Beruflich Dokumente

Kultur Dokumente

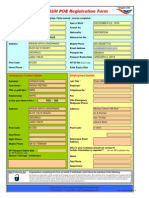

Economics 3and4

Hochgeladen von

James prajwal.R100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

413 Ansichten55 SeitenThe document discusses equivalent annual worth comparisons for decisions involving costs that are incurred over different time periods. It provides examples of problems comparing the equivalent annual costs of different equipment options that have unequal lifetimes, such as choosing between a machine with a lower upfront cost but higher operating expenses over a shorter lifetime versus a more expensive machine with lower operating costs over a longer lifetime. It also includes problems from VTU exams involving similar comparisons of equipment purchase versus leasing and selecting equipment based on equivalent annual costs being equal.

Originalbeschreibung:

Introduction to basic economics

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document discusses equivalent annual worth comparisons for decisions involving costs that are incurred over different time periods. It provides examples of problems comparing the equivalent annual costs of different equipment options that have unequal lifetimes, such as choosing between a machine with a lower upfront cost but higher operating expenses over a shorter lifetime versus a more expensive machine with lower operating costs over a longer lifetime. It also includes problems from VTU exams involving similar comparisons of equipment purchase versus leasing and selecting equipment based on equivalent annual costs being equal.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

413 Ansichten55 SeitenEconomics 3and4

Hochgeladen von

James prajwal.RThe document discusses equivalent annual worth comparisons for decisions involving costs that are incurred over different time periods. It provides examples of problems comparing the equivalent annual costs of different equipment options that have unequal lifetimes, such as choosing between a machine with a lower upfront cost but higher operating expenses over a shorter lifetime versus a more expensive machine with lower operating costs over a longer lifetime. It also includes problems from VTU exams involving similar comparisons of equipment purchase versus leasing and selecting equipment based on equivalent annual costs being equal.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 55

EQUIVALENT ANNUAL

WORTH COMPARISONS

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 1

■ A consulting firm proposes to provide “self inspection” training for

clerks who work with insurance claims. The program lasts for 1

year costs $2000/- per month, and professes to improve quality

while reducing clerical time. A potential user of the program

estimates that saving in the first month should amount to $800/-

and should increase by $400/- per month for the rest of the year

■ However operational confusion and work interference are expected

to boost clerical cost by $1200/- the first month, but this amount

should subsequently decline in equal increments at the rate of

$100/- per month. If the required return on money is 12%

compounded monthly and there is a stipulation that the program

must pay for itself within 1 year, should the consultant be hired

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 1

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 1 - Solution

■ Find Equivalent Monthly worth of savings

■ Annual savings = $ 2,947/-

■ Find Equivalent Monthly worth of Cost

■ Annual cost = $ 2,663/-

■ Net annual worth = Annual Savings – Annual Costs

■ Net Annual worth = $ 284/-

The program pays for itself hence, the consultant can be hired

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 2

■ The purchase of a truck with an operators platform on a

telescopic hydraulic boom will reduce labor cost for sign

installations by $ 15,000/- per year. The price of a boom

truck is $ 93,000/- and its operating cost will exceed

those of present equipment by $ 250/- per month. The

resale value is expected to be $ 18,000/- in 8 years.

Should the boom truck be purchased when the current

available interest rate is 7%

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 2

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 2 Solution

■ Find Equivalent Annual Savings

■ Annual saving= $ 16,754.46

■ Find Equivalent Annual Costs

■ Annual cost= $ 18,574.71

■ Equivalent Net Annual worth = Annual Savings – Annual Costs

■ EAW = $ - 1,820.25

Equivalent annual worth is negative hence purchasing the boom truck is to be deferred

until the annual savings increases

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 3

■ A supplier of laboratory equipment estimate that profit from

sales should increase by 20,000/- per year. If a mobile

demonstration unit is built. A large unit with sleeping

accommodations for driver will cost 97,000/- while a smaller

unit without sleeping quarters will be 63,000/- salvage values

for the larger and smaller units after 5 years in use will be

9,700/- and 3,000/- respectively. Lodging cost saved by the

larger unit should amount to 11,000/- annually, but its yearly

transformation cost will exceed those of the smaller unit by

3,100/-. With money at 9%, should a mobile demonstration

unit be built? And if so which size is preferable.

