoch keine Bewertungen

- Auxilo EIL Schedule of ChargesDokument2 SeitenAuxilo EIL Schedule of ChargesArun KumarNoch keine Bewertungen

- Schedule of Charges - Master - 27 10 23 1Dokument10 SeitenSchedule of Charges - Master - 27 10 23 1shuvam0016Noch keine Bewertungen

- Most Important Terms & ConditionsDokument11 SeitenMost Important Terms & Conditionsolxusenew123Noch keine Bewertungen

- Electric BillDokument2 SeitenElectric BillJagannath PanigrahiNoch keine Bewertungen

- Schedule of Charges - Protium ProtiumDokument1 SeiteSchedule of Charges - Protium Protiummufcrufc12345Noch keine Bewertungen

- CCPL MidDokument7 SeitenCCPL MidMuhammad AliNoch keine Bewertungen

- Khushi Home LoansDokument2 SeitenKhushi Home LoansGovind JhaNoch keine Bewertungen

- CPL MidDokument7 SeitenCPL MidMinhas ArshadNoch keine Bewertungen

- CCPL MidDokument7 SeitenCCPL Midshmirza2009Noch keine Bewertungen

- Private-Banking-Signature-July-Dec-23 JS BankDokument4 SeitenPrivate-Banking-Signature-July-Dec-23 JS BankMuhammad Aasim HassanNoch keine Bewertungen

- Home Loan: TCHFL HL MITC Version 17Dokument4 SeitenHome Loan: TCHFL HL MITC Version 17Ali Khan AKNoch keine Bewertungen

- Bike LoanDokument1 SeiteBike LoanKrishna KumarNoch keine Bewertungen

- CIVMB T3-3 Preliminaryassessment v2Dokument6 SeitenCIVMB T3-3 Preliminaryassessment v2Forin NeimNoch keine Bewertungen

- Schedule of Charges: Upfront Charges (Charges Before/During Disbursement)Dokument2 SeitenSchedule of Charges: Upfront Charges (Charges Before/During Disbursement)BharatSharmaNoch keine Bewertungen

- LoanDokument1 SeiteLoanPrateek SoniNoch keine Bewertungen

- Page 1 of 5: Customer Care: 1860 120 7777Dokument5 SeitenPage 1 of 5: Customer Care: 1860 120 7777SundarNoch keine Bewertungen

- Fees and Charges CompensiveDokument1 SeiteFees and Charges CompensiveGSAINTSSANoch keine Bewertungen

- HBL Credit Card - Basic Charges Sheet (Version 2 W.E.F July 01 2019)Dokument2 SeitenHBL Credit Card - Basic Charges Sheet (Version 2 W.E.F July 01 2019)shani908Noch keine Bewertungen

- Statement of Account - 81465036 - 015941Dokument4 SeitenStatement of Account - 81465036 - 015941krishnamondal6261Noch keine Bewertungen

- SALPL AgreementDokument30 SeitenSALPL AgreementVipul JainNoch keine Bewertungen

- Most Important Terms and ConditionsDokument20 SeitenMost Important Terms and Conditionsdharmendra palNoch keine Bewertungen

- Khan Sanction LetterDokument7 SeitenKhan Sanction LetterArman KhanNoch keine Bewertungen

- Home Loan and Loan Against PropertyDokument4 SeitenHome Loan and Loan Against PropertyPraveen KumarNoch keine Bewertungen

- Updated Key Fact SatementDokument4 SeitenUpdated Key Fact SatementYashodhan RajwadeNoch keine Bewertungen

- Navi Finserv Private Limited - HL - Fee and Schedule - 20202312 - 1000Dokument2 SeitenNavi Finserv Private Limited - HL - Fee and Schedule - 20202312 - 1000sachin BhartiNoch keine Bewertungen

- In Schedule of Charges June 17 GSTDokument1 SeiteIn Schedule of Charges June 17 GSTmanihar veeramalluNoch keine Bewertungen

- HBL - Updated Charges Wef From 1-Jan-2018Dokument3 SeitenHBL - Updated Charges Wef From 1-Jan-2018Mubin AshrafNoch keine Bewertungen

- Statement of Account - 040331278 PDFDokument4 SeitenStatement of Account - 040331278 PDFShaik Rafeeq AliNoch keine Bewertungen

- Purchase ReceiptDokument4 SeitenPurchase Receiptfrostscan01Noch keine Bewertungen

- Wireless Service AgreementDokument6 SeitenWireless Service AgreementSerguei100% (1)

- Sanction Saurhav PDFDokument7 SeitenSanction Saurhav PDFDigambar mhaskar officialsNoch keine Bewertungen

- Repayment ScheduleDokument2 SeitenRepayment ScheduleCharina MiclatNoch keine Bewertungen

- Application Loan 1Dokument4 SeitenApplication Loan 1pratibhamote8Noch keine Bewertungen