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 3

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 3 Solution

Large Mobile Demonstration Unit Small Mobile Demonstration Unit

■ Find Annual worth of large mobile ■ Find Annual worth of Small mobile

demonstration unit demonstration unit

■ EAW = Asavings – Acost ■ EAW = Asavings – Acost

■ Asavings = 32620.773 ■ Asavings = 20584.815

■ Acost = 28037.73 ■ Acost = 16196=67

■ Net EAWLarge = 4583=04 ■ Net EAWSmall = 4388=145

A per calculations EAW of Large unit is greater than EAW of smaller unit. Hence it is advisable

to choose Large Mobile Unit

Criteria is that Lodging rate remains same / constant throughout the analysis horizon and

fuel rate remains same / constant

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

COMPARISONS OF ASSETS WITH

EQUAL AND UNEQUAL LIVES

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Comparisons of Assets with Equal and Unequal

lives

■ Equivalent annual worth comparisons of assets with

equal and unequal lives.

– The annual worth or costs are found and then

compared

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 4

■ Two models of small machines perform the same

function Type 1 has a low initial cost of 9,500/- relatively

high operating cost of 1,900/- per year more than those

of the Type 2 machine and a short life of 4 years. The

more expensive Type 2 machine cost 25,100/- and be

kept in service economically for 8 years. The scrap value

from either machine at the end of its life will barely cover

its removal cost which is preferred when minimum

attractive rate of return is 8 %.

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 4

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 4 Solution

Model Type – 1 Machine Model Type – 2 Machine

■ All values are costs hence ■ All values are costs hence

calculate EAC of model Type 1 calculate EAC of Model Type 2

■ EAC = 4768/- ■ EAC = 4388/-

Type 2 model machine has a lower annual cost for service during next 8

years and hence Model Type 2 Machine is selected

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

VTU QUESTIONS

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 5

■ Two types of power converter Alpha and Beta are under

considerations for a particular application. An economic

comparison is to be made at an interest rate of 10%.

Following cost estimation has been obtained. Determine the

Annual equivalent costs of the two systems, select the best

converter (VTU – Dec2013 – Jan2014)

Cost Particulars Alpha Beta

Purchase Price Rs 10,000/- Rs 25,000/-

Estimated Service Life 5 years 9 years

Salvage Value Rs 3,000/- Rs 5,000/-

Annual Operating cost Rs 2,500/- Rs 1,200/-

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 5

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 5 Solution

■ Find EAC value of Alpha Convertor

– EAC = Capital recovery + Annual Costs

– EAC = 4646.6

■ Find EAC value of Beta convertor

– EAC = Capital recovery + Annual Costs

– EAC = 5448.80

■ Comparing both Alpha and Beta convertors EAC values which

are negative as they represent costs. Hence least negative

value should be selected which would be EAC of Alpha

convertor

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 6

■ A conventional Agricultural Equipment has a service of 6

years. Newly designed equipment is 50% costlier than the

conventional one but has many advantages. The

operating costs of both these equipment are almost

same and salvage value is negligible. What will be the

service life of the new equipment that makes its cost

comparable to that of the conventional one at i=10%?

(VTU – Dec 2013 – Jan 2014)

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 6 Solution

■ Condition is to make costs of new agricultural equipment

comparable to that of the conventional one

■ EAC of New = EAC of Old where n for old is know = 6

years

■ N = 11.11 years

■ The service life of the new equipment is to be N = 11.11

years which would make its costs comparable to that of

the conventional one

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 7

■ A city maintenance crew has experience with conventional

back hoe that suggests that its service life is 6 years. A newly

designed machine costs 50% more than the conventional

machine but is quieter in operations, which will make it more

adoptable to residential neighborhoods. Both machines will

have about the same operating costs, and salvage costs are

expected to be negligible. What will be the service life of the

new backhoe have to be to make its cost comparable to that

of conventional machine at i=10%? (VTU – Dec 2014 – Jan

2015)

■ Similar to the one already solved Problem No 5

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 8

■ A sheltered workshop requires a lift truck to handle pallets for

a new contract. A lift truck can be purchased for Rs

2,70,000/-. Annual insurance costs are 3% of the purchase

price, payable on the first of each year. An equivalent truck

can be rented Rs 15,000/- per month payable at the end of

each month. Operating costs are same for both alternatives.

For what minimum number of month must a purchased truck

be used on the contract to make purchasing more attractive

than leasing? Interest is 12% compounded monthly. Assume

that the purchased truck has no salvage value. (VTU – Dec

2014 – Jan 2015)

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 8

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 8 Solution

■ Interest i=12/12 = 1% per month

■ To Make purchase of truck more attractive than leasing

Match or equate two alternatives on monthly basis and

find N value

■ N = 19.98 Months or 20 Months

■ For 20 minimum number of months must a purchased

truck to be used so that purchasing options becomes

more attractive than leasing

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 9

■ Two models of small machines perform the same function.

Type 1 machine has a low initial cost of Rs. 9,500/- and

relatively high operating costs of Rs 1,900/- year more than

those of Type 2 Machine and a short life of 4 years. The more

expensive Type 2 machine costs Rs 25,100/- and can be kept

in service economically for 8 years. Which machine is

preferred when the MARR is 8% using equivalent annual cost

method? (VTU – Dec 2015 – Jan 2016)

■ Same as Problem No 4

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 10

■ A company invests in one of the two mutually exclusive

alternatives. The life of both alternatives is estimated to

be 5 years with the following cash flow. Determine the

best alternative based on the annual equivalent method

by assuming i=25%. (VTU – Dec 2015 – Jan 2016)

Alternative

Cash flow

A B

Investment (Rs) -1.5 Lakhs -1.75 Lakhs

Annual return (Rs) 60,000/- 70,000/-

Salvage Value (Rs) 15,000/- 35,000/-

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 10

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 10

■ Find Annual worth of Alternative A

■ EAW = 6050.25

■ Find Annual worth of Alternative B

■ EAW = 9191

■ Alternative B which has highest annual worth of 9191 is

the best alternative based on annual worth method

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 11

■ The following costs are estimated for two equal service

machines in a manufacturing plants. If the minimum

required rate of return is 15% per year, which machines

should be selected? (VTU – June/July 2014)

Machine – 1 Machine – 2

First cost (Rs) 2,60,000/- 3,60,000/-

Annual Maintenance cost (Rs) 8,000/- 3,000/-

Annual Labor cost (Rs) 1,10,000/- 70,000/-

Extra income taxes (Rs) - 26,000/-

Salvage Value (Rs) 20,000/- 30,000/-

Life (years) 4 4

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 11

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 11

■ Find Equivalent Annual costs EAC of Machine A

■ EAC = - 205,064.80 (negative Value)

■ Find Equivalent Annual costs EAC of Machine B

■ EAC = - 219,089.10 (Negative Value)

■ Of the two machine A and B, Machine A has the least

negative EAC value hence Machine A is to be selected

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 12

■ Two machine models A and B perform the same function Type

A machine has low initial cost of Rs 75,000/- relatively high

operating cost of Rs 15,000/- per year more than those of

type B machine and a short life of 4 years. Type B machine

cost Rs 1,00,000/- and operating cost of Rs 5,000/- per year

can be kept in service economically for 8 years. The scarp

value from either machine at the end of the life will barely

cover its removal cost. Which is preferred using an equivalent

annual cost, when the minimum attractive rate of return is

9%? (VTU – June/July 2014)