- Schedule of Charges 01-04-2018 Ad87dd241fDokument2 SeitenSchedule of Charges 01-04-2018 Ad87dd241fLeela ManoharNoch keine Bewertungen

- Page 1 of 7: Customer Care: 1800 1080Dokument7 SeitenPage 1 of 7: Customer Care: 1800 1080sunil.srfcNoch keine Bewertungen

- Statement of Account - 140577662 - 10566403Dokument4 SeitenStatement of Account - 140577662 - 1056640399rakeshghotiyaNoch keine Bewertungen

- Business Transport LoanDokument8 SeitenBusiness Transport LoanJan RootsNoch keine Bewertungen

- Credit Card Fees and Charges: Type of Fee / Charge Rate or FeeDokument1 SeiteCredit Card Fees and Charges: Type of Fee / Charge Rate or FeeKram Yer EtentepmocNoch keine Bewertungen

- Fees and Charges W.E.F. 17th Mar, 2021Dokument3 SeitenFees and Charges W.E.F. 17th Mar, 2021MANOJ PANSENoch keine Bewertungen

- Mitc Tariff For HSBC Smart Value CCDokument13 SeitenMitc Tariff For HSBC Smart Value CCsuresh10526_71653021Noch keine Bewertungen

- Fees and Charges W.E.F. 13th Dec, 2021Dokument4 SeitenFees and Charges W.E.F. 13th Dec, 2021Chandrashekar ReddyNoch keine Bewertungen

- Insta Overdraft Facility (Insta Od) Application Form: Application Id: CAOD0678881 IP Address: 14.139.245.68Dokument8 SeitenInsta Overdraft Facility (Insta Od) Application Form: Application Id: CAOD0678881 IP Address: 14.139.245.68Prem KumarNoch keine Bewertungen

- Mitc PDFDokument6 SeitenMitc PDFrocky themountainNoch keine Bewertungen

- All You Wanted To Know About Bajaj Finance Flexi LoanDokument6 SeitenAll You Wanted To Know About Bajaj Finance Flexi LoanAwadhesh Kumar KureelNoch keine Bewertungen

- Statement of Accounts - 234316892Dokument4 SeitenStatement of Accounts - 234316892musharaf manafNoch keine Bewertungen

- MITC - Scapia Credit Card - 15-June-2023Dokument5 SeitenMITC - Scapia Credit Card - 15-June-2023BhushanNoch keine Bewertungen

- Statement of Accounts - 113642969Dokument4 SeitenStatement of Accounts - 113642969MEDIDA DURGARAONoch keine Bewertungen

- Page 1 of 7: Customer Care: 1860 120 7777Dokument7 SeitenPage 1 of 7: Customer Care: 1860 120 7777prashil parmarNoch keine Bewertungen

- Applicable Schedule of Charges and Penal Interest For Farmer Funding (B2C) Businesses of Bharat Enterprises (W.e.f 1st April 2023)Dokument4 SeitenApplicable Schedule of Charges and Penal Interest For Farmer Funding (B2C) Businesses of Bharat Enterprises (W.e.f 1st April 2023)Raj kumarNoch keine Bewertungen

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesVon EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNoch keine Bewertungen

- BFM Module B Risk ManagementDokument32 SeitenBFM Module B Risk ManagementRajivNoch keine Bewertungen

- Kisan Credit Card (KCC) and Crop Loaning SystemDokument17 SeitenKisan Credit Card (KCC) and Crop Loaning SystemRajivNoch keine Bewertungen

- Final Term 3 Maths 2019Dokument6 SeitenFinal Term 3 Maths 2019RajivNoch keine Bewertungen

- Pursuasive CommnDokument20 SeitenPursuasive CommnRajivNoch keine Bewertungen

- Internship Handbook CBNK BoMDokument46 SeitenInternship Handbook CBNK BoMRajivNoch keine Bewertungen

- FAB-M Analysis Mahasanchay Systematic Deposit Plan (MSDP)Dokument1 SeiteFAB-M Analysis Mahasanchay Systematic Deposit Plan (MSDP)RajivNoch keine Bewertungen

- E Frauds in BankingDokument5 SeitenE Frauds in BankingRajivNoch keine Bewertungen

- MCQ Banking QuizDokument8 SeitenMCQ Banking QuizRajivNoch keine Bewertungen

- Minutes of Meeting Role PlayDokument7 SeitenMinutes of Meeting Role PlayRajivNoch keine Bewertungen

- Writing Effective Emails: Around 80 Emails Each DayDokument5 SeitenWriting Effective Emails: Around 80 Emails Each DayRajivNoch keine Bewertungen

- Writing Effective Emails: Around 80 Emails Each DayDokument5 SeitenWriting Effective Emails: Around 80 Emails Each DayRajivNoch keine Bewertungen

- Mindy Martin Case StudyDokument3 SeitenMindy Martin Case StudyRajiv50% (4)

- Sections From The Indian Penal Code Pertaining To Self-Defence: 96 To 106Dokument3 SeitenSections From The Indian Penal Code Pertaining To Self-Defence: 96 To 106RajivNoch keine Bewertungen

- ChannelsofdistributionDokument16 SeitenChannelsofdistributionRajivNoch keine Bewertungen

- Banking Awareness Quick Reference Guide 2015 PDFDokument64 SeitenBanking Awareness Quick Reference Guide 2015 PDFRajivNoch keine Bewertungen

- Aapki Ek MuskurahaT NE HamareY HosH UdaA DiyE BiG - BosSDokument4 SeitenAapki Ek MuskurahaT NE HamareY HosH UdaA DiyE BiG - BosSRajivNoch keine Bewertungen

- FAB AnalysisDokument3 SeitenFAB AnalysisRajivNoch keine Bewertungen

- Power Plants PDFDokument4 SeitenPower Plants PDFRajivNoch keine Bewertungen

- EU Regulation On The Approval of L-Category VehiclesDokument15 SeitenEU Regulation On The Approval of L-Category Vehicles3r0sNoch keine Bewertungen

- Agony of ReformDokument3 SeitenAgony of ReformHarmon SolanteNoch keine Bewertungen

- Designing For Adaptation: Mia Lehrer + AssociatesDokument55 SeitenDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Noch keine Bewertungen

- Acknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisDokument78 SeitenAcknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisKuldeep BatraNoch keine Bewertungen

- Measure of Eco WelfareDokument7 SeitenMeasure of Eco WelfareRUDRESH SINGHNoch keine Bewertungen

- Chap014 Solution Manual Financial Institutions Management A Risk Management ApproachDokument19 SeitenChap014 Solution Manual Financial Institutions Management A Risk Management ApproachFami FamzNoch keine Bewertungen

- IBDokument26 SeitenIBKedar SonawaneNoch keine Bewertungen

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokument1 SeiteBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSudesh SharmaNoch keine Bewertungen

- Voltas Case StudyDokument27 SeitenVoltas Case Studyvasistakiran100% (3)

- Monsoon 2023 Registration NoticeDokument2 SeitenMonsoon 2023 Registration NoticeAbhinav AbhiNoch keine Bewertungen

- EOQ HomeworkDokument4 SeitenEOQ HomeworkCésar Vázquez ArzateNoch keine Bewertungen

- Sample Business ProposalDokument10 SeitenSample Business Proposalvladimir_kolessov100% (8)

- Report of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Dokument42 SeitenReport of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Ravi Shankar KolluruNoch keine Bewertungen

- Feasibilities - Updated - BTS DropsDokument4 SeitenFeasibilities - Updated - BTS DropsSunny SonkarNoch keine Bewertungen

- Buku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiaDokument17 SeitenBuku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiadianNoch keine Bewertungen

- Benetton (A) CaseDokument15 SeitenBenetton (A) CaseRaminder NagpalNoch keine Bewertungen

- HQ01 - General Principles of TaxationDokument14 SeitenHQ01 - General Principles of TaxationJimmyChao100% (1)

- Is Enron OverpricedDokument3 SeitenIs Enron Overpricedgarimag2kNoch keine Bewertungen

- Malta in A NutshellDokument4 SeitenMalta in A NutshellsjplepNoch keine Bewertungen

- DX210WDokument13 SeitenDX210WScanner Camiones CáceresNoch keine Bewertungen

- Accra Resilience Strategy DocumentDokument63 SeitenAccra Resilience Strategy DocumentKweku Zurek100% (1)

- India'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelDokument10 SeitenIndia'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelAnonymous cRMw8feac8Noch keine Bewertungen

- Project On SurveyorsDokument40 SeitenProject On SurveyorsamitNoch keine Bewertungen

- Manual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesDokument15 SeitenManual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesAlbert ChangNoch keine Bewertungen

- The Making of A Global World 1Dokument6 SeitenThe Making of A Global World 1SujitnkbpsNoch keine Bewertungen

- What Is Zoning?Dokument6 SeitenWhat Is Zoning?M-NCPPCNoch keine Bewertungen

- Belt and Road InitiativeDokument17 SeitenBelt and Road Initiativetahi69100% (2)

- Why The Strengths Are Interesting?: FormulationDokument5 SeitenWhy The Strengths Are Interesting?: FormulationTang Zhen HaoNoch keine Bewertungen

- Dog and Cat Food Packaging in ColombiaDokument4 SeitenDog and Cat Food Packaging in ColombiaCamilo CahuanaNoch keine Bewertungen

- TCW Act #4 EdoraDokument5 SeitenTCW Act #4 EdoraMon RamNoch keine Bewertungen