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 12

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 12

■ Find Equivalent Annual worth of Model A Machine

■ EAC = 38,150.25

■ Find Equivalent Annual worth of Model A machine

■ EAC = 23,067

■ Machine Model B has less EAC value hence Machine

Model B is preferred

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 13

■ First cost of an asset is Rs 5,00,000/-. The annual

maintenance in the first year is Rs 2,000/- and increase

by Rs 1,000/- every year up to 10th year. The annual

income is expected to be Rs 50,000/- in the first year

with increase of Rs 25,000 every year up to 10th year.

The operating cost is Rs 6,000/- per year. The salvage

value is Rs 30,000/- at the end of 10th year. Find the

equivalent annual cost of the machine at 12% interest

rate. (VTU – June / July 2016)

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 13 Solution

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 13 Solution

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 14

■ An asset was purchased five years ago for Rs 52,000/-. It

was expected to have an economic life of 8 years at

which salvage value would be Rs 4,000/-. If the function

of the asset would no longer needed for what price must

be sold now to recover the invested capital when i=12%.

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 14

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 14

■ Find EAC for 8 years

■ EAC = 10,142.40

■ Find Present Value of remaining EAC value to find selling price

of the asset as of today

■ Present Value (P) of EAC at year 5 of remaining 3 years

■ P = 24,360.32

■ The asset is to be sold at 24,360.32 or above to recover the

invested capital

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

GENERAL PROBLEMS

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 15

■ A large gasoline station is required by the city to install vapor

containment equipment on its gasoline pump nozzles and

storage tank vents. The immediate conversion cost will be $

180,000 with an estimated $ 600 per year for maintenance.

It will be necessary to update the equipment every 3 years at

a cost of $ 3,500. The station pumps an average of 1 million

gallons of gasoline per month. On an annual basis what would

be the price increase per gallon necessary to pay for the

conversion over a six year period? Include 6th year update

cost in your analysis and assume an interest rate of 14%

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 15

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 15

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 16

■ A food beverage company is planning expansion of its

cold storage facility. Three alternatives site design

proposal are being considered that uses of MARR 10%.

Plan A and B require an expenditure of Rs 35,00,000/-

for land and which will retain its value in 10 years. While

Plan C requires Rs 45,00,000/- for land which will also

retain its value in 10 years. The estimated income

increase due to facility available is annualized at

24,80,000/- per year. The company requires that a life of

10 years be used for analysis

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 16

■ Estimate which proposal to recommend using equated

annual worth analysis and rank proposals.

Proposal A Proposal B Proposal C

Building and Installation 60,00,000/- 70,00,000/- 40,00,000/-

Compressors 10,00,000/- 13,50,000/- 8,50,000/-

Expected energy cost 1 year 6,50,000/- 4,80,000/- 6,50,000/-

Energy cost increase for each

30,000/- 20,000/- 35,000/-

additional year

Annual maintenance cost 2,00,000/- 1,50,000/- 5,00,000/-

Estimated Salvage value 3,50,000/- 4,30,000/- 1,80,000/-

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 16 – Proposal A

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 16 – Proposal B

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 16 – Proposal C

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 16

■ Find EAW of all Proposal

■ Proposal A = -168676.30/-

■ Proposal B = -126114.20/-

■ Proposal C = -310808.60/-

■ Equivalent annual worth of Proposal B is less compared

to all 3 plans hence Proposal B is considered for

Implementation

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 17

■ A Company owns several gasoline stations in a major city. It is

decided that a major television advertising campaign will greatly

improve income. Initial development cost for the advertisements

will be 120,000/- monthly television airing costs are quoted at

35,000/- for the first month decreasing by 500/- per month there

after during the period the ads will run, which is 18 months.

Revenues are expected to increase by 40,000/- in the first month

and increase 700/- per month there after for 11 months more. The

last 6 months of the study are expected to see a linear decline of

300/- per month from for the peak increase. Determine whether

the campaign will be economically viable using a equivalent

monthly worth analysis. Assume nominal interest rate of 12% with

monthly compounding.

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 18

■ The athletic department of a university is proposing that a new general purpose

stadium be constructed on campus. A design utilization, a combination earth

work bowl with a steel upper deck and press box is being considered. The

following cost estimated have been developed

First cost of complete construction 32000000

Paint steel structure every 6 years 2000000

Replace wooden seats every 10 years 4000000

Repave parking facilities and ramps every 12 years 3000000

Annual maintenance 1500000

■ Assume a 60 year life and negligible salvage value determine the minimum

annual revenue that could justify the project. Using tax free interest rate of 7%

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 19

■ Granite rock and gravel company is considering the feasibility of purchasing a piece of

land for a small quarrying operations. The following cost estimates have been developed

for evaluating the venture

Cost of Land 2,000,000

Site clearing and road preparation 200,000

Annual operating cost

First year 400,000

Increase for each additional year of operations 50,000

Site cleanup prior to resale 100,000

■ The quarry will probably have a useful life of 10 years and the reclaimed site should have

a resale value of $ 1 million. Using an interest rate of 15% determine the equivalent

annual cost of this operation.

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Problem 20

■ A person wants to buy a home theatre system. He estimates

that it will last at least for 10 Years at the end of which it will

not have any salvage value. Show room offers him two

alternative ways to pay for the system. Pay Rs 100,000/-

immediately and Rs 50,000/- at the end of one year

■ Pay nothing until the end of three years and make a single

payment of Rs 200,000/-

■ If the buyer believes 12% is a suitable rate of interest which

alternative is best? (VTU – June/July – 2015)

Module 4 – Annual Present Worth Comparisons Global Academy of Technology

Das könnte Ihnen auch gefallen

- Automated Vehicular Identification and Authentication SystemDokument4 SeitenAutomated Vehicular Identification and Authentication SystemInternational Journal of Innovations in Engineering and Technology (IJIET)Noch keine Bewertungen

- Parafin Teaser 2020-12Dokument13 SeitenParafin Teaser 2020-12Brian AhmesNoch keine Bewertungen

- Programming Assignment 2 Udp Pinger VerDokument7 SeitenProgramming Assignment 2 Udp Pinger Verapi-479141525Noch keine Bewertungen

- Data Path and Control: Dr. Rohith S Assoc. Professor Department of ECE NCET, BangaloreDokument7 SeitenData Path and Control: Dr. Rohith S Assoc. Professor Department of ECE NCET, BangalorePruthvi100% (1)

- i) ii) iii) (Scale) : (SIZE) (Colour) 非1:1Dokument19 Seiteni) ii) iii) (Scale) : (SIZE) (Colour) 非1:1Filipe ConceiçãoNoch keine Bewertungen

- OS Electromechanical L4Dokument79 SeitenOS Electromechanical L4Jeji HirboraNoch keine Bewertungen

- WiFi CVE-2019-6496 Marvell's StatementDokument1 SeiteWiFi CVE-2019-6496 Marvell's StatementCatalin Cimpanu [ZDNet]50% (2)

- 06 08 2017 G2a GTDokument2 Seiten06 08 2017 G2a GTNagarajan RajaNoch keine Bewertungen

- NITDA Strategic Roadmap and Action Plan (SRAP) Implementation ProgramDokument21 SeitenNITDA Strategic Roadmap and Action Plan (SRAP) Implementation ProgramHamza KaniNoch keine Bewertungen

- Khalifa and Shen, 2005Dokument10 SeitenKhalifa and Shen, 2005Ali MehmoodNoch keine Bewertungen

- Sound Transit - Realignment Board Briefing Book - January 2021Dokument53 SeitenSound Transit - Realignment Board Briefing Book - January 2021The UrbanistNoch keine Bewertungen

- Semester Project: COMSATS University Islamabad, Virtual Campus HUM102 Report Writing Skills Assignment # 03 Spring 2020Dokument4 SeitenSemester Project: COMSATS University Islamabad, Virtual Campus HUM102 Report Writing Skills Assignment # 03 Spring 2020UzairNoch keine Bewertungen

- Stub Axle Design Stub Axle Design Stub Axle Design Stub Axle DesignDokument1 SeiteStub Axle Design Stub Axle Design Stub Axle Design Stub Axle DesignNano NanoNoch keine Bewertungen

- 2014 ACCT2111 Midterm KeyDokument11 Seiten2014 ACCT2111 Midterm KeyDonald YumNoch keine Bewertungen

- Marketing Product Level - Eg. EarphonesDokument2 SeitenMarketing Product Level - Eg. EarphonesViksit ChoudharyNoch keine Bewertungen

- IZEVA 2020 Assembly SummaryDokument15 SeitenIZEVA 2020 Assembly SummaryThe International Council on Clean TransportationNoch keine Bewertungen

- Due Date:: T1 2021: ICT272 Web Design and Development Assignment 2 - 10% Week 6 - Sunday 18/4/2021 at 11:59pmDokument4 SeitenDue Date:: T1 2021: ICT272 Web Design and Development Assignment 2 - 10% Week 6 - Sunday 18/4/2021 at 11:59pmRaja Mubeen0% (1)

- Cisco 2 Chapter 11 Study GuideDokument7 SeitenCisco 2 Chapter 11 Study GuideGreg MillerNoch keine Bewertungen

- PDF Report Jakpat Brand Health Tracking Q1 of 2019 - Instant Noodle Free Version 19047Dokument15 SeitenPDF Report Jakpat Brand Health Tracking Q1 of 2019 - Instant Noodle Free Version 19047J Septanti100% (1)

- GPL Reference GuideDokument149 SeitenGPL Reference GuideblasdeoteroNoch keine Bewertungen

- Synopsis On SRS DocumentDokument10 SeitenSynopsis On SRS DocumentGoldi SinghNoch keine Bewertungen

- 5 6179095781476139217Dokument240 Seiten5 6179095781476139217Ãã Kā ShNoch keine Bewertungen

- Mango Grading Based On Size Using Image ProcessingDokument40 SeitenMango Grading Based On Size Using Image ProcessingdubstepoNoch keine Bewertungen

- Alternatives To Breadboard: SpringboardDokument3 SeitenAlternatives To Breadboard: SpringboardSomesh KshirsagarNoch keine Bewertungen

- Effectiveness of Advertising in First Person Shooter GamesDokument21 SeitenEffectiveness of Advertising in First Person Shooter GamesStef CobelensNoch keine Bewertungen

- Asia Pacific University of Technology and Innovation (APU) Page 1 of 3Dokument3 SeitenAsia Pacific University of Technology and Innovation (APU) Page 1 of 3Kapil Pokhrel50% (2)

- See HeimDokument5 SeitenSee HeimMarvin NjengaNoch keine Bewertungen

- Real Estate Pitch Deck TemplateDokument10 SeitenReal Estate Pitch Deck Templatejoel ositaNoch keine Bewertungen

- T.MSD309.8B: Service ManualDokument16 SeitenT.MSD309.8B: Service ManualmirelaNoch keine Bewertungen

- Brochure Rutter Radar 100S6Dokument4 SeitenBrochure Rutter Radar 100S6Suresh Kumar SaripalliNoch keine Bewertungen

- Oracle 10G Client and MC Installation Manual (ENG)Dokument24 SeitenOracle 10G Client and MC Installation Manual (ENG)Ranko LazeskiNoch keine Bewertungen

- Group 5 BNM & AmlaDokument32 SeitenGroup 5 BNM & AmlaSitiSarahNoch keine Bewertungen

- Types and Functional Unit of ComputersDokument4 SeitenTypes and Functional Unit of ComputersAqila EbrahimiNoch keine Bewertungen

- Software Test Design SpecificationDokument17 SeitenSoftware Test Design SpecificationIoana Augusta PopNoch keine Bewertungen

- KRA SAP Consultants 0809-2Dokument1 SeiteKRA SAP Consultants 0809-2Rahul SinghNoch keine Bewertungen

- 2019 12 en PDFDokument116 Seiten2019 12 en PDFYash AgarwalNoch keine Bewertungen

- Mini ProjectDokument4 SeitenMini ProjectshabbupathanNoch keine Bewertungen

- Tutorial 1Dokument4 SeitenTutorial 1Kei0% (3)

- Utest-Bug ReportDokument2 SeitenUtest-Bug ReportHaribabu PalneediNoch keine Bewertungen

- Effect Design On Store ImageDokument13 SeitenEffect Design On Store Imagebermand75Noch keine Bewertungen

- Netman Q3Dokument6 SeitenNetman Q3boscoNoch keine Bewertungen

- Nursing in The Prison ServiceDokument148 SeitenNursing in The Prison ServiceptsievccdNoch keine Bewertungen

- Mock Exam With KeyDokument14 SeitenMock Exam With KeyHildaNoch keine Bewertungen

- EVPIDokument9 SeitenEVPIAkshay MallNoch keine Bewertungen

- Abaqus Manual Concrete ExamplesDokument2 SeitenAbaqus Manual Concrete ExamplesMohamad Reza0% (1)

- Abhra Bhattacharyya Kumar Gaurav Narendra Singh Rana Vishal Deep Sharma Vinay Kumar Singh Vivek KantDokument23 SeitenAbhra Bhattacharyya Kumar Gaurav Narendra Singh Rana Vishal Deep Sharma Vinay Kumar Singh Vivek KantNavya AgarwalNoch keine Bewertungen

- Oracle Hyperion Financial ManagementDokument45 SeitenOracle Hyperion Financial ManagementZaid ShammoutNoch keine Bewertungen

- Mangaung IPTN 2016-2020Dokument73 SeitenMangaung IPTN 2016-2020Ntate MoloiNoch keine Bewertungen

- Deliverable 1 Fyp FinalDokument11 SeitenDeliverable 1 Fyp FinalMian MuzammilNoch keine Bewertungen

- ME08 ImDokument14 SeitenME08 ImLohith KumarNoch keine Bewertungen

- TS EDCET-B.ed Counselling Procedure 2015Dokument3 SeitenTS EDCET-B.ed Counselling Procedure 2015MruthyunjayNoch keine Bewertungen

- Vsf011 Form - Removal and or Inspection of A Veh at A VSFDokument2 SeitenVsf011 Form - Removal and or Inspection of A Veh at A VSFTyler Beals0% (1)

- Vantage Syst Form1Dokument7 SeitenVantage Syst Form1GunawanArpulNoch keine Bewertungen

- Skelly Corp WACCDokument2 SeitenSkelly Corp WACCwerewolf2010Noch keine Bewertungen

- PHP Assignment 1Dokument2 SeitenPHP Assignment 1Raunaq100% (1)

- REPLACEMENT1Dokument51 SeitenREPLACEMENT1Ramees KpNoch keine Bewertungen

- 6 Comparing AlternativesDokument49 Seiten6 Comparing AlternativesTrimar DagandanNoch keine Bewertungen

- Topic 9Dokument18 SeitenTopic 9SUREINTHARAAN A/L NATHAN / UPMNoch keine Bewertungen

- Working Hours Method WHM and UnitDokument11 SeitenWorking Hours Method WHM and UnitSharryne Pador ManabatNoch keine Bewertungen

- New Section: Jeff Is Quite Tall. Karl Is The Same Height As JeffDokument6 SeitenNew Section: Jeff Is Quite Tall. Karl Is The Same Height As JeffIbrahim MahmoudNoch keine Bewertungen

- AagaazDokument27 SeitenAagaazKompella HaripriyaNoch keine Bewertungen

- P 14Dokument728 SeitenP 14Moaaz Ahmed100% (1)

- Trading Secrets ExposedDokument27 SeitenTrading Secrets ExposedElizaphan Ngari0% (1)

- Harpers Bazaar UK - 07 2019Dokument219 SeitenHarpers Bazaar UK - 07 2019Chantal Elie100% (2)

- Bata IMC StrategyDokument3 SeitenBata IMC StrategyMeghna Shah100% (6)

- B2BDokument13 SeitenB2BOz VessaliusNoch keine Bewertungen

- AdMob Machine PDFDokument41 SeitenAdMob Machine PDFOpenbsd ManiaNoch keine Bewertungen

- PMJAY Brand Guidelines 31st Aug 2018 PDFDokument10 SeitenPMJAY Brand Guidelines 31st Aug 2018 PDFalkaNoch keine Bewertungen

- Momo Brand ManualDokument26 SeitenMomo Brand ManualMilana VelebitNoch keine Bewertungen

- Prog Copywriting 01 PDFDokument66 SeitenProg Copywriting 01 PDFEduardo Alvarez Mendizabal100% (3)

- CANON 2edeDokument3 SeitenCANON 2edeAbby ParaisoNoch keine Bewertungen

- Mcs WalmartDokument2 SeitenMcs WalmartbrojeemNoch keine Bewertungen

- Amusement Park - Final ProjectDokument34 SeitenAmusement Park - Final Projectroohan Adeel100% (2)

- ANA Lead Generation PlaybookDokument25 SeitenANA Lead Generation PlaybookDemand Metric100% (2)

- Shanghai Tang Marketing AnalysisDokument12 SeitenShanghai Tang Marketing AnalysisJeremy Koh100% (1)

- MUDIM ZAKARIA Ent.Dokument25 SeitenMUDIM ZAKARIA Ent.Ziza Yusup50% (6)

- Advertising, Personal Selling and SalesmanshipDokument4 SeitenAdvertising, Personal Selling and SalesmanshipKomal KumariNoch keine Bewertungen

- Tupperware UttamDokument22 SeitenTupperware UttamUttam Kr PatraNoch keine Bewertungen

- Sim FBMDokument7 SeitenSim FBMShaluNoch keine Bewertungen

- ColgateDokument6 SeitenColgateziming wangNoch keine Bewertungen

- April 7, 2009 - Daily Tarheel NCAA Championship NewspaperDokument12 SeitenApril 7, 2009 - Daily Tarheel NCAA Championship NewspaperThe Daily Tar HeelNoch keine Bewertungen

- S Ramachandra-Marketers Dont Build Brands Consumers DoDokument10 SeitenS Ramachandra-Marketers Dont Build Brands Consumers Domaheshwari_pallavNoch keine Bewertungen

- Functions and Types of AdvertisementDokument43 SeitenFunctions and Types of Advertisementmansi singhNoch keine Bewertungen

- Advertising and Promotion British English Teacher Ver2Dokument4 SeitenAdvertising and Promotion British English Teacher Ver2carolina freire weffortNoch keine Bewertungen

- Red Bull 3 Year StrategyDokument20 SeitenRed Bull 3 Year StrategyJehangir AhmedNoch keine Bewertungen

- New Trends in Marketing-FinalDokument67 SeitenNew Trends in Marketing-FinalarushiparasharNoch keine Bewertungen

- Unit - 4 Safety FirstDokument53 SeitenUnit - 4 Safety FirstKADDOUR95% (20)

- Market Survey of Cement Industry by SnehaDokument17 SeitenMarket Survey of Cement Industry by SnehaSneha Sinha100% (2)

- Hislop College Nagpur: The Consumer Buying Behavior For Colour TelevisionsDokument48 SeitenHislop College Nagpur: The Consumer Buying Behavior For Colour Televisionssarvesh.bhartiNoch keine Bewertungen